Escolar Documentos

Profissional Documentos

Cultura Documentos

Thesun 2009-06-12 Page15 Epfs q1 Investment Income Drops 10

Enviado por

Impulsive collectorDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Thesun 2009-06-12 Page15 Epfs q1 Investment Income Drops 10

Enviado por

Impulsive collectorDireitos autorais:

Formatos disponíveis

theSun | FRIDAY JUNE 12 2009 15

business

KUALA LUMPUR: The Em-

ployees Provident Fund’s (EPF)

investment income dropped

10.47% to RM3.26 billion for the

first quarter ended March 31,

from RM3.64 billion recorded in

the fourth quarter of 2008.

EPF’s Q1 investment income

drops 10.47% to RM3.26bil

The decline is due to lower

investment returns from both

fixed income instruments and

equities, said EPF in a statement

yesterday.

The highest income contribu-

tor in the first quarter was loans

and bonds, which contributed RM1.11 billion, a drop of 13.23% contributed RM223.83 million after in- “The market condition is expected million to the EPF income down from

RM1.78 billion, a drop of 2.15% from RM1.28 billion earned by vestment provisioning resulting from to remain challenging in the near term RM51.32 million earned in the previ-

compared with RM1.82 billion MGS in the last quarter of 2008. the decline in equity prices, compared following the impact of the global re- ous quarter.

in the fourth quarter of last “Despite the drop in earnings with RM342.54 million in the previous cession on the domestic economy. The EPF’s total fund size currently

year. from loans and bonds and MGS quarter. “However, improving outlook on stands at RM348.16 billion, up 1.93%

As at March 31 this year, this quarter, we will continue to The EPF continued to invest in the external front, strong domestic fis- from RM341.56 billion in the last quar-

36.81% of loans and bonds invest in these investments as bluechip stocks with a strong focus cal impulse and the existence of ample ter of 2008.

investments was in companies they provide capital preserva- in two sectors. Of the funds invested liquidity are expected to help bolster “The uncertainties surrounding the

with AAA credit ratings and tion and the stability of returns, in the equities market, 37.43% was in market performance in the second half global economy continue to affect EPF’s

49.97% was in companies with which is in accordance with our trade and services sector while 33.93% of 2009,” said Azlan. investments. We anticipate that it will

AA ratings. investment mandate that favour was in the finance sector. Money Market Instruments returned be a tough year going forward but, as

Malaysian Government Se- low-risk instruments,” EPF chief Smaller investments of less than RM120.11 million in the first quarter, a a long-term investor, we look forward

curities (MGS) was the second executive officer Tan Sri Azlan 10% were made in sectors such as drop from RM143.21 million earned in to capitalising on the opportunities that

highest income earner during Zainol said in the statement. plantation (8.66%), industrial products the fourth quarter of 2008. these challenging times can bring,” he

the period reviewed, returning During the quarter, equities (6.98%) and construction (4.59%). Properties contributed RM20.63 added. – Bernama

Nestle to boost

investment in halal

products operation

SHAH ALAM: The growing global opportunities in halal foods and products

has encouraged the Nestle Group to boost its investment in halal manu-

facturing and capacity building.

Its executive vice-president/zone director for Asia, Oceania, Africa and

Middle East, Datuk Frits van Dijk, said this trend would augur well for Nestle

Malaysia as the group continued to expand its workforce.

“Malaysia has long been recognised as Nestle Group’s halal centre of

excellence and a leading exporter of halal products which account for more

than 20% of its total turnover in this country,” he said at the graduation

ceremony of 31 participants of Nestle Malaysia’s executive diploma in

manufacturing management (EDMM) programme here on Wednesday.

Van Dijk said Nestle employed more than 280,000 people worldwide

and considered human capital development as an important investment.

“At Nestle, the average number of years of service at retirement is 27

years (in the top 20 countries that employ 80% of our people), and we

believe that one of the reasons for the low turnover is that we help people

grow in their personal capabilities,” he said.

The EDMM programme, developed jointly by Nestle Malaysia and Open

University of Malaysia (OUM) was launched in 2006 to develop Nestle’s

production executives into first-line managers.

The 20-month programme is based on a thoroughly-researched job

analysis of the first-line manager position in Nestle factories, with each

topic taught supporting a performance objective and the goal of delivering

specific workplace competencies. – Bernama

when making an investment deci-

sion, it added. – Bernama

briefs CCM eyes 10% rise in

export revenue

KUALA LUMPUR: Chemical Com-

Bursa issues queries pany of Malaysia (CCM) hopes to

increase its export revenue to 40%

to Compugates, SAAG by 2010 from the current 30%, its

KUALA LUMPUR: Bursa Malaysia group managing director Datuk Dr

Securities Bhd yesterday issued Mohamad Hashim Ahmad Tajudin

an unusual market activity (UMA) said yesterday.

query to Compugates Holdings Bhd To achieve this target, the group

due to the high daily volume in the will intensify its promotion in exist-

company’s shares recently. ing overseas markets for its ferti-

A similar query was also is- liser, pharmaceutical and chemical

sued to SAAG Consolidated (M) businesses, Mohamad Hashim told

Bhd for the persistent high trading reporters after a meeting with

interest in the company’s securities CCM’s stakeholders here.

yesterday, the exchange said in a More than 700 of the group’s

statement. products are currently marketed in

Both Compugates and SAAG are 28 countries, including Singapore,

required to publicly confirm, among Indonesia, Vietnam, Thailand and

others, whether there were any cor- the Philippines, and those in the

porate development relating to their Middle East, Africa and Eastern

business and affairs that have not Europe, he said.

been previously announced, which Indonesia is the largest overseas

those in the stage of negotiation or market revenue contributor with

discussion, Bursa Securities said. about 25%.

The two companies also needed CCM achieved a turnover of

to explain whether there was any RM2.2 billion for its financial year

corporate development relating to ended Dec 31, 2008, which exceed-

their business and affairs that have ed its key performance indicator

not been previously announced, the (KPI) target of RM1.7 billion.

exchange said. Its pre-tax profit stood at

Investors are advised to take note RM120.3 million, which was higher

of both companies’ replies which compared with RM105.6 million

would be posted on their website, previously. – Bernama

Você também pode gostar

- Provincial Facilitation for Investment and Trade Index: Measuring Economic Governance for Business Development in the Lao People’s Democratic Republic-Second EditionNo EverandProvincial Facilitation for Investment and Trade Index: Measuring Economic Governance for Business Development in the Lao People’s Democratic Republic-Second EditionAinda não há avaliações

- Thesun 2009-08-19 Page14 Zeti Upbeat On Bond MarketDocumento1 páginaThesun 2009-08-19 Page14 Zeti Upbeat On Bond MarketImpulsive collectorAinda não há avaliações

- Asia Small and Medium-Sized Enterprise Monitor 2021 Volume IV: Pilot SME Development Index: Applying Probabilistic Principal Component AnalysisNo EverandAsia Small and Medium-Sized Enterprise Monitor 2021 Volume IV: Pilot SME Development Index: Applying Probabilistic Principal Component AnalysisAinda não há avaliações

- Thesun 2009-05-22 Page14 Maybanks q3 Pre-Tax Profit Eases To rm653Documento1 páginaThesun 2009-05-22 Page14 Maybanks q3 Pre-Tax Profit Eases To rm653Impulsive collectorAinda não há avaliações

- ASEAN Corporate Governance Scorecard Country Reports and Assessments 2019No EverandASEAN Corporate Governance Scorecard Country Reports and Assessments 2019Ainda não há avaliações

- Thesun 2009-06-23 Page16 Life Insurance Industry Growing Despite SlowdownDocumento1 páginaThesun 2009-06-23 Page16 Life Insurance Industry Growing Despite SlowdownImpulsive collectorAinda não há avaliações

- Thesun 20090226 Page13 Public Bank To See Reduced Interest MarginDocumento1 páginaThesun 20090226 Page13 Public Bank To See Reduced Interest MarginMevika MerchantAinda não há avaliações

- The Sun 2011032112Documento1 páginaThe Sun 2011032112apish_1Ainda não há avaliações

- Goldis AR 2010Documento139 páginasGoldis AR 2010AshAinda não há avaliações

- Economic Transformation ProgrammeDocumento4 páginasEconomic Transformation ProgrammeFadli Sukor SaniAinda não há avaliações

- SME Annual Report 2009-2010Documento6 páginasSME Annual Report 2009-2010Zulkifli Mohd YusofAinda não há avaliações

- FY20 Media Release - 260620 (F)Documento5 páginasFY20 Media Release - 260620 (F)Gan Zhi HanAinda não há avaliações

- The Main Points of The Article Are Summarised Clearly and SuccinctlyDocumento5 páginasThe Main Points of The Article Are Summarised Clearly and SuccinctlyKHAIRIL HAJAR BINTI AHMADAinda não há avaliações

- SM SwotDocumento11 páginasSM SwotNorlinda Mokhtar100% (3)

- Assignment 1 - Compare and Contrast The Potential Outlook of PLCsDocumento9 páginasAssignment 1 - Compare and Contrast The Potential Outlook of PLCsNadhirah Abd Rahman0% (1)

- TheSun 2009-01-23 Page18 Spore Taps Reserves For Budget Stimulus Cuts TaxDocumento1 páginaTheSun 2009-01-23 Page18 Spore Taps Reserves For Budget Stimulus Cuts TaxImpulsive collectorAinda não há avaliações

- UEMEd - Q3 2023 (Press Release)Documento3 páginasUEMEd - Q3 2023 (Press Release)Gan ZhiHanAinda não há avaliações

- MediaStatement 2Documento6 páginasMediaStatement 2Justin NathanAinda não há avaliações

- FP Source 2Documento3 páginasFP Source 2水TaoAinda não há avaliações

- Thesun 2009-05-27 Page14 National Automotive Policy Under ReviewDocumento1 páginaThesun 2009-05-27 Page14 National Automotive Policy Under ReviewImpulsive collectorAinda não há avaliações

- Genting Swot AnalysisDocumento9 páginasGenting Swot AnalysisAlexander Chow Yee Min0% (1)

- YYH (KWSP) - EPF Records RM34.05 Billion in Investment Income For 1H 2021Documento4 páginasYYH (KWSP) - EPF Records RM34.05 Billion in Investment Income For 1H 2021Calvin YeohAinda não há avaliações

- Astra 2010-10-28 - 9M10 Results ReleaseDocumento4 páginasAstra 2010-10-28 - 9M10 Results ReleaseJim Andy HermawanAinda não há avaliações

- Newz Bits: Highlights of The DayDocumento10 páginasNewz Bits: Highlights of The DaytheheavybolterAinda não há avaliações

- MPRC100 Fy2017 PDFDocumento24 páginasMPRC100 Fy2017 PDFAnisAinda não há avaliações

- Economic Transformation ProgrammeDocumento2 páginasEconomic Transformation ProgrammePooja MuruganAinda não há avaliações

- 1213 PDFDocumento23 páginas1213 PDFnamasralAinda não há avaliações

- Makmur Fund - Apr 23Documento3 páginasMakmur Fund - Apr 23mid_cycloneAinda não há avaliações

- Thesun 2009-07-23 Page15 Petronas Gas To Spend Rm1bil To Revamp Ageing PlantsDocumento1 páginaThesun 2009-07-23 Page15 Petronas Gas To Spend Rm1bil To Revamp Ageing PlantsImpulsive collectorAinda não há avaliações

- ZP Weekly Corporate Highlights - Issue 185Documento9 páginasZP Weekly Corporate Highlights - Issue 185Johnnie ChewAinda não há avaliações

- Credit Guarantee Corporation Malaysia Berhad Steering SME Development in MalaysiaDocumento16 páginasCredit Guarantee Corporation Malaysia Berhad Steering SME Development in MalaysiaLi Jean TanAinda não há avaliações

- Sme CorpDocumento13 páginasSme CorpFaridz RahimAinda não há avaliações

- Assignment # 2: Article # 1Documento3 páginasAssignment # 2: Article # 1Saad Ahmed AwanAinda não há avaliações

- Annual Report 2009Documento92 páginasAnnual Report 2009syazrellAinda não há avaliações

- SME Bank BizPulse Issue 20Documento12 páginasSME Bank BizPulse Issue 20SME Bank MalaysiaAinda não há avaliações

- Financial StatementsDocumento114 páginasFinancial StatementsKumanan MunusamyAinda não há avaliações

- Assignment Final FinanceDocumento17 páginasAssignment Final FinanceTamil Arasu100% (1)

- DUTALND AnnualReport2013Documento134 páginasDUTALND AnnualReport2013Hèñry LimAinda não há avaliações

- Pad 370 Task 1 Report Am110 UitmDocumento27 páginasPad 370 Task 1 Report Am110 UitmAsh DenemAinda não há avaliações

- Freight Management Holdings: Results ReportDocumento3 páginasFreight Management Holdings: Results ReportAmir AsrafAinda não há avaliações

- Annual Report: Malaysia Marine and Heavy Engineering Holdings BerhadDocumento34 páginasAnnual Report: Malaysia Marine and Heavy Engineering Holdings BerhadAzizan Mohamed YasinAinda não há avaliações

- Manager's Report: For The Financial Period 1 April To 30 June 2012Documento9 páginasManager's Report: For The Financial Period 1 April To 30 June 2012Madu BiruAinda não há avaliações

- 3.0 ChallengesDocumento4 páginas3.0 ChallengesYoges Sweat HurtAinda não há avaliações

- Q1FY21 Media Release - 260820 (F)Documento5 páginasQ1FY21 Media Release - 260820 (F)Gan Zhi HanAinda não há avaliações

- Goldis AR 2009Documento114 páginasGoldis AR 2009AshAinda não há avaliações

- Tejari RR1 H09Documento5 páginasTejari RR1 H09anis_tehahAinda não há avaliações

- Manufacturing To Service SectorDocumento4 páginasManufacturing To Service SectorNorlina Mohd SallehAinda não há avaliações

- SCOMNET - Research Hive - 7 Sept 2020Documento2 páginasSCOMNET - Research Hive - 7 Sept 2020JazzyAinda não há avaliações

- Financial StatementsDocumento108 páginasFinancial StatementsKumanan MunusamyAinda não há avaliações

- Financial Report Analysis: Analisis Pelaporan KewanganDocumento12 páginasFinancial Report Analysis: Analisis Pelaporan KewangantanaAinda não há avaliações

- Thesun 2009-10-28 Page14 Masteel Clinches Rm120mil Deal With Aussie FirmDocumento1 páginaThesun 2009-10-28 Page14 Masteel Clinches Rm120mil Deal With Aussie FirmImpulsive collectorAinda não há avaliações

- Maybank Islamic Financial Statements FY2019Documento229 páginasMaybank Islamic Financial Statements FY2019Nuranis QhaleedaAinda não há avaliações

- Kenyataan TNBDocumento5 páginasKenyataan TNBEmzy ElAinda não há avaliações

- Media Release Malaysia Remains Steadfast To Accelerate Quality InvestmentsDocumento3 páginasMedia Release Malaysia Remains Steadfast To Accelerate Quality InvestmentsMohd Samsul GhazaliAinda não há avaliações

- TCS - Research Hive - 11 Jan 2021Documento2 páginasTCS - Research Hive - 11 Jan 2021JazzyAinda não há avaliações

- RHB Equity 360° (Market, Motor, Ta Ann, Evergreen, ILB, MAS Technical: MAS) - 17/08/2010Documento4 páginasRHB Equity 360° (Market, Motor, Ta Ann, Evergreen, ILB, MAS Technical: MAS) - 17/08/2010Rhb InvestAinda não há avaliações

- TCS Q3 Revenues at $1,483 Million: EspañolDocumento3 páginasTCS Q3 Revenues at $1,483 Million: Españolxyris_sAinda não há avaliações

- Accounting For Managers SP Setia and Sunway Berhad Financial ComparisonDocumento35 páginasAccounting For Managers SP Setia and Sunway Berhad Financial ComparisonMOHAMMAD SAAD MALIKAinda não há avaliações

- AMEDIA Annualreport2019 30092019 31012020Documento167 páginasAMEDIA Annualreport2019 30092019 31012020Vanan MuthuAinda não há avaliações

- Economic Transformation Programme FinaleDocumento29 páginasEconomic Transformation Programme FinaleKamarul ChemAinda não há avaliações

- KPMG CEO StudyDocumento32 páginasKPMG CEO StudyImpulsive collectorAinda não há avaliações

- Global Talent 2021Documento21 páginasGlobal Talent 2021rsrobinsuarezAinda não há avaliações

- Coaching in OrganisationsDocumento18 páginasCoaching in OrganisationsImpulsive collectorAinda não há avaliações

- Islamic Financial Services Act 2013Documento177 páginasIslamic Financial Services Act 2013Impulsive collectorAinda não há avaliações

- IGP 2013 - Malaysia Social Security and Private Employee BenefitsDocumento5 páginasIGP 2013 - Malaysia Social Security and Private Employee BenefitsImpulsive collectorAinda não há avaliações

- Global Added Value of Flexible BenefitsDocumento4 páginasGlobal Added Value of Flexible BenefitsImpulsive collectorAinda não há avaliações

- HayGroup Job Measurement: An IntroductionDocumento17 páginasHayGroup Job Measurement: An IntroductionImpulsive collector100% (1)

- Emotional or Transactional Engagement CIPD 2012Documento36 páginasEmotional or Transactional Engagement CIPD 2012Impulsive collectorAinda não há avaliações

- Hay Group Guide Chart - Profile Method of Job EvaluationDocumento27 páginasHay Group Guide Chart - Profile Method of Job EvaluationImpulsive collector75% (8)

- HayGroup Rewarding Malaysia July 2010Documento8 páginasHayGroup Rewarding Malaysia July 2010Impulsive collectorAinda não há avaliações

- Stanford Business Magazine 2013 AutumnDocumento68 páginasStanford Business Magazine 2013 AutumnImpulsive collectorAinda não há avaliações

- Futuretrends in Leadership DevelopmentDocumento36 páginasFuturetrends in Leadership DevelopmentImpulsive collector100% (1)

- Hay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewDocumento15 páginasHay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewAyman ShetaAinda não há avaliações

- Hay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewDocumento4 páginasHay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewImpulsive collector100% (1)

- CLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesDocumento117 páginasCLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesImpulsive collector100% (1)

- Managing Conflict at Work - A Guide For Line ManagersDocumento22 páginasManaging Conflict at Work - A Guide For Line ManagersRoxana VornicescuAinda não há avaliações

- Developing An Enterprise Leadership MindsetDocumento36 páginasDeveloping An Enterprise Leadership MindsetImpulsive collectorAinda não há avaliações

- Flexible Working Good Business - How Small Firms Are Doing ItDocumento20 páginasFlexible Working Good Business - How Small Firms Are Doing ItImpulsive collectorAinda não há avaliações

- Megatrends Report 2015Documento56 páginasMegatrends Report 2015Cleverson TabajaraAinda não há avaliações

- Compensation Fundamentals - Towers WatsonDocumento31 páginasCompensation Fundamentals - Towers WatsonImpulsive collector80% (5)

- 2016 Summer Strategy+business PDFDocumento116 páginas2016 Summer Strategy+business PDFImpulsive collectorAinda não há avaliações

- Strategy+Business - Winter 2014Documento108 páginasStrategy+Business - Winter 2014GustavoLopezGAinda não há avaliações

- Strategy+Business Magazine 2016 AutumnDocumento132 páginasStrategy+Business Magazine 2016 AutumnImpulsive collector100% (3)

- 2012 Metrics and Analytics - Patterns of Use and ValueDocumento19 páginas2012 Metrics and Analytics - Patterns of Use and ValueImpulsive collectorAinda não há avaliações

- Deloitte Analytics Analytics Advantage Report 061913Documento21 páginasDeloitte Analytics Analytics Advantage Report 061913Impulsive collectorAinda não há avaliações

- 2015 Summer Strategy+business PDFDocumento104 páginas2015 Summer Strategy+business PDFImpulsive collectorAinda não há avaliações

- Talent Analytics and Big DataDocumento28 páginasTalent Analytics and Big DataImpulsive collectorAinda não há avaliações

- HBR - HR Joins The Analytics RevolutionDocumento12 páginasHBR - HR Joins The Analytics RevolutionImpulsive collectorAinda não há avaliações

- IBM - Using Workforce Analytics To Drive Business ResultsDocumento24 páginasIBM - Using Workforce Analytics To Drive Business ResultsImpulsive collectorAinda não há avaliações

- TalentoDocumento28 páginasTalentogeopicAinda não há avaliações

- Follow Fibonacci Ratio Dynamic Approach in TradeDocumento4 páginasFollow Fibonacci Ratio Dynamic Approach in TradeLatika DhamAinda não há avaliações

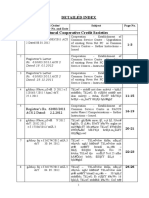

- Detailed Index: Sl. No. Government Order/ Registrar'Circular No. and Date Subject Page NoDocumento10 páginasDetailed Index: Sl. No. Government Order/ Registrar'Circular No. and Date Subject Page NokalkibookAinda não há avaliações

- The Paddington Place - Studio 23.67sqmDocumento14 páginasThe Paddington Place - Studio 23.67sqmGenki DayouAinda não há avaliações

- Property Valuation: Valuation Number: 1021106693NHC UPI: 1/02/11/06/693Documento8 páginasProperty Valuation: Valuation Number: 1021106693NHC UPI: 1/02/11/06/693fido1983Ainda não há avaliações

- Assignment 01-Fin421Documento11 páginasAssignment 01-Fin421i CrYAinda não há avaliações

- Merchandising Reviewer 2Documento5 páginasMerchandising Reviewer 2Sandro Marie N. ObraAinda não há avaliações

- Investment Environment and Investment Management Process-1Documento1 páginaInvestment Environment and Investment Management Process-1CalvinsAinda não há avaliações

- Working Capital Management Maruti SuzukiDocumento76 páginasWorking Capital Management Maruti SuzukiAbhay Gupta81% (32)

- 10 Musharka FinancingDocumento24 páginas10 Musharka FinancingFaheemullah HaddadAinda não há avaliações

- SRM Sem1 Exam Fee ReceiptDocumento2 páginasSRM Sem1 Exam Fee Receiptdeeksha6548gkAinda não há avaliações

- Macroeconomics Canadian 15th Edition Ragan Solutions ManualDocumento13 páginasMacroeconomics Canadian 15th Edition Ragan Solutions Manualmabelleonardn75s2100% (30)

- Project Report LissstDocumento6 páginasProject Report LissstShivareddyAinda não há avaliações

- Final ProjectDocumento64 páginasFinal ProjectprashanthAinda não há avaliações

- Genet Tadesse - A Small Business Borrower in EthiopiaDocumento2 páginasGenet Tadesse - A Small Business Borrower in EthiopiaWedpPepeAinda não há avaliações

- Sherry Hunt Case - Team CDocumento4 páginasSherry Hunt Case - Team CMariano BonillaAinda não há avaliações

- SDH 231Documento3 páginasSDH 231darff45Ainda não há avaliações

- Banking Theory, Law and PracticeDocumento51 páginasBanking Theory, Law and PracticePrem Kumar.DAinda não há avaliações

- Collins Apple PDFDocumento1 páginaCollins Apple PDFGh UnlockersAinda não há avaliações

- Lesson 1 - Overview of Valuation Concepts and MethodsDocumento5 páginasLesson 1 - Overview of Valuation Concepts and MethodsF l o w e rAinda não há avaliações

- Profile Summary: Harkesh GargDocumento3 páginasProfile Summary: Harkesh Gargharkesh gargAinda não há avaliações

- GSTIN 18ABPFM4435K1ZQ: InvoiceDocumento2 páginasGSTIN 18ABPFM4435K1ZQ: InvoicenirajAinda não há avaliações

- 1 Point: Failure of Rakham To Collect The Debt Within Three Years From The Date It Becomes DueDocumento17 páginas1 Point: Failure of Rakham To Collect The Debt Within Three Years From The Date It Becomes DueClarince Joyce Lao DoroyAinda não há avaliações

- Notes - FAR - Loans and Receivables (Financial Assets at Amortized Cost)Documento10 páginasNotes - FAR - Loans and Receivables (Financial Assets at Amortized Cost)ElaineJrV-IgotAinda não há avaliações

- Module 1.3 Understanding The Entity and Its Environment Including IC - For POSTINGDocumento12 páginasModule 1.3 Understanding The Entity and Its Environment Including IC - For POSTINGMae Gamit LaglivaAinda não há avaliações

- TATA MOTORS Atif PDFDocumento9 páginasTATA MOTORS Atif PDFAtif Raza AkbarAinda não há avaliações

- Company Name: Starting Date Cash Balance Alert MinimumDocumento3 páginasCompany Name: Starting Date Cash Balance Alert MinimumdantevariasAinda não há avaliações

- Quarterly Report (Q3 2023) - 13 November 2023Documento59 páginasQuarterly Report (Q3 2023) - 13 November 2023judy jace thaddeus AlejoAinda não há avaliações

- Strategy 10: Long StraddleDocumento9 páginasStrategy 10: Long StraddlenemchandAinda não há avaliações

- Documentary Stamp TaxDocumento120 páginasDocumentary Stamp Taxnegotiator50% (2)

- Delayed: Intermediaries, They CollecDocumento16 páginasDelayed: Intermediaries, They CollecNadeesha UdayanganiAinda não há avaliações