Escolar Documentos

Profissional Documentos

Cultura Documentos

Practice Set - Financial Statement Analysis

Enviado por

Shruti SarrafDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Practice Set - Financial Statement Analysis

Enviado por

Shruti SarrafDireitos autorais:

Formatos disponíveis

Problems Ratio Analysis 1.

The following are the extract for the financial statements of blue and red ltd. as on 31st March, 1997 ad 1998 respectively. Particular 31st March 1997 31st March 1998 Stock 10,000 25,000 Debt 20,000 20,000 Bills receivable 10,000 5000 Advances ( recoverable in cash or 2,000 kind) Cash in hand 18,000 15,000 Bills payable 15,000 20,000 Bank overdraft ------2,000 9 % Debentures,2000 5,00,000 5,00,000 Sales for the year 3,50,000 3,00,000 Gross Profit 70,000 50,000 You are required to compute for both years: i. Current ratio ii. Liquidity ratio iii. Stock turnover ratio iv. Number of days outstanding of debtors v. Stock working capital ratio 2. From the following details prepare a statement of proprietary fund (balance sheet with as many details as possible Stock velocity ratio Fixed Assets Turnover ratio Capital turnover ratio Gross profit turnover ration Debtors velocity months Creditors velocity days The gross profit was Reserves and surplus amounted to Closing stock was Rs.5,000 in excess of opening stock 6 4 2 20% 20 73 Rs.60,000 Rs. 20,000

3. With the following ratios and further information given below prepare a Trading accounting, Profit and Loss a/c and Balance Sheet of Mr.X Particulars Gross profit ratio Net profit ratio Stock turnover Net profit to capital Capital to total liabilities Fixed assets/capital Fixed assets Closing stock Amount 25% 20% 10 1/5 1/2 5/4 Rs.10,00,000 Rs.1,00,000

4. The ratios relating to Cosmos Ltd are given as follows Gross Profit Ratio : 15 % stock velocity 6 months debtors velocity 3 month creditors velocity 3 months Gross profit for the year ending 31/1/2001 mounts Rs.60,000. Closing stock is equal to opening stock. Find out Sales 2

Closing stock Sundry debtors Sundry creditors

5. From the following information make a Balance Sheet with as many details at possible Current ratio 2.5 Liquid ratio 1.5 Fixed assets /proprietary funds 0.75 Working capital Rs.60,000 Reserves and surplus Rs.40,000 Bank overdraft Rs.10,000. There are no long term loans 6. Using the details, Prepare a balance sheet of Kamini Limited Current ratio 2.75 Acid ratio 2.25 Working capital Rs.7,00,000 Reserves and surplus Rs.1,00,000 Total current assets include sock debtors and cash only which are in the ratio of 2:6:3 Total current liabilities included creditors and bills payable in the ratio 3:2 Fixed assets are 50 % of share capital The share capital is Rs.12,00,000. There are no other items of assets or liabilities 7. Following is the information of G Company Gross profit ratio = 30% Net profit ratio = 20% Sales/inventory ratio= 8 Fixed assets/total current assets= 2/2 Fixed assets/total capital=3/2 Total capital /total outside liabilities = 2/4 Inventory= Rs.6,00,000 Fixed Assets= 40,00,000 Fill the following accounts Trading & Profit & Loss account

Balance sheet Liabilities Capital(Balancing Fig) Add: Net Profit Outside liabilities Total

Amount (Rs.) .. . ..

Assets Fixed Assets Current Assets Stock Other current assets Total

Amount (Rs.) .. .. .

8. The following is information related to xyz organization Particular Year 1 Year 2 Stock 40,000 1,00,000 Debt 60,000 60,000 Bills receivable 40,000 20,000 Advances ( recoverable in cash or 8,000 kind) Cash in hand 72,000 60,000 Bills payable 60,000 80,000 To cost of sales .. ------By sales 8,000 Bank overdraft To profit c/d . Netgross Profit 1,50,00 1,00,000 0 Gross Profit 2,80,00 2,00,000 To expenses By gross profit b/d 0 Sales To net profit . 8,00,00 1,50,000 0 ______________ ______________ ____ Calculate for both years Current ratio Liquidity ratio Stock turnover ratio Net Profit Ratio Gross Profit Ratio 9. A companys sales are Rs.36,00,000, compute balance sheet Sales /total assets 3 Sales /fixed assets 5 Sales/current assets 7.5 Sales /inventories 20 Sales /debtors 2

. . .. ____________ ____________ ____

Current ratio 2.5 Debt equity 1 Balance sheet Liabilities Amount Assets Amount Net worth Fixed assets Long term debt Inventories Current liabilities Debtors Liquid assess

10. From the following prepare balance sheet Current ratio 1.75 Liquid ratio 1.25 Stock turnover ratio (cost of sales /closing stock) Gross profit ratio 25 % Debt collection period 11/2 months Reserves and surplus to capital 0.2 Turn over to fixed assets 1.2 Capital gearing ration (long term debt to equity capital) 1.25 Sales for the year Rs.12,00,000

Você também pode gostar

- Fleet Management System A Complete Guide - 2021 EditionNo EverandFleet Management System A Complete Guide - 2021 EditionAinda não há avaliações

- Training Dilemma at Hardee'sDocumento8 páginasTraining Dilemma at Hardee'sNadeem AhmadAinda não há avaliações

- Evaluation Tax Assessment and Collection Practice of Category "C" Tax Payers The Case of Nefas Silk Nifas Silk Lafto Sub City Woreda 01Documento56 páginasEvaluation Tax Assessment and Collection Practice of Category "C" Tax Payers The Case of Nefas Silk Nifas Silk Lafto Sub City Woreda 01Nate WorkAinda não há avaliações

- "On The Water" Business PlanDocumento22 páginas"On The Water" Business Planmohammad10000100% (2)

- Sample Audit ReportsDocumento3 páginasSample Audit Reportsvivek1119100% (1)

- Cost of Making BreadDocumento15 páginasCost of Making BreadRahul RanganathanAinda não há avaliações

- Asgar Food Production Project)Documento12 páginasAsgar Food Production Project)Harshal KushwahAinda não há avaliações

- Company ProfileDocumento17 páginasCompany ProfileBecca BuenaobraAinda não há avaliações

- A Report: ON Start Up Business ModelDocumento19 páginasA Report: ON Start Up Business ModelaminaiAinda não há avaliações

- Cafe' / Restaurant FinancialsDocumento5 páginasCafe' / Restaurant Financialstmir_1Ainda não há avaliações

- Retail Salesperson Job DutiesDocumento4 páginasRetail Salesperson Job DutiesshahrozeAinda não há avaliações

- Cash ManagementDocumento16 páginasCash ManagementdhruvAinda não há avaliações

- Granut Oil Product TionDocumento18 páginasGranut Oil Product TionAsk Melody100% (1)

- PERMALINO - Learning Activity 19. Working Capital ManagementDocumento3 páginasPERMALINO - Learning Activity 19. Working Capital ManagementAra Joyce PermalinoAinda não há avaliações

- ConsultancyDocumento4 páginasConsultancyRicher Lee Bartolome GangosoAinda não há avaliações

- Review of Mission Statement and VisionDocumento3 páginasReview of Mission Statement and VisionLohith KumarAinda não há avaliações

- 22 Articulo - Restaurant Operating Expenses and Their Effects On Profitability EnhancementDocumento9 páginas22 Articulo - Restaurant Operating Expenses and Their Effects On Profitability EnhancementCristian Santivañez MillaAinda não há avaliações

- MMZ Accountancy School PH 09 453197062: 15 Mark Questions: Preparing Simple Consolidated Financial StatementsDocumento7 páginasMMZ Accountancy School PH 09 453197062: 15 Mark Questions: Preparing Simple Consolidated Financial StatementsSerena100% (1)

- Feasibility Report of RestaurantDocumento9 páginasFeasibility Report of RestaurantMadiha KhanAinda não há avaliações

- Operations Management, 10th Edition Chapter 4Documento114 páginasOperations Management, 10th Edition Chapter 4Ardale Palillo50% (2)

- Optional Standard Deductions ExampleDocumento7 páginasOptional Standard Deductions ExampleSandia EspejoAinda não há avaliações

- Unit Three Flexible Budget and StandardsDocumento17 páginasUnit Three Flexible Budget and StandardsShimelis TesemaAinda não há avaliações

- (84650977) Variance Accounting Case Study - PD1Documento24 páginas(84650977) Variance Accounting Case Study - PD1Mukesh ManwaniAinda não há avaliações

- Chapter 4 ACCA F2Documento7 páginasChapter 4 ACCA F2siksha100% (1)

- Salary Increase Letter 12Documento2 páginasSalary Increase Letter 12Bhobz 1135Ainda não há avaliações

- Branch Accounts Theory and ProblemsDocumento18 páginasBranch Accounts Theory and Problemsjacky111100% (1)

- Updated - Salary Sheet With Auto Salary Tax Calculator For FY 2075-2076 (Nepali Talim)Documento13 páginasUpdated - Salary Sheet With Auto Salary Tax Calculator For FY 2075-2076 (Nepali Talim)samAinda não há avaliações

- Mission Statements of NikeDocumento12 páginasMission Statements of Nikemkam212Ainda não há avaliações

- Term Report: Strategic ManagementDocumento32 páginasTerm Report: Strategic ManagementMunesh KumarAinda não há avaliações

- F & B ControlDocumento23 páginasF & B Controlankit.kaushal14100% (1)

- Chart of Accounts For HotelDocumento24 páginasChart of Accounts For HotelJonathan Oni100% (2)

- Internal Controls of RestaurantsDocumento58 páginasInternal Controls of RestaurantsBrail NazarenoAinda não há avaliações

- Hote Business Plan AssignmentDocumento49 páginasHote Business Plan AssignmentPeter OgollaAinda não há avaliações

- JollibeeDocumento5 páginasJollibeeGlyssa AlcantaraAinda não há avaliações

- Furniture Manufacturing Business Plan ExampleDocumento35 páginasFurniture Manufacturing Business Plan ExampleSufian100% (1)

- Draft of Audit ProgramDocumento4 páginasDraft of Audit ProgramCecile UmaliAinda não há avaliações

- Australian Hardware - Wollongong StoreDocumento42 páginasAustralian Hardware - Wollongong StoreJoyce BalagotAinda não há avaliações

- Allah Din Group of Company Internship ReportDocumento22 páginasAllah Din Group of Company Internship ReportSaleh Khan100% (3)

- Financial Statements Review CenterDocumento40 páginasFinancial Statements Review Centermario sinAinda não há avaliações

- WRFWRF Topic 2 - Financial Planning - Lecture Notes (2021 Adj)Documento19 páginasWRFWRF Topic 2 - Financial Planning - Lecture Notes (2021 Adj)Govardan SureshAinda não há avaliações

- Mark Feasibility StudyDocumento1 páginaMark Feasibility StudyMark Rivera MediloAinda não há avaliações

- StudentDocumento48 páginasStudentMary Grace Abales LaboAinda não há avaliações

- Feasibility Report: Pure Drinking Water by Muzamil, Mudassar, Anas, Kaukab, WaqarDocumento13 páginasFeasibility Report: Pure Drinking Water by Muzamil, Mudassar, Anas, Kaukab, WaqarWaqar AfzalAinda não há avaliações

- Report On Comparison of Performance Analysis and Risk Management Between DBBL & IBBLDocumento22 páginasReport On Comparison of Performance Analysis and Risk Management Between DBBL & IBBLsagor007Ainda não há avaliações

- Allocation and ApportionmentDocumento11 páginasAllocation and ApportionmentpRiNcE DuDhAtRa100% (2)

- Debtors & Creditors Reconciliation StatementDocumento6 páginasDebtors & Creditors Reconciliation StatementAnkur KalakotiAinda não há avaliações

- Canteen Store DepartmentDocumento5 páginasCanteen Store DepartmentZamina RiXviAinda não há avaliações

- Oper ManDocumento38 páginasOper ManDiane UyAinda não há avaliações

- Franchise ProposalDocumento9 páginasFranchise ProposalChristine Angeli AritaAinda não há avaliações

- Financial StatementDocumento42 páginasFinancial StatementMariz LegazpiAinda não há avaliações

- ToA Quizzer 1 - Intro To PFRS (3TAY1617)Documento6 páginasToA Quizzer 1 - Intro To PFRS (3TAY1617)Kyle ParisAinda não há avaliações

- Tally 9.1 NotesDocumento28 páginasTally 9.1 NotesAbdulhussain Jariwala100% (2)

- Riphah International UniversityDocumento17 páginasRiphah International UniversitySameera ZamanAinda não há avaliações

- Marketing Sales: Seminars inDocumento6 páginasMarketing Sales: Seminars insboaduappiahAinda não há avaliações

- Chart of AccountDocumento5 páginasChart of Accountsana82966534100% (1)

- CH 2 Ratio ProblemsDocumento21 páginasCH 2 Ratio ProblemsRohith100% (1)

- QRatiosDocumento5 páginasQRatiosstriderjebby6512Ainda não há avaliações

- Financial AnalysisDocumento47 páginasFinancial Analysis20B81A1235cvr.ac.in G RUSHI BHARGAVAinda não há avaliações

- RatioanalysisanswersDocumento5 páginasRatioanalysisanswersAnu PriyaAinda não há avaliações

- Problems On Cash Flow StatementsDocumento12 páginasProblems On Cash Flow StatementsAnjali Mehta100% (1)

- Butterstick AlishaDocumento22 páginasButterstick AlishaShruti SarrafAinda não há avaliações

- National Institute of Fashion Technology:, KolkataDocumento10 páginasNational Institute of Fashion Technology:, KolkataShruti SarrafAinda não há avaliações

- International Human Resourse ManagementDocumento10 páginasInternational Human Resourse ManagementShruti SarrafAinda não há avaliações

- LeadershipDocumento33 páginasLeadershipShruti SarrafAinda não há avaliações

- Solution Manual For Financial Accounting An Introduction To Concepts Methods and Uses 13th Edition by StickneyDocumento32 páginasSolution Manual For Financial Accounting An Introduction To Concepts Methods and Uses 13th Edition by Stickneya540142314Ainda não há avaliações

- Common Size Statements: ParticularsDocumento3 páginasCommon Size Statements: ParticularsChandan GuptaAinda não há avaliações

- Module 3 Financial Statements Anlysis NotesDocumento38 páginasModule 3 Financial Statements Anlysis NotesNil Justeen GarciaAinda não há avaliações

- MasDocumento33 páginasMasAmalina SolahuddinAinda não há avaliações

- Acc311 2021 2Documento4 páginasAcc311 2021 2hoghidan1Ainda não há avaliações

- Financial Management: Dr. Saurabh Pratap Iiit DM JabalpurDocumento40 páginasFinancial Management: Dr. Saurabh Pratap Iiit DM JabalpurPrince SinghAinda não há avaliações

- Debit: Cash / Bank Account Credit: Share Capital AccountDocumento2 páginasDebit: Cash / Bank Account Credit: Share Capital AccountAkram HussainAinda não há avaliações

- Financial Statements 2018 Adidas Ag eDocumento86 páginasFinancial Statements 2018 Adidas Ag ewaskithaAinda não há avaliações

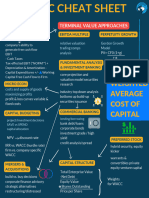

- Comprehensive Finance Cheat Sheet Collection 1698244606Documento52 páginasComprehensive Finance Cheat Sheet Collection 1698244606muratgreywolf100% (1)

- Baf SyllabusDocumento12 páginasBaf SyllabusJana MakAinda não há avaliações

- Inventory: Measurement: Learning Objectives - Coverage by QuestionDocumento39 páginasInventory: Measurement: Learning Objectives - Coverage by QuestionKNVS Siva KumarAinda não há avaliações

- Specific Financial Reporting Questions & Answers: Suggested Solution 1Documento37 páginasSpecific Financial Reporting Questions & Answers: Suggested Solution 1Tawanda Tatenda Herbert100% (2)

- BORROWING COSTS With AnswerDocumento3 páginasBORROWING COSTS With AnswerMaeAinda não há avaliações

- Individual Paper Income Tax Return 2016Documento39 páginasIndividual Paper Income Tax Return 2016aarizahmadAinda não há avaliações

- Arlune Boarding House: Bachelor of Science in Entrepreneurial ManagementDocumento33 páginasArlune Boarding House: Bachelor of Science in Entrepreneurial ManagementAristanti Retnaning94% (35)

- Asignacion - 3 FinancialDocumento4 páginasAsignacion - 3 FinancialLeslie Leah0% (1)

- Urban Economics and Real Estate Markets DiPasquale&Amp WheatonDocumento197 páginasUrban Economics and Real Estate Markets DiPasquale&Amp Wheaton何周涵子Ainda não há avaliações

- Coffee Shop Business Plan - Amit BhargavDocumento20 páginasCoffee Shop Business Plan - Amit BhargavAmit Bhargav100% (1)

- BSA REVIEW Cash TheoriesDocumento4 páginasBSA REVIEW Cash TheorieschristineAinda não há avaliações

- Sap ConfigDocumento192 páginasSap ConfigAmarnath Panda100% (1)

- 04 FM 9Documento8 páginas04 FM 9Lam Wai KitAinda não há avaliações

- Solution Manual For Financial Managerial Accounting 10th by Carl S Warren James M Reeve Jonathan Duchac Full DownloadDocumento33 páginasSolution Manual For Financial Managerial Accounting 10th by Carl S Warren James M Reeve Jonathan Duchac Full Downloadbrandonfowler12031998mgj100% (40)

- Solution Manual For Advanced Accounting 11th Edition by HoyleDocumento24 páginasSolution Manual For Advanced Accounting 11th Edition by HoyleCherylElliotttfkg100% (42)

- Accounting For Religious Organization OrginalDocumento20 páginasAccounting For Religious Organization Orginaltsedekselashi90Ainda não há avaliações

- IFM11 Solution To Ch09 P11 Build A ModelDocumento18 páginasIFM11 Solution To Ch09 P11 Build A ModelDiana SorianoAinda não há avaliações

- Wiley - Chapter 12: Intangible AssetsDocumento20 páginasWiley - Chapter 12: Intangible AssetsIvan BliminseAinda não há avaliações

- Pamantasan NG Lungsod NG MarikinaDocumento24 páginasPamantasan NG Lungsod NG MarikinaAngel AnacanAinda não há avaliações

- Srivas Montage EnterprisesDocumento58 páginasSrivas Montage EnterprisesAman shrivasAinda não há avaliações

- Hotel Budget TemplateDocumento44 páginasHotel Budget TemplateClarisse30Ainda não há avaliações

- Company Analysis Report of BRITANNIADocumento47 páginasCompany Analysis Report of BRITANNIAJaiHanumankiAinda não há avaliações

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)No EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Nota: 4.5 de 5 estrelas4.5/5 (13)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)No EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Nota: 4.5 de 5 estrelas4.5/5 (5)

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyNo EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyNota: 4.5 de 5 estrelas4.5/5 (37)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindNo EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindNota: 5 de 5 estrelas5/5 (231)

- Getting to Yes: How to Negotiate Agreement Without Giving InNo EverandGetting to Yes: How to Negotiate Agreement Without Giving InNota: 4 de 5 estrelas4/5 (652)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantNo EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantNota: 4.5 de 5 estrelas4.5/5 (146)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyNo EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyNota: 5 de 5 estrelas5/5 (1)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItNo EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItNota: 5 de 5 estrelas5/5 (13)

- The Credit Formula: The Guide To Building and Rebuilding Lendable CreditNo EverandThe Credit Formula: The Guide To Building and Rebuilding Lendable CreditNota: 5 de 5 estrelas5/5 (1)

- Finance Basics (HBR 20-Minute Manager Series)No EverandFinance Basics (HBR 20-Minute Manager Series)Nota: 4.5 de 5 estrelas4.5/5 (32)

- Ledger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceNo EverandLedger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceAinda não há avaliações

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelAinda não há avaliações

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)No EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Nota: 4 de 5 estrelas4/5 (33)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineAinda não há avaliações

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsNo EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsNota: 5 de 5 estrelas5/5 (1)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesAinda não há avaliações

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeNo EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeNota: 4 de 5 estrelas4/5 (21)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsNo EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsNota: 4 de 5 estrelas4/5 (7)

- Warren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageNo EverandWarren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageNota: 4.5 de 5 estrelas4.5/5 (109)

- Accounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)No EverandAccounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Nota: 4.5 de 5 estrelas4.5/5 (5)

- I'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)No EverandI'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)Nota: 4.5 de 5 estrelas4.5/5 (24)

- The Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingNo EverandThe Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingNota: 4.5 de 5 estrelas4.5/5 (760)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanNo EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanNota: 4.5 de 5 estrelas4.5/5 (79)

- Bookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesNo EverandBookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesNota: 5 de 5 estrelas5/5 (4)