Escolar Documentos

Profissional Documentos

Cultura Documentos

DB

Enviado por

arunasagar_2011Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

DB

Enviado por

arunasagar_2011Direitos autorais:

Formatos disponíveis

Excel Function Dictionary 1998 - 2000 Peter Noneley A 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 B C D E F G H

DB Page 1 of 3 I

DB

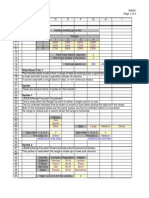

Purchase Price : Life in Years : Salvage value : Year 1 2 3 4 5 Total Depreciation : 5,000 5 200 Deprecation 2,375.00 1,246.88 654.61 343.67 180.43

=DB(E3,E5,E4,D8) =DB(E3,E5,E4,D9) =DB(E3,E5,E4,D10) =DB(E3,E5,E4,D11) =DB(E3,E5,E4,D12)

4,800.58 * See example 4 below.

What Does It Do ? This function calculates deprecation based upon a fixed percentage. The first year is depreciated by the fixed percentage. The second year uses the same percentage, but uses the original value of the item less the first years depreciation. Any subsequent years use the same percentage, using the original value of the item less the depreciation of the previous years. The percentage used in the depreciation is not set by the user, the function calculates the necessary percentage, which will be vary based upon the values inputted by the user. An additional feature of this function is the ability to take into account when the item was originally purchased. If the item was purchased part way through the financial year, the first years depreciation will be based on the remaining part of the year. Syntax =DB(PurchasePrice,SalvageValue,Life,PeriodToCalculate,FirstYearMonth) The FirstYearMonth is the month in which the item was purchased during the first financial year. This is an optional value, if it not used the function will assume 12 as the value. Formatting No special formatting is needed. Example 1 This example shows the percentage used in the depreciation. Year 1 depreciation is based upon the original Purchase Price alone. Year 2 depreciation is based upon the original Purchase Price minus Year 1 deprecation. Year 3 deprecation is based upon original Purchase Price minus Year 1 + Year 2 deprecation. The % Deprc has been calculated purely to demonstrate what % is being used. Purchase Price : Salvage value : Life in Years : 5,000 1,000 5

Excel Function Dictionary 1998 - 2000 Peter Noneley A 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 B C D Year 1 2 3 4 5 E F Deprecation 1,375.00 996.88 722.73 523.98 379.89 =DB(E47,E48,E49,D56) 3,998.48 G % Deprc 27.50% 27.50% 27.50% 27.50% 27.50% H

DB Page 2 of 3 I

Total Depreciation :

Example 2 This example is similar to the previous, with the exception of the deprecation being calculated on a monthly basis. This has been done by multiplying the years by 12. Purchase Price : Life in Years : Salvage value : Month 56 57 58 59 60 5,000 5 100 Deprecation 8.79 8.24 7.72 7.23 6.78 =DB(E66,E68,E67*12,D75)

Example 3 This example shows how the length of the first years ownership has been taken into account. Purchase Price : Life in Years : Salvage value : First Year Ownership In Months : Year 1 2 3 4 5 5,000 5 1,000 6 Deprecation 687.50 1,185.94 859.80 623.36 451.93 =DB(E74,E76,E75,D84,E77) 3,808.54 % Deprc 13.75% 27.50% 27.50% 27.50% 27.50%

Total Depreciation :

Why Is The Answer Wrong ? In all of the examples above the total depreceation may not be exactly the expected value. This is due to the way in which the percentage value for the depreceation has been calculated by the =DB() fumction.

Excel Function Dictionary 1998 - 2000 Peter Noneley A 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 124 125 126 127 128 129 B C D E F G H The percentage rate is calculated by Execl using the formula = 1 - ((salvage / cost) ^ (1 / life)). The result of this calculation is then rounded to three decimal places. Although this rounding may only make a minor change to the percentage rate, when applied to large values, the differnce is compounded resulting in what could be considered as approximate values for the the depreceation. Example 4 This example has been created with both the Excel calculated percentage and the 'real' percentage calculated manually. The Excel Deprecation uses the =DB() function. The Real Deprecation uses a manual calculation. This is the 'real' deprecation percentage, calculated manually : 27.522034% =1-((E117/E116)^(1/E118)) Purchase Price : 5,000 = 1 - ((salvage / cost) ^ (1 / life)). Salvage value : 1,000 Life in Years : 5 Excel Deprecation 1,375.0000 996.8750 722.7344 523.9824 379.8873 3,998.48 Real Depreciation 1,376.1017 997.3705 722.8739 523.9243 379.7297 4,000.00 1.52

DB Page 3 of 3 I

Year 1 2 3 4 5 Total Depreciation :

Excel % Deprc 27.500% 27.500% 27.500% 27.500% 27.500%

Error difference :

Você também pode gostar

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- 23-08-19 Investigation Report For OOSDocumento2 páginas23-08-19 Investigation Report For OOSDeepak67% (3)

- Advantages and Disadvantages of FFT Analyzer TechnologyDocumento3 páginasAdvantages and Disadvantages of FFT Analyzer TechnologyNarendra KulkarniAinda não há avaliações

- SWOT Analysis of HuaweiDocumento7 páginasSWOT Analysis of HuaweiSyed Haider33% (3)

- PowerSHAPE 2012Documento332 páginasPowerSHAPE 2012anon_97996709575% (4)

- Security Cabin Qty Details 2274/DSN/TW/D/012 R:R1 Dtd:16.12.2013Documento4 páginasSecurity Cabin Qty Details 2274/DSN/TW/D/012 R:R1 Dtd:16.12.2013arunasagar_2011Ainda não há avaliações

- 800 MAX (C4:G4) : What Does It Do ?Documento1 página800 MAX (C4:G4) : What Does It Do ?arunasagar_2011Ainda não há avaliações

- Alan 1000 5000 Bob 6000 5000 Carol 2000 4000: What Does It Do?Documento2 páginasAlan 1000 5000 Bob 6000 5000 Carol 2000 4000: What Does It Do?arunasagar_2011Ainda não há avaliações

- What Does It Do ?: 2 MOD (C4, D4) 6 MOD (C5, D5) 0 MOD (C6, D6) 1 MOD (C7, D7) 3 MOD (C8, D8)Documento1 páginaWhat Does It Do ?: 2 MOD (C4, D4) 6 MOD (C5, D5) 0 MOD (C6, D6) 1 MOD (C7, D7) 3 MOD (C8, D8)arunasagar_2011Ainda não há avaliações

- Civil DesignDocumento2 páginasCivil Designarunasagar_2011Ainda não há avaliações

- Lower: Alan Jones Bob Smith Carol Williams Cardiff ABC123Documento1 páginaLower: Alan Jones Bob Smith Carol Williams Cardiff ABC123arunasagar_2011Ainda não há avaliações

- MeadianDocumento1 páginaMeadianarunasagar_2011Ainda não há avaliações

- MmultDocumento2 páginasMmultarunasagar_2011Ainda não há avaliações

- Abcdedf 1 3 Abcdedf 2 3 Abcdedf 5 2 ABC-100-DEF ABC-200-DEF ABC-300-DEF Item Size: Large Item Size: Medium Item Size: SmallDocumento2 páginasAbcdedf 1 3 Abcdedf 2 3 Abcdedf 5 2 ABC-100-DEF ABC-200-DEF ABC-300-DEF Item Size: Large Item Size: Medium Item Size: Smallarunasagar_2011Ainda não há avaliações

- Minute: What Does It Do?Documento2 páginasMinute: What Does It Do?arunasagar_2011Ainda não há avaliações

- Iseven: 1 2 2.5 2.6 3.5 3.6 Hello 1-Feb-98 1-Feb-96Documento1 páginaIseven: 1 2 2.5 2.6 3.5 3.6 Hello 1-Feb-98 1-Feb-96arunasagar_2011Ainda não há avaliações

- ISNONTEXTDocumento1 páginaISNONTEXTarunasagar_2011Ainda não há avaliações

- Match: Bob 250 Alan 600 David 1000 Carol 4000 Alan 1000Documento3 páginasMatch: Bob 250 Alan 600 David 1000 Carol 4000 Alan 1000arunasagar_2011Ainda não há avaliações

- Lookup VectorDocumento1 páginaLookup Vectorarunasagar_2011Ainda não há avaliações

- IsrefDocumento1 páginaIsrefarunasagar_2011Ainda não há avaliações

- LargeDocumento1 páginaLargearunasagar_2011Ainda não há avaliações

- What Does It Do ?: 60 LCM (C4, D4) 36 LCM (C5, D5) 1632 LCM (C6, D6)Documento1 páginaWhat Does It Do ?: 60 LCM (C4, D4) 36 LCM (C5, D5) 1632 LCM (C6, D6)arunasagar_2011Ainda não há avaliações

- LookupDocumento2 páginasLookuparunasagar_2011Ainda não há avaliações

- IserrDocumento1 páginaIserrarunasagar_2011Ainda não há avaliações

- Islogical: False True 20 1-Jan-98 Hello #DIV/0!Documento1 páginaIslogical: False True 20 1-Jan-98 Hello #DIV/0!arunasagar_2011Ainda não há avaliações

- 1 Hello 1-Jan-98 #N/A: What Does It Do?Documento1 página1 Hello 1-Jan-98 #N/A: What Does It Do?arunasagar_2011Ainda não há avaliações

- IsblankDocumento1 páginaIsblankarunasagar_2011Ainda não há avaliações

- Index: 250 INDEX (D7:G9, G11, G12)Documento3 páginasIndex: 250 INDEX (D7:G9, G11, G12)arunasagar_2011Ainda não há avaliações

- What Does It Do ?: 1 INT (C4) 2 INT (C5) 10 INT (C6) - 2 INT (C7)Documento2 páginasWhat Does It Do ?: 1 INT (C4) 2 INT (C5) 10 INT (C6) - 2 INT (C7)arunasagar_2011Ainda não há avaliações

- Alan 1000 5000 Bob 6000 5000 Carol 2000 4000: What Does It Do?Documento2 páginasAlan 1000 5000 Bob 6000 5000 Carol 2000 4000: What Does It Do?arunasagar_2011Ainda não há avaliações

- Indirect: What Does It Do ?Documento2 páginasIndirect: What Does It Do ?arunasagar_2011Ainda não há avaliações

- What Does It Do ?: 3 GCD (C4, D4) 7 GCD (C5, D5) 1 GCD (C6, D6)Documento1 páginaWhat Does It Do ?: 3 GCD (C4, D4) 7 GCD (C5, D5) 1 GCD (C6, D6)arunasagar_2011Ainda não há avaliações

- Calculator - Million, Billion, TrillionDocumento1 páginaCalculator - Million, Billion, Trillionarunasagar_2011Ainda não há avaliações

- What Does It Do?: 21 HOUR (C4) 6 HOUR (C5)Documento1 páginaWhat Does It Do?: 21 HOUR (C4) 6 HOUR (C5)arunasagar_2011Ainda não há avaliações

- Hex2Dec: 0 1 2 3 1A 1B 7Fffffffff 8000000000 FFFFFFFFFF Fffffffffe FFFFFFFFFDDocumento1 páginaHex2Dec: 0 1 2 3 1A 1B 7Fffffffff 8000000000 FFFFFFFFFF Fffffffffe FFFFFFFFFDarunasagar_2011Ainda não há avaliações

- Tecnotree Services DatasheetDocumento2 páginasTecnotree Services Datasheetjhtan84Ainda não há avaliações

- Use Python & R With ReticulateDocumento2 páginasUse Python & R With ReticulateDipanwita BhuyanAinda não há avaliações

- BIM Roadmap - Cheng Tai FattDocumento33 páginasBIM Roadmap - Cheng Tai Fattusernaga84Ainda não há avaliações

- 3.distributed Mutual ExclusionDocumento2 páginas3.distributed Mutual ExclusionShashank GosaviAinda não há avaliações

- Me 2028 Robotics With QBDocumento133 páginasMe 2028 Robotics With QBDharmendra Kumar0% (1)

- Peningkatan Hasil Belajar Ipa Terpadu Melalui Model Pembelajaran KontekstualDocumento5 páginasPeningkatan Hasil Belajar Ipa Terpadu Melalui Model Pembelajaran KontekstualZafnaAinda não há avaliações

- Compiler Lab ProgramsDocumento47 páginasCompiler Lab ProgramsAchyuth ChallaAinda não há avaliações

- Biodata 1Documento3 páginasBiodata 1Skillytek ServiceAinda não há avaliações

- ANSYS, Inc. Known Issues and LimitationsDocumento28 páginasANSYS, Inc. Known Issues and Limitationsapple.scotch.fool3550Ainda não há avaliações

- Notes On Modular ArithmeticDocumento4 páginasNotes On Modular ArithmeticKevin LuAinda não há avaliações

- Bootstrap Examples (Código Stata)Documento8 páginasBootstrap Examples (Código Stata)ManuelFloresMijangosAinda não há avaliações

- StdOut JavaDocumento4 páginasStdOut JavaPutria FebrianaAinda não há avaliações

- Kingston 8GB DDR3 1600 PC3-12800 (KVR16N11-8)Documento2 páginasKingston 8GB DDR3 1600 PC3-12800 (KVR16N11-8)ninjasinarutoAinda não há avaliações

- 2-Wire Serial Eeprom: FeaturesDocumento11 páginas2-Wire Serial Eeprom: FeaturesRomel Ranin CalangAinda não há avaliações

- Project G2 EightPuzzleDocumento22 páginasProject G2 EightPuzzleCarlos Ronquillo CastroAinda não há avaliações

- BIOS Power Management SettingsDocumento4 páginasBIOS Power Management SettingskthusiAinda não há avaliações

- Republic of The Philippines Department of Education Region Iv - A Calabarzon City Schools Division of CabuyaoDocumento2 páginasRepublic of The Philippines Department of Education Region Iv - A Calabarzon City Schools Division of CabuyaoMaann RubioAinda não há avaliações

- IBM VTL 7500 Intro & Planning GuideDocumento143 páginasIBM VTL 7500 Intro & Planning Guidemeghach80Ainda não há avaliações

- SpywareDocumento35 páginasSpywareSai Pavan CheripallyAinda não há avaliações

- Advertising Presentation Vodafone ZooZooDocumento14 páginasAdvertising Presentation Vodafone ZooZoolathifullalAinda não há avaliações

- pcm5121 PDFDocumento121 páginaspcm5121 PDFdubby trap4Ainda não há avaliações

- Laboratory1 - Algorithm Pseudocode FlowchartDocumento8 páginasLaboratory1 - Algorithm Pseudocode FlowchartDivine Vine100% (1)

- I Path Inference in Wireless Sensor NetworksDocumento57 páginasI Path Inference in Wireless Sensor NetworksJupaka PraveenAinda não há avaliações

- Apollo DevelopmentsDocumento2 páginasApollo DevelopmentscarlosAinda não há avaliações

- (IJCST-V3I2P31) : Smita Patil, Gopal PrajapatiDocumento4 páginas(IJCST-V3I2P31) : Smita Patil, Gopal PrajapatiEighthSenseGroupAinda não há avaliações

- SRIM Setup MessageDocumento3 páginasSRIM Setup MessageRicardo Bim100% (1)