Escolar Documentos

Profissional Documentos

Cultura Documentos

China - Real Estate - Price Sales Indices

Enviado por

Eduardo PetazzeDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

China - Real Estate - Price Sales Indices

Enviado por

Eduardo PetazzeDireitos autorais:

Formatos disponíveis

China - Real Estate - Price Sales Indices

by Eduardo Petazze

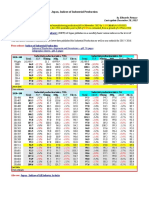

In May 2014, widespread, prices of residential and commercial buildings, have stopped growing

registering a slight monthly backing down.

Reduced the likelihood of a housing bubble, the Central Bank of China has arranged reduced, from

June 16, 2014, and selectively for some financial institutions, the RMB deposit reserve ratio by 0.5

percentage points, recovering substantial policy instrument monetary, intended to sustain economic

growth (*).

The National Bureau of Statistics of China published monthly details of the evolution of housing

prices (new and second-hand) and commercial buildings for 70 cities and by floor space

The following is a summary of simple averages for the 70 cities

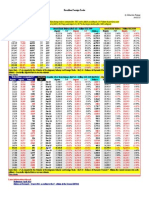

Sales Price Indices of Buildings Average of 70 Large and Medium-Sized Cities

New

New

Second2010 = 100

Y/Y

Y/Y

Y/Y

residential

commercial

hand

2011

104.17

4.2%

104.34

4.3%

102.79

2.8%

2012

103.46

-0.7%

103.57

-0.7%

101.24

-1.5%

2013

109.59

5.9%

110.06

6.3%

104.51

3.2%

Jan-13

104.56

0.7%

104.73

0.7%

101.76

0.2%

Feb-13

105.62

1.8%

105.85

1.9%

102.36

1.0%

Mar-13

106.70

3.1%

107.01

3.3%

103.00

1.8%

Apr-13

107.68

4.3%

108.05

4.6%

103.54

2.5%

May-13

108.61

5.3%

109.04

5.7%

104.06

3.1%

Jun-13

109.46

6.1%

109.94

6.5%

104.44

3.4%

Jul-13

110.22

6.7%

110.75

7.1%

104.78

3.6%

Aug-13

111.09

7.5%

111.66

8.0%

105.16

3.9%

Sep-13

111.86

8.2%

112.48

8.7%

105.60

4.3%

Oct-13

112.53

8.8%

113.17

9.3%

106.06

4.7%

Nov-13

113.13

9.1%

113.81

9.7%

106.49

5.1%

Dec-13

113.57

9.2%

114.27

9.7%

106.86

5.3%

Jan-14

114.01

9.0%

114.74

9.6%

107.06

5.2%

Feb-14

114.33

8.2%

115.07

8.7%

107.22

4.7%

Mar-14

114.59

7.4%

115.35

7.8%

107.36

4.2%

Apr-14

114.66

6.5%

115.43

6.8%

107.45

3.8%

May-14

114.50

5.4%

115.25

5.7%

107.36

3.2%

Mar14 M/M

-0.15%

-0.16%

-0.08%

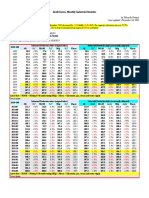

Sales Price Index for New residential buildings in some cities (2010=100)

Shanghai

Beijing

Tianjin

Quanzhou Shenzhen

Wuhan

New

residential

2011

102.1

102.9

104.1

100.8

103.9

104.0

2012

101.1

102.5

103.4

100.3

102.6

103.7

2013

113.1

115.1

109.1

104.4

117.5

111.5

2013 Y/Y

11.8%

12.3%

5.4%

4.1%

14.5%

7.6%

Jan-13

102.9

105.9

104.7

100.6

106.6

106.1

Feb-13

104.8

108.5

106.1

101.3

108.9

107.3

Mar-13

107.6

110.8

107.6

101.3

111.8

108.3

Apr-13

109.5

112.4

108.3

102.8

113.9

109.4

May-13

111.0

113.8

108.7

103.5

116.0

110.4

Jun-13

113.0

115.3

109.0

103.9

117.9

111.3

Jul-13

114.9

116.8

109.5

104.9

118.9

112.2

Aug-13

116.5

117.8

110.0

105.4

120.5

113.3

Sep-13

118.1

119.0

110.6

106.6

122.2

113.8

Oct-13

118.9

119.7

110.9

107.1

123.3

114.8

Nov-13

119.6

120.3

111.4

107.5

124.5

115.4

Dec-13

120.3

121.0

111.9

108.1

125.1

115.8

Jan-14

120.8

121.5

112.4

108.6

125.6

116.3

Feb-14

121.3

121.7

112.8

109.3

125.9

116.7

Mar-14

121.7

122.2

113.1

109.4

126.2

117.2

Apr-14

122.0

122.4

113.2

109.5

126.4

117.3

May-14

121.7

122.5

113.2

109.3

126.1

117.3

May-14 M/M

-0.2%

0.1%

0.0%

-0.2%

-0.2%

0.0%

May-14 Y/Y

9.6%

7.6%

4.1%

5.6%

8.7%

6.3%

Also see: In May 2014, the consumer price index (CPI) went up by 2.5% Y/Y (+0.1% M/M)

House renting grew 0.0% M/M (3.4% Y/Y)

(*) People's Bank of China has been actively and vigorously support the use of monetary policy tools

to adjust the economic structure, especially to encourage and guide financial institutions to allocate

credit more resources to the areas of the "agriculture" and small and micro enterprises

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- India - Index of Industrial ProductionDocumento1 páginaIndia - Index of Industrial ProductionEduardo PetazzeAinda não há avaliações

- WTI Spot PriceDocumento4 páginasWTI Spot PriceEduardo Petazze100% (1)

- Turkey - Gross Domestic Product, Outlook 2016-2017Documento1 páginaTurkey - Gross Domestic Product, Outlook 2016-2017Eduardo PetazzeAinda não há avaliações

- China - Price IndicesDocumento1 páginaChina - Price IndicesEduardo PetazzeAinda não há avaliações

- Analysis and Estimation of The US Oil ProductionDocumento1 páginaAnalysis and Estimation of The US Oil ProductionEduardo PetazzeAinda não há avaliações

- China - Demand For Petroleum, Energy Efficiency and Consumption Per CapitaDocumento1 páginaChina - Demand For Petroleum, Energy Efficiency and Consumption Per CapitaEduardo PetazzeAinda não há avaliações

- Germany - Renewable Energies ActDocumento1 páginaGermany - Renewable Energies ActEduardo PetazzeAinda não há avaliações

- Highlights, Wednesday June 8, 2016Documento1 páginaHighlights, Wednesday June 8, 2016Eduardo PetazzeAinda não há avaliações

- India 2015 GDPDocumento1 páginaIndia 2015 GDPEduardo PetazzeAinda não há avaliações

- U.S. Employment Situation - 2015 / 2017 OutlookDocumento1 páginaU.S. Employment Situation - 2015 / 2017 OutlookEduardo PetazzeAinda não há avaliações

- Commitment of Traders - Futures Only Contracts - NYMEX (American)Documento1 páginaCommitment of Traders - Futures Only Contracts - NYMEX (American)Eduardo PetazzeAinda não há avaliações

- Reflections On The Greek Crisis and The Level of EmploymentDocumento1 páginaReflections On The Greek Crisis and The Level of EmploymentEduardo PetazzeAinda não há avaliações

- South Africa - 2015 GDP OutlookDocumento1 páginaSouth Africa - 2015 GDP OutlookEduardo PetazzeAinda não há avaliações

- U.S. New Home Sales and House Price IndexDocumento1 páginaU.S. New Home Sales and House Price IndexEduardo PetazzeAinda não há avaliações

- China - Power GenerationDocumento1 páginaChina - Power GenerationEduardo PetazzeAinda não há avaliações

- Mainland China - Interest Rates and InflationDocumento1 páginaMainland China - Interest Rates and InflationEduardo PetazzeAinda não há avaliações

- México, PBI 2015Documento1 páginaMéxico, PBI 2015Eduardo PetazzeAinda não há avaliações

- Singapore - 2015 GDP OutlookDocumento1 páginaSingapore - 2015 GDP OutlookEduardo PetazzeAinda não há avaliações

- U.S. Federal Open Market Committee: Federal Funds RateDocumento1 páginaU.S. Federal Open Market Committee: Federal Funds RateEduardo PetazzeAinda não há avaliações

- US Mining Production IndexDocumento1 páginaUS Mining Production IndexEduardo PetazzeAinda não há avaliações

- Highlights in Scribd, Updated in April 2015Documento1 páginaHighlights in Scribd, Updated in April 2015Eduardo PetazzeAinda não há avaliações

- USA - Oil and Gas Extraction - Estimated Impact by Low Prices On Economic AggregatesDocumento1 páginaUSA - Oil and Gas Extraction - Estimated Impact by Low Prices On Economic AggregatesEduardo PetazzeAinda não há avaliações

- European Commission, Spring 2015 Economic Forecast, Employment SituationDocumento1 páginaEuropean Commission, Spring 2015 Economic Forecast, Employment SituationEduardo PetazzeAinda não há avaliações

- Brazilian Foreign TradeDocumento1 páginaBrazilian Foreign TradeEduardo PetazzeAinda não há avaliações

- South Korea, Monthly Industrial StatisticsDocumento1 páginaSouth Korea, Monthly Industrial StatisticsEduardo PetazzeAinda não há avaliações

- Chile, Monthly Index of Economic Activity, IMACECDocumento2 páginasChile, Monthly Index of Economic Activity, IMACECEduardo PetazzeAinda não há avaliações

- US - Personal Income and Outlays - 2015-2016 OutlookDocumento1 páginaUS - Personal Income and Outlays - 2015-2016 OutlookEduardo PetazzeAinda não há avaliações

- Japan, Population and Labour Force - 2015-2017 OutlookDocumento1 páginaJapan, Population and Labour Force - 2015-2017 OutlookEduardo PetazzeAinda não há avaliações

- Japan, Indices of Industrial ProductionDocumento1 páginaJapan, Indices of Industrial ProductionEduardo PetazzeAinda não há avaliações

- United States - Gross Domestic Product by IndustryDocumento1 páginaUnited States - Gross Domestic Product by IndustryEduardo PetazzeAinda não há avaliações

- MUMURIPa SAMRAt CKPDocumento10 páginasMUMURIPa SAMRAt CKPRafatul IslamAinda não há avaliações

- Cimb Clicks Apr 2020Documento3 páginasCimb Clicks Apr 2020roslan musaAinda não há avaliações

- Evolution of Money and BankingDocumento17 páginasEvolution of Money and BankingUmar HayatAinda não há avaliações

- 2nd-Q - Week-1-BF-Amortization - JOSEPH AURELLODocumento13 páginas2nd-Q - Week-1-BF-Amortization - JOSEPH AURELLOFairly May LaysonAinda não há avaliações

- Give Some News About Today Economic CrisisDocumento2 páginasGive Some News About Today Economic CrisisSAJIT SAPKOTAAinda não há avaliações

- Economics Money and Banking Worksheet Set BDocumento6 páginasEconomics Money and Banking Worksheet Set Bdennis greenAinda não há avaliações

- Summary of Money Market and Monetary Operations in IndiaDocumento1 páginaSummary of Money Market and Monetary Operations in IndiaSubigya BasnetAinda não há avaliações

- Assignment - Banking & InsuranceDocumento4 páginasAssignment - Banking & Insurancesandeep_kadam_7Ainda não há avaliações

- FinalDocumento16 páginasFinalAshish Saini0% (1)

- CF - 04Documento54 páginasCF - 04Нндн Н'Ainda não há avaliações

- Exchange Rate SystemsDocumento27 páginasExchange Rate SystemsmaurishkaAinda não há avaliações

- 5 Int Monetary SystemDocumento43 páginas5 Int Monetary SystemumangAinda não há avaliações

- Central Bank - WikipediaDocumento21 páginasCentral Bank - WikipediaiazpiazuAinda não há avaliações

- Money Supply and Money Demand: MacroeconomicsDocumento37 páginasMoney Supply and Money Demand: MacroeconomicsHay JirenyaaAinda não há avaliações

- How RBI Went Wrong On Inflation - MintDocumento11 páginasHow RBI Went Wrong On Inflation - MintUdbhavAinda não há avaliações

- Macroeconomics Homework 2Documento6 páginasMacroeconomics Homework 2JoeAinda não há avaliações

- Foreign Exchange RateDocumento7 páginasForeign Exchange RateAryan RawatAinda não há avaliações

- MS Ceemea 2024Documento28 páginasMS Ceemea 2024impartscavenger710Ainda não há avaliações

- Mortgage CalculatorDocumento9 páginasMortgage CalculatorJSOAinda não há avaliações

- Relative Purchasing Power Parity Relative Purchasing Power ParityDocumento2 páginasRelative Purchasing Power Parity Relative Purchasing Power ParityMohammad HammoudehAinda não há avaliações

- Monetary Policy of IndiaDocumento6 páginasMonetary Policy of IndiaSOURAV SAMALAinda não há avaliações

- FIN350 - Solutions Slides 9Documento4 páginasFIN350 - Solutions Slides 9David NguyenAinda não há avaliações

- What Is The Minimum CIBIL Score Required For Loan Against Property - Bajaj FinservDocumento11 páginasWhat Is The Minimum CIBIL Score Required For Loan Against Property - Bajaj FinservRahul RajAinda não há avaliações

- GECO 6210 - Topics in Economic Analsysis Inflation Syllabus PDFDocumento2 páginasGECO 6210 - Topics in Economic Analsysis Inflation Syllabus PDFRoger WenceslaoAinda não há avaliações

- DNB Working Paper: No. 475 / June 2015Documento35 páginasDNB Working Paper: No. 475 / June 2015Тимур ЯкимовAinda não há avaliações

- Engecon ReviewerDocumento2 páginasEngecon Reviewerdaday el machoAinda não há avaliações

- Ugba 101b Test 2 2008Documento12 páginasUgba 101b Test 2 2008Minji KimAinda não há avaliações

- GKK - Banking Monetary PolicyDocumento10 páginasGKK - Banking Monetary PolicyNeha MayekarAinda não há avaliações

- Money and BankingDocumento13 páginasMoney and BankingVirencarpediem0% (1)

- Central Bank and Commercial BanksDocumento5 páginasCentral Bank and Commercial BanksHaseebAinda não há avaliações