Escolar Documentos

Profissional Documentos

Cultura Documentos

Franklin India Oppoturnity Fund

Enviado por

Sandeep BorseDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Franklin India Oppoturnity Fund

Enviado por

Sandeep BorseDireitos autorais:

Formatos disponíveis

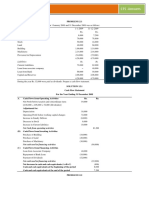

Value Research

FUNDCARD

Franklin India Opp

Rating:

Equity: Diversified

"The scheme aims to generate capital

appreciation by capitalising on the long-term

growth opportunities in the India economy."

Launch

Plans

Div Freq.

Redeem Time

Management Fee (%)

Dealing Time (Hrs.)

Min Investment (Rs.)

Min SIP Investment (Rs.)

Registrar

NAV

Click here to view this fund on ValueReseachOnline.com

Portfolio Manager

K N Siva Subramanian

(Since Jul 2007)

Advisor

Load:

Portfolio Analysis

10-03-04

Growth, Dividend

1.25

15 Hrs.

5000

500

Inhouse

29.27(2007-07-06)

2.25 % for investment upto Rs. 4.999 Cr.

High

Below Avg.

History

2007

2007

NAV

Total Return

Category Rank

2005

2005

2004

2004

2003

2003

2002

200

34.35

33.02

6.27

6433

6.81

65,875

%

13.89

25.57

41.48

Composition (%)

Equity

96.27

Debt

0.03

Cash

3.70

18.77

NA

34.15

56.53

35.01

Company

Inst.

India Cements

Construction 10.17

P/E

%Asset

9.21

HLL

Cons. ND

26.47

7.53

Siemens

Basic/Eng.

61.96

6.65

India Infoline

Technology 69.34

5.84

Bharat Electronics

Technology 20.51

5.48

Reliance Capital

Financial

41.36

4.91

Amara Raja Batteries

Basic/Eng.

12.65

4.61

16.70

11.43

9.21

5.01

8.39

56.09

48.03

NA

NA

NA

CESC

Energy

26.43

4.27

NA

Indian Hotels Co.

Services

30.37

4.19

Simplex Infrastructures Construction 35.68

4.13

Sun Pharmaceutical

Health Care 32.03

4.03

Reliance Communications Technology 43.46

3.96

Ansal Prop & Infra

Construction 22.24

3.39

Television Eighteen

Services

132.11

3.01

Matrix Laboratories

Health Care 40.23

2.84

16.51

14.23

NA

NA

9/145

44/101

NA

NA

NA

914.8

687.2

329.5

238.3

NA

NA

LOW

MODERATE

HIGH

Expenses & Turnover

Performance

Qtr 1

Qtr 2

Qtr 3

Qtr 4

Total

-8.75

27.37

-3.59

-7.06

-10.18

18.78

-13.21

14.88

-5.72

7.56

NA

23.02

23.62

14.75

37.60

NA

16.29

6.71

23.43

38.29

NA

58.14

46.11

24.03

83.83

2007-07-06

+/Category Growth of

Benchmark

Rank Rs 10,000

4.03

43/167

-2.64 122/163

13.11 26/161

9.38

22/116

11.07

17/81

7.43

25/56

7.48

--

% Allocation

26.41

Based on Standard Deviation

23.91

7.80

55.76

49.30

53.01

43.00

38.15

Benchmark

34

28.63

103/163

Net Assets Rs. Cr

Risk Meter

2006

2006

-0.61

+/-S&P CNX Nifty

3 Months

6 Months

1 Years

2 Years

3 Years

5 Years

SinceLaunch

Fund

Concentration

Top 5

Top 10

Top 3 (Sector)

Fund Performance Vs

Category Average

! Quarterly Fund Return

+/- Category Average

Category Baseline

Total

Fund Style Details

Total Stocks

P/E Ratio

P/B Ratio

Avg Mkt Cap(Cr.)

Market Cap

Giant

Large

Mid

Small

Tiny

Profile

Trailing Returns

Growth Blend Value

3 Working Days

Address: 4th Floor, Wockhardt Towers Next to NSE,

Bandra Kurla Complex, Bandra (East), ,

URL : www.franklintempletonindia.com

2007

2006

2005

2004

2003

FUND STYLE

Investment Style

NA

Advisor : Franklin Templeton Asset Management India

Return

Risk

2007-06-30

Capitalisation

Investment Information

Large Medium Small

Stated Objective Growth

12,391

10,780

15,576

22,290

35,823

59,856

29,270

Expense Ratio %

Management Fee

Turnover Ratio %

Net Assets Rs. Cr

03-07

03-06

03-05

03-04

2.22

2.34

2.30

2.34

1.15

NA

1.09 1.01

NA 90.97

1.11

NA

797.5

385.0 219.3

219.9

Risk Analysis

Volatility Measurements

Mean

Beta

3.80

1.01

Standard Deviation

R-Squared

6.69

0.74

0.51

0.65

Sharpe Ratio

Alpha

Best/Worst Ret

Best(Period)

Worst(Period)

Month

23.49(06/06-07/06) -34.53(05/06-06/06)

Quarter

47.65(06/06-09/06) -24.24(04/06-07/06)

Year

120.18(05/05-05/06) 3.27(04/06-04/07)

Sector

Weightings

% of

Stocks

Automobile

Basic/Eng.

Chemicals

Construction

Consumer D

Cons. ND

Diversified

Energy

Financial

Health Care

Metals

Others

Services

Technology

Textiles

2.91

11.27

1.76

19.81

NA

7.53

NA

4.84

7.27

8.41

NA

NA

12.65

17.16

2.65

Rel to

5-yyear

Benchmark High

Low

4.95

5.77

1.34

4.98

0.19

6.05

6.32

16.51

20.78

4.26

5.45

NA

3.25

19.95

0.21

18.44

11.27

5.18

34.45

2.32

10.53

22.42

16.78

19.61

19.26

15.79

14.35

18.34

32.56

8.63

2.76

0.26

0.63

0.05

0.16

0.08

2.26

1.04

0.55

0.19

1.10

0.00

3.02

0.00

0.04

www.valueresearchonline.com

2133-070710172830

Você também pode gostar

- Unstuck & Unstoppable: Revolutionizing Organizational GrowthNo EverandUnstuck & Unstoppable: Revolutionizing Organizational GrowthAinda não há avaliações

- HDFC Equity FundDocumento1 páginaHDFC Equity FundSandeep BorseAinda não há avaliações

- Franklin India Flexicap FundDocumento1 páginaFranklin India Flexicap FundSandeep BorseAinda não há avaliações

- Reliance Equity Opportunities FundDocumento1 páginaReliance Equity Opportunities FundSandeep BorseAinda não há avaliações

- Fidelity Special Situations FundDocumento1 páginaFidelity Special Situations FundSandeep BorseAinda não há avaliações

- Top Pick SMFDocumento5 páginasTop Pick SMFDebjit DasAinda não há avaliações

- HDFC Mutual FUNDDocumento22 páginasHDFC Mutual FUNDSushma VegesnaAinda não há avaliações

- Reliance GrowthDocumento2 páginasReliance GrowthRoseRose RoseAinda não há avaliações

- 05aug2014 India DailyDocumento73 páginas05aug2014 India DailyChaitanya JagarlapudiAinda não há avaliações

- Uti SunderDocumento1 páginaUti SunderSairam PrasathAinda não há avaliações

- Asc 202311013 2050Documento1 páginaAsc 202311013 2050Harendra BabuAinda não há avaliações

- Presented By: Himanshu Gurani Roll No. 33Documento27 páginasPresented By: Himanshu Gurani Roll No. 33AshishBhardwajAinda não há avaliações

- JM Emerging LeadersDocumento1 páginaJM Emerging LeadersSandeep BorseAinda não há avaliações

- Axis Factsheet February 2015Documento20 páginasAxis Factsheet February 2015Sumit GuptaAinda não há avaliações

- Quippo Energy Private Limited-10152013 PDFDocumento3 páginasQuippo Energy Private Limited-10152013 PDFJagadeesh YathirajulaAinda não há avaliações

- Value Research: JM Emerging LeadersDocumento2 páginasValue Research: JM Emerging LeadersSandeep BorseAinda não há avaliações

- DSP Blackrock Top 100 Equity Fund: International School of Management ExcellenceDocumento17 páginasDSP Blackrock Top 100 Equity Fund: International School of Management ExcellencePreeti SinghAinda não há avaliações

- 20th July, 2020Documento8 páginas20th July, 2020samuel debebeAinda não há avaliações

- Asc 202311011 20501Documento1 páginaAsc 202311011 20501Harendra BabuAinda não há avaliações

- DSP Blackrock Investment Managers Pvt. LTDDocumento31 páginasDSP Blackrock Investment Managers Pvt. LTDAsish BeheraAinda não há avaliações

- Morning Star Report 20141103125737Documento1 páginaMorning Star Report 20141103125737saiyuvatechAinda não há avaliações

- Fidelity Equity FundDocumento2 páginasFidelity Equity FundSandeep Borse100% (1)

- High Dividend Yield Stocks Feb 2016Documento2 páginasHigh Dividend Yield Stocks Feb 2016parry0843Ainda não há avaliações

- Submitted By:-Shelza Gupta Roll No: - 500901509Documento29 páginasSubmitted By:-Shelza Gupta Roll No: - 500901509digvijaygargAinda não há avaliações

- Performance Data and Analytics Dec-14: MUFAP Recommended FormatDocumento1 páginaPerformance Data and Analytics Dec-14: MUFAP Recommended FormatjibranqqAinda não há avaliações

- Debt Returns As On 04-12-2009.Documento13 páginasDebt Returns As On 04-12-2009.baldev_solankiAinda não há avaliações

- Debt Returns As On 04-12-2009.Documento13 páginasDebt Returns As On 04-12-2009.baldev_solankiAinda não há avaliações

- Debt Returns As On 04-12-2009.Documento13 páginasDebt Returns As On 04-12-2009.baldev_solankiAinda não há avaliações

- Sharekhan's Top SIP Fund PicksDocumento4 páginasSharekhan's Top SIP Fund PicksLaharii MerugumallaAinda não há avaliações

- R R R Research Esearch Esearch Esearch D D D Desk Esk Esk EskDocumento10 páginasR R R Research Esearch Esearch Esearch D D D Desk Esk Esk EskTirthankar DasAinda não há avaliações

- Debt Returns As On 04-12-2009.Documento13 páginasDebt Returns As On 04-12-2009.baldev_solankiAinda não há avaliações

- ValueResearchFundcard ICICIPrudentialDiscovery 2012may20Documento6 páginasValueResearchFundcard ICICIPrudentialDiscovery 2012may20Dinanath DabholkarAinda não há avaliações

- Presented By: Presented To:: KabeerDocumento11 páginasPresented By: Presented To:: KabeerkItan0uAinda não há avaliações

- Axis Equity Fund: Investment Growth Trailing Returns Investment ObjectiveDocumento1 páginaAxis Equity Fund: Investment Growth Trailing Returns Investment Objectiveway2iimaAinda não há avaliações

- Assignment - Corporate FinanceDocumento9 páginasAssignment - Corporate FinanceShivam GoelAinda não há avaliações

- Asc 202311014 2050Documento1 páginaAsc 202311014 2050Harendra BabuAinda não há avaliações

- List of Companies With Highest EPS: WWW - Eddfin.co - inDocumento7 páginasList of Companies With Highest EPS: WWW - Eddfin.co - inapi-243249821Ainda não há avaliações

- Morning CallDocumento1 páginaMorning CallnmkdsarmaAinda não há avaliações

- Top 5 Mutual Funds 555Documento25 páginasTop 5 Mutual Funds 555Khushal GorwadiyaAinda não há avaliações

- ProdMonitorAKDOFJul07 PDFDocumento1 páginaProdMonitorAKDOFJul07 PDFUsman RajputAinda não há avaliações

- Annual Report of Equity and Exchange Traded Schemes For The F.Y. 2011-12Documento248 páginasAnnual Report of Equity and Exchange Traded Schemes For The F.Y. 2011-12Yuvaraj KanagarajAinda não há avaliações

- HDFC Equity FundsDocumento2 páginasHDFC Equity FundsAmit MalikAinda não há avaliações

- Franklin India Prim A Plus FundDocumento2 páginasFranklin India Prim A Plus FundBaargdon Rio GunaAinda não há avaliações

- Resume MathanRaj MBADocumento4 páginasResume MathanRaj MBAMathan RajAinda não há avaliações

- ValueResearchFundcard ICICIPrudentialTop100 2012feb02Documento6 páginasValueResearchFundcard ICICIPrudentialTop100 2012feb02Ahmed Ahmed AliAinda não há avaliações

- HDFC EquityDocumento2 páginasHDFC EquitygunasridharanAinda não há avaliações

- Sharekhan's Top Equity Mutual Fund Picks: August 23, 2011Documento6 páginasSharekhan's Top Equity Mutual Fund Picks: August 23, 2011ravipottiAinda não há avaliações

- Signals and Symptoms: - Decline in Capacity UtilizationDocumento19 páginasSignals and Symptoms: - Decline in Capacity UtilizationVinay KumarAinda não há avaliações

- Asc 202311014 20504Documento1 páginaAsc 202311014 20504Harendra BabuAinda não há avaliações

- Max KotakDocumento26 páginasMax KotakMary GonsalvesAinda não há avaliações

- Sharekhan's Top Equity Fund Picks: IndexDocumento4 páginasSharekhan's Top Equity Fund Picks: IndexHaAinda não há avaliações

- A Presentation On Value Drivers With Special Reference To Icici BankDocumento22 páginasA Presentation On Value Drivers With Special Reference To Icici Bankaj_01Ainda não há avaliações

- Y YY Y YY: BY, SatheesDocumento15 páginasY YY Y YY: BY, SatheesSathees KumarAinda não há avaliações

- DWSAlphaEquityFund 2014jul07Documento4 páginasDWSAlphaEquityFund 2014jul07Yogi173Ainda não há avaliações

- Fundcard FranklinAsianEquityDocumento4 páginasFundcard FranklinAsianEquityYogi173Ainda não há avaliações

- 08 - Chapter 4 PDFDocumento62 páginas08 - Chapter 4 PDFHariAinda não há avaliações

- Axis Equity Growth: Investment ObjectiveDocumento1 páginaAxis Equity Growth: Investment ObjectivepeterAinda não há avaliações

- Kotak Bankingand PSUDebtDocumento4 páginasKotak Bankingand PSUDebtYogi173Ainda não há avaliações

- Cairn India: Performance HighlightsDocumento10 páginasCairn India: Performance HighlightsAngel BrokingAinda não há avaliações

- Scheme NAV (Daily) 3-Yr Return 5-Yr Return 10-Yr Retur Value Research Expense Ratio Fund Size (Rs CR) CommentsDocumento4 páginasScheme NAV (Daily) 3-Yr Return 5-Yr Return 10-Yr Retur Value Research Expense Ratio Fund Size (Rs CR) Commentssrinivas3usAinda não há avaliações

- Gilt Funds Traling Returns From 2015Documento2 páginasGilt Funds Traling Returns From 2015Sandeep BorseAinda não há avaliações

- Eastings and NorthingsDocumento1 páginaEastings and NorthingsSandeep BorseAinda não há avaliações

- CCP - One PagerDocumento1 páginaCCP - One PagerSandeep BorseAinda não há avaliações

- Cover Page PicsDocumento3 páginasCover Page PicsSandeep BorseAinda não há avaliações

- 7th ScienceDocumento22 páginas7th ScienceSandeep BorseAinda não há avaliações

- Geography Worksheet IsceDocumento1 páginaGeography Worksheet IsceSandeep BorseAinda não há avaliações

- Gilt Funds Trailing Returns From 2019Documento2 páginasGilt Funds Trailing Returns From 2019Sandeep BorseAinda não há avaliações

- ARN Circular No. 17 Dt. 26-Sep-14 - Revised Self Declaration FormatsDocumento5 páginasARN Circular No. 17 Dt. 26-Sep-14 - Revised Self Declaration FormatsSandeep BorseAinda não há avaliações

- REC Capital Gain Bond-10200083Documento4 páginasREC Capital Gain Bond-10200083viralshukla4290Ainda não há avaliações

- IDBI India Top 100 Equity Fund - Growth: 1 M 3 M 6 M 1 Y 2 Y 3 Y 5 Y 10 YDocumento1 páginaIDBI India Top 100 Equity Fund - Growth: 1 M 3 M 6 M 1 Y 2 Y 3 Y 5 Y 10 YSandeep BorseAinda não há avaliações

- Debt Fund Portfolio June 2017Documento10 páginasDebt Fund Portfolio June 2017Sandeep BorseAinda não há avaliações

- Nhai54ecapr16 21705523Documento2 páginasNhai54ecapr16 21705523Sandeep BorseAinda não há avaliações

- Crisil Composite Bond Debt: Credit Opportunities Open-Ended Oct 31, 2011Documento1 páginaCrisil Composite Bond Debt: Credit Opportunities Open-Ended Oct 31, 2011Sandeep BorseAinda não há avaliações

- BNP Paribas Equity Fund - Growth: 1 M 3 M 6 M 1 Y 2 Y 3 Y 5 Y 10 YDocumento1 páginaBNP Paribas Equity Fund - Growth: 1 M 3 M 6 M 1 Y 2 Y 3 Y 5 Y 10 YSandeep BorseAinda não há avaliações

- Transactions - Apartment FundDocumento5 páginasTransactions - Apartment FundSandeep BorseAinda não há avaliações

- DSP Focus 25Documento1 páginaDSP Focus 25Sandeep BorseAinda não há avaliações

- PolicySchedule PDFDocumento1 páginaPolicySchedule PDFSandeep Borse100% (1)

- There'S Life Beyond Bank FdsDocumento20 páginasThere'S Life Beyond Bank FdsSandeep BorseAinda não há avaliações

- Project Sunrise Grande Floor PlanDocumento6 páginasProject Sunrise Grande Floor PlanSandeep BorseAinda não há avaliações

- Large Funds Performance Jan 2016Documento1 páginaLarge Funds Performance Jan 2016Sandeep BorseAinda não há avaliações

- Asset AllocationDocumento29 páginasAsset AllocationSandeep BorseAinda não há avaliações

- Mahalaxmi Presentation InvestorsDocumento29 páginasMahalaxmi Presentation InvestorsSandeep BorseAinda não há avaliações

- Indiareit Apartment FundDocumento18 páginasIndiareit Apartment FundSandeep BorseAinda não há avaliações

- Sunita RuiaDocumento3 páginasSunita RuiaSandeep BorseAinda não há avaliações

- Melvin Jones FellowDocumento4 páginasMelvin Jones FellowSandeep BorseAinda não há avaliações

- Magicbricks OfferDocumento14 páginasMagicbricks OfferSandeep BorseAinda não há avaliações

- Landmark Capital - Fund BrochureDocumento37 páginasLandmark Capital - Fund BrochureSandeep BorseAinda não há avaliações

- Atlantis C Wing Lower FLRDocumento1 páginaAtlantis C Wing Lower FLRSandeep BorseAinda não há avaliações

- Khar PropertyDocumento7 páginasKhar PropertySandeep BorseAinda não há avaliações

- New Nri FormDocumento2 páginasNew Nri FormSharath BhavanasiAinda não há avaliações

- Order BlockDocumento6 páginasOrder BlockFranco LeguizamonAinda não há avaliações

- Commerce - Practice Test 17 - Kautilya 2.0 21st JanDocumento10 páginasCommerce - Practice Test 17 - Kautilya 2.0 21st Janitika.chaudharyAinda não há avaliações

- Sebi (Icdr), 2018Documento63 páginasSebi (Icdr), 2018Vedant KshatriyaAinda não há avaliações

- Partnership Dissolution: Problem FDocumento7 páginasPartnership Dissolution: Problem FJoeneil DamalerioAinda não há avaliações

- DISSERTATION On Commodities MarketDocumento75 páginasDISSERTATION On Commodities MarketnishantforpptAinda não há avaliações

- Financial ManagementDocumento18 páginasFinancial ManagementsreelakshmisureshAinda não há avaliações

- Anil Rana ProjectDocumento34 páginasAnil Rana Projectanil ranaAinda não há avaliações

- Riv Palm Lot 140 Ilot 8 06 BP 6940 ABIDJAN 06 Riv Palm Lot 140 Ilot 8Documento1 páginaRiv Palm Lot 140 Ilot 8 06 BP 6940 ABIDJAN 06 Riv Palm Lot 140 Ilot 8Alimatou Traore KossougroAinda não há avaliações

- The Game in Wall Street - NotesDocumento3 páginasThe Game in Wall Street - Notesskyduck100% (1)

- Chapter 19Documento43 páginasChapter 19rafay khawajaAinda não há avaliações

- Analysis: Global Investment Banking, Securities and Investment Management FirmDocumento10 páginasAnalysis: Global Investment Banking, Securities and Investment Management Firmkenn benAinda não há avaliações

- Intermediate Financial Management 11th Edition Brigham Test BankDocumento20 páginasIntermediate Financial Management 11th Edition Brigham Test Banknicholasyoungxqwsbcdogz100% (34)

- Revisiting Bob Farrell's 10-Rules of Investing - Zero HedgeDocumento13 páginasRevisiting Bob Farrell's 10-Rules of Investing - Zero HedgeeliforuAinda não há avaliações

- Financial Accounting IFRS EditionDocumento1 páginaFinancial Accounting IFRS EditionAcho Jie100% (1)

- What Is An ISDA Master AgreementDocumento4 páginasWhat Is An ISDA Master AgreementUday JainAinda não há avaliações

- A Strategic Analysis of Tune GroupDocumento7 páginasA Strategic Analysis of Tune Groupchristinenyamoita2019Ainda não há avaliações

- Financial Ratios of HulDocumento21 páginasFinancial Ratios of HulVaibhav Trivedi0% (1)

- Quiz - Investment ANSWERDocumento3 páginasQuiz - Investment ANSWERJaylord ReyesAinda não há avaliações

- Forex ViewDocumento2 páginasForex ViewSabeloAinda não há avaliações

- Case Study - Hill Country Snack Foods Co.Documento4 páginasCase Study - Hill Country Snack Foods Co.Saurabh Agarwal0% (1)

- Value Chain Development: Brand and BrandingDocumento3 páginasValue Chain Development: Brand and BrandingBint OsmanAinda não há avaliações

- Berkshire Transcripts (1994-2018)Documento3.057 páginasBerkshire Transcripts (1994-2018)Anonymous JDEI8SZ9PAinda não há avaliações

- Balance Sheet of Axis BankDocumento8 páginasBalance Sheet of Axis BankKushal GuptaAinda não há avaliações

- Cash Flow Statement Problems PDFDocumento32 páginasCash Flow Statement Problems PDFnsrivastav180% (30)

- Ta Tutorial - Module 04Documento4 páginasTa Tutorial - Module 04analyst_anil14Ainda não há avaliações

- Test Bank For Accounting Principles Volume 1 8th Canadian Edition WeygandtDocumento37 páginasTest Bank For Accounting Principles Volume 1 8th Canadian Edition Weygandtdupuisheavenz100% (11)

- Factsheet - Premia China Property ETFDocumento2 páginasFactsheet - Premia China Property ETFkwongyuan88_11867164Ainda não há avaliações

- Capital Stroke - Best Trading Tips Service ProviderDocumento15 páginasCapital Stroke - Best Trading Tips Service Providercapitalstroke1Ainda não há avaliações

- Residual Income Valuation:: Valuing Common EquityDocumento39 páginasResidual Income Valuation:: Valuing Common EquitywinwinAinda não há avaliações

- Mba Syllabus, DocDocumento3 páginasMba Syllabus, Docsachinkumar3009Ainda não há avaliações