Escolar Documentos

Profissional Documentos

Cultura Documentos

Assignment #2 Exchange Rate Behavior

Enviado por

josephblinkTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Assignment #2 Exchange Rate Behavior

Enviado por

josephblinkDireitos autorais:

Formatos disponíveis

Exchange Rate Behavior

November 6th, 2011 International Financial Management Assignment # 2

Exchange Rate Behavior

As an employee of the foreign exchange department for a large company, you have been given the following information: Beginning of Year Spot rate of = $1.596 Spot rate of Australian dollar (A$) = $.70 Cross exchange rate: 1 =A$2.28 One-Year forward rate of A$ = $.71 One-Year forward rate of = $1.58004 One- Year U.S. interest rate = 8.00% One-Year British interest rate = 9.09% One-Year Australian interest rate = 7.00% Determine whether triangular arbitrage is feasible and, if so, how it should be conducted to make a profit.

The triangular arbitrage is not feasible because the cross exchange rate between and A$ is properly quoted and rate is not equal to the markets implicit cross exchange rate. If the market cross exchange rate quoted by a bank is equal to the implicit cross exchange rate or implied from the exchange rates of other currencies, then a no arbitrage condition is sustained. Proper Cross exchange rate = Spot rate of $1.596/Spot rate of A$ (.7) = 2.28

Exchange Rate Behavior

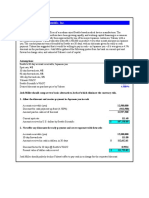

Using the information in question 1, determine whether covered interest arbitrage is feasible and, if so, how it should be conducted to make a profit. Covered interest arbitrage is only feasible when interest rate parity does not exist.

Currency

Forward Premium

Actual forward Premium

Pound ()

P= (1 + ih)/(1 + if) -1

P = F S/S

= (1.08)/(1.0909) -1

= $1.58004- $1.596/ $1.596

= -.01

= -.01

Australian Dollar (A$)

P = (1 + ih)/(1 +ir)

P = F S/S = (.71 -$.70)/ $.70 = .01428

= (1.08)/(1.07) -1 = .0093

Interest rate parity exists for the British pound. However, interest rate parity does not exist for the Australian Dollar. The premium is higher than it should be, the United States investors could benefit from the discrepancy by using covered interest arbitrage. The forward premium would receive when selling the Australian Dollar at the end the year more and offsets the interest rate

Exchange Rate Behavior

and the United States will receive 1% less interest on the Australian investment, they receive 1.428% more when selling Australian dollar will initially pay. In the real exchange rate reverts to some mean level over time, this suggests that it is constant in the long run, and any deviations from the mean are temporary. Conversely, if the real exchange rates move randomly without any predictable pattern, it does not revert to some mean level and therefore cannot be viewed as constant in the long run. (2010 Madura pg. 242). Based on the information in question 1 for the beginning of the year, use the international Fisher effect (IFE) theory to forecast the annual percentage change in the British pounds value over the year. The IFE (International Fisher Effect) suggests that given two currencies, the currency with a higher interest rate reflects higher expected inflation, which will place downward pressure on the value of that currency. The IFE is the application of the Fisher effect to two countries in order to derive the expected change in the exchange rate. It suggests that nominal interest rates of two countries differ because of the difference in expected inflation between the two countries (2010 Madura, pg. 243). The currency adjustment will offset the differential in interest rates.

Ef = (1 + ih)/(1 + ir) -1 = (1 + .08)/(1 + .0909) -1 = -.01 which is -1% Pound is expected to depreciate by 1 percent over the year. There are 3 scenarios of IFE. First resulting in Local currency depreciated by level of inflation, which is shown above. Second is

Exchange Rate Behavior

Local currency value appreciated by level of inflation differential, and finally local currency value is not affected by inflation. Assume that at the beginning of the year, the pounds value is in equilibrium. Assume that over that year the British inflation rate is 6% while the U.S. inflation rate is 4%. Assume that any change in the pounds value due to the inflation differential has occurred by the end of the year. Using this information and the information provided in question 1; determine how the pounds value changed over the year. If PPP the pound changes by the following formula

Eq = (1 +1h)/(1 +1f) -1

= 1.04/1.06 1 = 0.189 or 1.89% The pound changed by 1.89% of the year. Assume that the pounds depreciation over the year was attributed directly to central bank intervention. Explain the type of direct intervention that would place downward pressure on the value of the pound. The direct intervention of the foreign exchange market by the central banks used pounds to buy U.S. dollars place downward pressure on the pounds value. But central banks may purposely try to raise interest rates to attract funds or strengthen the value of their own currencies. A lot of

Exchange Rate Behavior

MNC invest cash in money market securities to develop countries with a slightly higher interest rate.

Exchange Rate Behavior

References

Madura, J. (2010). International financial management: 2010 custom edition (10th Ed.). Mason, OH: South-Western, Cengage Learning.

Você também pode gostar

- UntitledDocumento5 páginasUntitledsuperorbitalAinda não há avaliações

- As An Employee of The Foreign Exchange Department For A LargeDocumento1 páginaAs An Employee of The Foreign Exchange Department For A Largetrilocksp SinghAinda não há avaliações

- Introduction To Foreign Exchange Rates, Second EditionDocumento32 páginasIntroduction To Foreign Exchange Rates, Second EditionCharleneKronstedt100% (1)

- Chapter Fourteen Foreign Exchange RiskDocumento14 páginasChapter Fourteen Foreign Exchange Risknmurar01Ainda não há avaliações

- CH 18Documento4 páginasCH 18Ahmed_AbdelkariemAinda não há avaliações

- Case Study of Transaction Exposure Lufthansa 1985Documento3 páginasCase Study of Transaction Exposure Lufthansa 1985Trisha86Ainda não há avaliações

- Chap 6 ProblemsDocumento5 páginasChap 6 ProblemsCecilia Ooi Shu QingAinda não há avaliações

- Finance - Module 7Documento3 páginasFinance - Module 7luckybella100% (1)

- Blades Case Exposure to International Flow of FundsDocumento1 páginaBlades Case Exposure to International Flow of FundsWulandari Pramithasari50% (2)

- MF 6Documento29 páginasMF 6Hueg HsienAinda não há avaliações

- Blade's CaseDocumento8 páginasBlade's CaseEly HarunoAinda não há avaliações

- Total Inflow Total Outflow Net Inflow or Ouftlow Expected Exchange Rate Net Inflow or Outflow As Measured in US Dollars British PoundsterlingDocumento3 páginasTotal Inflow Total Outflow Net Inflow or Ouftlow Expected Exchange Rate Net Inflow or Outflow As Measured in US Dollars British Poundsterlingcatarina alexandriaAinda não há avaliações

- Chapter 10Documento27 páginasChapter 10trevorsum123Ainda não há avaliações

- CH 16 e 9 Country Risk AnalysisDocumento16 páginasCH 16 e 9 Country Risk AnalysisanashussainAinda não há avaliações

- CH 5Documento46 páginasCH 5芮璇Ainda não há avaliações

- Chapter 13 Direct Foreign Investment Lecture Outline Benefits and FactorsDocumento11 páginasChapter 13 Direct Foreign Investment Lecture Outline Benefits and FactorsselyabiAinda não há avaliações

- Problem 19.1 Trefica de Honduras: Assumptions ValuesDocumento2 páginasProblem 19.1 Trefica de Honduras: Assumptions ValueskamlAinda não há avaliações

- Foreign Currency Derivatives and Swaps: QuestionsDocumento6 páginasForeign Currency Derivatives and Swaps: QuestionsCarl AzizAinda não há avaliações

- BladesDocumento19 páginasBladescristianofoni100% (1)

- CHAPTER 2 Chapter 1 - Exchange Rate DeterminationDocumento48 páginasCHAPTER 2 Chapter 1 - Exchange Rate Determinationupf123100% (2)

- Blades Chapter 11Documento2 páginasBlades Chapter 11yanks246Ainda não há avaliações

- International Financial Management: Assignment # 1Documento7 páginasInternational Financial Management: Assignment # 1Sadia JavedAinda não há avaliações

- Blades Inc. CaseDocumento2 páginasBlades Inc. Caseplanet_sami0% (1)

- Summer 2021 FIN 6055 New Test 2Documento2 páginasSummer 2021 FIN 6055 New Test 2Michael Pirone0% (1)

- SolDocumento3 páginasSolilovevietnam007Ainda não há avaliações

- MBF14e Chap02 Monetary System PbmsDocumento13 páginasMBF14e Chap02 Monetary System PbmsKarlAinda não há avaliações

- Rolls-Royce FX Hedging & Disney ReceivablesDocumento3 páginasRolls-Royce FX Hedging & Disney ReceivablesLena ZhengAinda não há avaliações

- Chapter 11Documento2 páginasChapter 11atuanaini0% (1)

- Int Finance Practice - SolDocumento7 páginasInt Finance Practice - SolAlexisAinda não há avaliações

- Forward Rate AgreementDocumento8 páginasForward Rate AgreementNaveen BhatiaAinda não há avaliações

- Lecture 10 (Chapter 8) - Relationship Among Inflation, Interest Rate and Exchage RateDocumento21 páginasLecture 10 (Chapter 8) - Relationship Among Inflation, Interest Rate and Exchage RateTivinesh MorganAinda não há avaliações

- International Financial Markets Chapter 3 SummaryDocumento22 páginasInternational Financial Markets Chapter 3 SummaryFeriel El IlmiAinda não há avaliações

- Ifm AssignmentDocumento4 páginasIfm AssignmentKanupriya Kohli100% (2)

- International Financial ManagementDocumento23 páginasInternational Financial Managementsureshmooha100% (1)

- Chapter 15Documento20 páginasChapter 15sdfklmjsdlklskfjdAinda não há avaliações

- Tutorial 1 AnswersDocumento3 páginasTutorial 1 AnswersAmeer FulatAinda não há avaliações

- Measuring Exposure To Exchange Rate FluctuationsDocumento21 páginasMeasuring Exposure To Exchange Rate FluctuationsMohitAinda não há avaliações

- 2Documento2 páginas2akhil107043Ainda não há avaliações

- Ch07 SSolDocumento7 páginasCh07 SSolvenkeeeee100% (1)

- Solnik Chapter 3 Solutions To Questions & Problems (6th Edition)Documento6 páginasSolnik Chapter 3 Solutions To Questions & Problems (6th Edition)gilli1trAinda não há avaliações

- SM Multinational Financial Management ch09Documento5 páginasSM Multinational Financial Management ch09ariftanur100% (1)

- Chapter 4-Exchange Rate DeterminationDocumento21 páginasChapter 4-Exchange Rate DeterminationMelva CynthiaAinda não há avaliações

- Chapter 5Documento1 páginaChapter 5abcAinda não há avaliações

- Chapter 2 - Part 2 - Problems - AnswersDocumento3 páginasChapter 2 - Part 2 - Problems - Answersyenlth940% (2)

- Chapter 4Documento14 páginasChapter 4Selena JungAinda não há avaliações

- Blades, Inc. Case: Sirisha Prasanna Purba Mukherjee Smita Wardhan Soumya Sucharita Mahapatra Suchanda SomDocumento13 páginasBlades, Inc. Case: Sirisha Prasanna Purba Mukherjee Smita Wardhan Soumya Sucharita Mahapatra Suchanda Somsmita379Ainda não há avaliações

- Comparing cash flow plans for investing excess funds from Thailand operationsDocumento3 páginasComparing cash flow plans for investing excess funds from Thailand operationsmasskillz33% (3)

- Sallie Schnudel speculates on Singapore dollar appreciationDocumento25 páginasSallie Schnudel speculates on Singapore dollar appreciationveronika100% (1)

- Case Study Lufthansa Corporation and Transaction ExposureDocumento3 páginasCase Study Lufthansa Corporation and Transaction ExposureThanh Tam VuAinda não há avaliações

- IMChap 011Documento24 páginasIMChap 011Aaron Hamilton100% (2)

- CH 5Documento24 páginasCH 5Rizwan ShahidAinda não há avaliações

- Blades PLC: International Flow of Funds: A Case StudyDocumento10 páginasBlades PLC: International Flow of Funds: A Case StudyKristelle Brooke Dianne Jarabelo100% (2)

- Global Investments PPT PresentationDocumento48 páginasGlobal Investments PPT Presentationgilli1trAinda não há avaliações

- Exchange Rate BehaviorDocumento3 páginasExchange Rate BehaviorAriel Logacho0% (1)

- Assignment 2Documento1 páginaAssignment 2orosunAinda não há avaliações

- Topic 3 Solutions: I S E I I SDocumento8 páginasTopic 3 Solutions: I S E I I SNaeemAinda não há avaliações

- IlliquidDocumento3 páginasIlliquidyến lêAinda não há avaliações

- Final ExamDocumento18 páginasFinal ExamHarryAinda não há avaliações

- Sol Multinational Financial Management Shapiro 9eDocumento14 páginasSol Multinational Financial Management Shapiro 9eNitin SharmaAinda não há avaliações

- Inflation Hacking: Inflation Investing Techniques to Benefit from High InflationNo EverandInflation Hacking: Inflation Investing Techniques to Benefit from High InflationAinda não há avaliações

- Reshmi BakeryDocumento14 páginasReshmi BakeryAbhishek A PAinda não há avaliações

- T04 - Profits TaxDocumento18 páginasT04 - Profits Taxting ting shihAinda não há avaliações

- Principles of MacroeconomicsDocumento52 páginasPrinciples of Macroeconomicsmoaz21100% (1)

- Module 1, Part I - AmalgamationDocumento14 páginasModule 1, Part I - AmalgamationAbdullahAinda não há avaliações

- Account Opening DisclosuresDocumento7 páginasAccount Opening DisclosuresMarcus Wilson100% (1)

- Audit Property Plant EquipmentDocumento5 páginasAudit Property Plant EquipmentMonica GarciaAinda não há avaliações

- B 1 Bank TransactionsDocumento16 páginasB 1 Bank TransactionsMahima SherigarAinda não há avaliações

- 6681606Documento3 páginas6681606Jay O CalubayanAinda não há avaliações

- Mini Case 29Documento3 páginasMini Case 29Avon Jade RamosAinda não há avaliações

- Jones Electrical Distribution AnswersDocumento29 páginasJones Electrical Distribution AnswersVera Lúcia Batista SantosAinda não há avaliações

- GEN009 - q2Documento14 páginasGEN009 - q2CRYPTO KNIGHTAinda não há avaliações

- Fim01 - 02 - Basic FsDocumento8 páginasFim01 - 02 - Basic FsJomar VillenaAinda não há avaliações

- SBR Notes by Ali Amir 20-21Documento68 páginasSBR Notes by Ali Amir 20-21Mensur Ćuprija100% (1)

- Amulya Kumar Verma 26asDocumento4 páginasAmulya Kumar Verma 26asSatyendra SinghAinda não há avaliações

- Calculations OnlyDocumento10 páginasCalculations OnlyPatience AkpanAinda não há avaliações

- Introduction To Corporate FinanceDocumento29 páginasIntroduction To Corporate FinanceYee Mon AungAinda não há avaliações

- Intermediate Accounting 17th Edition Kieso Solutions ManualDocumento22 páginasIntermediate Accounting 17th Edition Kieso Solutions Manualdilysiristtes5100% (29)

- Issue and Redemption of DebenturesDocumento78 páginasIssue and Redemption of DebenturesApollo Institute of Hospital Administration50% (2)

- Philippine Money - MicsDocumento9 páginasPhilippine Money - MicsMichaela VillanuevaAinda não há avaliações

- XI Accountancy Project WorkDocumento1 páginaXI Accountancy Project Workkulsum bhopalAinda não há avaliações

- Shubh Nivesh Brochure - BRDocumento15 páginasShubh Nivesh Brochure - BRSumit RpAinda não há avaliações

- Notes PayableDocumento38 páginasNotes PayableNadira AristyaAinda não há avaliações

- Syllabus For BankingDocumento15 páginasSyllabus For BankingAnil NamosheAinda não há avaliações

- Instructional Material FOR ECON 30063 Monetary Economics: Polytechnic University of The PhilippinesDocumento9 páginasInstructional Material FOR ECON 30063 Monetary Economics: Polytechnic University of The PhilippinesMonicDuranAinda não há avaliações

- Advanced Accounting Chapter 5Documento19 páginasAdvanced Accounting Chapter 5Ya Lun100% (1)

- Substantive Procedures For Evaluation of LoansDocumento3 páginasSubstantive Procedures For Evaluation of LoansChristian PerezAinda não há avaliações

- Journal Ledger & Trial BalanceDocumento32 páginasJournal Ledger & Trial BalanceMr. Demon ExtraAinda não há avaliações

- 3A Micro Finance PromisorryDocumento1 página3A Micro Finance PromisorryNeil Mhartin NapolesAinda não há avaliações

- Commercial RE Private Equity Understand and Navigating The Options Workshop PrimerDocumento65 páginasCommercial RE Private Equity Understand and Navigating The Options Workshop PrimerPropertywizz100% (2)

- Analyze Financial Statements with Common-Size StatementsDocumento33 páginasAnalyze Financial Statements with Common-Size StatementsAiden Pats100% (1)