Escolar Documentos

Profissional Documentos

Cultura Documentos

Capitalbudgeting

Enviado por

kbps143Descrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Capitalbudgeting

Enviado por

kbps143Direitos autorais:

Formatos disponíveis

CAPITAL BUDGETING

CAPITAL BUDGETING =INVESTING in Long-term Assets CAPITAL: Fixed assets used in production BUDGET: Plan of in- and outflows during some period CAPITAL BUDGET: A list of planned investment (i.e., expenditures onfixed assets) outlays for different projects. CAPITAL BUDGETING: Process of selecting viable investment projects.

SIGNIFICANCE OF CAPITAL BUDGETING:

1. Substantial Capital Outlays: capital budgeting decisions involve substantial capital outlays. 2. Long-term implications: capital budgeting proposals are of longer duration and hence have longterm implications. 3. Strategic in nature: capital budgeting decision can affect the future of the company significantly as it constitutes the strategic determinant for success of the company. a right investment decision is the secret of the success of many business enterprises. 4. Irreversible: once the funds are committed to a particular project, we cannot take back the decision. if the decision is to be reversed, we may have to lose a significant portion of the funds already committed. it may involve loss of time and efforts. In other words, the capital budgeting decisions are irreversible or may not be easily reversible.

BASIC STEPS OF CAPITAL BUDGETING:

1. 2. 3. 4. 5.

Estimate the cash flows Assess the riskiness of the cash flows. Determine the appropriate discount rate. Find the PV of the expected cash flows. Accept the project if PV of inflows > costs.

Capital budgeting decisions: 1. Construction of a new building, or renovation of existing old buildings. 2. Interior decoration of a given building. 3. Purchase of technology from a foreign country. 4. Building a production facility 5. Buying a new delivery truck. 6. Making a new product. 7. Starting a new business 8. Replacement decisions for replacing worn out or damaged equipment as well as replacing obsolete equipment. And so on. METHOD OF CAPITAL BUDGETING: A) Traditional methods 1. Payback period. 2. Accounting rate of return B) Discounted cash flow methods 1. Internal rate of return 2. Net present value 3. Profitability index Payback period. The length of time until the accumulated cash flows from the investment equal or exceed the original cost. We will assume that cash flows are generated continuously during a period. Advantages and Disadvantages of the Payback Rule Advantages Easy to Understand Biased toward liquidity Allows for quick evaluation of managers Adjusts for uncertainty of later cash flows (by ignoring them altogether)

Disadvantages Ignores the time value of money Ignores cash flow beyond the payback period Biased against long-term projects Internal rate of return: The discount rate that makes the present value of future cash flows equal to the initial cost of the investment.

Advantages and Disadvantages of the IRR Rule

Advantages

Closely related to NPV rule, often leading to the same decisions Easy to understand and communicate

Disadvantages

May result in multiple answers with non-conventional cash flows.

May lead to incorrect decisions with mutually exclusive investment projects.

Not always easy to calculate.

Net Present Value Rule (NPV): The net present value is the difference between the market value

of an investment and its cost.

Você também pode gostar

- Applied Corporate Finance. What is a Company worth?No EverandApplied Corporate Finance. What is a Company worth?Nota: 3 de 5 estrelas3/5 (2)

- Capital Budgeting: Presented by AglaiaDocumento12 páginasCapital Budgeting: Presented by AglaiaVishal AsijaAinda não há avaliações

- FM Group AssignmentDocumento11 páginasFM Group AssignmentHailemelekot TerefeAinda não há avaliações

- Financial Management 2Documento159 páginasFinancial Management 2Ivani Katal0% (2)

- FM Unit 2 CB Part B QaDocumento6 páginasFM Unit 2 CB Part B QaVasugi KumarAinda não há avaliações

- Capital Budgeting NotesDocumento46 páginasCapital Budgeting NotesShilpa Arora NarangAinda não há avaliações

- 1,,WEEK 1-2 - Introduction To Capital BudgetingDocumento31 páginas1,,WEEK 1-2 - Introduction To Capital BudgetingKelvin mwaiAinda não há avaliações

- Capital Budgeting - THEORYDocumento9 páginasCapital Budgeting - THEORYAarti PandeyAinda não há avaliações

- UntitledDocumento12 páginasUntitledPikki LovarajuAinda não há avaliações

- Financial Management Notes SRK UNIT 2Documento13 páginasFinancial Management Notes SRK UNIT 2Pruthvi RajAinda não há avaliações

- Ajith ProjectDocumento89 páginasAjith ProjectAnonymous MhCdtwxQIAinda não há avaliações

- Capital BudgetingDocumento13 páginasCapital Budgetingaon aliAinda não há avaliações

- Unit 7Documento29 páginasUnit 7Nigussie BerhanuAinda não há avaliações

- Mba Capital BudgetingDocumento14 páginasMba Capital BudgetingGagan Deep0% (1)

- Capital Budgeting MeaningDocumento13 páginasCapital Budgeting MeaningHarihara PuthiranAinda não há avaliações

- Importance of Capital BudgetingDocumento4 páginasImportance of Capital BudgetingSauhard AlungAinda não há avaliações

- Investment Appraisal MethodsDocumento15 páginasInvestment Appraisal MethodsFaruk Hossain100% (1)

- Treatise On Capital BudgetingDocumento6 páginasTreatise On Capital BudgetingRohit BajpaiAinda não há avaliações

- CH 5 6 Capital BudgetingDocumento94 páginasCH 5 6 Capital BudgetingNikita AggarwalAinda não há avaliações

- Discuss The Techniques of Capital BudgetingDocumento1 páginaDiscuss The Techniques of Capital BudgetingMokhlesurAinda não há avaliações

- Concept of Capital Budgeting: Capital Budgeting Is A Process of Planning That Is Used To AscertainDocumento11 páginasConcept of Capital Budgeting: Capital Budgeting Is A Process of Planning That Is Used To AscertainLeena SachdevaAinda não há avaliações

- Chapter One: Capital Budgeting Decisions: 1.2. Classification of Projects Independent Verses Mutually Exclusive ProjectsDocumento25 páginasChapter One: Capital Budgeting Decisions: 1.2. Classification of Projects Independent Verses Mutually Exclusive ProjectsezanaAinda não há avaliações

- Capital Budgeting: Seminar OnDocumento14 páginasCapital Budgeting: Seminar OnRamaque Jawaid WarsiAinda não há avaliações

- Final ProjectDocumento65 páginasFinal ProjectD PriyankaAinda não há avaliações

- Unit 3 ID - CBDocumento62 páginasUnit 3 ID - CBASHISH KUMARAinda não há avaliações

- Chapter 7 - Capital BudgetingDocumento3 páginasChapter 7 - Capital BudgetingAngelica Joy ManaoisAinda não há avaliações

- Long Term Inv + FundamentalsDocumento13 páginasLong Term Inv + Fundamentalssamuel kebedeAinda não há avaliações

- Capital BudgetingDocumento2 páginasCapital BudgetingMuhammad Akmal HossainAinda não há avaliações

- Session 3-4 Capital BudgetingDocumento39 páginasSession 3-4 Capital BudgetingHaritika ChhatwalAinda não há avaliações

- Vinay ProjectDocumento55 páginasVinay ProjectD Priyanka100% (1)

- Unit 3 - Scoman2Documento10 páginasUnit 3 - Scoman2christian guile figueroaAinda não há avaliações

- Study Note - 7: Capital BudgetingDocumento36 páginasStudy Note - 7: Capital Budgetingshivam kumarAinda não há avaliações

- An Overview of Capital BudgetingDocumento3 páginasAn Overview of Capital BudgetingChristene Grava TenebrosoAinda não há avaliações

- Capital Budgeting and Time Value of MoneyDocumento35 páginasCapital Budgeting and Time Value of MoneyJiyaAinda não há avaliações

- Capital BudgetingDocumento20 páginasCapital BudgetingiptrcrmlAinda não há avaliações

- (Lecture 1 & 2) - Introduction To Investment Appraisal MethodsDocumento21 páginas(Lecture 1 & 2) - Introduction To Investment Appraisal MethodsAjay Kumar Takiar100% (1)

- Capital BudgetingDocumento18 páginasCapital BudgetingHelping HandAinda não há avaliações

- Capital Budgeting Addresses The Issue Ofstrategic Long-Term InvestmentDocumento3 páginasCapital Budgeting Addresses The Issue Ofstrategic Long-Term InvestmentBryan LluismaAinda não há avaliações

- Capital Budgeting Decision Is An Important, Crucial and Critical Business Decision Due ToDocumento7 páginasCapital Budgeting Decision Is An Important, Crucial and Critical Business Decision Due ToGaganAinda não há avaliações

- Managers.: Investment Decisions Are Made by Investors and InvestmentDocumento5 páginasManagers.: Investment Decisions Are Made by Investors and InvestmentRe KhanAinda não há avaliações

- FM 1 CH 4 (Lti) My MLC ExtDocumento19 páginasFM 1 CH 4 (Lti) My MLC ExtMELAT ROBELAinda não há avaliações

- KC Financial DecisionsDocumento111 páginasKC Financial DecisionsSatish PatilAinda não há avaliações

- FFM Chapter 8Documento5 páginasFFM Chapter 8Dawn CaldeiraAinda não há avaliações

- Chapter VDocumento32 páginasChapter Vhenokal99Ainda não há avaliações

- .... Capital Budgeting at YES BankDocumento50 páginas.... Capital Budgeting at YES Bankmoula nawazAinda não há avaliações

- Capital Budgeting-Research FinalDocumento22 páginasCapital Budgeting-Research FinalNour Fawaz100% (1)

- An Assignment On Capital Budgeting ManojDocumento9 páginasAn Assignment On Capital Budgeting Manojrupesh220387Ainda não há avaliações

- Mba Sem 2 Corporate Finance Capital BudgetingDocumento17 páginasMba Sem 2 Corporate Finance Capital Budgetingekta mehtaAinda não há avaliações

- FM I - CH 6 NoteDocumento22 páginasFM I - CH 6 NoteEtsub SamuelAinda não há avaliações

- 8.capital BudgetingDocumento82 páginas8.capital BudgetingOblivion OblivionAinda não há avaliações

- Lec5. Capital BudgetingDocumento78 páginasLec5. Capital Budgetingvivek patelAinda não há avaliações

- Management of Capital BudgetingDocumento4 páginasManagement of Capital BudgetingMuhammad Furqan AkramAinda não há avaliações

- DM On CapExp - StudentDocumento24 páginasDM On CapExp - StudentrbnbalachandranAinda não há avaliações

- Capital Budgeing ReviewDocumento20 páginasCapital Budgeing ReviewBalakrishna ChakaliAinda não há avaliações

- Financial Management Assignment 10747Documento11 páginasFinancial Management Assignment 10747Deeksha ThakurAinda não há avaliações

- Capital BudgetingDocumento64 páginasCapital BudgetingNiaz AhmedAinda não há avaliações

- (Lecture 1 & 2) - Introduction To Investment Appraisal Methods 2Documento21 páginas(Lecture 1 & 2) - Introduction To Investment Appraisal Methods 2Ajay Kumar TakiarAinda não há avaliações

- Capital Budgeting Decision: NPV Vs Irr Conflicts and ResolutionDocumento18 páginasCapital Budgeting Decision: NPV Vs Irr Conflicts and Resolutionnasir abdulAinda não há avaliações

- MB20202 Corporate Finance Unit II Study MaterialsDocumento18 páginasMB20202 Corporate Finance Unit II Study MaterialsSarath kumar CAinda não há avaliações

- Leadership Theories, Styles and SkillsDocumento9 páginasLeadership Theories, Styles and SkillsCharles Sauer0% (1)

- Ashrae Certification Brochure PDFDocumento4 páginasAshrae Certification Brochure PDFAsiful islamAinda não há avaliações

- Lab Manual: B.Tech 1 SEMDocumento4 páginasLab Manual: B.Tech 1 SEMSumit PandeyAinda não há avaliações

- I) If Any of The Three Components Are Missing, Then A Fire Cannot Start. Ii) If Any of The Three Components Are Removed, Then The Fire Will Go OutDocumento3 páginasI) If Any of The Three Components Are Missing, Then A Fire Cannot Start. Ii) If Any of The Three Components Are Removed, Then The Fire Will Go OutRohit YadavAinda não há avaliações

- Database Design ConceptDocumento4 páginasDatabase Design ConceptChiranSJ100% (1)

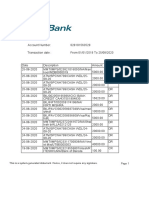

- This Is A System-Generated Statement. Hence, It Does Not Require Any SignatureDocumento15 páginasThis Is A System-Generated Statement. Hence, It Does Not Require Any SignaturemohitAinda não há avaliações

- Fuel Consumption ParametersDocumento8 páginasFuel Consumption ParametersdanutspataruAinda não há avaliações

- France (Comparative Local System)Documento9 páginasFrance (Comparative Local System)Ahmed TarekAinda não há avaliações

- (9-7) Sps. Bernardo vs. Union BankDocumento3 páginas(9-7) Sps. Bernardo vs. Union BankJan Carlo SanchezAinda não há avaliações

- Image Fusion: An Overview: Zaid Omar Tania StathakiDocumento5 páginasImage Fusion: An Overview: Zaid Omar Tania Stathakipraveenkumar smAinda não há avaliações

- Collections Management Policy: Approved by The Board of Trustees On March 2, 2021Documento21 páginasCollections Management Policy: Approved by The Board of Trustees On March 2, 2021ﺗﺴﻨﻴﻢ بن مهيديAinda não há avaliações

- Politeness Theory and Conversational Refusals Associations Between Various Types of Face Threatand Perceived CompetenceDocumento21 páginasPoliteness Theory and Conversational Refusals Associations Between Various Types of Face Threatand Perceived CompetenceDavid LeAinda não há avaliações

- Strategies Adopted by SwiggyDocumento3 páginasStrategies Adopted by SwiggyStuti JainAinda não há avaliações

- Digital Technology Revives ..Documento6 páginasDigital Technology Revives ..Chien C TschangAinda não há avaliações

- Basics JavaDocumento27 páginasBasics JavaSabari NathanAinda não há avaliações

- Disk Cleanup PDFDocumento3 páginasDisk Cleanup PDFMohammed Abdul MajeedAinda não há avaliações

- Leadership - Lecture - 2Documento65 páginasLeadership - Lecture - 2Tri Akhmad FirdausAinda não há avaliações

- University of Southeastern Philippines: Graduate School of EducationDocumento3 páginasUniversity of Southeastern Philippines: Graduate School of EducationRonna GoalsAinda não há avaliações

- Crime PreventionDocumento21 páginasCrime PreventionJun Mark BascoAinda não há avaliações

- CGHS FormDocumento3 páginasCGHS FormHarpreet SinghAinda não há avaliações

- Hacienda Starke V CuencaDocumento2 páginasHacienda Starke V CuencaGino Alejandro SisonAinda não há avaliações

- Finite Difference Method of Modelling Groundwater FlowDocumento7 páginasFinite Difference Method of Modelling Groundwater FlowVenegasAinda não há avaliações

- Division Memorandum No. 469, s.2020Documento5 páginasDivision Memorandum No. 469, s.2020Nolan T. AlzolAinda não há avaliações

- Accord - DA-XDocumento95 páginasAccord - DA-XPeter TurnšekAinda não há avaliações

- Companion: Material Safety Data Sheet ® Liquid Biological FungicideDocumento2 páginasCompanion: Material Safety Data Sheet ® Liquid Biological FungicideNatalie TorresAinda não há avaliações

- Session 3 - Objective - Understanding The Leadership Systems Dessign An Principles (Catagory 1)Documento53 páginasSession 3 - Objective - Understanding The Leadership Systems Dessign An Principles (Catagory 1)Anonymous HfKaQUGXAinda não há avaliações

- 107 CalculationsDocumento3 páginas107 CalculationsAna Tabanao100% (1)

- PERKINS 2206a-E13tag5 Electropak Pn1882Documento2 páginasPERKINS 2206a-E13tag5 Electropak Pn1882Patricia J ÁngelesAinda não há avaliações

- Final Year Project "Addressing Marketing and Growth Issues of Chattha's Pakistani Street Food" BBA-8Documento143 páginasFinal Year Project "Addressing Marketing and Growth Issues of Chattha's Pakistani Street Food" BBA-8Muhammad Humayun KhanAinda não há avaliações

- Fairtrade, Employment and Poverty Reduction in Ethiopia and Uganda - Final Report To DFID, April 2014Documento143 páginasFairtrade, Employment and Poverty Reduction in Ethiopia and Uganda - Final Report To DFID, April 2014poorfarmerAinda não há avaliações