Escolar Documentos

Profissional Documentos

Cultura Documentos

Import Export Code Reg Procedure PP 03

Enviado por

sahuanTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Import Export Code Reg Procedure PP 03

Enviado por

sahuanDireitos autorais:

Formatos disponíveis

thousand. 12.

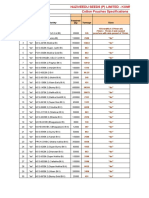

Application for Import Licence under Export Promotion Capital Goods (EPCG) Scheme Two per Thousand or part thereof subject to a minimum of Rs.Two hundred and maximum of Rs. One lakh. However, for applications filed electronically, the fee would be Rs.1/1000 or part thereof subject to a minimum of Rs. Two hundred and maximum of rupees Rs. fifty thousand. Five Thousand

13.

Application for Enlistment as an authorised agency under Appendix 4C and Appendix 6

NOTE:1 Notwithstanding the above, the application fee for all applications filed electronically would be 50% of the amount specified in this Table. The word Electronically wherever appearing in this Appendix would mean Digitally Signed and submitted through EFT on DGFT website (Online/Offline). NOTE: 2 No application fee shall required to be paid for any of the Schemes under Chapter 3 of FTP.

3. MODE OF DEPOSIT (1)

The application fee shall be deposited in the following manner:-

Deposit in an authorised Branch of Central Bank of India as given Appendix 3 indicating the "Head of Accounts 1453 Foreign Trade and Export Promotion- Minor Head 102-Import Licence application fee". The Bank receipt must show the name of the department viz. "Directorate General of Foreign Trade". The Bank Receipt drawn in favour of Pay & Accounts Officer (Foreign Trade), indicating the station of the Pay & Accounts Officer concerned. Such fees can also be deposited with Indian Missions abroad. OR

(2)

(3)

Crossed Demand Draft on a Scheduled Bank for the requisite amount should be made in favour of the concerned licensing authority (Joint Director General of Foreign Trade) where the application is filed. OR Through running deposit account maintained with concerned RLA in the following manner: -

Note:

The applicants may deposit the anticipated amount as per their needs for six months with the concerned Regional Licensing Authority through cheque/DD in the name of concerned Pay & Accounts Officer (Commerce). Initially, this amount will be credited into public accounts under Major Head 8443-Civil Deposits, 114-Export Trade Deposits adjustable against Licence Application Fees. The licensing authority at the time of admitting the application fee will carry out an adjustment in Broad Sheet of Export Trade Deposits and debit the value of application fee from the Head Export Trade Deposits by contra credit to Revenue Head Head-1453-Foreign Trade & Export Promotion, 103-Export Licensing Application Fees. The licensing Authority may furnish the details of all such transactions (like the amount transferred from Public Accounts to Revenue Account etc.) to the Pay and Accounts Officer concerned who may carry out adjustment entry in the monthly compilation of accounts. A copy of the transactions may also be forwarded to the concerned firm for the purpose of reconciliation. The firms who want to resort to this mode of payment should be established and regular applicants having at least 25 applications/ transactions during the last licensing year. The minimum deposit under the scheme will not be less than Rs.1, 00,000/-. All subsequent payment in replenishment of the deposit will be made through Pay order in favour of the concerned office of CPAO. No licence application will be entertained/ considered so long as the firms have a deposit balance in their account. All the charges in connection with the depositor transaction with DGFT including undercharges detected subsequently in course of audit will be debited from the Depositor amounts. Likewise, any excess payment or wrong payment of fee will be refunded as per the procedure mentioned in this appendix.

3|Page

Você também pode gostar

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Starbuck Case StudyDocumento2 páginasStarbuck Case StudysahuanAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- S.No Plot Type/No. Plot Areas in SQ.M Plot Areas in SQ - FT DescriptionDocumento6 páginasS.No Plot Type/No. Plot Areas in SQ.M Plot Areas in SQ - FT DescriptionsahuanAinda não há avaliações

- Starbuck Case StudyDocumento2 páginasStarbuck Case StudysahuanAinda não há avaliações

- Import Export Code Reg Procedure PP 04Documento1 páginaImport Export Code Reg Procedure PP 04sahuanAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Procedure For Clearance of Export GoodsDocumento11 páginasProcedure For Clearance of Export GoodssahuanAinda não há avaliações

- Import Export Code Reg Procedure PP 01Documento1 páginaImport Export Code Reg Procedure PP 01sahuanAinda não há avaliações

- Registration With APEDA PP 01Documento1 páginaRegistration With APEDA PP 01sahuanAinda não há avaliações

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Sample Melting Steel Scrap ContractDocumento4 páginasSample Melting Steel Scrap ContractsahuanAinda não há avaliações

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- IndemnityDocumento1 páginaIndemnitysahuanAinda não há avaliações

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Memorandum of Agreement Page 2Documento1 páginaMemorandum of Agreement Page 2sahuanAinda não há avaliações

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Memorandum of Agreement Page 1Documento1 páginaMemorandum of Agreement Page 1sahuanAinda não há avaliações

- Construction Dynamics 2Documento1 páginaConstruction Dynamics 2sahuanAinda não há avaliações

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- PR - Sweet Homes - English) Final 18 AprilDocumento2 páginasPR - Sweet Homes - English) Final 18 AprilsahuanAinda não há avaliações

- Construction Dynamics 2BDocumento1 páginaConstruction Dynamics 2BsahuanAinda não há avaliações

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Garden City 2Documento1 páginaGarden City 2sahuanAinda não há avaliações

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- Garden City 1Documento1 páginaGarden City 1sahuanAinda não há avaliações

- An Introduction To BasisDocumento8 páginasAn Introduction To BasissahuanAinda não há avaliações

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Authority MatrixDocumento1 páginaAuthority Matrixsahuan100% (1)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- European OperationDocumento20 páginasEuropean OperationsahuanAinda não há avaliações

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Affection PlanDocumento1 páginaAffection PlansahuanAinda não há avaliações

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- T2T - One - U12 - Grammarworksheet - 1 Should For Advice PDFDocumento1 páginaT2T - One - U12 - Grammarworksheet - 1 Should For Advice PDFGrissellAinda não há avaliações

- Sportex 2017Documento108 páginasSportex 2017AleksaE77100% (1)

- Corrugated Board Bonding Defect VisualizDocumento33 páginasCorrugated Board Bonding Defect VisualizVijaykumarAinda não há avaliações

- DB - Empirically Based TheoriesDocumento3 páginasDB - Empirically Based TheoriesKayliah BaskervilleAinda não há avaliações

- Compare Visual Studio 2013 EditionsDocumento3 páginasCompare Visual Studio 2013 EditionsankurbhatiaAinda não há avaliações

- Types of Vegetation in Western EuropeDocumento12 páginasTypes of Vegetation in Western EuropeChemutai EzekielAinda não há avaliações

- Send Me An AngelDocumento3 páginasSend Me An AngeldeezersamAinda não há avaliações

- WIKADocumento10 páginasWIKAPatnubay B TiamsonAinda não há avaliações

- Bus Organization of 8085 MicroprocessorDocumento6 páginasBus Organization of 8085 MicroprocessorsrikrishnathotaAinda não há avaliações

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Surge Protectionfor ACMachineryDocumento8 páginasSurge Protectionfor ACMachineryvyroreiAinda não há avaliações

- Judges Kings ProphetsDocumento60 páginasJudges Kings ProphetsKim John BolardeAinda não há avaliações

- Music 10: 1 Quarterly Assessment (Mapeh 10 Written Work)Documento4 páginasMusic 10: 1 Quarterly Assessment (Mapeh 10 Written Work)Kate Mary50% (2)

- Kindergarten Report Card SampleDocumento3 páginasKindergarten Report Card Sampleapi-294165063Ainda não há avaliações

- Tutorial Class 4: Finders As Bailee Right of A Bailee General LienDocumento26 páginasTutorial Class 4: Finders As Bailee Right of A Bailee General Lienchirag jainAinda não há avaliações

- Student Management System - Full DocumentDocumento46 páginasStudent Management System - Full DocumentI NoAinda não há avaliações

- IKEA AyeshaDocumento41 páginasIKEA AyeshaAYESHAREHMAN100Ainda não há avaliações

- 7 CAAT-AIR-GM03 Guidance-Material-for-Foreign-Approved-Maintenance-Organization - I3R0 - 30oct2019 PDFDocumento59 páginas7 CAAT-AIR-GM03 Guidance-Material-for-Foreign-Approved-Maintenance-Organization - I3R0 - 30oct2019 PDFJindarat KasemsooksakulAinda não há avaliações

- The Problem Between Teacher and Students: Name: Dinda Chintya Sinaga (2152121008) Astry Iswara Kelana Citra (2152121005)Documento3 páginasThe Problem Between Teacher and Students: Name: Dinda Chintya Sinaga (2152121008) Astry Iswara Kelana Citra (2152121005)Astry Iswara Kelana CitraAinda não há avaliações

- PEDIA OPD RubricsDocumento11 páginasPEDIA OPD RubricsKylle AlimosaAinda não há avaliações

- Hirarc Form: 1. Hazard Identification 2. Risk Analysis 3. Risk ControlDocumento2 páginasHirarc Form: 1. Hazard Identification 2. Risk Analysis 3. Risk ControlQurratulain Syarifuddinzaini100% (1)

- Determination of Physicochemical Pollutants in Wastewater and Some Food Crops Grown Along Kakuri Brewery Wastewater Channels, Kaduna State, NigeriaDocumento5 páginasDetermination of Physicochemical Pollutants in Wastewater and Some Food Crops Grown Along Kakuri Brewery Wastewater Channels, Kaduna State, NigeriamiguelAinda não há avaliações

- SPE-199498-MS Reuse of Produced Water in The Oil and Gas IndustryDocumento10 páginasSPE-199498-MS Reuse of Produced Water in The Oil and Gas Industry叶芊Ainda não há avaliações

- Green IguanaDocumento31 páginasGreen IguanaM 'Athieq Al-GhiffariAinda não há avaliações

- Tateni Home Care ServicesDocumento2 páginasTateni Home Care ServicesAlejandro CardonaAinda não há avaliações

- G.R. No. 186450Documento6 páginasG.R. No. 186450Jose Gonzalo SaldajenoAinda não há avaliações

- January Payslip 2023.pdf - 1-2Documento1 páginaJanuary Payslip 2023.pdf - 1-2Arbaz KhanAinda não há avaliações

- Harper 2001Documento6 páginasHarper 2001Elena GologanAinda não há avaliações

- RPS Manajemen Keuangan IIDocumento2 páginasRPS Manajemen Keuangan IIaulia endiniAinda não há avaliações

- Referensi PUR - Urethane Surface coating-BlockedISO (Baxenden) - 20160802 PDFDocumento6 páginasReferensi PUR - Urethane Surface coating-BlockedISO (Baxenden) - 20160802 PDFFahmi Januar AnugrahAinda não há avaliações

- Cotton Pouches SpecificationsDocumento2 páginasCotton Pouches SpecificationspunnareddytAinda não há avaliações

- A Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsNo EverandA Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsAinda não há avaliações