Escolar Documentos

Profissional Documentos

Cultura Documentos

The Teleshopping Business in India

Enviado por

kristokunsDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

The Teleshopping Business in India

Enviado por

kristokunsDireitos autorais:

Formatos disponíveis

THE TELESHOPPING BUSINESS IN INDIA

Case code - MKTG-036 Published-2002 OFFERING 'MIRACULOUS' PRODUCTS! "Interested in reducing that 'extra flab' on your body in a matter of hours? Would you like to grow hair on that balding pate of yours in just a few days? All you need to do is watch the television (TV) and order the 'miraculous' products being advertised through the phone."

Welcome to the world of teleshopping networks, a phenomenon that had become a part of the lives of Indian TV viewers by early 2000. Day in and day out, customers were swamped with images of models showing off their 'fabulous flat abdomens,' 'blemishfree skins,' selling disease-curing teas, wondrous kitchen and household equipment, on almost every TV channel. Though teleshopping networks became operational in the mid-1990s in the country, their presence was never felt as strongly as it was during the early 21st century. A majority of these infomercials[1] were dubbed versions of English (or other foreign languages). Many consumers found it extremely amusing to see foreigners mouthing chaste Hindi (and other regional Indian languages) while advertising these products. However, it was the nature of the products being offered by these networks that attracted the maximum attention. Most of the infomercials featured products that claimed to provide miraculous results. There were products, which could help one reduce weight and get into shape without exercise or dieting. There were other products that promised to make people give-up smoking and improve body posture. The range of products included creams, potions, solutions, toys etc Analysts questioned the reliability of such personal care products that claimed to beautify and tone up the body in a matter of days. They considered these infomercials, which depicted common people using the product and explaining its effectiveness, a farce. They argued that, these people were paid to speak well about products. Analysts criticized the teleshopping networks for trying to deceive the viewers into buying products with the belief that those people had actually used them. Despite these allegations, teleshopping as a concept was gaining popularity in India and more and more customers were showing readiness to try innovative products. BACKGROUND NOTE

Consumer marketing channels can be broadly classified based on the number of sales levels between the manufacturer and the consumer. One-two-three-four level channels are the most commonly used and involve wholesalers and retailers (also called mass marketing). Direct marketing is a zero-level channel, wherein marketers interact with the customer on a one-to-one basis (Refer Exhibit I for a comparison between mass marketing and direct marketing and various kinds of direct marketing techniques). Direct response marketing motivates customers to take prompt action. The prerequisites for a promotion technique to be considered as direct response marketing included placing an order directly before the potential customer and prompting the customer to take immediate action (such as requesting for additional information or making a purchase decision). Teleshopping is another name for Direct Response Television (DRTV) shopping, a concept that originated in the US in the mid-1980s. It is one of the direct response marketing techniques. Other major direct response marketing techniques included catalog and direct mail retailing, and interactive/online home shopping. While in catalog/direct mail retailing, product details are communicated to the customer through a catalog or mailer (letters, brochures, pamphlets), in interactive/online shopping, product details and pictures are sent directly to the customers through an electronic medium such as the Internet.

Since the 1990s, two types of infomercials have been used. Some featured people from various walks of life, using the product and benefiting from it. These were scheduled between TV programs. At the end of the infomercial, the teleshopping networks provided their telephone numbers (usually toll-free), prompting viewers to call for further enquiries or place orders. Other infomercials were 'in-studio' productions with a live audience. The companies attempted to convince viewers that it was a regular show and not a mere commercial aimed at luring them to buy their products. Some teleshopping networks designed 30-60 minute programs, wherein they introduced their product range and carried out in-depth product demonstrations. In countries like the US and Australia, teleshopping networks had dedicated 24-hour home-shopping channels that offered extensive information regarding their product range such as product details and price. Though the concept received a lukewarm response in its early years, in the mid-1990s, it started gaining popularity. By 2000, the teleshopping market in the US was valued at around $2 billion. Presently, there are two major teleshopping networks in the US - the Home Shopping Network and QVC, which have their own, exclusive 24-hour teleshopping channels. These channels offer products aimed at specific customer groups at different time slots to enable viewers to plan their viewing time accordingly. In 2000, the teleshopping market in the US was valued at around $ 2 billion. However,

teleshopping was not as successful in other parts of the world as it was in the US. This was due to several problems, which included low penetration of television, lack of innovative offerings, poor promotion and advertisement techniques, and lack of awareness among the customers. But with the changes in teleshopping business in teleshopping growing popularity of satellite and cable television in the late 1990s, lifestyle and a general improvement in the standard of living, picked up momentum. By 2001, the total teleshopping network the world amounted to over $ 5 billion (Refer Table I for major networks in various countries).

TABLE I MAJOR TELESHOPPING NETWORKS IN VARIOUS COUNTRIES

COUNTRY US Belgium Germany Italy Japan Europe Israel Australia Korea China Brazil UK India

MAJOR TELE-SHOPPING CHANNELS Home Shopping Network, QVC, Telebrands, TSN L.T.A, Shopping H.O.T., QVC Deutschland GmbH HSN-SBS Italia, Shopping America Shop Channel TV-Shop C.E.D. TVSN LGHS, CH. 39, TV Home Shopping China Shopping Network Shop Time QVC Telebrands (India), Asian Sky Shop

THE INDIAN SCENARIO During the early 1990s, Indian laws prohibited customers to import products, without acquiring prior permission from the regulating authorities.

These laws also restricted the repatriation of money (out of India), without the prior permission of the country's central bank, the Reserve Bank of India (RBI). This was a major reason for the evolution of teleshopping in India, unlike the US, where teleshopping evolved due to the changing societal norms. During the mid-1990s, Telebrands India, a 100% subsidiary of Telebrands Corp., pioneered the concept of teleshopping in India and soon grew into a leading teleshopping network in the country. In mid1995, TSN (another major US-based teleshopping network) and Asian Sky Shop (ASK), owned by the media giant - Zee[1] , also entered the market. The other major players in the Indian teleshopping market were TVC, TSNM and Star Warnaco. All these networks adopted the following modus operandi: Buying time slots on popular channels that had high penetration and enjoyed good viewership among the target customers. These time slots ranged from two minutes to 1 hour and comprised infomercials/product presentations, explaining the product's utility.Providing a special product code for every product and displaying it along with its price.Setting up call centers in various cities, on the basis of the scale of operations and the extent of penetration expected. Providing viewers with telephone numbers of these call centers and asking them to call their nearest call centre for further enquiries or to order the product. However, the Indian teleshopping network grew at a very slow pace, on account of factors such as the lack of education and awareness among people, low standard of living, low rate of women employment, and low penetration of TVs/telephones. Moreover, unlike the Western countries, shopping for an average Indian had traditionally been an occasion for 'social outing' and enjoyment. The 'feel-and-touch' factor for buying almost anything had always been given great importance. Thus, teleshopping networks initially had a tough time, to make the concept acceptable. The companies developed several strategies with regard to product offerings, promotional practices, pricing and distribution, to overcome the above hurdles and make a success of their teleshopping initiatives. HOW THE INDIAN TELESHOPPING MARKET WAS WON During the late 1990s, the traditional Indian societal setup of joint families gave way to nuclear families. In the metros and even some smaller cities, the number of families where, both the husband and wife were pursuing careers had increased substantially and there was little time available for shopping outdoors. Teleshopping companies believed that this segment offered tremendous marketing potential and would easily take to convenient shopping from their homes. In

addition, the networks decided to target the premiumend TV viewers, with high purchasing power. The growing sophistication among these customers enhanced their readiness to try new, innovative products, even at a premium. While deciding on the product-mix, teleshopping networks focused more on offering innovative and value for money products, which were not available in the market otherwise. These were primarily, impulse buying products, aimed at attracting viewers and inducing them to take an buying decision promptly. Thus, a select range of imported products were offered that mainly included electronic goods, fitness devices, home appliances and toys. The networks sourced their products with help of their agents (both in India and abroad) who identified and certified the quality of these products. In some instances, the manufacturers of the products approached the networks directly for marketing and distribution of their products. The India-based networks such as ASK also offered products made in India apart from their imported range. In early 2000, many local players also entered the teleshopping market and began offering products on local cable channels. However, the imported products were more successful as compared to the Indian products being offered. Analysts attribute this to the novelty of imported products and the inherent customer orientation towards foreign goods in India. In the early 2000s, the networks began offering various customized products such as jewellery with birth-stone, which became very popular. New products were introduced constantly to attract customer attention and ward off competition. The products offered were broadly divided into two categories, Utility products (fitness devices, heathcare/autocare products, household appliances and electrical devices) and Value-expressive products (jewellery, apparels and, home decor). The range of product offerings increased through 2001 and encompassed many more products that included electronic goods, toys, clothes, books and music (Refer Table II for some of the popular teleshopping products). Utility products accounted for a majority of teleshopping sales in India, while value-expressive products registered low sales. Explaining the rationale behind this, analysts said that Indian customers were used to go to their trusted shop-keepers for buying such high-value products and liked to ascertain the product's worth by physically handling and inspecting it. continued from : HOW THE INDIAN TELESHOPPING MARKET WAS WON Teleshopping networks adopted two types of persuasion modes to induce viewers to buy their products, namely Functional Congruity and Self Congruity. While functional congruity aimed at attracting consumers by emphasizing the utilitarian aspect of the product, self-congruity aimed at attracting customers by matching the product user image

with

that

of

customer's

self-image.

The products were advertised through infomercials which were aired in 1-2 minute time capsules between scheduled programs (both national and regional) or in 30-minute time capsules on various TV channels. Most of these infomercials were aired only on weekdays while a few were aired seven days a week (Refer Table III for air-time of various teleshopping networks).

TABLE II TELE-SHOPPING PRODUCTS POPULAR IN INDIA

PRODUCT CATEGORY

PRODUCT Torso Tiger Ab Slim

Reduce Fat Fast Torso Roller Ab Crunch

Fitness Personal Care

Abdominal Rocker Gymtronix Advanced Foldable Treadmill Body Vibes Acu Slim Clear Tone Dental White Facial Magic Eagle Eyes

Ervamatin Hair Lotion

Fix Amazonia Gel

Bio White Skin Whitening Cream Epil Stop and Spray Fat Free Tablets

Amazon Cigarette Repulsor Astha Ban

Health Care

Magnetic Neck Belt/Belly Belt/Head Belt/Diabetic Belt/BP Belt Proactive Static Duster Iron Quick System Roti Maker Bonzai Blade Smart Chopper

Household Articles and Appliances

Ezee Knife Set Tough & Glow Lamps Cutlery Fashion Entertainment Education Apparels

Pearl Jewellery Diamond Jewellery

BirthStone Jewellery Electronic Games, Toys Mathemagics Memory Power Mega Maths

Britannica India Series

Music Autocare

Classics (English) Motor Up

Since initially, only imported products were being offered and the market was very limited, companies did not find it commercially viable to prepare detailed infomercials for them. Hence, they offered dubbed versions (English, Hindi and other regional languages) of the original infomercials (made in different foreign languages). As the product range expanded to include domestic products as well, the networks developed (shooted) infomercials in India. Most of these were developed in studios and featured well-known personalities such as former film and TV stars. However, dubbed versions of infomercials were used even in the early 2000s, as foreign products still formed a substantial part of product portfolio of all major teleshopping networks in India. To ensure success, teleshopping networks paid special attention to their pricing strategies. In the initial years, most of the products offered by these networks were lifestyle products that came last in priority of a typical Indian household.

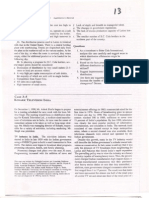

TABLE III AIR-TIME OF MAJOR TELE-SHOPPING NETWORKS IN INDIA

Networ``k

Channels

Format

Air Air Per Per Week Day

Zee TV, Music Asia, Zee Cinema Zee News, Zee Movies, Zee English.

1.5 minutes 3 (min) hours infomercial (hrs). 15 times a day on each channel for 7days of a week.

21hrs.

Asian Sky Shop

1.5 min 1.24 9.48hrs. infomercial hrs. 14 times a day on each channel for 7 days of a week. 1.5-min 36 4hrs. infomercial min. Zee Europe, Zee America, 8 times a Zee Africa day for 7 days of a week. 5hrs. 35hrs.

Alpha Network - Marathi, Gujarati, Punjabi and Bengali.

Total Air Time

Telebrands

CVO, In Mumbai, Also on South Channels

Gurjari, Lashkara

30 min program on 1hr. week days only 30-min program on week days only. 1 hr.

5hrs.

5hrs.

TSN

1-2 min infomercial 1 hr 20 16 8-10 times min - 3 DD, Vijay, Star Plus (halfmin of a day, on hrs 30 40 hour) week days min. min. only. 1 hrs 6 hrs 20 16 min - 8 min - hrs 20

Total Air Time

1 hr 40 min . 30 min program on 1hr. week days only

min.

TSNM

DD Kannada, Sun TV

5hrs.

Star Warnaco

Star TV

1.5 min infomercial, 64-5 times a 30 - 37.5 7.5 day on min min . week days only

TVC

30 min program on 30 Local Cable Networks Only week days min only

2 hrs 30 min

Though the price of the products offered by various networks in the late 1990s was as low as Rs 500[1] , most of them were priced at a premium to target the upper classes. However, over the years, the number of utility products increased and the price of the products was also brought down to make them more affordable. In 2002, the price of the articles offered ranged between Rs 200 to Rs 12,000, with a majority of the products falling in the Rs 1,000-5,000 range. The teleshopping networks competed with each other in terms of offering the same benefits at lower prices. This was particularly observed for various weight reduction products. All the networks marketed different gadgets that claimed to reduce weight derided the offerings of rival teleshopping networks claiming to be cheaper and much more effective. Hectic activities took place on the promotional front as well, with networks offering 'early bird' prizes, price reductions, money return (if not satisfied with the product) offers, free accessories and double product packs at the same price. For effective distribution of their products, the networks focused on strengthening their franchisee base across the country. All the major networks in India had their franchisers across major metros and semi-metros in the country. Towards the end of the year 2001, the franchisee network of Telebrands India extended to over 90 cities across the country, while ASK's network spanned across 60 cities. The networks provided the telephone numbers of all their distributors at the end of their infomercials, so that the customers could call their nearest distributor for further enquiries or to place an order. On receiving a purchase order from a customer, the product was delivered to him/her through courier. Payment was generally made on delivery of the product. Unlike the late-1990s, when products were only delivered against cash payment, in the early2000s, the networks began accepting credit cards to encourage customers to respond to their offers.

As a result of all the above initiatives, the awareness about the merits of teleshopping increased. Customers, who followed global trends in lifestyles and product usage, began to buy teleshopping products, and the market picked up momentum. In 2001, the market registered an annual growth rate of over 20% and amounted to Rs 500 million. In 2002, Telebrands led the market with an estimated turnover of over 250 million, followed by ASK with a turnover of over 200 million. TELESHOPPING TRAUMAS Though teleshopping market was showing positive growth trend, its growth rate was much below the expectations of the players involved. According to a report[1], most of the teleshopping networks in the country were not making any profits. In fact, TSN had closed its teleshopping activities in 2002 and was concentrating only on online retailing (www.tsnshop.com). According to market sources, Telebrands was the only network that was able to sustain itself and make profits - though it was attributed by many to the strong support it received from its parent company, Telebrands Inc.

The reasons for the slow growth of the teleshopping market in India were many, the most important being the abundant supply of imitation product. Local entrepreneurs copied the products advertised on TV and very soon the markets were flooded with imitated versions of these products. These products were not only cheaper compared to organized sector products, but also offered consumers the facility to personally touch and appraise them. Mahesh Panna of Telebrands said, "What happens is that we come out with a product and it is promptly copied by a local player. He obviously sells it at a lesser price. This way the whole market goes out of our hands." To address this problem, networks such as Telebrands and ASK opened special retail outlets in all major metros and semi-metros to enable customers to personally appraise the products offered, before making a purchase decision. Apart from the new products, the companies also retailed those products, which had been taken off air (to make place for new products) but still had potential for sale. However, the local retailers still enjoyed a substantial price advantage over the teleshopping networks due to local manufacturing, low transportation costs and elimination of distribution/delivery costs. Though the teleshopping networks claimed that their pricing strategies were in tune with the target customer's profile, the reality was very different. The higher prices were proving to be a major hindrance for the growth of teleshopping networks. Most of the products were priced between Rs 1,000-5,000. Customers were found to be unwilling to pay this amount for lifestyle products that ranked rather low in their household purchasing priority list. The differences in the culture and language also posed problems and hampered the prospects of teleshopping market in India. As teleshopping networks needed to

telecast their programs in different regions, they dubbed most of their infomercials into the regional languages. However, they failed to have any impact in prospective customers as they did reflect the native culture of the region. Another major problem for the teleshopping networks was the growing criticism for some of its products. There were a host of products that claimed to do 'seemingly impossible' tasks for consumers. For instance, products promising to reduce weight, remove unwanted hair, improve posture, improve hearing and cure chronic diseases were eyed with suspicion by a majority of Indians. Also, the 'over-enthusiastic' and 'chirpy' foreign models that appeared in the dubbed infomercials were criticized on the grounds of being rather awkward mouthing dialogs in Hindi and other regional languages. Problems were further compounded due to limited reach of teleshopping products. The networks focused mainly on metros and B-class cities, neglecting towns and semi-rural areas which also had a growing base of educated and premium end customers who aspired for convenience and novelty products.

To address this problem, major teleshopping networks announced plans to expand their distributor base and extend their reach to all corners of India. Every distributor or franchisee was supplied with a minimum stock level, based on the expected market of the product in that specific region. The players also entered into marketing agreements with leading retail outlets in various cities, where their range of products could be displayed. However, with all the networks preparing to leverage the growth potential in the market, the competition was expected to intensify. To withstand competition, it became essential for teleshopping networks to continuously innovate and offer new products. This posed a serious challenge for them. The biggest threat for teleshopping, however, seemed to be the emergence of interactive home shopping, wherein the retailers and consumers used interactive electronic systems such as a digital TVs or the Internet (popularly called e-tailing) to buy products online. The concept was still in its initial stages in the early 2000s. However, industry observers felt that it would not be long before this concept became popular, given the growing techno saviness of Indian consumers and the increasing Internet user base in the country. It was being increasingly felt that the networks which did not embrace this new phenomenon would find it difficult to survive in the coming years. FUTURE PROSPECTS Despite all the above problems, the teleshopping market was believed to hold a lot of potential in India. This was primarily on account of the increasing base of convenience-seeking people and the middle-class population. As the standard of

living of these people improved, they became more receptive towards trying out innovative products and concepts. Teleshopping networks, therefore, focused on integrating their operations and increasing their reach for these customer segments. The decision to offer online-shopping services through special retail websites was made with the same objective. By mid-2002, most of the major networks such as Telebrands and ASK were deriving their revenues from three sources - websites (www.asianskyshop.com and www.telebrandsindia.com respectively), teleshopping and retail outlets, with a major part of the revenues coming from the teleshopping (franchise centers). The revenues from websites were low due to the lack of online purchase awareness among the customers and the low rate of credit card penetration in India. Since global teleshopping networks proved to be a huge success, there seemed to be a strong possibility of their being successful in India, as well. But for that, teleshopping networks would need to play their cards right. (Refer Exhibit II for the key success factors for a teleshopping network), it would not be too far-fetched to think of 24-hour dedicated teleshopping channels in India in the future.

QUESTIONS FOR DISCUSSION: 1. Explain the concept of teleshopping and its working mechanism, benefits and factors that contributed to its success. Discuss the worldwide trends in the teleshopping business and the factors that have contributed to its success in the US. Also, describe the circumstances that led to the entry of teleshopping networks in India. 2. Discuss the strategies followed by major teleshopping networks in India with specific reference to each element of the marketing mix. Do you think the allegations against products claiming to offer 'miraculous benefits are justified? Give reasons to support your answer. 3. Critically examine the problems faced by teleshopping networks in India. Do you think the market has a potential to grow in the future in the light of the above problems? According to you, what measures should the teleshopping networks in India adopt to address these problems and grow in future? ADDITIONAL READINGS & REFERENCES: 1.Margolis Budd,TV Home Shopping,www.ourworld.compuserve.com,April 1999. 2.Subramaniam.A,Dissertation Proposal Abstract,www.hec.ohio-state.edu,2000. 3.Mehta Mona,Telebrands to Expand Product Portfolio,www.expressindia.com,February 2001. 4.ET Knowledge Series, Retail 2000-2001. 5.Kaur Gagandeep,Telemarketing Holds its Own in Retailing,Times of India,September 2002. 6.www.asianskyshop.com

7. 8. 9. 10. 11. 12. 13. 14. 15. www.pangaea.net.

www.telebrandsindia.com www.ishopathome.com www.vlsfinance.com www.geocities.com www.bullz-eye.com www.indianexpress.com www.hec.ohio-state.edu www.dcmg.com

Você também pode gostar

- The Rise of Teleshopping in IndiaDocumento7 páginasThe Rise of Teleshopping in IndiaAswathy SathyanAinda não há avaliações

- Indian Teleshopping Market: Presented By:-Amrit Pal Singh Rahul Gupta Shailender Chaudhary Varun BhardwajDocumento22 páginasIndian Teleshopping Market: Presented By:-Amrit Pal Singh Rahul Gupta Shailender Chaudhary Varun Bhardwajsharma_tanyaAinda não há avaliações

- Presented By: Mayur Saxena 11137Documento20 páginasPresented By: Mayur Saxena 11137mayursaxena99Ainda não há avaliações

- The Teleshopping Business in IndiaDocumento22 páginasThe Teleshopping Business in IndiaAjay GroverAinda não há avaliações

- Teleshopping Business India Trends Strategies Problems PotentialDocumento27 páginasTeleshopping Business India Trends Strategies Problems PotentialShriyansh Raj GuptaAinda não há avaliações

- Tele ShoppingDocumento7 páginasTele ShoppingBhargavChaudhari100% (1)

- Consumer Buying Behavior for Colour TelevisionsDocumento48 páginasConsumer Buying Behavior for Colour Televisionssarvesh.bhartiAinda não há avaliações

- Marketing Role of TV AdvertisementsDocumento55 páginasMarketing Role of TV AdvertisementsRaj naveenAinda não há avaliações

- Vijay Srinivasan (NMVC-10) : Presentation ON My Research ProposalDocumento22 páginasVijay Srinivasan (NMVC-10) : Presentation ON My Research ProposalVijay SrinivasanAinda não há avaliações

- by Priyadarshini R Ponmathi S Raaj Koushik N Kavitha S Madhumitha BDocumento29 páginasby Priyadarshini R Ponmathi S Raaj Koushik N Kavitha S Madhumitha Bkavi87Ainda não há avaliações

- Carpe Diem Case Study - Mobile MarketingDocumento5 páginasCarpe Diem Case Study - Mobile MarketingAmanMishraAinda não há avaliações

- Market ResearchDocumento11 páginasMarket ResearchDevshri UmaleAinda não há avaliações

- Commercial Studies ProjectDocumento6 páginasCommercial Studies ProjectsoumAinda não há avaliações

- Evolution of Marketing Channels from Traditional to DigitalDocumento3 páginasEvolution of Marketing Channels from Traditional to DigitalJulia CanoAinda não há avaliações

- Moving Up Digital MarketingDocumento16 páginasMoving Up Digital MarketingDaraJoeAinda não há avaliações

- Industry AnalysisDocumento83 páginasIndustry Analysismaulesh1982Ainda não há avaliações

- Promotion Notes Marketing IssuesDocumento4 páginasPromotion Notes Marketing IssuessheheryarAinda não há avaliações

- Promotion Tools and Integrated Marketing CommunicationDocumento23 páginasPromotion Tools and Integrated Marketing CommunicationVishal MalhiAinda não há avaliações

- How Advertising in Pakistan Has Evolved for Changing ConsumersDocumento21 páginasHow Advertising in Pakistan Has Evolved for Changing Consumersqirat nadeemAinda não há avaliações

- Mobile Marketing PowerPointDocumento19 páginasMobile Marketing PowerPointKyle Hutchens100% (1)

- Impact of Social Advertisement On Indian SocietyDocumento122 páginasImpact of Social Advertisement On Indian SocietyashisutharAinda não há avaliações

- Promotion - FinalDocumento22 páginasPromotion - Finalzunaira khanAinda não há avaliações

- Project Report (Omer's Group)Documento4 páginasProject Report (Omer's Group)Jibran AhsanAinda não há avaliações

- Konark TV CaseDocumento5 páginasKonark TV CaseSoumya Jyoti BhattacharyaAinda não há avaliações

- Consumer Preference of AC in Urban AreasDocumento29 páginasConsumer Preference of AC in Urban AreasNiranjan PradhanAinda não há avaliações

- Consumer Electronics - VCD, DVD, Mobile Phones: Durable GoodsDocumento8 páginasConsumer Electronics - VCD, DVD, Mobile Phones: Durable GoodssarthakAinda não há avaliações

- Major ProjectDocumento63 páginasMajor ProjectGleny SequiraAinda não há avaliações

- TiVo's Troubles in 2000Documento7 páginasTiVo's Troubles in 2000AHussain281Ainda não há avaliações

- Advertising in The WorldDocumento7 páginasAdvertising in The WorldHerepean AlexandraAinda não há avaliações

- Advertising Appeals and Media DifferencesDocumento79 páginasAdvertising Appeals and Media DifferencesVinayak SharmaAinda não há avaliações

- Sample Project 1Documento18 páginasSample Project 1A & P CORPORATE SOLUTIONSAinda não há avaliações

- Advertising Lecture NotesDocumento18 páginasAdvertising Lecture NotesNeha RastogiAinda não há avaliações

- Advertising & Media Management GuideDocumento49 páginasAdvertising & Media Management GuideSonakshi VikranthAinda não há avaliações

- Indian T.V IndustryDocumento34 páginasIndian T.V IndustryPrachi Jain0% (1)

- Understand The Structure of The Television and Video Industry in The UkDocumento4 páginasUnderstand The Structure of The Television and Video Industry in The Ukapi-425190825Ainda não há avaliações

- MBA Marketing Management Assignment on Distribution Channels and Pricing StrategiesDocumento15 páginasMBA Marketing Management Assignment on Distribution Channels and Pricing StrategiesKanchan WadhwaAinda não há avaliações

- MarketingDocumento19 páginasMarketingAnonymous ILvFoTZAinda não há avaliações

- TIVO Marketing PlanDocumento8 páginasTIVO Marketing PlanAtul SharmaAinda não há avaliações

- "Infomercials": Direct Marketing ToolDocumento16 páginas"Infomercials": Direct Marketing Toolanju_toxicAinda não há avaliações

- 14 Questionnaire PDFDocumento12 páginas14 Questionnaire PDFPuny RamAinda não há avaliações

- Customer Satisfaction Study on Mobile Phones in DharmapuriDocumento81 páginasCustomer Satisfaction Study on Mobile Phones in DharmapuriSumesh BalaAinda não há avaliações

- Advertising: It's EverywhereDocumento17 páginasAdvertising: It's EverywhereAayush GuptaAinda não há avaliações

- Types of AdvertisingDocumento22 páginasTypes of Advertisinganjali mohandasAinda não há avaliações

- Advertising Lesson 1 PresentationDocumento31 páginasAdvertising Lesson 1 Presentationwinelyn.alaoAinda não há avaliações

- TCS Internship ProjectDocumento23 páginasTCS Internship ProjectAnand DesaiAinda não há avaliações

- ThesisDocumento26 páginasThesisronaldAinda não há avaliações

- Marketing StrategyDocumento5 páginasMarketing StrategypdabhaadeAinda não há avaliações

- Different Kinds of AdvertisementDocumento3 páginasDifferent Kinds of AdvertisementGerald CAsAinda não há avaliações

- How Advertising Attracts People to Buy Products in Different WaysDocumento5 páginasHow Advertising Attracts People to Buy Products in Different WaysCiucica Alina100% (1)

- The Tele-Shopping Business in India: Presented By: Kiranjot KaurDocumento7 páginasThe Tele-Shopping Business in India: Presented By: Kiranjot KaurKiran WlcAinda não há avaliações

- Impact of Celebrity Endorsements and Promises in Indian TV CommercialsDocumento3 páginasImpact of Celebrity Endorsements and Promises in Indian TV CommercialsSheetal KambleAinda não há avaliações

- Prepared By: Ishita Barai Jatin Shah Priyam Mehta Pratik Shah Pratik JariwalaDocumento58 páginasPrepared By: Ishita Barai Jatin Shah Priyam Mehta Pratik Shah Pratik Jariwalajatinshah1986Ainda não há avaliações

- Advertising Types and Industry ReportDocumento6 páginasAdvertising Types and Industry ReportNagesh HosamaniAinda não há avaliações

- Digital Marketing Chapter 1 IntroductionDocumento27 páginasDigital Marketing Chapter 1 IntroductionBilman S Dalbot ShiraAinda não há avaliações

- Binter PresentDocumento3 páginasBinter PresentAnggita DwiantariAinda não há avaliações

- Digital Marketing Evolution and TypesDocumento29 páginasDigital Marketing Evolution and TypesBilman S Dalbot Shira100% (1)

- AB501A Advertising Principles and PracticesDocumento3 páginasAB501A Advertising Principles and PracticesJanica Seguido HandayanAinda não há avaliações

- ECO645: Industrial Economics Advertising and DisclosureDocumento24 páginasECO645: Industrial Economics Advertising and DisclosurehafizmellowAinda não há avaliações

- Taking Back Retail: Transforming Traditional Retailers Into Digital RetailersNo EverandTaking Back Retail: Transforming Traditional Retailers Into Digital RetailersAinda não há avaliações

- ProductApproval (17 05 2013) PDFDocumento10 páginasProductApproval (17 05 2013) PDFkristokunsAinda não há avaliações

- Case 1Documento5 páginasCase 1kristokunsAinda não há avaliações

- FSSAI Regulations PDFDocumento573 páginasFSSAI Regulations PDFkristokunsAinda não há avaliações

- Manpower PLanning Recrutiment and Selection PDFDocumento1 páginaManpower PLanning Recrutiment and Selection PDFkristokunsAinda não há avaliações

- Marketing Management PDFDocumento2 páginasMarketing Management PDFkristokunsAinda não há avaliações

- Case Study 2Documento7 páginasCase Study 2kristokunsAinda não há avaliações

- Performance Management System PDFDocumento1 páginaPerformance Management System PDFkristokunsAinda não há avaliações

- CBBDocumento7 páginasCBBkristokunsAinda não há avaliações

- Consumer Behaviour Health Drink PDFDocumento5 páginasConsumer Behaviour Health Drink PDFkristokunsAinda não há avaliações

- Recruitment & Retail MKTGDocumento8 páginasRecruitment & Retail MKTGkristokunsAinda não há avaliações

- Industrial Relations & Labour Laws PDFDocumento1 páginaIndustrial Relations & Labour Laws PDFkristokunsAinda não há avaliações

- HCIT A Case Study PDFDocumento5 páginasHCIT A Case Study PDFkristokunsAinda não há avaliações

- Explore the philosophical and political views on philanthropyDocumento15 páginasExplore the philosophical and political views on philanthropykristokunsAinda não há avaliações

- PhilanthropyDocumento3 páginasPhilanthropykristokuns100% (1)

- Sterling Institute of Management StudiesDocumento12 páginasSterling Institute of Management StudieskristokunsAinda não há avaliações

- Luxor Writing Instruments Private LimitedDocumento11 páginasLuxor Writing Instruments Private LimitedkristokunsAinda não há avaliações

- Marketing Management PDFDocumento2 páginasMarketing Management PDFkristokunsAinda não há avaliações

- Color A Brand Differentiator PDFDocumento2 páginasColor A Brand Differentiator PDFkristokunsAinda não há avaliações

- Corporate Identity MakeoverDocumento3 páginasCorporate Identity MakeoverkristokunsAinda não há avaliações

- Videocon PDFDocumento4 páginasVideocon PDFkristokunsAinda não há avaliações

- CISCO SYSTEMS - Supply Chain StoryDocumento7 páginasCISCO SYSTEMS - Supply Chain StorykristokunsAinda não há avaliações

- BPCL Retail RevolutionDocumento7 páginasBPCL Retail RevolutionkristokunsAinda não há avaliações

- Discovery ChannelDocumento12 páginasDiscovery ChannelkristokunsAinda não há avaliações

- Sci QuestDocumento6 páginasSci QuestkrunalpshahAinda não há avaliações

- Life Insurance Marketing in IndiaDocumento16 páginasLife Insurance Marketing in IndiakristokunsAinda não há avaliações

- HALDIRAM Looking For Right Marketing MixDocumento9 páginasHALDIRAM Looking For Right Marketing MixkristokunsAinda não há avaliações

- Corporate Identity MakeoverDocumento3 páginasCorporate Identity MakeoverkristokunsAinda não há avaliações

- Baron India MarketingDocumento9 páginasBaron India MarketingkristokunsAinda não há avaliações

- Coca Cola India - Thirst For Rural MarketDocumento8 páginasCoca Cola India - Thirst For Rural MarketkristokunsAinda não há avaliações

- Airtel RepositioningDocumento12 páginasAirtel RepositioningkristokunsAinda não há avaliações

- Key factors and internal strengths and weaknesses for market penetration of a coffee shopDocumento4 páginasKey factors and internal strengths and weaknesses for market penetration of a coffee shopClint Jan SalvañaAinda não há avaliações

- Lesson 1 Abm 2Documento35 páginasLesson 1 Abm 2Albert Gaddiel CobicoAinda não há avaliações

- Designing and Copywriting For ICT ProjectsDocumento9 páginasDesigning and Copywriting For ICT ProjectsLorenz Bello100% (1)

- Exploitation of ConsumersDocumento12 páginasExploitation of ConsumersKim Jong - unAinda não há avaliações

- Website Analysis Overview Report: March 2019Documento4 páginasWebsite Analysis Overview Report: March 2019Krutika RaoAinda não há avaliações

- From Fragmentation To Collaboration in Tourism Promotion, An Analysis of The Adoption of IMC in The Amalfi Coast PDFDocumento24 páginasFrom Fragmentation To Collaboration in Tourism Promotion, An Analysis of The Adoption of IMC in The Amalfi Coast PDFAdin RadinsyahAinda não há avaliações

- The Real Potential of Cloud KitchensDocumento23 páginasThe Real Potential of Cloud KitchensKritin AgarwalAinda não há avaliações

- Advanced Marketing Management: Case Study: Culinarian Cookware: Pondering Price PromotionDocumento3 páginasAdvanced Marketing Management: Case Study: Culinarian Cookware: Pondering Price PromotionKRISHNA YELDIAinda não há avaliações

- Marketing Strategy for Maliban Cream CrackerDocumento27 páginasMarketing Strategy for Maliban Cream CrackerAnuruddha Rajasuriya84% (25)

- Marketing ManagementDocumento8 páginasMarketing ManagementAarti DivyaAinda não há avaliações

- Corporate Event ManagementDocumento2 páginasCorporate Event ManagementKaran Chheda100% (1)

- Business Plan for New CompanyDocumento9 páginasBusiness Plan for New CompanyNathan MoraldaAinda não há avaliações

- Nutrition Club Rules India-Sep 2010Documento12 páginasNutrition Club Rules India-Sep 2010Prateek BatraAinda não há avaliações

- Llbean Final PaperDocumento11 páginasLlbean Final Paperapi-289321664Ainda não há avaliações

- Product & Brand Management (2017) v2Documento27 páginasProduct & Brand Management (2017) v2Nitish Kaku100% (2)

- Visa Europe Operating Regulations Volume I - General Rules, May 2013Documento790 páginasVisa Europe Operating Regulations Volume I - General Rules, May 2013soricel23Ainda não há avaliações

- Chapter Six Strategic Control and EvaluationDocumento68 páginasChapter Six Strategic Control and EvaluationbutwalserviceAinda não há avaliações

- How To Write Executive Summary of A ThesisDocumento6 páginasHow To Write Executive Summary of A Thesiskristenleewashington100% (2)

- HRM Planning For Knowledge HubDocumento23 páginasHRM Planning For Knowledge Hubsujata shahAinda não há avaliações

- Loeb Electric Announces New Website and RebrandingDocumento2 páginasLoeb Electric Announces New Website and RebrandingPR.comAinda não há avaliações

- Pepsi Cola - Social Marketing PlanDocumento26 páginasPepsi Cola - Social Marketing PlanNgọc NhiAinda não há avaliações

- Cisco Case Study AnalysisDocumento2 páginasCisco Case Study AnalysisSanal Jose67% (3)

- How cultural factors impact changing customer expectationsDocumento16 páginasHow cultural factors impact changing customer expectationsManish AroraAinda não há avaliações

- AdvertisingDocumento51 páginasAdvertisingParag Korgaonkar100% (1)

- Porter's Five of M&SDocumento3 páginasPorter's Five of M&SImon Kalyan SarkarAinda não há avaliações

- Market Growth Strategies in XYZ Healthcare, MalaysiaDocumento15 páginasMarket Growth Strategies in XYZ Healthcare, MalaysiaAzamAinda não há avaliações

- Newsvendor ProblemDocumento24 páginasNewsvendor ProblemNestor Diaz LunaAinda não há avaliações

- Comparative study of marketing analysis of Urban Clap vs LooksDocumento9 páginasComparative study of marketing analysis of Urban Clap vs LooksMegha Matta100% (1)

- Documentary Treatment - Template 1Documento10 páginasDocumentary Treatment - Template 1api-690596217Ainda não há avaliações

- DANNYS ATM INC RETAIL SALES TITLEDocumento12 páginasDANNYS ATM INC RETAIL SALES TITLEAndres TabaresAinda não há avaliações