Escolar Documentos

Profissional Documentos

Cultura Documentos

Countrywide Settles With CA Attorney General

Enviado por

Razmik BoghossianDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Countrywide Settles With CA Attorney General

Enviado por

Razmik BoghossianDireitos autorais:

Formatos disponíveis

Countrywide settles with California Attorney General Office

Jan 26th, 2009 By: Keith Dunnagan, Esq. (Washington) and Stephen J. Beede, Esq. (California) BPE Law Group, Inc. www.bpelaw.com All of you in the real estate market are keenly aware of the recession affecting the housing market. Many of you are probably aware that in June 2008 the California Office of Attorney General filed a lawsuit in Los Angeles County for violations of Californias Business and Professions Code as a result of Countrywides predatory lending practices for the past 4 years. As you well know, Countrywide was the chief culprit in the subprime lending debacle that led to artificially high prices for residential properties and foreclosure of a high volume of subprime loans. What many of you may not know is that on October 20, 2008, Countrywide and the State of California settled the AGs lawsuit by entry of a Stipulated Judgment and Injunction (Settlement). This settlement is of particular import as the requirements place a heavy burden on Countrywide. Aside from the 1.7 million dollar attorneys fees provision, the creation of a nearly 28 million dollar foreclosure relief program for the State of California, and that former CEO Angelo Mozilo and COO David Sambol are still involved with litigation commenced by the California, Countrywide has agreed to a myriad of things that could be of import to you as a borrower, real estate agent, potential seller or potential buyer. The first and most important fact to understand is that the Settlement affects both Countrywide Originated loans and loans that Countrywide purchased on the secondary mortgage market. This means that if JP Morgan purchased a mortgage loan covered by the Settlement that was originated by Countrywide, the Settlement would cover the loan even though Countrywide has no stake in the loan. What makes the settlement really interesting is that if JP Morgan would have been the originator and Countrywide purchased the loan on the secondary market and was servicing loan, then the loan would be covered by the terms of the Settlement. But onto the nitty gritty of the Settlement. The termination date of the Settlement is June 30, 2012. Therefore, over the next four years Countrywide will be obligated to work with the borrowers of California to attempt to remedy the predatory lending and foreclosure epidemic in California. There are a few requirements that need to be satisfied to be eligible for relief under the Settlement, however, the main element is that the mortgage must be for an owner occupied 14 unit residential property. Unfortunately, under the term of this Settlement, real estate investors are not covered. However, they may have remedies under other legal constructs. At the most basic level the Settlement requires Countrywide to attempt modify loans that are currently in default or likely to be in default at a substantial loss to both Countrywide and now Bank of America which purchase Countrywide earlier this year. The purpose of the Settlement was to require Countrywide to identify loans likely to face default and attempt to modify loans to a more traditional loan or a government backed loan to facilitate home retention.

To accomplish this Countrywide as agreed to multitude of provisions. Countrywide has agreed to not initiate or advance any foreclosure process until a borrowers ability to modify a loan has been assessed. If a borrower can not qualify for a modified loan, has abandoned the property or has no interest in remaining in the property, there is no obligation for Countrywide to stay any foreclosure action in that instance. However, if an individual is foreclosed upon, they would qualify for assistance from the State under the Foreclosure Relief Program funded by Countrywide. The financial assistance available is fairly small and very limited. More importantly though is the ability to modify an existing loan that is in default. The term affordability equation will be used and refers to a loan not exceeding either 42% or 34% of the borrowers income. The percentage is based upon the nature of the modified loan. The loans that are specifically targeted as part of this Settlement include Subprime 2,3,5,7 and 10 Hybrid Arms, Pay Option Arms and Subprime First Mortgage Loans. In each case, we are looking to see what the LTV is (loan to market value). You are looking for LTV greater than 75%. Mortgages with LTVs less than 75% may not be precluded from protection, but the Settlement is not specifically directed at them. In the case that a borrower is delinquent or seriously delinquent (more than 60 days in arrears) the Settlement is triggered. In the case of Hybrid Arms the following options are available: (1) the borrower can modify their loan into a government backed HOPE or FHA loan, (2) a modification of the loan to restore the initial rate for a period of five years before becoming a traditional ARM loan or (3) a fully amortizing loan subject to the affordability equation which would include a restoration of the introductory rate or lower depending on the current market rates but not lower than 3.5% and after five years the loan would automatically convert to a fixed rate mortgage at whichever is higher the Fannie Rate or the introductory rate, (4) a fully amortizing loan, with a ten year interest only period and then modification to a traditional ARM where the interest rate is no lower than the interest rate floor (between 3.5% and 2.5% depending on circumstances) and capped at the introductory rate. In the case that the borrower is delinquent or seriously delinquent on a pay option loan the following options are available: (1) the borrower can modify their loan into a government backed HOPE or FHA loan, (2) a modification to a fully amortizing ARM loan eliminating negative amortization, including an optional ten year interest only payment and reduction of the interest rate to the interest rate floor and capped at 7% and if the borrower owns only one residential property and the LTV is greater than 95% the borrower is eligible for a write down of the principal to an LTV of 95%. Countrywide is not obligated to go any lower than that. In the case of any other subprime loan, the borrower is eligible for HOPE and FHA modifications as well as the fully amortizing loan identified under (3) of the Hybrid Arm loan modifications. As part of the loan modification process for qualified mortgages contained in the Settlement Countrywide has agreed to waive all late and delinquency fees, prepayment penalty fees and will not charges to the extent permitted any fees for modification of the loan to government HOPE and FHA loans. Further, if an eligible borrowers who prior to this Settlement modified a loan is still eligible to modifications under the Settlement. Finally, once the modification process has been commenced, Countrywide is obligated to make a the offer to modify an existing loan on average not more than 60 days after identifying the eligible borrower and having received necessary income documentation. Due to the potential that individuals may take advantage of the

modification program under the Settlement, in the event an eligible borrower intentionally becomes delinquent to benefit from the program, Countrywide can require intensive full documentation prequalification of a modified loan. The government does not want the legitimate delinquent borrowers ability to modify an unaffordable loan slowed or hampered because of intentional defaults by borrowers that can afford their loan. Further, the pre-qualification would have the effect of possibly eliminating some of the benefits from modifying including the elimination of a rate reduction for the intentionally defaulting borrower. Finally, in an effort to ensure compliance, Countrywide is obligated to provide annual reports to the AGs office. There is a lot more to this Settlement and one should consult an attorney before entering into a modification of an existing loan. If you have specific questions, feel free to contact us at BPE Law

Você também pode gostar

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Lamb V Nationstar Mortg LLC 1Documento3 páginasLamb V Nationstar Mortg LLC 1Razmik BoghossianAinda não há avaliações

- T. Sevillano ProofDocumento3 páginasT. Sevillano ProofRazmik BoghossianAinda não há avaliações

- CFPB Servicing-Rules SummaryDocumento6 páginasCFPB Servicing-Rules SummaryRazmik BoghossianAinda não há avaliações

- Deutsche Bank Burden in UDocumento8 páginasDeutsche Bank Burden in URazmik BoghossianAinda não há avaliações

- Securities Exchange vs. Deutsche BankDocumento13 páginasSecurities Exchange vs. Deutsche BankRazmik BoghossianAinda não há avaliações

- Leticia Quintana Example FromReaderDocumento1 páginaLeticia Quintana Example FromReaderRazmik BoghossianAinda não há avaliações

- AssignmentDocumento11 páginasAssignmentRazmik BoghossianAinda não há avaliações

- Securities Exchange vs. Deutsche BankDocumento13 páginasSecurities Exchange vs. Deutsche BankRazmik BoghossianAinda não há avaliações

- GSAA Home Equity Trust 2005-15, Tranche 1A1, Fannie Mae - FHFA, As Receiver, Sues Goldman SachsDocumento136 páginasGSAA Home Equity Trust 2005-15, Tranche 1A1, Fannie Mae - FHFA, As Receiver, Sues Goldman SachsTim BryantAinda não há avaliações

- Lamb V Nationstar Mortg LLC 1Documento3 páginasLamb V Nationstar Mortg LLC 1Razmik BoghossianAinda não há avaliações

- Deutsche Bank Securities IncDocumento3 páginasDeutsche Bank Securities IncRazmik BoghossianAinda não há avaliações

- Nationwide Keeping Customers HappyDocumento20 páginasNationwide Keeping Customers HappyRazmik BoghossianAinda não há avaliações

- Glaski V Bank of America JP Morgan ChaseDocumento29 páginasGlaski V Bank of America JP Morgan ChaseRazmik BoghossianAinda não há avaliações

- Full Extinguishment of Second LoanDocumento2 páginasFull Extinguishment of Second LoanRazmik BoghossianAinda não há avaliações

- Morgan Stanley RMBS SuitDocumento311 páginasMorgan Stanley RMBS SuitRazmik BoghossianAinda não há avaliações

- Mccoy V BNC MTG - Bky orDocumento8 páginasMccoy V BNC MTG - Bky orQuerpAinda não há avaliações

- Documents Used For ForeclosureDocumento3 páginasDocuments Used For ForeclosureRazmik BoghossianAinda não há avaliações

- PIMCO Funds CommodityRealReturn Strategy Fund Portfolio Holdings 731Documento46 páginasPIMCO Funds CommodityRealReturn Strategy Fund Portfolio Holdings 731Razmik BoghossianAinda não há avaliações

- Attorney Arango's Deposition Regarding Mers, Countrywide and Assignments Jan 2011Documento106 páginasAttorney Arango's Deposition Regarding Mers, Countrywide and Assignments Jan 201183jjmack0% (1)

- Bank of America VP Deposition on Kirby Foreclosure CaseDocumento25 páginasBank of America VP Deposition on Kirby Foreclosure CaseRazmik BoghossianAinda não há avaliações

- Neuces County TX V MERS Et Al Recording Fraudulent LiensDocumento37 páginasNeuces County TX V MERS Et Al Recording Fraudulent LiensMike_DillonAinda não há avaliações

- US vs. Bank of America Case 1:12-Cv-00361-RMCDocumento99 páginasUS vs. Bank of America Case 1:12-Cv-00361-RMCcagumshoeAinda não há avaliações

- SEC InfoDocumento168 páginasSEC InfoRazmik BoghossianAinda não há avaliações

- An Introduction To Mortgage Securitization and Foreclosures Involving Securitized TrustsDocumento17 páginasAn Introduction To Mortgage Securitization and Foreclosures Involving Securitized TrustsOccupyOurHomes100% (2)

- Countrywide RMBS Settlement11Documento3 páginasCountrywide RMBS Settlement11Razmik BoghossianAinda não há avaliações

- Court Files $25B Mortgage SettlementDocumento3 páginasCourt Files $25B Mortgage SettlementRazmik BoghossianAinda não há avaliações

- Countrywide Lawsuit 2008Documento26 páginasCountrywide Lawsuit 2008Lucid A AwareAinda não há avaliações

- President Barack Obama Announced The HAMP Program in February 2009Documento4 páginasPresident Barack Obama Announced The HAMP Program in February 2009Razmik BoghossianAinda não há avaliações

- ShortSale-Authorization To Release InformationDocumento1 páginaShortSale-Authorization To Release InformationRazmik BoghossianAinda não há avaliações

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- American Woodworker No 171 April-May 2014Documento76 páginasAmerican Woodworker No 171 April-May 2014Darius White75% (4)

- Ohta, Honey Ren R. - Activity 7.2 (Reflection Agriculture and Religion)Documento5 páginasOhta, Honey Ren R. - Activity 7.2 (Reflection Agriculture and Religion)honey ohtaAinda não há avaliações

- Checklist For Mold RemediationDocumento2 páginasChecklist For Mold Remediation631052Ainda não há avaliações

- Lte Numbering and AddressingDocumento3 páginasLte Numbering and AddressingRoderick OchiAinda não há avaliações

- Government of The Punjab Primary & Secondary Healthcare DepartmentDocumento3 páginasGovernment of The Punjab Primary & Secondary Healthcare DepartmentYasir GhafoorAinda não há avaliações

- SIO 12 Syllabus 17Documento3 páginasSIO 12 Syllabus 17Paul RobaiaAinda não há avaliações

- Mutaz Abdelrahim - Doa - MT-103Documento17 páginasMutaz Abdelrahim - Doa - MT-103Minh KentAinda não há avaliações

- DMDPrework QuizDocumento5 páginasDMDPrework Quizjunpe- yuutoAinda não há avaliações

- 2 Case StudyDocumento8 páginas2 Case Studysehrish khawerAinda não há avaliações

- Project On International BusinessDocumento18 páginasProject On International BusinessAmrita Bharaj100% (1)

- Network Theory - BASICS - : By: Mr. Vinod SalunkheDocumento17 páginasNetwork Theory - BASICS - : By: Mr. Vinod Salunkhevinod SALUNKHEAinda não há avaliações

- Assessment (L4) : Case Analysis: Managerial EconomicsDocumento4 páginasAssessment (L4) : Case Analysis: Managerial EconomicsRocel DomingoAinda não há avaliações

- Costos estándar clase viernesDocumento9 páginasCostos estándar clase viernesSergio Yamil Cuevas CruzAinda não há avaliações

- Putri KartikaDocumento17 páginasPutri KartikaRamotSilabanAinda não há avaliações

- 1 20《经济学家》读译参考Documento62 páginas1 20《经济学家》读译参考xinying94Ainda não há avaliações

- North American Countries ListDocumento4 páginasNorth American Countries ListApril WoodsAinda não há avaliações

- Table of Contents and Executive SummaryDocumento38 páginasTable of Contents and Executive SummarySourav Ojha0% (1)

- What Is Inventory Management?Documento31 páginasWhat Is Inventory Management?Naina SobtiAinda não há avaliações

- Capex Vs RescoDocumento1 páginaCapex Vs Rescosingla.nishant1245Ainda não há avaliações

- Fuather, That Smid Govern-: Such Time As It May Deem Proper: TeDocumento18 páginasFuather, That Smid Govern-: Such Time As It May Deem Proper: Tencwazzy100% (1)

- Hotels Cost ModelDocumento6 páginasHotels Cost ModelThilini SumithrarachchiAinda não há avaliações

- Lesson Plan 12 Climate ChangeDocumento5 páginasLesson Plan 12 Climate ChangeRey Bello MalicayAinda não há avaliações

- Module-1 STSDocumento35 páginasModule-1 STSMARYLIZA SAEZAinda não há avaliações

- Expose Anglais TelephoneDocumento6 páginasExpose Anglais TelephoneAlexis SoméAinda não há avaliações

- Marriage Gift PolicyDocumento4 páginasMarriage Gift PolicyGanesh Gaikwad100% (3)

- Research PaperDocumento15 páginasResearch PapershrirangAinda não há avaliações

- Exercise C: Cocurrent and Countercurrent FlowDocumento6 páginasExercise C: Cocurrent and Countercurrent FlowJuniorAinda não há avaliações

- MP & MC Module-4Documento72 páginasMP & MC Module-4jeezAinda não há avaliações

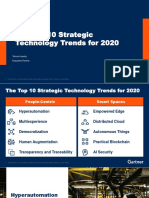

- The Top 10 Strategic Technology Trends For 2020: Tomas Huseby Executive PartnerDocumento31 páginasThe Top 10 Strategic Technology Trends For 2020: Tomas Huseby Executive PartnerCarlos Stuars Echeandia CastilloAinda não há avaliações

- Value Chain AnalysisDocumento4 páginasValue Chain AnalysisnidamahAinda não há avaliações