Escolar Documentos

Profissional Documentos

Cultura Documentos

Vasundara Oil and Ami Limited Case Soln

Enviado por

Barath JeganDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Vasundara Oil and Ami Limited Case Soln

Enviado por

Barath JeganDireitos autorais:

Formatos disponíveis

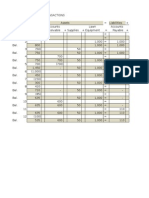

Vasundhra Oil India

FIFO

LIFO

Average

Sales

9,45,000

9,45,000

9,45,000

Beginning Inventory

3,00,000

3,00,000

3,00,000

Purchases

8,73,000

8,73,000

8,73,000

Closing Inventory

3,88,500

3,85,500

3,81,225

COGS

7,84,500

7,87,500

7,91,775

25,000

25,000

25,000

1,35,500

1,32,500

1,28,225

Expenses

Total Profit/Loss

Purchases

!

2,00,000 x 2.85 = Rs. 5,70,000

!

!

!

1,00,000 x 3.03 = Rs. 3,03,000

!

!

____________

!

!

Rs. 8,73,000

Closing Inventory

!

FIFO

LIFO

Weighted Average

!

!

!

!

((1,00,000 x 3.00) + (2,00,000 x 2.85) + (1,00,000 x 3.03)) / 4,00,000

= 2.9325 per litre

1,30,000 x 2.9325 = Rs. 3,81,225

(1,00,000 x 3.03) + (30,000 x 2.85) = Rs. 3,88,500

(1,00,000 x 3.00) + (30,000 x 2.85) = Rs. 3,85,500

Ami Limited - FIFO

Date

Particulars

Amount

(Dr.)

Date

June

Opening Stock

8,400

October

July

Purchase

August

Particulars

Amount

(Cr.)

Cost of Sales

22,540

9,200

November Cost of Sales

35,510

Purchase

24,700

December Cost of Sales

26,250

September Purchase

52,500

December Goods Lost

5,250

Closing Stock

5,250

COGS

!

!

!

!

October:

!

!

Opening Stock value = 8400/200 = Rs. 42.00 per unit

(200 x 42.00) + (200 x 46.00) + (100 x 49.40) = Rs. 22,540

!

!

!

!

November:

!

!

(400 x 49.40) + (300 x 52.50) = Rs. 35,510

!

!

!

!

December:

!

!

(500 x 52.50) = Rs. 26,250

!

!

!

!

!

!

(100 x 52.50) = Rs. 5,250

Profit/Loss

!

!

!

!

Total Sales:

!

!

(500 x 66.00) + (700 x 70.00) + (500 x 75.00) = Rs. 1,19,500

!

!

!

!

Expenses:

!

!

Total Profit/Loss: 119500 - 84300 - 15250 = Rs. 19,950

Total COGS: 22540 + 35510 + 26250 = Rs. 84,300

10,000 + 5,250 = Rs. 15,250

Ami Limited - LIFO

Date

Particulars

Amount

(Dr.)

Date

June

Opening Stock

8,400

October

July

Purchase

August

Particulars

Amount

(Cr.)

Cost of Sales

26,250

9,200

November Cost of Sales

36,130

Purchase

24,700

December Cost of Sales

24,020

September Purchase

52,500

December Goods Lost

4,200

Closing Stock

4,200

COGS

Opening Stock value = 8400/200 = Rs. 42.00 per unit

!

!

!

!

October:

!

!

(500 x 52.50) = Rs. 26,250

!

!

!

!

November:

!

!

(500 x 52.50) + (200 x 49.40) = Rs. 36,130

!

!

!

!

December:

!

!

(300 x 49.40) + (200 x 46.00) = Rs. 24,020

!

!

!

!

!

!

(100 x 42.00) = Rs. 4,200

Profit/Loss

!

!

!

!

Total Sales:

!

!

(500 x 66.00) + (700 x 70.00) + (500 x 75.00) = Rs. 1,19,500

!

!

!

!

Expenses:

!

!

Total Profit/Loss: 119500 - 86,400 - 14200 = Rs. 18,900

Total COGS: 26250 + 36130 + 24020 = Rs. 86,400

10,000 + 4,200 = Rs. 14,200

Ami Limited - Weighted Average

Date

Particulars

Amount

(Dr.)

Date

June

Opening Stock

8,400

October

July

Purchase

August

Particulars

Amount

(Cr.)

Cost of Sales

24,947.50

9,200

November Cost of Sales

34,926.50

Purchase

24,700

December Cost of Sales

24,947.50

September Purchase

52,500

December Goods Lost

4,989.50

Closing Stock

4,989

COGS

Opening Stock value = 8400/200 = Rs. 42.00 per unit

!

!

!

!

!

!

Stock Value:

!

!

((200 x 42.00) + (200 x 46.00) + (500 x 49.40) +

!

!

(1000 x 52.50)) / 1900 = Rs. 49.895

!

!

!

!

October:

!

!

(500 x 49.895) = Rs. 24,947.50

!

!

!

!

November:

!

!

(700 x 49.895) = Rs. 34,926.50

!

!

!

!

December:

!

!

(500 x 49.895) = Rs. 24,947.50

!

!

!

!

!

!

(100 x 49.895) = Rs. 4,989.50

Profit/Loss

!

!

!

!

Total Sales:

!

!

(500 x 66.00) + (700 x 70.00) + (500 x 75.00) = Rs. 1,19,500

!

!

!

!

Expenses:

!

!

Total Profit/Loss: 119500 - 84,821.50 - 14989 = Rs. 19,689.50

Total COGS: 24947.50 + 34926.50 + 24947.50 = Rs. 84,821.50

10,000 + 4,989 = Rs. 14,989

Ami Limited - Best Valuation Method for Profit Measure

Last In First Out (LIFO) would be the best method of valuation for

measuring profit in this scenario. This is because the scenario depicts one with positive

rate of inflation and the prices keep increasing, in this case the net income quoted in the

income statement will be the least in LIFO, as can be observed from the results, as a

result the tax that would be payable is greatly minimized and would result in increased

cash flow. Even if all the inventory were to be exhausted, the tax payable would be equal

to FIFO and still the payment would have been delayed.

Você também pode gostar

- EOS1100D BrochureDocumento10 páginasEOS1100D BrochurecmizalpccfuAinda não há avaliações

- Who's Afraid of The Uncanny ValleyDocumento4 páginasWho's Afraid of The Uncanny ValleyBarath JeganAinda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (894)

- MWCDocumento22 páginasMWCBarath Jegan100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Brain - Computer Interfacing (BCI)Documento21 páginasBrain - Computer Interfacing (BCI)Barath JeganAinda não há avaliações

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Lange - Pre-Startup Formal Business Plans and Post-Startup Performance. A Study of 116 New VentureDocumento26 páginasLange - Pre-Startup Formal Business Plans and Post-Startup Performance. A Study of 116 New VentureYosimar Canchari LaquiAinda não há avaliações

- Recitation Quiz 1Documento5 páginasRecitation Quiz 1BlairEmrallafAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Cagayan State University Taxation Law 1 NotesDocumento21 páginasCagayan State University Taxation Law 1 NotesBill DanaoAinda não há avaliações

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- PartnershipDocumento92 páginasPartnershipMary Louise VillegasAinda não há avaliações

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- EFM4, CH 05, Slides, 07-02-18Documento44 páginasEFM4, CH 05, Slides, 07-02-18Ainun Nisa NAinda não há avaliações

- Final Account of Sole Trading ConcernDocumento7 páginasFinal Account of Sole Trading ConcernAMIN BUHARI ABDUL KHADER50% (2)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Corporate Governance IntroductionDocumento34 páginasCorporate Governance IntroductionIndira Thayil100% (2)

- Jim's LawncareDocumento18 páginasJim's LawncareJakeDickersonAinda não há avaliações

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- EY Managing Bribery and Corruption Risk in The Oil and Gas Industry PDFDocumento24 páginasEY Managing Bribery and Corruption Risk in The Oil and Gas Industry PDFNicolle HurtadoAinda não há avaliações

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Cost of Goods Old Transport Operating ExpDocumento24 páginasCost of Goods Old Transport Operating Expapi-3705996Ainda não há avaliações

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- Statement of Cash Flows Ca5106Documento57 páginasStatement of Cash Flows Ca5106Bon juric Jr.Ainda não há avaliações

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- MANAGEMENT ADVISORY SERVICES ENGAGEMENTDocumento12 páginasMANAGEMENT ADVISORY SERVICES ENGAGEMENTKim Cristian MaañoAinda não há avaliações

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Exercises: Ex. 10-131-Plant Asset AccountingDocumento4 páginasExercises: Ex. 10-131-Plant Asset AccountingCarlo ParasAinda não há avaliações

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- Marginal productivity theory explains factor pricingDocumento19 páginasMarginal productivity theory explains factor pricingM ManjunathAinda não há avaliações

- Afibl C1-50%Documento1 páginaAfibl C1-50%Mope SASAinda não há avaliações

- Geetha M.Com Practical RecordsDocumento79 páginasGeetha M.Com Practical Recordsgeethrk12Ainda não há avaliações

- Tax On IndividualsDocumento9 páginasTax On IndividualsshakiraAinda não há avaliações

- Plant Business PlanDocumento9 páginasPlant Business PlanramsekherAinda não há avaliações

- Ebook b291 Ab E3i1 Web027466Documento40 páginasEbook b291 Ab E3i1 Web027466Graham Burns100% (1)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Liquidity and Financial Performance A Correlational Analysis of Quoted Non Financial Firms in GhanaDocumento11 páginasLiquidity and Financial Performance A Correlational Analysis of Quoted Non Financial Firms in GhanaEditor IJTSRDAinda não há avaliações

- 6th Sessiom - Audit of Investment STUDENTDocumento17 páginas6th Sessiom - Audit of Investment STUDENTNIMOTHI LASEAinda não há avaliações

- Bhurelal Money LaunderingDocumento262 páginasBhurelal Money Launderingtyrwer100% (1)

- Capital Gain Tax-CGT System: NCCPLDocumento49 páginasCapital Gain Tax-CGT System: NCCPLNaveed KhanAinda não há avaliações

- Knowledge Process OutsourcingDocumento48 páginasKnowledge Process OutsourcingCalmguy ChaituAinda não há avaliações

- Dodd - For Whom Are Corporate Managers TrusteesDocumento20 páginasDodd - For Whom Are Corporate Managers TrusteesPleshakov Andrey100% (1)

- PayslipDocumento1 páginaPayslipChristine Aev OlasaAinda não há avaliações

- Final Exammm 3Documento10 páginasFinal Exammm 3Marianne Adalid MadrigalAinda não há avaliações

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Financial Performance Analysis of Nabil BankDocumento48 páginasFinancial Performance Analysis of Nabil BankKishan SahAinda não há avaliações

- Partnership Formation, Operation, and Change in OwnershipDocumento99 páginasPartnership Formation, Operation, and Change in Ownershipbaldoewszxc80% (5)

- Illustrative Financial Statements O 201210Documento316 páginasIllustrative Financial Statements O 201210Yogeeshwaran Ponnuchamy100% (1)