Escolar Documentos

Profissional Documentos

Cultura Documentos

An Investigation Into The Socio Economic Impacts of Voluntary Severance Scheme On The Employees of SME Bank by Naushad Kazi

Enviado por

Naushad KaziDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

An Investigation Into The Socio Economic Impacts of Voluntary Severance Scheme On The Employees of SME Bank by Naushad Kazi

Enviado por

Naushad KaziDireitos autorais:

Formatos disponíveis

AN INVESTIGATION INTO THE SOCIO ECONOMIC IMPACTS OF VOLUNTARY SEVERANCE SCHEME ON THE EMPLOYEES OF SME BANK LTD, PAKISTAN

Dissertation: An Investigation Into nto The Socio Economic Impacts Of Voluntary Severance Scheme On The Employees Of SME Bank Ltd, Pakistan

Case Study of SME BankBank Voluntary Severance Scheme 2009

Author: Subject: Student ID: Supervisor: Naushad Raza Kazi M.A International Management (2010-2011) (2 099096276 Dr. Elewechi Okike

AN INVESTIGATION INTO THE SOCIO ECONOMIC IMPACTS OF VOLUNTARY SEVERANCE SCHEME ON THE EMPLOYEES OF SME BANK LTD, PAKISTAN

DEDICATED TO MY BELOVED FATHER LATE ENGINEER IMDAD HUSSAIN KAZI (1948-1978)

AN INVESTIGATION INTO THE SOCIO ECONOMIC IMPACTS OF VOLUNTARY SEVERANCE SCHEME ON THE EMPLOYEES OF SME BANK LTD, PAKISTAN

Acknowledgement

First and foremost, Im thankful to Almighty God who gave me courage to complete my dissertation. It was aim in my life to study in the one of the finest universities of United Kingdom. I also managed to fund my studies without relying on external support or sponsorship. I believe that I was given the power and patience by God to stay strong and work hard to achieve my goal of life. I would like to thank my supervisor Dr. Elewechi Okike for her kind guidance and supervision that enabled me to critically reflect on the pursued directions of the research and thus gave me the confidence to continue pursuing my chosen directions for the research. Further, I would like to thank the all research respondents; those provided me the valuable primary data which enabled me in finalization of my dissertation. While the dissertation, my friends also encouraged and helped me in the pilot testing. Hence, I also would like to thank all of them. In addition, I would like to thank my program leader Maam Sandy for her moral support and encouragement while my academic life at the university. Last but not least, I would like to thank my beloved mother and loving wife, who continuously remained to encourage me and they didnt show any kind of difficulty which they faced in my absence.

AN INVESTIGATION INTO THE SOCIO ECONOMIC IMPACTS OF VOLUNTARY SEVERANCE SCHEME ON THE EMPLOYEES OF SME BANK LTD, PAKISTAN

Table of Contents Sr.# Contents Chapter- 1: Introduction

1.1 1.2 1.3 1.4 1.5 1.6 1.7 Abstract Introduction Rationale/ scope Main Research Question & Sub Question Objectives Research Hypothesis Theoretical Research Framework 06 07 08 09 09 10 11

Page

Chapter- 2: Case Study of SME Bank Pakistan

2 2.1 2.2 2.3 2.4 2.5 2.6 2.7 2.8 2.9 2.9 A A case study background of SME Bank Ltd, Pakistan Significance of SME Bank sector in Pakistan Amalgamation of SBFC & RDFC into SME Bank SME Definition in terms of Central Bank of Pakistan Corporate Objectives of SME Bank Ltd, Pakistan Bank Key Products Grade Positions in SME Bank Reason Behind the Introducing VSS Nature of the Voluntary Severance Scheme VSS - 2009 VSS Benefit Calculation / Computation Review of financial statements of SME Bank Ltd 12 12 13 14 14 14 15 16 17 19 20

Chapter- 3: Literature Review

3.1 3.2 33 3.4 3.5 3.6 Voluntary Severance Scheme (VSS) Global History of downsizing & its effects Downsizing Strategies & Role of Management Socio Economic Effects of VSS on Employees Theories of Human Needs & VSS View of Strategic Authors And Downsizing 22 22 24 26 28 30

AN INVESTIGATION INTO THE SOCIO ECONOMIC IMPACTS OF VOLUNTARY SEVERANCE SCHEME ON THE EMPLOYEES OF SME BANK LTD, PAKISTAN

Sr.#

Contents Chapter- 4: Methodology

Page

4.1 4.2 4.3 4.4 4.5 4.6 4.7 a b 4.8 4.9

Research Methodology & data collection Research philosophies Approaches in Research Methodology Quantitative Data Qualitative Data Deductive Approach VS Inductive Approach Adopted Research Strategies Survey Strategies Case Study Strategies Questionnaire & Pilot Testing Population & Sampling

37 37 38 39 39 41 41 42 43 43 45

Chapter- 5: Design of Study

5.1 5.2 5.3 5.4 Design of Study Data Collection Instruments Limitation of Research Ethics of Research 48 48 48 49

Chapter- 6: Quantitative Analysis

6.1 6.2 6.3 6.4 6.5 Data Analysis Analysis of Financial Status Analysis of Social Status Analysis of Socio Economic Factors in the VSS Summary of Main Findings 50 57 62 65 71

Chapter- 7: Recommendation & Conclusion

7.1 7.2 Suggestions/ Recommendations Conclusion 73 75

Bibliography/References

8 References 77

AN INVESTIGATION INTO THE SOCIO ECONOMIC IMPACTS OF VOLUNTARY SEVERANCE SCHEME ON THE EMPLOYEES OF SME BANK LTD, PAKISTAN

CHAPTER-I

INTRODUCTION

1.1

ABSTRACT

The cost-saving approach has been used in various countries to increase the efficiency of the public sector organizations. It was argued that the downsizing is a major approach to reduce the burden of expenses and to increase the productivity of the financial and public sector organizations. (See chapter 3) Thus, the organizational output was made directly related to the right-sizing of the employees working in these companies. Although, this approach has achieved a measure of success in some developed countries, yet, the developing countries have not been able to make most of these output-oriented efforts. In the developing countries including Pakistan, the world financial institutions have supported these measures. In order to make this policy successful, the developing countries are required to minimize the loss of human resource. In Pakistan, the policy of Volunteer Severance Scheme was adopted to reduce massive redundancy in the financial institution. Since the inception of this policy no enough research has been done on this aspect of human resource management. This study was initiated to investigate the impact of Voluntary Severance Scheme (VSS) policy on life of the employees who accepted the VSS. The study has argued that there was a direct relationship between the VSS and the financial and social status. In the case study chapter 2, the author of this report presented calculation table regarding profit and losses of SME Bank in terms of relieving experienced employees under VSS 2009. In this table, comparison is given of before and after relieving impacts of VSS on SME Bank Ltd, these are also described in graphs. In same chapter, the researcher provided the answers of research sub questions a, b and c through the help of primary and secondary data. In order to examine the impacts of VSS on employees; the responses of the employees were collected through survey method for further explanation. The data analysis suggested that VSS had a positive impact on the life of the employees. They were able

6

AN INVESTIGATION INTO THE SOCIO ECONOMIC IMPACTS OF VOLUNTARY SEVERANCE SCHEME ON THE EMPLOYEES OF SME BANK LTD, PAKISTAN

to raise their monthly incomes. Therefore, the majority of the respondents (84%) agreed that the VSS had a positive impact on the life of the employees. (Table 5) The study also comes with some recommendations and suggestions for the all stake holders to improve the efficiency of the VSS scheme in Pakistan.

1.2

INTRODUCTION

The development of human capital is considered an important factor for the effectiveness and efficiency of any organization. This can be achieved through employing an appropriate number of workers. Hence, in order to reorganize the institutions, the downsizing of an overcrowded employees, has become increasingly important in modern times especially in the developed countries. It has been observed that massive redundancy or downsizing always create more complicated problems than solutions and firms rarely achieve their financial goals. Therefore, before implementing retrenchment or downsizing plan management should use right approach and less painful strategic plan of downsizing. (Management Research News Emerald 2003) The downsizing approach is also being employed in the financial and other public sector organizations in the developing countries including Pakistan. These countries have been funded by the World Bank and the Asian Development Bank to reform their economies by transforming their fragile organizational structures into productive businesses. It is observed that Voluntary Severance/Separation Scheme (VSS) is being used by many national and International organizations as a HR tool of downsizing. In this approach employees are offered fair and attractive lump sum compensation package for leaving the organization. After availing this option employee who opt VSS, they take their all service benefits in lump sum with their own consent and further they cannot claim any benefit in future. Hence, this is called soft HR downsizing approach. (Staff community forum for Malaysia 2008) The researcher has chosen the topic VSS -VOLUNTARY SEPARATION OR SEVERANCE SCHEME for dissertation. The aim of this research is to find out the social and economic causes and effects of such a scheme on employees who avail this option for early retirement on one hand and institutional losses on the other hand.

7

AN INVESTIGATION INTO THE SOCIO ECONOMIC IMPACTS OF VOLUNTARY SEVERANCE SCHEME ON THE EMPLOYEES OF SME BANK LTD, PAKISTAN

Very little research has been undertaken on the topic and no research is found particularly in the country under study. The Government of Pakistan introduced the scheme under study in various forms to improve the functioning of economic institutions in public sector organizations. These schemes if modified can play a vital role in accelerating economic growth and development. Hence the researcher has selected VSS Voluntary severance/Separation Scheme of SME Bank Ltd Pakistan as a case study. It is a public sector bank under the Ministry of Finance (MoF) Government of Pakistan (GoP). The Government of Pakistan intends to privatize SME Bank since 2003. As per the instructions of GoP instruction, the top management of SME Bank offered VSS to their regular employees. The last VSS was offered in Oct 2009, in this VSS bank relieved about 139 employees against the cost of approximately 661 million Pak Rupees. (SME Bank Financial Statements 2010). The author of this report feel necessary to mention here that as the researchers population is ex employees of SME Bank who accepted VSS and relieved from their services, hence they have not need to get the departmental permission for participation in the research.

1.3

RATIONALE / SCOPE

The survey of literature on the topic suggests that study of the VSS in SME bank is unique because no other scholar has conducted research on this topic of vital importance for an emerging economy such as Pakistan. This provides a rationale for present study to find out factors for ineffectiveness of the VSS scheme. It will also be helpful for SME bank management who is currently engaged in HR restructuring. This research will enable us to make opinion regarding employees experience and skills that opted VSS. In this research, the researchers main objective is to suggest employees who have been offered VSS by their organizations whether VSS acceptance is a right decision for their families. While literature review author of this research noticed that many public sector organizations/banks have offered VSS to their employees in Pakistan like Pakistan Telecommunication Authority (PTA), United Bank Ltd (UBL), Habib Bank Ltd (HBL) and various banks. (Pakistan Economist, 2002)

AN INVESTIGATION INTO THE SOCIO ECONOMIC IMPACTS OF VOLUNTARY SEVERANCE SCHEME ON THE EMPLOYEES OF SME BANK LTD, PAKISTAN

Therefore, the author has decided to pin point hard issues of unemployment and provide the guide line to avoid these terrible problems while downsizing, researcher also briefly described the negative impacts of the downsizing on organizations. In the end of this research, the researcher gives some useful suggestions/ recommendations to SME Bank management, Government of Pakistan and the employees.

1.4

MAIN RESEARCH QUESTION AND SUB QUESTIONS

ANY SOCIO ECONOMIC IMPACT ON THE

DID THE VOLUNTARY SEVERANCE SCHEME EMPLOYED BY THE SME BANK LTD HAVE

EMPLOYEES OF THE BANK?

RESEARCH SUB QUESTIONS

a. Why did the government introduce Voluntary Severance/Separation Scheme

as a part of its HR restructuring in SME Bank Ltd, Pakistan?

b. What is the nature of the VSS introduced by SME Bank Ltd, Pakistan? c. Did the SME Bank suffer loss after relieving professional employees under

VSS?

d. Were the employees able to benefit from the scheme?

1.5

OBJECTIVES

a. To find out the reason behind the introduction of VSS in SME Bank Ltd by

the Government of Pakistan.

b. To give an overview of the nature of VSS policy introduced by the

Government of Pakistan.

c. To explore the functions of VSS policy. d. To investigate the institutional losses caused by the VSS in terms of skilled

manpower.

e. To analyze the impact of VSS on socio economic conditions of the employees. f.

To find out psychological effects on VSS optees and their families.

g. To workout the recommendations for making the policy more workable in

peculiar conditions of developing country such as Pakistan.

9

AN INVESTIGATION INTO THE SOCIO ECONOMIC IMPACTS OF VOLUNTARY SEVERANCE SCHEME ON THE EMPLOYEES OF SME BANK LTD, PAKISTAN

1.6

RESEARCH HYPOTHESIS

Null Hypotheses Alternate Hypotheses = = H0 : a b H1 : a = b

Following Hypothesis to be tested in the study:-

a.

H0:

Financial Status Hypothesis

VSS funds did not provide opportunities to the employees to improve their financial conditions.

H1:

VSS funds provided opportunities to the employees to improve their financial conditions.

Independent Variable 1. Voluntary Severance Scheme Dependent Variable 1. Financial Status 2. Investment Opportunity

b. Social Status Hypothesis

H0: H1: The employees did not improve their social life and status by mean of VSS. The employees improved their social life and status by mean of VSS.

Independent Variable 1. Voluntary Severance Scheme Dependent Variable 1. Social Status 2. Increase In Buying Power

10

AN INVESTIGATION INTO THE SOCIO ECONOMIC IMPACTS OF VOLUNTARY SEVERANCE SCHEME ON THE EMPLOYEES OF SME BANK LTD, PAKISTAN

1.7

THEORETICAL RESEARCH FRAMEWORK

This research framework is based on the famous work of Max- Neef (1991) theory of fundamental needs. Further theory has been discussed in literature review.

SOCIO ECONOMIC FACTORS

Belief

Subsistence Protection Affection Understanding Participation Leisure Creation Identity Freedom

Attitude

SUCCESS OR FAILURE AFTER VSS Low morale Lack of work commitment (IMPACT)

SPOUSE FRIENDS FAMILY MANAGER COLLEAGUE MANAGEMENT ECONOIMC CONDITIONS UNCERTAINTY BUSINESS ENVIRONMENT MONEY INFLATION PAY INCENTIVES PROMOTION

Fig.1. Creation of author source Max Neef (1991)

11

AN INVESTIGATION INTO THE SOCIO ECONOMIC IMPACTS OF VOLUNTARY SEVERANCE SCHEME ON THE EMPLOYEES OF SME BANK LTD, PAKISTAN

CHAPTER-II

CASE STUDY OF SME BANK LTD, PAKISTAN

2. CASE STUDY BACKGROUND OF SME BANK LTD, PAKISTAN

Most of the economies worldwide depend on small and medium enterprises (SME). Hence the Government of Pakistan realized the importance of SME sector. The most significant step was taken for the development of SMEs which was establishment of SME Bank to provide speedy financial support to this sector. Hence, the Government decided to amalgamate two NBFI (Non banking financial institutions), namely the Regional Development Financial Institution (RDFC) and Small Business Finance Corporation (SBFC) and established a new organization in the form of SME Bank Ltd Pakistan. Like many others public sector organizations both were conceptually sound but due to the bureaucratic approach, political interference, corruption from lower to higher level and non professional management, the loan were disbursed to non deserving people for appeasing the political influence without meritorious considerations. Therefore, both institutions became a liability in the form of huge NPL (Non performing Loans) approximately amounting to 16 billion Pakistani Rupees. According Ex President also first CEO of SME Bank Mr. Qaiser. H.Naseem while his interview ( Pakistan Economist, 2002) described some basic reasons of SBFC and RDFC amalgamation and establishment of new institution as SME Bank Ltd, Pakistan, which are mentioned as below: a. Political Government interference b. Lack of required skills in both organizations c. Weak internal controls and Integrity issues.

2.1

SIGNIFICANCE OF THE SME SECTOR IN PAKISTAN

SMEs play an important role in the growth and development of various leading global economies like USA, South Korea, Japan and Malaysia. In the EU, SME comprises about 99% of all firms and employs a workforce of 65 million people. As similarly SMEs constitute more than 90% of business in Pakistan, and at the same time provides employment opportunities to lower income group, hence it plays key role in

12

AN INVESTIGATION INTO THE SOCIO ECONOMIC IMPACTS OF VOLUNTARY SEVERANCE SCHEME ON THE EMPLOYEES OF SME BANK LTD, PAKISTAN

poverty reduction. Overall the SMEs provide employment opportunities to 80% of the work force and contribute to value addition by 30%. This signifies a huge role of SMEs in the economic development of Pakistan. (South Asian Journal 2005)

SME SUB SECTOR CONTRIBITION IN PAKISAN

No. SUB SECTOR

%

10% 13% 4% 16% 7% 4% 35% 5%

1 2 3 4 5 6 7 8

Wood and furniture Cotton Weaving Carpet Grain Milling Metal Products Jewelry Others Art Silk

(Table.1.South Asian Journal 2005)

2.2

AMALGAMATION OF SBFC AND RDFC INTO SME BANK

The both institutions brief detail is mentioned as below: a. SMALL BUSINESS FINANCE CORPORATION (SBFC): The SBFC was established in 1972. The aim behind the creation of this institution was to fulfill the financial needs of particular small business in Pakistan. It had around 98% loans provided against personal guarantee and only 2% loans were financed against collateral. In different times, political government directed and announced fully sponsored self employment schemes for providing loans to small borrowers on low markup rates. (Pakistan Economist, 2002) b. REGIONAL DEVELOPMENT FINANCE CORPORATION (RDFC) This institution was established with an aim to fulfill the financial needs of private sector for special projects and industries. The prime objective of RDFC was to fulfill the financing needs in remote area industrial projects and to establish industrial estates on regional basis in less developing areas. (Pakistan Economist, 2002)

13

AN INVESTIGATION INTO THE SOCIO ECONOMIC IMPACTS OF VOLUNTARY SEVERANCE SCHEME ON THE EMPLOYEES OF SME BANK LTD, PAKISTAN

c. CREATION OF SME BANK LTD PAKISTAN The SME Bank Ltd was formed and incorporated as a public Ltd Company under the companys ordinance 1984 with effect from 1st Jan 2002, after the amalgamation of SBFC and RDFC. The paid up capital of the bank is 2.392 billion (Pak Rupees). The government of Pakistan is major share holder of SME Bank Ltd. It has flat based organizational structure with few management layers. (SME Bank, 2010)

2.3

SME DEFINITION IN TERMS OF CENTRAL BANK PAKISTAN

According State Bank of Pakistan (SBP), SME is an entity which is not ideally a public limited company; it does not employ more than 250 peoples in manufacturing, and whereas it has a maximum limit up to 50 employees is fixed for trading and services. Further as per SBP terms condition regarding SME project investment has given as below: 1) Trading & Services sector up to limit 50 millions. 2) A manufacturing sector up to limit 100 millions. 3) Any concern which should not exceeding sales limit Rs. 300 millions as per financial statements (SME Bank, 2010).

2.4

CORPORATE OBJECTIVES OF SME BANK LTD

To develop, support and promote Small Medium Enterprises (SMEs) by facilitating them necessary financial and technical assistance. Through SME financing create the job opportunities and reduce poverty. (SME Bank, 2010)

2.5

BANK KEY PRODUCTS

Currently bank is offering two types of banking products, lending and commercial banking products such as smart loan facility, asset finance, running finance, current account, PLS account and SME regular TDR account. (SME Bank, 2010).

14

AN INVESTIGATION INTO THE SOCIO ECONOMIC IMPACTS OF VOLUNTARY SEVERANCE SCHEME ON THE EMPLOYEES OF SME BANK LTD, PAKISTAN

2.6

GRADE POSITION IN SME BANK LTD, PAKISTAN

PRESIDENT / CEO OPERATION AND BUSINESS DEVELOPMENT DIVISION

CREDIT RISK MANAGEMENT DIVISION HR AND SERVICES DIVISION IT DIVISION

BACR DIVISION

INVESTIGATION DIVISION INTERNAL AUDIT DIVISION TREASURY DIVISION

*

Fig.2. Creation by the researcher source of inf. SME Bank (010)

R. A. Chughtai Nasser Durrani President & CEO Senior Executive Vice President Head Operations & Business Development Division Executive Vice President Head Credit Risk Management Vice President Acting Chief Financial Officer & Company Secretary Executive Vice President Head Investigation Division Senior Vice President Head Human Resource & Services Division Senior Vice President Acting Head Internal Audit Vice President Acting Head Information Technology Division Assistant Vice President Acting Head Treasury Division

Sardar Usman Rashid

Mehboob Hussain

Syed Akbar Shah

Raja Muhammad Altaf

Najam Akhtar

Muhammad Mubeen Mufti Syed Oshaid Akhtar

(Table.2. Source SME Bank, 2010)

15

AN INVESTIGATION INTO THE SOCIO ECONOMIC IMPACTS OF VOLUNTARY SEVERANCE SCHEME ON THE EMPLOYEES OF SME BANK LTD, PAKISTAN

1) Senior Executive Vice President (SEVP) 2) Executive Vice President (EVP) 3) Senior Vice President (SVP) 4) Vice President (VP) 5) Assistant Vice President (AVP) 6) Officer Grade 1 (OG 1) 7) OG II 8) OG III 9) Senior Assistant 10) Assistant (Clerical Grade) (Clerical Grade)

11) Driver, Messenger, Watch man and Sweeper (Non Clerical)

2.7

REASON BEHIND THE INTRODUCTION OF VOLUNTARY SEVERANCE SCHEME (VSS) IN SME BANK AS PART OF HR RESTRUCTURING

The Asian Development Bank (ADB) launched SME sector development program in Pakistan with the assistance of federal Government of Pakistan. The loaning agreement for this program was signed and agreed between the Government of Pakistan and ADB. As well as project agreement was signed by ADB, State Bank of Pakistan (SBP), Small Medium Enterprises Development Authority (SMEDA) and SME Bank Ltd for development of SME sector on 10th Feb 2004. In this agreement, following important terms and conditions for restructuring of SME bank were agreed upon. (SME BANK FINANCIAL STATEMENT, 2010) 1) Reduction in the number of recovery branches 2) Staff downsizing through Voluntary Severance Scheme (VSS) 3) HR Audit 4) Hiring of new professional staff 5) Preparation of privatization of bank In the view of above mentioned agreement, Government of Pakistan and SME Bank Pakistan introduced Voluntary Severance Scheme (VSS).

16

AN INVESTIGATION INTO THE SOCIO ECONOMIC IMPACTS OF VOLUNTARY SEVERANCE SCHEME ON THE EMPLOYEES OF SME BANK LTD, PAKISTAN

2.8

NATURE OF THE VOLUNTARY SEVARANCE SCHEME (VSS) 2009 OF SME BANK LTD.

According SME Bank VSS Circular (2009) dated:15th Oct. 2009 that due to the high establishment cost of the organization and assets size of bank which is very small to meet the current expenses, hence in the view to prevent the erosion of the banks equity and to protect the interest of depositors, the bank has decided to offer of Voluntary Severance Scheme (VSS) to all regular employees of defunct SBFC or RDFC, those were working in SME Bank whose terms and conditions of service were protected under the Amalgamation and Conversion ordinance LV1 of 2001, as per Privatization Commission of Pakistan, the CBA and the Officer Association agreement Memorandum of Understanding dated 8th Sept. 2008. Since last few years bank is in the process of privatization and almost all feasibilities had been worked out by the Government of Pakistan. It was clearly described by the management that it was the last and final opportunity for the concerned employees to close their service contracts. The exercise of option in favor of the scheme was at the absolute discretion of the employees. The employees who in their absolute discretion decide not to avail the VSS shall be entitled to the protection of the terms and conditions of service under the previous employer for a period of one year, effective from the date of transfer of management control of the bank to the private sector. The last date of submission was 30th Oct 2009. The declaration of option forms duly filled and signed by employees in the presence of two witnesses, further terms conditions are mentioned as below: (Appendix.2. VSS Circular 2009) a. ELIGIBILITY All regular employees of defunct SBFC and RDFC those currently serving in SME Bank were eligible to avail this opportunity, except those employees against whom disciplinary action, enquiry and criminal case or legal case is pending or who are otherwise involved in any kind of litigation with the bank. In case of those employees against whom disciplinary action or legal cases were pending, they were allowed to benefits of the scheme if their charges exonerated or the charges were withdrawn /finalized before the close of submission date. (Appendix.2. VSS Circular 2009).

17

AN INVESTIGATION INTO THE SOCIO ECONOMIC IMPACTS OF VOLUNTARY SEVERANCE SCHEME ON THE EMPLOYEES OF SME BANK LTD, PAKISTAN

b. CUT OF DATE Benefits under VSS 2009 were calculated on the basis of pay and allowances drawn on 30th June 2009. (Appendix.2. VSS Circular 2009) c. SALARY INCREMENT Employees opting for the scheme were allowed an increase of 20% in their basic pay before calculating their benefits under VSS 2009. (Appendix.2. VSS Circular 2009) d. LEAVE ENCASHMENT Leave encashment of any balance leave at credit, subject to a maximum of 180 days, as per admissible rules. (Appendix.2. VSS Circular 2009) e. SEVERANCE PACKAGE o 100% commutation of pension to the eligible employees o Provident funds as per admissible rules o Benevolent funds up to the amount funded by SME Bank Limited o Leave Encashment admissible as per rules o TADA admissible as per rules o For clerical and non clerical staff severance incentive equal to four basic salaries for each year of service completed up to the effective date. o For officer grade Severance incentive equal to two basic salaries for each year of service completed up to the effective date. (Appendix.2. VSS Circular 2009) f. MEDICAL FACILITY Employees who have completed twenty five years of service on the effective date were entitled to a lump sum amount equal to 10 years of normal medical annual monetary ceiling presently admissible to employees and paid a long with monthly salary. (Appendix.2. VSS Circular 2009) g. INCOME TAX AND PAYMENT

The employees who had opted VSS their final payments made to them within 30 thirty days of the effective date. Any payment made to an employee under this scheme was subject to adjustment of employees loans and other liabilities towards including loan repayment guarantees was given on behalf of any employees of the bank. Tax liability was the responsibility of the employees and adjusted as per relevant tax law. (Appendix.2. VSS Circular 2009)

18

AN INVESTIGATION INTO THE SOCIO ECONOMIC IMPACTS OF VOLUNTARY SEVERANCE SCHEME ON THE EMPLOYEES OF SME BANK LTD, PAKISTAN

h. WITHDRAWL AND FINAL DECISION Whilst this scheme was optional at the absolute discretion of the employees, once the option was exercised by duly filling, signing and submitting the Declaration of Option Form to the competent authority it could not be withdrawn under any circumstance. The President and CEO was the final authority for any decisions on individual VSS applications which processed by HR and Services Division. (Appendix.2. VSS Circular 2009)

2.9 . VSS BENEFIT CALCULATION / COMPUTATION

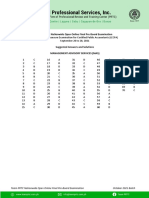

The researcher has given here his own benefit computations / calculation sheet as a case study for better understanding of the research. The sheet was provided by SME bank to the researcher at the time of VSS. SME BANK LTD, PAKISTAN VSS COMPUTATION SHEET VOLUNTARY SEPARATION SCHME 2009

Name of Employer: Naushad Kazi Grade / Designation Officer: (OG-III) Date of Joining: 01/02/1999 FINANCIAL INFORMATION: 1. BASIC PAY AS ON: 30/06/2006 2. GROSS PAY AS ON: 30/06/2009 BENEFITS: 1. COMMUTATION OF PENSION: BASIS: (SERVICE 11 YEARS) 2. PROVIDENT FUND 3. BENEVOLENT FUND 4. SEVERANCE INCENTIVE: BASIS: (COMPLETED YEAR: 10) 5. LEAVE ENCASHMENT: BASIS: (DAYS 178.5) A: Sub Total LESS: Loans and Advance 1. Transport Loan (M/Car) 2. Other Loans: (Computer / advance salary etc) B: Sub Total Net payable (A-B) 18,548.00 2,715,226.00 99,673.00 165,868.00 472,780.00 253,178,00 3,706,725.00 23,639.00 42,551.00

PKR Amount

38,247.00 3,668,478.00

Table 3: Authors own calculation sheet was given by the SME

19

AN INVESTIGATION INTO THE SOCIO ECONOMIC IMPACTS OF VOLUNTARY SEVERANCE SCHEME ON THE EMPLOYEES OF SME BANK LTD, PAKISTAN

2.9(a) REVIEW OF SME BANK FINANCIAL STATEMENTS (010)

FACTS AND FIGURES COMPARISION OF SME BANK AFTER VSS 2009

DIFF: NO DESCRIPTION DEC. 2009 SEPT 2010 in million Comments

1 2 3 4 5

Non Performing loans (NPL'S) Operating pre tax loss Total income amounted SME Lending Operation Recoveries portfolio

490 million 228 million 593 million 282 million 94 million

712 million 290 million 459 million 242 million 6 million

-222 -62 134 40 88

*Institutional loss *Institutional loss *Institutional loss *Institutional loss *Institutional loss

6 8 7

Money marketing borrowing Administrative Expenses Average cost of funds

342 million 401 million 11.76%

276 million 373 million 9.81%

66 28 1.95%

*Institutional profit *Institutional profit *Institutional profit

Table 4: SME Bank Financial Statement (2010)

*Institutional loss indicates that due to professional/ experienced staff downsizing through VSS, bank sustained loss. *Institutional profit indicates that due to downsizing organization achieved profit.

20

AN INVESTIGATION INTO THE SOCIO ECONOMIC IMPACTS OF VOLUNTARY SEVERANCE SCHEME ON THE EMPLOYEES OF SME BANK LTD, PAKISTAN

After VSS Loss of bank in millions PAK RUPEES

PKR 250.00 PKR 200.00 PKR 150.00 PKR 100.00 PKR 50.00 PKR 0.00

After VSS Loss of bank in millions

Graph.1. Creation of author source SME Bank financial statements (2010)

Institutional profit after VSS in millions Pak Rupees

PKR 70.00 PKR 60.00 PKR 50.00 PKR 40.00 PKR 30.00 PKR 20.00 PKR 10.00 PKR 0.00 Money marketing borrowing Administrative Expenses

Institutional profit after VSS in millions

Graph.2. Creation of author source SME Bank financial statements (2010)

21

AN INVESTIGATION INTO THE SOCIO ECONOMIC IMPACTS OF VOLUNTARY SEVERANCE SCHEME ON THE EMPLOYEES OF SME BANK LTD, PAKISTAN

CHAPTER-III

LITERATURE REVIEW

3.1 VOLUNTARY SEPARATION/ SEVERANCE SCHEME (VSS):

According Bashar (2001) Voluntary Severance Scheme (VSS) is a new term which was previously used as a Golden Handshake for staff downsizing. It means an early retirement benefits. Hence we can say it is a fashionable form of retrenchment. Hollet (2001) have classified three basic forms of employees downsizing /retrenchment which are categorized as under: a. Involuntary Separation: In this option, staff is fired forcefully at organizations discretion. b. Voluntary Separation Scheme (VSS): In this option employees of any age or level are offered incentives to leave organization. c. Voluntary Early Retirement (VER): In this VSS scheme employees are

offered early retirement incentives; those who are near to the age of retirement.

According to Roch (2001) that organization always introduce various downsizing terms such as retrenchment, redundancy, laid off, optional resignation offer, Voluntary Separation Scheme (VSS) and planned retrenchment, these all different means to avoid negative effects on the part of employees, it is very difficult to listen three words You are fired.

3.2

GLOBAL HISTORY OF DOWNSIZING AND ITS EFFECTS ON THE EMPLOYEES

Since early 1980, downsizing and retrenchment became an important part of management practice. During this era corporate world observed various dramatic and continual changes. These changes are concerned with global competitive pressures, advancement in latest technology and customer base market demand. In this era the important feature with respect to downsizing was white collar worker, such as in UK from 1992 93, the British Telecom laid down about 5000 middle managers and

22

AN INVESTIGATION INTO THE SOCIO ECONOMIC IMPACTS OF VOLUNTARY SEVERANCE SCHEME ON THE EMPLOYEES OF SME BANK LTD, PAKISTAN

approximately 900 senior managers. Whereas, Uniliver also adopted downsizing approach and retrenched approximately 1926 employees in the white collar category. The downsizing increases workload as well as responsibility of existing employees; the focus of this exercise is to reduce the establishment cost. (Swetswise 1999) According to Turner (2000) since the 1980s, about 10 million employees have been fired in an effort to reduce costs and improve performance. Whereas the same was observed by Hamisah (2001) again in year 2001, 10 to 15% work force was affected by the VSS during the merger and privatization exercised by the banks. It is observed that most of those who opted for VSS were clerical staff. According the Ministry of Human Resource Malaysia that approximately 13920 employees had fired or retrenched in the year 2000 and about 50% staff was reduced through VSS. In year 2001, number of employees downsized up to 28801, and similarly in 2002, they were about 26452. (Ministry of HR Malaysia 2002) In year 2008, it is reported that at least 2.5 million people lost their jobs in USA, and yet they are losing six hundred thousand jobs every month. (Wiley 2009) The same downsizing approach was also used by Government of Pakistan and basic philosophy behind this was to save 20 to 30 million Pakistani Rupees annually. The World Bank, Asian development Bank, IMF and State Bank of Pakistan offered to meet all downsizing expenses. As up to June 1998, almost about 22642 employees of Development Financial Institutions (DFI) availed Golden Hand Shake and payment about 29.1 billion Pakistani Rupees was made to them in terms of their early retirement. Again there was huge downsizing in the year 2004, from Aug to Sept, about 6495 executives and officer had retired under Golden Hand Shake program offered by United Bank Ltd Pakistan (UBL) and Habib Bank Ltd Pakistan (HBL). This offer was made to 30,000 employees all over Pakistan. (Scribd Internet Report 2008) During the research, it was found that in the private sector, organization were offering retirement incentives which dropped from 13.2% to 10.8% within a period of five years. Similarly it also dropped from 27.9% to 16.5 in the public sector organizations/banks. It is very interesting that employees number of early retirement acceptance increased and in contrast, the number of such early retirement schemes offer to employees reduced by the organizations/banks. In the year 1991, downsizing was 32.7% and it went up to 42.4% in 1995. (Burke,R,J. and Cooper, C,L 2000)

23

AN INVESTIGATION INTO THE SOCIO ECONOMIC IMPACTS OF VOLUNTARY SEVERANCE SCHEME ON THE EMPLOYEES OF SME BANK LTD, PAKISTAN

3.3

DOWNSIZING STRATEGIES AND MANAGEMENT

According to Kets De Vries and Balazs (1996) downsizing could be implemented through combination of various strategies like restructuring, de layering and organization redesign with the process of systemic changes. Further they suggested that HR should have right selection methods for staff redundancy. No doubt some HR professionals believe that downsizing is an opportunity to relieve the poor performers but it is observed that the high performer keenly opt for options like VSS. According to Cross (1993), when we see in the past, it is very clear that mostly companies were under different pressures, both external as well as internal which have essential need of changes in management style and management functions. Hence companies mostly tried to understand and reviewing their personnel policy. Due to increasing use of advance technology, companies rely on less manpower. Therefore, they are engaged in downsizing for increasing profitability and reducing cost. Sumati Reddy of ICFAI University Hyderabad India has described that if according organization restructuring plan, downsizing is considered inevitable then management should pay serious attention on the employees involvement in designing Voluntary Severance Scheme, then they can consider rationalization or downsizing program, if they conveyance and involve them in designing some reasonable downsizing program, in terms of fair and equitable policy, it could be better for both organization as well as employees. The organizational restructuring major benefit is increased the value to share holders and improved profitability. The smooth communication, less bureaucracy and quick decision making are some of the important characteristics of restructuring. (Scribd Internet Report 2008) Haltiwanger and Singh (1999) observe some errors in retrenchment/downsizing program of organizations, further they described that total number of employees who retrenched is greater than the total number of employees has been reduced in organizations. It indicates staff rehiring. The need of employees rehiring produces evidence that some employees are necessary to running the affairs of organization that were wrongly separated. In their research it is found that almost 20% employees rehired in all departments. This is basic risk in retrenchment program. No doubt that

24

AN INVESTIGATION INTO THE SOCIO ECONOMIC IMPACTS OF VOLUNTARY SEVERANCE SCHEME ON THE EMPLOYEES OF SME BANK LTD, PAKISTAN

over staffing usually leads to the unsustainable fiscal deficit. Hence cutting a financial cost and increasing economic growth have been focused by most of the developing countries through downsizing of public sector organizations. While downsizing good severance packages create an incentive opportunity for the good productive workers to switch from their organization because they usually have better opportunities in other organizations and find lesser incentives in continuing with the same. The firms usually do not use policy of firing the employees because it affects negatively and produce bad reputation. There are various practices regarding compensation package which varies firm to firm and industry to industry. Generally it depends on financial stability of firm. In Malaysia, it is compulsory for every organization/bank to get permission from Government of Malaysia, before announcement of any downsizing/ retrenchment program. This is mandatory for both private and public sector organization/bank. As author of this report believe, in the view of this practice, Government of Malaysia can avoid from possible negative effects on the society. (Staff community forum for Malaysia 2008) The Pakistan Telecommunication Authority during privatization first categorized their employees in to two groups, mentioned as below: a. The employees who are necessary to run the business b. Surplus employees, those were overstaffed. Hence, it seems that organization has focused on employees that are more concerned with their job professional requirements and work productivity, hence downsizing approach used by them and announced Voluntary Severance Scheme (VSS). (The News Pakistan 2008) In some cases the management also offers bridge retirement program to employees those who opt early retirement scheme, this mean they fully first take their full and final benefit then again join organization for fix period of two or more years on contract basis. The employees often prefer to opt for this option because they fell that it provides better incentives for them. This kind of offer is generally given to the employees who performed their job for long time period such as more than 15 years service. (Ruhm 1990 and Atchley 1989)

25

AN INVESTIGATION INTO THE SOCIO ECONOMIC IMPACTS OF VOLUNTARY SEVERANCE SCHEME ON THE EMPLOYEES OF SME BANK LTD, PAKISTAN

3.4

SOCIO ECONOMIC EFFECTS OF VSS ON EMPLOYEES

The socio economics is the study about the relationship between the social life and economic activity, it studies the impact of economic changes on the social life e.g. distribution of income and market manipulation. (Blackwell 2010) Margulis (1994) have described some worst and negative extensive retrenchment syndromes like threat of broken marriages, suicide and nervous breakdown. The management should work out on proposed change but carefully minimize negative effects on remaining employees. Moreover according him the extensive employee downsizing creates low commitment and high absenteeism in staff. Hence internal communication is very important in organizational goals achievement. According Wolcott (1998) and Taylor (2001) both have described that spouses influence play an important element in opting early retirement or VSS by employees. Wiley (2009) observe that in USA from 2006 to 2008, many people when availed retirement, their accounts get devastated and they also loosed 20% to 50% value of their houses and amount of money which people save for their childrens education and for their rest of life after retirement which was wiped out. According to Martikainen (2000) some factors could not be denied in availing opportunities like Voluntary Severance Scheme e.g. health, income, gender, future incentive, job satisfaction and family factors. The over work load, fear of made redundant and stress of work also play essential role in taking a VSS by workers. (Coombs 1996) It was found in quality of working life survey by the Institute of Management that due to continuous change and restructuring of organization, employees feel lower in morale, job insecurity, and lack of loyalty and motivation. Due to poor communication, employees remain uncertain regarding their future employability, even managers feel insecurity as they do not know organizations future strategy. (Burke,R,J. and Cooper, C,L 2000) Heckscher (1995) found reduced level of loyalty while organizational restructuring, as he examined and interviewed 250 middle managers of 14 organizations which were under restructuring process. About 10 organizations faced trouble and lost their employee loyalty, further only 4 firms achieved organizational goal.

26

AN INVESTIGATION INTO THE SOCIO ECONOMIC IMPACTS OF VOLUNTARY SEVERANCE SCHEME ON THE EMPLOYEES OF SME BANK LTD, PAKISTAN

While privatization of Telecommunication of Pakistan announced VSS and about 6000 employees opted Voluntary Separation Scheme. The employees were notified about their redundant status. Hence most of employees felt insecure about them and decided to avail the VSS. One old employee in his comments to the news reporter

that people want to take this opportunity and availing money without doing anything but at the end there will be no money and everything will be finished. It seemed during survey that due to the privatization most of the employees who availed VSS were afraid to work with new management. (The News Pakistan 2008) In 90% organizations, it was found while survey that they have not been offering job security, hence employees feel very insecure. (Burke,R,J. and Cooper, C,L 2000) The various studies consistently denoted that while downsizing survivors had dropped their morale and lost productivity. Also they become narrow minded and they do not trust on management. (Scribd Internet Report 2008) According Stewart and Barling (1996) that employees job insecurity has negative influence on childrens behavior. In acceptance of early retirement incentive scheme, major influence is considered financial status which is primary factor. While the economic research of early retirement, it was found that old employees decisions mostly influenced due to expected future income stream. While literatures review of socio- economic factors, it is found that in various articles and research papers, the author found negative effects on employees and organizations during restructuring and downsizing, which are mentioned below: 1) Productivity loss 2) Poor morale 3) Decline in quality 4) Anxiety and low level of loyalty 5) Apathy 6) Un secure feeling regarding job 7) Family problems e.g. spouse issues, child behavior problems 8) Lack of career opportunities e.g. Promotion, rise in salary and incentives 9) 20% again rehiring in all departments after downsizing. (Error in downsizing program).

27

AN INVESTIGATION INTO THE SOCIO ECONOMIC IMPACTS OF VOLUNTARY SEVERANCE SCHEME ON THE EMPLOYEES OF SME BANK LTD, PAKISTAN

Description Employee morale Motivation Staff commitment Promotion Opportunities Job satisfaction

Australia

Newzealand Decrease in %

South Africa

65.9 50 51.4

37.5 25.3 25.9

75.4 70.8 68.8

51.1

17.9

43.2

16.4

23.7 Increase in %

20.8

Concern about job security

71

56

80

H0:Employee morale is good while restructuring and downsizing Dis Agree Highly disagree 47.3% 18.5%

(Table.5. Burke,R,J.and Cooper, C,L 2000)

3.5

THEORIES OF HUMAN NEEDS AND VSS

The theory of Reason Action was introduced by Ajzen and Fishbein (1980). This theory relates to the people behavior and belief which are directly concerned with attitude. The influence of attitude in performing some action is called behavior. Hence, in acceptance of VSS, there could be some specific reason, as employees those opted VSS of course motivated due to the creation of intention to decide either VSS could be better for them. The Influence of fundamental or basic needs play an important role in the decision of VSS. According to Feldman (1994) there are three basic factors which describe human needs, given as under:

28

AN INVESTIGATION INTO THE SOCIO ECONOMIC IMPACTS OF VOLUNTARY SEVERANCE SCHEME ON THE EMPLOYEES OF SME BANK LTD, PAKISTAN

1) Psychological factors (social needs such as self respect and self actualization) 2) Physiological factors (Health needs) 3) Financial factors (Job security needs)

A theory of motivation and personality written by Maslow (1943) described hierarchy of needs which is portrayed as a pyramid, it is concerned with basic needs and those are mentioned as under:

Maslow S Hierarchy of Needs Pyramid

1. Self Actualization 2. Self Esteem 3. Social or Love belonging Needs 4. Safety Needs 5. Physiological Needs

Fig.3.Creation of author source Maslow (1943)

1. Self Actualization: It relates to the potential of person that what man can do. 2. Self Esteem: Every normal man has a desire to gain self recognition or self respect. 3. Love and belonging or Social: It is basic need to love and beloved e.g. friendship, family, office culture, depression, social anxiety etc. 4. Safety needs: Job security, insurance policy, personal security, financial security and health security. 5. Physiological need: Breathing, Nutrition, water, sleep and sex etc. Hofstede opposed the theory of Maslow Hierarchy Needs, he described that Maslow was American thats why he used individual approach, due to the lack of collective approach. Hence it had weaknesses. (Nyegaards 1986) Maslow (1943) theory was also opposed by Max- Neef who was an economist. He and his colleagues developed the theory of human needs and human scale development. Through this theory society can indicate and identify their poverties and

29

AN INVESTIGATION INTO THE SOCIO ECONOMIC IMPACTS OF VOLUNTARY SEVERANCE SCHEME ON THE EMPLOYEES OF SME BANK LTD, PAKISTAN

wealth. The focus of theory is concerned and based on satisfaction of basic human needs. It is very important to understand that human needs are considered as a system as inter related and interactive. Therefore, according to this, the theory of Hierarchy Needs do not exist. (Rain Forest 2010) Need Subsistence Protection Affection Understanding Participation Leisure Creation Identity Freedom Being (qualities) Psychological pressure like Mental and health physical issues Autonomy, Care And Adaptability Generosity, Respect, Sense of humor And Sensuality Intuition, Critical capacity And curiosity, Dedication And Receptiveness Spontaneity, Imagination And Tranquillity Curiosity, Imagination, Inventiveness And Boldness Self Esteem, Sense of belonging And Consistency Passion, Autonomy , Self-esteem And Open-mindedness (Table.6. Rain Forest 2010) Above mentioned theories are related with basic human needs, hence in availing VSS, all concerned employees accepted or rejected the opportunities in terms of their needs. Therefore, VSS and human needs are interlinked in the authors view.

3.6

VIEW OF STRATEGIC AUTHORS AND DOWNSIZING

According to Cascio (1998) that many restructuring programs failed to reach expected financial objectives because most of the downsizing programs were badly managed. In one of the survey of American Management Association, it was revealed during the survey of 1142 firms that about 50% firms were not pre planned and those were without any program or policy to reduce the worst effects. (Greenberg 1990) Axmith (1995) found while his Canadian research that 85% firms reduced cost, 58% improved productivity, 63% earned more and about 36% firm achieved better improvement in customer services. Whereas, Cascio (1998) and Greenberg (1990) both have described negative VSS impacts but Axmith (1995) has give some positive aspects of VSS. Therefore the author of this research would take some steps to get better management strategy for downsizing.

30

AN INVESTIGATION INTO THE SOCIO ECONOMIC IMPACTS OF VOLUNTARY SEVERANCE SCHEME ON THE EMPLOYEES OF SME BANK LTD, PAKISTAN

Cascio (1993) introduced some guidelines about effective management of downsizing. Further he described top down hierarchy and bottom up delegation of power and short term strategies as well as long term planning/strategies. He suggested that organization should bring some changes in system of culture. It could be helpful to get sustained improvement in quality, productivity and reducing headcount. In his view, downsizing is not only way to get best result for profitability and enhancing competitiveness. Noer (1993) suggested four level process of handling downsizing and their impacts on employees. His four levels process is mentioned as under: 1. Managing organizations lay off process effectively and focus on reducing survivor psychological syndromes/sicknesses. 2. While second level organization should address the employees grievance and providing opportunity to express their feelings and emotions. 3. The third level is concerned with morally support to survivors as they regain their confidence, sense of control, self actualization and self esteem. 4. In level four organizations should develop policies and procedures. This level consists on employees participation, short term job strategy and encouragement of work force empowerment and independence. Above mentioned theory expressed opinions regarding downsizing implementation but in fact every author has his own logic but the author of this research believes that this is a good approach to get better result and avoid worst effects. All strategies are used to get some result that is the way to achieve specific objectives. Some people view that organizations basically owned by shareholders and hence it should follow shareholders interests.

(Fig.4. Source Wit and Meyer 2004)

31

AN INVESTIGATION INTO THE SOCIO ECONOMIC IMPACTS OF VOLUNTARY SEVERANCE SCHEME ON THE EMPLOYEES OF SME BANK LTD, PAKISTAN

Further the organization strategies of Porter (1985), Barney, J (1991) and Prahalad, C, K & Hamel, G (1990) are discussed. According to Porter (1985) the appropriateness of the activities of an organization can be measured through its competition, because these activities contribute to its performance. There are many industries but all industries are not offering same level of profit sustainability. Basically it all depends on industry attractiveness. Hence Porter (1985) more focused on external factors of an organization and introduced five forces; their ultimate aim is to provide the competitive strategy which changes environment in to the favor of an organization. These five competitive forces are mentioned as under: 1. The entry of new Competitors 2. The threat of substitutes 3. The bargaining power of buyers 4. The bargaining power of supplier 5. The rivalry among the existing competitors The power and strength of these five forces mostly varies from firm to firm and industry to industry. An industry profitability is not concerned with high or low technology and products look, but it relates to the industry structure. As SME Bank is chosen as a case study, hence it is discussed here that due to the weak organizational structure of SME Bank Ltd Pakistan and poor competitive strategy, Government of Pakistan (GoP) interferes in management because it is a government bank. As out of five forces, three forces like entry of new competitors, the threat of substitute and rivalry among existing customers, the top management of SME Bank and GoP were compelled to take the decision of downsizing and restructuring. The framework of five forces allows an organization to watch out complexity and indicate those factors which are critical to compete in an industry; the ultimate aim is also to identify strategic innovations for improvement of the industry. The Porter (1985) five force model briefly describes an attractive industry attributes, it provides greater opportunities of less threat.

32

AN INVESTIGATION INTO THE SOCIO ECONOMIC IMPACTS OF VOLUNTARY SEVERANCE SCHEME ON THE EMPLOYEES OF SME BANK LTD, PAKISTAN

Determinants of Supply power Presence of substitute input Importance of volume to suppliers Switching cost of suppliers Etc

Rivalry Determinants Industry growth Diversity of competitors Brand Identity Corporate Stakes etc

Determinants of substitute threats Relative price performance etc

Entry Barriers Government policy Capital requirements Access to distribution Economies of scale Etc.

Determinants of Buyer power Buyer volume Pull through Buyer concentration etc.

Fig.5. Creation of Author source Porter, M (1985). In contrast, Barney, J (1991) presented different view than Porter (1985), as Barney (1991) describes firm internal characteristics and performance; he focused on organization internal resources, hence his theory is called resource based sustained competitive advantages. According to Barney (1991) organizational resources consist of all assets, organizational processes, capabilities, firm attributes, knowledge and information etc, these all resources are controlled by an organization. It enables the organization to implement the strategies that enhance effectiveness and efficiency. Various authors discussed and provided list of organizational attributes, as the organizational resources are considered their strength. Further, firm resources are here classified in to three types, mentioned as below: a. Physical Capital Resources b. Human Capital Resources c. Organizational Capital Resources Implementation of value creating strategy by firm provides it a competitive advantage. According to Barney (1991) It is said to have a sustained competitive advantage when it is implementing a value creating strategy not simultaneously being implemented by any current or potential competitors and when these other firms are unable to duplicate the benefits of this strategy. As Barney (1991) described firm internal resources, so in terms of my research, employees are basic element, as he considered employee as a firm human capital, hence Barney, J (1991) directly relates to this research because organization without human resources cannot be successful in any strategy, most of the firm internal

33

AN INVESTIGATION INTO THE SOCIO ECONOMIC IMPACTS OF VOLUNTARY SEVERANCE SCHEME ON THE EMPLOYEES OF SME BANK LTD, PAKISTAN

strategies focused on employees. Now in this research, author has used SME Bank as a case study, while restructuring bank has focused on particularly downsizing but it can be seen in case study chapter, it is found that after relieving till to date, bank has sustained more losses than profits. Therefore, the author believes, if management used proper strategy in terms of Barney (1991) model and find out alternate ways to get maximum profitability, instead of the bank used and concentrated on continuous downsizing. The researchers theoretical frame work is based on Max- Neef (1991) theory of fundamental human needs, so Barney (1991) also gives importance to employee satisfaction; therefore the author of this report believes that strategically SME Bank should work out on the model of Barney (1991). Hence the same strategic approach is adopted by the researcher.

Firm Resource Heterogeneity

Value Rareness Imperfect Imitation History Dependent Casual Ambiguity Social complexity Substitutability

Sustained Competitive Advantage

Firm Resource Immobility

Fig.6. Creation of Author source Barney (1991)

34

AN INVESTIGATION INTO THE SOCIO ECONOMIC IMPACTS OF VOLUNTARY SEVERANCE SCHEME ON THE EMPLOYEES OF SME BANK LTD, PAKISTAN

Another famous theory of core competence was introduced by CK Parahalad and Gary Hamel (1990). According to the theory of competitiveness that it can be derived from an ability that means firm can build and workout their core competence at much lower /cheap cost and through this firms can produce better strategy and more specialized commodities/services faster than other competitors. It can be seen that

this theory has focused on particular firm resources which is different opinion than J. Barney (1991) as he emphasized on skill, technology and knowledge for developing firm core competence. CK Parahalad and Garry Hamel (1990) argue that firms should invest more in people, research development and technology to get their core competence. J Barney (1991) stressed more on firm internal resources, as these are key elements in development of sustainable competitive advantage. As an example Honda company engines and Intel Micro Processors could be seen as the core competence of Honda Company and Intel Corporation respectively. Now according the researchers point of view, if SME Bank utilize its resources in development of its core competence such as SME specialized banking products and focus on market research and development than there is no doubt that the bank can achieve required core competence but it focused more on continuous downsizing which is no doubt within itself considered as a good strategy for achieving profitability. However the author believes that if SME Bank Ltd wants to achieve long term sustainable profitability then it should work out more on specialized products and which may assure better marketability than the competitors for long run firm success. Finally author of this research reached at this point that if SME Bank or any organization is interested to carry out the downsizing program; it should initially perform force field analysis as introduced by Kurt Lewin in the year 1950. Hence, it is in favor of SME Bank Pakistan that it should watch carefully first driving and restraining forces of downsizing/restructuring. According to the theory of driving forces, it has a potential to improve the organizational productivity. (Cited in Watson and Gallagher 2009) Please See a Force Field Diagram on next page.

35

AN INVESTIGATION INTO THE SOCIO ECONOMIC IMPACTS OF VOLUNTARY SEVERANCE SCHEME ON THE EMPLOYEES OF SME BANK LTD, PAKISTAN

FORCE FIELD ANALYSIS OF DOWNSIZING OF SME BANK DRIVING FORCES High Medium Low Low RESTRAINING FORCES Medium High

Government and ADB

Employees of SME Bank

(Asian Development Bank) Senior Management

Staff Union and Officer Association

Fresh Qualified

VSS High Cost

Future profitability

loosing the experience staff & new hiring

(Cited in Watson and Gallagher 2009)

36

AN INVESTIGATION INTO THE SOCIO ECONOMIC IMPACTS OF VOLUNTARY SEVERANCE SCHEME ON THE EMPLOYEES OF SME BANK LTD, PAKISTAN

CHAPTER-IV RESEARCH METHODOLOGY AND DATA COLLECTION

4.1

RESEARCH METHODOLOGY AND DATA COLLECTION

According to Collis and Hussey (2003) the aim of research methodology is to provide an approach to the researcher. ESRC (2008) described research methodology as the way of organized techniques and methods to answer the research questions.

4.2

RESEARCH PHILOSOPHIES

The research philosophies contain very important assumptions in which researcher looks the view of the world and these assumptions will enable them to work out their research strategy and methodology. There are three major assumptions which mentioned as under: (Saunders et al. 2009)

No 1 2 3

Research Assumptions Name of Assumption Description ONTOLOGY It is concerned with nature of reality. It is concerned to constitute acceptable EPISTEMOLOGY knowledge in study field, such as data, facts etc. It is concerned with the role of values in AXIOLOGY research. (Table.7. Saunders et al. 2009)

Basically research philosophy gives the vision to the researcher about the world and it describes the researcher opinion and point of view that how he /she views the entire world. There are two major research philosophies Positivism and social constructivism. (Saunders et al. 2009). According Johnson and Clark (2006) that it is not important issue whether our research would be philosophically informed, the researchers main objective is to make them enable for defending their philosophical choices. The following six stages are very important in research process.

37

AN INVESTIGATION INTO THE SOCIO ECONOMIC IMPACTS OF VOLUNTARY SEVERANCE SCHEME ON THE EMPLOYEES OF SME BANK LTD, PAKISTAN

Fig.7. Author creation Concept from Collis and Hussey (2003)

In positivist research approach, the natural reality is considered external externa and it does not change. In this view, the researcher assumes that every person has some certain boundaries in terms of options which provides in the questionnaire, hence in positivist approach the questionnaire called structured. (Saunders et al. 2009). 2009) According to Gill and Johnson (2002) the positivism is highly structured philosophical methodology, it depends on statistical interpretation of hypothesis. In contrast, social constructivism philosophy is based on assumption that reality is social constructed ucted and it is concerned with the human who develop it, hence human behavior and feelings insight as well as their perception about reality is very important in this approach. Further this approach consists on semi structured interviews which are used to evaluate the research model. (Saunders et al. 2009)

4.3

APPROACHES IN RESEARCH METHODOLOGY

There are different methods and ways to collect the research data, according to Jankowiez (2005) that it cannot be assumed that in both approaches which one is best, this could be appropriate according to your research questions and environment in which you are dealing. The second factor which relates to your research is more concerned with the type of thesis in which researcher is engaged. Moreover, he does not feel necessary that only rely on single approach, in some case both approaches are mutually complementary. There are two types of data analysis quantitative and

38

AN INVESTIGATION INTO THE SOCIO ECONOMIC IMPACTS OF VOLUNTARY SEVERANCE SCHEME ON THE EMPLOYEES OF SME BANK LTD, PAKISTAN

qualitative analysis. Further as author of this research has adopted quantitative data analysis, the major difference between both types of data analysis such as quantitative and qualitative analysis, given as below:

4.4

QUANTITATIVE DATA

The quantitative data analysis is based on deductive approach. It is the process of interpreting and presenting numerical data, it has deductive approach. The data gathering instrument is questionnaire. This type of data analysis mostly contains inferential statistics and descriptive statistics, both are further mentioned as below: (UWE 2007) a. Descriptive Statistics: It consists of central tendency measures (mean, mode, average and median) and variability measures such average standard deviation, time varying volatility (ARCH and its variants such GARCH, BEKK GARCH, CCC GARCH and DCC GACH) and structure dependent volatilities (Markov Switching Models) etc. Through these measures the reader can make a clear vision about the research project. (UWE 2007)

b. Inferential statistics: It is the result outcomes of statistical tests; it helps in data collection and test hypothesis and relating findings to the population or sample. (UWE 2007)

4.5

QUALITATIVE DATA

The qualitative data analysis is based on inductive approach, in this type of analysis, researcher uses the semi structured interviews and data collection initiate without the theoretical framework. The development of theory and data gathering consist on series of observations. In this kind of analysis the data expressed through words and analysis are used through conceptualization. In qualitative data analysis unitizing data is very important e.g. a complete paragraph, the number of sentences, words etc. In this approach an explicit focus remains on action and a researcher remains involved in the problem. As this type is concerned with the interviews, hence researcher realized the need to describe here types of interviews, these three types are mentioned as below: (Saunders et al. 2009).

39

AN INVESTIGATION INTO THE SOCIO ECONOMIC IMPACTS OF VOLUNTARY SEVERANCE SCHEME ON THE EMPLOYEES OF SME BANK LTD, PAKISTAN

No. 1. 2

Types of interviews Structured Interviews Semi structured interviews

Description Predetermined, standard and identical questions. These questions may vary interview to interview and researcher asks question in terms of particular theme.

Un structured/ in depth

There is no any predetermined questions list, while interview subject is allowed to give answers freely about concerned topic (Table.8. Saunders et al. 2009)

If researcher feels that research period of time is short, then the interview approach is more flexible and favorable comparatively survey based questionnaire approach which takes much time. It also depends on number of factors, such as if researcher realizes then he would ask open ended questions. In this qualitative approach

researcher relies on subjective judgment and interpretation. Also he should encourage the interviewee to give the appropriate answers and reveal the opinion and facts. (Saunders et al. 2009).

(Fig.8. Source Saunders et al. 2009)

40

AN INVESTIGATION INTO THE SOCIO ECONOMIC IMPACTS OF VOLUNTARY SEVERANCE SCHEME ON THE EMPLOYEES OF SME BANK LTD, PAKISTAN

4.6

DEDUCTIVE APPROACH VS INDUCTIVE APPROACH

Inductive Approach This approach is concerned with the human feelings. According to this approach humans are more attached with the events.

Deductive Approach

It is based on scientific principal.

It moves theory to data. It is a general compared to a specific approach. It is concerned with quantitative data collection. This is a highly structured approach The researcher is independent in his research. In deductive approach, it is necessary to select sample size.

This approach is more concerned with the understanding of research.

This approach is consisting on qualitative data collection. It has a more flexible structure to adopt changes It is particular to general and less relates to the need of generalization.

(Table.9. Saunders et al. 2009)

4.7

ADOPTED RESEARCH STRATEGIES:

There is no research strategy that may be called superior to others. It is only up to the researchers choice, the strategy always proceeds research questions and guided by research objectives, in terms of extent of present knowledge, time, financial resources and other related resources which are available to the researcher. It is also possible that the researcher can use two strategies at the same time such as the survey strategy in the case study strategy. (Saunders et al 2009). There are various research strategies but the researcher is using a survey questionnaire and the SME Bank case study approach in his study. Both the strategies are described as under:

41

AN INVESTIGATION INTO THE SOCIO ECONOMIC IMPACTS OF VOLUNTARY SEVERANCE SCHEME ON THE EMPLOYEES OF SME BANK LTD, PAKISTAN

a. SURVEY STRATEGY

It is often linked with the quantitative analysis and based on deductive approach. Nowadays, it is very famous and commonly used in management research. This survey strategy is frequently used for answering who, how, where and what types of questions. It is often used in descriptive and exploratory research. The survey strategy is very popular because it allows the large quantity of data from a considerable size of population in reasonable economic cost. It is mostly gathered through an instrument of questionnaire. Further it also allows easy comparison and analysis. Later collecting the data through questionnaire, it can be analyzed with the help of inferential and descriptive statistics. This strategy provides the control in research process. While using survey strategy researcher must take care in sample size that it should be a representative of whole population. The questionnaire designing and pilot testing makes it more result oriented and it could be ensure that response rate would be better.(Saunders et al 2009). After getting the data researcher will be independent because many researcher feel difficulty while the period of collecting data due to dependency on respondents. The less skill is required in questionnaire comparatively conducting interviews. Usually self administered questionnaire are filled and completed by respondents. Mostly people administer electronically using internet via email or post to respondent, who return after completion via email or post.(Jankowicz 2005). In data collection, the researchers also observe some variables. According to Dillman (2007) there are three types of data variables, which are mentioned as below: Types of data variable

No

Description It is about how respondent feeling and describes. It is about the act of respondent. About respondent characteristics. (Table 10- Dillman 2007)

1 2 3

Opinion Behavior Attribute

42

AN INVESTIGATION INTO THE SOCIO ECONOMIC IMPACTS OF VOLUNTARY SEVERANCE SCHEME ON THE EMPLOYEES OF SME BANK LTD, PAKISTAN

b. CASE STUDY STRATEGY The analysis of a single unit is known as a case study. This type of strategy is often used in exploratory and explanatory research. The data gathering techniques can be various and these also may be used in combination such as interviews, documentary analysis, observations and questionnaires. (Saunders et al 2009). According to Yin (1994) it is not necessary that a researcher carries his research on a single case study during his research but at the same time he can be engaged in several cases. Whereas Eisenhardt (1989) describes that in case study different data collection methods are used like quantitative in numbers and qualitative in words. Whenever we use case study strategy, it reflects the need of different data collection techniques; hence it is called triangulation data collection approach. The author of this research has used this particular case study strategy.

4.8

QUESTIONNAIRE AND PILOT TESTING

The questionnaire is an instrument of primary data collection, in designing the questionnaire review of literature plays very essential role, after review researcher develop their ideas. (Saunders et al 2009).

a. IMPORTANT QUESTIONNAIRE ATTRIBUTES

The researcher designed all questions close ended, only in multiple choices questions if there is other option, selected by a respondent, then please specify is used as an open question. As the researcher designed self administered questionnaire via email, so in designing it utmost care was observed on the basis of population, as questionnaire will be sent to banker who opted Voluntary Severance Scheme 2009, hence they are all computer literate. administering questionnaire. As the author has chosen survey strategy so instrument of data collection is a questionnaire. Therefore, they will not feel difficulty in

43

AN INVESTIGATION INTO THE SOCIO ECONOMIC IMPACTS OF VOLUNTARY SEVERANCE SCHEME ON THE EMPLOYEES OF SME BANK LTD, PAKISTAN

The researcher has used three types of questions in his questionnaire, mentioned as under: No 1 2 3 Type of questions Dichotomous Multiple choice LIKERT Description Two choices yes or no Based on five choices Based on scales like agreed disagreed and highly agreed No of Questions 16 10 8

34 Table 11- Creation of author based on the researchers types of question

LIKERT QUESTIONNAIRE SCALES

Liker Questionnaire Scales Highly agree Agree Indifferent Disagree Highly disagree 1 2 3 4 5 Coding/Options

Table 12: Creation of author based on the researchers coding of questions There are two types of questionnaire administration, self administered and interviewer administered but researcher has designed self administered questionnaire, hence it is mentioned as below: a. Self administered: As the researcher is using questionnaire for the data collection, it is based on self administered type. This type of the questionnaire was completely filled by the respondent. It can be administered via email, telephone and through post but researcher will send this via email, so it will be administered via email. Later receiving questionnaire respondent return these after completion via email, postal, or by hand and if it is telephonic then the author records answers at the same time of conversation.(Saunders et al 2009).

44

AN INVESTIGATION INTO THE SOCIO ECONOMIC IMPACTS OF VOLUNTARY SEVERANCE SCHEME ON THE EMPLOYEES OF SME BANK LTD, PAKISTAN

b. Pilot Testing: The pilot testing is defined by the Saunders et al. (2009) as the researcher collects the data before sending the questionnaire for assessment so that the respondent does not feel any problem in filling the questionnaire. It is also a way to refine the questionnaire, further pilot testing enables the researcher to get some assessment on reliability and validity of questionnaire. In this technique researcher sends the questionnaire to at least ten concerned people or friends who send back after filling questionnaire. Later the researcher ensures that he has completed pilot questionnaire had no problems in answering questions by respondents and they have followed all instructions correctly. (Fink 2003b). According to Bell (2005) researcher should also observe, how much time would take place in filling the questionnaire by respondents while pilot testing. Therefore, researcher has selected ten people for data collection while pilot testing, he received and recoded observation regarding their questionnaire from his banker

colleagues and friends via email, after careful study of the responses, the researcher made some changes in the questionnaire.

4.9

POPULATION AND SAMPLING

a. POPULATION: The meaning of population in research is quite different from its meaning in general. Saunders et al (2009) defines population as The full set of cases from which a sample is taken is called the population. Hence it is not necessary that term population only used for people but it can be different then actual meaning of word for example a researcher conducted his research particularly on Pakistani universities, then his population is Universities of Pakistan. As the author of this research conducted his research on socio economic causes of VSS on employees of SME Bank Pakistan, hence his population is employees of SME Bank who opted for VSS in 2009. There were about 312 employees who were offered Voluntary Separation/Severance Scheme (VSS) but only 139 employees opted for this opportunity. Hence the researchers total population is 139 ex employees.

45

AN INVESTIGATION INTO THE SOCIO ECONOMIC IMPACTS OF VOLUNTARY SEVERANCE SCHEME ON THE EMPLOYEES OF SME BANK LTD, PAKISTAN

b. SAMPLING: According to Saunders et al (2009) there are two major types of sampling techniques which are further sub divided into other types. The sampling major types are mentioned as below: 1. Representative Sampling (Probability) 2. Judgmental Sampling (Non-Probability)