Escolar Documentos

Profissional Documentos

Cultura Documentos

Accounting For Intangible Assets

Enviado por

Nelson SinghTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Accounting For Intangible Assets

Enviado por

Nelson SinghDireitos autorais:

Formatos disponíveis

Accounting for Intangible Assets Lecture 7 Chapter 11

The basic issues are wether intangibles are assets, if so, the appropriate method of accounting for their initial recognition and subsequent measurement Intangible noncurrent assets are those without physical form such as patents, copyrights, trademarks, brand names, franchises and licences. These can be distinguished from long term investments and long term receivables on the grounds that intangible assets are non monetary assets (An asset (such as equipment, inventory, land, or plant) that does not have a fixed exchange cash value, but whose value depends on economic conditions.) AASB138 refers to three factors necessary for the existence of intangible assets. They are: Identifiable: The term is not used in the framework definition of assets. AASB138 discusses identififiability and indicates that an asset is considered to be identifiable if it is seperatable (capable of being separated from and entity and sold or transferred) or it the asset arises from contractual or other legal rights However there is a problem with including this requirement as intangibles are essentially inert that is, by and of themselves they neither create value nor generate growth. Intangible assets need support and enhancement systems to create value Including separability as a necessary characteristic of intangibles is contrary to the argument that intangible assets are inherently inert and only contribute to firm value when embedded in appropriate systems and procedures In practise, drawing a distinction between intangible assets (which are separable) and components of goodwill (which are not separable) may be difficult Control: A resource controlled by the entity And, the existence of future economic benefits: Intangibles qualify as assets when they represent future economic benefits controlled by the entity as a result of past events. The requirement for control and the existence of future economic benefits are common to both the framework definition of assets and the AASB 138 definition of intangible assets

Distinguishing intangible assets from Goodwill: AASB138 explains that the requirement for intangible assets to be identifiable is made to distinguish intangible assets from goodwill Goodwill represents future economic benefits from assets that are not capable of being individually identified and separately recognized. An entity may have a number of assets, such as loyal and efficient employees, an established clientele and a good image. Collectively these are referred to as goodwill The difference is accounting treatments (for intangible assets and goodwill) results mainly from the apparent difficulty of estimating the amount that one entity would be prepared to pay for the goodwill of another entity unless the transaction has taken place. As a result, it is

argued that a reliable measure of goodwill is available only when one entity purchases another (compared with intangible assets which can be recognized by being developed internally OR as a result of a an arms length transaction) Accounting for Intangible assets: Initial recognition of Intangible assets: If future economic benefits are acquired, than an asset should be recognised, provided it is probable that those benefits will be received and the assets cost or other value can be measured reliably However, it is sometimes argued that the cost of intangibles should be recognized as an expense in the period in which the cost is incurred. This immediate expensing of a cost of intangibles is usually justified on three grounds: 1. It is consistent with the treatment of the cost for income tax purposes; 2. The cost fails to meet the asset recognition criteria; Accountants sometimes suggest that recognizing the cost of intangibles as expenses in the period in which the cost is incurred is justified because of the uncertainty about the amount and timing of future economic benefits from them. For intangible assets bought it can be argued that there is likely to flow a stream of benefits as a result of the acquisition, as if this is not the case the intangible will likely to not be bought. However, in the case where intangibles are developed internally, there may be more uncertainty about both the recovery of future economic benefits and the amount that should be recognized as the cost or other value of the asset. This higher level of uncertainty may be used to justify prohibiting the recognition of (some) internally developed intangible assets 3. The cost of intangibles is frequently immaterial

Accounting standards on Intangible assets: AASB 138 assess the definition and recognition of intangible assets differently depending on whether the intangible asset is either purchased or developed internally The recognition of an item as an intangible asset requires an entity to demonstrate that the item meets: The definition of an intangible asset (i.e. identifiable, under the control of the entity, and able to generate future economic benefits) The recognition criteria: AASB 138 requires that an intangible asset must be recognised if, and only if:

a) It is probable that the expected future economic benefits that are attributable to the asset will flow to the entity; and b) The cost of the asset can be measured reliably However the above is only for purchased intangible assets (i.e. externally generated assets), recognition of internally generated assets is different. AASB 138 discusses the recognition of internally generated intangibles by distinguishing between a research phase and a development phase: For research expenditure, or expenditures arising from the research phase of a project, no intangible assets may be recognised. This is justified on the grounds that an entity cannot demonstrate that expenditures undertaken in the research phase generate probable future benefits. Thus costs arising from the research phase must be recognised as expenses and cannot be recognised as assets For development expenditure, or expenditure arising from the development phase of a project can be recognised upon the satisfaction of the following six criteria; (1) (2) (3) (4) The technical feasibility of completing the intangible asset so that it will be available for use or sale; Its intention to complete the intangible asset and use or sell it; Its ability to use or sell the intangible asset; How the intangible asset will generate probable future economic benefits. Among other things, the entity can demonstrate the existence of a market for the output of the intangible asset or the intangible asset itself or, if it is to be used internally, the usefulness of the intangible asset; The availability of adequate technical, financial and other resources to complete the development and to use or sell the intangible asset; and Its ability to measure reliably the expenditure attributable to the intangible asset during its development.

(5) (6)

Subsequent measurement of Intangible assets: Subsequent measurement of intangible assets are to be carried out using either the cost model OR the revaluation model Cost Model: o o Carrying amount is to be at cost less accumulated amortisation and any accumulated impairment losses For intangible assets purchased separately cost is the purchase price of the asset including any import duties, taxes and any directly attributable costs of preparing the asset for its intended use For intangible assets acquired as part of a business combination, cost is fair value at date of acquisition. Fair value is most reliably indicated by quoted market (bid) prices in an active market. If no active market exists, fair value is the amount that the entity would have paid for the asset in an arms length transaction between knowledgeable and willing parties

For internally developed intangible assets, cost is the sum of expenditure incurred from the date when the intangible asset first meets the recognition criteria until the time it is ready for intended use by management

Revaluation Model: o o o Intangible assets are revalued to fair value less any subsequent accumulated amortisation and any subsequent accumulated impairment losses The basis is only permitted if there is an active market for the asset AASB136 identifies three ways of measuring fair value. The best measure is price in a binding sales agreement, the next best is bid prices in an active market the third is the price that willing, knowledgeable parties would agree in an arms length transaction. Very few intangible assets trade in active markets (as the intangible assets are normally inert to the business, ensuring that they cannot be separated from the business itself due to the unique support systems it requires. This makes it difficult to trade intangible assets), hence in measuring fair value, reliance is likely to be placed on estimates of market prices However the unreliability of estimated market prices for intangible assets is one of the main reasons why revaluation of intangible assets is not permitted by AASB 138 (unless the intangible assets trade in active markets)

Impairment and Amortisation of intangible assets contingent on whether useful life is finite or infinite A finite intangible asset shall be amortised over its useful life. Pattern determined by expected consumption. Straight line is the default and residual = zero An infinite life intangible is not subject to amortisation but is subject to an impairment test. Based on the rationale that any unpredictable decline (as consumption is not uniform of predictable over the products life) in value is best accounted for via periodic impairment testing. The weakness of this argument is that assessment of impairment relies on judgement. Likewise Goodwill is not allowed to be amortised but is subject to an impairment test

Research and Development:

AASB recognises two categories research and development Research is defined as the original and planned investigation undertaken with the prospect of gaining new scientific or technical knowledge and understanding. Research is defined as the pursuit of knowledge, without any defined commercial objective Development is defined as the application of research findings or other knowledge to a plan or design for the production or design for the production of new or substantially improved materials, devices, products, processes, systems, or services before the start of commercial production or use. That is development is focused on commercial application prior to production Initial recognition or research and development costs (selective capitalisation method): Method of recognition required by AASB138 Requires the recognition of research costs as expenses in the period of outlay Development costs, mat be recognised as intangible assets, provided that they meet the definition of intangible assets: Identifiable

Under the control of the entity Able to generate future economic benefits , the recognition criteria for intangible assets: Probable flow of expected future benefits Cost can be measured reliably , as well as the six other specified conditions: the technical feasibility of completing the intangible asset so that it will be available for use or sale; its intention to complete the intangible asset and use or sell it; its ability to use or sell the intangible asset; How the intangible asset will generate probable future economic benefits. Among other things, the entity can demonstrate the existence of a market for the output of the intangible asset or the intangible asset itself or, if it is to be used internally, the usefulness of the intangible asset; the availability of adequate technical, financial and other resources to complete the development and to use or sell the intangible asset; and Its ability to measure reliably the expenditure attributable to the intangible asset during its development. Paragraphs 33 and 34 of AASB 138 permit the recognition of research and development purchased in a business combination when it meets the definition of an intangible asset and its fair value can be measured reliably. Purchased research and development is not specifically required to meet the probable future economic benefits recognition criterion for asset recognition in the framework, nor is it required to meet the six conditions outlined above. This is presumably because fair value reflects the future economic benefits expected from research and development

Subsequent measurement of research and development: Consistent with the treatment of other intangible assets, AASB 138 requires that intangible development assets be subsequently measured using either the cost model or the revaluation model However, the use of the revaluation model is restricted to assets traded in an active market As development assets do not trade in an active market, only the cost model can be used Hence, subsequent measurement of development assets must be at cost less any accumulated amortisation and any accumulated impairment losses

It seems unlikely that development expenditure could lead to intangible assets with indefinite lives, so it is expected that the depreciable amount of intangible development assets will be allocated systematically over their useful lives with the expected pattern of future economic benefits Intangible development assets are subject to impairment testing according to AASB 138. However measuring the fair value and value of intangible development assets can be challenging. Measurement of value in use requires an estimate of the future cash flows the entity expects to derive from the asset. Estimating future cash flows from intangibles assets is extremely difficult especially in light of Levs argument that intangibles are essentially inert and their capacity to generate cash flows depends on their being embedded in appropriate business systems and processes

Goodwill: Goodwill is measured for accounting purposes as the difference between the price paid for an entity and the fair value of the identifiable net assets acquired It is generally agreed by accountants that goodwill should not be recognised in the accounts unless there is an arm length purchase of one entity by another For accounting purposes, the amount of goodwill is simply the difference between the price paid to purchase the entity and the fair value of the identifiable net assets acquired Goodwill can be interpreted as the present value of the expected future economic benefits from unidentifiable intangible assets. Goodwill is thus the cost incurred in anticipation of probable future economic benefits. It should, therefore, be recognised as an asset in the statement of financial position.

Accounting for excess on acquisition: The amount by which the sum of the fair values of the identifiable net assets exceeds the cost of acquisition The amount of the excess on acquisition is to be allocated to the identifiable net assets so that their carrying amounts represent their cost to the purchaser. This is consistent with historical cost accounting under which assets are recorded initially at the cost of acquisition

Initial Recognition: For initial recognition a distinction is drawn between purchased goodwill and internally generated goodwill The prohibition on recognising internally generated goodwill is justified on two grounds in AASB138: 1. The first is, internally generated goodwill is not recognised as an asset because it is not an identifiable resource (i.e. it is not separable) 2. Secondly is that the recognition of internally generated goodwill does not meet the recognition criteria in AASB138 because it cannot be measured reliably at cost Subsequent Measurement:

Amortisation of goodwill is no longer permitted AASB136 requires goodwill to be tested for impairment at least annually To measure the amount of goodwill impairment, it is necessary to measure the difference between the recoverable amount of the cash generating unit (defined as the higher of fair value less costs to sell and value in use of the cash generating unit) and the net fair value of the identifiable aster, liabilities and contingent liabilities the entity would recognise if it acquired the cash generating unit at that date. If this amount is less than the carrying amount of goodwill, the goodwill must be written down to the lower value.

Você também pode gostar

- Chapter 21 INTANGIBLE ASSSETSDocumento38 páginasChapter 21 INTANGIBLE ASSSETSmarj ponceAinda não há avaliações

- Chapter 11 Intagible AssetsDocumento5 páginasChapter 11 Intagible Assetsmaria isabellaAinda não há avaliações

- Chapter 7 Intangible AssetsDocumento70 páginasChapter 7 Intangible AssetsLovely AbadianoAinda não há avaliações

- Ias 38Documento33 páginasIas 38Reever River100% (1)

- IAS 38 Intangible Assets: Technical SummaryDocumento5 páginasIAS 38 Intangible Assets: Technical Summaryanon-553693100% (2)

- Chapter 20Documento25 páginasChapter 20Crysta LeeAinda não há avaliações

- Assets ClassificationDocumento21 páginasAssets Classificationhamarshi2010Ainda não há avaliações

- Intangible Assets Under Pfrs ScopeDocumento12 páginasIntangible Assets Under Pfrs ScopeYsabella ChenAinda não há avaliações

- Intangible AssetsDocumento99 páginasIntangible AssetsXAinda não há avaliações

- IAS 38 Intangible Assets: Technical SummaryDocumento5 páginasIAS 38 Intangible Assets: Technical SummaryFoititika.net100% (2)

- Accounting For Property, Plant and Equipment, Intangibles and Impairment of Assets Week 12-13 AssessmentsDocumento13 páginasAccounting For Property, Plant and Equipment, Intangibles and Impairment of Assets Week 12-13 AssessmentsAllia LandigAinda não há avaliações

- Chapter 7: Audit of Intangibles and Other Assets: Internal Control Over IntangiblesDocumento28 páginasChapter 7: Audit of Intangibles and Other Assets: Internal Control Over IntangiblesUn knownAinda não há avaliações

- Accounting Standard 26 - Intangible Assets Issuing Authority: Status: Effective DateDocumento6 páginasAccounting Standard 26 - Intangible Assets Issuing Authority: Status: Effective DatePiyush AgarwalAinda não há avaliações

- Intangible Assets NotesDocumento6 páginasIntangible Assets NotesRaizel RamirezAinda não há avaliações

- Module 4 - INTACC2 Intangible AssetsDocumento20 páginasModule 4 - INTACC2 Intangible AssetsKhan TanAinda não há avaliações

- Psak 19Documento8 páginasPsak 19Nadia NathaniaAinda não há avaliações

- Fixed AssetsDocumento46 páginasFixed AssetsSprancenatu Lavinia0% (1)

- Accounting For Intangible Asset IAS 38Documento2 páginasAccounting For Intangible Asset IAS 38MIKIYAS BERHEAinda não há avaliações

- Intangible AssetDocumento38 páginasIntangible AssetRimissha Udenia 2Ainda não há avaliações

- Isa 38Documento7 páginasIsa 38shahidgondal17Ainda não há avaliações

- Chapter 9Documento10 páginasChapter 9Jesther John Vocal100% (2)

- Intangible Assets and LiabilitiesDocumento13 páginasIntangible Assets and LiabilitiesApril ManjaresAinda não há avaliações

- AP.1205B Intangible-Assets-W HIGHLIGHTSDocumento16 páginasAP.1205B Intangible-Assets-W HIGHLIGHTSdave excelleAinda não há avaliações

- Ias 38Documento6 páginasIas 38nychan99Ainda não há avaliações

- Exam QuestionsDocumento30 páginasExam QuestionsForeign GraduateAinda não há avaliações

- Accounting For Intangibles ACC C205 202A INTERMEDIATE ACCTG 1 PDFDocumento5 páginasAccounting For Intangibles ACC C205 202A INTERMEDIATE ACCTG 1 PDFAsdfghjkl LkjhgfdsaAinda não há avaliações

- Intangible Assets1Documento22 páginasIntangible Assets1hamarshi2010Ainda não há avaliações

- Intangible AssetsDocumento9 páginasIntangible AssetsDaniellaAinda não há avaliações

- 19 - Intangible AssetsDocumento10 páginas19 - Intangible AssetsYudna YuAinda não há avaliações

- Pfrs 3Documento15 páginasPfrs 3Kei VenusaAinda não há avaliações

- Module 7 IntangiblesDocumento14 páginasModule 7 IntangiblesEarl EAinda não há avaliações

- Advance AccountsDocumento6 páginasAdvance Accountsashish.jhaa756Ainda não há avaliações

- Module 7 IntangiblesDocumento14 páginasModule 7 Intangiblestite ko'y malakeAinda não há avaliações

- Ind AS-38: Intangible Assets: 1. ScopeDocumento21 páginasInd AS-38: Intangible Assets: 1. ScopeRochak ShresthaAinda não há avaliações

- ASKs 2008Documento42 páginasASKs 2008rishijain4Ainda não há avaliações

- Ias 38 PP 2023Documento41 páginasIas 38 PP 2023SaeedAinda não há avaliações

- HSBC0469, D, Priyansh - Group D11Documento14 páginasHSBC0469, D, Priyansh - Group D11Priyansh KhatriAinda não há avaliações

- Accounting For Property Plant and EquipmentDocumento6 páginasAccounting For Property Plant and EquipmentmostafaAinda não há avaliações

- Financial Accounting AssignmentDocumento6 páginasFinancial Accounting AssignmentSanjeevParajuliAinda não há avaliações

- Chapter 7 Intangible AssetsDocumento34 páginasChapter 7 Intangible AssetsHammad Ahmad100% (5)

- As-28 (Impairment of Assets)Documento11 páginasAs-28 (Impairment of Assets)api-3828505100% (1)

- Theoretical Aspects Regarding The Valuation of Intangible AssetsDocumento5 páginasTheoretical Aspects Regarding The Valuation of Intangible AssetsellennaAinda não há avaliações

- Ipsas 31-Intangable Assets IpsasDocumento6 páginasIpsas 31-Intangable Assets IpsasSolomon MollaAinda não há avaliações

- Farap 4505Documento7 páginasFarap 4505Marya NvlzAinda não há avaliações

- INTANGIBLESDocumento40 páginasINTANGIBLESPhoebe Dayrit CunananAinda não há avaliações

- Intangible Assets Picker Et Al (2012) Chapter 13 IAS 38 Intangible AssetsDocumento22 páginasIntangible Assets Picker Et Al (2012) Chapter 13 IAS 38 Intangible AssetsBrenden KapoAinda não há avaliações

- Accounting Research Memo Proj Acct 540Documento9 páginasAccounting Research Memo Proj Acct 540Carolyn Robinson WhitlockAinda não há avaliações

- Pas 38 - Intangible AssetsDocumento6 páginasPas 38 - Intangible AssetsJessie ForpublicuseAinda não há avaliações

- Accounting GuidanceDocumento5 páginasAccounting GuidanceVibha MittalAinda não há avaliações

- Notes AccountingDocumento5 páginasNotes AccountingSoleil SierraAinda não há avaliações

- APC 403 PFRS For SEs (Section 1-2)Documento3 páginasAPC 403 PFRS For SEs (Section 1-2)AnnSareineMamadesAinda não há avaliações

- Accounting for Intangible AssetsDocumento14 páginasAccounting for Intangible AssetsJuthika Bora100% (1)

- Ias 16 PropertyDocumento11 páginasIas 16 PropertyFolarin EmmanuelAinda não há avaliações

- Financial Accounting: Theory & Practice Intangible AssetsDocumento81 páginasFinancial Accounting: Theory & Practice Intangible AssetsXAinda não há avaliações

- 08-NBDB2022_Part1-Notes_to_FSDocumento23 páginas08-NBDB2022_Part1-Notes_to_FSjoevincentgrisolaAinda não há avaliações

- Micro and Other Legal Entities Code of Practice: 0. Taxpayers According To The Accounting ActDocumento19 páginasMicro and Other Legal Entities Code of Practice: 0. Taxpayers According To The Accounting ActIvana MatovićAinda não há avaliações

- Philippine Accounting Standards 38 (Intangible Assets2)Documento72 páginasPhilippine Accounting Standards 38 (Intangible Assets2)Princess Edreah NuñalAinda não há avaliações

- Valuing Intangible AssetsDocumento10 páginasValuing Intangible AssetsR. KhushbuAinda não há avaliações

- Chapter 21 Intangible AssetsDocumento10 páginasChapter 21 Intangible AssetsEllen MaskariñoAinda não há avaliações

- FIRSTSTRIKEDocumento8 páginasFIRSTSTRIKEMirthe FreseAinda não há avaliações

- Paper4 CmaDocumento9 páginasPaper4 CmaRon Weasley100% (1)

- LeanDocumento16 páginasLeanMuhammad Nauman AnwarAinda não há avaliações

- MBA 512 Chapter 1: Introduction to Operations ManagementDocumento56 páginasMBA 512 Chapter 1: Introduction to Operations ManagementAnik BhowmickAinda não há avaliações

- Reading Comprehension: Tecnología Gestión de Mercados File: 2282476Documento7 páginasReading Comprehension: Tecnología Gestión de Mercados File: 2282476ESMERALDA GUTIERREZAinda não há avaliações

- Digital MarketingDocumento10 páginasDigital MarketingArun SharmaAinda não há avaliações

- Basics of Retail MerchandisingDocumento38 páginasBasics of Retail MerchandisingRishabh SharmaAinda não há avaliações

- Financial Management CourseDocumento14 páginasFinancial Management CourseJasper Andrew AdjaraniAinda não há avaliações

- 1-The Nature and Importance of EntrepreneurshipDocumento10 páginas1-The Nature and Importance of EntrepreneurshipMuhammad AtharAinda não há avaliações

- 2023-09-07 - Aipa - III - 240 Pages - Part II - With Page #SDocumento240 páginas2023-09-07 - Aipa - III - 240 Pages - Part II - With Page #Smait.menonAinda não há avaliações

- Alliance, Acquisitions, Joint Ventures, Strat FormulationDocumento16 páginasAlliance, Acquisitions, Joint Ventures, Strat FormulationMilbert John LlenaAinda não há avaliações

- Chapter 6 (Standard Cost)Documento98 páginasChapter 6 (Standard Cost)annur azalillahAinda não há avaliações

- Strategy of Challenger, Leader and FollowerDocumento26 páginasStrategy of Challenger, Leader and Followergohelgohel100% (2)

- (Foreign Exchange Market-Part1) PDFDocumento22 páginas(Foreign Exchange Market-Part1) PDFEdward Joseph A. RamosAinda não há avaliações

- Firms in Competitive MarketsDocumento41 páginasFirms in Competitive MarketsNita AstutyAinda não há avaliações

- InfoQSample KanbanFromThe Inside Chapt4Documento41 páginasInfoQSample KanbanFromThe Inside Chapt4chansk4003Ainda não há avaliações

- Group 8 RevenuesDocumento72 páginasGroup 8 RevenuesChristine Marie T. RamirezAinda não há avaliações

- G1 6.2 Partnership - ReconstitutionDocumento55 páginasG1 6.2 Partnership - Reconstitutionsridhartks100% (1)

- EbayDocumento81 páginasEbayJohnny ChanAinda não há avaliações

- 2022-2023 FT Ss2 Econs ExamDocumento10 páginas2022-2023 FT Ss2 Econs ExamCHIEMELAAinda não há avaliações

- Bata Ratio AnalysisDocumento22 páginasBata Ratio Analysissaba_spice0% (1)

- A Study On Customer Satifaction Towards FlipkartDocumento5 páginasA Study On Customer Satifaction Towards FlipkartDulcet LyricsAinda não há avaliações

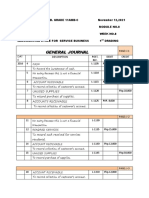

- Accounting Cycle for a Service BusinessDocumento5 páginasAccounting Cycle for a Service BusinessKristel Mae PayotAinda não há avaliações

- Reading 3 - Through What Channels Can You Get Teas Onto The European MarketDocumento9 páginasReading 3 - Through What Channels Can You Get Teas Onto The European MarketTrần Lê Uyên ThiAinda não há avaliações

- IMC Planning Process Research and Target Market SegmentationDocumento10 páginasIMC Planning Process Research and Target Market SegmentationAnastasia OstrozhnaiaAinda não há avaliações

- Name: Nikhil P. PalanDocumento7 páginasName: Nikhil P. PalanVinit BhindeAinda não há avaliações

- English DiscussDocumento3 páginasEnglish Discusscucuc lulunAinda não há avaliações

- Marketing Strategies of Olper's Milk and MilkpakDocumento25 páginasMarketing Strategies of Olper's Milk and MilkpakKhadija Haider71% (14)

- Imc TestDocumento16 páginasImc TestChen SingAinda não há avaliações

- Accounting Practices and Challenges of MSMEs in Quezon ProvinceDocumento13 páginasAccounting Practices and Challenges of MSMEs in Quezon Provincely chnAinda não há avaliações