Escolar Documentos

Profissional Documentos

Cultura Documentos

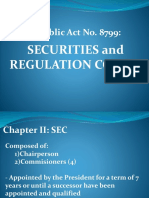

Securities and Regulations Code

Enviado por

Brige Serv-NavDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Securities and Regulations Code

Enviado por

Brige Serv-NavDireitos autorais:

Formatos disponíveis

Course Outline in Commercial Law Review Securities Regulations Code (SRC) Fiscal R.S.

Aquino-Tambasacan

C. Definition and general classification of securities (Sec. 3)

SEC. 3. Definition of Terms. 3.1. Securities are shares, participation or interests in a corporation or in a commercial enterprise or profit-making venture and evidenced ! a certificate, contract, instrument, "hether "ritten or electronic in character. #t includes$ %a& Shares of stock, onds, de entures, notes, evidences of inde tedness, asset- acked securities' % & #nvestment contracts, certificates of interest or participation in a profit sharing agreement, certificates of deposit for a future su scription' %c& (ractional undivided interests in oil, gas or other mineral rights' %d& )erivatives like option and "arrants' %e& Certificates of assignments, certificates of participation, trust certificates, voting trust certificates or similar instruments' %f& *roprietar! or non proprietar! mem ership certificates incorporations' and %g& +ther instruments as ma! in the future e determined ! the Commission. Profit Participation Certificate

and "ith recogni8ed competence in social and economic disciplines$ Provided, -hat the ma:orit! of Commissioners, including the Chairperson, shall e mem ers of the *hilippine ;ar. ,.3. -he Chairperson is the chief e.ecutive officer of the Commission. -he Chairperson shall e.ecute and administer the policies, decisions, orders and resolutions approved ! the Commission and shall have the general e.ecutive direction and supervision of the "ork and operation of the Commission and of its mem ers, odies, oards, offices, personnel and all its administrative usiness. ,.,. -he salar! of the Chairperson and the Commissioners shall e fi.ed ! the *resident of the *hilippines ased on an o :ective classification s!stem, at a sum compara le to the mem ers of the <onetar! ;oard and commensurate to the importance and responsi ilities attached to the position. ,.9. -he Commission shall hold meetings at least once a "eek for the conduct of usiness or as often as ma! e necessar! upon call of the Chairperson or upon the re0uest of three %3& Commissioners. -he notice of the meeting shall e given to all Commissioners and the presence of three %3& Commissioners shall constitute a 0uorum. #n the a sence of the Chairperson, the most senior Commissioner shall act as presiding officer of the meeting. ,.=. -he Commission ma!, for purposes of efficienc!, delegate an! of its functions to an! department or office of the Commission, an individual Commissioner or staff mem er of the Commission e.cept its revie" or appellate authorit! and its po"er to adopt, alter and supplement an! rule or regulation. -he Commission ma! revie" upon its o"n initiative or upon the petition of an! interested part! an! action of an! department or office, individual Commissioner, or staff mem er of the Commission. SEC. =. Indemnification and Responsibilities of Commissioners.- =.1. -he Commission shall indemnif! each Commissioner and other officials of the Commission, including personnel performing supervision and e.amination functions for all costs and e.penses reasona l! incurred ! such persons in connection "ith an! civil or criminal actions, suits or proceedings to "hich the! ma! e or made a part! ! reason of the performance of their functions or duties, unless the! are finall! ad:udged in such actions or proceedings to e lia le for gross negligence or misconduct. #n the event of settlement or compromise, indemnification shall e provided onl! in connection "ith such matters covered ! the settlement as to "hich the Commission is advised ! e.ternal counsel that the persons to e indemnified did not commit an! gross negligence or misconduct. -he costs and e.penses incurred in defending the aforementioned action, suit or proceeding ma! e paid ! the Commission in advance of the final disposition of such action, suit or proceeding upon receipt of an

Certificate of Membership

D. SEC Structure (Secs. 4 and 6 S!C !ules 3)

SEC. ,. Administrative Agency.

,.1. -his Code shall e administered ! the Securities and E.change Commission %hereafter the Commission& as a collegial od!, composed of a Chairperson and four %,& Commissioners, appointed ! the *resident for a term of seven %/& !ears each and "ho shall serve as such until their successor shall have een appointed and 0ualified. 1 Commissioner appointed to fill a vacanc! occurring prior to the e.piration of the term for "hich his2her predecessor "as appointed, shall serve onl! for the une.pired portion of such term. -he incum ent Chairperson and Commissioners at the effectivit! of this Code, shall serve the une.pired portion of their terms under *residential )ecree 3o. 456-1. 7nless the conte.t indicates other"ise, the term Commissioner includes the Chairperson. ,.6. -he Commissioners must e natural- orn citi8ens of the *hilippines, at least fort! %,5& !ears of age for the Chairperson and at least thirt!-five %39& !ears of age for the Commissioners, of good moral character, of un0uestiona le integrit!, of kno"n pro it! and patriotism,

Consolidated by Didit!, P"P#$a%

*age " of 64

Course Outline in Commercial Law Review Securities Regulations Code (SRC) Fiscal R.S. Aquino-Tambasacan

undertaking ! or on ehalf of the Commissioner, officer or emplo!ee to repa! the amount advanced should it ultimatel! e determined ! the Commission that he2she is not entitled to e indemnified as provided in this su section. =.6. -he Commissioners, officers and emplo!ees of the Commission "ho "illfull! violate this Code or "ho are guilt! of negligence, a use or acts of malfeasance or fail to e.ercise e.traordinar! diligence in the performance of their duties shall e held lia le for an! loss or in:ur! suffered ! the Commission or other institutions as a result of such violation, negligence, a use, malfeasance, or failure to e.ercise e.traordinar! diligence. Similar responsi ilit! shall appl! to the Commissioners, officers and emplo!ees of the Commission for %1& the disclosure of an! information, discussion or resolution of the Commission of a confidential nature, or a out the confidential operations of the Commission, unless the disclosure is in connection "ith the performance of official functions "ith the Commission or "ith prior authori8ation of the Commissioners' or %6& the use of such information for personal gain or to the detriment of the government, the Commission or third parties$ Provided, !o%ever, -hat an! data or information re0uired to e su mitted to the *resident and2or Congress or its appropriate committee, or to e pu lished under the provisions of this Code shall not e considered confidential.

%f& #mpose sanctions for the violation of la"s and the rules, regulations and orders issued pursuant thereto' %g& *repare, approve, amend or repeal rules, regulations and orders, and issue opinions and provide guidance on and supervise compliance "ith such rules, regulations and orders' %h& Enlist the aid and support of and2or deputi8e an! and all enforcement agencies of the @overnment, civil or militar! as "ell as an! private institution, corporation, firm, association or person in the implementation of its po"ers and functions under this Code' %i& #ssue cease and desist orders to prevent fraud or in:ur! to the investing pu lic' %:& *unish for contempt of the Commission, oth direct and indirect, in accordance "ith the pertinent provisions of and penalties prescri ed ! the Aules of Court' %k& Compel the officers of an! registered corporation or association to call meetings of stockholders or mem ers thereof under its supervision' %l& #ssue subpoena duces tecum and summon "itnesses to appear in an! proceedings of the Commission and in appropriate cases, order the e.amination, search and sei8ure of all documents, papers, files and records, ta. returns, and ooks of accounts of an! entit! or person under investigation as ma! e necessar! for the proper disposition of the cases efore it, su :ect to the provisions of e.isting la"s' %m& Suspend, or revoke, after proper notice and hearing the franchise or certificate of registration of corporations, partnerships or associations, upon an! of the grounds provided ! la"' and %n& E.ercise such other po"ers as ma! e provided ! la" as "ell as those "hich ma! e implied from, or "hich are necessar! or incidental to the carr!ing out of, the e.press po"ers granted the Commission to achieve the o :ectives and purposes of these la"s. 9.6. -he CommissionBs :urisdiction over all cases enumerated under Section 9 of *residential )ecree 3o. 456-1 is here ! transferred to the Courts of general :urisdiction or the appropriate Aegional -rial Court$ Provided, that the Supreme Court in the e.ercise of its authorit! ma! designate the Aegional -rial Court ranches that shall e.ercise :urisdiction over these cases. -he Commission shall retain :urisdiction over pending cases involving intra-corporate disputes su mitted for final resolution "hich should e resolved "ithin one %1& !ear from the enactment of this Code. -he Commission shall retain :urisdiction over pending suspension of pa!ments2reha ilitation cases filed as of 35 Cune 6555 until finall! disposed. &ppointment of rehabilitation recei'er

E. SEC po#ers and $urisdiction (Sec. %)

SEC. 9. Po%ers and &unctions of t!e Commission'# 9.1. -he Commission shall act "ith transparenc! and shall have the po"ers and functions provided ! this Code, *residential )ecree 3o. 456-1, the Corporation Code, the #nvestment >ouses ?a", the (inancing Compan! 1ct and other e.isting la"s. *ursuant thereto the Commission shall have, among others, the follo"ing po"ers and functions$ %a& >ave :urisdiction and supervision over all corporations, partnerships or associations "ho are the grantees of primar! franchises and2or a license or permit issued ! the @overnment' % & (ormulate policies and recommendations on issues concerning the securities market, advise Congress and other government agencies on all aspects of the securities market and propose legislation and amendments thereto' %c& 1pprove, re:ect, suspend, revoke or re0uire amendments to registration statements, and registration and licensing applications' %d& Aegulate, investigate or supervise the activities of persons to ensure compliance' %e& Supervise, monitor, suspend or take over the activities of e.changes, clearing agencies and other SA+s'

Consolidated by Didit!, P"P#$a%

*age ( of 64

Course Outline in Commercial Law Review Securities Regulations Code (SRC) Fiscal R.S. Aquino-Tambasacan

)nspection of boo*s

Case+ PSE 's. C& (regulator $S#) ,&C-S+

!ower o" S#C over

-he SEC found oth Cualoping and (idelit! e0uall! negligent in the performance of their duties here ! orders them to %1& :ointl! replace the su :ect shares and for (idelit! to cause the transfer thereof in the names of the u!ers and %6& to pa! a fine of *95,555,55 each for havGingH violated Section 64 %a& of the Aevised Securities 1ct. C1 reversed. )SS.E+ I+3 oth parties are negligent. /E0D+ DES. -he first aspect of the SEC decision appealed to the Court of 1ppeals, i'e', that portion "hich orders the t"o stock transfer agencies to J:ointl! replace the su :ect shares and for (#)E?#-D to cause the transfer thereof in the names of the u!ersJ clearl! calls for an e.ercise of SECLs ad:udicative :urisdiction. -his case, it might e recalled, has started onl! on the asis of a re0uest ! (#)E?#-D for an opinion from the SEC. -he stockholders "ho have een deprived of their certificates of stock or the persons to "hom the forged certificates have ultimatel! een transferred ! the supposed indorsee thereof are !et to initiate, if minded, an appropriate adversarial action. 3either have the! een made parties to the proceedings no" at ench. 1 :usticia le controvers! such as can occasion an e.ercise of SECLs e.clusive :urisdiction "ould re0uire an assertion of a right ! a proper part! against another "ho, in turn, contests it. % #t is one instituted ! and against parties having interest in the su :ect matter appropriate for :udicial determination predicated on a given state of facts. -hat controvers! must e raised ! the part! entitled to maintain the action. >e is the person to "hom the right to seek :udicial redress or relief elongs "hich can e enforced against the part! correspondingl! charged "ith having een responsi le for, or to have given rise to, the cause of action. 1 person or entit! tasked "ith the po"er to ad:udicate stands neutral and impartial and acts on the asis of the admissi le representations of the contending parties. #n the case at ench, the proper parties that can ring the controvers! and can cause an e.ercise ! the SEC of its original and e.clusive :urisdiction "ould e all or an! of those "ho are adversel! affected ! the transfer of the pilfered certificates of stock. 1n! peremptor! :udgment ! the SEC, "ithout such proceedings having first een initiated, "ould e precipitate. Ie thus see nothing erroneous in the decision of the Court of 1ppeals, albeit not for the reason given ! it, to set aside the SECLs ad:udication J"ithout pre:udiceJ to the right of persons in:ured to file the necessar! proceedings for appropriate relief. %on the issue of the legal propriet1 of the imposition b1 the SEC of a P%2 222 fine on each of ,)DE0)-3 and C.&04P)56&-here is, to our mind, no 0uestion that oth (#)E?#-D and C71?+*#3@ have een guilt! of negligence in the conduct of their affairs involving the 0uestioned certificates of stock. -o constitute ho#e'er a 'iolation of the !e'ised Securities &ct that can #arrant an imposition of a fine under Section (7(3) in relation to Section 46 of the &ct fraud or deceit not mere negligence on the part of the offender must be established. (raud here is a*in to bad faith #hich

Cualoping Securities Corporation %C71?+*#3@ for revit!& is a stock roker, (idelit! Stock -ransfer, #nc. %(#)E?#-D for revit!&, on the other hand, is the stock transfer agent of *hile. <ining Corporation %*>#?EE for revit!&. +n or a out the first half of 14FF, certificates of stock of *>#?EE representing one million four hundred GthousandH %1,,55,555& shares "ere stolen from the premises of (#)E?#-D. -hese stock certificates consisting of stock dividends of certain *>#?EE shareholders had een returned to (#)E?#-D for lack of for"arding addresses of the shareholders concerned. ?ater, the stolen stock certificates ended in the hands of a certain 1gustin ?ope8, a messenger of (e% )orld Security Inc., an entirel! different stock rokerage firm. #n the first half of 14F4, 1gustin ?ope8 rought the stolen stock certificates to C71?+*#3@ for trading and sale "ith the stock e.change. Ihen the said stocks "ere rought to C71?+*#3@, all of the said stock certificates ore the JapparentJ indorsement %signature& in blan* of the o"ners %the stockholders to "hom the stocks "ere issued ! *>#?EE& thereof. 1t the side of these indorsements %signatures&, the "ords JSignature KerifiedJ apparently of &ID+$IT, "ere stamped on each and ever! certificate. (urther, on the "ords JSignature KerifiedJ sho"ed the usual initials of the officers of (#)E?#-D. 7pon receipt of the said certificates from 1gustin ?ope8, C71?+*#3@ stamped each and ever! certificate "ith the "ords J#ndorsement @uaranteed,J and thereafter traded the same "ith the stock e.change. 1fter the stock e.change a"arded and confirmed the sale of the stocks represented ! said certificates to different u!ers, the same "ere delivered to (#)E?#-D for the cancellation of the stocks certificates and for issuance of ne" certificates in the name of the ne" u!ers. 1gustin ?ope8 on the other hand "as paid ! C71?+*#3@ "ith several checks for (our >undred -housand %*,55,555.55& *esos for the value of the stocks. 1fter ac0uiring kno"ledge of the pilferage, (#)E?#-D conducted an investigation "ith assistance of the 3ational ;ureau of #nvestigation %3;#& and found that t"o of its emplo!ees "ere involved and signed the certificates. 1fter t"o %6& months from receipt of said stock certificates, (#)E?#-D re:ected the issuance of ne" certificates in favor of the u!ers for reasons that the signatures of the o"ners of the certificates "ere allegedl! forged and thus the cancellation and ne" issuance thereof cannot e effected.

Consolidated by Didit!, P"P#$a%

*age 3 of 64

Course Outline in Commercial Law Review Securities Regulations Code (SRC) Fiscal R.S. Aquino-Tambasacan

implies a conscious and intentional design to do a #rongful act for a dishonest purpose or moral obli8uit19 it is unli*e that of the negati'e idea of negligence in that fraud or bad faith contemplates a state of mind affirmati'el1 operating #ith furti'e ob$ecti'es. @iven the factual circumstances found ! the appellate court, neither (#)E?#-D nor C71?+*#3@, albeit indeed remiss in the o servance of due diligence, can e held lia le under the a ove provisions of the Aevised Securities 1ct. Ie do not impl!, ho"ever, that the negligence committed ! private respondents "ould not at all e actiona le' upon the other hand, as "e have earlier intimated, such an action elongs not to the SEC ut to those "hose rights have een in:ured. Case+ Cemco /oldings 's. 5ational 0ife )nsurance (!ower o" S#C to nulli" acquisitions violating t%e law) ,&C-S+ 7nion Cement Corporation %7CC&, a pu licl!listed compan!, has t"o principal stockholders 7C>C, a non-listed compan!, "ith shares amounting to =5.91M, and petitioner Cemco "ith1/.53M. <a:orit! of 7C>CBs stocks "ere o"ned ! ;C# "ith 61.31M and 1CC "ith 64.=4M. Cemco, on the other hand, o"ned 4M of 7C>C stocks. #n a disclosure letter, ;C# informed the *hilippine Stock E.change %*SE& that it and its su sidiar! 1CC had passed resolutions to sell to Cemco ;C#Bs stocks in 7C>C e0uivalent to 61.31M and 1CCBs stocks in 7C>C e0uivalent to 64.=4M. 1s a conse0uence of this disclosure, the *SE in0uired as to "hether the -ender +ffer Aule under Aule 14 of the #mplementing Aules of the Securities Aegulation Code is not applica le to the purchase ! petitioner of the ma:orit! of shares of 7CC. -he SEC en anc had resolved that the Cemco transaction "as not covered ! the tender offer rule. (eeling aggrieved ! the transaction, respondent 3ational ?ife #nsurance Compan! of the *hilippines, #nc., a minorit! stockholder of 7CC, sent a letter to Cemco demanding the latter to compl! "ith the rule on mandator! tender offer. Cemco, ho"ever, refused. Aespondent 3ational ?ife #nsurance Compan! of the *hilippines, #nc. filed a complaint "ith the SEC asking it to reverse its 6/ Cul! 655, Aesolution and to declare the purchase agreement of Cemco void and pra!ing that the mandator! tender offer rule e applied to its 7CC shares. -he SEC ruled in favor of the respondent ! reversing and setting aside its 6/ Cul! 655,Aesolution and directed petitioner Cemco to make a tender offer for 7CC shares to respondent and other holders of 7CC shares similar to the class held ! 7C>C in accordance "ith Section 4%E&, Aule 14 of the Securities Aegulation Code. +n petition to the Court of 1ppeals, the C1 rendered a decision affirming the ruling of the SEC. #t ruled that the SEC has :urisdiction to render the 0uestioned decision and, in an! event, Cemco "as

arred ! :urisdiction.

estoppel

from

0uestioning

the

SECBs

#t, like"ise, held that the tender offer re0uirement under the Securities Aegulation Code and its #mplementing Aules applies to CemcoBs purchase of 7C>C stocks. CemcoBs motion for reconsideration "as like"ise denied. )SS.ES+ 1. Ihether or not the SEC has :urisdiction over respondentBs complaint and to re0uire Cemco to make a tender offer for respondentBs 7CC shares. 6. Ihether or not the rule on mandator! tender offer applies to the indirect ac0uisition of shares in a listed compan!, in this case, the indirect ac0uisition ! Cemco of 3=M of 7CC, a pu licl!-listed compan!, through its purchase of the shares in 7C>C, a non-listed compan!. /E0D+ 1. DES. #n taking cogni8ance of respondentBs complaint against petitioner and eventuall! rendering a :udgment "hich ordered the latter to make a tender offer, the SEC "as acting pursuant to Aule14%13& of the 1mended #mplementing Aules and Aegulations of the Securities Aegulation Code, to "it$ 13. Kiolation #f there shall e violation of this Aule ! pursuing a purchase of e0uit! shares of a pu lic compan! at threshold amounts "ithout the re0uired tender offer, the Commission, upon complaint, ma! nullif! the said ac0uisition and direct the holding of a tender offer. -his shall e "ithout pre:udice to the imposition of other sanctions under the Code. -he foregoing rule emanates from the SECBs po"er and authorit! to regulate, investigate or supervise the activities of persons to ensure compliance "ith the Securities Aegulation Code, more specificall! the provision on mandator! tender offer under Section 14thereof. <oreover, petitioner is arred from 0uestioning the :urisdiction of the SEC. #t must e pointed out that petitioner had participated in all the proceedings efore the SEC and had pra!ed for affirmative relief. 6. DES. -ender offer is a pu licl! announced intention ! a person acting alone or in concert "ith other persons to ac0uire e0uit! securities of a pu lic compan!. 1 pu lic compan! is defined as a corporation "hich is listed on an e.change, or a corporation "ith assets e.ceeding *95,555,555.55 and "ith 655 or more stockholders, at least 655 of them holding not less than 155 shares of such compan! . Stated differentl!, a tender offer isan offer ! the ac0uiring person to stockholders of a pu lic compan! for them to tender their shares therein on the terms specified in the offer. -ender offer is in place to protect minorit! shareholders against an! scheme that

Consolidated by Didit!, P"P#$a%

*age 4 of 64

Course Outline in Commercial Law Review Securities Regulations Code (SRC) Fiscal R.S. Aquino-Tambasacan

dilutes the share value of their investments. #t gives the minorit! shareholders the chance to e.it the compan! under reasona le terms, giving them the opportunit! to sell their shares at the same price as those of the ma:orit! shareholders. -he SEC and the Court of 1ppeals ruled that the indirect ac0uisition ! petitioner of 3=M of 7CC shares through the ac0uisition of the nonlisted 7C>C shares is covered ! the mandator! tender offer rule. -he legislative intent of Section 14 of the Code is to regulate activities relating to ac0uisition of control of the listed compan! and for the purpose of protecting the minorit! stockholders of a listed corporation. Ihatever ma! e the method ! "hich control of a pu lic compan! iso tained, either through the direct purchase of its stocks or through an indirect means, mandator! tender offer applies. 1s appropriatel! held ! the Court of 1ppeals$ -he petitioner posits that "hat it ac0uired "ere stocks of 7C>C and not 7CC. ;! happenstance, as a result of the transaction, it ecame an indirect o"ner of 7CC. Ie are constrained, ho"ever, to construe o"nership ac0uisition to mean oth direct and indirect. Ihat is decisive is the determination of the po"er of control. -he legislative intent ehind the tender offer rule makes clear that the t!pe of activit! intended to e regulated is the ac0uisition of control of the listed compan! through the purchase of shares. Control ma! G eH effected through a direct and indirect ac0uisition of stock, and "hen this takes place, irrespective of the means, a tender offer must occur. -he ottom line of the la" is to give the shareholder of the listed compan! the opportunit! to decide "hether or not to sell in connection "ith a transfer of control. . . . Case+ Phil. &ssociation of Stoc* -ransfer and !egistr1 &gencies )nc. 's C& (!ower to regulate "ees) ,&C-S+ *etitioner *hilippine 1ssociation of Stock -ransfer and Aegistr! 1gencies, #nc.%*1S-A1& is an association of stock transfer agents principall! engaged in the registration of stock transfers in the stock-andtransfer ook of corporations. +n <a! 15, 144=, petitionerBs ;oard of )irectors unanimousl! approved a resolution allo"ing its mem ers to increase the transfer processing fee the! charge their clients. 1fter a dialogue "ith petitioner, pu lic respondent Securities and E.change Commission %SEC& allo"ed petitioner to impose the */9 per certificate transfer fee and *65 per certificate cancellation fee effective Cul! 1, 144=. ;ut, approval of the additional increase of the transfer fees to *155 per certificate effective +cto er 1,

144=, "as "ithheld until after a pu lic hearing. -he SEC issued a letter-authori8ation to this effect. -he *hilippine 1ssociation of Securities ;rokers and )ealers, #nc. registered its o :ection to the measure advanced ! petitioner and re0uested the SEC to defer its implementation. +n Cune 6/, 144=, the SEC advised petitioner to hold in a e!ance the implementation of the increases until the matter "as cleared "ith all the parties concerned. *etitioner nonetheless proceeded implementation of the increased fees. "ith the

*etitionerBs Contention$ that the SEC cannot restrict petitionerBs mem ers from increasing the transfer and processing fees the! charge their clients ecause there is no specific la", rule or regulation authori8ing it. Section ,5 of the then Aevised Securities 1ct, according to petitioner, onl! la!s do"n the general po"ers of the SEC to regulate and supervise the corporate activities of organi8ations related to or connected "ith the securities market like petitioner. #t could not e interpreted to :ustif! the SECBs un:ustified interference "ith petitionerBs decision to increase its transfer fees and impose processing fees, especiall! since the decision involved a management prerogative and "as intended to protect the via ilit! of petitionerBs mem ers. +n Cul! F, 144=, the SEC issued +rder 3o. 15,, series of 144=, en:oining petitioner from imposing the ne" fees %pursuant to Sec. ,5 of the Aevised Securities 1ct& and to sho" a cause "h! no administrative sanctions should e imposed upon the oard and officers of *1S-A1. Su se0uentl! on Cul! 11, 144=, after hearing SEC ordered petitioner to pa! a asic fine of *9,555 and a dail! fine of *955 for continuing violations' it is here ! ordered to immediatel! cease and desist from imposing the ne" rates for issuance and cancellation of stock certificates, until further orders from this Commission. C1 affirmed. >ence this petition. %:hile this case #as pending -he !e'ised Securities &ct b1 authorit1 of #hich the assailed orders #ere issued #as repealed b1 !epublic &ct 5o. ;<77 or -he Securities !egulation Code 6 #hich became effecti'e on &ugust ; (222. 3onetheless,.. Cul! 11, 144= +rder had not een o literated ! the repeal of -he Aevised Securities 1ct and there is still present a need to rule on "hether petitioner "as lia le for the fees imposed upon it&. )SS.E+ "hether the SEC acted "ith grave a use of discretion or lack or e.cess of :urisdiction in issuing the controverted +rders of Cul! F and 11, 144=. /E0D+ 54. Ie find the instant petition ereft of merit. -he Court notes that efore its repeal, Section 4< of -he !e'ised Securities &ct clearl1 ga'e the SEC the po#er to en$oin the acts or practices of securities=

Consolidated by Didit!, P"P#$a%

*age % of 64

Course Outline in Commercial Law Review Securities Regulations Code (SRC) Fiscal R.S. Aquino-Tambasacan

related organi>ations e'en #ithout first conducting a hearing if upon proper in'estigation or 'erification the SEC is of the opinion that there e?ists the possibilit1 that the act or practice ma1 cause gra'e or irreparable in$ur1 to the in'esting public if left unrestrained. Section ,/ clearl! provided, SEC. ,/. Cease and desist order.N-he Commission, after proper investigation or verification, motu proprio, or upon verified complaint ! an! aggrieved part!, ma! issue a cease and desist order "ithout the necessit! of a prior hearing if in its :udgment the act or practice, unless restrained ma1 cause gra'e or irreparable in$ur1 or pre$udice to the in'esting public or ma! amount to fraud or violation of the disclosure re0uirements of this 1ct and the rules and regulations of the Commission. %Emphasis supplied.& Said section enforces the po"er of general supervision of the SEC under Section ,5 of the then Aevised Securities 1ct. 1s a securities-related organi8ation under the :urisdiction and supervision of the SEC ! virtue of Section ,5 of -he Aevised Securities 1ct and Section 3 of *residential )ecree 3o. 456-1,15 petitioner "as under the o ligation to compl! "ith the Cul! F, 144= +rder. )efiance of the order "as su :ect to administrative sanctions provided in Section ,=11 of -he Aevised Securities 1ct. *etitioner "as fined for violating the SECBs desist order "hich the SEC had issued to interest of the investing pu lic, and not e.ercising its :udgment in the manner appropriate for its usiness. cease-andprotect the simpl! for it deems

pending cases involving intra-corporate disputes su mitted for final resolution "hich should e resolved "ithin one %1& !ear from the enactment of this Code. -he Commission shall retain :urisdiction over pending suspension of pa!ments2reha ilitation cases filed as of 35 Cune 6555 until finall! disposed. P!ES)DE5-)&0 DEC!EE 54. 72(=& SEC !E4!6&5)A&-)45 &C&arc% ''( ')*+ Sec. 9. #n addition to the regulator! and ad:udicative functions of the Securities and E.change Commission over corporations, partnerships and other forms of associations registered "ith it as e.pressl! granted under e.isting la"s and decrees, it shall have original and e.clusive :urisdiction to hear and decide cases involving. %a& )evices or schemes emplo!ed ! or an! acts, of the oard of directors, usiness associates, its officers or partnership, amounting to fraud and misrepresentation "hich ma! e detrimental to the interest of the pu lic and2or of the stockholder, partners, mem ers of associations or organi8ations registered "ith the Commission' % & Controversies arising out of intra-corporate or partnership relations, et"een and among stockholders, mem ers, or associates' et"een an! or all of them and the corporation, partnership or association of "hich the! are stockholders, mem ers or associates, respectivel!' and et"een such corporation, partnership or association and the state insofar as it concerns their individual franchise or right to e.ist as such entit!' and %c& Controversies in the election or appointments of directors, trustees, officers or managers of such corporations, partnerships or associations. ". De'ices and schemes amounting to fraud Case+ Sumndad 's. /aringgan ,acts+ *laintiff >arrigan %no" respondent in this case& filed a complaint for collection of sum of mone! "ith a pra!er for preliminar! attachment "ith the A-C <akati against respondent ;oraca! ;each Clu >otel, #nc. %;;C>#&. >arrigan pra!ed for the issuance of the "rit of preliminar! attachment pending the case "hich "as granted ! the trial court after he posted an attachment ond amounting to * 6 million. Su se0uetl!, >arrigan filed an amended complaint impleading the management committee of ;;C># through its acting chairman. -he trial court admitted the amended complaint and issued an amended order for the issuance of "rit of attachment. -hen, petitioner Sumndad filed an 7rgent <otion for ?eave to #ntervene "ith a pra!er for Status Ouo2Supension, pra!ing that she e allo"ed to intervene as a plaintiff or as a defendant. >o"ever, Sumndad "as declared in default upon motion of >arrigan due to her failure to file an ans"er "ithin the reglementar! period as provided under the rules and as a conse0uence the trial

-he regulator1 and super'isor1 po#ers of the Commission under Section 42 of the then !e'ised Securities &ct in our 'ie# #ere broad enough to include the po#er to regulate petitioner@s fees. #ndeed, Section ,/ gave the Commission the po"er to en:oin motu proprio an! act or practice of petitioner "hich could cause grave or irrepara le in:ur! or pre:udice to the investing pu lic. -he intentional omission in the la" of an! 0ualification as to "hat acts or practices are su :ect to the control and supervision of the SEC under Section ,/ confirms the road e.tent of the SECBs regulator! po"ers over the operations of securities-related organi8ations like petitioner.

,. &mendments introduced b1 Sec. %.( to Sec % of PD 72(=&

9.6. -he CommissionBs :urisdiction over all cases enumerated under Section 9 of *residential )ecree 3o. 456-1 is here ! transferred to the Courts of general :urisdiction or the appropriate Aegional -rial Court$ Provided, that the Supreme Court in the e.ercise of its authorit! ma! designate the Aegional -rial Court ranches that shall e.ercise :urisdiction over these cases. -he Commission shall retain :urisdiction over

Consolidated by Didit!, P"P#$a%

*age 6 of 64

Course Outline in Commercial Law Review Securities Regulations Code (SRC) Fiscal R.S. Aquino-Tambasacan

court proceeded "ith the e. parte presentation of evidence. >arrigan filed a <otion for Cudgment on the *leadings. -he trial court acting on >arriganBs motion for :udgment on the pleadings rendered :udgment in favor of plaintiff >arrigan and ordered ;;C># to pa! the amount of * F million plus 16 M interest per annum, plus attorne!Bs fees and the costs of the suit. 3ot satisfied "ith the decision, the petitioner Sumndad filed a motion for reconsideration "hich "as denied ! the trial court, 1s a recourse, the petitioner then filed "ith the C1, a petition for certiorari, prohi ition and mandamus, ho"ever the C1 dismissed the petition for lack of merit. *etitioner again moved for reconsideration ut "as denied ! the C1' hence, this recourse of petition for revie" on certiorari. Petitioner@s contention+ it is the SEC that has :urisdiction ! virtue of *residential )ecree 3o. 456-1 %Aeorgani8ation of the Securities and E.change Commission "ith 1dditional *o"ers& ecause the complaint alludes to fraud committed ! respondent corporation, and the complainant is a stockholder of the respondent corporation. Pri'ate respondent@s contention+ maintains that :urisdiction is lodged "ith the regular courts, it eing a simple collection case. )ssue+ #s it the regular court or the Securities and E.change Commission %SEC& that has :urisdiction over the su :ect matter of the caseP !uling+ -he petition is unmeritorious. (irst. -he rule is that :urisdiction over the su :ect matter of the case is conferred ! la" and determined ! the allegations of the complaint. -herefore, to resolve the issue raised to us, an interpretation and application of the la" on :urisdiction, must e made vis#-#vis the averments of the petitionerBs complaint. -he la" on :urisdiction of the SEC, Section 9 of *) 4561, states that in addition to the regulator! and ad:udicative functions of the SEC over corporations, partnerships and other forms of associations registered "ith it as e.pressl! granted under the e.isting la"s and decrees, it shall have original and e.clusive :urisdiction to hear and decide cases involving devises or schemes emplo!ed ! or an! acts of the ;oard of )irectors, usiness associates, its officers and partners, amounting to fraud and misrepresentation "hich ma! e detrimental to the interest of the pu lic and2or to the stockholders, partners, mem ers of associations or organi8ations registered "ith the Commission. 3o", from the averments of the amended complaint filed "ith the trial court as 0uoted a ove, >arrigan seeks to collect from ;;C># his advances or loans in the amount of at least *F million, "hich are demanda le in character

pursuant to their agreement, including interest at 65M per annum accruing from Septem er 1, 1445. -he cause of action of the suit is, clearl!, for the collection of a sum of mone!. >o"ever, petitioner interprets said collection complaint as one involving mainl! the issue of fraud committed ! respondent corporation, "hich makes the controvers! fall under the am it of *) 456-1. -he particular portion of the amended complaint referred to ! petitioner states$ 1,. #n so allo"ing another person to have the absolute and uncontrolled possession, management, and utili8ation of the uildings and facilities of the ;oraca! ;each Clu >otel resort "ithout an! corresponding financial return or material enefit therefor, and the misappropriation ! said third part! of the income from the operation of the resort usiness therein, since Cul! 6F, 144, and up to the present or for a period of over seven ./0 mont!s no", defendant has, in effect, disposed of and continues to 1C-71??D )#S*+SE of and2or "antonl! "aste2dissipate said corporate properties and funds, in fraud of its creditors, "hich include herein plaintiff. -o our mind, from the totalit! of the complaint filed ! >arrigan, the main issue is "hether or not he is entitled to collect the loan and not "hether or not he "as defrauded ! ;;C>#. -he mere use of the phrase Jin fraud of creditorsJ does not, ipso facto, thro" the case "ithin SECBs :urisdiction. -he amended complaint filed ! >arrigan does not sufficientl! allege acts amounting to fraud and misrepresentation committed ! respondent corporation. #n Alle1e vs' CA, JfraudJ is defined as a generic term em racing all multifarious means %!ic! !uman ingenuity can devise, and "hich are resorted to ! one individual to secure an advantage over another by false suggestions or by suppression of trut! and includes all surprise, tric*, cunning, dissembling and any unfair %ay by %!ic! anot!er is c!eated. Iithin the conte.t of the complaint as 0uoted a ove, the phrase Jin fraud of creditorsJ can onl! mean, Jto the pre:udice of creditorsJ and not to the use of devises or schemes tantamount to fraud and misrepresentation emplo!ed ! the ;oard of )irectors, usiness associates or its officers and partners to divert corporate funds and assets for personal use, as contemplated in Section 9 of *) 456-1. E0uall! unavailing is petitionerBs contention that the case involves an intra-corporate controvers!, or one et"een the corporation and its stockholder transposing it "ithin the domain of the SEC. #t should e noted that the issue has ecome moot and academic ecause "ith Aepu lic 1ct 3o. F/44, Securities Aegulation Code, it is no" the Aegional -rial Court and no longer the SEC that has :urisdiction. 7nder Section 9.6 of Aepu lic 1ct 3o. F/44, original and e.clusive :urisdiction to hear and decide cases involving intra-corporate controversies have een transferred to a court of general :urisdiction or the appropriate Aegional -rial Court.

Consolidated by Didit!, P"P#$a%

*age < of 64

Course Outline in Commercial Law Review Securities Regulations Code (SRC) Fiscal R.S. Aquino-Tambasacan

(oregoing given, >arriganBs complaint against petitioner to recoup his financial e.posure "ith ;;C># "as properl! lodged "ith the regular court and not "ith the SEC. -his vie" is in accord "ith the rudimentar! principle that administrative agencies, like the SEC, are tri unals of limited :urisdiction and, as such, could "ield onl! such po"ers as are specificall! granted to them ! their ena ling statutes. (. )ntra=corporate contro'ersies )5-E!)M !.0ES 4, P!4CED.!E ,4! )5-!&= C4!P4!&-E C45-!4BE!S)ES Rule , 6E5E!&0 P!4B)S)45S Section 1. %a& Cases covered' - -hese Aules shall govern the procedure to e o served in civil cases involving the follo"ing$ %1& )evices or schemes emplo!ed !, or an! act of, the oard of directors, usiness associates, officers or partners, amounting to fraud or misrepresentation "hich ma! e detrimental to the interest of the pu lic and2or of the stockholders, partners, or mem ers of an! corporation, partnership, or association' %6& Controversies arising out of intra-corporate, partnership, or association relations, et"een and among stockholders, mem ers, or associates' and et"een, an! or all of them and the corporation, partnership, or association of "hich the! are stockholders, mem ers, or associates, respectivel!' %3& Controversies in the election or appointment of directors, trustees, officers, or managers of corporations, partnerships, or associations' %,& )erivative suits' %9& #nspection of corporate ooks % & Pro!ibition against nuisance and !arassment suits' 3uisance and harassment suits are prohi ited. #n determining "hether a suit is a nuisance or harassment suit, the court shall consider, among others, the follo"ing$ %1& -he e.tent of the shareholding or interest of the initiating stockholder or mem er' %6& Su :ect matter of the suit' %3& ?egal and factual asis of the complaint' %,& 1vaila ilit! of appraisal rights for the act or acts complained of' and %9& *re:udice or damage to the corporation, partnership, or association in relation to the relief sought.crala" #n case of nuisance or harassment suits, the court ma!, motu proprio or upon motion, forth"ith dismiss the case. Sec. 6. Suppletory application of t!e Rules of Court . -he Aules of Court, in so far as the! ma! e applica le

and are not inconsistent "ith these Aules, are here ! adopted to form an integral part of these Aules. Definition9 #ho has $urisdiction

!-C not di'ested of $urisdiction if a person is no longer a stoc*holder

Corporate officer@s dismissal intra=corporate

Cu1ing=out corporate

shares

considered

intra=

Stoc*holder 's stoc*holder considered intra=corporate

dispute

Suit against a non=stoc*holder not intra= corporate

Member 's. corporation considered intra= corporate

Cases+ SPEED D)S-!)C.-)56 C4!P. 0)-& M&!CE04 )!E5E4 M&!CE04 and PED!4 &D.)54 petitioners, vs. C4.!- 4, &PPE&0S and !.,)5& 0)M respondents. ,&C-S+ *astor ?im died intestate and "as survived ! his "ife, the private respondent, and his informall! adopted daughter ?ita ?im <arcelo, among others. +n <arch 1/, 1449, the private respondent, through her nephe" and attorne!-in-fact @eorge ?u!, filed a petition for the administration of the estate of her deceased hus and efore the Aegional -rial Court. -he complaint %su :ect if the issue& is one for the nullification of the deed of a solute sale e.ecuted ! ?eslim %one of the corporations of the deceased& in favor of Speed %another one of the corporations of the deceased& over the propert! covered ! -C- 3o. -3==1/ in the name of ?eslim, the cancellation of -C- 3o. --11=/1= in the name of Speed, as "ell as the

Consolidated by Didit!, P"P#$a%

*age ; of 64

Course Outline in Commercial Law Review Securities Regulations Code (SRC) Fiscal R.S. Aquino-Tambasacan

Secretar!Bs Certificate dated 1ugust 66, 144,. -he private respondent alleged that since her deceased hus and, *astor ?im, ac0uired the propert! during their marriage, the said propert! is con:ugal in nature, although registered under the name of ?eslim under -C3o. --3==1/. She asserted that the petitioners connived to deprive the estate of *astor ?im and his heirs of their possession and o"nership over the said propert! using a falsified Secretar!Bs Certificate stating that the ;oard of )irectors of ?eslim had a meeting on 1ugust 14, 1449, "hen, in fact, no such meeting "as held. Petitioner 0ita 0im #as ne'er a stoc*holder of 0eslim or a member of its Coard of Directors9 her husband petitioner )reneo Marcelo #as the Bice=President of Speed9 and petitioner Pedro &8uino #as 0eslim@s corporate secretar1. -he private respondent further averred that the amount of *3,455,555.55, the purchase price of the propert! under the deed of a solute sale, "as not paid to ?eslim, and that petitioners Spouses <arcelo and petitioner *edro 10uino contrived the said deed to consummate their devious scheme and chicaner!. -he private respondent concluded that the )eed of 1 solute Sale "as simulated' hence, null and void. )SS.E+ I+3 the case at corporate dispute ar is one involving intra-

E.change Commission %SEC& on 6= <arch 144/ against the Kesagas and 1sis %SEC Case 53-4/-994F&. -he spouses Aaniel asked the Commission to declare as illegal their e.pulsion from the clu as it "as allegedl! done in utter disregard of the provisions of its !-la"s as "ell as the re0uirements of due process. -he! like"ise sought the annulment of the amendments to the !-la"s made on F )ecem er 144=, changing the annual meeting of the clu from the last Sunda! of Canuar! to 3ovem er and increasing the num er of trustees from nine to fifteen. (inall!, the! pra!ed for the issuance of a -emporar! Aestraining +rder and Irit of *reliminar! #n:unction. -he application for -A+ "as denied ! SEC >earing +fficer Soller in an +rder dated 64 1pril 144/. ;efore the hearing officer could start proceeding "ith the case, ho"ever, Kesagas and 1sis filed a motion to dismiss on the ground that the SEC lacks :urisdiction over the su :ect matter of the case. -he motion "as denied on 9 1ugust 144/. -heir su se0uent move to have the ruling reconsidered "as like"ise denied. 7npertur ed, the! filed a petition for certiorari "ith the SEC En ;anc seeking a revie" of the hearing officerLs orders. -he petition "as again denied for lack of merit, and so "as the motion for its reconsideration in separate orders, dated 1, Cul! 144F and 1/ 3ovem er 144F, respectivel!. )issatisfied "ith the verdict, Kesagas and 1sis promptl! sought relief "ith the Court of 1ppeals contesting the ruling of the Commission en anc. -he appellate court, ho"ever, dismissed the petition for lack of merit in a )ecision promulgated on 35 Cul! 1444. -hen, in a resolution rendered on 1= <arch 6555, it similarl! denied their motion for reconsideration. Kesagas and 1sis filed the petition for revie" on certiorari. )ssue+ Ihether the clu corporate od!. /eld+ -he clu , according to the SECLs e.plicit finding, "as dul! registered and a certificate of incorporation "as issued in its favor. -he 0uestion of "hether the clu "as indeed registered and issued a certification or not is one "hich necessitates a factual in0uir!. -he finding of the Commission, as the administrative agenc! tasked "ith among others the function of registering and administering corporations, is given great "eight and accorded high respect. <oreover, ! their o"n admission contained in the various pleadings "hich the! have filed in the different stages of this case, Kesagas and 1sis themselves have considered the clu as a corporation. +ther"ise, there is no cogenc! in spearheading the move for its dissolution. Kesagas and 1sis "ere therefore "ell a"are of the incorporation of the clu and even agreed to get elected and serve as its responsi le officers efore the! reconsidered dissolving its corporate form. +n the other hand, at the time of the institution of the case "ith the SEC, the clu "as not dissolved ! virtue of an alleged ;oard resolution. -he Corporation Code esta lishes the procedure and other formal re0uirements a corporation needs to follo" in case it elects to dissolve and terminate its structure voluntaril! and "here no rights of creditors ma! possi l! e pre:udiced. Section 11F %Koluntar! dissolution "here no has alread! ceased to e a

/E0D$ 3+. -o determine "hether a case involves an intra-corporate controvers!, and is to e heard and decided ! the ;ranches of the A-C specificall! designated ! the Court to tr! and decide such cases, t"o elements must concur$ %a& the status or relationship of the parties' and %6& the nature of the 0uestion that is the su :ect of their controvers!. -he first element re0uires that the controvers! must arise out of intra-corporate or partnership relations et"een an! or all of the parties and the corporation, partnership or association of "hich the! are stockholders, mem ers or associates' et"een an! or all of them and the corporation, partnership or association of "hich the! are stockholders, mem ers or associates, respectivel!' and et"een such corporation, partnership or association and the State insofar as it concerns their individual franchises. -he second element re0uires that the dispute among the parties e intrinsicall! connected "ith the regulation of the corporation. if the nature of the controvers! involves matters that are purel! civil in character, necessaril!, the case does not involve an intra-corporate controvers!. -he determination of "hether a contract is simulated or not is an issue that could e resolved ! appl!ing pertinent provisions of the Civil Code.

Besagas 's. Court of &ppeals E6! "4(7(4 December % (22"F ,acts+ Spouses )elfino and >elenda Aaniel are mem ers in good standing of the ?u8 Killage -ennis Clu , #nc. -eodoro ;. Kesagas, "ho claims to e the clu Ls dul! elected president, "ith Iilfred ). 1sis, "ho, in turn, claims to e its dul! elected vice-president and legal counsel, allegedl! summaril! stripped them of their la"ful mem ership, "ithout due process of la". -hereafter, the spouses filed a Complaint "ith the Securities and

Consolidated by Didit!, P"P#$a%

*age 7 of 64

Course Outline in Commercial Law Review Securities Regulations Code (SRC) Fiscal R.S. Aquino-Tambasacan

creditors are affected& of the Corporation Code provides that J#f dissolution of a corporation does not pre:udice the rights of an! creditor having a claim against it, the dissolution ma! e effected ! ma:orit! vote of the oard of directors or trustees and ! a resolution dul! adopted ! the affirmative vote of the stockholders o"ning at least t"o-thirds %623& of the outstanding capital stock or at least t"o-thirds %623& of the mem ers at a meeting to e held upon call of the directors or trustees after pu lication of the notice of time, place and o :ect of the meeting for three %3& consecutive "eeks in a ne"spaper pu lished in the place "here the principal office of said corporation is located' and if no ne"spaper is pu lished in such place, then in a ne"spaper of general circulation in the *hilippines, after sending such notice to each stockholder or mem er either ! registered mail or ! personal deliver! at least 35 da!s prior to said meeting. 1 cop! of the resolution authori8ing the dissolution shall e certified ! a ma:orit! of the oard of directors or trustees and countersigned ! the secretar! of the corporation. -he Securities and E.change Commission shall thereupon issue the certificate of dissolution.J -o su stantiate their claim of dissolution, Kesagas and 1sis su mitted onl! t"o relevant documents$ the <inutes of the (irst ;oard <eeting held on 9 Canuar! 144/, and the oard resolution issued on 1, 1pril 144/ "hich declared Jto continue to consider the clu as a non-registered or a non-corporate entit! and :ust a social association of respecta le and respecting individual mem ers "ho have associated themselves, since the 14/5Ls, for the purpose of pla!ing the sports of tennis.J -hese t"o documents "ill not suffice. -he re0uirements mandated ! the Corporation Code should have een strictl! complied "ith ! the mem ers of the clu . -he records reveal that no proof "as offered ! Kesagas and 1sis "ith regard to the notice and pu lication re0uirements. Similarl! "anting is the proof of the oard mem ersL certification. ?astl!, and most important of all, the SEC +rder of )issolution "as never su mitted as evidence. 3. Election officers Cases+ appointment remo'al of corporate

petitioner respecting the settlement of the loan, advised him ! letter dated Cul! 19, 144F that he ma! use his retirement enefits in Sk! Kision in partial settlement of his loan after he settles his accounta ilities to the latter and gives his "ritten instructions to it %Sk! Kision&. *etitioner protested the computation in the said letter. Aespondent filed a complaint for collection of sum of mone! "ith damages at A-C *asig. against petitioner, alleging that petitioner violated the a ove-0uoted Section = of the loan agreement as he failed to put up the needed collateral for the loan and pa! the installments as the! ecame due, and that despite his receipt of letters of demand dated )ecem er 1, 144// and Canuar! 13, 144F,Fhe refused to pa!. #n his ans"er, petitioner alleged that the loan agreement did not reflect his true agreement "ith respondent, it eing merel! a Jcover documentJ to evidence the re"ard to him of ten million pesos %*15,555,555.55& for his lo!alt! and e.cellent performance as @eneral <anager of Sk! Kision... *etitioner thus pra!ed for the dismissal of the complaint and the a"ard of the follo"ing sums of mone! in the form of compulsor1 counterclaims+ 1. *153,565,555.55, *?7S the value of )efendantBs stock options and unpaid share from the net income "ith *laintiff corporation %to e computed& as actual damages' 6. *19,555,555.55, as moral damages' and 3. *1,955,555.55, as attorne!Bs fees plus appearance fees and the costs of suit. QAemedial$ Aespondent filed a manifestation and a motion to dismiss the counterclaim for "ant of :urisdiction. A-C of *asig denied respondentBs motion to dismiss the counterclaim on the follo"ing premises$ 1 counterclaim eing essentiall! a complaint, the principle that a motion to dismiss h!potheticall! admits the allegations of the complaint is applica le' the counterclaim is compulsor!, hence, "ithin its :urisdiction' and there is identit! of interest et"een respondent and Sk! Kision to merit the piercing of the veil of corporate fiction. <A denied. *etition for certiorari at the Court of 1ppeals "hich held that respondent is not the real part!-in-interest on the counterclaim and that there "as failure to sho" the presence of an! of the circumstances to :ustif! the application of the principle of Jpiercing the veil of corporate fiction.J -he +rders of the trial court "ere thus set aside and the counterclaims of petitioner "ere accordingl! dismissed. *etitionerBs <A denied. >ence, this *etition for Aevie". )SS.E+ "hether the defendant in a complaint for collection of sum of mone! can raise a counterclaim for retirement enefits, unpaid salaries and incentives, and other enefits arising from services rendered ! him in a su sidiar! of the plaintiff corporation.

ME0 B. vs. 04PEA )5C. respondent.

BE0&!DE petitioner,

,&C-S+ +n Canuar! =, 144/, Eugenio ?ope8 Cr., then *resident of respondent ?ope8, #nc., as ?E3)EA, and petitioner <el Kelarde, then @eneral <anager of Sk! Kision Corporation %Sk! Kision&, a su sidiar! of respondent, as ;+AA+IEA, forged a notari8ed loan agreement covering the amount of ten million %*15,555,555.55& pesos. -he agreement e.pressl! provided for, among other things, the manner of pa!ment and the circumstances constituting default "hich "ould give the lender the right to declare the loan together "ith accrued interest immediatel! due and pa!a le. petitioner failed to pa! the installments as the! ecame due, respondent, apparentl! in ans"er to a proposal of

Consolidated by Didit!, P"P#$a%

*age "2 of 64

Course Outline in Commercial Law Review Securities Regulations Code (SRC) Fiscal R.S. Aquino-Tambasacan

/E0D+ 54. Section 9%c& of *.). 456-1 %as amended ! A.1. F/44, the Securities Aegulation Code& applies to a corporate officerBs dismissal. (or a corporate officerBs dismissal is al"a!s a corporate act and2or an intracorporate controvers! and that its nature is not altered ! the reason or "isdom "hich the ;oard of )irectors ma! have in taking such action.6, Iith regard to petitionerBs claim for unpaid salaries, unpaid share in net income, reasona le return on the stock o"nership plan and other enefits for services rendered to Sk! Kision, :urisdiction thereon pertains to the Securities E.change Commission even if the complaint ! a corporate officer includes mone! claims since such claims are actuall! part of the prere0uisite of his position and, therefore, interlinked "ith his relations "ith the corporation.69 -he 8uestion of remuneration in'ol'ing a person #ho is not a mere emplo1ee but a stoc*holder and officer of the corporation is not a simple labor problem but a matter that comes #ithin the area of corporate affairs and management and is in fact a corporate contro'ers1 in contemplation of the Corporation Code. ;ut even if the su :ect matter of the counterclaims is no" cogni8a le ! A-Cs, the filing thereof against respondent is improper, it not eing the real part!-in-interest, for it is petitionerBs emplo!er Sk! Kision, respondentBs su sidiar!. #t cannot e gainsaid that a su sidiar! has an independent and separate :uridical personalit!, distinct from that of its parent compan!, hence, an! claim or suit against the latter does not ind the former and vice versa. *etitioner argues nevertheless that :urisdiction over the su sidiar! is :ustified ! piercing the veil of corporate fiction. 3o"here, ho"ever, in the pleadings and other records of the case can it e gathered that respondent has complete control over Sk! Kision, not onl! of finances ut of polic! and usiness practice in respect to the transaction attacked, so that Sk! Kision had at the time of the transaction no separate mind, "ill or e.istence of its o"n. -he e.istence of interlocking directors, corporate officers and shareholders is not enough :ustification to pierce the veil of corporate fiction in the a sence of fraud or other pu lic polic! considerations. -his Court is thus not con'inced that the real part1= in=interest #ith regard to the counterclaim for damages arising from the alleged tortuous manner b1 #hich petitioner #as forced to retire as 6eneral Manager of S*1 Bision is respondent. <oreover, effect a set-off, it is a condition sine 0ua non that the approval thereof ! JSk!2CentralJ must e o tained, and that petitioner li0uidate his advances from Sk! Kision. -hese conditions hardl! manifest that respondent possessed that degree of control over Sk! Kision as to make the latter its mere instrumentalit!, agenc! or ad:unct. PE-)-)45 DE5)ED.

6.!. 5o. "44<6<

March (" (22(

D)03 D&53 5&CP)0 petitioner, vs. )5-E!5&-)45&0 C!4&DC&S-)56 C4!P4!&-)45 respondent. ,acts+ *etitioner states that he "as 1ssistant @eneral <anager for (inance21dministration and Comptroller of private respondent #ntercontinental ;roadcasting Corporation %#;C& from 144= until 1pril 144/. 1ccording to petitioner, "hen Emiliano -emplo "as appointed to replace #;C *resident -omas @ome8 ### sometime in <arch 144/, the former %-emplo& told the ;oard of )irectors that as soon as he assumes the #;C presidenc!, he "ould terminate the services of petitioner. 1pparentl!, -emplo lamed petitioner, along "ith a certain <r. ;asilio and <r. @ome8, for the prior mismanagement of #;C. 7pon his assumption of the #;C presidenc!, -emplo allegedl! harassed, insulted, humiliated and pressured petitioner into resigning until the latter "as forced to retire. >o"ever, -emplo refused to pa! him his retirement enefits. (urthermore, -emplo allegedl! refused to recogni8e petitionerLs emplo!ment, claiming that petitioner "as not the 1ssistant @eneral <anager2Comptroller of #;C ut merel! usurped the po"ers of the Comptroller. >ence, petitioner filed "ith the ?a or 1r iter a complaint for illegal dismissal and nonpa!ment of enefits. #nstead of filing its position paper, #;C filed a motion to dismiss alleging that the ?a or 1r iter had no :urisdiction over the case. #;C contended that petitioner "as a corporate officer "ho "as dul! elected ! the ;oard of )irectors of #;C' hence, the case 0ualifies as an intracorporate dispute falling "ithin the :urisdiction of the Securities and E.change Commission %SEC&. >o"ever, the motion "as denied ! the ?a or 1r iter in an +rder. -he ?a or 1r iter rendered a )ecision stating that petitioner had een illegall! dismissed. #;C appealed to the 3?AC, ut the same "as dismissed in a Aesolution. #;C then filed a motion for reconsideration that "as like"ise denied. #;C then filed "ith the Court of 1ppeals a petition for certiorari under Aule =9, "hich petition "as granted ! the appellate court in its )ecision "hich reversed and set aside the decision of the ?a or 1r iter and the 3?AC and dismissed the complaint "ithout pre:udice. *etitioner then filed a motion for reconsideration, "hich "as denied ! the appellate court. >ence, this petition. )ssue+ Ihether the ?a or 1r iter had :urisdiction over the case for illegal dismissal and non-pa!ment of enefits filed ! petitioner. !uling+ -he Court finds that the 0abor &rbiter had no $urisdiction o'er the same.

Consolidated by Didit!, P"P#$a%

*age "" of 64

Course Outline in Commercial Law Review Securities Regulations Code (SRC) Fiscal R.S. Aquino-Tambasacan

7nder *residential )ecree 3o. 456-1 %the Aevised Securities 1ct&, the la" in force "hen the complaint for illegal dismissal "as instituted ! petitioner in 144/, the follo"ing cases fall under the e.clusive of the SEC$ a& )evices or schemes emplo!ed ! or an! acts of the oard of directors, usiness associates, its officers or partners, amounting to fraud and misrepresentation "hich ma! e detrimental to the interest of the pu lic and2or of the stockholders, partners, mem ers of associations or organi8ations registered "ith the Commission' & Controversies arising out of intra-corporate or partnership relations, et"een and among stockholders, mem ers or associates' et"een an! or all of them and the corporation, partnership or association of "hich the! are stockholders, mem ers or associates, respectivel!' and et"een such corporation, partnership or association and the State insofar as it concerns their individual franchise or right to e.ist as such entit!' c& Contro'ersies in the election or appointment of directors trustees officers or managers of such corporations partnerships or associations9 d& *etitions of corporations, partnerships, or associations to e declared in the state of suspension of pa!ments in cases "here the corporation, partnership or association possesses propert! to cover all of its de ts ut foresees the impossi ilit! of meeting them "hen the! respectivel! fall due or in cases "here the corporation, partnership or association has no sufficient assets to cover its lia ilities, ut is under the <anagement Committee created pursuant to this decree. %Emphasis supplied.& -he Court has consistentl! held that there are t"o elements to e considered in determining "hether the SEC has :urisdiction over the controvers!, to "it$ %1& the status or relationship of the parties' and %6& the nature of the 0uestion that is the su :ect of their controvers!. *etitioner argues that he is not a corporate officer of the #;C ut an emplo!ee thereof since he had not een elected nor appointed as Comptroller and 1ssistant <anager ! the #;CLs ;oard of )irectors. >e points out that he had actuall! een appointed as such on Canuar! 11, 1449 ! the #;CLs @eneral <anager, Ceferino ;asilio. #n support of his argument, petitioner underscores the fact that the #;CLs ;!-?a"s does not even include the position of comptroller in its roster of corporate officers. >e therefore contends that his dismissal is a controvers! falling "ithin the :urisdiction of the la or courts. *etitionerLs argument is untena le. Even assuming that he "as in fact appointed ! the @eneral <anager, such appointment "as su se0uentl! approved ! the ;oard of )irectors of the #;C. -hat the position of Comptroller is

not e.pressl! mentioned among the officers of the #;C in the ;!-?a"s is of no moment, ecause the #;CLs ;oard of )irectors is empo"ered under Section 69 of the Corporation Code and under the corporationLs ;!-?a"s to appoint such other officers as it ma! deem necessar!. -he ;!-?a"s of the #;C categoricall! provides$ E##. +((#CEAS -he officers of the corporation shall consist of a *resident, a Kice-*resident, a Secretar!-reasurer, a @eneral <anager, and such other officers as the Coard of Directors ma1 from time to time does fit to pro'ide for. Said officers shall be elected b1 ma$orit1 'ote of the Coard of Directors and shall have such po"ers and duties as shall hereinafter provide %Emphasis supplied&. -he Court has held that in most cases the 2 !-la"s ma! and usuall! do provide for such other officers,J and that "here a corporate office is not specificall! indicated in the roster of corporate offices in the !-la"s of a corporation, the oard of directors ma! also e empo"ered under the !-la"s to create additional officers as ma! e necessar!. 1n JofficeJ has een defined as a creation of the charter of a corporation, "hile an JofficerJ as a person elected ! the directors or stockholders. +n the other hand, an Jemplo!eeJ occupies no office and is generall! emplo!ed not ! action of the directors and stockholders ut ! the managing officer of the corporation "ho also determines the compensation to e paid to such emplo!ee. 1s petitionerLs appointment as comptroller re0uired the approval and formal action of the #;CLs ;oard of )irectors to ecome valid, it is clear therefore holds that petitioner is a corporate officer "hose dismissal ma! e the su :ect of a controvers! cogni8a le ! the SEC under Section 9%c& of *.). 456-1 "hich includes controversies involving oth election and appointment of corporate directors, trustees, officers, and managers. >ad petitioner een an ordinar! emplo!ee, such oard action "ould not have een re0uired. -hus, the Court of 1ppeals correctl! held that$ Since complainantLs appointment "as approved unanimousl! ! the ;oard of )irectors of the corporation, he is therefore considered a corporate officer and his claim of illegal dismissal is a controvers! that falls under the :urisdiction of the SEC as contemplated ! Section 9 of *.). 456-1. -he rule is that dismissal or non-appointment of a corporate officer is clearl! an intra-corporate matter and :urisdiction over the case properl! elongs to the SEC, not to the 3?AC. Considering the foregoing, the Court holds that no error "as committed ! the Court of 1ppeals in dismissing the

Consolidated by Didit!, P"P#$a%

*age "( of 64

Course Outline in Commercial Law Review Securities Regulations Code (SRC) Fiscal R.S. Aquino-Tambasacan

case filed efore the ?a or 1r iter, "ithout pre:udice to the filing of an appropriate action in the proper court. #t must e noted that under Section 9.6 of the Securities Aegulation Code %Aepu lic 1ct 3o. F/44& "hich "as signed into la" ! then *resident Coseph E:ercito Estrada on Cul! 14, 6555, the SECLs :urisdiction over all cases enumerated in Section 9 of *.). 456-1 has een transferred to the Aegional -rial Courts. :/E!E,4!E, the petition is here ! D)SM)SSED and the )ecision of the Court of 1ppeals is &,,)!MED. 4. Suspension of pa1ments (PD "<%; amending PD 72(=&) P!ES)DE5-)&0 DEC!EE 5o. "<%; &ME5D)56 ,.!-/E! SEC-)45S ( 3 % 6 &5D ; 4, P!ES)DE5-)&0 DEC!EE 54. 72(=& I>EAE1S, one of the o :ectives of the government as envisioned under *residential )ecree 3o. 456-1, as amended ! *.). 1=93, is to attract and to mo ili8e investments, domestic and foreign, through the participation of private enterprises in activities identified as most contri utive to the gro"th of the national econom!' I>EAE1S, in order to attain this national o :ective, it is incum ent upon government to provide a favora le climate for investments to e vigorousl! mo ili8ed to insure a "ider and more meaningful e0uita le distri ution of "ealth' I>EAE1S, eing the principal agenc! of the governing charged "ith the esta lishment of the needed atmosphere in all phases of the countr!Ls economic and industrial development, the Securities and E.change Commission must e provided "ith the appropriate organi8ational structure, financial support and manpo"er capa ilities commensurate "ith the scope of its tasks' and I>EAE1S, for these programs to succeed, there is no" a pressing need to restructure the Securities and E.change Commission not onl! to make it a more potent, responsive and effective arm of the government ut to ena le it to pla! a more effective role in the socioeconomic development of the countr!' 3+I, ->EAE(+AE, #, (EA)#313) E. <1AC+S, *resident of the *hilippines, ! virtue of the po"ers vested in me ! the Constitution, and the authorit! vested in me ! *residential )ecree 3o. 1,1=, do here ! order and decree$ Section ". -he first and second paragraphs of Section 6 of *residential )ecree 3o. 456-1, as amended ! *residential )ecree 3o. 1=93, is here ! further amended to read as follo"s$

JSec. 6. -hat the Commission shall e a collegial od! composed of a Chairman and four %,& 1ssociate Commissioners "ho shall e appointed ! the *resident and the term of office of each mem er shall e seven %/& !ears' *rovided, ho"ever, -hat the Chairman and the t"o %6& 1ssociate Commissioners of the Commission first appointed ! the *resident shall serve for a period of seven %/& !ears' five %9& !ears and three %3& !ears, as fi.ed in their respective appointments, and shall continue in +ffice in accordance "ith the terms fi.ed in their current respective appointments, and the t"o additional 1ssociate Commissioners first appointed ! the *resident under this )ecree, as amended, shall serve for five %9& !ears and three %3& !ears as fi.ed in their respective appointments' *rovided, further, -hat upon the e.piration of his term, a mem er shall serve as such until his successor shall have een appointed and 0ualified' 1nd *rovided, finall!, -hat no vacanc! shall e filled e.cept for the une.pired portion of the term. -he Commission shall meet as often as ma! e necessar! on such da! or da!s as the Chairman ma! fi.. -he notice of the meeting shall e given to all mem ers of the Commission and the presence of at least three %3& shall constitute a 0uorum. #n the a sence of the Chairman, the more senior 1ssociate Commissioner shall act as presiding officer of the meeting.J Section (. Section 3 of the same *residential )ecree as amended ! *residential )ecree 3o. 1=93, is here ! further amended to read as follo"s$ JSec. 3. -he Commission shall have a solute :urisdiction, supervision and control over all corporations, partnerships, or associations, "ho are the grantees of primar! franchises and2or a license or permit issued ! the government to operate in the *hilippines, and in the e.ercise of its authorit!, it shall have the po"er to enlist the aid and support of and to deputi8e an! and all enforcement, agencies of the government, civil or militar! as "ell as an! private institution, corporation, firm, association or person.J Section 3. Section 9 of the same *residential )ecree is here ! amended ! adding thereunder su -paragraph d& to read as follo"s$ Jd& *etitions of corporations, partnerships or associations to e declared in the state of suspension of pa!ments in cases "here the corporation, partnership or association possesses sufficient propert! to cover all its de ts ut foresees the impossi ilit! of meeting them "hen the! respectivel! fall due or in cases "here the corporation, partnership or association has no sufficient assets to cover its lia ilities, ut is under the management of a Aeha ilitation Aeceiver or <anagement Committee created pursuant to this )ecree.J Section 4. Su -paragraphs c&, d&, h& and m& of Section = of *residential )ecree 3o. 456-1, as amended ! *residential )ecree 3o. 1=93, is here ! further amended to read as follo"s$

Consolidated by Didit!, P"P#$a%

*age "3 of 64

Course Outline in Commercial Law Review Securities Regulations Code (SRC) Fiscal R.S. Aquino-Tambasacan

Jc& -o appoint one or more receivers of the propert!, real or personal, "hich is the su :ect of the action pending efore the Commission in accordance "ith the pertinent provisions of the Aules of Court in such other cases "henever necessar! in order to preserve the rights of the parties-litigants and2or protect the interest of the investing pu lic and creditors. *rovided, ho"ever, -hat the Commission ma!, in appropriate cases, appoint a Aeha ilitation Aeceiver "ho shall have, in addition to the po"ers of a regular receiver under the provisions of the Aules of Court, such functions and po"ers as are provided for in the succeeding paragraph d& hereof. *rovided, further, that upon appointment of a management committee, reha ilitation receiver, oard or od!, pursuant to this )ecree, all actions for claims against corporations, partnerships or associations under management or receivership pending efore an! court, tri unal, oard or od! shall e suspended accordingl!.J Jd& -o create and appoint a management committee, oard, or od! upon petition or motu propio to undertake the management of corporations, partnerships or other associations in appropriate cases "hen there is imminent danger of dissipation, loss, "astage or destruction of assets or other properties or paral!8ation of usiness operations of such corporations or entities "hich ma! e pre:udicial to the interest of minorit! stockholders, parties-litigants or the general pu lic. -he management committee or reha ilitation receiver, oard or od! shall have the po"er to take custod! of and control over, all the e.isting assets and propert! of such entities under management' to evaluate the e.isting assets and lia ilities, earnings and operations of such corporations, partnerships or other associations' to determine the est "a! to salvage and protect the interest of the investors and creditors' to stud!, revie" and evaluate the feasi ilit! of continuing operations and restructure and reha ilitate such entities if determined to e feasi le ! the Commission. #t shall report and e responsi le to the Commission until dissolved ! order of the Commission. *rovided, ho"ever, -hat the Commission, ma!, on the asis of the findings and recommendation of the management committee, or reha ilitation receiver, oard or od!, or on its o"n findings, determine that the continuance in usiness of such corporation or entit! "ould not e feasi le or profita le nor "ork to the est interest of the stockholders, parties-litigants, creditors, or the general pu lic, order the dissolution of such corporation entit! and its remaining assets li0uidated accordingl!. -he management committee or reha ilitation receiver, oard or od! ma! overrule or revoke the actions of the previous management and oard of directors of the entit! or entities under management not"ithstanding an! provision of la", articles of incorporation or !-la"s to the contrar!. -he management committee, or reha ilitation receiver, oard or od! shall not e su :ect to an! action, claim or demand for, or in connection "ith, an! act done or omitted to e done ! it in good faith in the e.ercise of its functions, or in connection "ith the e.ercise of its po"er herein conferred.J

Jh& -o issue su poena duces tecum and summon "itnesses to appear in an! proceedings of the Commission and in appropriate cases order the e.amination, search and sei8ure or cause the e.amination, search and sei8ure of all documents papers, files and records, ta. returns, ooks of accounts, as "ell as all deposits of "hatever nature "ith ank or anking institutions in the *hilippines, including investments in onds issued ! the @overnment of the *hilippines, its political su divisions and its instrumentalities and similar documents, of an! entit! or person under investigation as ma! e necessar! for the proper disposition of the cases efore it, not"ithstanding the provisions of an! la" to the contrar!.J Jm& -o e.ercise such po"ers as ma! e provided ! la" as "ell as those "hich ma! e implied from, or "hich are necessar! or incidental to the carr!ing out of, the e.press po"ers granted to the Commission to achieve the o :ectives and purposes of this )ecree.J Section %. Section F of the same *residential )ecree, as amended ! *residential )ecree 3o. 1=93, is here ! further amended to read as follo"s$ JSec. F. -he Commission shall have nine %4& departments each to e headed ! a director, namel!$ Corporate and ?egal' E.aminers and 1ppraisers' ;rokers and E.changes' <one! <arket +perations' Securities #nvestigations and Clearing' 1dministrative and (inance' *rosecution and Enforcement' and Supervision and <onitoring )epartments. -he staffing pattern to implement this amended departmental structure shall e approved pursuant to Section ,5 of *.). 3o. 11//, "ith an! additional costs incurred for 14F5 and 14F1 to e charged to the Special 1ctivities (und of the corresponding !ear upon approval ! the *resident.J Section 6. -he *rosecution and Enforcement )epartment shall have, su :ect to the CommissionLs control and supervision, the e.clusive authorit! to investigate, on complaint or motu propio, an! act or omission of the ;oard of )irectors2 -rustees of corporations, or of partnerships, or other associations, or of their stockholders, officers or partners, including an! fraudulent devices, schemes or representations, in violation of an! la" or rules and regulations administered and enforced ! the Commission' to file and prosecute in accordance "ith la" and rules and regulations issued ! the Commission and in appropriate cases, the corresponding criminal or civil case efore the Commission or the proper court or od! upon prima facie finding of violation of an! la"s or rules and regulations administered and enforced ! the Commission' and to perform such other po"ers and functions as ma! e provided ! la" or dul! delegated to it ! the Commission. *rosecution under this )ecree or an! 1ct, ?a", Aules and Aegulations enforced and administered ! the Commission shall e "ithout pre:udice to an! lia ilit! for violation of an! provision of the Aevised *enal Code.

Consolidated by Didit!, P"P#$a%

*age "4 of 64

Course Outline in Commercial Law Review Securities Regulations Code (SRC) Fiscal R.S. Aquino-Tambasacan

Section <. -he Supervision and <onitoring )epartment shall have the po"er of supervision over all corporations, partnership and associations registered "ith the Commission in all matters pertaining to their compliance "ith the la"s, mandator! provisions and re0uirements of pertinent rules and regulations administered and enforced ! the Commission, as "ell as their respective !-la"s dul! approved ! the Commission, integrate, anal!8e and evaluate ongoing operations or activities of such entities' coordinate "ith, and recommend to the appropriate departments for proper action and enforcement' and to do and perform such other functions as ma! e dul! delegated ! the Commission. Section ;. -he proceeds and effects of crimes committed ! an! person or entit! in violation of the la"s and regulations administered and enforced ! the Commission shall e forfeited, sei8ed and confiscated in favor of the State upon order of the Commission, after due notice and hearing. Section 7. 1n! provisions of e.isting la", decree, order, rules and regulations inconsistent "ith this )ecree, is here ! repealed, amended or modified accordingl!. Section "2. -his )ecree shall take effect immediatel!. )one in the Cit! of <anila, this 6nd da! of Canuar!, in the !ear of +ur ?ord, nineteen hundred and eight!-one.