Escolar Documentos

Profissional Documentos

Cultura Documentos

Apples Cash 031907

Enviado por

Arik HesseldahlDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Apples Cash 031907

Enviado por

Arik HesseldahlDireitos autorais:

Formatos disponíveis

InfoTech Venture Capital

COMMENTARY

BY ARIK HESSELDAHL

What to Do with Apple's Cash

Its $12 billion and tech expertise could nurture promising startups

W

HAT WOULD YOU DO

with $12 billion? That's

how much cash Apple

Inc. had on its balance

sheet when it reported

its latest quarterly earnings on Jan. 17.

Driven by the wild success of the iPod

line and the rejuvenated Macintosh, Steve

Jobs and crew are rolling in it. And that

cash hoard is growing by about $1 billion

and change per quarter. Apple might not be the investments added $214 million to the parent

richest tech outfit around: Microsoft Corp., after

all, has about $29 billion in cash. But with 61%

Abetter company's net income.

Not every roll of the dice comes up a winner. In

of its assets held in cash, Apple dwarfs Microsoft way for fact, Intel Capital's holdings lost a net $45 million

(44%) on a relative basis.

Any other company with such a fat savings . Jobs & Co.'s in 2005. But getting richer in the short term isn't

the point. Intel's agenda is to use its considerable

account—and zero debt—might be castigated n O f J T Y l tf) resources—cash, technical expertise, and industry

by shareholders or even become a target of pri- insight—to discover and nurture a few dozen bril-

vate raiders. That's unlikely, given Apple's $76

billion market cap. You would at least expect to

benefit liant startups. Their success could lead to a surge

in chip demand down the road.

see investor-friendly gestures such as buying

back some stock, or paying dividends, as Apple

shareholders Imagine what could come of making Apple's

cash, together with its technical expertise and de-

did from 1987 to 1995. Or, a shopping spree. But sign sense, available to a raft of startup companies.

tech takeovers have a high failure rate, and Jobs If you're a music-software outfit, wouldn't you

is a big believer in the power of small teams and focused op- want guidance from the folks who developed the iPod, clearly

erations. He's not going to throw cash against the wall just to the biggest thing in consumer electronics in a decade, and the

become a player in lots of markets. iTunes Store, the single force to contend with in the still-nascent

In the rare cases where Apple does deals, it tends to buy age of digital media distribution? The Mac OS X computer op-

small outfits that can be integrated into projects already under erating system has more buzz around it than anything coming

development. In 2002, Apple paid $30 million for EMagic, the from that company outside Seattle. IfJobs' latest hunch is right,

German company behind the Logic program for professional the iPhone may prove to be even bigger than the iPod.

musicians. That led to a popular Mac program called Garage- There are plenty of branches of the Apple tree that could use

Band. Apple also has used its cash to ensure a solid supply of nourishment. Once you get beyond the big names, like Micro-

components. In 2005 it bought up a big slice of the world's soft, Adobe, Intuit, and a batch of others, the most prominent

NAND flash-memory manufacturing capacity. Those chips are names developing Mac software are small companies with

key components in the iPod nano and shuffle. limited resources. Gaming on the Mac still lags far behind the

But now consider another bet Apple could make: What if Windows world. And while there's a healthy industry worth

it took, say, $1 billion and handed it out to little Apples in the $1 billion or more in iPod accessories, ideas for products built

making, through a company-owned venture capital arm? around enhancing the iPhone and Apple TV (which sends In-

Plenty of other tech giants have gone the VC route, includ- ternet video to a TV) are just now taking shape.

ing Qualcomm, Motorola, IBM, and Intel. Intel Capital has Apple hasn't always been this successful. At one point in the

invested $4 billion in 1,000 companies over 15 years—$1 bil- mid-1990s it had barely enough cash to keep its doors open for

lion of that in 2006. Some 160 of those companies have been two months. Now, those days seem a long way off. And Apple

scooped up by other companies, while a further 150 have gone has a chance to use some of its winnings to help other struggling

public. Either way, Intel can cash in. Last year, Intel Capital's entrepreneurs—and enrich shareholders in the process. •

80 I BusinessWeek I March 19, 2007

Você também pode gostar

- CS-2 Apple - What's NextDocumento3 páginasCS-2 Apple - What's NextapapAinda não há avaliações

- Swot Analysis:: StrengthDocumento5 páginasSwot Analysis:: StrengthJency SebastianAinda não há avaliações

- Project Report Apple - OrganizedDocumento70 páginasProject Report Apple - OrganizedLucky SrivastavaAinda não há avaliações

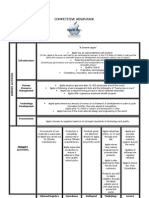

- Competitive Position AnalysisDocumento14 páginasCompetitive Position AnalysisYashraj PatilAinda não há avaliações

- Apple Computers Research PaperDocumento4 páginasApple Computers Research Paperjpkoptplg100% (1)

- Organizational Dynamics Group Assignment (2) Organizational Life CycleDocumento12 páginasOrganizational Dynamics Group Assignment (2) Organizational Life CycleSuraj KumarAinda não há avaliações

- Apple CorporationDocumento16 páginasApple CorporationMuhammad OsafAinda não há avaliações

- Apple CaseDocumento21 páginasApple CaseAlbert Krohn SandahlAinda não há avaliações

- The Rise and Fall and Rise of AppleDocumento5 páginasThe Rise and Fall and Rise of AppleDiastarAinda não há avaliações

- Apple Computers: " Take A Byte Out of An Apple"Documento18 páginasApple Computers: " Take A Byte Out of An Apple"Zaineb Khalid UsmaniAinda não há avaliações

- Report On AppleDocumento27 páginasReport On AppleJoy BiswasAinda não há avaliações

- Apple Inc Case AnalysisDocumento4 páginasApple Inc Case AnalysisKumar Krishnamoorthy100% (2)

- Case 1Documento14 páginasCase 1Andre Jericko VidamoAinda não há avaliações

- Apple PESTLE AnalysisDocumento20 páginasApple PESTLE AnalysisRaja Ammar Sarwar Janjua67% (3)

- Marketing Strategies of Apple CompanyDocumento69 páginasMarketing Strategies of Apple CompanyMunir ShaikhAinda não há avaliações

- BusinessWeek: Welcome To Apple WorldDocumento5 páginasBusinessWeek: Welcome To Apple WorldArik HesseldahlAinda não há avaliações

- Competitive Advantage Apple Inc.: InfrastructureDocumento6 páginasCompetitive Advantage Apple Inc.: InfrastructureAyna Dia100% (1)

- How Microsoft, Apple, and HP achieved success and failure through innovationDocumento5 páginasHow Microsoft, Apple, and HP achieved success and failure through innovationamber baigAinda não há avaliações

- Tanisha Ray_merged (1)_230520_093104 (2)Documento68 páginasTanisha Ray_merged (1)_230520_093104 (2)VANSHIKA 1758Ainda não há avaliações

- Advice To Tim CookDocumento5 páginasAdvice To Tim CookJaydeep SarnaikAinda não há avaliações

- Apple Presentation (Alex)Documento39 páginasApple Presentation (Alex)Alex Shehu100% (1)

- Fintech Final Project AppleDocumento31 páginasFintech Final Project AppleAn NguyễnAinda não há avaliações

- Apple and the Digital Revolution: The firm at the cutting edge of technologyNo EverandApple and the Digital Revolution: The firm at the cutting edge of technologyAinda não há avaliações

- Apple Success Decoded: The Key Factors That Led To Its Success: Discover How The Most Successful Company In History Creates, Innovates And RedesignsNo EverandApple Success Decoded: The Key Factors That Led To Its Success: Discover How The Most Successful Company In History Creates, Innovates And RedesignsAinda não há avaliações

- Operations Strategy of Apple IncDocumento6 páginasOperations Strategy of Apple IncSoumya Ranjan50% (2)

- Apple Strategic Audit AnalysisDocumento14 páginasApple Strategic Audit AnalysisShaff Mubashir BhattiAinda não há avaliações

- Apple Hovered Just Below That Level As of Early October 2020Documento4 páginasApple Hovered Just Below That Level As of Early October 2020Arch. ZionAinda não há avaliações

- Apple Case StudyDocumento16 páginasApple Case StudyAli AmmadAinda não há avaliações

- Aapl Apple Inc. Common Stock NasdaqDocumento5 páginasAapl Apple Inc. Common Stock NasdaqJasmin AbcedeAinda não há avaliações

- 07 Activity 1Documento5 páginas07 Activity 1Shania GualbertoAinda não há avaliações

- Apple PlanDocumento42 páginasApple PlanValdécy Cardoso da CostaAinda não há avaliações

- What Would Apple Do?: How You Can Learn from Apple and Make MoneyNo EverandWhat Would Apple Do?: How You Can Learn from Apple and Make MoneyAinda não há avaliações

- AppleDocumento5 páginasAppleAarit shahAinda não há avaliações

- Final Apple DraftDocumento8 páginasFinal Apple Draftapi-219822436Ainda não há avaliações

- Apple Inc Thesis StatementDocumento4 páginasApple Inc Thesis Statementafkollnsw100% (2)

- Apple Inc. AssignmentDocumento10 páginasApple Inc. AssignmentMeet Buch100% (2)

- Apple's unprecedented success across 11 areasDocumento7 páginasApple's unprecedented success across 11 areasAzis MuhdianaAinda não há avaliações

- A Study of The Marketing Strategies and Scope of Apple ComputersDocumento62 páginasA Study of The Marketing Strategies and Scope of Apple ComputersKaran TanwarAinda não há avaliações

- Apple Inc. Doing Great in Global Recession-Strategic Management - Case StudyDocumento3 páginasApple Inc. Doing Great in Global Recession-Strategic Management - Case StudyShamarat RahmanAinda não há avaliações

- Project 4 Sem 3 Danda Yoga KrishnaDocumento70 páginasProject 4 Sem 3 Danda Yoga Krishnadanda yoga krishnaAinda não há avaliações

- Apple Project PDFDocumento76 páginasApple Project PDFPriyaAinda não há avaliações

- Apple Business Strategy AnalysisDocumento44 páginasApple Business Strategy AnalysisMaricar LavacanacruzAinda não há avaliações

- Mba Project Report On AppleDocumento68 páginasMba Project Report On AppleNihar BagdeAinda não há avaliações

- Apple AnalysisDocumento12 páginasApple AnalysisYugendra R100% (3)

- Apple Inc. Case2Documento10 páginasApple Inc. Case2melody panaliganAinda não há avaliações

- Apple SWOT AnalysisDocumento4 páginasApple SWOT AnalysisAlex Grecu100% (1)

- Expert-Intelligence_Apple-Strategy-TeardownDocumento34 páginasExpert-Intelligence_Apple-Strategy-TeardownAlexandre Farias FrotaAinda não há avaliações

- Core Competencies and Dynamic CapabilitiesDocumento10 páginasCore Competencies and Dynamic CapabilitiesshizabidiAinda não há avaliações

- Apple Basic InformationDocumento15 páginasApple Basic InformationJoseph PanganibanAinda não há avaliações

- Apple Company Analysis: Presented By: VagmitaDocumento16 páginasApple Company Analysis: Presented By: VagmitaPadma Priya RAinda não há avaliações

- Case Study No. 3Documento4 páginasCase Study No. 3CJ IbaleAinda não há avaliações

- Apple Future PlanDocumento7 páginasApple Future PlanEka DarmadiAinda não há avaliações

- AppleDocumento5 páginasAppleirfan alamAinda não há avaliações

- Apple IncDocumento24 páginasApple IncAravind ShekharAinda não há avaliações

- AppleDocumento5 páginasApplesandymakhijaAinda não há avaliações

- Financial Statement AnalysisDocumento18 páginasFinancial Statement AnalysisHenry WaribuhAinda não há avaliações

- Thesis On Apple IncDocumento7 páginasThesis On Apple Incrikkiwrightarlington100% (2)

- Apple Inc 2010 ScribdDocumento6 páginasApple Inc 2010 ScribdshampresAinda não há avaliações

- Etc Handson 31Documento1 páginaEtc Handson 31Arik HesseldahlAinda não há avaliações

- Cyber Worm43Documento1 páginaCyber Worm43Arik HesseldahlAinda não há avaliações

- Eba 1299Documento1 páginaEba 1299Arik HesseldahlAinda não há avaliações

- Apple Builds Hope Around New Net ProductsDocumento1 páginaApple Builds Hope Around New Net ProductsArik HesseldahlAinda não há avaliações

- Clifford Chance Letter in Response To HP's Claim 050515sigDocumento42 páginasClifford Chance Letter in Response To HP's Claim 050515sigArik HesseldahlAinda não há avaliações

- CJR Jan/Feb 1998: Can Hackers Break Into PrintDocumento1 páginaCJR Jan/Feb 1998: Can Hackers Break Into PrintArik HesseldahlAinda não há avaliações

- Particulars of Claim HP Vs Lynch Et Al.Documento134 páginasParticulars of Claim HP Vs Lynch Et Al.Arik HesseldahlAinda não há avaliações

- Fathi Et Al IndictmentDocumento18 páginasFathi Et Al IndictmentArik HesseldahlAinda não há avaliações

- AFGE President Cox Letter To OPM Archuletta - Cyber BreachDocumento2 páginasAFGE President Cox Letter To OPM Archuletta - Cyber BreachDustin VolzAinda não há avaliações

- MD 3Documento39 páginasMD 3Arik HesseldahlAinda não há avaliações

- IW 040198spammerDocumento1 páginaIW 040198spammerArik HesseldahlAinda não há avaliações

- IW Site AttackDocumento1 páginaIW Site AttackArik HesseldahlAinda não há avaliações

- 2015.02.05 (#293) Hussain Response To Fourth Proposed SettlementDocumento10 páginas2015.02.05 (#293) Hussain Response To Fourth Proposed SettlementArik HesseldahlAinda não há avaliações

- CJR Jan/Feb 1999: After The HackDocumento1 páginaCJR Jan/Feb 1999: After The HackArik HesseldahlAinda não há avaliações

- Elliott - EMC LetterDocumento13 páginasElliott - EMC LetterArik HesseldahlAinda não há avaliações

- Sony Letter To Re/codeDocumento3 páginasSony Letter To Re/codeArik HesseldahlAinda não há avaliações

- HP Memorandum ISO Prelim Approval Settlement and Opposing InterventionDocumento34 páginasHP Memorandum ISO Prelim Approval Settlement and Opposing InterventionArik HesseldahlAinda não há avaliações

- U.S. Department of Justice: Federal Bureau of InvestigationDocumento3 páginasU.S. Department of Justice: Federal Bureau of InvestigationArik HesseldahlAinda não há avaliações

- Hacking The Great FirewallDocumento1 páginaHacking The Great FirewallArik HesseldahlAinda não há avaliações

- OQletterDocumento1 páginaOQletterArik HesseldahlAinda não há avaliações

- FILED Motion To Intervenechallenge SettlementDocumento12 páginasFILED Motion To Intervenechallenge SettlementArik HesseldahlAinda não há avaliações

- Going, Going, GonzoDocumento5 páginasGoing, Going, GonzoArik HesseldahlAinda não há avaliações

- Fisa Court Challenge RulingDocumento31 páginasFisa Court Challenge RulingArik HesseldahlAinda não há avaliações

- Sushovan Hussain's Reply ISO MotionDocumento17 páginasSushovan Hussain's Reply ISO MotionArik HesseldahlAinda não há avaliações

- US PLA IndictmentDocumento56 páginasUS PLA IndictmentArik HesseldahlAinda não há avaliações

- Verizon Vs FCCDocumento81 páginasVerizon Vs FCCArik HesseldahlAinda não há avaliações

- HP Court Motion Against Sushovan HussainDocumento8 páginasHP Court Motion Against Sushovan HussainJulieB188Ainda não há avaliações

- Oracle-Google-Java Appeal DecisionDocumento69 páginasOracle-Google-Java Appeal DecisionArik Hesseldahl100% (1)

- Hiring SettlementDocumento1 páginaHiring SettlementArik HesseldahlAinda não há avaliações

- USDOJ: Joint Statement Re: Transparency ReportsDocumento4 páginasUSDOJ: Joint Statement Re: Transparency ReportsRachel KingAinda não há avaliações

- Buy 13-Inch MacBook Pro - Apple (IN)Documento1 páginaBuy 13-Inch MacBook Pro - Apple (IN)dummy page7007Ainda não há avaliações

- TVL Css11 q2 m5 Os InstallationDocumento7 páginasTVL Css11 q2 m5 Os InstallationSergio B. Goco Jr.Ainda não há avaliações

- Embedded Systems VirtualizationDocumento14 páginasEmbedded Systems VirtualizationStevan MilinkovicAinda não há avaliações

- en - Differences Between SIMATIC ModbusTCP Redundant VersionsDocumento1 páginaen - Differences Between SIMATIC ModbusTCP Redundant VersionsKourosh52Ainda não há avaliações

- WWW - Vinafix.vn: Schem, MLB - Kepler - 2phase, J31Documento105 páginasWWW - Vinafix.vn: Schem, MLB - Kepler - 2phase, J31Fabian RojasAinda não há avaliações

- 02 FOX515H - Presentation - 2011-02-08 PDFDocumento44 páginas02 FOX515H - Presentation - 2011-02-08 PDFSalvador FayssalAinda não há avaliações

- SOM M2 SchematicDocumento12 páginasSOM M2 Schematicsiddharthbaisane4193Ainda não há avaliações

- PortLock Boot CD User GuideDocumento16 páginasPortLock Boot CD User GuideJohn WongAinda não há avaliações

- PCX ALL OUT EXPRESS DISCOUNT PROMODocumento2 páginasPCX ALL OUT EXPRESS DISCOUNT PROMOironchefjunAinda não há avaliações

- Annexure - I Bill of Material (Bom) Table (A) - Servers and SystemsDocumento16 páginasAnnexure - I Bill of Material (Bom) Table (A) - Servers and SystemsBullzeye StrategyAinda não há avaliações

- RM Young 61302 ManualDocumento2 páginasRM Young 61302 ManualJimmy Calle GonzálezAinda não há avaliações

- Deltron HuancayoDocumento106 páginasDeltron HuancayoVictor PaucarAinda não há avaliações

- LogDocumento30 páginasLogKristof SavskiAinda não há avaliações

- SM-J111M Esquematico Completo Anibal Garcia IrepairDocumento9 páginasSM-J111M Esquematico Completo Anibal Garcia IrepairSamir Sanchez GarnicaAinda não há avaliações

- 8085 Assembly Language Programs & ExplanationsDocumento35 páginas8085 Assembly Language Programs & ExplanationsVikas MahorAinda não há avaliações

- G991P11U-datasheet HTMLDocumento2 páginasG991P11U-datasheet HTMLpowerrsAinda não há avaliações

- Punta Integrated School First Periodical Test in TVL Ict - Css G9Documento4 páginasPunta Integrated School First Periodical Test in TVL Ict - Css G9Carmela Dollentas EscañoAinda não há avaliações

- 2013 Transputer ArchitectureDocumento61 páginas2013 Transputer ArchitecturerobbyyuAinda não há avaliações

- ASUSTeK Computer Inc. - Support - Technical Documents Eee PC 1215B 03Documento3 páginasASUSTeK Computer Inc. - Support - Technical Documents Eee PC 1215B 03burhanuddinAinda não há avaliações

- FAS900 Series DocumentationDocumento154 páginasFAS900 Series DocumentationAcalPDAinda não há avaliações

- Guide Lines For Using XBoot - XBOOTDocumento1 páginaGuide Lines For Using XBoot - XBOOTСтив ИгалAinda não há avaliações

- Game LogDocumento29 páginasGame LogÁngel Aguilar MorenoAinda não há avaliações

- iDXA DatenblattDocumento2 páginasiDXA DatenblattDigo OtávioAinda não há avaliações

- Pricing - Linux Virtual Machines - Microsoft AzureDocumento33 páginasPricing - Linux Virtual Machines - Microsoft AzureDavidAinda não há avaliações

- Samsung CLP-300 Color Laser Printer ManualDocumento160 páginasSamsung CLP-300 Color Laser Printer ManualFrederico SouzaAinda não há avaliações

- PAG-IBIG DES Installation Guide v1.0.1Documento15 páginasPAG-IBIG DES Installation Guide v1.0.1Sarah Jane Abas0% (2)

- Ds d5b75rb DDocumento10 páginasDs d5b75rb DworldwidevisionpvtltdAinda não há avaliações

- MIC QB Units 2.5Documento2 páginasMIC QB Units 2.5Ojaswini BorseAinda não há avaliações

- Install Device Driver in 40 CharactersDocumento12 páginasInstall Device Driver in 40 CharactersGerald E BaculnaAinda não há avaliações

- CD TechnologyDocumento16 páginasCD TechnologyprafulaAinda não há avaliações