Escolar Documentos

Profissional Documentos

Cultura Documentos

Valuing intangible assets like brands

Enviado por

Garima MadanDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Valuing intangible assets like brands

Enviado por

Garima MadanDireitos autorais:

Formatos disponíveis

24/08/2013

Intangibles

Intangible assets have a significant role in growth of a company. Intangibles include: Tradename/ Trademark (Brand) Human Resources Proprietary Technology/ R&D Capability Distribution Systems Business Relations(Suppliers, Customers) Brand is an Intangible Asset

Brand Valuation 2

Brand Valuation

Benefits of Brands

What is in a (Brand) Name Costs to create Long life(trade names) Provide stable and profitable earnings stream Help increase market share Provide Barriers to entry Differentiate products (even commodities) International recognition Leverage equity into new markets

What Brands are?

Brand includes: Trademarks & logo Packaging & get-up Proprietary design For the purpose of valuation, Brand generally recognised as a: specific, separable, and transferable asset No finite life Clear legal title

3 Brand Valuation 4

Brand Valuation

Why value Brands?

Acquisitions/Disposal/Joint Ventures Licensing/Franchising Strategic Planning/Reorganization Image Building: Additional information to shareholders & other stakeholders

Acquirer Coca-Cola Godrej R&C Colgate Dabur

Brand Valuations in India

Acquisition Deals:

Brand Parle owned brands (Thums Up etc.) Transelectra Burnol Cibaca Binaca Value (Rs Crores) 180 80 12 131 1

Additional Information:

Infosys BPL Cheminor Drugs

Brand Valuation

Brand Valuation

24/08/2013

Brand Valuation - Methodologies

Brand Earning Multiple Approach (Interbrand)

Deduct non-brand profits from historical EBIT stream

Brand Earning Multiple Approach (Interbrand) Excess Value Approach Relief from Royalty Approach Capitalization of Losses/Advertisement expenditure Restate at present value using Inflation compound factor and calculate weighted average profits Deduct Remuneration on Average Capital employed and tax outflow to arrive at the Net Brand Earnings Apply Brand Value/Brand Earning multiple (Based on Value Drivers) to obtain Brand Value.

Brand Valuation 8

Brand Valuation

Interbrand Approach: An Illustration

(Rs. Lacs)

Determination of Brand Earning Multiple (Value Driver Analysis)

Yr 1 20.95 24.44

1. 2. 3. 4. 5. 6. 7. 8.

Particulars EBIT less Non-brand Income Present Value of Brand Profits

(Compounded @ inflation=8% p.a.)

Yr 3 63.43 63.43 48.54 7.15 14.48 26.90 18.65 501.69

Yr 2 35.41 38.24

Weighted Average Brand Profits

(Weights 3:2:1)

Value Driver Leadership Stability Market

Less:Remuneration on Capital Employed

(@ 5% of Capital Employed)

Taxes (@ 35%) Post-Tax Brand Profits Brand Value/Brand Earnings Multiple Brand Value

Market Share & Influence Long estab lished Type of Market,Market Structure,Growth Trend Internationality International acceptance & appeal Longetivity,ab ility to Trend rem ain relevant Consistent investm ent, Support Management focus Registered tradem ark, Protection statutory protection

Max Score Brand Score 25 20 20 18 20 18 10 10 10 5 8 8 9 4

Brand Valuation

Brand Valuation

10

Determination of Brand Earning Multiple

(S-Curve Interpolation)

Excess Value Approach

Assessment of Enterprise Value using DCF/Multiple/ other approaches Determination of fair value of tangible assets Assessment of Intangible value by deducting the fair value of Tangible assets from Enterprise Value Allocation of Intangible value to Brand and Other Intangibles

Brand Valuation

11

Brand Valuation

12

24/08/2013

Excess Value Approach: An Illustration

(Rs Lacs)

Determination of Brand Share in Intangibles

Intangible Assets Human Resources Management Quality Proprietary Technology Customer Relationship Supplier Relationship Distribution System Product/Corporate Brand Relevance ** ** * ** * *** **** 45%

14

Particulars

Total Enterprise value Less: Assessment of Tangible Assets Value of Attributable to Intangibles Share of Brand in Total Intangibles Value of Brand

Min

750 293 457 45% 206

Max

820 293 527 45% 237

Strength of Company M M L M L H H

Share of Brand in Total Intangibles

Brand Valuation 13 Brand Valuation

Relief from Royalty Approach

Premise: Savings in Royalty by owning the Brand Forecast Revenue attributable to Brand Multiple by applicable Royalty Rate Deduct tax to arrive at net royalty savings Discount the royalty savings stream to present value to arrive at the Brand Value

Relief from Royalty Approach

(Rs Lacs)

Particulars Revenue attributable to Brand Royalty(@ 10%) Taxes (@ 35%) After-tax Royalty cost savings Present Value Factor (@10%) PV of Royalty Savings Sum of PV of Royalty Savings

Brand Valuation 15 Brand Valuation

Yr 1

Yr 2

Yr 3

Yr 4

Perpetuity ~ ~ ~ ~ ~ ~

479.10 535.50 613.70 717.30 47.91 16.77 31.14 53.55 18.74 34.81 61.37 21.48 39.89 71.73 25.11 46.62

0.9091 0.8264 0.7513 0.6830 28.31 530.31 28.77 29.97 31.85

16

Capitalization of Losses/Ad Exp.

Assess the losses/expenditure incurred on Advertisement on the Brand over the years; Calculate the Present worth of such losses; Capitalize the Present worth to have a fix on the Brand Value.

Brand Valuation

17

Você também pode gostar

- Valuation and modelling toolkitDocumento440 páginasValuation and modelling toolkitFaizan Maqsood98% (40)

- Petition To Approve AccountingDocumento6 páginasPetition To Approve AccountingBryan Coryell100% (2)

- WACC Workout FullDocumento29 páginasWACC Workout Fulldevilcaeser2010Ainda não há avaliações

- MBA 290-Strategic AnalysisDocumento110 páginasMBA 290-Strategic AnalysisAllan YeungAinda não há avaliações

- Cost Benefit AnalysisDocumento2 páginasCost Benefit AnalysisPrayush RajbhandariAinda não há avaliações

- Jeff Bishop-10x Portfolio Blueprint PDFDocumento61 páginasJeff Bishop-10x Portfolio Blueprint PDFkuda hitam50% (4)

- Balanced Scorecard Framework ExplainedDocumento19 páginasBalanced Scorecard Framework Explainedraj92117Ainda não há avaliações

- Advanced Strategic ManagementDocumento110 páginasAdvanced Strategic ManagementDr Rushen SinghAinda não há avaliações

- ValComp Tutorial 2014 (Unlocked)Documento36 páginasValComp Tutorial 2014 (Unlocked)Harsh ChandaliyaAinda não há avaliações

- Business Process Mapping: How to improve customer experience and increase profitability in a post-COVID worldNo EverandBusiness Process Mapping: How to improve customer experience and increase profitability in a post-COVID worldAinda não há avaliações

- Managing Performance with Balanced ScorecardDocumento25 páginasManaging Performance with Balanced ScorecardPooja RanaAinda não há avaliações

- 04.situation Analysis Value ChainDocumento32 páginas04.situation Analysis Value ChainSubham DuttaAinda não há avaliações

- Principles of Finance 6th Edition Besley Solutions ManualDocumento36 páginasPrinciples of Finance 6th Edition Besley Solutions Manualalexandrapearli5zj100% (27)

- MBA 290-Strategic AnalysisDocumento110 páginasMBA 290-Strategic AnalysisAbhishek SoniAinda não há avaliações

- Dealer Reference GuideDocumento2 páginasDealer Reference GuideFranquAinda não há avaliações

- 100 Baggers: Stocks That Return 100-To-1 and How To Find Them - ValueWalkDocumento7 páginas100 Baggers: Stocks That Return 100-To-1 and How To Find Them - ValueWalkkasipetAinda não há avaliações

- IT Sourcing StrategyDocumento14 páginasIT Sourcing StrategysameerparadiaAinda não há avaliações

- Business Strategy: Differentiation, Cost Leadership, and IntegrationDocumento50 páginasBusiness Strategy: Differentiation, Cost Leadership, and IntegrationiftikharAinda não há avaliações

- Build an M&A StrategyDocumento30 páginasBuild an M&A StrategySerge BerezovskyAinda não há avaliações

- America's Most Successful Startups LessonsDocumento179 páginasAmerica's Most Successful Startups Lessonssclark2006100% (1)

- Keller SBM5e Accessible CH09Documento25 páginasKeller SBM5e Accessible CH09Vương Trần Cao PhướcAinda não há avaliações

- Session - Brand Metrics PDFDocumento132 páginasSession - Brand Metrics PDFTejesh PatelAinda não há avaliações

- Chapter 15 Company AnalysisDocumento51 páginasChapter 15 Company Analysissharktale282850% (2)

- Chapter 15 Company AnalysisDocumento52 páginasChapter 15 Company AnalysisSamantha WrightAinda não há avaliações

- Brand Finance Global 500Documento40 páginasBrand Finance Global 500JulianAinda não há avaliações

- How to Apply Marketing Theories for "The Marketing Audit": 27 Theories Practical Example insideNo EverandHow to Apply Marketing Theories for "The Marketing Audit": 27 Theories Practical Example insideAinda não há avaliações

- The Revenue Acceleration Rules: Supercharge Sales and Marketing Through Artificial Intelligence, Predictive Technologies and Account-Based StrategiesNo EverandThe Revenue Acceleration Rules: Supercharge Sales and Marketing Through Artificial Intelligence, Predictive Technologies and Account-Based StrategiesAinda não há avaliações

- Value Based ManagementDocumento13 páginasValue Based Managementvipul100% (1)

- Goals, Values and Performance: OutlineDocumento15 páginasGoals, Values and Performance: OutlineNarayanan SubramanianAinda não há avaliações

- MarriottDocumento16 páginasMarriotta.hasan670Ainda não há avaliações

- Evaluation and Control: - Which Measures To Use To Assess Performance Depends OnDocumento35 páginasEvaluation and Control: - Which Measures To Use To Assess Performance Depends OndongakodluAinda não há avaliações

- Measuring Outcome of Brand EquityDocumento38 páginasMeasuring Outcome of Brand EquityMitali KolambekarAinda não há avaliações

- Session 5 A (CH 12) - Strategy & BS - Canvas - TeachingDocumento32 páginasSession 5 A (CH 12) - Strategy & BS - Canvas - Teaching長長Ainda não há avaliações

- Session 3-Intrinsic Valuation-IDocumento22 páginasSession 3-Intrinsic Valuation-IHariSharanPanjwaniAinda não há avaliações

- Brand EquityDocumento52 páginasBrand Equityshanupuneet100% (1)

- Business Level StrategyDocumento24 páginasBusiness Level StrategyagrawalshrutiAinda não há avaliações

- Chapter Two: Implementing Strategy: The Value Chain, The Balanced Scorecard, and The Strategy MapDocumento27 páginasChapter Two: Implementing Strategy: The Value Chain, The Balanced Scorecard, and The Strategy MapMeyling NatasiaAinda não há avaliações

- Pertemuan Ke 5 Management StrategicDocumento33 páginasPertemuan Ke 5 Management StrategicErica SPAinda não há avaliações

- Brand Valuation - MercDocumento11 páginasBrand Valuation - MercLakshya ChawlaAinda não há avaliações

- Strategy Class 5.B BusinessDocumento20 páginasStrategy Class 5.B BusinessmartalebronvillenAinda não há avaliações

- Company AnalysisDocumento26 páginasCompany AnalysisNelson LiewAinda não há avaliações

- BBA IT 2009 E-StrategyDocumento73 páginasBBA IT 2009 E-StrategyKushagra JainAinda não há avaliações

- Corporate Image, Product Positioning and Brand Equity: The Successful Use of Trademarks and Industrial DesignsDocumento66 páginasCorporate Image, Product Positioning and Brand Equity: The Successful Use of Trademarks and Industrial DesignsPramod MauryaAinda não há avaliações

- How To Create A Research ReportDocumento24 páginasHow To Create A Research ReportJayden JiangAinda não há avaliações

- Organisational Appraisal 7s Mckinsey 3Documento51 páginasOrganisational Appraisal 7s Mckinsey 3Niharika GaurAinda não há avaliações

- SIBM-2013-International Syllabus Naren AyyarDocumento72 páginasSIBM-2013-International Syllabus Naren AyyarSwapnil KulkarniAinda não há avaliações

- Introduction to BrandingDocumento16 páginasIntroduction to BrandingjsmnjasminesAinda não há avaliações

- I UnitDocumento37 páginasI Unityogitha reddyAinda não há avaliações

- IPPTChap001 1Documento19 páginasIPPTChap001 1dannavillafuenteAinda não há avaliações

- Goals, Values and PerformanceDocumento13 páginasGoals, Values and PerformanceNarayanan SubramanianAinda não há avaliações

- Developing A Brand Equity Measurement and Management SystemDocumento17 páginasDeveloping A Brand Equity Measurement and Management SystemSyed Zeeshan Hyder ZaidiAinda não há avaliações

- Chapter 1 Financial Management and Its RolesDocumento24 páginasChapter 1 Financial Management and Its RolesDesu GashuAinda não há avaliações

- George PresentationDocumento39 páginasGeorge PresentationGeorge Lugembe MalyetaAinda não há avaliações

- Brainstorming Session On New Business Venture "House Appliances" Group 7Documento39 páginasBrainstorming Session On New Business Venture "House Appliances" Group 7sajibAinda não há avaliações

- Developing Marketing Strategies and PlansDocumento47 páginasDeveloping Marketing Strategies and PlansPooja SuranaAinda não há avaliações

- Chap 8 BSDocumento38 páginasChap 8 BSPrazavi JainAinda não há avaliações

- OF Strategic Planning ConceptsDocumento61 páginasOF Strategic Planning ConceptsHarshal NaikAinda não há avaliações

- Goals, Value and PerformanceDocumento18 páginasGoals, Value and PerformanceSamridh AgarwalAinda não há avaliações

- CH 7 E Business StrategiesDocumento46 páginasCH 7 E Business Strategiesanuraj kapuskarAinda não há avaliações

- BIMTECH MMI VII Company AnalysisDocumento81 páginasBIMTECH MMI VII Company AnalysisHitesh SharmaAinda não há avaliações

- Operations Strategy PresentationDocumento22 páginasOperations Strategy PresentationbamneakashfunAinda não há avaliações

- Operational Definition of BenchmarkingDocumento26 páginasOperational Definition of BenchmarkingtgvnayagamAinda não há avaliações

- Unit 4-Formulation of Corporate, Business, and Functional StrategiesDocumento20 páginasUnit 4-Formulation of Corporate, Business, and Functional StrategiesChandu TammanaAinda não há avaliações

- Value Based ManagementDocumento13 páginasValue Based Managementgagan8352100% (1)

- Implication of Walmart's Acquisition of FlipkartDocumento5 páginasImplication of Walmart's Acquisition of FlipkartGarima Madan100% (1)

- 3 PDFDocumento22 páginas3 PDFGarima MadanAinda não há avaliações

- 3 PDFDocumento22 páginas3 PDFGarima MadanAinda não há avaliações

- 2.world Economy EconomistDocumento8 páginas2.world Economy EconomistGarima MadanAinda não há avaliações

- Part-2 - Subsi Financials FY18 PDFDocumento568 páginasPart-2 - Subsi Financials FY18 PDFGarima MadanAinda não há avaliações

- Monetary PolicyDocumento47 páginasMonetary PolicyGarima MadanAinda não há avaliações

- Eco India ReformsDocumento50 páginasEco India ReformsGarima MadanAinda não há avaliações

- Economic Environment of BusinessDocumento54 páginasEconomic Environment of BusinessJaideep JainAinda não há avaliações

- Electromagnetic WarheadsDocumento16 páginasElectromagnetic WarheadsGarima MadanAinda não há avaliações

- Corporate Restructuring, Mergers & Acquisitions OverviewDocumento25 páginasCorporate Restructuring, Mergers & Acquisitions OverviewGarima MadanAinda não há avaliações

- 29 - 12th Five Year Plan - NASSCOM Inputs - April 2011Documento18 páginas29 - 12th Five Year Plan - NASSCOM Inputs - April 2011mkshriAinda não há avaliações

- Start Stop System Automobiles: Submitted By: Garima Madan Eee 7 SEM ROLL NO. 0771504907Documento52 páginasStart Stop System Automobiles: Submitted By: Garima Madan Eee 7 SEM ROLL NO. 0771504907Garima MadanAinda não há avaliações

- ChinaDocumento103 páginasChinaGarima MadanAinda não há avaliações

- Start Stop System Automobiles: Submitted By: Garima Madan Eee 7 SEM ROLL NO. 0771504907Documento52 páginasStart Stop System Automobiles: Submitted By: Garima Madan Eee 7 SEM ROLL NO. 0771504907Garima MadanAinda não há avaliações

- Start Stop System Automobiles: Submitted By: Garima Madan Eee 7 SEM ROLL NO. 0771504907Documento52 páginasStart Stop System Automobiles: Submitted By: Garima Madan Eee 7 SEM ROLL NO. 0771504907Garima MadanAinda não há avaliações

- Be 313 - Week 4-5 - Unit Learning CDocumento32 páginasBe 313 - Week 4-5 - Unit Learning Cmhel cabigonAinda não há avaliações

- IPCC Auditing NotesDocumento17 páginasIPCC Auditing NotesAshish Bhojwani50% (4)

- Module 4 - The Essence of Financial StatementsDocumento31 páginasModule 4 - The Essence of Financial StatementsBellela DumpAinda não há avaliações

- LSBF Strategic Planning Longitudinal StudyDocumento8 páginasLSBF Strategic Planning Longitudinal StudyRuhi QuadriAinda não há avaliações

- Fin254 Chapter 6Documento18 páginasFin254 Chapter 6Wasif KhanAinda não há avaliações

- TNC and MNCDocumento23 páginasTNC and MNCShashank GoelAinda não há avaliações

- Period Cash Flow Future Value: Investment 2Documento2 páginasPeriod Cash Flow Future Value: Investment 2Kim FloresAinda não há avaliações

- Annual Report 2019 PDFDocumento178 páginasAnnual Report 2019 PDFSalauddin Imran MumitAinda não há avaliações

- Xerox Case - MS PresentationDocumento7 páginasXerox Case - MS PresentationsrinivasAinda não há avaliações

- A Project Report On Depository: in Partial Fulfilment of The Degree in Master of Business Administration (MBA)Documento88 páginasA Project Report On Depository: in Partial Fulfilment of The Degree in Master of Business Administration (MBA)Ekta AnejaAinda não há avaliações

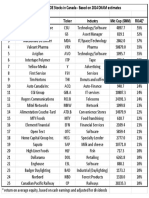

- High ROE Stocks in Canada 2014Documento1 páginaHigh ROE Stocks in Canada 2014PattyPattersonAinda não há avaliações

- Joint yacht operation revenue, expenses, and profit share calculationDocumento3 páginasJoint yacht operation revenue, expenses, and profit share calculationMitch Tokong MinglanaAinda não há avaliações

- A Study On Role of Gold Portfolio AllocationDocumento6 páginasA Study On Role of Gold Portfolio AllocationNITINAinda não há avaliações

- The Visible HandDocumento41 páginasThe Visible HandZerohedge100% (11)

- Personal Wealth Planning and ManagementDocumento28 páginasPersonal Wealth Planning and Managementanandyadav_imgAinda não há avaliações

- PDocumento21 páginasPjordenAinda não há avaliações

- Financial Ratio AnalysisDocumento32 páginasFinancial Ratio AnalysisTriechia LaudAinda não há avaliações

- Negative Rates and Bank ProfitabilityDocumento17 páginasNegative Rates and Bank ProfitabilityADBI EventsAinda não há avaliações

- Difference between Family and General Takaful (38Documento2 páginasDifference between Family and General Takaful (38Ibn Bashir Ar-Raisi100% (5)

- Corpfin8 PDFDocumento3 páginasCorpfin8 PDFLê Chấn PhongAinda não há avaliações

- Chique PresentationDocumento7 páginasChique Presentationapi-282632105Ainda não há avaliações

- Partnership: INTPRAB Notes From Brian Lim HDV/DNGDocumento28 páginasPartnership: INTPRAB Notes From Brian Lim HDV/DNGAbegail Llobo Gitana100% (1)

- Mathematical Methods for Economics: Calculating DerivativesDocumento8 páginasMathematical Methods for Economics: Calculating DerivativesLennard PangAinda não há avaliações