Escolar Documentos

Profissional Documentos

Cultura Documentos

Economic Outlook and Indicators - External Trade - August

Enviado por

Policy and Management Consulting GroupTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Economic Outlook and Indicators - External Trade - August

Enviado por

Policy and Management Consulting GroupDireitos autorais:

Formatos disponíveis

Outlook and Indicators

www.pmcg-i.com External Trade

Issue #8

Economic

M20.08.2013

Share of Export and Import in External Trade Turnover

80% 70%

Share

78%

2500 2000 1500 1000 500 0

In the second quarter of 2013, the dynamics of external trade turnover was 2568.2 mln.USD, which is lower (-1.2%) than the corresponding indicator of previous year, but it exceeds the corresponding indicator of the first quarter 2013 (19.7%). In the second quarter of 2013, the share of export in external trade turnover increased (26%) compared to the corresponding figure in 2012 (23%),but the share of import in total trade is reduced (74%) compared to the corresponding figure in 2013, but is similar to the corresponding indicator of the first quarter 2013.

60% 50% 40% 30% 20% 10% 0%

77%

77%

74%

74%

24%

2011 I

26%

II

22%

III

24%

IV

24%

2012 I

23%

II

23%

III

23%

IV

26%

2013 I

26%

II

Export

Import

External Trade Turnover

External Trade Balance

2500 0 -200 2000 -400

In the second quarter of 2013, the dynamics of export as well as import is similar to the dynamics of corresponding indicators in the previous years. In the second quarter of 2013, the volume of export increased (11.5%), but the volume of import reduced (-5%), in comparison with the corresponding indicators of the second quarter of 2012. Total export increased due to increase of export of: mineral waters (51.9%), Copper ores and concentrates (91.7%) and natural wines of grape (29.8%). Similar to the first quarter of 2013, Georgia recorded negative trade balance in the second quarter of 2013 (-1226.9 mln.USD), which was 48% of external trade turnover. In this period the deficit of external trade balance reduced (12%) compared to the second quarter of 2012, but increased (21%) in comparison with the same indicator of the first quarter 2013.

mln.USD

1500

-800 1000 -1000 -1200 -1400 0 -1600

500

2011 I

II

III

IV

2012 I

II

III Export

IV

2013 I Import

II

External Trade Balance

mln.USD

-600

Export and Import Monthly Dinamics,20102013

Import Export 1,000 900 800 700

In June 2013, the volume of import reduced compared to the corresponding indicator of June 2012 (-4.7%), as well as in comparison with the indicator of May 2013 (-9.3%). In June 2013, the volume of export increased in comparison with the indicators of June 2012 (30.9%), as well as in comparison with the indicator of May 2013 (8.6%). The volume of export increased due to increase of export of: Copper ores and concentrates (940%), Semi-finished products of iron or non-alloy steel (712%) and Ferro-alloys (108%). In the period of 2010-2013 export as well as import volumes were characterised by monthly fluctuations.The amplitude of those fluctuations is higher in case of import compared to the case of export.

500 400 300 200 100

2010 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2011 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2012 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2013 Jan Feb Mar Apr May Jun

mln.USD

600

External Trade Turnover.mln.USD

In the second quarter of 2013, the dynamics of external trade turnover is similar to the dynamics of the same indicator in previous years.

100% 90%

3000

76%

74%

76%

76%

77%

Outlook and Indicators

www.pmcg-i.com External Trade

Share of the Top Trading Partners in Total Exports I-II quarters,2013

Share of Major Commodity Positions by Export I-II quarter,2013

Economic

Issue # 8

M20.08.2013

Other countries 42%

Azerbaijan 27%

Motor Cars 26%

Armenia 11% USA 7%

Other Products 52%

Ferro-alloys 10%

Ukraine 6%

Turkey 7%

Fertilizers 4% Mineral Waters 4% Copper ores 4%

In the first two quarters of 2013, top five trading partner countries by export were: Azerbaijan (27%), Armenia (11%), United States (7%), Turkey (7%), Ukraine (6%) and five major exported commodities were: motor cars (26%), ferro-alloys (10%), fertilizers (4%), copper ores (4%), mineral waters (4%). Based on the fact that cars were not local production and were just re-exported through Georgia, Ferro-Alloys can be considered to be the major exported commodity in the first two quarters of 2013. In this period, the top three trading partners by turnover were: Turkey, Azerbaijan and Ukraine.The major commodities exported in Turkey were: knitted T-shirts,semi-finished products of iron or non-alloy steel, flours, meals and pellents unfit for human consumption.The major commodities exported in Azerbaijan were: motor cars (re-export), live bovine animals, cement, fittings. The major commodities exported in Ukraine were: mineral waters, ethyl alcohol and alcoholic beverages, natural wines of grape and Ferro-Alloys.

Share of the Top Trading Partners in Total Imports I-II quarter,2013

Share of Major Commodity Positions by Imports I-II quarter,2013

Turkey 17%

Petroleum 11% Motor Cars 10%

China 8% Other countries 52% Azerbaijan 8% Ukraine 8%

Other Products 69%

Gases 4% Medicaments 4% Telephones 2%

Russia 7%

In the first two quarters of 2013, the top five trading partner countries by import were: Turkey (17%), China (8%), Azerbaijan (8%), Ukraine (8%), Russia (7%) and five major imported commodities were: petroleum (11%), motor cars (10%), gases (4%), medicaments (4%), telephones (2%).

Basic Economic Indicators

Nominal GDP in current prices (mln USD)

Per capita GDP (USD) GDP real growth, percent Consumer Price Index Foreign Direct Investment (USD) Unemployment Rate External Public Debt (mln USD) Poverty Level

2011

14 438 3 230.7 7.20% 8,5% 1 117 15.10% 4200.5

2012

15829.7* 3519.6* 6.1%* -0.9%* 911.6 15% 4357.1

I12*

3388.3 753.4

6.70%

II12*

3918.3 871.2

8.20%

III12*

4156.1 924.1

7.50%

IV12*

4367.6

I 13*

3487.6

Contact Information

971.1

2.80% 233.7

777.8

2.40% 226.2

PMC Research

Tamar Jugheli

E-mail: pmcresearchcenter@pmcg.ge

E-mail: t.jugheli@pmcg.ge T: (+995) 2 921171 www.pmcg-i.com

261.2

-

217.7

-

199

-

9.20%

9.7%*

Source:

National Statistics Office of Georgia, Ministry of Finance of Georgia, National Bank of Georgia

*projected

-2-

Você também pode gostar

- Navigating The EU Integration ProcessDocumento1 páginaNavigating The EU Integration ProcessPolicy and Management Consulting GroupAinda não há avaliações

- Media Announcement - Sharing Experience of Public-Private Dialogue in EU Integration Process For Moldova and GeorgiaDocumento2 páginasMedia Announcement - Sharing Experience of Public-Private Dialogue in EU Integration Process For Moldova and GeorgiaPolicy and Management Consulting GroupAinda não há avaliações

- Press ReleaseDocumento1 páginaPress ReleasePolicy and Management Consulting GroupAinda não há avaliações

- Economic Outlook and Indicators - Tax Revenues - January - August 2013Documento2 páginasEconomic Outlook and Indicators - Tax Revenues - January - August 2013Policy and Management Consulting GroupAinda não há avaliações

- Economic Outlook and Indicators - Tax Revenues - July 2013Documento2 páginasEconomic Outlook and Indicators - Tax Revenues - July 2013Policy and Management Consulting GroupAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- LECTURE NOTES-EAT 359 (Water Resources Engineering) - Lecture 1 - StudentDocumento32 páginasLECTURE NOTES-EAT 359 (Water Resources Engineering) - Lecture 1 - StudentmusabAinda não há avaliações

- Buss 37 ZemaljaDocumento50 páginasBuss 37 ZemaljaOlga KovacevicAinda não há avaliações

- DR K.M.NAIR - GEOSCIENTIST EXEMPLARDocumento4 páginasDR K.M.NAIR - GEOSCIENTIST EXEMPLARDrThrivikramji KythAinda não há avaliações

- A V N 2 0 0 0 9 Airspace Management and Air Traffic Services Assignment 1Documento2 páginasA V N 2 0 0 0 9 Airspace Management and Air Traffic Services Assignment 1Tanzim Islam KhanAinda não há avaliações

- Floret Fall Mini Course Dahlia Sources Updated 211012Documento3 páginasFloret Fall Mini Course Dahlia Sources Updated 211012Luthfian DaryonoAinda não há avaliações

- Datasheet MEC MPS200 v1 2018Documento4 páginasDatasheet MEC MPS200 v1 2018Cepi Sindang KamulanAinda não há avaliações

- Safety AuditDocumento9 páginasSafety AuditRobena Nagum BagasAinda não há avaliações

- CARBOWAX™ Polyethylene Glycol (PEG) 1000Documento2 páginasCARBOWAX™ Polyethylene Glycol (PEG) 1000Anonymous vJPniV7Ainda não há avaliações

- Unknown Facts About Physicians Email List - AverickMediaDocumento13 páginasUnknown Facts About Physicians Email List - AverickMediaJames AndersonAinda não há avaliações

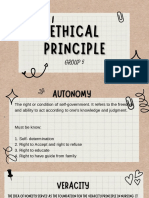

- Group 5 - Ethical PrinciplesDocumento11 páginasGroup 5 - Ethical Principlesvirgo paigeAinda não há avaliações

- Library PDFDocumento74 páginasLibrary PDFfumiAinda não há avaliações

- 99 AutomaticDocumento6 páginas99 AutomaticDustin BrownAinda não há avaliações

- 13105389Documento22 páginas13105389Larry RicoAinda não há avaliações

- Experiment Number 16 Formal ReportDocumento4 páginasExperiment Number 16 Formal Reportapi-524547303Ainda não há avaliações

- Dissertation On: To Asses The Impact of Organizational Retention Strategies On Employee Turnover: A Case of TescoDocumento44 páginasDissertation On: To Asses The Impact of Organizational Retention Strategies On Employee Turnover: A Case of TescoAhnafTahmidAinda não há avaliações

- Emission Estimation Technique Manual: For Mining and Processing of Non-Metallic MineralsDocumento84 páginasEmission Estimation Technique Manual: For Mining and Processing of Non-Metallic MineralsAbdelaziem mahmoud abdelaalAinda não há avaliações

- Rajivgandhi University of Health Sciences Bangalore, KarnatakaDocumento19 páginasRajivgandhi University of Health Sciences Bangalore, KarnatakaHUSSAINA BANOAinda não há avaliações

- Dryer Regenerative Blower Purge DBP 02250195 405 R00 PDFDocumento84 páginasDryer Regenerative Blower Purge DBP 02250195 405 R00 PDFjennyAinda não há avaliações

- UgpeDocumento3 páginasUgpeOlety Subrahmanya SastryAinda não há avaliações

- Biomedical Admissions Test 4500/12: Section 2 Scientific Knowledge and ApplicationsDocumento20 páginasBiomedical Admissions Test 4500/12: Section 2 Scientific Knowledge and Applicationshirajavaid246Ainda não há avaliações

- Electric Field Summary NotesDocumento11 páginasElectric Field Summary NotesVoyce Xavier PehAinda não há avaliações

- Issue of HomosexualityDocumento4 páginasIssue of HomosexualityT-2000Ainda não há avaliações

- SA 8000 Audit Check List VeeraDocumento6 páginasSA 8000 Audit Check List Veeranallasivam v92% (12)

- Earth Loop ImpedanceDocumento5 páginasEarth Loop ImpedanceKaranjaAinda não há avaliações

- Facts About Concussion and Brain Injury: Where To Get HelpDocumento20 páginasFacts About Concussion and Brain Injury: Where To Get HelpJess GracaAinda não há avaliações

- Boeco BM-800 - User ManualDocumento21 páginasBoeco BM-800 - User ManualJuan Carlos CrespoAinda não há avaliações

- MAOH600 Ropu 48 Presentation Script and ReferencesDocumento10 páginasMAOH600 Ropu 48 Presentation Script and ReferencesFano AsiataAinda não há avaliações

- Hemostatic AgentsDocumento18 páginasHemostatic AgentshariAinda não há avaliações

- Grand Hyatt Manila In-Room Dining MenuDocumento14 páginasGrand Hyatt Manila In-Room Dining MenuMetroStaycation100% (1)