Escolar Documentos

Profissional Documentos

Cultura Documentos

T4 B12 Yousef - Hawala FDR - Entire Contents - 11-14-01 Tarik M Yousef Senate Banking Testimony - 1st PG Scanned For Reference 036

Enviado por

9/11 Document ArchiveDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

T4 B12 Yousef - Hawala FDR - Entire Contents - 11-14-01 Tarik M Yousef Senate Banking Testimony - 1st PG Scanned For Reference 036

Enviado por

9/11 Document ArchiveDireitos autorais:

Formatos disponíveis

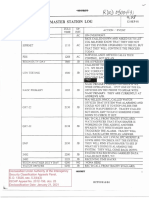

^Testimony — Yousef Page 1 of 3

U.S. SENATE COMMITTEE ON

BANKING. HOUSING, AND URBAN AFFAII

Subcommittee on International Trade and Finance

Hearing on "Hawala and Underground Terrorist Financing Mechanisms."

Prepared Statement of Dr. Tarik M. Yousef

Professor - Department of Economics

School of Foreign Service

Georgetown University

2:30 p.m., Wednesday, November 14,2001 - Dirksen 538

Mr. Chairman and Distinguished members of this Subcommittee:

I am pleased to testify before you today on the topic of the Hawala institution, its origin, how it

functions and what can be done to regulate it. The Hawala institution has drawn much attention recently

in the context of the US war on terrorism whose goals include interrupting and preventing the

mobilization of resources and transfer of funds through formal or informal channels to finance terrorist

activities in the US or elsewhere.

Let me first provide a context for understanding the place of the Hawala in the modern financial system

including in the Muslim world. I will do so by reference to my own personal experience. Prior to the last

decade, in all my travel and living experience in numerous countries in the Muslim world, I had never

observed others nor did I settle a personal or business transaction by any means other than cash. The

reasons are not hard to find. For historical and policy reasons, financial development in many

developing countries including the Muslim world has lagged behind the advanced OECD countries.

The late start with modernization in the post-WWII era has implied that the financial systems of most

countries in the Muslim world lack depth and sophistication and that the institutions of regulation and

supervision are not fully developed. More importantly, extensive government intervention in these

societies including through repressive financial policies, excessive taxation, foreign exchange and trade

restrictions and a banking system that is driven by the needs of governments have retarded the

emergence of modern financial systems.

Reflecting these conditions, cash remains the preferred medium for settling transactions and dominates

the composition of liquidity in many banking systems. Banking institutions* are concentrated in urban

centers and cater mainly to the needs of governments and elite segments of;so6iety. Modern habits of

banking have yet to affect the majority of populations especially in rural areas. Protection of personal

property is imperfect, enforcement of contracts is weak, government corruption is endemic and tax

evasion is widespread

The Hawala institution should be understood in this broader context as an informal means of

http://banking.senate.gov/01_l lhrg/111401/yousef.htm 6/27/03

Você também pode gostar

- The impact of money laundering on economic development and political stability in developing countriesDocumento17 páginasThe impact of money laundering on economic development and political stability in developing countriesyanuar_akuntansiAinda não há avaliações

- Kaufmann, Rethinking Governance, 2003Documento47 páginasKaufmann, Rethinking Governance, 2003Cauc BiancaAinda não há avaliações

- Afrika CoyDocumento8 páginasAfrika CoyRandy BrahmantyoAinda não há avaliações

- Global 4Documento51 páginasGlobal 4taysirbestAinda não há avaliações

- African Vulture InvestingDocumento24 páginasAfrican Vulture Investinghowardstern3Ainda não há avaliações

- Yasir Ali PresentationDocumento6 páginasYasir Ali PresentationNasir MuhammadAinda não há avaliações

- The Global Interstate System AND Contemporary Global GovernanceDocumento21 páginasThe Global Interstate System AND Contemporary Global GovernanceJustin Paul TumaliuanAinda não há avaliações

- The Comparative Advantages of Islamic Banking and Finance: M. Nejatullah SiddiqiDocumento6 páginasThe Comparative Advantages of Islamic Banking and Finance: M. Nejatullah SiddiqiNasir MahmoodAinda não há avaliações

- AlnurDocumento3 páginasAlnurAlfaida BantasAinda não há avaliações

- Contemporary World Finals GagayDocumento14 páginasContemporary World Finals GagayMae Cedenio - DatoonAinda não há avaliações

- Constraints ON State Intervention Since Independence: Course Code - 153400101Documento19 páginasConstraints ON State Intervention Since Independence: Course Code - 153400101Sanjana KhandelwalAinda não há avaliações

- YES Political-Instrumentalization-of-Islam-and-the-Risk-of-Obs - 2011 - World-DeveloDocumento18 páginasYES Political-Instrumentalization-of-Islam-and-the-Risk-of-Obs - 2011 - World-DeveloStefan AtmanAinda não há avaliações

- Middle EastDocumento11 páginasMiddle EastMaleehaAinda não há avaliações

- Currency and Coercion: The Political Economy of International Monetary PowerNo EverandCurrency and Coercion: The Political Economy of International Monetary PowerAinda não há avaliações

- The Obstacles To Regulating The Hawala - A Cultural Norm or A TerrDocumento57 páginasThe Obstacles To Regulating The Hawala - A Cultural Norm or A TerrBrendan LanzaAinda não há avaliações

- Reflection on Globalization and International OrganizationsDocumento2 páginasReflection on Globalization and International OrganizationsMariefe AmadaAinda não há avaliações

- Your Countrys Balance SheetDocumento3 páginasYour Countrys Balance SheetAbdul NasirAinda não há avaliações

- 4 The Global GovernanceDocumento5 páginas4 The Global GovernanceMYKA ROSE MORATEAinda não há avaliações

- TCWD PPT PrelimDocumento77 páginasTCWD PPT PrelimJUDYANN PINEDAAinda não há avaliações

- Money Laundering in Zambia - Chitengi Sipho JustineDocumento47 páginasMoney Laundering in Zambia - Chitengi Sipho JustineCHITENGI SIPHO JUSTINE, PhD Candidate- Law & Policy100% (5)

- Globalization RevisitedDocumento33 páginasGlobalization RevisitedMuhammad AdeelAinda não há avaliações

- The Contemporary World: General Education - 3Documento24 páginasThe Contemporary World: General Education - 3Arthur Anthony AdameAinda não há avaliações

- The Contemporary World: Gec04 Module 4Documento6 páginasThe Contemporary World: Gec04 Module 4Regina Razo100% (1)

- Globalization Decision MakingDocumento2 páginasGlobalization Decision MakingSky BejeranoAinda não há avaliações

- Islam, Development, and The Middle EastDocumento14 páginasIslam, Development, and The Middle EastAkh Bahrul Dzu HimmahAinda não há avaliações

- Need For Enhanced Cooperation Among The Muslims in Contemporary WorldDocumento18 páginasNeed For Enhanced Cooperation Among The Muslims in Contemporary WorldSyed AliAinda não há avaliações

- Remesas Son ContracíclicasDocumento27 páginasRemesas Son ContracíclicasAlexandra ParedesAinda não há avaliações

- Global 4Documento29 páginasGlobal 4obnaaletaAinda não há avaliações

- Ruccio, David F. 2003 'Globalization and Imperialism' Rethinking Marxism, Vol. 15, No. 1 (Jan., Pp. 75 - 94)Documento20 páginasRuccio, David F. 2003 'Globalization and Imperialism' Rethinking Marxism, Vol. 15, No. 1 (Jan., Pp. 75 - 94)voxpop88Ainda não há avaliações

- Autarky in International TradeDocumento7 páginasAutarky in International TradevowomAinda não há avaliações

- Activity Sheet No 1Documento8 páginasActivity Sheet No 1Noah Ras LobitañaAinda não há avaliações

- GlobalizationDocumento2 páginasGlobalizationIqra MalikAinda não há avaliações

- MB 0037 Internal Business ManagementDocumento14 páginasMB 0037 Internal Business ManagementUlhas MahaleAinda não há avaliações

- Adzriah Jalali, BSN - TCWDocumento9 páginasAdzriah Jalali, BSN - TCWAZ DamsidAinda não há avaliações

- Moore 2001 Political UnderdevelopmentDocumento35 páginasMoore 2001 Political UnderdevelopmentyauliyacuAinda não há avaliações

- The World Bank Is Widely Considered The WorldDocumento9 páginasThe World Bank Is Widely Considered The WorldKinetibebAinda não há avaliações

- Walden Bello 2Documento12 páginasWalden Bello 2temujin03Ainda não há avaliações

- THE STUDY OF GLOBALIZATION - CHAPTER 1Documento20 páginasTHE STUDY OF GLOBALIZATION - CHAPTER 1Wild RiftAinda não há avaliações

- Exploring Exploitation-Multinationals in AfricaDocumento12 páginasExploring Exploitation-Multinationals in AfricaJake Dabang Dan-AzumiAinda não há avaliações

- ACHERAIOU CH 9Documento16 páginasACHERAIOU CH 9FlorwadaAinda não há avaliações

- Mscsm626 Justice Pilot Tapera-Qsn 1.2 PDFDocumento8 páginasMscsm626 Justice Pilot Tapera-Qsn 1.2 PDFJustice Pilot TaperaAinda não há avaliações

- State-Building in Somalia Voices from the International Community and Somali DiasporaDocumento35 páginasState-Building in Somalia Voices from the International Community and Somali DiasporaAmal GhazalAinda não há avaliações

- Hollifield MIGRATIONTRADENATIONSTATE 1998Documento43 páginasHollifield MIGRATIONTRADENATIONSTATE 1998selim canAinda não há avaliações

- Chapter FourDocumento25 páginasChapter FourAansi FuulleeAinda não há avaliações

- Imf, World Bank & Adb Agenda on Privatisation Volume Ii: ‘Dubious Deals’ in Sri Lanka What a Paradox !No EverandImf, World Bank & Adb Agenda on Privatisation Volume Ii: ‘Dubious Deals’ in Sri Lanka What a Paradox !Ainda não há avaliações

- Global Affairs - PP-4Documento21 páginasGlobal Affairs - PP-4Abdi AberaAinda não há avaliações

- Reviewer GEd 104 The Contemporary WorldDocumento3 páginasReviewer GEd 104 The Contemporary Worldbonna agojoAinda não há avaliações

- Ethics in Organization PalehDocumento11 páginasEthics in Organization PalehFaith Paleh RobertsAinda não há avaliações

- CW Reviewer 201blatestDocumento15 páginasCW Reviewer 201blatestORACION, Mark GerlexAinda não há avaliações

- PositionPaper Historical Globalization Learning Task 2Documento2 páginasPositionPaper Historical Globalization Learning Task 2Melvin Pogi138Ainda não há avaliações

- Ngozi Okonjo-Iweala: Corruption: Myths & Realities in A Developing Country ContextDocumento26 páginasNgozi Okonjo-Iweala: Corruption: Myths & Realities in A Developing Country Contextmusu35Ainda não há avaliações

- Modernization Theories of Development AnDocumento6 páginasModernization Theories of Development AnAulineu BangtanAinda não há avaliações

- The Long DivergenceDocumento7 páginasThe Long DivergenceBoudaoud FamilyAinda não há avaliações

- Financial Literacy5Documento9 páginasFinancial Literacy5waxkale igadhehAinda não há avaliações

- The Coming Financial Wars by Juan C. ZarateDocumento12 páginasThe Coming Financial Wars by Juan C. ZaratevoobergAinda não há avaliações

- Factors Pushing For GovernanceDocumento21 páginasFactors Pushing For Governancemaria claveria100% (1)

- 3.3 Periodising Money and Currency Relations: Part Two - Chapter SixDocumento7 páginas3.3 Periodising Money and Currency Relations: Part Two - Chapter SixFrancisco MartinezAinda não há avaliações

- Economic GlobalizationDocumento41 páginasEconomic GlobalizationMarjorie O. MalinaoAinda não há avaliações

- MB0037 - International Business ManagementDocumento40 páginasMB0037 - International Business ManagementManoj ArunAinda não há avaliações

- PIDB Potus Letter 9 11 Recommendations Final 1Documento2 páginasPIDB Potus Letter 9 11 Recommendations Final 19/11 Document ArchiveAinda não há avaliações

- 2012-156 Doc 25Documento3 páginas2012-156 Doc 259/11 Document ArchiveAinda não há avaliações

- Commission Meeting With The President and Vice President of The United States 29 April 2004, 9:25-12:40Documento31 páginasCommission Meeting With The President and Vice President of The United States 29 April 2004, 9:25-12:409/11 Document Archive100% (1)

- 2012-163 (Larson) NARA (CLA) Decision (Personal Info Redacted) 9/11 Commission Interview of Bush Cheney - Zelikow MFRDocumento3 páginas2012-163 (Larson) NARA (CLA) Decision (Personal Info Redacted) 9/11 Commission Interview of Bush Cheney - Zelikow MFR9/11 Document ArchiveAinda não há avaliações

- 2012-156 Doc 26Documento20 páginas2012-156 Doc 269/11 Document ArchiveAinda não há avaliações

- 2012-156 Doc 22Documento2 páginas2012-156 Doc 229/11 Document ArchiveAinda não há avaliações

- 2012-156 Doc 24Documento1 página2012-156 Doc 249/11 Document ArchiveAinda não há avaliações

- 2012-156 Doc 23Documento3 páginas2012-156 Doc 239/11 Document ArchiveAinda não há avaliações

- 2012-156 Doc 20Documento1 página2012-156 Doc 209/11 Document Archive0% (1)

- 2012-156 Doc 18Documento6 páginas2012-156 Doc 189/11 Document ArchiveAinda não há avaliações

- 2012-156 Larson NARA-CLA Release Signed Copy2Documento7 páginas2012-156 Larson NARA-CLA Release Signed Copy29/11 Document ArchiveAinda não há avaliações

- 2012-156 Doc 19Documento1 página2012-156 Doc 199/11 Document ArchiveAinda não há avaliações

- 2012-156 Doc 13 Part 1Documento25 páginas2012-156 Doc 13 Part 19/11 Document ArchiveAinda não há avaliações

- 2012-156 Doc 17Documento5 páginas2012-156 Doc 179/11 Document ArchiveAinda não há avaliações

- 2012-156 Doc 15Documento10 páginas2012-156 Doc 159/11 Document ArchiveAinda não há avaliações

- 2012-156 Doc 11 Part 4Documento16 páginas2012-156 Doc 11 Part 49/11 Document ArchiveAinda não há avaliações

- 2012-156 Doc 21Documento23 páginas2012-156 Doc 219/11 Document ArchiveAinda não há avaliações

- 2012-156 Doc 14 Part 1Documento18 páginas2012-156 Doc 14 Part 19/11 Document ArchiveAinda não há avaliações

- 2012-156 Doc 12 Part 1Documento26 páginas2012-156 Doc 12 Part 19/11 Document ArchiveAinda não há avaliações

- 2012-156 Doc 14 Part 2Documento22 páginas2012-156 Doc 14 Part 29/11 Document Archive100% (1)

- 2012-156 Doc 13 Part 2Documento27 páginas2012-156 Doc 13 Part 29/11 Document ArchiveAinda não há avaliações

- 2012-156 Doc 12 Part 3Documento33 páginas2012-156 Doc 12 Part 39/11 Document ArchiveAinda não há avaliações

- 2012-156 Doc 11 Part 2Documento24 páginas2012-156 Doc 11 Part 29/11 Document ArchiveAinda não há avaliações

- 2012-156 Doc 11 Part 1Documento27 páginas2012-156 Doc 11 Part 19/11 Document ArchiveAinda não há avaliações

- 2012-156 Doc 12 Part 2Documento28 páginas2012-156 Doc 12 Part 29/11 Document ArchiveAinda não há avaliações

- 2012-156 Doc 10 Part 2Documento24 páginas2012-156 Doc 10 Part 29/11 Document ArchiveAinda não há avaliações

- 2012-156 Doc 9 Part 3Documento27 páginas2012-156 Doc 9 Part 39/11 Document ArchiveAinda não há avaliações

- 2012-156 Doc 11 Part 3Documento23 páginas2012-156 Doc 11 Part 39/11 Document ArchiveAinda não há avaliações

- 2012-156 Doc 9 Part 6Documento17 páginas2012-156 Doc 9 Part 69/11 Document ArchiveAinda não há avaliações

- 2012-156 Doc 9 Part 5Documento21 páginas2012-156 Doc 9 Part 59/11 Document ArchiveAinda não há avaliações

- Texaco Racism Case Exposes Institutional DiscriminationDocumento4 páginasTexaco Racism Case Exposes Institutional DiscriminationDinesh PatelAinda não há avaliações

- Excelsior: DailyDocumento12 páginasExcelsior: DailyAnil PeshinAinda não há avaliações

- PDF Deaf Welfare Awareness Foundation.Documento8 páginasPDF Deaf Welfare Awareness Foundation.Ahmad ShahzadAinda não há avaliações

- Lfo 1970Documento2 páginasLfo 1970Noor e IlmAinda não há avaliações

- Counter Affidavit Against Subang FINALDocumento6 páginasCounter Affidavit Against Subang FINALMichelle SilvaAinda não há avaliações

- Articles of Impeachment Against President Donald J. TrumpDocumento25 páginasArticles of Impeachment Against President Donald J. TrumpAnonymous GF8PPILW580% (5)

- Span of ControlDocumento18 páginasSpan of ControlIpsita AcharyaAinda não há avaliações

- Chapter 9 Grade 9Documento27 páginasChapter 9 Grade 9api-326175299Ainda não há avaliações

- An Introduction To International ArbitrationDocumento24 páginasAn Introduction To International ArbitrationManish Kumar PandeyAinda não há avaliações

- Sharica Marie Go-Tan Vs Spouses TanDocumento2 páginasSharica Marie Go-Tan Vs Spouses Tanmerlyn gutierrezAinda não há avaliações

- History - From - Below - OcredDocumento8 páginasHistory - From - Below - Ocredchristliu1024Ainda não há avaliações

- Social Justice and Brooklyn Development: 500 Years of StruggleDocumento11 páginasSocial Justice and Brooklyn Development: 500 Years of StruggleJerry KraseAinda não há avaliações

- Appeals Opening Brief Court Stamped FiledDocumento34 páginasAppeals Opening Brief Court Stamped FiledJeff MaehrAinda não há avaliações

- Law 2013Documento88 páginasLaw 2013Rebecca SpencerAinda não há avaliações

- Shanghai dancers depicted in 1920s woodcutDocumento17 páginasShanghai dancers depicted in 1920s woodcutロベルト マチャード100% (1)

- A Comparison of The Manual Electoral System and The Automated Electoral System in The PhilippinesDocumento42 páginasA Comparison of The Manual Electoral System and The Automated Electoral System in The PhilippineschaynagirlAinda não há avaliações

- Kenneth S. Greenberg-Nat Turner - A Slave Rebellion in History and Memory (2003)Documento310 páginasKenneth S. Greenberg-Nat Turner - A Slave Rebellion in History and Memory (2003)Hego RoseAinda não há avaliações

- Anna Hazare - Wikipedia, The Free EncyclopediaDocumento27 páginasAnna Hazare - Wikipedia, The Free EncyclopediaProf C.S.PurushothamanAinda não há avaliações

- What Is A Contract? 1Documento10 páginasWhat Is A Contract? 1TiffAinda não há avaliações

- Andrea Untalan ResumeDocumento3 páginasAndrea Untalan ResumeRegail SarmientoAinda não há avaliações

- Dayton Reinsurance LetterDocumento1 páginaDayton Reinsurance LetterdhmontgomeryAinda não há avaliações

- Midterm Examination CSCDocumento7 páginasMidterm Examination CSCAimee SalangAinda não há avaliações

- Theories of IR - Realism, Liberalism & MoreDocumento4 páginasTheories of IR - Realism, Liberalism & MoreLewis Wanyama0% (1)

- The Politics of Denial Israel and The Pa - Nur Masalha PDFDocumento303 páginasThe Politics of Denial Israel and The Pa - Nur Masalha PDFJujyfruits80% (5)

- EMPLOYEE LISTDocumento13 páginasEMPLOYEE LISTSaimaAinda não há avaliações

- Ben Carson Super-PAC The 2016 Committee Financial Report First Half of YearDocumento1.079 páginasBen Carson Super-PAC The 2016 Committee Financial Report First Half of YearThe Conservative TreehouseAinda não há avaliações

- Case DigestDocumento10 páginasCase DigestEmmylou Francisco MagnoAinda não há avaliações

- Nottingham Letter and ElGAsDocumento32 páginasNottingham Letter and ElGAsLawDogAinda não há avaliações

- STP CalculationDocumento2 páginasSTP CalculationSilambarasan Subramaniyan100% (1)

- AP English 3 Satire Essay (No Child Left Behind)Documento5 páginasAP English 3 Satire Essay (No Child Left Behind)gongsterrAinda não há avaliações