Escolar Documentos

Profissional Documentos

Cultura Documentos

Lesson 12

Enviado por

Thomas NerneyDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Lesson 12

Enviado por

Thomas NerneyDireitos autorais:

Formatos disponíveis

LESSON 12: CONVERSION, MERGER AND SPIN-OFF OF COMPANIES

SUMMARY: 1.-Introduction 2.-Conversions a) Concept and types b) Procedure 3.-Mergers a) Concept and types b) Requirements c) Procedure 4.-Spin-offs a) Concept and types b) Procedure 5.- Vocabulary

1.-Introduction

The conversion, merger and spin-off of companies cannot be considered simple amendments to the articles of association. They are significant modifications of a companys structure which are regulated in Law 3/2009 on Structural Changes of Trading Companies (Ley 3/2009, de 3 de abril, sobre modificaciones esctructurales, LME). The LME unifies the regulation of the conversion, merger and spin-off procedures and, at the same time, introduces a specific regulation for the international merger of companies, as well as for the international transfer of a companys domicile.

2.-Conversions

a) Concept and types

A conversion is a legal transaction whereby a company changes its legal corporate form to another which will govern its structure, organization and the relationships with its partners and third parties (art. 3 LME). By using the conversion procedure, it is possible to simplify the change of legal form, avoiding the money and time spent while the company is dissolved, liquidated, extinguished and set up again under another legal form. It is important to highlight that, during the conversion, the company continues to be a legal person.

LESSON 12. Conversion, merger and spin-off of companies

Taking into account the different legal forms that can be adopted by Spanish companies, there are a number of possible conversions to be mentioned (art 4 LME): A public limited liability company (SA) can be converted into a private limited liability company (SL), a general partnership (sociedad colectiva), a limited partnership (sociedad comanditaria), a cooperative, a European company (SAE), an economic interest group (AIE) or a civil law company. A private limited liability company can be converted into a public limited liability company (SA), a general partnership (sociedad colectiva), a limited partnership (sociedad comanditaria), a cooperative, a European company (SAE), an economic interest group (AIE) or a civil law company. A general partnership (sociedad colectiva) and limited partnership (sociedad comanditaria) can be converted into a public or private liability company, a cooperative or an economic interest group. A civil law company can be converted into any of the legal forms which can be adopted by a trading company. A cooperative can be converted into a European cooperative and vice versa. An economic interest group can be converted into a European economic interest group and vice versa.

b) Procedure

1.-In the first place, a general meeting resolution is required to convert the company according to the quorums and majorities set out by the LSC. The resolution to convert a general partnership, limited partnership or civil law company must be unanimously adopted by all the company partners (art. 8 LME). When convening the general meeting, the body of administration should make the following information available to all the partners at the companys domicile: the conversion project drawn up by the directors, the companys balance sheet at the time of the conversion, the companys audit report after examining the balance sheet, if the company is obligated to audit its accounts, and the proposed articles of association of the company resulting from the conversion. Partners also have the right to request the delivery of these documents free of charge, even through electronic means. 2.-The general meeting resolution to convert the company must be published in the BORME and in a widely read newspaper in the province where the company has its domicile. The publication will not be required when all the

2

LESSON 12. Conversion, merger and spin-off of companies

partners are personally informed of the general meeting resolution (art. 14 LME). 3.-Within a month after the general meeting resolution to convert the company, owners of special rights other than shares or equity participations can oppose the conversion. By doing this, the conversion procedure will be interrupted (art. 16 LME). 4.-The conversion of a company involves significant changes to partners status. In order to maintain their interests, the LSC has designed some protection instruments (art. 15 LSC). As a general rule, partners who voted against the resolution to convert the company can exercise the right to withdraw. Together with this general rule, there are other protection instruments to be taken into account: Partners who voted against the resolution to convert the company will automatically be removed when the conversion involves assuming personal liability for company debts. When a company has issued bonds or other kind of securities and wants to be converted into another legal form which does not accept the issuance of those financial instruments, the conversion cannot be carried out unless the bonds or securities issued are converted or cancelled. When the company wants to be converted into a legal form which requires the full payment of the subscribed share capital, it will be necessary to pay the amount or reduce the capital before the general meeting adopts the resolution to convert the company. When the company is converted into a legal form which does not accept industrial partners, the contributions of the former industrial partners to the converted company will have to be that established in the articles of association or agreed by all the partners. The former industrial partners can continue with their personal obligations in the converted company if they agree and the articles of association of the converted company regulate their personal obligations as ancillary services.

5.-The conversion of the company should be recorded in a public deed, which should meet all the requirements necessary for the organization of the company in its new corporate form. The public deed should be filed for entry at the trade register and published in the BORME (art. 18 LME). 6.-From the company creditors standpoint, the conversion does not involve a change of debtor. The debtor continues to be the same legal person but under another legal form. Nevertheless, the LME introduces certain rules in order to protect the creditors interest when a company is converted (art. 21 LME).

LESSON 12. Conversion, merger and spin-off of companies

Partners who assume a personal liability for the companys debts after the company conversion will respond in the same way for all the existing debts before the conversion. When the conversion involves a change in the partners personal liability for company debts which becomes a limited liability, partners will maintain their personal liability for all existing debts before the conversion, unless the companys creditors have accepted the change of legal form.

3.-Mergers

a) Concept and types

A merger is a legal transaction involving two or more companies, in which one or more of them are dissolved and the partners and equities merge with an existing company or merge and are consolidated as a new company. Two different merger procedures should be mentioned. Firstly, the merger strictly speaking, which involves the dissolution of one or more of the merging companies (non-surviving companies) and the continuation of one or more of the merging companies (surviving companies) which will take over all the partners and equity of the dissolved companies. Secondly, the merger by consolidation, in which all the merging companies are dissolved and then consolidated to form a new company which will include all the partners and equities of the dissolved companies (arts. 22 y 23 LME).

b) Requirements

In order to merge companies, some previous requirements should be taken into account: One, several or all the companies involved in the merger procedure must be dissolved previously. The dissolution must not lead to the liquidation and extinction of the non-surviving companies. The net worth and partners of the non-surviving companies must be transferred to the newly created company or to the surviving company, depending on the merger procedure. The surviving company or the new company resulting from the merger receives the net worth of the dissolved companies and provides their partners with shares or equity participations in return.

4

LESSON 12. Conversion, merger and spin-off of companies

d) Procedure

For a merger procedure to be successfully concluded, it has to complete all the different stages in strict compliance with the required terms. 1.-The directors of the merging companies must draw up a merger project (art. 30 LME).. 2.-The merger project must be available on the website of the merging companies, and this fact will be freely published in the BORME, indicating the website and the time on which the information was made available on it. If any of the merging companies does not have a website, their directors will have to enter the merger project at the trade register of the locality where each company has its domicile. This fact will be published in the BORME (art. 32 LME). 3.-Two reports will be attached to the merger project. A) One drawn up by the directors of each merging company, to explain the legal and economic aspects of the project in detail, stating the conversion rate of the shares and any particular difficulty in their valuation. B) Another report drawn up by independent experts appointed by the Trade Register, in case the merging companies are obligated to have their accounts audited (arts. 33 y 34 LME). 4.-The merger must be approved by the general meeting of the merging companies according to the quorums and majorities required by law. Together with the general meeting resolution, the merger of companies will require the individual consent of those partners who are going to assume a personal liability for the companys debts as a consequence of the merger (art. 40 LME) . 5.-The general meeting of each merging company must also approve the merger balance sheet (art. 36 LME). 6.-The merger resolution must be published in the BORME and in one widely read newspaper in the provinces where each merging company has its domicile. The publication will not be required when the resolution and all the attached documentation is communicated in writing to each companys partner and creditor (art. 43 LME). 7.-Creditors whose expected rights may be affected by the merger may oppose the merger within a month after the publication of the general meeting resolution. This right suspends the actual performance of the approved merger until the rights of the creditors who oppose it are satisfied or until all the credits are adequately secured (art. 44 LME).

LESSON 12. Conversion, merger and spin-off of companies

8.-After the opposition period has elapsed, the merger and capital increase of the surviving company will be recorded in a public deed which will be filed for entry at the Trade Register and published in the BORME (arts. 45 y 46 LME). 9.- The LME does not provide the members of the merging companies with the right to withdraw because it has given priority to the merging companies interests over the interests of those partners who do not want to abandon the non-surviving company and be part of another one. Nevertheless, the art. 47 of the LME provides the partners with the right to challenge the registered mergers of companies when the procedure has not respected all the legal requirements.

4.- Spin-offs

a) Concept and types

A spin-off is the opposite of a merger. It has two alternative forms, each of which is subject to a different procedure (arts. 68 to 71 LME): Total spin-off of companies: this occurs when a company is dissolved, dividing its entire net worth into two or more parts, each of which is transferred to a newly created company or to a previously existing company. Partial spin-off of companies: this occurs when one or more parties of the net worth of a company are separated without dissolving the company and the different parts separated are transferred into one or more newly created or previously existing companies. Segregation: this occurs when a part of the net worth of a company is transferred by universal succession to another one. Through the segregation, the segregated company acquires shares or equity participations from the receiving company in return. The main difference between a segregation and spin-off is that, in a segregation, the segregated company itself, and not its partners, receives the shares or equity participations in return for its non-monetary contribution to the receiving company. In a segregation, the contribution of the segregated company consists of a part of its net worth as an economic unit.

b) Procedure

The spin-off procedure is similar to the merger, but with some special features to be mentioned:

LESSON 12. Conversion, merger and spin-off of companies

1.- The directors of the companies involved must draw up a spin-off project which should include the statements required for a merger and those specifically required for the spin-off which are: a) an accurate designation and distribution of the assets and liabilities that should be transferred to each of the beneficiary companies; b) distribution among the members of the spun-off company of the shares or equity participations to which they are entitled in the capital of the beneficiary companies (art. 74 LME). 2.- The spin-off project must be available on the website of the spun-off companies, and this fact will be freely published in the BORME, indicating the name of the website and the time on which the information was made available on it. If any of the spun- off companies does not have a website, their directors will have to enter the spin-off project at the trade register of the locality where each company has its domicile. This fact will be published in the BORME. 3.- The spin-off itself and the spin-off balance sheet must be approved by the general meeting of the spun-off companies according to the quorums and majorities required by law. 4.- The spin-off resolution must be published in the BORME and in one widely read newspaper in the provinces where each spun-off company has its domicile. 5.- Creditors whose expected rights may be affected by the spin off may oppose it within a month after the publication of the general meeting resolution. 6.-After the expiry of the time fixed to oppose, the spin-off and increase of capital of the surviving company will be recorded in a public deed which will be filed for entry at the Trade Register and published in the BORME Together with the right to oppose, the LME has introduced another instrument to protect the creditors interests, creating a special liability system for the participating companies, depending on the type of spin-off (art. 80 LME). Total spin-off of companies. If one of the beneficiary companies does not comply with an obligation assumed in the spin-off, the other beneficiary companies will be jointly liable for compliance with such obligation. Partial spin-off of companies. The beneficiary company is liable for all the obligations acquired through the spin-off, while the segregated company maintains a subsidiary responsibility for such obligations.

Comentario [LYB1]: Creo que se refiere a spin-off aqu en este contexto. Comentario [LYB2]: idem

5.- Vocabulary

Con formato: Espaol (alfab. internacional)

Conversion- Transformacin

LESSON 12. Conversion, merger and spin-off of companies

Merger- Fusin Spin-off- Escisin Amendments to the articles of association- Modificaciones estatutarias Company balance sheet- Balance de la sociedad Audit report- Informe de los auditores Economic interest group- Agrupacin de inters econmico (AIE) To oppose a resolution- Oponerse a un acuerdo de la junta Right to withdraw- Derecho de separacin Bonds (or other kind of securities)- Obligaciones (u otros instrumentos de financiacin) To file for entry at the Trade Register- Presentar (una escritura) para ser inscrita en el Registro To challenge- Impugnar Net worth- Patrimonio neto

Con formato: Espaol (alfab. internacional) Con formato: Espaol (alfab. internacional)

BIBLIOGRAPHY OF THE LESSON 12

ANDREU MART, M.M./MART MOYA, V. (coord. FERRANDO VILLALBA, L.), Derecho de sociedades, Ed. Aranzadi, Cizur Menor, 2010, pp BROSETA PONT, M. / MARTNEZ SANZ, F. Manual de Derecho Mercantil, Ed. Tecnos, 2012, vol. I, captulo 22. SNCHEZ CALERO, F./ SNCHEZ-CALERO GUILARTE, J., Instituciones de Derecho Mercantil, vol. I, Ed. Aranzadi, Cizur Menor, ltima edicin, captulo XXXI.

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Christena Nippert-Eng - Watching Closely - A Guide To Ethnographic Observation-Oxford University Press (2015)Documento293 páginasChristena Nippert-Eng - Watching Closely - A Guide To Ethnographic Observation-Oxford University Press (2015)Emiliano CalabazaAinda não há avaliações

- Stewart, Mary - The Little BroomstickDocumento159 páginasStewart, Mary - The Little BroomstickYunon100% (1)

- Mark Magazine#65Documento196 páginasMark Magazine#65AndrewKanischevAinda não há avaliações

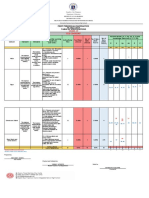

- Revised Final Quarter 1 Tos-Rbt-Sy-2022-2023 Tle-Cookery 10Documento6 páginasRevised Final Quarter 1 Tos-Rbt-Sy-2022-2023 Tle-Cookery 10May Ann GuintoAinda não há avaliações

- T-Tess Six Educator StandardsDocumento1 páginaT-Tess Six Educator Standardsapi-351054075100% (1)

- Restaurant Report Card: February 9, 2023Documento4 páginasRestaurant Report Card: February 9, 2023KBTXAinda não há avaliações

- Broiler ProductionDocumento13 páginasBroiler ProductionAlexa Khrystal Eve Gorgod100% (1)

- Principles of Business Grade 10 June 2021 Time: 1 1/2 Hrs. Paper 2 Answer ONLY 1 Question in Section I. Section IDocumento3 páginasPrinciples of Business Grade 10 June 2021 Time: 1 1/2 Hrs. Paper 2 Answer ONLY 1 Question in Section I. Section Iapi-556426590Ainda não há avaliações

- Biblical Foundations For Baptist Churches A Contemporary Ecclesiology by John S. Hammett PDFDocumento400 páginasBiblical Foundations For Baptist Churches A Contemporary Ecclesiology by John S. Hammett PDFSourav SircarAinda não há avaliações

- Holiday AssignmentDocumento18 páginasHoliday AssignmentAadhitya PranavAinda não há avaliações

- Innovativ and Liabl :: Professional Electronic Control Unit Diagnosis From BoschDocumento28 páginasInnovativ and Liabl :: Professional Electronic Control Unit Diagnosis From BoschacairalexAinda não há avaliações

- Intervensi Terapi Pada Sepsis PDFDocumento28 páginasIntervensi Terapi Pada Sepsis PDFifan zulfantriAinda não há avaliações

- Rockwell Collins RDRDocumento24 páginasRockwell Collins RDRMatty Torchia100% (5)

- Revit 2023 Architecture FudamentalDocumento52 páginasRevit 2023 Architecture FudamentalTrung Kiên TrầnAinda não há avaliações

- WinCC Control CenterDocumento300 páginasWinCC Control Centerwww.otomasyonegitimi.comAinda não há avaliações

- LavazzaDocumento2 páginasLavazzajendakimAinda não há avaliações

- Part Time Civil SyllabusDocumento67 páginasPart Time Civil SyllabusEr Govind Singh ChauhanAinda não há avaliações

- Corvina PRIMEDocumento28 páginasCorvina PRIMEMillerIndigoAinda não há avaliações

- Dehn Brian Intonation SolutionsDocumento76 páginasDehn Brian Intonation SolutionsEthan NealAinda não há avaliações

- Eu Schengen Catalogue enDocumento54 páginasEu Schengen Catalogue enSorin din ConstanțaAinda não há avaliações

- Settlement Report - 14feb17Documento10 páginasSettlement Report - 14feb17Abdul SalamAinda não há avaliações

- The Piano Lesson Companion Book: Level 1Documento17 páginasThe Piano Lesson Companion Book: Level 1TsogtsaikhanEnerelAinda não há avaliações

- NHM Thane Recruitment 2022 For 280 PostsDocumento9 páginasNHM Thane Recruitment 2022 For 280 PostsDr.kailas Gaikwad , MO UPHC Turbhe NMMCAinda não há avaliações

- Dialog InggrisDocumento4 páginasDialog Inggrisبايو سيتياوانAinda não há avaliações

- Accounting Worksheet Problem 4Documento19 páginasAccounting Worksheet Problem 4RELLON, James, M.100% (1)

- Business Statistic Handout Bba - Sem 2Documento7 páginasBusiness Statistic Handout Bba - Sem 2hanirveshAinda não há avaliações

- LicencesDocumento5 páginasLicencesstopnaggingmeAinda não há avaliações

- UnixDocumento251 páginasUnixAnkush AgarwalAinda não há avaliações

- Onset Hobo Trade T Cdi 5200 5400 User ManualDocumento3 páginasOnset Hobo Trade T Cdi 5200 5400 User Manualpaull20020% (1)

- DISCHARGE PLAN CuyosDocumento6 páginasDISCHARGE PLAN CuyosShaweeyah Mariano BabaoAinda não há avaliações