Escolar Documentos

Profissional Documentos

Cultura Documentos

22 Upper Brook Street, London, United Kingdom W1K 7PZ

Enviado por

api-26055241Descrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

22 Upper Brook Street, London, United Kingdom W1K 7PZ

Enviado por

api-26055241Direitos autorais:

Formatos disponíveis

22 Upper Brook Street, London, United Kingdom W1K 7PZ, T: +44 (0) 20 7659 9444, Authorised and Regulated

by the FSA

67/F The Centre, 99 Queen’s Road, Central, Hong Kong, T: +852 2169 3905, Authorised and Regulated by the SFC

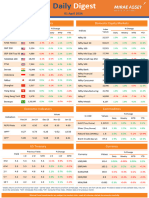

Maple Leaf Macro Volatility Fund May 2009 May-09 Month-end Capital Usage

STRATEGY: P&L (% VaR Budget)

To trade implied volatility as an asset class on a relative value Attrib Long Short RV Correl MacroV Net

or outright (long or short) basis, with a dual approach to trades

Equity -0.51% 12.0% 8.0% 3.0% 0.0% 1.0% 19.0%

from a volatility and macro perspective, within four markets

Fixed Income -0.16% 0.0% 2.0% 0.0% 0.0% 0.0% 2.0%

(equity, fixed income, foreign exchange, commodity) as well 0.0% 23.0%

Currency -0.66% 19.0% 19.0% 0.0% 5.0%

as cross market volatility trades. The multi-asset volatility Commodity 0.13% 6.0% 0.0% 3.0% 0.0% 4.0% 13.0%

approach creates significant synergies for derivatives trading, model-

ling and research.

INVESTMENT PHILOSOPHY: Fees: 1.5/20 with high watermark

Strive to be the premier hedge fund in volatility trading with Liquidity: Monthly, 180 day notice

expertise in modelling, executing, and managing risk in derivative Shares: Cayman master feeder & US LLC

markets based on four fundamental principles: 1. Dynamic Prime Brokers: Newedge, Deutsche Bank,

allocation of capital between asset classes. 2. Diversification of UBS

returns due to involvement in different asset classes and strate- Fund Administrator: Citi Hedge Fund Services

gies. 3. Double Alpha approach of screening every trade through Fund Auditors: Grant Thornton

a macro and a volatility filter. 4. Transfer of derivative knowledge Legal Advisors: Walkers, Bingham McCutchen

across markets in order to exploit synergies into profits.

TARGET ANNUAL RETURN: 15 %

TARGET RISK: 1.3% 1 day 95% VaR (13% Volatility)

Performance Statistics

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Totals*

2009 -0.58% 4.41% -2.57% -1.88% -1.20% -1.94%

2008 -3.11% 1.79% -1.70% 1.33% 2.34% 1.03% -1.70% -2.12% -1.91% -4.23% -0.66% -0.53% -9.29%

2007 0.82% 1.39% 0.44% 3.13% 2.32% 0.08% 2.96% -0.62% 2.30% 2.58% 1.04% 2.57% 20.69%

2006 6.17% 0.69% 1.61% 3.19% -3.34% -2.17% 1.03% 0.03% 0.43% 0.75% 1.83% 2.46% 13.07%

2005 0.30% -1.00% 0.45% 2.21% -0.20% -2.32% -0.22% 0.60% 0.22% 0.50% 1.39% 2.37% 4.29%

2004 4.77% 0.32% 1.91% 8.81% -0.96% 1.44% 1.19% 0.86% -0.85% 1.82% 0.14% 0.24% 21.11%

Standard Deviation 7.55%, Sharpe Ratio 0.65, Positive Months 68% May-09 estimate * After fees

Stress Test By Asset Class

EQUITY - current time decay -1 bps/day FX - current time decay 0 bps/day

Spot unch Spot 5sd Spot 5sd Spot unch Spot 5sd Spot 5sd

P&L Time Decay P&L Time Decay P&L Time Decay P&L Time Decay P&L Time Decay P&L Time Decay

Vols 20% -0.11% -0.01% 0.42% -0.01% 0.08% -0.01% Vols 20% -0.22% 0.00% -0.13% 0.00% -0.31% 0.00%

Vols 20% 0.12% -0.01% 0.63% -0.01% 0.27% -0.01% Vols 20% 0.21% 0.00% 0.33% 0.00% 0.10% 0.00%

FI - current time decay +1 bps/day COMM - current time decay -1 bps/day

Spot unch Spot 5sd Spot 5sd Spot unch Spot 5sd Spot 5sd

P&L Time Decay P&L Time Decay P&L Time Decay P&L Time Decay P&L Time Decay P&L Time Decay

Vols 20% -0.04% 0.01% -0.22% 0.01% -0.21% 0.01% Vols 20% -0.35% -0.01% -0.28% -0.01% -0.05% -0.02%

Vols 20% 0.04% 0.01% -0.16% 0.01% -0.15% 0.01% Vols 20% 0.38% -0.02% 0.28% -0.01% 0.87% -0.02%

LEGAL DISCLAIMER: This document is for information purposes only and should not be construed as an offer to sell or a solicitation of an offer

to buy any product or security. Any offer to sell investments will be subject to information circulated by the relevant Fund in a formal prospectus

or equivalent document and not on the basis of the information contained in this document. This document is intended for the sole use of the

recipient and is not to be reproduced or redistributed. Past performance is no guide to future returns.

The information in this document is strictly confidential.

Você também pode gostar

- Return and RiskDocumento20 páginasReturn and Riskdkriray100% (1)

- Academic Year 2019-2020: St. John College of Humanities & SciencesDocumento78 páginasAcademic Year 2019-2020: St. John College of Humanities & SciencesRinkesh SoniAinda não há avaliações

- Analyze Incremental Costs & Revenues for Better DecisionsDocumento80 páginasAnalyze Incremental Costs & Revenues for Better DecisionsJoshAinda não há avaliações

- Introduction To CandlestickDocumento28 páginasIntroduction To CandlestickAhmed Saeed AbdullahAinda não há avaliações

- Short Adxcellence Power Trend Strategies Charles SchaapDocumento85 páginasShort Adxcellence Power Trend Strategies Charles SchaapMedical Skg100% (1)

- GS Inflation Implementation 10-20Documento20 páginasGS Inflation Implementation 10-20bobmezzAinda não há avaliações

- Derivatives and Risk ManagementDocumento136 páginasDerivatives and Risk Managementabbas ali100% (3)

- OBN - Small Banks and The OTC Discount - Issue 34 (March 2021)Documento2 páginasOBN - Small Banks and The OTC Discount - Issue 34 (March 2021)Nate TobikAinda não há avaliações

- Work Sample - M&A Private Equity Buyside AdvisingDocumento20 páginasWork Sample - M&A Private Equity Buyside AdvisingsunnybrsraoAinda não há avaliações

- Own Brand Cosmetics and SkincareDocumento4 páginasOwn Brand Cosmetics and SkincareShe Carli0% (2)

- Gold Chart PatternsDocumento6 páginasGold Chart PatternsIndia shortsAinda não há avaliações

- Project evaluation factorsDocumento10 páginasProject evaluation factorssimmi33Ainda não há avaliações

- Currency Strategy: The Practitioner's Guide to Currency Investing, Hedging and ForecastingNo EverandCurrency Strategy: The Practitioner's Guide to Currency Investing, Hedging and ForecastingAinda não há avaliações

- Mercer-Capital Bank Valuation AKG PDFDocumento60 páginasMercer-Capital Bank Valuation AKG PDFDesmond Dujon HenryAinda não há avaliações

- Financial Valuation ToolsDocumento82 páginasFinancial Valuation Toolsomar100% (1)

- Third Point Investors Limited: Feeder Fund Into Third Point Offshore Fund, LTDDocumento4 páginasThird Point Investors Limited: Feeder Fund Into Third Point Offshore Fund, LTDPranab PattanaikAinda não há avaliações

- Fin 4150 Week 8 LecturesDocumento46 páginasFin 4150 Week 8 LecturesEric McLaughlinAinda não há avaliações

- ML Stragegic Balance INDEX - FACT SHEETDocumento3 páginasML Stragegic Balance INDEX - FACT SHEETRaj JarAinda não há avaliações

- ValuEngine Weekly NewsletterDocumento14 páginasValuEngine Weekly NewsletterValuEngine.comAinda não há avaliações

- Satori Fund II LP Monthly Newsletter - 2023 06Documento7 páginasSatori Fund II LP Monthly Newsletter - 2023 06Anthony CastelliAinda não há avaliações

- Understanding Risk and Return in Financial InvestmentsDocumento21 páginasUnderstanding Risk and Return in Financial InvestmentsAvinav SrivastavaAinda não há avaliações

- Selected Topic: The Role of Financial Derivatives in Emerging MarketsDocumento18 páginasSelected Topic: The Role of Financial Derivatives in Emerging MarketsAna RomeroAinda não há avaliações

- Aviva UK: One Aviva Twice The ValueDocumento17 páginasAviva UK: One Aviva Twice The ValueAviva GroupAinda não há avaliações

- Risk and Return PPT 2022 PDFDocumento54 páginasRisk and Return PPT 2022 PDFAvinav SrivastavaAinda não há avaliações

- Risk-Return Analysis of Stocks and PortfoliosDocumento8 páginasRisk-Return Analysis of Stocks and PortfoliosZAinda não há avaliações

- Chapter 4.risk Management For Changing Interest Rates - StudentDocumento22 páginasChapter 4.risk Management For Changing Interest Rates - StudentQuynh NguyenAinda não há avaliações

- Risk Measures: Risk Analysis Distribution of ReturnsDocumento7 páginasRisk Measures: Risk Analysis Distribution of ReturnsJBPS Capital ManagementAinda não há avaliações

- To Middle East: ReturnDocumento5 páginasTo Middle East: ReturnAndre_Setiawan_1986Ainda não há avaliações

- HDFC Asset Allocator Fund of Funds - NFO LeafletDocumento4 páginasHDFC Asset Allocator Fund of Funds - NFO LeafletJignesh PatelAinda não há avaliações

- Pavise Equity Partners LP Performance Summary and Commentary for July 2022Documento4 páginasPavise Equity Partners LP Performance Summary and Commentary for July 2022Kan ZhouAinda não há avaliações

- Global Div Inv Grade Income Trust II-IndyMac 2005-AR14!3!31-10Documento17 páginasGlobal Div Inv Grade Income Trust II-IndyMac 2005-AR14!3!31-10Barbara J. FordeAinda não há avaliações

- Too LiveDocumento2 páginasToo LiveValuEngine.comAinda não há avaliações

- Principles of Managerial Finance: Risk and ReturnDocumento57 páginasPrinciples of Managerial Finance: Risk and ReturnJoshAinda não há avaliações

- FX Composite InstitutionalDocumento1 páginaFX Composite InstitutionalDanger AlvarezAinda não há avaliações

- Mortgage Delinquency Rates: Mba Commercial/MultifamilyDocumento10 páginasMortgage Delinquency Rates: Mba Commercial/MultifamilyZerohedgeAinda não há avaliações

- On Portugal: .DJI 12,170.56 (+84.54) .SPX 1,309.66 (+12.12) .IXIC 2,736.42 (+38.12)Documento5 páginasOn Portugal: .DJI 12,170.56 (+84.54) .SPX 1,309.66 (+12.12) .IXIC 2,736.42 (+38.12)Andre SetiawanAinda não há avaliações

- 9-Risk ManagementDocumento21 páginas9-Risk ManagementNine Not Darp EightAinda não há avaliações

- 2point2 Capital - Investor Update Q1 FY22Documento6 páginas2point2 Capital - Investor Update Q1 FY22Anil GowdaAinda não há avaliações

- Historic Returns - Multi Cap Fund, Multi Cap Fund Performance Tracker Mutual Funds With Highest ReturnsDocumento5 páginasHistoric Returns - Multi Cap Fund, Multi Cap Fund Performance Tracker Mutual Funds With Highest ReturnssantuAinda não há avaliações

- Price and Return Data For Walmart (WMT) and Target (TGT)Documento8 páginasPrice and Return Data For Walmart (WMT) and Target (TGT)Raja17Ainda não há avaliações

- EDHEC-Risk Alternative Indexes - Overview February 2011Documento1 páginaEDHEC-Risk Alternative Indexes - Overview February 2011chris_clair9652Ainda não há avaliações

- Financial Risk ManagementDocumento30 páginasFinancial Risk ManagementVarun Kumar ChalotraAinda não há avaliações

- Daily Digest - 01 April, 2024Documento2 páginasDaily Digest - 01 April, 2024saraonahembram3Ainda não há avaliações

- January 29, 2010: Market OverviewDocumento9 páginasJanuary 29, 2010: Market OverviewValuEngine.comAinda não há avaliações

- ValuEngine Weekly Newsletter July 9, 2010Documento13 páginasValuEngine Weekly Newsletter July 9, 2010ValuEngine.comAinda não há avaliações

- Assignment Bond Equity Portfolio Management Strategies Chapter 8 Update 18.12.2022Documento11 páginasAssignment Bond Equity Portfolio Management Strategies Chapter 8 Update 18.12.2022Tya FauzieAinda não há avaliações

- Strategy Focus Report - Market Neutral EquityDocumento5 páginasStrategy Focus Report - Market Neutral EquityZerohedgeAinda não há avaliações

- Mini Case Chapter 6 - Week 3Documento6 páginasMini Case Chapter 6 - Week 3georgejane100% (3)

- Says "No" To BAC: .DJI 12,086.02 (+67.39) .SPX 1,297.54 (+3.77) .IXIC 2,698.30 (+14.43)Documento4 páginasSays "No" To BAC: .DJI 12,086.02 (+67.39) .SPX 1,297.54 (+3.77) .IXIC 2,698.30 (+14.43)Andre SetiawanAinda não há avaliações

- Crisis As A Crucible: A Jedi Guide To Investment Serenity!: Look Forward, You Must!Documento76 páginasCrisis As A Crucible: A Jedi Guide To Investment Serenity!: Look Forward, You Must!Izhar Rahman DwiputraAinda não há avaliações

- The ValuEngine Weekly Is An Investor Education Newsletter Focused OnDocumento10 páginasThe ValuEngine Weekly Is An Investor Education Newsletter Focused OnValuEngine.comAinda não há avaliações

- Black GoldDocumento2 páginasBlack GoldValuEngine.comAinda não há avaliações

- Daily Digest - 15 June, 2023Documento2 páginasDaily Digest - 15 June, 2023Anant VishnoiAinda não há avaliações

- ATARAXIA FUND Long/Short Performance and Risk Measures. June 2019.Documento4 páginasATARAXIA FUND Long/Short Performance and Risk Measures. June 2019.JBPS Capital ManagementAinda não há avaliações

- Wolfram - Alpha MSFT YHOO GOOG ReportDocumento7 páginasWolfram - Alpha MSFT YHOO GOOG ReportDvNetAinda não há avaliações

- Shinhan Balance Fund - Agustus - 2023 - enDocumento1 páginaShinhan Balance Fund - Agustus - 2023 - enwongjuliusAinda não há avaliações

- ValuEngine Weekly Newsletter July 30, 2010Documento16 páginasValuEngine Weekly Newsletter July 30, 2010ValuEngine.comAinda não há avaliações

- Final Market: Towards A New Hierarchy of Risks ?Documento19 páginasFinal Market: Towards A New Hierarchy of Risks ?Morningstar FranceAinda não há avaliações

- Penalized On Revenue Miss: .DJI 12,263.60 (-117.53.06) .SPX 1,314.16 (-10.30) .IXIC 2,744.79 (-26.72)Documento6 páginasPenalized On Revenue Miss: .DJI 12,263.60 (-117.53.06) .SPX 1,314.16 (-10.30) .IXIC 2,744.79 (-26.72)Andre SetiawanAinda não há avaliações

- Radasham Chandra Sarkar (038) JONY RAJ (098) Minhaz ArafatDocumento37 páginasRadasham Chandra Sarkar (038) JONY RAJ (098) Minhaz Arafatitsp.solution104Ainda não há avaliações

- CLO MathematicsDocumento7 páginasCLO MathematicsOUSSAMA NASRAinda não há avaliações

- GGP Final2010Documento23 páginasGGP Final2010Frank ParkerAinda não há avaliações

- Strategy Portfolio: Dravyaniti Consulting LLPDocumento13 páginasStrategy Portfolio: Dravyaniti Consulting LLPChidambara StAinda não há avaliações

- Interest Rate Derivatives: Fixed Income Markets Weekly, J. Younger Et Al., 27Documento3 páginasInterest Rate Derivatives: Fixed Income Markets Weekly, J. Younger Et Al., 27mittleAinda não há avaliações

- Skema TeknikalDocumento4 páginasSkema TeknikalBastian Calvin DeranggaAinda não há avaliações

- To Drop Capsugel: .DJI 12,400.03 (+22.31) .SPX 1,332.87 (+0.46) .IXIC 2,789.19 (-0.41)Documento5 páginasTo Drop Capsugel: .DJI 12,400.03 (+22.31) .SPX 1,332.87 (+0.46) .IXIC 2,789.19 (-0.41)Andre SetiawanAinda não há avaliações

- 107 23 Uber Valuation SlidesDocumento19 páginas107 23 Uber Valuation SlidesYeli LiuAinda não há avaliações

- B. RAK Ceramics (Bangladesh) Ltd. (For The Year Ended 31 December XXX)Documento6 páginasB. RAK Ceramics (Bangladesh) Ltd. (For The Year Ended 31 December XXX)Imdad JeshinAinda não há avaliações

- Exercise 3: Chapter 3Documento5 páginasExercise 3: Chapter 3ying huiAinda não há avaliações

- PI Foods Case Study: Resolving Distribution IssuesDocumento3 páginasPI Foods Case Study: Resolving Distribution Issuessushil messiAinda não há avaliações

- Accounting For Special Transaction C8 Prob 5Documento2 páginasAccounting For Special Transaction C8 Prob 5skilled legilimenceAinda não há avaliações

- Practice Question -2 Portfolio ManagementDocumento5 páginasPractice Question -2 Portfolio Managementzoyaatique72Ainda não há avaliações

- HGS Recognized As A Leader in Digital Marketing (Company Update)Documento2 páginasHGS Recognized As A Leader in Digital Marketing (Company Update)Shyam SunderAinda não há avaliações

- BSLR Del 1600447723 1 1Documento1 páginaBSLR Del 1600447723 1 1AdityaAinda não há avaliações

- GR Apwgraph AnswersDocumento7 páginasGR Apwgraph AnswersEzra Denise Lubong Ramel73% (15)

- New York Mercantile ExchangeDocumento16 páginasNew York Mercantile ExchangeTanzila khan100% (1)

- Detailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Documento11 páginasDetailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Charo GironellaAinda não há avaliações

- Midterm Exam - Attempt ReviewDocumento6 páginasMidterm Exam - Attempt ReviewMahmoud AliAinda não há avaliações

- 5684 SampleDocumento1 página5684 SampleChessking Siew HeeAinda não há avaliações

- Dyer2013 PDFDocumento574 páginasDyer2013 PDFMiguel Alejandro Diaz CastilloAinda não há avaliações

- The Impact of Digital Media and Technology On The Marketing MixDocumento40 páginasThe Impact of Digital Media and Technology On The Marketing MixFatin IzzatiAinda não há avaliações

- Unit 12 Capitalist Industrialization: StructureDocumento20 páginasUnit 12 Capitalist Industrialization: StructureAbhijeet JhaAinda não há avaliações

- Wal-Mart's Low-Cost StrategyDocumento2 páginasWal-Mart's Low-Cost StrategyShella FadelaAinda não há avaliações

- Sales Force, Internet and Direct MarketingDocumento30 páginasSales Force, Internet and Direct MarketingDedeMuhammadLuthfi0% (1)

- Derivative Market in IndiaDocumento13 páginasDerivative Market in IndiagunpriyaAinda não há avaliações

- Ind As 109 PDFDocumento5 páginasInd As 109 PDFashmit bahlAinda não há avaliações

- Sample QuestionsDocumento2 páginasSample QuestionsKajal JainAinda não há avaliações

- June 9-Acquisition of PPEDocumento2 páginasJune 9-Acquisition of PPEJolo RomanAinda não há avaliações

- FovewivusDocumento2 páginasFovewivusSREENIVASA MURTHY RAinda não há avaliações

- Bows Tie Die For Sy15 Businessplanpresentation Patricia Eusantos Allyssa SuarezDocumento14 páginasBows Tie Die For Sy15 Businessplanpresentation Patricia Eusantos Allyssa Suarezapi-358820386Ainda não há avaliações