Escolar Documentos

Profissional Documentos

Cultura Documentos

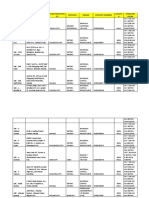

Manila Standard Today - Business Daily Stocks Review (September 10, 2013)

Enviado por

Manila Standard TodayDireitos autorais

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Manila Standard Today - Business Daily Stocks Review (September 10, 2013)

Enviado por

Manila Standard TodayDireitos autorais:

MST Business Daily Stocks Review

M

S

T

Tuesday, September 10, 2013

52 Weeks

High Low

STOCKS

Previous

Close

2.75

105.5

99

114

1.6

481.8

21.65

37.85

0.9

3.25

750

139.5

38.85

117

145

515

74.5

206.4

160

2.92

2.12

68

58.9

71.75

0.67

48

17.7

19.3

0.68

2

440

90.2

23.7

68.75

83.5

360

43

117.7

101

1.79

AG Finance

Asia United Bank

Banco de Oro Unibank Inc.

Bank of PI

Bankard, Inc.

China Bank

COL Financial

Eastwest Bank

First Abacus

I-Remit Inc.

Manulife Fin. Corp.

Metrobank

PB Bank

Phil. National Bank

Phil. Savings Bank

PSE Inc.

RCBC `A

Security Bank

Union Bank

Vantage Equities

2.6

63

72.50

92.10

1.02

53.90

18

25.7

0.84

2.80

655.50

78.00

22.8

80.15

125.90

367.8

44.9

116.6

119.00

2.5

40.5

8.95

2.26

50.5

1.59

39

11

3.12

29.3

8.24

30.25

8.6

7.9

15.9

3.8

27.45

113.8

19.96

0.027

15.98

5

0.87

179.5

12.24

28.4

2.5

41.4

24.2

22.5

397

13.5

6.88

16.3

19.48

11.18

6.15

3.74

7.6

125

900

3.34

2.1

0.220

3.3

3

132.6

2.92

2.92

30.5

5

1.15

13

1.2

17

2.42

2.54

9.25

0.96

20

4.32

4.94

7.2

1

15.7

68

12.5

0.0130

11.98

2.15

0.47

94

8.4

11.34

1.39

26.2

12.7

2.5

240

6.8

3.36

9.88

10.16

4.8

3.88

1.98

3

76.4

210

0.9

1.69

0.123

1.59

1.08

59.9

1.79

1.79

Aboitiz Power Corp.

Agrinurture Inc.

Alliance Tuna Intl Inc.

Alphaland Corp.

Alsons Cons.

Asiabest Group

Calapan Venture

Chemrez Technologies Inc.

Cirtek Holdings (Chips)

Da Vinci Capital

Del Monte

DNL Industries Inc.

Energy Devt. Corp. (EDC)

EEI

Euro-Med Lab.

First Gen Corp.

First Holdings A

Ginebra San Miguel Inc.

Greenergy

Holcim Philippines Inc.

Integ. Micro-Electronics

Ionics Inc

Jollibee Foods Corp.

Lafarge Rep

LT Group

Mabuhay Vinyl Corp.

Manila Water Co. Inc.

Megawide

Melco Crown

Mla. Elect. Co `A

Pancake House Inc.

Pepsi-Cola Products Phil.

Petron Corporation

Phinma Corporation

Phoenix Petroleum Phils.

RFM Corporation

Roxas Holdings

Salcon Power Corp.

San Miguel Corp `A

San MiguelPure Foods `B

Seacem

Splash Corporation

Swift Foods, Inc.

TKC Steel Corp.

Trans-Asia Oil

Universal Robina

Victorias Milling

Vulcan Indl.

32

5.25

1.16

43

1.31

16

6.24

2.95

14.9

1.02

27

6.21

5.40

9.89

1.73

16.8

77.5

17.52

0.0140

13.74

1.88

0.510

165.00

9.84

19.48

1.91

31.85

12.980

9.93

271.40

12.50

5.51

12.00

13.22

5.04

4.75

2.5

4.95

71.00

233

1.02

1.85

0.130

2.32

2.15

121.80

1.58

1.43

0.81

61

28.4

2.7

7.3

1.69

688

18.1

61.2

6.99

883.5

9.3

50

7.68

1.39

0.81

2.39

6.33

7.65

0.0620

2.7

7.6

1213

2.54

1.4

0.315

0.350

0.770

0.61

40

11.22

1.8

4.53

0.9

409

0.017

44

3.97

521

4.75

31.4

4.75

0.61

0.320

1.400

4

4.7

0.030

1.02

3.4

702

1.5

1.03

0.189

0.160

0.270

Abacus Cons. `A

Aboitiz Equity

Alliance Global Inc.

Anglo Holdings A

Anscor `A

ATN Holdings A

Ayala Corp `A

Cosco Capital

DMCI Holdings

Filinvest Dev. Corp.

GT Capital

House of Inv.

JG Summit Holdings

Lopez Holdings Corp.

Lodestar Invt. Holdg.Corp.

Mabuhay Holdings `A

Marcventures Hldgs., Inc.

Metro Pacific Inv. Corp.

Minerales Industrias Corp.

Pacifica `A

Prime Media Hldg

Seafront `A

SM Investments Inc.

Solid Group Inc.

South China Res. Inc.

Unioil Res. & Hldgs

Wellex Industries

Zeus Holdings

0.59

45.45

26.55

2.00

6.52

1

540

9.67

47.00

4.24

765

6.29

35.05

5.09

0.69

0.620

1.78

5.00

5.3

0.0330

1.380

1.64

699.00

1.60

1.06

0.1930

0.2200

0.390

48

3.89

2.26

0.240

35.7

7.1

6.73

2.44

3

1.21

0.91

1.21

2.76

2.27

1.73

4.31

0.197

26.9

4.33

26.9

3.74

3.95

21.9

1.35

4.1

2.4

2.92

15

1.5

0.47

0.168

21.4

4.41

3.7

1.2

1.21

0.97

0.49

0.78

1.54

1.25

1.05

2.15

0.077

17.9

2.4

17.9

1.98

2.62

13.58

0.58

3.42

0.49

1.79

Anchor Land Holdings Inc.

A. Brown Co., Inc.

Araneta Prop `A

Arthaland Corp.

Ayala Land `B

Belle Corp. `A

Cebu Holdings

Century Property

City & Land Dev.

Cityland Dev. `A

Cyber Bay Corp.

Empire East Land

Global-Estate

Filinvest Land,Inc.

Interport `A

Megaworld Corp.

MRC Allied Ind.

Phil. Realty `A

Primex Corp.

Robinsons Land `B

Rockwell

Shang Properties Inc.

SM Prime Holdings

Sta. Lucia Land Inc.

Starmalls

Suntrust Home Dev. Inc.

Vista Land & Lifescapes

23.90

1.46

1.540

0.210

24.85

4.51

5.56

1.34

1.70

1.01

0.52

0.950

1.44

1.42

1.59

3.11

0.0950

0.4150

3.38

19.20

1.81

3.30

16.26

0.62

3.85

1.510

5.210

3.15

47

1.61

0.95

16.88

0.2090

7.78

84.8

4

1300

1670

9.99

100.5

10

10.42

0.07

3.1400

9.9

1.7

1.06

1.29

5.99

16

7.83

3.47

150

17.06

3290

0.365

43.6

2.42

1.62

24.1

1.01

0.6

8.36

0.1090

3.1

50.8

2.09

970

1058

8.08

65.9

4.65

1.75

0.016

1.950

6

1.24

0.6

0.3

0.010

13.78

4.5

1.9

67.5

11.90

2480

0.275

28.1

0.75

2GO Group

ABS-CBN

Acesite Hotel

APC Group, Inc.

Bloomberry

Boulevard Holdings

Calata Corp.

Cebu Air Inc. (5J)

Easy Call Common

FEUI

Globe Telecom

GMA Network Inc.

I.C.T.S.I.

IPeople Inc. `A

IP Converge

IP E-Game Ventures Inc.

ISM Communications

Leisure & Resorts

Lorenzo Shipping

Manila Bulletin

MG Holdings

Nextstage Inc.

Pacific Online Sys. Corp.

PAL Holdings Inc.

Paxys Inc.

Phil. Seven Corp.

Philweb.Com Inc.

PLDT Common

PremiereHorizon

Puregold

STI Holdings

1.55

32.5

1.25

0.770

10.60

0.1480

3.14

49.9

2.58

1200

1492

8.22

95

11.3

6

0.016

1.9000

6.09

1.18

0.74

0.360

2.13

15.5

5.50

2.02

108.00

11.04

2812.00

0.270

39.25

0.79

23.35

28.05

0.315

25.5

1.35

1.68

25.3

0.6

1.29

1.380

0.066

0.073

28.55

8.48

4.95

7.24

19.76

37.3

0.052

305.8

13.4

10

0.240

12

0.7

0.85

5.35

0.4

0.3950

0.4250

0.028

0.030

14.78

2.55

1.16

5.8

8.8

8.5

0.033

214.4

Atlas Cons. `A

Atok-Big Wedge `A

Basic Energy Corp.

Benguet Corp `A

Century Peak Metals Hldgs

Coal Asia

Dizon

Geograce Res. Phil. Inc.

Lepanto `A

Lepanto `B

Manila Mining `A

Manila Mining `B

Nickelasia

Nihao Mineral Resources

Oriental Peninsula Res.

Petroenergy Res. Corp.

Philex `A

PhilexPetroleum

Philodrill Corp. `A

Semirara Corp.

12.96

19.50

0.245

8.36

0.66

0.94

5.32

0.430

0.495

0.530

0.0290

0.0310

15.48

2.8

1.590

6.15

9.95

10.66

0.040

240.20

49.9

10.26

115

80.5

77.5

84

1080

22.65

7.94

104.1

74.5

73

74.5

1005

ABS-CBN Holdings Corp.

GMA Holdings Inc.

PCOR-Preferred

SMC Preferred A

SMC Preferred B

SMC Preferred C

SMPFC Preferred

32

8.4

109.3

76.65

77.2

77.5

1040

11.88

4.21

Ripple E-Business Intl

18

High

Low

FINANCIAL

2.58

2.41

63.1

62.65

74.60

73.80

93.00

92.30

1.10

1.02

57.00

54.00

18

17.8

26.4

25.7

0.77

0.77

2.62

2.62

660.50

656.50

80.50

79.00

23

23

81.30

80.20

128.50

128.50

368

365

45

44.9

118

116.8

120.90

118.00

2.54

2.5

INDUSTRIAL

32.75

32.05

5.25

5.02

1.15

1.13

43

35

1.30

1.30

16

16

6.25

6.1

3.05

2.95

14.9

14.9

1.09

1.04

27

27

6.450

6.28

5.52

5.43

10.00

9.90

1.62

1.60

17.3

17

78.5

77.05

21.60

17.30

0.0140

0.0140

13.70

13.70

2

1.99

0.510

0.510

168.90

166.60

9.95

9.83

20.05

19.78

1.91

1.9

32.55

31.75

13.100

12.920

10.06

9.99

279.20

278.20

12.50

12.50

5.7

5.39

12.14

11.66

13.22

13.20

5.10

5.03

4.79

4.61

2.5

2.5

4.9

4

72.00

71.35

240

233.4

1.03

1.02

1.95

1.95

0.130

0.130

2.36

2.36

2.22

2.19

127.00

123.20

1.65

1.61

1.48

1.43

HOLDING FIRMS

0.59

0.59

47.20

46.25

27.40

26.75

2.00

2.00

6.56

6.51

1.1

1.1

554

544.5

9.88

9.7

48.00

47.50

4.21

4.20

801

767

6.31

6.00

36.00

35.15

5.14

5.04

0.71

0.67

0.640

0.620

1.91

1.8

5.13

4.99

5.45

5.35

0.0330

0.0330

1.350

1.320

1.65

1.65

725.00

712.00

1.56

1.55

1.06

1.06

0.1960

0.1640

0.2240

0.2200

0.395

0.375

PROPERTY

23.00

22.00

1.41

1.37

1.540

1.500

0.210

0.210

25.80

25.15

4.65

4.52

5.7

5.53

1.39

1.35

1.75

1.70

1.03

1.01

0.53

0.53

0.950

0.950

1.47

1.43

1.49

1.45

1.63

1.58

3.21

3.12

0.0990

0.0950

0.4500

0.4500

2.70

2.70

20.05

19.10

1.82

0.8

3.30

3.30

16.92

16.46

0.63

0.62

3.85

3.85

1.540

1.460

5.400

5.210

SERVICES

1.7

1.6

34.8

33.55

1.21

1.13

0.780

0.750

11.22

10.74

0.1510

0.1400

3.15

3.11

50.5

49.8

2.82

2.75

1200

1200

1555

1510

8.49

8.30

96.5

95.1

11.5

11.3

6.7

6.1

0.016

0.014

1.9000

1.8200

6.10

5.91

1.18

1.18

0.74

0.74

0.390

0.390

2.13

2.02

15.5

15.32

5.75

5.50

2.02

2

108.00

102.10

11.40

11.04

2876.00

2844.00

0.270

0.265

40.05

39.20

0.80

0.78

MINING & OIL

13.10

12.98

19.50

18.00

0.245

0.245

8.36

8.18

0.65

0.65

0.95

0.94

5.50

5.24

0.450

0.42

0.520

0.495

0.550

0.510

0.0300

0.0290

0.0310

0.0300

16.12

15.4

2.95

2.79

1.580

1.510

6.15

6.15

10.000

9.770

11.2

10.72

0.040

0.040

245.00

240.00

PREFERRED

32.95

31.7

8.5

8.5

109.5

109.4

77.5

76.7

77

77

77.95

77.8

1040

1030

SME

19.98

15

Close Change Volume

Net Foreign

Trade/Buying

2.43

62.8

74.25

92.30

1.10

55.50

18

26

0.77

2.62

660.50

79.80

23

80.90

128.50

365

44.95

117

118.00

2.5

-6.54

-0.32

2.41

0.22

7.84

2.97

0.00

1.17

-8.33

-6.43

0.76

2.31

0.88

0.94

2.07

-0.76

0.11

0.34

-0.84

0.00

182,000

563,710

6,516,280

1,021,410

195,000

67,430

81,600

1,518,500

20,000

5,000

290

5,899,210

49,200

1,701,660

20

530

713,100.00

3,457,000

22,610

26,000

32.4

5.22

1.14

43

1.30

16

6.21

2.95

14.9

1.06

27

6.32

5.44

9.98

1.60

17

77.05

20.80

0.0140

13.70

1.99

0.510

167.70

9.84

19.84

1.9

31.85

12.920

10

277.40

12.50

5.5

11.70

13.20

5.04

4.75

2.5

4

72.00

239

1.03

1.95

0.130

2.36

2.19

125.00

1.62

1.45

1.25

-0.57

-1.72

0.00

-0.76

0.00

-0.48

0.00

0.00

3.92

0.00

1.77

0.74

0.91

-7.51

1.19

-0.58

18.72

0.00

-0.29

5.85

0.00

1.64

0.00

1.85

-0.52

0.00

-0.46

0.70

2.21

0.00

-0.18

-2.50

-0.15

0.00

0.00

0.00

-19.19

1.41

2.58

0.98

5.41

0.00

1.72

1.86

2.63

2.53

1.40

3,784,000

30,500

38,000

4,200

12,000

100

2,200

229,000

2,800

942,000

1,400

1,892,800

7,112,700

3,010,600

14,000

3,231,400

198,350

2,244,700

22,000,000

200

20,000

9,000

922,930

282,300

21,078,500

24,000

1,208,400

1,746,800

5,144,400

1,150,060

1,700

1,453,000

10,854,600

3,300

263,500

518,000

50,000

70,000

264,850

6,830

430,000

46,000

1,680,000

1,000

5,157,000

4,617,130

220,000

548,000

0.59

46.25

26.90

2.00

6.55

1.1

552.5

9.8

47.60

4.20

800

6.31

35.45

5.04

0.67

0.640

1.82

5.00

5.35

0.0330

1.320

1.65

717.50

1.55

1.06

0.1640

0.2200

0.385

0.00

1.76

1.32

0.00

0.46

10.00

2.31

1.34

1.28

-0.94

4.58

0.32

1.14

-0.98

-2.90

3.23

2.25

0.00

0.94

0.00

-4.35

0.61

2.65

-3.13

0.00

-15.03

0.00

-1.28

483,000.00

2,384,700

19,510,500

1,000

27,400

105,000

542,430

14,166,800

931,800

35,000

297,680

1,500

4,231,400

2,403,300

213,000

223,000

4,152,000

46,983,000

79,000

100,000

45,000

3,000

654,340

30,000

115,000

130,000

50,000

550,000

23.00

1.40

1.540

0.210

25.30

4.52

5.53

1.38

1.70

1.01

0.53

0.950

1.45

1.45

1.58

3.14

0.0950

0.4500

2.70

19.60

1.8

3.30

16.60

0.62

3.85

1.460

5.210

-3.77

-4.11

0.00

0.00

1.81

0.22

-0.54

2.99

0.00

0.00

1.92

0.00

0.69

2.11

-0.63

0.96

0.00

8.43

-20.12

2.08

-0.55

0.00

2.09

0.00

0.00

-3.31

0.00

1,100

1,244,000

12,000

20,000

16,577,200

5,794,000

370,400

15,535,000

69,000

116,000

272,000

1,000

1,012,000

21,444,000

1,085,000

80,580,000

380,000

2,000,000

4,000

5,998,300

189,000

8,000

40,386,100

1,017,000

94,000

5,701,000

3,763,100

1.7

33.55

1.21

0.760

11.00

0.1400

3.11

49.9

2.82

1200

1525

8.30

95.35

11.5

6.2

0.015

1.9000

6.00

1.18

0.74

0.390

2.03

15.32

5.70

2

102.20

11.40

2848.00

0.270

39.20

0.79

9.68

3.23

-3.20

-1.30

3.77

-5.41

-0.96

0.00

9.30

0.00

2.21

0.97

0.37

1.77

3.33

-6.25

0.00

-1.48

0.00

0.00

8.33

-4.69

-1.16

3.64

-0.99

-5.37

3.26

1.28

0.00

-0.13

0.00

4,000

1,800

6,000

14,810,000

12,163,800

157,200,000

144,000

482,100

9,000

110

133,305

354,000

2,077,010

25,100

6,000

11,100,000

17,000

236,000

50,000

1,000

50,000

35,000

16,300

97,300

250,000

870

2,412,700

135,300

830,000

2,002,800

4,267,000

12.98

19.50

0.245

8.36

0.65

0.94

5.24

0.415

0.495

0.510

0.0290

0.0300

15.6

2.82

1.520

6.15

9.77

10.8

0.040

240.00

0.15

0.00

0.00

0.00

-1.52

0.00

-1.50

-3.49

0.00

-3.77

0.00

-3.23

0.78

0.71

-4.40

0.00

-1.81

1.31

0.00

-0.08

284,200

9,000

80,000

11,100

500,000

332,000

25,000

440,000

42,430,000

9,576,000

208,700,000

76,800,000

1,041,900

511,000

110,000

400

570,600

151,300

167,100,000

42,710

1,449,196.00

32

8.5

109.4

76.9

77

77.8

1030

0.00

1.19

0.09

0.33

-0.26

0.39

-0.96

181,900

1,197,200

25,700

1,094,230

1,000

258,470

8,830

173,720.00

42,500.00

15

-16.67

15,800

122,100.00

-16,958,302.50

246,687,676.50

-4,741,157.50

110,000.00

1,432,060.00

5,011,760.00

-27,530,987.50

-761,300.00

54,749,759.50

-2,570.00

-1,157,285.00

-24,071,882.00

379,565.00

24,656,570.00

-1,370.00

-5,400.00

-2,631,564.00

-4,743,176.00

-637,650.00

28,402,000.00

-6,311,084.50

1,538,563.00

-2,740.00

-10,000.00

42,081,847.00

1,278,658.00

-53,018,128.00

-19,823,780.00

-469,790.00

4,374,932.00

80,525,606.00

-1,315,115.00

-31,234,330.00

-244,020.00

1,252,890.00

8,000.00

-3,396,829.00

434,004.00

174,465,116.00

90,152,045.00

39,224,535.00

2,000.00

158,945,715.00

25,011,137.00

21,165,295.00

-138,730.00

14,086,290.00

-48,378,060.00

435,626.00

46,000.00

40,627,475.00

22,155,655.00

4,500.00

-50,863,055.00

5,924,910.00

-995,400.00

9,727,080.00

383,100.00

10,379,580.00

10,398,410.00

-10,800.00

7,087,368.00

54,600.00

-26,400.00

130,129,570.00

-237,320.00

-106,641.00

-9,050,750.00

11,064,548.00

256,660.00

63,000.00

-15,189,875.00

4,653,160.00

50,790,104.00

31,000.00

169,478.00

22,353.00

-6,483,174.00

-16,061,750.00

16,667,695.00

-711,000.00

43,790.00

456,340.00

-496,000.00

-1,093,408.00

103,800.00

553,348.00

-1,420,000.00

-635,750.00

65,708,804.00

Você também pode gostar

- Manila Standard Today - Business Daily Stocks Review (December 23, 2014)Documento1 páginaManila Standard Today - Business Daily Stocks Review (December 23, 2014)Manila Standard TodayAinda não há avaliações

- The Standard - Business Daily Stocks Review (June 8, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (June 8, 2015)Manila Standard TodayAinda não há avaliações

- The Standard - Business Daily Stocks Review (June 9, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (June 9, 2015)Manila Standard TodayAinda não há avaliações

- Manila Standard Today - Business Weekly Stock Review (May 25 - 29, 2015)Documento1 páginaManila Standard Today - Business Weekly Stock Review (May 25 - 29, 2015)Manila Standard TodayAinda não há avaliações

- The Standard - Business Daily Stocks Review (June 3, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (June 3, 2015)Manila Standard TodayAinda não há avaliações

- The Standard - Business Daily Stocks Review (June 4, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (June 4, 2015)Manila Standard TodayAinda não há avaliações

- The Standard - Business Daily Stocks Review (June 5, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (June 5, 2015)Manila Standard TodayAinda não há avaliações

- The Standard - Business Daily Stocks Review (June 2, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (June 2, 2015)Manila Standard TodayAinda não há avaliações

- The Standard - Business Daily Stocks Review (May 25, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (May 25, 2015)Manila Standard TodayAinda não há avaliações

- Manila Standard Today - Business Daily Stocks Review (February 5, 2014)Documento1 páginaManila Standard Today - Business Daily Stocks Review (February 5, 2014)Manila Standard TodayAinda não há avaliações

- The Standard - Business Daily Stocks Review (May 29, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (May 29, 2015)Manila Standard TodayAinda não há avaliações

- The Standard - Business Daily Stocks Review (May 26, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (May 26, 2015)Manila Standard TodayAinda não há avaliações

- The Standard - Business Daily Stocks Review (May 15, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (May 15, 2015)Guillerson AlanguilanAinda não há avaliações

- The Standard - Business Daily Stocks Review (May 7, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayAinda não há avaliações

- The Standard - Business Daily Stocks Review (May 22, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (May 22, 2015)Manila Standard TodayAinda não há avaliações

- The Standard - Business Daily Stocks Review (May 7, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayAinda não há avaliações

- The Standard - Business Daily Stocks Review (May 11, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (May 11, 2015)Manila Standard TodayAinda não há avaliações

- Manila Standard Today - Business Daily Stock Review (May 08, 2015)Documento1 páginaManila Standard Today - Business Daily Stock Review (May 08, 2015)Manila Standard TodayAinda não há avaliações

- The Standard - Business Daily Stocks Review (May 7, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayAinda não há avaliações

- The Standard - Business Daily Stocks Review (May 18, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (May 18, 2015)Manila Standard TodayAinda não há avaliações

- The Standard - Business Daily Stocks Review (May 5, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (May 5, 2015)Manila Standard TodayAinda não há avaliações

- The Standard - Business Daily Stocks Review (May 15, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (May 15, 2015)Guillerson AlanguilanAinda não há avaliações

- Manila Standard Today - Business Daily Stocks Review (March 6, 2015)Documento1 páginaManila Standard Today - Business Daily Stocks Review (March 6, 2015)Manila Standard TodayAinda não há avaliações

- The Standard - Business Daily Stocks Review (May 20, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (May 20, 2015)Manila Standard TodayAinda não há avaliações

- Manila Standard Today - Business Daily Stocks Review (July 3, 2014)Documento1 páginaManila Standard Today - Business Daily Stocks Review (July 3, 2014)Manila Standard TodayAinda não há avaliações

- The Standard - Business Daily Stocks Review (May 12, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (May 12, 2015)Manila Standard TodayAinda não há avaliações

- The Standard - Business Daily Stocks Review (May 7, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayAinda não há avaliações

- The Standard - Business Daily Stocks Review (May 6, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (May 6, 2015)Manila Standard TodayAinda não há avaliações

- The Standard - Business Daily Stocks Review (May 13, 2015)Documento1 páginaThe Standard - Business Daily Stocks Review (May 13, 2015)Manila Standard TodayAinda não há avaliações

- Manila Standard Today - Busines Weekly Stock Review (May 4-8, 2015)Documento1 páginaManila Standard Today - Busines Weekly Stock Review (May 4-8, 2015)Manila Standard TodayAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Banatasa Act 4Documento3 páginasBanatasa Act 4Mars John BanatasaAinda não há avaliações

- Lamberto Vera AvellanaDocumento9 páginasLamberto Vera AvellanaPhilip Floro100% (1)

- The Philippine Peace Process: History, Profile and Status of Negotiations With The CPP-NDFP and The MILFDocumento17 páginasThe Philippine Peace Process: History, Profile and Status of Negotiations With The CPP-NDFP and The MILFPatAinda não há avaliações

- Region VI - Western Visayas Schools Division of Iloilo CityDocumento5 páginasRegion VI - Western Visayas Schools Division of Iloilo Cityrose ann chavezAinda não há avaliações

- The Life and Works of Jose RizalDocumento2 páginasThe Life and Works of Jose RizalJo MAinda não há avaliações

- History - 17th Century of The PhilDocumento30 páginasHistory - 17th Century of The PhilDante RamosAinda não há avaliações

- SOCIAL0814 TugueDocumento11 páginasSOCIAL0814 TugueangelomercedeblogAinda não há avaliações

- NLC Closing ProgramDocumento20 páginasNLC Closing ProgramTifanyAinda não há avaliações

- Reading Philippine History Long Quiz 1Documento5 páginasReading Philippine History Long Quiz 1Daryl ZabalaAinda não há avaliações

- Science Technology and SocietyDocumento8 páginasScience Technology and SocietyMadison CruzAinda não há avaliações

- Check Out These Official National Symbols of The Philippines: National FlagDocumento7 páginasCheck Out These Official National Symbols of The Philippines: National FlagCecil Dela PenaAinda não há avaliações

- Manila Media Monitor - OCTOBER 2009Documento40 páginasManila Media Monitor - OCTOBER 2009manilamediaAinda não há avaliações

- For Tanod EquipmentDocumento2 páginasFor Tanod EquipmentBarangaymananaoevsiqAinda não há avaliações

- Philippine History TimelineDocumento11 páginasPhilippine History TimelineJustin Caliguia100% (1)

- Annotated BibliographyDocumento8 páginasAnnotated Bibliographyapi-341770106Ainda não há avaliações

- Module 3C LiteratureDocumento13 páginasModule 3C LiteratureFernandez, Nadine Kate T.100% (1)

- TALAPAMANA National - Luzon As of 2020-02-25Documento1 páginaTALAPAMANA National - Luzon As of 2020-02-25Erianne DecenaAinda não há avaliações

- P H I L I P P I N e L I T e R A T U R eDocumento2 páginasP H I L I P P I N e L I T e R A T U R eAngelo Jude CobachaAinda não há avaliações

- Ate Jean Check FormatDocumento41 páginasAte Jean Check FormatgraceAinda não há avaliações

- 2023 Actual ItemsDocumento18 páginas2023 Actual Itemsgt211Ainda não há avaliações

- Certified List of Candidates For Congressional and Local Positions For The May 13, 2013 2013 National, Local and Armm ElectionsDocumento3 páginasCertified List of Candidates For Congressional and Local Positions For The May 13, 2013 2013 National, Local and Armm ElectionsSunStar Philippine NewsAinda não há avaliações

- Customs of The TagalogsDocumento4 páginasCustoms of The TagalogsMaria PotpotAinda não há avaliações

- Script DebateDocumento4 páginasScript DebateImee Dhell Dimaano73% (11)

- Philippines TreasureDocumento2 páginasPhilippines TreasureJohn Aaron TamayoAinda não há avaliações

- MuslimDocumento8 páginasMuslimAimee TumlosAinda não há avaliações

- What?: Katipunan Is BornDocumento4 páginasWhat?: Katipunan Is BornErika ValderamaAinda não há avaliações

- LBC PDFDocumento198 páginasLBC PDFNavi NayagAinda não há avaliações

- In 1961 The Servicio FilipinoDocumento1 páginaIn 1961 The Servicio Filipinochristian denoyAinda não há avaliações

- Cebu DentalDocumento144 páginasCebu DentalrestomataAinda não há avaliações

- Alternative Work Schedule PlanDocumento31 páginasAlternative Work Schedule Planmichael mantalabaAinda não há avaliações