Escolar Documentos

Profissional Documentos

Cultura Documentos

GARCH On Commodities

Enviado por

tty933298Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

GARCH On Commodities

Enviado por

tty933298Direitos autorais:

Formatos disponíveis

International Conference On Applied Economics ICOAE 2010 573

MEAN REVERSI ON AND SEASONALI TY I N GARCH OF AGRICULTURAL COMMODI TI ES

KOMKRIT OVARARIN

1

- NIGEL MEADE

2

Abstract

In this article we model the returns volatility on 3 agricultural commodities, rough rice, rubber and white sugar. We investigate mean

reversion and seasonality. A GARCH model is used to capture volatility clustering. There are several patterns of seasonality. For

instance, a day-of-the-week seasonality represents investor behaviour in the futures markets and yearly seasonality demonstrates the

effect of the harvest. We find no evidence of mean reversion in our samples. Seasonal patterns dominate in the volatility estimation-

GARCH (1,1) with seasonality in mean equation and GARCH (1,1) with seasonality in mean equation and volatility. Therefore, the

seasonality is a crucial determinant providing more realistic volatility model for agricultural products.

JEL codes: C10, C220, Q140

Key Words: Mean reversion; Seasonality; Agricultural commodities; GARCH

1 Introduction

In the last decade, many researchers offer contributions to finance agricultural research by explaining price behaviour, the

volatility process and convenience yield.

We have found that the volatility process is an important element in both pricing and risk management. Constant volatility is a

primary assumption in pricing procedure; however, counter evidence has been raised by many quantitative papers. They suggest that

time-varying volatility model provides better risk measurement.

Prices and volatility of agricultural products have distinctive features from other financial products. That mean reversion and

seasonality of many agricultural products are general characteristics have been detected in research papers.

The main objective of this paper is to study volatility models. The proposed volatility models have been modified from the

generalized autoregressive conditional heteroskedasticity (GARCH) model which is used to evaluate the volatility behaviour of

agricultural commodity.

The extensions of GARCH model are generated by including the mean reversion and seasonality in mean equation and volatility

process. The results indicate that the seasonality components exist in both mean equation and volatility process. The proposed

conditional volatility model with seasonality seems to be a realistic pricing model for agriculture.

The remainder of this paper is structured as follows. Section 2 provides the critical literature reviews of the related subjects. The

used data and the methodology will be explained in the section 3 and 4. In section 5, the estimated parameters are presented and

discussed. The conclusion of this paper is given in the last section.

2 Previous Research

Volatility forecasting is an important fundamental element in investment strategy, option pricing and risk management. This is an

indicator by which the price changes in the financial market. Poon and Granger (2005) conduct a volatility review over the last 20

years. The comparisons of 93 volatility studies indicate that the implied volatility model provides the best performance, following by

the GARCH and the historical volatility model. However, the performance of volatility model is not dominated by one model

according to the mixed results in many papers.

Many researchers apply the ARCH-family volatility model in financial market, particularly in commodity market, such as Oglend

and Sikveland (2008), Huang et al. (2009). Moreover, Samuelson (1965) states that the volatility of agricultural future prices

increases while the time to maturity decrease. This property is well known as Samuelson Effect.

Additionally, there are many evidences to support the time-varying volatility model is more suitable to incorporate in the pricing

or risk management. For instance, Tian and Fackler (2000) claim that the constant volatility is assumed in diffusion factor models for

future price is known to be unsatisfactory in commodity markets. Power and Turvey (2008) also present a long-range dependence in

the price volatility of many commodity and agricultural futures prices. They test a null hypothesis of Hurst coefficient is equal to 0.5

which imply to a Geometric Brownian Motion of 14 samples of commodity and agricultural future prices. The results indicate that all

series are rejected, meaning all future price volatility has a long memory process.

Mean reversion is the process of the price approaching a long term mean. This is inconsistent with a random walk. The concept of

mean reversion, which is popularly used in many fields, has been found in 1930 by Ornstein-Uhlenbeck. For example, Cadenillas et

al (2007) contribute an optimal dividend policy strategy by assuming a mean reverting process in cash reservoir of financial

company. Coporale and Gil-Alana (2009) analyse daily structure of 1, 3, 5, 7 and 10 US Treasury constant maturity rate by using

fractional integration techniques.

In commodity literature, the first proposal of mean reverting process in commodity pricing is addressed by Schwartz (1997). He

compares the performance of three models that take into account mean reverting with stochastic process. Then, the conclusions

suggest that mean reversion should be considered in the financial decision, in order to obtain the realisable numbers. Moreover, there

have been any financial commodity papers related with mean reversion (see, e.g., Tomek and Peterson (2001), Cartea and Figueroa

(2005), and Miltersen (2003)).

1

Doctoral research student, Imperial College Business School , London; E-mail k.ovararin08@imperial.ac.uk

2

Professor of Quantitative Finance, Imperial College Business School, London; E-mail: n.meade@imperial.ac.uk

574 International Conference On Applied Economics ICOAE 2010

Next, the seasonality of agricultural products is an essential feature because of production periods and climate changes. Robert

(2001) states that production of agricultural product has a distinctive behaviour in commodity price, as a result of a seasonality

pattern in production. Therefore, seasonality is a one of the empirical characteristics that distinguish some agricultural commodities

from the other financial assets. Stifel and Randrianarisoa (2006) state that significant seasonality is exhibited in price series and

volatility process of agricultural products, such as rice, maize and cassava in Madagascar.

Moreover, Tomek and Peterson (2001) also suggest that the demand or supply for an agricultural product is a major cause of

seasonality in spot prices, which is as same as Karali and Thurman (2009). Furthermore, Borovkova and Geman (2007) claim that the

agricultural prices exhibit the seasonal pattern are driven by seasonal supply. The upward price movement are always shown before

the harvest. They also suggest that the other commodity prices, such as gas and electricity, represent the seasonality. There are many

research papers that related with the agricultural product, for example, Malick and Ward (1987) study frozen concentrated orange

juice and Netz (1996) investigates the seasonal effect in corn. Their empirical results confirm the existence of seasonality.

3 Data

We describe the analysis of time series of commodities prices series, namely rubber, rough rice and white sugar. We investigate

the presence of the effects discussed in the previous section; volatility, mean reversion and seasonality. All data are collected from

DataStream.

The near month future prices are collected as a proxy of the spot price for agricultural products from the most active trading

market on each sample. Firstly, the rubber future settlement prices at Tokyo Commodity Exchange set extends over the period 1st

January 1991 31st December 2009. There are 4958 daily observations which are recorded every weekday. Thus, there are 260 days

a year. Secondly, the 2349 daily observations of rough rice future settlement prices at Chicago Board of Trade in the period 1st

January 2001 to 31st December 2009. Finally, the white sugar future settlement prices at Euronext.liffe, London are in the period 1st

January 1996 to 31st December 2009 which consists of 3654 daily observations.

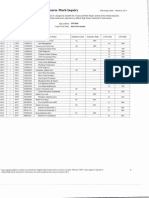

Table 1 provides the summary statistics of daily logarithm return of three commodities. There are wide differences across three

samples. For average daily return, the highest rubber average return is on Monday and lowest average return is on Wednesday. The

mean rough rice returns are all positive expect Tuesday. The maximum return occurs on Friday. The last sample returns have a peak

on Friday, and reach a bottom on Monday.

The skewness value is a measure of the asymmetry of the probability distribution. All these samples present the negative

skewness or left-skewed which are -0.24, -0.30, -0.91 of the rubber, rough rice and white sugar respectively. The rubber return

demonstrates the lowest kurtosis which is 2.75; on the other hand, the rough rice and white sugar returns show the leptokurtic

distribution.

Table 19: Moment of the distribution by day of the week

Source: Thomson Reuters DataStream

4 Methodology

4.1 Generalized autoregressive conditional heteroskedasticity (GARCH) model

This paper is bases on the popular volatility model which is the generalized autoregressive conditional heteroskedasticity

(GARCH model), introduced by Bollerslev (1986). We start by defining the daily log return of agricultural future prices as the

change of the logarithm of the daily closing of future prices. The daily log return can be written as

) ln( ) ln(

1 t t t

P P y

(5)

A discrete-time log daily return is assumed for this paper, giving the form of mean equation and the error term process as

following

t t

y

(6)

t t

y

(7)

where the error term is a function of the log daily return and the unconditional mean. These equations are the starting equations

for the following assumptions. To examine the effect the mean reversion and the seasonality, the simplest generalized autoregressive

conditional heteroskedasticity (GARCH) is utilized to estimate the parameters in which is expressed as follows:

International Conference On Applied Economics ICOAE 2010 575

( ) ( )

2

1

2

1

2

+ + =

t t t

o | c o e o

(8)

where >0, ,>0 and + <1. These restrictions represent important information for the volatility model. First, the mean of

volatility will not be negative value. The coefficiency of previous volatility and noise term are positive estimations that depict the

stylised fact of volatility clustering. Moreover, the sum of and measures the persistence of a shock to the variance which shows

the mean reversion characteristic of volatility model.

4.2 GARCH (1,1) with mean reversion process in mean equation

The second approach attempts to modify the volatility model by adding mean reversion process of Ornstein-Uhlenbeck (1930) to

the mean equation (2). Mean reversion is generally introduced into the model by the drift term. The GARCH (1,1), thus, with mean

reversion in mean is given by

) ( )) ln ( (

2

1

2

1 1

2

+ + =

t t t t

P a y o | o e o

(9)

4.3 GARCH (1,1) with seasonality in mean equation

Moreover, this paper introduces a seasonal pattern into the mean equation as represented in term of the trigonometric function

was introduced by Hannan, Terrell, and Tuckwell (1970) to offer the alternative approach to model the seasonality. The

trigonometric deterministic seasonal process can equivalently be written in the mean equation as

( ) ( ) | |

=

+ + + =

*

1

2 2

sin cos

K

k

t S

kt

k S

kt

k t

y c |

t t

(10)

where k representing the number of term in the sum,

k

and

k

is the coefficient estimated and S is the number of observations

in one period, for example, s=5 for daily observation when estimating the day-of-the-week effect and s=260 for daily observations

when estimating the yearly seasonal effect.

According to the trigonometric representation of seasonality, the GARCH model will be modified from the original. This

representation of seasonal modelling is chosen because it is convenience to capture the dynamic of high frequency observations.

Thus, the GARCH (1,1) with trigonometric representation of weekly and yearly seasonality is represented in the forms as follows:

( ) ( ) | |

( ) ( ) | | ( )

2

1

2

*

1

260

2

260

2

2

1

5

2

5

2

1

2

)) sin cos

sin cos ( (

=

=

+ + +

+ + + =

t

yk

yk

kt

k

kt

k

wk

kt

wk

kt

wk t t

y

o |

o e o

t t

t t

(11)

In addition, this model also captures the yearly seasonality; therefore, the estimated parameters of yearly seasonality have been

defined and K optimal is chosen from the Akaike Information Criterion (AIC).

4.4 GARCH (1,1) with seasonality in mean equation and volatility

The last approach of this paper desires to contribute the conditional volatility model which captures both importance features in

mean equation and GARCH specification. The extending conditional volatility model is begun from the optimal GARCH with the

day-of-the week seasonality. This model also captures the effect of day-of the week and monthly seasonality as represented in

( ) ( ) | |

( ) ( ) | | ( )

( ) ( ) | | ( ) ( ) | |)) sin cos ) sin cos , 0 max(

)) sin cos

sin cos ( (

*

1

5

2

260

2

2

1

5

2

5

2

2

1

2

*

1

260

2

260

2

2

1

5

2

5

2

1

2

= =

=

=

+ + + +

+ + +

+ + + =

vyk

vyk

kt

vyk

kt

vyk

vwk

kt

vwk

kt

vwk

t

myk

myk

kt

myk

kt

myk

mwk

kt

mwk

kt

mwk t t

y

t t t t

t t

t t

o |

o e o

(12)

According to the condition of variance restriction, the value of conditional variance cannot be a negative value. Therefore, the

restriction of the non-negative value of the sum of the trigonometric terms is settled by accepting the maximum value between the

seasonal components of volatility and zero.

The unconditional long run constant variance is given by,

) ( 1

2

| o

e

o

+

= is used initialize the GARCH variance. All estimations

are preformed in MATLAB. The estimation initially processes the condition variance equation using the log-likelihood function. The

common method to calibrate the parameters is to maximize the likelihood function which is

( )) exp ln( max ) ln( max ln max

2

2

2

2

2

1

H

= =

T

t

y

t

t

t

t

l L

o

o

(13)

5 Empirical Results and Discussion

The empirical results of all models of individual sample are explained. The rubber future prices estimations in four composed

models are entirely explained, then, section 5.2 presents the brief explanations of rough rice and white sugar. Finally, weekly and

yearly seasonal graphs would be discussed.

576 International Conference On Applied Economics ICOAE 2010

5.1 Rubber

5.1.1 GARCH (1,1) Model

The GARCH model parameters are represented in the table 2. The drift term of variance process is 0.000008. The value of the

parameter is 0.907986 which indicates a time varying volatility having long memory for rubber future return. Moreover, the sum of

and is being 0.982591 which imply a volatility half life of about 40 days. In addition, the value of the drift term of return process

is 0.000378. All parameters are significances as the value of t-statistic greater than 1.96 at 95% confidence level. The log-likelihood

is 12494.00.

5.1.2 GARCH (1,1) with Mean Reversion Process in Mean Equation

From these results, the speed of reversion parameter which used to capture the mean reversion process of log daily return process

is insignificant, based on the t-statistic. This implies that the log daily return process not presents the mean reversion feature, thus it

not optimal to include the mean reversion parameters of log return process in the second moment.

Moreover, the log-likelihood of the GARCH with mean reversion is lower than the original GARCH. This situation is caused by

adding not optimal parameters in the model. This implies that the GARCH with mean reversion in mean equation provides less

accuracy volatility forecasting model.

5.1.3 GARCH (1,1) with Trigonometric Representation in Mean Equation

Furthermore, the third column of table 2 illustrates the calibrating results of the GARCH with seasonality in mean equation as

shown in equation 7. There are four estimated parameters representing the day-of-the-week by indexing Monday, Tuesday,

Wednesday and Thursday respectively. The number of the sum, describing a weekday seasonality, is K=2.

In addition, this model also captures the yearly seasonality; therefore, the estimated parameters of yearly seasonality have been

defined and K optimal is chosen from the Akaike Information Criterion (AIC). The lowest AIC points out that the optimal yearl y K

of rubber future return is K=5. Hence, there are 10 estimated parameters for yearly seasonality.

All four parameters of the weekly seasonality in mean equation are significances. These imply that the repeat of price movement

is the consequence of the investors trading behaviour or some regulated event in the futures markets.

Table 20 : The Rubber Estimated parameters of all Time-varying Models

GARCH

(1,1)

GARCH

(1,1) with

Mean

Reversion

Process

GARCH (1,1)

with

Trigonometric

Representation

in Mean

Equation

GARCH (1,1) with

Trigonometric

Representation in Mean

Equation and Volatility

0.000008*

(0.000001)

0.000008*

(0.000001)

0.000008*

(0.000001)

0.000009*

(0.000001)

0.074605*

(0.003207)

0.073962*

(0.010841)

0.07529*

(0.004065)

0.03823*

(0.00184)

0.907986*

(0.004312)

0.908946*

(0.010184)

0.907661*

(0.004786)

0.903201*

(0.004588)

a 0.000378*

(0.000127)

6.21E-09

(0.000273) - -

-0.01815*

(0.000061)

0.000343*

(0.000132)

0.000339*

(0.000126)

mw1 0.000761*

(0.000193)

0.000741*

(0.000179)

mw1 0.000452*

(0.000189)

0.000453*

(0.000175)

mw2 -0.00042*

(0.00019)

-0.000429*

(0.000178)

mw2 -0.00042*

(0.000191)

-0.000420*

(0.000178)

my1

0.000693*

(0.000197)

0.000666*

(0.000179)

my1

0.000788*

(0.000198)

0.000778*

(0.000176)

my2

0.000151

(0.000198)

0.000133

(0.000174)

my2

-0.00031

(0.000192)

-0.000311

(0.000183)

my3

0.000441*

(0.000186)

0.000417*

(0.000185)

my3

0.001123*

(0.000203)

0.001112*

(0.000173)

International Conference On Applied Economics ICOAE 2010 577

my4

-0.00011

(0.000195)

-0.000125

(0.000178)

my4

0.000372

(0.000192)

0.000360*

(0.000183)

mw5

0.000684*

(0.000196)

0.000671*

(0.000178)

my5

-0.00077*

(0.000195)

-0.000793*

(0.000177)

vw1 -0.157727

(0.483818)

vw1 0.328179

(0.491524)

vw2 0.259494

(0.497672)

vw2 0.059823

(0.477492)

vy1 0.656322

(0.475053)

vy1 -0.026395

(0.496932)

vy2 -0.006261

(0.475053)

vy2 0.033047

(0.489187)

vy3 -0.007203

(0.475053)

vy3 0.269616

(0.480551)

vy4 0.456322

(0.475053)

vy4 0.870596

(0.425173)

vy5 -3.413193

(0.475053)

vy5 0.863452

(0.41735)

Log-

likelihood

12494.00 12492.89 12503.65 12509.63

AIC -24991.30 -24963.27

Note: Standard errors in parentheses, * indicates significance at 95% confidential level

Moreover, six-tenths estimated parameters of yearly seasonality in mean equation are significances. There are more positive

coefficients, this causes to a high conditional variance when take an account of the yearly seasonality. This phenomenon is not a

surprise since in general the high seasonal affect induces the high volatility of the return.

Furthermore, the log-likelihood of this model rises from 12492.89 to 12503.64. This means that there are improvements when

including the seasonality in mean equation.

5.1.4 GARCH (1,1) with Trigonometric Representation in Mean Equation and Volatility

The last model considered is the GARCH (1,1) with seasonality in mean equation and volatility. This model is an extension of the

previous optimal GARCH (1,1) with seasonality in mean equation which is represented in equation 8.The optimal K of seasonal

volatility as exogenous volatility variable is chosen from the lowest AIC.

Table 2 represents the estimated value of the GARCH (1,1) with seasonality in mean equation and volatility. There are 32

estimated parameters regarding to the lowest AIC. The K optimal for seasonal volatility is 5. The adding parameters from the last

equation consist of 4 weekly seasonal-volatility and 10 yearly seasonal-volatility parameters.

According to the t-statistic, three-tenths yearly seasonal volatility variables are significances. For the seasonality in mean

equation, seven-tenths seasonal variables are significances. These findings indicate that the yearly seasonality exist in the conditional

volatility model as commonly see in the agricultural commodities. The log-likelihood value of this model is 12509.63 which is higher

than the GARCH (1,1) with seasonality in mean equation.

All weekly seasonal parameters in mean equation are significances. On the other hand, all weekly seasonal volatility parameters

are not significant. This seems that there is seasonality in the log daily return, probably due to the investors behaviours in the future

market during the week, however, these actions do not effect to the volatility process. Furthermore, the seasonal components in the

mean equation have more strong effect than the seasonality in volatility.

578 International Conference On Applied Economics ICOAE 2010

5.2 Rough Rice and White Sugar

The estimated parameters of rough rice future prices and white sugars are shown in table 3. This table provides the estimated

coefficients and the standard error of individual sample from the calibrations. Moreover, the statistic values for making decision,

which is AIC, are displayed in the tables when estimate the seasonality in mean equation and volatility model.

5.2.1 GARCH (1,1) Model

Table 3 shows GARCH (1,1) parameters of rough rice future prices. All parameters are significances at 95% confident level. The

drift term is 0.000053 and the sum of and is 0.846097. These imply that the volatility half life is about 5.15 days which is quickly

than the rubber. This figure also presents the time for volatility to move half-way back to its mean.

Table 21: Rough rice and White sugar Estimated Parameters

Rough Rice White Sugar

GARCH

(1,1)

GARCH

(1,1) with

Mean

Reversion

Process

GARCH (1,1)

with

Trigonometric

Representatio

n in Mean

Equation

GARCH (1,1)

with

Trigonometric

Representatio

n in Mean

Equation and

Volatility

GARCH

(1,1)

GARCH

(1,1)

with

Mean

Reversio

n Process

GARCH (1,1)

with

Trigonometric

Representation

in Mean

Equation

GARCH

(1,1) with

Trigonometri

c

Representati

on in Mean

Equation and

Volatility

0.000053*

(0.000007)

0.000056*

(0.000008

)

0.000051*

(0.000006)

0.000139*

(0.000003)

0.000029*

(0.000003)

0.000029

*

(0.00000

3)

0.000028*

(0.000003)

0.000025*

(0.000003)

0.150219*

(0.010391)

0.147534*

(0.011220

)

0.148910*

(0.011662)

0.139034*

(0.010877)

0.216713*

(0.012198)

0.216790

*

(0.01222

7)

0.219747*

(0.012343)

0.209738*

(0.012437)

0.695878*

(0.027310)

0.691436*

(0.029746

)

0.703818*

(0.027181)

0.697652*

(0.027131)

0.701772*

(0.017090)

0.701424

*

(0.01644

1)

0.700818*

(0.016696)

0.702549*

(0.021006)

a

-

0.000000

(0.000004

) - - -

0.000023

(0.00001

9) -

0.000880*

(0.000176) -

0.037592*

(0.000173

)

0.000870*

(0.000177)

0.000530*

(0.000214)

-0.000140

(0.000111)

-

0.046495

*

(0.00033

7)

-0.000158*

(0.000110)

-0.000138

(0.000114)

mw1 0.000928*

(0.000247)

0.001119*

(0.000319)

0.000688*

(0.000155)

0.000806*

(0.000166)

mw1 -0.000384

(0.000258)

-0.000616*

(0.000293)

-0.000580*

(0.000156)

-0.000572*

(0.000175)

mw2 0.000019

(0.000250)

0.000731*

(0.000280)

0.000538*

(0.000157)

0.000557*

(0.000180)

mw2 0.000736*

(0.000243)

0.000733*

(0.000240)

0.000110

(0.000156)

0.000125

(0.000180)

my1 0.000328

(0.000251)

0.000413

(0.000333)

0.000183

(0.000153)

0.000219

(0.000176)

my1 0.000385

(0.000252)

0.001002*

(0.000259)

0.000371*

(0.000155)

0.000337*

(0.000162)

my2

-

0.000522*

(0.000153)

0.000483*

(0.000179)

my2

-

-0.000992*

(0.000154)

-0.001050*

(0.000185)

vw1 -0.000026*

(0.000010)

-2E-06

(0.000002)

vw1 0.000041

(0.000028)

0.000002

(0.000002)

vw2 0.000061

(0.000034)

-2E-06

(0.000003)

vw2 0.000076* -1E-06

International Conference On Applied Economics ICOAE 2010 579

Note: Standard errors in parentheses, * indicates significance at 95% confidential level

The GARCH (1,1) parameters of white sugar future prices are represented in right half-column of table 3. The , and are

significances at 95% confidence level. However, the t-statistic on sugars mean which is equal to -1.26 indicates that the null

hypothesis cannot be rejected. The drift term is 0.000029 and the sum of and is 0.918485. Therefore, the volatility half life is

about 9.15 days being quickly than the rubber but has more persistence than the rough rice. The log-likelihood is 10144.85.

5.2.2 GARCH (1,1) with Mean Reversion Process in Mean Equation

The hypothesis of mean reversion in mean exist in the GARCH (1,1) is examined and the results of rough rice confirm that the

insignificant speed of reversion estimations have been found on both samples. These results match with the rubber futures prices;

therefore, the mean reversion in mean is not fit on the conditional volatility.

5.2.3 GARCH (1,1) with Trigonometric Representation in Mean Equation

For rough rice futures prices, the lowest AIC have been found when K=1. The main parameters of GARCH (1,1) are

significances. Moreover, only Monday and Thursday illustrate the repeated pattern in the week, thus investors in the rough rice

futures markets can forecast the same occurrences on Monday and Thursday. The yearly seasonality parameters do not present any

significance. The including of seasonality in mean equation leads to the higher conditional volatility as the coefficients of the

significant parameters are positive values.

The white sugar estimations consist of GARCH (1,1) elements, 4 weekly seasonality parameters and 4 yearly seasonality

parameters, according to the lowest AIC. Three-fourths of weekly seasonality parameters are significant which represent Monday,

Tuesday and Thursday. In addition, more than a half of yearly seasonality parameters are significances.

Moreover, the greater log-likelihoods have been found of both rough rice and white sugar. The log-likelihood of rough rice is

6166.16 and the log-likelihood of white sugar is 10157.83 which are bigger than the previous models. This shows the improving

model when includes the seasonality into the conditional volatility model.

5.2.4 GARCH (1,1) with Trigonometric Representation in Mean Equation and Volatility

This model is an extension of the optimal seasonality in mean equation model. The construction of GARCH (1,1) with seasonality

in mean equation and volatility of rough rice and white sugar resembles the rubber modelling , so there are eight weekly seasonality

parameters which composes of four parameters for mean equation and the rest for volatility. The yearly seasonality parameters in

volatility, then are chosen by the lowest AIC which has been found when K equal to 6. Therefore, there are 26 estimated parameters

in the rough rice equation. For white sugar, the lowest AIC has been found when K equal to 2, so there are 20 parameters.

From calibration, the weekly seasonality parameters in mean equation seem appropriate variables to involve in the rough rice

conditional volatility model. Moreover, the yearly seasonality parameter is also significant at 95% confidence level. Furthermore,

many seasonality parameters of volatility process are also significances. The log-likelihood is 10164.92, which is greater than the

previous model. This volatility model can capture the seasonality of both the price and volatility processes.

The results of white sugar do not distinguish from the rubber and white sugar which indicate the existence of seasonality in the

volatility model. The adding parameters provide more appropriate volatility prediction. The weekly seasonality parameters in mean

equation are significances as same as the model without seasonal volatility.

(0.000020) (0.000002)

vy1 -0.000078*

(0.000014)

0.000002

(0.000004)

vy1 -0.000006

(0.000017)

-6E-06

(0.000003)

vy2 0.000018

(0.000023)

-0.00001*

(0.000004)

vy2 0.000010

(0.000023)

-7E-06*

(0.000001)

vy3 -0.000077

(0.000012)

vy3 0.000042

(0.000030)

vy4 0.000019

(0.000017)

vy4 0.000028

(0.000015)

vy5 0.000010

(0.000020)

vy5 0.000039*

(0.000020)

vy6 0.000110*

(0.000019)

vy6 0.000075*

(0.000021)

Log-

likeliho

od

6162.30 6159.08 6166.16 6198.67 10144.8

5

10144.79 10157.83 10164.92

AIC -12312.32 -12345.35 -20291.65 -20289.80

580 International Conference On Applied Economics ICOAE 2010

However, according to the results, the weekly seasonal parameters of volatility are not important to be taken into a consideration.

There are not significant at 95% confidence interval. On the other hand, half of yearly seasonality parameters are significance. These

cause a reduction of volatility estimation because most of coefficients are negative value.

Now the forms of seasonal patterns are displayed in the figure 1. These seasonal patterns are plotted by substituting the estimated

parameters in table 2 and 3 for rubber, rough rice and white sugar into the trigonometric representations.

For rubber, the seasonal pattern shows the fluctuated curve, due to the uncertainty of production supply. Basically, the planting of

rubber trees are about 5-6 years old, and then the first harvest would be begun.

The highest rubber return has been found in May due to the shed leaves of rubber tree and the reduction of production in summer

which start from April. The large amount of latex would be collected at the beginning of raining season that is June; however, if there

is a heavy rainfall, it will be a seriously effect to the harvesting process. This produces diluted latex which is unqualified products.

Therefore, the price of rubber will climb to the high point again in the beginning of October. The rubber price seasonal movement is

not resulted only from the supply condition, but it also is affected from the demand condition. The high demand in the world rubber

market is usually in January especially from China, so this leads to the high rubber price in January.

For rough rice, the seasonal curve is presented smoother curve than other samples because there are more rice stocks, due to the

whole year production. There are two main time-periods of a rice production planting in late May and early December for rained rice

and off-season rice respectively. The rice is growing within 3-4 months, thus the harvesting season is between August to September

and February to March. These lead to low seasonal component in February and August, because of the high supply. The graph

indicates that the peak have been found in May and November that are one month before planting. However, the seasonality

parameters are insignificances as results of GARCH (1,1) with seasonality in mean equation. Thus, yearly seasonality parameters of

rough rice are an inappropriate expresser of the price movement during the year.

Figure 12: The estimated yearly seasonal patterns of rubber, rough rice and white sugar by substituting the estimated

parameter into the trigonometric representative function

The last seasonal pattern is the curvature of white sugar. As you know, white sugar is produced from the sugarcane. Famers prefer

to start their planting during May-July for began-rain sugarcane and in December-February for ended-rain sugarcane, they require

10-14 months for growing. The harvesting period for sugarcane begins in July-August and February-March for began-rain sugarcane

and the ended-rain sugarcane, respectively. Therefore, the seasonal pattern graph illustrates the peak in May and November, taking

place 2-3 months before harvest.

Figure 2 illustrates the day-of-the-week seasonality of rubber, rough rice and white sugar. For rubber, the day-of-the-week peaks

on Monday and reach the bottom on Wednesday. For rough rice and white sugar, the day-of-the-week peaks on Friday, in addition,

the lowest points have been found on Tuesday for rough rice and on Monday for white sugar. These weekly seasonality graphs

present the highest and lowest points which are similar to the data summary in Table 1. Therefore, the weekly seasonality parameters

in modified GARCH (1,1) model perfectly capture the price movement during the week. The situations have been found when

trading behaviours in the future market is set to be an assumption of the model.

Figure 13: The estimated weekly seasonal patterns of rubber, rough rice and white sugar by substituting the estimated

parameter into the trigonometric representative function

6 Conclusion

This paper aims to model the returns volatility models with the mean reversion and seasonality on 3 agricultural products,

namely, rubber, rough rice and white sugar.

GARCH model is used to incorporate the mean reversion and seasonality. From the literature, there are 2 patterns of seasonality,

namely, a day-of-the-week seasonality and yearly seasonality. The day-of-the week seasonality represents the investor behaviour in

the futures markets and the yearly seasonality illustrates the harvest and lean period of the agriculture.

Firstly, the mean reversion and seasonal pattern are assumed in the price process which used to estimate the volatility. The error

term of the price process is including these two features, and then substituting in the GARCH (1,1). The existence of seasonality in

International Conference On Applied Economics ICOAE 2010 581

volatility process has been raised as a second assumption of this paper. The second volatility model is an extension model from the

optimal GARCH (1,1) with the seasonality in mean equation.

Three types of nearest daily future contract prices are collected from the different future markets which are Tokyo Commodity

Exchange, Chicago Board of Trade and Euronet for rubber, rough rice and white sugar respectively. In addition, the estimated

parameters of all models are generated by using the maximum likelihood function.

The results present that the mean reversions in mean equation of three observations are not significances in the volatility process.

On the other hand, seasonal patterns dominate in the volatility estimation- GARCH (1,1) with seasonality in mean equation and

GARCH (1,1) with seasonality in mean equation and volatility. Therefore, the seasonality is an important additional parameter which

provides more realistic volatility model for agricultural products. For the future research, it is very interesting to utilize this volatility

process in financial risk management tools, such as value at risk (VaR), and be incorporated in pricing model.

7 References

Borovkova, S. and Geman, H. (2007), Seasonal and stochastic effects in commodity forward curves, Review of Derivatives

Research, 9(2): 167-186.

Bollerslev, T. (1986), Generalized Autoregressive Conditional Heteroskedasticity Journal of Econometrics, 31: 307-327.

Cadenillas, A., Sarkar, S. and Zapatero, F. (2007), Optimal dividend policy with

mean-reverting cash reservoir, Mathematical Finance, 17(1): 81-94.

Cartea, A., Figueroa, M. and Street, M. (2005), In Electricity Markets: A Mean

Reverting Jump diffusion Model with Seasonality, Applied Mathematical Finance, 12(4): 313-335.

Caporale, G. and Gil-Alana, L. (2009), Mean reversion in the US treasury constant maturity rates, International Journal of Risk

Assessment and Management, 11(1): 59 - 66.

Hannan, E., Terrell, R. & Tuckwell, N. (1970), The seasonal adjustment of economic time series, International Economic

Review, 11(1): 2452.

Huang, B. Chen, M. Chang, C. and Mcaleer, M. (2009), Modelling risk in agricultural finance: Application to the poultry

industry in Taiwan, Mathematics and Computers in Simulation, 79(5):1472-1487.

Karali, B. and Thurman, W. (2009), Components of Grain Futures Price Volatility, forthcoming in the Journal of Agricultural

and Resource Economics, 2010.

Malick, W. and Ronald, W. (1987), Stock Effects and Seasonality in the FCOJ future Basic, Journal of Futures Markets, 7: 157-

167.

Miltersen, K.R. (2003), Commodity Price Modelling that Matches current Observables: a New Approach, Quantitative Finance,

3(1): 51-58.

Netz, J.S. (1996), An Empirical Test of the Effect of Basic Risk on Cash Market Positions, Journal of Future Markets, 16: 189-

311.

Oglend, A. and Sikveland, M. (2008), The Behaviour of Salmon Price Volatility, Marine Resource Economics, 23(4): 487506.

Poon, S. and Granger, C. (2005), Practical Issues in Forecasting Volatility, Financial Analysts Journal, 61(1):45-56.

Power, G. and Turvey, C. (2008), On Term Structure Models of Commodity Futures Prices and the Kaldor-Working

Hypothesis, Proceeding of NCCC-134 Conference on Applied Commodity Price Analysis, Forecasting, and Market Risk

Management Conference, April 21-22, 2008, St. Louis, Missouri.

Roberts, M. (2001), Commodities, options, and volatility: modelling agricultural futures prices, Working paper: The Ohio State

University

Samuelson, P. A. (1965), Proof that Properly Anticipated Prices Fluctuate Randomly Industrial Management Review, 6: 41-49.

Schwartz, E. (1997), The Stochastic Behavior of Commodity Prices: Implications for Valuation and Hedging, The Journal of

Finance, 52(3):923973.

Stifel, D. and Randrianarisoa, J. (2006), Agricultural policy in Madagascar: A seasonal multi-market model, Journal of Policy

Modeling, 28(9): 1023-1027.

Tian, Y. and Fackler, P. (2000), A seasonal Stochastic Volatility Model for Futures Price Term Structure, Working Paper, North

California State University.

Tomek, W. and Peterson, H. (2001), Risk management in agricultural markets: A review, Journal of Futures Markets, 21(10):

953985.

Uhlenbeck, G. and Ornstein, L. (1930), On the theory of the Brownian motion., Physical Review, 36(5): 823841.

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Grade 3 - Unit 1 Increase and Decrease PatternDocumento7 páginasGrade 3 - Unit 1 Increase and Decrease PatternKyo ToeyAinda não há avaliações

- The Turning Circle of VehiclesDocumento2 páginasThe Turning Circle of Vehiclesanon_170098985Ainda não há avaliações

- Subject OrientationDocumento15 páginasSubject OrientationPearl OgayonAinda não há avaliações

- Grade 8 Science - Second GradingDocumento5 páginasGrade 8 Science - Second GradingMykelCañete0% (1)

- 02 Object Modeling TechniqueDocumento50 páginas02 Object Modeling TechniqueMuhammad Romadhon Batukarang EsdAinda não há avaliações

- Genuine Fakes: How Phony Things Teach Us About Real StuffDocumento2 páginasGenuine Fakes: How Phony Things Teach Us About Real StuffGail LeondarWrightAinda não há avaliações

- IT Level 4 COCDocumento2 páginasIT Level 4 COCfikru tesefaye0% (1)

- Toolbox TalkDocumento14 páginasToolbox Talkcall_mustafas2361Ainda não há avaliações

- 3D Printing & Embedded ElectronicsDocumento7 páginas3D Printing & Embedded ElectronicsSantiago PatitucciAinda não há avaliações

- SIVACON 8PS - Planning With SIVACON 8PS Planning Manual, 11/2016, A5E01541101-04Documento1 páginaSIVACON 8PS - Planning With SIVACON 8PS Planning Manual, 11/2016, A5E01541101-04marcospmmAinda não há avaliações

- Claim of FactDocumento11 páginasClaim of FactXeb UlritzAinda não há avaliações

- The Scope and Method of Economics: © 2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and FairDocumento36 páginasThe Scope and Method of Economics: © 2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and FairLangson phiriAinda não há avaliações

- Lodge at The Ancient City Information Kit / Great ZimbabweDocumento37 páginasLodge at The Ancient City Information Kit / Great ZimbabwecitysolutionsAinda não há avaliações

- J.K. Brimacombe - Design of Continuous Casting MachinesDocumento13 páginasJ.K. Brimacombe - Design of Continuous Casting MachinesJavier GómezAinda não há avaliações

- Job Satisfaction VariableDocumento2 páginasJob Satisfaction VariableAnagha Pawar - 34Ainda não há avaliações

- MFE Module 1 .Documento15 páginasMFE Module 1 .Adarsh KAinda não há avaliações

- Perdarahan Uterus AbnormalDocumento15 páginasPerdarahan Uterus Abnormalarfiah100% (1)

- 10 1108 - TQM 03 2020 0066 PDFDocumento23 páginas10 1108 - TQM 03 2020 0066 PDFLejandra MAinda não há avaliações

- Chapter 5 Constructing An Agile Implementation PlanDocumento4 páginasChapter 5 Constructing An Agile Implementation PlanAHMADAinda não há avaliações

- World War II D-Day Invasion by SlidesgoDocumento55 páginasWorld War II D-Day Invasion by SlidesgoPreston SandsAinda não há avaliações

- ST Arduino Labs CombinedDocumento80 páginasST Arduino Labs CombineddevProAinda não há avaliações

- Maya Deren PaperDocumento9 páginasMaya Deren PaperquietinstrumentalsAinda não há avaliações

- A Comparative Study of Public Private Life Insurance Companies in IndiaDocumento5 páginasA Comparative Study of Public Private Life Insurance Companies in IndiaAkansha GoyalAinda não há avaliações

- Img 20201010 0005Documento1 páginaImg 20201010 0005Tarek SalehAinda não há avaliações

- KDE11SSDocumento2 páginasKDE11SSluisgomezpasion1Ainda não há avaliações

- Img 20150510 0001Documento2 páginasImg 20150510 0001api-284663984Ainda não há avaliações

- Vitamins - CyanocobalaminDocumento12 páginasVitamins - CyanocobalaminK PrashasthaAinda não há avaliações

- Financial Market - Bsa 2A Dr. Ben E. Bunyi: Imus Institute of Science and TechnologyDocumento3 páginasFinancial Market - Bsa 2A Dr. Ben E. Bunyi: Imus Institute of Science and TechnologyAsh imoAinda não há avaliações

- Case Study - Suprema CarsDocumento5 páginasCase Study - Suprema CarsALFONSO PATRICIO GUERRA CARVAJALAinda não há avaliações

- I. Learning Objectives / Learning Outcomes: Esson LANDocumento3 páginasI. Learning Objectives / Learning Outcomes: Esson LANWilliams M. Gamarra ArateaAinda não há avaliações