Escolar Documentos

Profissional Documentos

Cultura Documentos

Laconia Daily Sun - JUA 06-18-09

Enviado por

Grant Bosse0 notas0% acharam este documento útil (0 voto)

104 visualizações1 páginaLaconia Daily Sun reporter Michael Kitch writes about the filing of a lawsuit against the state of New Hampshire over its plan to seize $110 million from the Joint Underwriting Association.

June 18, 2009

Título original

Laconia Daily Sun- JUA 06-18-09

Direitos autorais

© Attribution Non-Commercial (BY-NC)

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoLaconia Daily Sun reporter Michael Kitch writes about the filing of a lawsuit against the state of New Hampshire over its plan to seize $110 million from the Joint Underwriting Association.

June 18, 2009

Direitos autorais:

Attribution Non-Commercial (BY-NC)

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

104 visualizações1 páginaLaconia Daily Sun - JUA 06-18-09

Enviado por

Grant BosseLaconia Daily Sun reporter Michael Kitch writes about the filing of a lawsuit against the state of New Hampshire over its plan to seize $110 million from the Joint Underwriting Association.

June 18, 2009

Direitos autorais:

Attribution Non-Commercial (BY-NC)

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 1

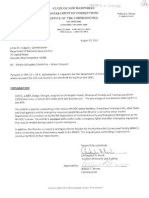

Thursday, June 18, 2009

JUA charge state with theft

by Michael Kitch

Laconia — A group of more than 200 health care reduce the access to health care. The fund is managed

providers insured by New Hampshire Medical by a board of directors according to rules adopted by

Malpractice Joint Underwriting Association (JUA), the Insurance Department. About half of the

including LRGHealthcare — one of the three named approximately 900 policy holders are physicians.

plaintiffs, yesterday brought suit against the JUA and LRGHealthcare, which operates Lakes Region General

the state in Belknap County Superior Court to forestall and Franklin Regional hospitals, is the lone hospital

the transfer of $110-million in JUA funds, which they group insured by the JUA while other policy holders

claim belong to the policyholders, not to the state include more than 20 nursing homes, home health

general fund. agencies and individual nurses, physicians' assistants,

The policyholders flung down the gauntlet just as podiatrists, chiropractors and optometrists.

lawmakers struggled to balance the 2010-2011 state Although the state created the JUA, it has never

budget, which now includes the $110-million. In contributed to funding it.

February, Governor John Lynch proposed using the Instead, the JUA operates much like a mutual

funds to help overcome yawning deficits in the state insurance company, paying its losses and meeting its

budget. On the strength of an opinion by the New expenses from the premiums paid by policyholders.

Hampshire Attorney General's office, the House of The rules set up by lawmakers provide that if JUA

Representatives included the measure as the first accumulates a surplus, that is if premiums "exceed the

section of House Bill 2 and the Senate concurred as amount necessary to pay losses and expenses," then the

Senator Lou D'Allesandro (D-Manchester) called the board shall . . . distribute such excess to those health

money "the easiest $110-million I have ever raised." care providers covered by the association, in such a

The court has scheduled a hearing in the case before manner as is just and equitable."

Judge Kathleen McGuire on June 29, the day before The Insurance Department has calculated that by

the state budget is due to be adopted. Meanwhile, on operating efficiently, investing wisely and managing

learning of the suit, lawmakers amended HB-2 to claims effectively the JUA holds about $165-million to

provide that the funds may be transferred from the JUA meet its obligations, but requires just $55-million,

to the state not later than July 31, instead of June 30, to describing the difference — $110-million — as

ensure that $65-million of the surplus can be applied "surplus."

against a projected deficit in the current fiscal year and The policyholders went to court only after failing to

the balance used in the next two years. persuade the governor, legislative leadership, JUA,

Representing the policyholders, attorney Kevin Insurance Department and Attorney General to follow

Fitzgerald of Nixon and Peabody of Manchester the law. In fact, the suit alleges that when the

opened the pleadings filed yesterday by declaring "this policyholders asserted their claim to the surplus and

case can be summed up in a simple commandment: challenged the legality of transferring it to the state, "the

Thou shall not steal" and referred to the ploy as "a Insurance Commissioner and Attorney General

raid," "theft," and "plunder" throughout the brief. "This responded with thug-like behavior" designed to dissuade

case is all about whose money is it," Fitzgerald said the JUA from fulfilling its duties.

yesterday. "We're not questioning that the state needs Henry Lipman, senior vice-president and chief

the money, but we are insisting that they must pursue financial officer of LRGH, who was party to these

lawful means to get it." efforts said that when they were rebuffed, litigation

The JUA was established in 1975 when private remained the sole alternative. LRGH pays $1.1-million

insurance carriers failed to offer malpractice policies at in annual premiums, which he estimated may represent

reasonable rates, threatening to increase the cost and between a fifth and a quarter of the total.

Você também pode gostar

- Laconia Daily Sun - JUA 06-26-09Documento1 páginaLaconia Daily Sun - JUA 06-26-09Grant BosseAinda não há avaliações

- Laconia Daily Sun - JUA 07-30-09Documento2 páginasLaconia Daily Sun - JUA 07-30-09Grant Bosse100% (2)

- Justices Seem Skeptical of State's Position in $110M JUA CaseDocumento2 páginasJustices Seem Skeptical of State's Position in $110M JUA CaseGrant BosseAinda não há avaliações

- Laconia Daily Sun - JUA 04-29-10Documento2 páginasLaconia Daily Sun - JUA 04-29-10Grant BosseAinda não há avaliações

- Conway Release Aug 21Documento4 páginasConway Release Aug 21mgreenAinda não há avaliações

- Justice Dept. Announces Dozens of Fraud Charges in Small-Business Aid Program - The New York TimesDocumento3 páginasJustice Dept. Announces Dozens of Fraud Charges in Small-Business Aid Program - The New York TimesAnonymousAinda não há avaliações

- Laconia Daily Sun - JUA 06-24-09Documento1 páginaLaconia Daily Sun - JUA 06-24-09Grant BosseAinda não há avaliações

- Tim Bullock Email On Fdic V Chase Settlement Admission Not Successor-In-Interest Wamu Loans 11282017Documento5 páginasTim Bullock Email On Fdic V Chase Settlement Admission Not Successor-In-Interest Wamu Loans 11282017api-321082827Ainda não há avaliações

- Summary of These Are the Plunderers by Gretchen Morgenson: How Private Equity Runs—and Wrecks—AmericaNo EverandSummary of These Are the Plunderers by Gretchen Morgenson: How Private Equity Runs—and Wrecks—AmericaAinda não há avaliações

- 2010 0114 EnforcementMeasuresDocumento2 páginas2010 0114 EnforcementMeasuresShyamal PatelAinda não há avaliações

- United States v. Anthony J. Pisani, M.D., 646 F.2d 83, 3rd Cir. (1981)Documento10 páginasUnited States v. Anthony J. Pisani, M.D., 646 F.2d 83, 3rd Cir. (1981)Scribd Government DocsAinda não há avaliações

- In Re First Alliance Mortgage Company, 471 F.3d 977, 1st Cir. (2006)Documento37 páginasIn Re First Alliance Mortgage Company, 471 F.3d 977, 1st Cir. (2006)Scribd Government DocsAinda não há avaliações

- Anthony Todt Federal InvestigationDocumento36 páginasAnthony Todt Federal InvestigationLeigh Egan100% (1)

- Federal News Release From A Qui Tam Lawsuit Involving Kickbacks For Antipsychotic DrugsDocumento3 páginasFederal News Release From A Qui Tam Lawsuit Involving Kickbacks For Antipsychotic DrugsBehn and Wyetzner, CharteredAinda não há avaliações

- Schneiderman Fraud RecoveryDocumento4 páginasSchneiderman Fraud RecoveryCeleste KatzAinda não há avaliações

- Multimillion-Dollar Healthcare Insurance Fraud Lawsuit Against Johnson & Johnson Filed in CADocumento2 páginasMultimillion-Dollar Healthcare Insurance Fraud Lawsuit Against Johnson & Johnson Filed in CACarmen SimmonsAinda não há avaliações

- Our Qui Tam Lawsuit Against CVSDocumento3 páginasOur Qui Tam Lawsuit Against CVSBehn and Wyetzner, CharteredAinda não há avaliações

- Was The Insurer Responsible For The Wrongful Acts of Its Agent?Documento2 páginasWas The Insurer Responsible For The Wrongful Acts of Its Agent?api-253200350Ainda não há avaliações

- OCC - THE REGULATOR Stands in The Way of Potential Multi Billion Dollar Settlement - ForeclolsuresDocumento6 páginasOCC - THE REGULATOR Stands in The Way of Potential Multi Billion Dollar Settlement - Foreclolsures83jjmackAinda não há avaliações

- October 13, 2011 - The Federal Crimes Watch DailyDocumento7 páginasOctober 13, 2011 - The Federal Crimes Watch DailyDouglas McNabbAinda não há avaliações

- TPP & Investment - Services.finalDocumento3 páginasTPP & Investment - Services.finalaloysius1Ainda não há avaliações

- California Edition: Providers Line Up Against InitiativeDocumento7 páginasCalifornia Edition: Providers Line Up Against InitiativePayersandProvidersAinda não há avaliações

- Dodd FrankactDocumento3 páginasDodd FrankactPamela Moore YoungAinda não há avaliações

- States and Cities Near Tentative $26 Billion Deal in Opioids Cases - The New York TimesDocumento3 páginasStates and Cities Near Tentative $26 Billion Deal in Opioids Cases - The New York TimesMinh MinhAinda não há avaliações

- Obamacare OrderDocumento29 páginasObamacare OrderRoger DuPuisAinda não há avaliações

- CIT Files BankruptcyDocumento2 páginasCIT Files BankruptcyAdam HollierAinda não há avaliações

- 110720deaddebt PDFDocumento10 páginas110720deaddebt PDFMark ReinhardtAinda não há avaliações

- AAJ Report: Ten Worst Insurance Companies FINALDocumento29 páginasAAJ Report: Ten Worst Insurance Companies FINALTimothy Richard GAinda não há avaliações

- Trends Winter 2013Documento16 páginasTrends Winter 2013caitlynharveyAinda não há avaliações

- July 6, 2011 - The Federal Crimes Watch DailyDocumento7 páginasJuly 6, 2011 - The Federal Crimes Watch DailyDouglas McNabbAinda não há avaliações

- Key States On The Front Line of Stopping ObamaCareDocumento5 páginasKey States On The Front Line of Stopping ObamaCareIllinois PolicyAinda não há avaliações

- States Fall Short On Help For HousingDocumento14 páginasStates Fall Short On Help For HousingForeclosure FraudAinda não há avaliações

- Borrower Nightmares: Navy Pension Signed Over As Collateral For Costly Quick CashDocumento7 páginasBorrower Nightmares: Navy Pension Signed Over As Collateral For Costly Quick CashSimply Debt SolutionsAinda não há avaliações

- Corporate Abuse TaxDocumento8 páginasCorporate Abuse TaxChetan Kumar BhattAinda não há avaliações

- Allied Bank PRDocumento4 páginasAllied Bank PRMo WereAinda não há avaliações

- No Justice For The InjuredDocumento189 páginasNo Justice For The InjuredCenter for American Progress100% (1)

- Health Care Fraud 2-20-14Documento6 páginasHealth Care Fraud 2-20-14Greg OttoAinda não há avaliações

- Laconia Daily Sun - JUA 06-30-09Documento1 páginaLaconia Daily Sun - JUA 06-30-09Grant BosseAinda não há avaliações

- California Edition: Blue Cross Backs Off Some IncreasesDocumento6 páginasCalifornia Edition: Blue Cross Backs Off Some IncreasesPayersandProvidersAinda não há avaliações

- Financial Meltdown Was AvoidableDocumento2 páginasFinancial Meltdown Was Avoidablelynx310Ainda não há avaliações

- The Criminalization of American MedicineDocumento30 páginasThe Criminalization of American Medicinesolodocssolong100% (2)

- 2020 CRF Data BulletinDocumento26 páginas2020 CRF Data BulletinWKYTAinda não há avaliações

- The Jere Beasley Report, Aug. 2008Documento52 páginasThe Jere Beasley Report, Aug. 2008Beasley AllenAinda não há avaliações

- Planned Parenthood of Indiana v. Indiana Dept. of Health Et AlDocumento44 páginasPlanned Parenthood of Indiana v. Indiana Dept. of Health Et AlDoug MataconisAinda não há avaliações

- DiNapoli Merrill LynchDocumento1 páginaDiNapoli Merrill LynchCeleste KatzAinda não há avaliações

- HCC Class Action Complaint 2018Documento54 páginasHCC Class Action Complaint 2018johan guttenbergAinda não há avaliações

- 50 Vetoes: How States Can Stop the Obama Health Care LawNo Everand50 Vetoes: How States Can Stop the Obama Health Care LawAinda não há avaliações

- US Department of Justice Official Release - 01502-05 Civ 489Documento3 páginasUS Department of Justice Official Release - 01502-05 Civ 489legalmattersAinda não há avaliações

- Payers & Providers Midwest Edition - Issue of October 4, 2011Documento6 páginasPayers & Providers Midwest Edition - Issue of October 4, 2011PayersandProvidersAinda não há avaliações

- Deregulation Time LineDocumento7 páginasDeregulation Time Lineben3172Ainda não há avaliações

- Massachusetts Association For Retarded Citizens, Inc. v. Edward J. King, 668 F.2d 602, 1st Cir. (1981)Documento14 páginasMassachusetts Association For Retarded Citizens, Inc. v. Edward J. King, 668 F.2d 602, 1st Cir. (1981)Scribd Government DocsAinda não há avaliações

- Fraud Chaeges Against Former Executives of AHMIDocumento3 páginasFraud Chaeges Against Former Executives of AHMIwicholacayoAinda não há avaliações

- Payers & Providers California Edition - Issue of May 3, 2012Documento6 páginasPayers & Providers California Edition - Issue of May 3, 2012PayersandProvidersAinda não há avaliações

- California Edition: DMHC Orders Retroactive PaymentsDocumento6 páginasCalifornia Edition: DMHC Orders Retroactive PaymentsPayersandProvidersAinda não há avaliações

- Midwest Edition: AHA Examines Community ServicesDocumento5 páginasMidwest Edition: AHA Examines Community ServicesPayersandProvidersAinda não há avaliações

- 15 REASONS: Oppose Obama S Health Insurance ExchangesDocumento2 páginas15 REASONS: Oppose Obama S Health Insurance ExchangesBryan GraczykAinda não há avaliações

- Americans' Medical Debts Are Bigger Than Was Known, Totaling $140 Billion - The New York TimesDocumento3 páginasAmericans' Medical Debts Are Bigger Than Was Known, Totaling $140 Billion - The New York TimesMinh MinhAinda não há avaliações

- Issue Brief 20Documento7 páginasIssue Brief 20kirs0069Ainda não há avaliações

- Underwood To Denerstein Letter 1.13.14Documento15 páginasUnderwood To Denerstein Letter 1.13.14Casey SeilerAinda não há avaliações

- Sixth Circuit ACA OpinionDocumento64 páginasSixth Circuit ACA OpinionJoshua StokesAinda não há avaliações

- Impact On The State of New Hampshire of Implementing The Medicaid Expansion Under The ACADocumento29 páginasImpact On The State of New Hampshire of Implementing The Medicaid Expansion Under The ACAGrant BosseAinda não há avaliações

- NH DHHS Letter To CMS - June 22 2012Documento2 páginasNH DHHS Letter To CMS - June 22 2012Grant BosseAinda não há avaliações

- Balboni Letter - Charter Schools 10-10-12Documento3 páginasBalboni Letter - Charter Schools 10-10-12Grant BosseAinda não há avaliações

- Wallner V Gardner PetitionDocumento16 páginasWallner V Gardner PetitionGrant BosseAinda não há avaliações

- NH DHHS Response To CMS 06-04-12Documento3 páginasNH DHHS Response To CMS 06-04-12Grant BosseAinda não há avaliações

- McAuliffe Medicaid Order 09-27-12Documento14 páginasMcAuliffe Medicaid Order 09-27-12Grant BosseAinda não há avaliações

- Medicaid Access Monitoring - June 2012 - FinalDocumento81 páginasMedicaid Access Monitoring - June 2012 - FinalGrant BosseAinda não há avaliações

- Wallner V Gardner Cover LetterDocumento2 páginasWallner V Gardner Cover LetterGrant BosseAinda não há avaliações

- Irrational-Do Certificate of Need Laws Reduce Costs or Hurt Patients?Documento8 páginasIrrational-Do Certificate of Need Laws Reduce Costs or Hurt Patients?Grant BosseAinda não há avaliações

- Manchester V Gardner Order of NoticeDocumento1 páginaManchester V Gardner Order of NoticeGrant BosseAinda não há avaliações

- Wallner V Gardner ExhibitsDocumento121 páginasWallner V Gardner ExhibitsGrant BosseAinda não há avaliações

- McAuliffe Order - Dartmouth-Hitchcock V ToumpasDocumento3 páginasMcAuliffe Order - Dartmouth-Hitchcock V ToumpasGrant BosseAinda não há avaliações

- Concord V Gardner PetitionDocumento76 páginasConcord V Gardner PetitionGrant BosseAinda não há avaliações

- Manchester V Gardner PetitionDocumento9 páginasManchester V Gardner PetitionGrant BosseAinda não há avaliações

- Concord V Gardner ExhibitsDocumento16 páginasConcord V Gardner ExhibitsGrant BosseAinda não há avaliações

- Dred - Bald Mileage EstimateDocumento1 páginaDred - Bald Mileage EstimateGrant BosseAinda não há avaliações

- Dartmouth-Hitchcock V Toumpas 03-02-12 OrderDocumento31 páginasDartmouth-Hitchcock V Toumpas 03-02-12 OrderGrant BosseAinda não há avaliações

- Scholarship Tax Credit Programs AnalysisDocumento28 páginasScholarship Tax Credit Programs AnalysisGrant BosseAinda não há avaliações

- Defendant's Reply To Plaintiff's Objection To MTDDocumento10 páginasDefendant's Reply To Plaintiff's Objection To MTDGrant BosseAinda não há avaliações

- Fish and Game State VehiclesDocumento1 páginaFish and Game State VehiclesGrant BosseAinda não há avaliações

- Health and Human Services State VehiclesDocumento1 páginaHealth and Human Services State VehiclesGrant BosseAinda não há avaliações

- State of NH General Obligation Capital Improvement Bonds 2011Documento106 páginasState of NH General Obligation Capital Improvement Bonds 2011Grant BosseAinda não há avaliações

- Plaintiff's Reply in Support of Motion For Preliminary InjunctionDocumento20 páginasPlaintiff's Reply in Support of Motion For Preliminary InjunctionGrant BosseAinda não há avaliações

- Corrections State Vehicle RequestsDocumento2 páginasCorrections State Vehicle RequestsGrant BosseAinda não há avaliações

- NH DRED State Vehicle RequestsDocumento7 páginasNH DRED State Vehicle RequestsGrant BosseAinda não há avaliações

- NH Liquor Commission State Vehicles RequestsDocumento4 páginasNH Liquor Commission State Vehicles RequestsGrant BosseAinda não há avaliações

- Plaintiff's Objection To Defendant's Motion To DismissDocumento23 páginasPlaintiff's Objection To Defendant's Motion To DismissGrant BosseAinda não há avaliações

- Fitch Bond Statement On NH GO Bond Sale 10-18-2011Documento3 páginasFitch Bond Statement On NH GO Bond Sale 10-18-2011Grant BosseAinda não há avaliações

- S&P Bond Statement On NH GO Bonds 10-19-11Documento8 páginasS&P Bond Statement On NH GO Bonds 10-19-11Grant BosseAinda não há avaliações

- Smith Affidavit in Support of ObjectionDocumento3 páginasSmith Affidavit in Support of ObjectionGrant BosseAinda não há avaliações

- DILG Legal Opinion Archive IndexDocumento32 páginasDILG Legal Opinion Archive IndexFrankneil Adducul100% (3)

- AnnounceDocumento14 páginasAnnounceskydawn0% (1)

- Audit of Insurance IndustryDocumento2 páginasAudit of Insurance IndustryJuenAinda não há avaliações

- IIT Madras Fees Circular Jan-May 2020Documento14 páginasIIT Madras Fees Circular Jan-May 2020SAMIM AKHTARAinda não há avaliações

- Axa PhilippinesDocumento3 páginasAxa Philippinesaccounting probAinda não há avaliações

- Bancassurance FAQs for EFU Life InsuranceDocumento7 páginasBancassurance FAQs for EFU Life InsuranceAzeem AnwarAinda não há avaliações

- National Insurance Commission: NAICOM............................. For A Healthier Insurance Industry in NigeriaDocumento20 páginasNational Insurance Commission: NAICOM............................. For A Healthier Insurance Industry in NigeriaApuyor VictoryAinda não há avaliações

- Management Accounting SCDL: by Prof. Augustin AmaladasDocumento109 páginasManagement Accounting SCDL: by Prof. Augustin AmaladasMadhushree GavaskarAinda não há avaliações

- A1. Offer Document (Clean) PDFDocumento565 páginasA1. Offer Document (Clean) PDFInvest StockAinda não há avaliações

- Metro Board of Directors April 2019 AgendaDocumento20 páginasMetro Board of Directors April 2019 AgendaMetro Los AngelesAinda não há avaliações

- Bank of BarodaDocumento81 páginasBank of BarodalovelydineshAinda não há avaliações

- Icons of Hollywood Auction Catalog (Session 1)Documento145 páginasIcons of Hollywood Auction Catalog (Session 1)malagirlfriend0% (1)

- Reinstatement Form For Individual PolicyownerDocumento2 páginasReinstatement Form For Individual PolicyownerSamantha Joyce ValeraAinda não há avaliações

- Marketing Of Services For HDFC Life InsuranceDocumento24 páginasMarketing Of Services For HDFC Life InsuranceheenaAinda não há avaliações

- Bus Company Liable for Passenger's DeathDocumento3 páginasBus Company Liable for Passenger's DeathKrizzia GojarAinda não há avaliações

- Purchase Order: BAL LDS NLD/PUR/2029368Documento10 páginasPurchase Order: BAL LDS NLD/PUR/2029368chetanchodaAinda não há avaliações

- HW 2-SolnDocumento9 páginasHW 2-SolnZhaohui ChenAinda não há avaliações

- Fintech - Teaser Pitch Deck RedactedDocumento12 páginasFintech - Teaser Pitch Deck RedactedMinh NguyenAinda não há avaliações

- ING Global Real Estate FundDocumento3 páginasING Global Real Estate FundManoj V ReddyAinda não há avaliações

- N5 Financial Accounting - UpdatedDocumento28 páginasN5 Financial Accounting - UpdatedAnil HarichandreAinda não há avaliações

- EE Wefare GainDocumento29 páginasEE Wefare GainAditya ShahAinda não há avaliações

- Sol. Man. - Chapter 12 - Insurance Contracts - 2020 EditionDocumento4 páginasSol. Man. - Chapter 12 - Insurance Contracts - 2020 EditionKathleen Rose BambicoAinda não há avaliações

- 95 Phil Charter Insurance V Chemoil Lighterage CorpDocumento2 páginas95 Phil Charter Insurance V Chemoil Lighterage Corpsmtm06100% (1)

- GDS To MTS - SAPOST PDFDocumento40 páginasGDS To MTS - SAPOST PDFnani Kvpli100% (2)

- Claim Form - OPD TreatmentDocumento2 páginasClaim Form - OPD Treatmentsovan kumar pattasaniAinda não há avaliações

- Teachers' Benefits Privileges and WelfareDocumento79 páginasTeachers' Benefits Privileges and WelfareHerzenne TimtimanAinda não há avaliações

- International Logistics, Risks, and Insurance ClaimsDocumento26 páginasInternational Logistics, Risks, and Insurance ClaimsNgọc YếnAinda não há avaliações

- K.Venkat Reddy-Offerletter PDFDocumento21 páginasK.Venkat Reddy-Offerletter PDFFrontdoorAinda não há avaliações

- Final SIP Report 4Documento62 páginasFinal SIP Report 4Aveena GhoshAinda não há avaliações

- Religare Health Insurance Policy SummaryDocumento5 páginasReligare Health Insurance Policy SummarysomnathAinda não há avaliações