Escolar Documentos

Profissional Documentos

Cultura Documentos

Spss - Estudio de Caso

Enviado por

gustavo_ortizDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Spss - Estudio de Caso

Enviado por

gustavo_ortizDireitos autorais:

Formatos disponíveis

September 2008

Document

I93

ROI CASE STUDY SPSS INFINITY PROPERTY & CASUALTY

THE BOTTOM LINE

Infinity Property & Casualty Corporation (IPACC) deployed SPSS to reduce its payments on fraudulent claims and improve its ability to collect payments from other insurance companies. ROI: 403% Payback: 3 months

THE COMPANY

Infinity Property & Casualty Corporation (IPACC) is a provider of personal automobile insurance with an emphasis on nonstandard auto insurance. Nonstandard auto insurance provides coverage to drivers who, because of their driving record, age, or vehicle type, represent higher than normal risks and pay higher rates for coverage. The companys products provide insurance coverage for liability to others for bodily injury and property damage, and for physical damage to an insureds vehicle from collision and various other damages. IPACC distributes its products primarily through the Web and a network of independent agencies.

THE CHALLENGE

Because IPACC insures drivers who have higher incidences of accidents and claims, its profitability is highly dependent on its ability to identify fraudulent claims. It also needs to both maximize and accelerate the collection of subrogation payments, which are sought when a claim is the responsibility or partial responsibility of a driver who is not an IPACC policy holder. In early 2007, IPACC began looking for ways to automate the workflows and data gathering related to fraudulent and subrogated claims. The identification of potentially fraudulent claims was the responsibility of claims adjusters who had varying degrees of training and used inconsistent practices. As a result, data related to potentially fraudulent claims was typically not gathered rapidly or completely enough. Speed of investigation and the early gathering of key data are both important for claims investigators. The prompt initiation of fraud investigation tends to reduce factors that inflate the values of fraudulent claims, such as the number of injured parties and the extent of their injuries.

THE STRATEGY

In mid-2007, IPACC began looking for a solution that would enable the company to more rapidly identify and investigate suspicious claims. IPACC also wanted to be able to identify unsuspicious claims so that they could be handled rapidly in order

Corporate Headquarters Nucleus Research Inc. 100 State Street Boston, MA 02109 Phone: +1 617.720.2000 Fax: +1 617.720.2111

Nucleus Research Inc. NucleusResearch.com

September 2008

Document I93

TOPICS

Business Intelligence & Analytics

to improve customer satisfaction. IPACC evaluated solutions from ChoicePoint, IBM, and SPSS. The SPSS solution was chosen for a number of reasons, including: SPSS could be deployed on an on-premise basis, and IPACC wanted to maintain sole ownership of both the deployment and the underlying data. The SPSS platform could be expanded beyond claims management and could also be used for other insurance-specific functions including predictive models for pricing strategies, marketing strategies, product and agency management, and customer retention. Use of SPSS could also be expanded over time to support broader collection of data from different sources for analysis. The SPSS solution, although purpose-built for the insurance industry, could readily be customized to accommodate IPACCs workflows and preferences. After purchasing SPSS in July 2007, IPACC assembled a team of three people from IPACC who spent five months deploying the solution. The deployment required: Documentation. The team worked with the business units to create the optimal workflows for identifying suspicious claims, forwarding them for investigation, processing subrogated claims, and fast tracking unsuspicious claims. Rules building. Parameters were adjusted in SPSS to match IPACCs intended workflows. Fine tuning of red flags. The team fine tuned the settings in SPSS so that claims would be flagged as suspicious based on the geographic markets IPACC operates in and the riskier nature of its customer base. Testing. Once the rules and parameters were set, the tool was tested using an old body of claims for which the actual incidence of fraud was known. Based on these results, the tool was further fine tuned for deployment. SPSS was deployed in February 2008 and is used to identify suspicious claims before they are handled by investigators. Suspicious claims are forwarded to IPACCs 35 investigators who are now able to begin their investigations within days of a claim and have access to better data. Having used the tool to accelerate investigations and increase case closure rates, IPACC will soon utilize the textmining functionality to interpret and analyze the handwritten notes of claims adjusters so that they are more easily used in fraud investigations.

KEY BENEFIT AREAS

Adopting SPSS PredictiveClaims enabled IPACC to reduce claims payments and accelerate the collection of subrogation payments. Key benefits from the solution include: Accelerated payment collection. When an IPACC policy holder submits a claim in which another driver is partially or fully responsible for the accident, IPACC is now able to collect payment from that drivers insurer more rapidly because SPSS acquires and rapidly makes available the information required to successfully pursue collection. Additionally, the tool prioritizes collection efforts, so that payments from uninsured drivers are pursued last and payments from properly insured drivers are pursued first.

2008 Nucleus Research, Inc. Reproduction in whole or part without written permission is prohibited. Nucleus Research is the leading provider of bottom line-focused technology research and advice. www.NucleusResearch.com

September 2008

Document I93

BENEFITS

Indirect 1%

Direct 99%

TOTAL: $17,661,311

Reduced cost of claims payments. SPSS enables investigators to begin investigations earlier, before evidence becomes stale or peoples memories change. This leads to more successful investigations and reduced costs related to fraudulent claims activity.

KEY COST AREAS

Key cost areas for the deployment included software, consulting, personnel, and hardware.

COSTS

Personnel 8% Consulting 17% Hardware 3%

Training 2%

Software 70%

TOTAL: $1,270,063

The solution was deployed over a 5-month period by three employees of IPACC and three consultants from SPSS who assisted with construction of rules for data analysis and script building. At the end of the deployment, four employees received a week of training from SPSS. Software costs consisted of SPSS licenses and maintenance. Three new servers were deployed to support the project.

BEST PRACTICES

Although IPACC started using SPSS for claims, it chose SPSS over other applications because it could be expanded to additional business uses within and outside the claims department. For example, IPACC recently purchased an additional license for its actuarial area for customer retention and pricing analysis. As IPACC continues its deployment of SPSS, it plans to analyze how it can gain

2008 Nucleus Research, Inc. Reproduction in whole or part without written permission is prohibited. Nucleus Research is the leading provider of bottom line-focused technology research and advice. www.NucleusResearch.com

September 2008

Document I93

more value by both identifying new potential applications and how it can collect data from additional sources for more effective predictive modeling. IPACC is also using its knowledge from the initial deployment to fine-tune the application and make it a more integrated part of call center operations. For example, when a call center representative records a claim, the solution will continually reevaluate the claim as new details are entered into the system. Based on the interpretation of the claim, the application will give the call center representative a different response for the claimant based on whether the claim is likely to involve fraud, unlikely to involve fraud, or if more fraud-related data is needed. Because the proper questions will be asked and the proper data gathered during the first contact, SPSS will help IPACC to further streamline its claims management process.

CALCULATING THE ROI

Nucleus calculated the costs of software, consulting, personnel, hardware, and training over a 3-year period to quantify IPACCs total investment in SPSS. Direct benefits calculated included both avoided costs related to fraudulent claims and higher collection rates on subrogated claims. Indirect benefits consisted of accelerated collection of these claims. The value of avoided costs related to fraudulent claims was based on the increase in the number of successful investigations resulting from the deployment. The benefit from higher collection rates on subrogated claims was quantified based on the increased number of referrals to the subrogation claims department resulting from SPSS.

Nucleus Research is a global provider of investigative technology research and advisory services. Building on its unique ROI case study approach, for nearly a decade Nucleus Research has delivered insight and analysis on the true value of technology and strategies for maximizing current investments and exploiting new technology opportunities. For more information or a list of services, visit NucleusResearch.com, call +1-781-416-2900, or e-mail info@NucleusResearch.com.

2008 Nucleus Research, Inc. Reproduction in whole or part without written permission is prohibited. Nucleus Research is the leading provider of bottom line-focused technology research and advice. www.NucleusResearch.com

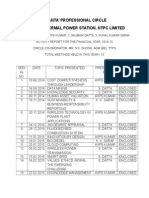

DETAILED FINANCIAL ANALYSIS INFINITY PROPERTY & CASUALTY

SUMMARY

Project: Annual return on investment (ROI) Payback period (years) Net present value (NPV) Average yearly cost of ownership SPSS 403% 0.25 5,967,279 426,765 Pre-start 0 0 0 Year 1 5,847,720 39,384 5,887,104 Year 2 5,847,720 39,384 5,887,104 Year 3 5,847,720 39,384 5,887,104

ANNUAL BENEFITS

Direct Indirect Total Benefits Per Period

DEPRECIATED ASSETS

Software Hardware Total Per Period

Pre-start 558,452 44,726 603,178

Year 1 0 0 0

Year 2 0 0 0

Year 3 0 0 0

DEPRECIATION SCHEDULE

Software Hardware Total Per Period

Pre-start 0 0 0

Year 1 111,690 8,945 120,636

Year 2 111,690 8,945 120,636

Year 3 111,690 8,945 120,636

EXPENSED COSTS

Software Hardware Consulting Personnel Training Other Total Per Period

Pre-start 0 0 223,614 15,963 10,232 0 249,809

Year 1 111,690 0 0 27,413 10,000 0 149,103

Year 2 111,690 0 0 27,413 0 0 139,103

Year 3 111,690 0 0 27,413 0 0 139,103

FINANCIAL ANALYSIS

Net cash flow before taxes Net cash flow after taxes Annual ROI - direct and indirect benefits Annual ROI - direct benefits only Net present value (NPV) Payback (years) Average annual cost of ownership 3-year IRR FINANCIAL ASSUMPTIONS All government taxes Discount rate

Pre-start (852,987) (728,082)

Year 1 5,738,001 2,929,318 402% 400%

Year 2 5,748,001 2,934,318 403% 400% 4,037,917 570,596

Year 3 5,748,001 2,934,318 403% 400% 5,967,279 0.25 426,765 399%

(728,082) 852,987 399%

1,819,151 1,002,089

50% 15%

2008 Nucleus Research, Inc. Reproduction in whole or part without written permission is prohibited. All calculations are based on Nucleus Research's independent analysis of the expected costs and benefits associated with the solution.

Você também pode gostar

- Automated Network Technology: The Changing Boundaries of Expert SystemsNo EverandAutomated Network Technology: The Changing Boundaries of Expert SystemsAinda não há avaliações

- Insurers Missing The Boat With Claims Technology: Property Casualty 360Documento4 páginasInsurers Missing The Boat With Claims Technology: Property Casualty 360Covenant22Ainda não há avaliações

- Data Analytics and The Auditor - ACCA GlobalDocumento5 páginasData Analytics and The Auditor - ACCA GlobalJasim UddinAinda não há avaliações

- Cloud Computing StudyDocumento3 páginasCloud Computing StudyShinoyAinda não há avaliações

- Case Study EcourierDocumento14 páginasCase Study EcourierHardik MevadaAinda não há avaliações

- Data AnalyticsDocumento5 páginasData AnalyticsMayal AhmedAinda não há avaliações

- Stackiq Insuranceind WPP FDocumento18 páginasStackiq Insuranceind WPP Fsmitanair143Ainda não há avaliações

- Future of Business Analytics PDFDocumento14 páginasFuture of Business Analytics PDFakay0505Ainda não há avaliações

- DATAMININGDocumento6 páginasDATAMININGWilliamMontenegroRiveraAinda não há avaliações

- SIA Romney Ch05Documento23 páginasSIA Romney Ch05Dewi SartikaAinda não há avaliações

- Privacy Impact Assessment Consultation Paper Automatic Number Plate Recognition Crimtrac Scoping StudyDocumento21 páginasPrivacy Impact Assessment Consultation Paper Automatic Number Plate Recognition Crimtrac Scoping StudykrishvickyAinda não há avaliações

- Fraud Detection and Analysis For Insurance Claim Using Machine LearningDocumento9 páginasFraud Detection and Analysis For Insurance Claim Using Machine LearningIJRASETPublicationsAinda não há avaliações

- 11 V May 2023Documento9 páginas11 V May 2023BrahimAinda não há avaliações

- Prediction of Enterprise Purchases Using Markov Models in Procurement Analytics ApplicationsDocumento10 páginasPrediction of Enterprise Purchases Using Markov Models in Procurement Analytics ApplicationsJunior John Fabian ArteagaAinda não há avaliações

- IbmDocumento6 páginasIbmhoangminh87Ainda não há avaliações

- Project Proposal CompiledDocumento13 páginasProject Proposal CompiledaukjiduAinda não há avaliações

- Innovation at Progressive: Pay As You Go InsuranceDocumento3 páginasInnovation at Progressive: Pay As You Go InsurancePatricia De La MotaAinda não há avaliações

- Insurance Fraud DetectionDocumento10 páginasInsurance Fraud DetectionNataraju GaddamaduguAinda não há avaliações

- Case Study: AirlinesDocumento6 páginasCase Study: AirlinesAngelica RoblesAinda não há avaliações

- B D A: C C I: by Michael W. Ellio, CPCU, AIAF, Senior Director of Knowledge Resources For The Ins TutesDocumento6 páginasB D A: C C I: by Michael W. Ellio, CPCU, AIAF, Senior Director of Knowledge Resources For The Ins Tutesdalyn carlAinda não há avaliações

- Bahut Bada File PDFDocumento6 páginasBahut Bada File PDFdalyn carlAinda não há avaliações

- Impact of Data Analytics On Reporting Quality of Forensic Audit - A Study Focus in Malaysian AuditorsDocumento24 páginasImpact of Data Analytics On Reporting Quality of Forensic Audit - A Study Focus in Malaysian AuditorsTherezia Tri RahayuAinda não há avaliações

- Ta-Data AnalyticsDocumento6 páginasTa-Data AnalyticsSubikshaa BaluAinda não há avaliações

- National Institute of Justice Fy07 Final Proposal Information-Led PolicingDocumento13 páginasNational Institute of Justice Fy07 Final Proposal Information-Led Policingali_winstonAinda não há avaliações

- Statistical Motor RatingDocumento88 páginasStatistical Motor RatingPaul WattellierAinda não há avaliações

- Claims Classification of Property Insurance Policies - SIET PaperDocumento3 páginasClaims Classification of Property Insurance Policies - SIET PaperHema Latha Krishna NairAinda não há avaliações

- Data Analytics and The Auditor PDFDocumento8 páginasData Analytics and The Auditor PDFAzeem KhanAinda não há avaliações

- Name Netid Group Number: Website Link: Tutorial Details Time Spent On AssignmentDocumento9 páginasName Netid Group Number: Website Link: Tutorial Details Time Spent On AssignmentTaniraFisher-MaramaAinda não há avaliações

- Insurance Management SystemDocumento5 páginasInsurance Management SystemVineet JainAinda não há avaliações

- Whitepaper: Insurance Business AnalyticsDocumento7 páginasWhitepaper: Insurance Business AnalyticsSanjay GuptaAinda não há avaliações

- Five Ways Artificial Intelligence and Machine Learning Deliver Business Impacts - GartnerDocumento8 páginasFive Ways Artificial Intelligence and Machine Learning Deliver Business Impacts - GartnerKeren MendesAinda não há avaliações

- Name Netid Group Number: Website Link: Tutorial Details: Tanira Fisher-MaramaDocumento9 páginasName Netid Group Number: Website Link: Tutorial Details: Tanira Fisher-MaramaTaniraFisher-MaramaAinda não há avaliações

- Analytix Industry White Paper - Big Data Accelerates Earnings Growth in Banking and InsuranceDocumento9 páginasAnalytix Industry White Paper - Big Data Accelerates Earnings Growth in Banking and Insurancejuergen_urbanski100% (1)

- Analytics Sales MaterialDocumento12 páginasAnalytics Sales MaterialJittesh Jagdish PurrohitAinda não há avaliações

- AXA Ireland Claims Management SystemDocumento5 páginasAXA Ireland Claims Management SystempToolsAinda não há avaliações

- Case Study - SISADocumento8 páginasCase Study - SISAApoorva ApoorvaAinda não há avaliações

- Quanta Professional CircleDocumento22 páginasQuanta Professional Circleron1234567890Ainda não há avaliações

- Epri It Eam 2007Documento134 páginasEpri It Eam 2007senohpAinda não há avaliações

- Project Proposal - Programming ProjectDocumento12 páginasProject Proposal - Programming ProjectMuema Kavulanya JoshuaAinda não há avaliações

- Chevyplan Group: Case StudyDocumento5 páginasChevyplan Group: Case StudyTris Retno0% (1)

- Early Detection of Critical Faults Using Time-Series Analysis On Heterogeneous Information Systems in The Automotive IndustryDocumento6 páginasEarly Detection of Critical Faults Using Time-Series Analysis On Heterogeneous Information Systems in The Automotive IndustryBruna RahdAinda não há avaliações

- AI in InsuranceDocumento8 páginasAI in InsuranceAjay BaviskarAinda não há avaliações

- Research Paper On Data Mining Techniques PDFDocumento4 páginasResearch Paper On Data Mining Techniques PDFgw0a869xAinda não há avaliações

- Business Analytics CIA 1Documento12 páginasBusiness Analytics CIA 1EKANSH DANGAYACH 20212619Ainda não há avaliações

- From Data To DecisionsThe Rise of Predictive Analytics in Decision MakingDocumento7 páginasFrom Data To DecisionsThe Rise of Predictive Analytics in Decision Makingamit.andre8144Ainda não há avaliações

- Making Cloud A Business AssetDocumento20 páginasMaking Cloud A Business Assetumaaruna uma11144Ainda não há avaliações

- Introduction To Predictive Analytics PDFDocumento10 páginasIntroduction To Predictive Analytics PDFEric Kevin LecarosAinda não há avaliações

- 041607Documento11 páginas041607Durga MaheshAinda não há avaliações

- Audit Command LanguageDocumento12 páginasAudit Command LanguageFrensarah RabinoAinda não há avaliações

- PPS Case Study For SilvermoonDocumento4 páginasPPS Case Study For SilvermoonMichael HauptAinda não há avaliações

- Ey Reporting Big Data Transform AuditDocumento5 páginasEy Reporting Big Data Transform AuditTHUY NGUYEN THANHAinda não há avaliações

- Sams Information Systems Deliverable 2 Group 514Documento10 páginasSams Information Systems Deliverable 2 Group 514SamJefferiesAinda não há avaliações

- Improving Automobile Insurance Ratemaking Using Telematics: Incorporating Mileage and Driver Behaviour DataDocumento23 páginasImproving Automobile Insurance Ratemaking Using Telematics: Incorporating Mileage and Driver Behaviour DataAdriana TirisAinda não há avaliações

- Case StudyDocumento4 páginasCase StudyGee-ann BadilloAinda não há avaliações

- CaseStudy3 71Documento1 páginaCaseStudy3 71Ankur SharmaAinda não há avaliações

- Why Data Is The FutureDocumento6 páginasWhy Data Is The FuturealvaroAinda não há avaliações

- Paper Propertys in Electrical EquipmentDocumento6 páginasPaper Propertys in Electrical EquipmentalumnopitagorasAinda não há avaliações

- Anurag Nayak ReportDocumento36 páginasAnurag Nayak Reporthimanshubehera73Ainda não há avaliações

- PM Planning - Case StudyDocumento88 páginasPM Planning - Case Studysunil_v550% (2)

- Cost Benefit Analysis Final DraftDocumento12 páginasCost Benefit Analysis Final Draftapi-545702063Ainda não há avaliações

- FABM2 (QUIZ 2) November 09, 2020 Ian BregueraDocumento2 páginasFABM2 (QUIZ 2) November 09, 2020 Ian Breguerafennie ilinah molinaAinda não há avaliações

- Strategies For Improving Capsule Filling EfficiencyDocumento4 páginasStrategies For Improving Capsule Filling EfficiencySangram KendreAinda não há avaliações

- Finman4e Quiz Mod18 040615Documento3 páginasFinman4e Quiz Mod18 040615Brian KangAinda não há avaliações

- Planning Notes Final 1Documento46 páginasPlanning Notes Final 1Aneej Neelakantan NAinda não há avaliações

- Quality Metal Service CenterDocumento5 páginasQuality Metal Service CenterDatuk JujuAinda não há avaliações

- Report PBCDocumento5 páginasReport PBCTOP No LimitAinda não há avaliações

- BrochureDocumento9 páginasBrochureLamro Triwandes SimatupangAinda não há avaliações

- De Guzman, Marie Pauline C. BSA 3-2 Transaction: ST ST ND NDDocumento10 páginasDe Guzman, Marie Pauline C. BSA 3-2 Transaction: ST ST ND NDMakoy BixenmanAinda não há avaliações

- Instructions For Products Excel FileDocumento4 páginasInstructions For Products Excel FileHelcon Ehl MagosAinda não há avaliações

- Complete Assignment - Docx (Final)Documento15 páginasComplete Assignment - Docx (Final)anmeannAinda não há avaliações

- Ceka - Icmd 2009 (B01)Documento4 páginasCeka - Icmd 2009 (B01)IshidaUryuuAinda não há avaliações

- Meetings For Merger & DemergerDocumento4 páginasMeetings For Merger & Demergerjinesh331Ainda não há avaliações

- UBI FullStatement PDFDocumento2 páginasUBI FullStatement PDFsamarth agrawal0% (1)

- Llanos de Juna Resort Project Feasibility Study (BSA-5A) 2014-2015Documento208 páginasLlanos de Juna Resort Project Feasibility Study (BSA-5A) 2014-2015snsdean100% (1)

- 2017/eur/pdf/DEVNET 2023 PDFDocumento45 páginas2017/eur/pdf/DEVNET 2023 PDFSayaOtanashiAinda não há avaliações

- Project FurnitureDocumento29 páginasProject FurnitureN sparklesAinda não há avaliações

- Magnetic Sponsoring by Mike DillardDocumento116 páginasMagnetic Sponsoring by Mike DillardChristine Stevie Grey100% (10)

- Presentation of Managerial Economics On: Banking Sector in IndiaDocumento16 páginasPresentation of Managerial Economics On: Banking Sector in IndiaArchana PawarAinda não há avaliações

- CIR Vs ST LukeDocumento7 páginasCIR Vs ST LukeMark Lester Lee Aure100% (2)

- HDFC Bank LTDDocumento1 páginaHDFC Bank LTDKhushi JainAinda não há avaliações

- Intro To Accounting Ch. 2Documento5 páginasIntro To Accounting Ch. 2Bambang HasmaraningtyasAinda não há avaliações

- Designing Good Fiscal System FinalDocumento54 páginasDesigning Good Fiscal System Finalbillal_m_aslamAinda não há avaliações

- Multinational Inventory ManagementDocumento2 páginasMultinational Inventory ManagementPiyush Chaturvedi75% (4)

- 1st Class: Certificate of Posting For Online PostageDocumento1 página1st Class: Certificate of Posting For Online PostageEllie JeanAinda não há avaliações

- Industry Analysis: Consumer ElectronicsDocumento11 páginasIndustry Analysis: Consumer ElectronicsHEM BANSALAinda não há avaliações

- 4 Differences Between Japanese and German Approaches To WorkDocumento3 páginas4 Differences Between Japanese and German Approaches To WorkParmpreet KaurAinda não há avaliações

- MOV Standard Food CostDocumento7 páginasMOV Standard Food CostAkbar Sullivan DaudAinda não há avaliações

- Money CreationDocumento3 páginasMoney CreationKarl_23Ainda não há avaliações

- Advertising (MNT Dew)Documento10 páginasAdvertising (MNT Dew)Yash GopalkaAinda não há avaliações

- Bus 100 Quiz 6 StrayerDocumento4 páginasBus 100 Quiz 6 Strayervfarkus7638Ainda não há avaliações