Escolar Documentos

Profissional Documentos

Cultura Documentos

Au 00110 PDF

Enviado por

Jhayanti Nithyananda KalyaniTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Au 00110 PDF

Enviado por

Jhayanti Nithyananda KalyaniDireitos autorais:

Formatos disponíveis

Responsibilities and Functions of the Independent Auditor

37

AU Section 110

Responsibilities and Functions of the Independent Auditor

Source: SAS No. 1, section 110; SAS No. 78; SAS No. 82. Issue date, unless otherwise indicated: November, 1972.

.01 The objective of the ordinary audit of nancial statements by the independent auditor is the expression of an opinion on the fairness with which they present, in all material respects, nancial position, results of operations, and its cash ows in conformity with generally accepted accounting principles. The auditor's report is the medium through which he expresses his opinion or, if circumstances require, disclaims an opinion. In either case, he states whether his audit has been made in accordance with generally accepted auditing standards. These standards require him to state whether, in his opinion, the nancial statements are presented in conformity with generally accepted accounting principles and to identify those circumstances in which such principles have not been consistently observed in the preparation of the nancial statements of the current period in relation to those of the preceding period.

Distinction Between Responsibilities of Auditor and Management

.02 The auditor has a responsibility to plan and perform the audit to obtain reasonable assurance about whether the nancial statements are free of material misstatement, whether caused by error or fraud.1 Because of the nature of audit evidence and the characteristics of fraud, the auditor is able to obtain reasonable, but not absolute, assurance that material misstatements are detected.2 The auditor has no responsibility to plan and perform the audit to obtain reasonable assurance that misstatements, whether caused by errors or fraud, that are not material to the nancial statements are detected. [Paragraph added, effective for audits of nancial statements for periods ending on or after December 15, 1997, by Statement on Auditing Standards No. 82.] .03 The nancial statements are management's responsibility. The auditor's responsibility is to express an opinion on the nancial statements. Management is responsible for adopting sound accounting policies and for establishing and maintaining internal control that will, among other things, initiate,

1 See section 312, Audit Risk and Materiality in Conducting an Audit, and section 316, Consideration of Fraud in a Financial Statement Audit. The auditor's consideration of illegal acts and responsibility for detecting misstatements resulting from illegal acts is dened in section 317, Illegal Acts by Clients. For those illegal acts that are dened in that section as having a direct and material effect on the determination of nancial statement amounts, the auditor's responsibility to detect misstatements resulting from such illegal acts is the same as that for error or fraud. [Footnote added, effective for audits of nancial statements for periods ending on or after December 15, 1997, by Statement on Auditing Standards No. 82.] 2 See section 230, Due Professional Care in the Performance of Work, paragraphs .10 through .13. [Footnote added, effective for audits of nancial statements for periods ending on or after December 15, 1997, by Statement on Auditing Standards No. 82.]

AU 110.03

38

Statements on Auditing Standards---Introduction

authorize, record, process, and report transactions (as well as events and conditions) consistent with management's assertions embodied in the nancial statements. The entity's transactions and the related assets, liabilities, and equity are within the direct knowledge and control of management. The auditor's knowledge of these matters and internal control is limited to that acquired through the audit. Thus, the fair presentation of nancial statements in conformity with generally accepted accounting principles3 is an implicit and integral part of management's responsibility. The independent auditor may make suggestions about the form or content of the nancial statements or draft them, in whole or in part, based on information from management during the performance of the audit. However, the auditor's responsibility for the nancial statements he or she has audited is conned to the expression of his or her opinion on them. [Revised, April 1989, to reect conforming changes necessary due to the issuance of Statement on Auditing Standards Nos. 53 through 62. As amended, effective for audits of nancial statements for periods beginning on or after January 1, 1997, by Statement on Auditing Standards No. 78. Paragraph renumbered by the issuance of Statement on Auditing Standards No. 82, February 1997. Revised, April 2002, to reect conforming changes necessary due to the issuance of Statement on Auditing Standards No. 94. Revised, March 2006, to reect conforming changes necessary due to the issuance of Statement on Auditing Standards No. 106.]

Professional Qualications

.04 The professional qualications required of the independent auditor are those of a person with the education and experience to practice as such. They do not include those of a person trained for or qualied to engage in another profession or occupation. For example, the independent auditor, in observing the taking of a physical inventory, does not purport to act as an appraiser, a valuer, or an expert in materials. Similarly, although the independent auditor is informed in a general manner about matters of commercial law, he does not purport to act in the capacity of a lawyer and may appropriately rely upon the advice of attorneys in all matters of law. [Paragraph renumbered by the issuance of Statement on Auditing Standards No. 82, February 1997.] .05 In the observance of generally accepted auditing standards, the independent auditor must exercise his judgment in determining which auditing procedures are necessary in the circumstances to afford a reasonable basis for his opinion. His judgment is required to be the informed judgment of a qualied professional person. [Paragraph renumbered by the issuance of Statement on Auditing Standards No. 82, February 1997.]

Detection of Fraud

[.06.09] [Superseded January 1977 by Statement on Auditing Standards No. 16, as superseded by Statement on Auditing Standards No. 53, as superseded by section 316. Paragraphs renumbered by the issuance of Statement on Auditing Standards No. 82, February 1997.]

3 The responsibilities and functions of the independent auditor are also applicable to nancial statements presented in conformity with a comprehensive basis of accounting other than generally accepted accounting principles; references in this section to nancial statements presented in conformity with generally accepted accounting principles also include those presentations. [Footnote added, effective for audits of nancial statements for periods beginning on or after January 1, 1997, by Statement on Auditing Standards No. 78. Footnote renumbered by the issuance of Statement on Auditing Standards No. 82, February 1997.]

AU 110.04

Responsibilities and Functions of the Independent Auditor

39

Responsibility to the Profession

.10 The independent auditor also has a responsibility to his profession, the responsibility to comply with the standards accepted by his fellow practitioners. In recognition of the importance of such compliance, the American Institute of Certied Public Accountants has adopted, as part of its Code of Professional Conduct, rules which support the standards and provide a basis for their enforcement. [Paragraph renumbered by the issuance of Statement on Auditing Standards No. 82, February 1997.]

AU 110.10

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- AS Unit 1 Revision Note Physics IAL EdexcelDocumento9 páginasAS Unit 1 Revision Note Physics IAL EdexcelMahbub Khan100% (1)

- KWU Recruit Select Online DISC Val Guide v3.2 PDFDocumento10 páginasKWU Recruit Select Online DISC Val Guide v3.2 PDFAntonio AlbieroAinda não há avaliações

- GCU CHP Flowchart PDFDocumento1 páginaGCU CHP Flowchart PDFJhayanti Nithyananda KalyaniAinda não há avaliações

- DCUBS Research Paper Series 13Documento33 páginasDCUBS Research Paper Series 13Jhayanti Nithyananda KalyaniAinda não há avaliações

- Soal Audit Chapter 7-13Documento6 páginasSoal Audit Chapter 7-13Jhayanti Nithyananda KalyaniAinda não há avaliações

- Sas 110Documento23 páginasSas 110Jhayanti Nithyananda KalyaniAinda não há avaliações

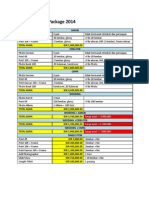

- Vphotography Package 2014: Harga Awal - 3.900.000 Harga Awal - 5.700.000 Harga Awal - 7.400.000Documento1 páginaVphotography Package 2014: Harga Awal - 3.900.000 Harga Awal - 5.700.000 Harga Awal - 7.400.000Jhayanti Nithyananda KalyaniAinda não há avaliações

- Branch Node City Node City Distance NodeDocumento3 páginasBranch Node City Node City Distance NodeJhayanti Nithyananda KalyaniAinda não há avaliações

- Sony: Betting It All On Blu-Ray SynopsisDocumento4 páginasSony: Betting It All On Blu-Ray SynopsisJhayanti Nithyananda KalyaniAinda não há avaliações

- Pertemuan 7Documento2 páginasPertemuan 7Jhayanti Nithyananda KalyaniAinda não há avaliações

- Objective Function Z X + X + X + X + X + X + X + X + X: Branch Node City Node City Distance Node Network FlowDocumento3 páginasObjective Function Z X + X + X + X + X + X + X + X + X: Branch Node City Node City Distance Node Network FlowJhayanti Nithyananda KalyaniAinda não há avaliações

- PHMSA Amended Corrective Action Order For Plains All American Pipeline Regarding Refugio Oil Spill in Santa Barbara CountyDocumento7 páginasPHMSA Amended Corrective Action Order For Plains All American Pipeline Regarding Refugio Oil Spill in Santa Barbara Countygiana_magnoliAinda não há avaliações

- Wall Chart - Drying - How Wood Loses MoistureDocumento1 páginaWall Chart - Drying - How Wood Loses MoistureXihuitl61100% (1)

- (I) (Ii) (Iii) (Iv) : Nahata Professional Academy Q1. Choose The Correct AnswerDocumento5 páginas(I) (Ii) (Iii) (Iv) : Nahata Professional Academy Q1. Choose The Correct AnswerBurhanuddin BohraAinda não há avaliações

- StratificationDocumento91 páginasStratificationAshish NairAinda não há avaliações

- MCQ Class VDocumento9 páginasMCQ Class VSneh MahajanAinda não há avaliações

- Assignment 1684490923Documento16 páginasAssignment 1684490923neha.engg45755Ainda não há avaliações

- Product Bulletin Fisher 8580 Rotary Valve en 123032Documento16 páginasProduct Bulletin Fisher 8580 Rotary Valve en 123032Rachmat MaulanaAinda não há avaliações

- Indian RailwaysDocumento20 páginasIndian RailwaysNirmalAinda não há avaliações

- DocuPrint C2255Documento2 páginasDocuPrint C2255sydengAinda não há avaliações

- Financial Fitness ChecklistDocumento4 páginasFinancial Fitness Checklistcoach_22Ainda não há avaliações

- Pass The TOEIC TestDocumento2 páginasPass The TOEIC TesteispupilAinda não há avaliações

- Price Negotiator E-CommerceDocumento17 páginasPrice Negotiator E-Commerce20261A3232 LAKKIREDDY RUTHWIK REDDYAinda não há avaliações

- Digitek Company Pre - QualificationDocumento103 páginasDigitek Company Pre - QualificationRey MichaelAinda não há avaliações

- Simulation of A Snake RobotDocumento61 páginasSimulation of A Snake Robotmuhammed inzamamAinda não há avaliações

- แบบฝึกหัด subjuctiveDocumento6 páginasแบบฝึกหัด subjuctiveรัฐพล ทองแตงAinda não há avaliações

- Memorandum For APDSA Indonesia 2Documento3 páginasMemorandum For APDSA Indonesia 2Renanda Rifki Ikhsandarujati RyanAinda não há avaliações

- SDS Jojoba Wax Beads 2860Documento7 páginasSDS Jojoba Wax Beads 2860swerAinda não há avaliações

- Practical No 4Documento5 páginasPractical No 4Mahin SarkarAinda não há avaliações

- Blood TestsDocumento3 páginasBlood TestsMarycharinelle Antolin MolinaAinda não há avaliações

- FAN XR UP1 - E7Documento26 páginasFAN XR UP1 - E7Mathieu MaesAinda não há avaliações

- A Plan of Life - Scepter BookletDocumento10 páginasA Plan of Life - Scepter Bookletpeteatkinson@gmail.comAinda não há avaliações

- Test A 10 - 12520231610Documento2 páginasTest A 10 - 12520231610Quang HuyAinda não há avaliações

- browningsong 안동Documento68 páginasbrowningsong 안동yooAinda não há avaliações

- Swift Case Study Mapping A Path To Iso 20022 With Swift Translator Jan2022Documento3 páginasSwift Case Study Mapping A Path To Iso 20022 With Swift Translator Jan2022Bolaji EsanAinda não há avaliações

- Anna May de Leon Galono, A089 528 341 (BIA Sept. 29, 2015)Documento7 páginasAnna May de Leon Galono, A089 528 341 (BIA Sept. 29, 2015)Immigrant & Refugee Appellate Center, LLCAinda não há avaliações

- Beacon Explorer B Press KitDocumento36 páginasBeacon Explorer B Press KitBob AndrepontAinda não há avaliações

- Aldehydes and Ketones LectureDocumento21 páginasAldehydes and Ketones LectureEvelyn MushangweAinda não há avaliações

- Dolomite in Manila Bay A Big HitDocumento3 páginasDolomite in Manila Bay A Big HitJoanaPauline FloresAinda não há avaliações