Escolar Documentos

Profissional Documentos

Cultura Documentos

Bfs Roundup Flip 69

Enviado por

Shresth KotishDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Bfs Roundup Flip 69

Enviado por

Shresth KotishDireitos autorais:

Formatos disponíveis

BFS69 16 Aug, 2013 Weekly

th

www.learnwithflip.com

BFS Roundup @ FLIP

Updates @ FLIP

More than a thousand Bschoolers (from 60+ premier b-schools) have already enrolled for the FLIP National Challenge, a fiercely fought all India contest ; where B Schoolers write select FLIP Certifications, to benchmark themselves, against their peers. An All India Ranking will be given to the top 50 scorers. Besides a strong Campus placement edge, the contest also offers off campus placement benefits to the top 10 scorers. This includes PPIs, Internships, Career Talks, Mock Interviews, and Resume Counseling etc. to Power Your Placements Click here to attempt live interview simulations in the areas of capital markets, corporate banking, finance and banking (summers), to check your preparedness for placements Click here to see the complete details of the contest. FLIP - setting a BFS knowledge benchmark. CAD Jitters: Customs duty on gold, platinum and silver raised to 10% The government increased Customs duty on gold, platinum and silver to 10 per cent, in a move aimed at curbing the imports of these precious metals to limit its current account deficit. Jewellers criticized the move the saying that this will encourage gold smuggling and increase the prices. FLIPs View: These imports contribute a whopping 61% of the CAD. That is the concern. With the festival season coming up, one will need to track how price sensitive this market is, in India.

The week that was.

US says BofA lied to investors about mortgage-bond risks The US government has filed two civil lawsuits against Bank of America alleging the bank of investor fraud in its sale of $850 million of residential mortgage-backed securities. Bank of America is accused of making misleading statements and failing to disclose important facts about the pool of mortgages underlying` these securities. FLIPs View: This is not surprising, and the investors are also possibly to blame for not doing their due diligence. But given the low interest rates, and lack of alternate investments, it was easy for BofA to down sell these without adequate disclosures. -------------------------------------------------Companies Bill passed The much-awaited Companies Bill has been passed by Rajya Sabha. Now, only the Presidents assent will be required for it to become law. New bill includes reforms on CSR, corporate governance, investor protection etc. FLIPs View: 1956 was the last bill that tells you how long it takes to overhaul the system in India. A good step, with far reaching implications. The focus of the new bill is on governance and transparency. ---------------------------------------------------Japan's debt tops 1,000 trillion yen Japans national debt exceeded 1000 trillion yen for the first time. This exceeds the economies of Germany, France and the UK combined. FLIPs View: Thats over 10 trillion dollars. To put it in perspective the US is at 17 trillion, and is about 3 times larger than Japan. Unless Abe and Kurodas experiment of kick starting the economy pans out, the problem can only get worse.

www.learnwithflip.com

BFS Roundup @ FLIP

Did you know?

Indian rupee hit a record low of 61.80 against the USD recently. Some facts on the Indian rupee which you might find interesting: 1947: Indian rupee was linked to the British pound (GBP), and its value was at par with American dollar. Yes! 1 USD = 1 INR 1948-1966: Post-independence, India chose to adopt a fixed rate currency regime. The rupee was pegged at INR 4.79 against a dollar between 1948 and 1966. 1966: Two consecutive wars, one with China in 1962 and another one with Pakistan in 1965, resulted in a huge deficit on India's budget, forcing the government to devalue the currency to INR 7.57 against the dollar. 1971: The rupee's link with the British currency was broken, and it was linked directly to the US dollar. 1975: The Indian rupee was then linked to a basket of three currencies comprising the US dollar, the Japanese yen and the German deutschemark. The value of the Indian rupee was pegged at INR 8.39 against a dollar. 1985: Rupee was further devalued to INR 12 against the dollar. 1991:India faced a serious balance of payment crisis and was forced to sharply devalue its currency. The currency was devalued to INR 17.90 against a dollar. 1993: The exchange rate was freed, to be determined by the market, with provisions of intervention by the central bank under a situation of extreme volatility. In 1993, one was required to pay INR 31.37 to get a dollar. 2000-2010: The rupee traded in the range of INR 40-50. It was mostly at around INR 45 against a dollar. It appreciated to a high of INR 39 in 2007. The Indian currency has gradually depreciated since the global 2008 economic crisis. Analysts say that rupee may touch INR 63 against USD in next couple of months.

www.learnwithflip.com

BFS Roundup @ FLIP

Term of the Week

Revaluation Reserve

We receive a lot of queries on what are revaluation reserves, and their treatment in financial statements. Well try to explain revaluation reserves in this section. A business purchases fixed assets for production of goods or delivery of services. These include building, land, machinery etc. Fixed assets are recorded at their cost of acquisition in the financial statements. However over time, their value may change, due to various reasons. Revaluation is done to reflect these changes in the financial statements. When do we revalue assets? Primarily, revaluation of an asset is done to serve the following purposes: When a company wants to sell the asset. When a company wants to borrow against the asset. To give a better estimate on return on capital employed. In case of a merger or acquisition. What is revaluation reserve? When we revalue assets and find that there has been an increase in value. We need to increase the liabilities section by the same amount for the balance sheet to balance. Thus, we create a revaluation reserve under the reserves and surplus head (on the liabilities side), which contains the amount by which fixed assets have been increased (on the asset side), on revaluation. In case of a decrease in the value of an asset (apart from depreciation), we deduct the same from the revaluation reserves account. Note: Unlike other items under reserves and surplus, revaluation reserves are only paper or non-cash reserves. They do not imply any money stored with the organization. Hope that helps!

www.learnwithflip.com

Você também pode gostar

- M A Strategy ArcelorMittal Part2Documento2 páginasM A Strategy ArcelorMittal Part2Shresth KotishAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- NHPC BSDocumento2 páginasNHPC BSShresth KotishAinda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Payment ReceiptDocumento1 páginaPayment ReceiptShresth KotishAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- BS NTPCDocumento2 páginasBS NTPCShresth KotishAinda não há avaliações

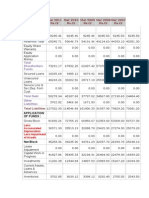

- Years Mar 2012 Rs - CR Mar 2011 Rs - CR Mar 2010 Rs - CR Mar 2009 Rs - CR Mar 2008 Rs - CRDocumento1 páginaYears Mar 2012 Rs - CR Mar 2011 Rs - CR Mar 2010 Rs - CR Mar 2009 Rs - CR Mar 2008 Rs - CRShresth KotishAinda não há avaliações

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- (224888313) Financial-Plan AnupamDocumento23 páginas(224888313) Financial-Plan AnupamShresth KotishAinda não há avaliações

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- A Synopsis ON: Comparison of The Profitability and Performance in The Financial Market of PGCIL With Its CompetitorsDocumento8 páginasA Synopsis ON: Comparison of The Profitability and Performance in The Financial Market of PGCIL With Its CompetitorsShresth KotishAinda não há avaliações

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Time and DistanceDocumento20 páginasTime and DistancedassreerenjiniAinda não há avaliações

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Sample Financial PlanDocumento34 páginasSample Financial PlanShresth KotishAinda não há avaliações

- Prepared For: Mr. Mahendra DixitDocumento31 páginasPrepared For: Mr. Mahendra DixitShresth KotishAinda não há avaliações

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Sample Family Financial Plan: Prepared ForDocumento22 páginasSample Family Financial Plan: Prepared ForShresth KotishAinda não há avaliações

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Financial PlanniingDocumento14 páginasFinancial PlanniingShresth KotishAinda não há avaliações

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Years Mar 2012 Rs - CR Mar 2011 Rs - CR Mar 2010 Rs - CR Mar 2009 Rs - CR Mar 2008 Rs - CRDocumento1 páginaYears Mar 2012 Rs - CR Mar 2011 Rs - CR Mar 2010 Rs - CR Mar 2009 Rs - CR Mar 2008 Rs - CRShresth KotishAinda não há avaliações

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- QUESTION # 3/15 Match The AntonymsDocumento2 páginasQUESTION # 3/15 Match The AntonymsShresth KotishAinda não há avaliações

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- When Do Corporate Ethics Come Into Play in The Case of AdhuDocumento2 páginasWhen Do Corporate Ethics Come Into Play in The Case of AdhuShresth KotishAinda não há avaliações

- Stats ProjectDocumento25 páginasStats ProjectShresth KotishAinda não há avaliações

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Choosing The Optimal Capital Structure-Example Chapter 16Documento33 páginasChoosing The Optimal Capital Structure-Example Chapter 16Shresth KotishAinda não há avaliações

- Chapter 6 - Problem Solving (Risk)Documento5 páginasChapter 6 - Problem Solving (Risk)Shresth KotishAinda não há avaliações

- Login or Sign Up: Our ServiceDocumento20 páginasLogin or Sign Up: Our ServiceShresth KotishAinda não há avaliações

- Financial Statement Analysis: Submitted By: Saket Jhanwar 09BS0002013Documento5 páginasFinancial Statement Analysis: Submitted By: Saket Jhanwar 09BS0002013saketjhanwarAinda não há avaliações

- Dissertation Report On Issue and Success Factors in Micro FinancingDocumento73 páginasDissertation Report On Issue and Success Factors in Micro FinancingArchit KhandelwalAinda não há avaliações

- A Strategic Plan Presented To The Faculty of College of Business Administration University of CordillerasDocumento23 páginasA Strategic Plan Presented To The Faculty of College of Business Administration University of CordillerasEurika Sheisha Manzo100% (1)

- Unit 20 and 21 - Derivatives and CommoditiesDocumento6 páginasUnit 20 and 21 - Derivatives and CommoditiesHemant bhanawatAinda não há avaliações

- Sow: 134 No Demand: Bar DescriptionDocumento91 páginasSow: 134 No Demand: Bar Description--Ainda não há avaliações

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Solution Manual For Principles of Corporate Finance 12th Edition by BrealeyDocumento3 páginasSolution Manual For Principles of Corporate Finance 12th Edition by BrealeyNgân HàAinda não há avaliações

- List of Tally LedgersDocumento20 páginasList of Tally LedgersRanjanAinda não há avaliações

- Change of BrokerDocumento1 páginaChange of BrokerFiniscope - Investment AdvisorsAinda não há avaliações

- Econtwo Final ExamsDocumento5 páginasEcontwo Final ExamsAl ChuaAinda não há avaliações

- Gold Purchase PlanDocumento4 páginasGold Purchase PlanRohit MishraAinda não há avaliações

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Business Plan QuestionnaireDocumento4 páginasBusiness Plan Questionnaireshantanu_malviya_1Ainda não há avaliações

- Sip ProjectDocumento126 páginasSip Projectsolanki_dipen2000100% (2)

- InvoiceDocumento1 páginaInvoiceMã H IêAinda não há avaliações

- Swabe Lords Piso Wifi Voucher GeneratorDocumento1 páginaSwabe Lords Piso Wifi Voucher GeneratorJohn Joseph VillafloresAinda não há avaliações

- Multination Finance Butler 5th EditionDocumento3 páginasMultination Finance Butler 5th EditionUnostudent2014Ainda não há avaliações

- Coprorate Finance Question Paper (3 Hours 1000 Words)Documento2 páginasCoprorate Finance Question Paper (3 Hours 1000 Words)Vasu PothunuruAinda não há avaliações

- Doctrine of Part PerformanceDocumento17 páginasDoctrine of Part PerformanceAnshul SinghalAinda não há avaliações

- Nile Plus Coffee Millers Limited Biz Plan - 15.12.2021 PDFDocumento216 páginasNile Plus Coffee Millers Limited Biz Plan - 15.12.2021 PDFHerbert BusharaAinda não há avaliações

- Designers & Consultancy: Dear SirDocumento2 páginasDesigners & Consultancy: Dear SirAjin SAinda não há avaliações

- Investments FINA-3720 Ligang Zhong: Lectures 12 & 13 (Chapter 18) Equity Evaluation ModelsDocumento46 páginasInvestments FINA-3720 Ligang Zhong: Lectures 12 & 13 (Chapter 18) Equity Evaluation ModelsroBinAinda não há avaliações

- Mutual Fund CategoriesDocumento7 páginasMutual Fund CategoriesSuneranirav DonAinda não há avaliações

- Gyanendra ResumeDocumento1 páginaGyanendra ResumeGyanendra BhadouriaAinda não há avaliações

- The Oxford Business Report Djibouti 2016Documento155 páginasThe Oxford Business Report Djibouti 2016Mahad AbdiAinda não há avaliações

- (G.R. NO. 190144 - August 1, 2012) Bank of The Philippine Islands, Petitioner, v. CARLITO LEE, Respondent. DecisionDocumento105 páginas(G.R. NO. 190144 - August 1, 2012) Bank of The Philippine Islands, Petitioner, v. CARLITO LEE, Respondent. DecisionNikkiAinda não há avaliações

- MSC Spring 2021 3rd 30-09-2022Documento2 páginasMSC Spring 2021 3rd 30-09-2022Tayyab SaleemAinda não há avaliações

- Strama LBP MapDocumento190 páginasStrama LBP Mapmitti panelAinda não há avaliações

- Confirmatory Order Against Mohit Aggarwal in The Matter of Radford Global Ltd.Documento3 páginasConfirmatory Order Against Mohit Aggarwal in The Matter of Radford Global Ltd.Shyam SunderAinda não há avaliações

- Duties of A Director.: Non-Executive DirectorsDocumento4 páginasDuties of A Director.: Non-Executive DirectorsHitesh ShahAinda não há avaliações

- IB2300012747 - HSMT GT Mua He Thong Thiet Bi Chong An Mon Cho 4 Xuong BP-WS-01, BP-WS-02, BP-WS-03 Va BP-WS-04Documento200 páginasIB2300012747 - HSMT GT Mua He Thong Thiet Bi Chong An Mon Cho 4 Xuong BP-WS-01, BP-WS-02, BP-WS-03 Va BP-WS-04nghiep congAinda não há avaliações

- (Original For Recipient) : Credit NoteDocumento1 página(Original For Recipient) : Credit NoteParthiva SinhaAinda não há avaliações

- John D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthNo EverandJohn D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthNota: 4 de 5 estrelas4/5 (20)