Escolar Documentos

Profissional Documentos

Cultura Documentos

It-5 Wht-Sale of Immovable Property

Enviado por

Zar NootDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

It-5 Wht-Sale of Immovable Property

Enviado por

Zar NootDireitos autorais:

Formatos disponíveis

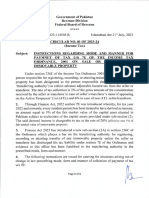

FEDERAL BOARD OF REVENUE APPLICATION TO THE REGISTERING/TRANSFERRING AUTHORITY FOR SALE/TRANSFER OF IMMOVABLE PROPERTY ( Note : This form can

be downloaded from FBR's website at http://fbr.gov.pk ) 1 2 3 4 5 6

IT-5

(Legal Size) (For extra sheets) Sheet

Part-1 Particulars and declaration of the Seller(s)

To : The Registering/Transferring Authority of immovable property: Province: Tehsil Town District Housing Authority Date :

of

I/We want to sell our immovable property to the party(ies) who's particulars are given in Part-2 whereas the particulars of the said immovable property are given in Part-3 below: Sr. CNIC/NTN/PP No. of Seller (s) 1 2 3 Name of Seller(s) & Owner(s)

%age Share Seller Type (*)

Part-2 Particulars of the Buyer(s)

7 Sr. CNIC/NTN/PP No. of Buyer (s) 1 2 3

(*) Type : O => Owner, A => Attorney

Name of Buyer(s)

%age Share

Buyer Type (*)

(Provide details of all owners and sellers even if the property is sold/purchased through Attorney)

Part-3 Location & Particulars of the property

8 9 10 11 12 Type Status Land Size

Covered Area

Commercial Building

Residential Flat

Agricultural Plot Land

_____ Acre(s) _____ Kanal(s) _____ Marla(s) _____ Sarsai(s) _____ Sq. Yard _____ Sq Ft.

In case of Flat & Constructed Land, covered area must be provided Sq. Yards Sq. Ft.

Location

Plot / House / Flat / Shop/ Office No. Street / Lane etc. No.

Sector / Phase / Mohalla/ Block etc.

13

Khasra/Khewat/Acre/etc. No.

Province

District/Tehsil/Housing Society

(Amounts in Pak Rupees)

Part-4 Value of Property & Tax Computation

14 15 16 Date of Purchase/Acquisition by the Current Seller Sale Price /Value Is Capital Gains Tax applicable Yes

Date of Sale/Transfer

No, because property is sold after two (2) years of purchase No, because the seller is a Government Department

17 18

If answer to Sr-16 is Yes, then Withholding Tax Payable @ 0.5% = [ Sr-15 * 0.5/100 ]

Amount of withholding taxpayable in words

Part-5 Declaration by Property Seller/Transferrer

19 I, bearing CNIC No. as principal seller hereby declare that the particulars given above are correct to the best of my knowledge and that the withholding tax computed at Sr-17 above has been deposited in the NBP/ SBP vide CPR (copy attached); Before submitting this form to the Registering/Transferring authority, NBP/SBP is requested to issue a CPR. This application is submitted along with other required documents for transfer of the above stated property. 20 21 22 CPR No. Date:

Note : NBP/SBP shall attach this application with the CPR to be sent to the Regional Tax Office concerned

Signature of Seller

Part-6 (FOR OFFICIAL USE OF REGISTRATION/TRANSFERRING AUTHORITY)

23 Transfer registered at Sr. No. ____________, vide Registration No. _____________ of the Financial Year _______ on (date) _________________ by ensuring that an amount of Rs. _________________ has been paid by the seller as withholding tax u/s 236C of the Income Tax Ordinance 2001 vide Bank CPR No referred above. Copy duly signed and stamped has been placed in the official record and one copy sent to the Regional Tax Office concerned.

24

Official Seal of the Authority

2) Seller 3) Buyer

Signature of Registration Authority

4) Concerned Regional Tax Office of FBR

Distribution : 1) Original for Registering/Transferring authority

Você também pode gostar

- Tax Sales for Rookies: A Beginner’s Guide to Understanding Property Tax SalesNo EverandTax Sales for Rookies: A Beginner’s Guide to Understanding Property Tax SalesAinda não há avaliações

- How to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionNo EverandHow to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionAinda não há avaliações

- Administrative TitlingDocumento12 páginasAdministrative TitlingDebra BraciaAinda não há avaliações

- Land Title Transfer StepsDocumento3 páginasLand Title Transfer StepsCookie100% (3)

- Capital Gains TaxDocumento5 páginasCapital Gains TaxJAYAR MENDZAinda não há avaliações

- How To Transfer Land Title in The PhilippinesDocumento3 páginasHow To Transfer Land Title in The PhilippinesMarilyn Perez OlañoAinda não há avaliações

- A. Steps in Casual Sale of Real Estate: Fees To Be IncurredDocumento9 páginasA. Steps in Casual Sale of Real Estate: Fees To Be IncurredMinmin WaganAinda não há avaliações

- Procedures in Capital Tax GainDocumento6 páginasProcedures in Capital Tax GainJyasmine Aura V. AgustinAinda não há avaliações

- How To Transfer TitleDocumento2 páginasHow To Transfer TitleRyden Doculan PascuaAinda não há avaliações

- Capital Gains Tax For Onerous Transfer of Real Property Classified As Capital AssetsDocumento6 páginasCapital Gains Tax For Onerous Transfer of Real Property Classified As Capital AssetsCyrill L. MarkAinda não há avaliações

- CGT ReturnDocumento2 páginasCGT Returnmborja15Ainda não há avaliações

- Documentary Requirements To Be Filed at Office of The Bureau of Internal RevenueDocumento3 páginasDocumentary Requirements To Be Filed at Office of The Bureau of Internal Revenuesheshe gamiao100% (1)

- Titling 1. File and Secure The Documentary Requirements at The Bureau of Internal Revenue Regional District Office (BIR RDDocumento3 páginasTitling 1. File and Secure The Documentary Requirements at The Bureau of Internal Revenue Regional District Office (BIR RDara abuAinda não há avaliações

- 1 Land Transfer ServicesDocumento4 páginas1 Land Transfer Servicesabogado101Ainda não há avaliações

- BIR CGT RequirementsDocumento3 páginasBIR CGT RequirementsGerald MesinaAinda não há avaliações

- Transfer Title RequirementsDocumento4 páginasTransfer Title RequirementsjoebzAinda não há avaliações

- Documents Needed For Capital Gains Tax & Transfer of TitleDocumento4 páginasDocuments Needed For Capital Gains Tax & Transfer of TitleBossing NicAinda não há avaliações

- Capital Gains Tax For Onerous Transfer of Real Property Classified As Capital AssetsDocumento11 páginasCapital Gains Tax For Onerous Transfer of Real Property Classified As Capital AssetsGrace G. ServanoAinda não há avaliações

- 6681606Documento3 páginas6681606Jay O CalubayanAinda não há avaliações

- Step by Step - Transfer of TitleDocumento4 páginasStep by Step - Transfer of TitleRommyr P. Caballero100% (2)

- Land Registration ProcessDocumento4 páginasLand Registration ProcessRheinhart Pahila100% (1)

- Index For Capital Gains TaxDocumento15 páginasIndex For Capital Gains TaxWilma P.Ainda não há avaliações

- Bir Forms 1706 (99) Capital Gains Tax ReturnDocumento5 páginasBir Forms 1706 (99) Capital Gains Tax ReturnArnel Melgar100% (2)

- Transfer of Title in The PhilsDocumento6 páginasTransfer of Title in The PhilsAriel FFulgencioAinda não há avaliações

- Index For Capital Gains TaxDocumento19 páginasIndex For Capital Gains TaxD GAinda não há avaliações

- Checklist and Steps For Land Title TransferDocumento3 páginasChecklist and Steps For Land Title TransferBeth de Vera100% (1)

- (BIR Form 1706) Capital Gains Tax ReturmDocumento2 páginas(BIR Form 1706) Capital Gains Tax Returmjongsn70057% (7)

- The Ultimate Checklist and Steps For Land Title TransferDocumento4 páginasThe Ultimate Checklist and Steps For Land Title Transferarmi tanguancoAinda não há avaliações

- BIR Form 1707Documento3 páginasBIR Form 1707catherine joy sangilAinda não há avaliações

- Procedure of Transfer Land Titles in The PhilippinesDocumento5 páginasProcedure of Transfer Land Titles in The Philippinesjayar medicoAinda não há avaliações

- Steps For Title TransferDocumento2 páginasSteps For Title TransferLisyela Fenol RaboyAinda não há avaliações

- Comtax - Up.nic - in - cSTAct - CST UP Form-1 With AnnexureDocumento4 páginasComtax - Up.nic - in - cSTAct - CST UP Form-1 With Annexuresaurabh261050% (2)

- Capital Gains Tax - Bureau of Internal RevenueDocumento15 páginasCapital Gains Tax - Bureau of Internal RevenueLRMAinda não há avaliações

- Bir Form 2000Documento4 páginasBir Form 2000Ricca Pearl SulitAinda não há avaliações

- 2023721217646921CircularNo 1of2023-2024Documento4 páginas2023721217646921CircularNo 1of2023-2024krebs38Ainda não há avaliações

- Guideline in The Transfer of Titles of Real PropertyDocumento4 páginasGuideline in The Transfer of Titles of Real PropertyLeolaida AragonAinda não há avaliações

- Steps in Transfer of TitleDocumento2 páginasSteps in Transfer of TitleApril Joy Ortilano- CajiloAinda não há avaliações

- Capital Gains Tax - Bureau of Internal RevenueDocumento1 páginaCapital Gains Tax - Bureau of Internal Revenuetan limAinda não há avaliações

- 1706Documento2 páginas1706Anonymous WeDQhtcmUAinda não há avaliações

- Real Estate Lectures and AssignmentDocumento3 páginasReal Estate Lectures and AssignmentsacostaAinda não há avaliações

- Guidelines 1702-EX June 2013Documento4 páginasGuidelines 1702-EX June 2013Julio Gabriel AseronAinda não há avaliações

- Bir 1600Documento13 páginasBir 1600Adelaida TuazonAinda não há avaliações

- 1706Documento2 páginas1706May Chan Cuyos100% (1)

- Federal Board of Revenue Taxpayer Registration Form (V-2) : Current NTN (If Already Issued)Documento5 páginasFederal Board of Revenue Taxpayer Registration Form (V-2) : Current NTN (If Already Issued)haseeb_javed_9Ainda não há avaliações

- Bir 53Documento4 páginasBir 53toofuuAinda não há avaliações

- Source: Revenue Regulations 2-2003Documento3 páginasSource: Revenue Regulations 2-2003Jennylyn Biltz AlbanoAinda não há avaliações

- Required Document ChecklistDocumento3 páginasRequired Document ChecklistFrederick Xavier LimAinda não há avaliações

- Capital Gains TaxDocumento11 páginasCapital Gains TaxRoma Sabrina GenoguinAinda não há avaliações

- Documentary Requirements: Estate TaxDocumento19 páginasDocumentary Requirements: Estate TaxAubrey CaballeroAinda não há avaliações

- LPGApplication PDFDocumento17 páginasLPGApplication PDFAnkur MongaAinda não há avaliações

- Complete Procedures of Documenting and Registering A Philippine Real Estate SaleDocumento2 páginasComplete Procedures of Documenting and Registering A Philippine Real Estate SaleRey Jan N. VillavicencioAinda não há avaliações

- Presentation 3 Real Property Gains TaxDocumento29 páginasPresentation 3 Real Property Gains TaxAimi AzemiAinda não há avaliações

- Capital Gains Tax For Onerous Transfer of Shares of Stocks Not Traded Through The Local Stock ExchangeDocumento2 páginasCapital Gains Tax For Onerous Transfer of Shares of Stocks Not Traded Through The Local Stock ExchangemtscoAinda não há avaliações

- Documentary Stamp Tax ReturnDocumento6 páginasDocumentary Stamp Tax ReturnSuzette BalucanagAinda não há avaliações

- DPWH Infr 08Documento10 páginasDPWH Infr 08Bert O'neilAinda não há avaliações

- Steps of Land TransferDocumento6 páginasSteps of Land TransferKeith LlaveAinda não há avaliações

- Bir EtformDocumento3 páginasBir EtformrjgingerpenAinda não há avaliações

- Land Ownership PhilippinesDocumento5 páginasLand Ownership PhilippinesCrisanta MarieAinda não há avaliações

- A Step-By-Step Guide To Land Title Transferring in The Philippines (INFOGRAPHIC)Documento5 páginasA Step-By-Step Guide To Land Title Transferring in The Philippines (INFOGRAPHIC)May YellowAinda não há avaliações

- Withholding Tax Remittance Return: Kawanihan NG Rentas InternasDocumento4 páginasWithholding Tax Remittance Return: Kawanihan NG Rentas InternasArlyn De Las AlasAinda não há avaliações

- Global Business Licence Company ("GBL") in Mauritius: An OverviewDocumento2 páginasGlobal Business Licence Company ("GBL") in Mauritius: An OverviewErwan CamphuisAinda não há avaliações

- Colorcroma LogoDocumento1 páginaColorcroma LogolahiruAinda não há avaliações

- Investment Income and Expenses: (Including Capital Gains and Losses)Documento76 páginasInvestment Income and Expenses: (Including Capital Gains and Losses)Kenny Svatek100% (1)

- Paper 4 Taxation Nov 14 PDFDocumento16 páginasPaper 4 Taxation Nov 14 PDFghsjgjAinda não há avaliações

- KVBDocumento10 páginasKVBkarthika4aAinda não há avaliações

- Sip On Income TaxDocumento75 páginasSip On Income TaxGaurav Jain0% (1)

- 1568166588816UGsd5mT3ZF2XLyzh PDFDocumento5 páginas1568166588816UGsd5mT3ZF2XLyzh PDFASHISH SINGHAinda não há avaliações

- InvoiceDocumento1 páginaInvoiceRohankant TateluAinda não há avaliações

- BIR Rul. 102-95Documento2 páginasBIR Rul. 102-95sdysangcoAinda não há avaliações

- Hdfcergo Pay Slip 25297 Sep 2023Documento1 páginaHdfcergo Pay Slip 25297 Sep 2023bunnyakg14Ainda não há avaliações

- Einvoice SchemaDocumento125 páginasEinvoice SchemaABHISHEKAinda não há avaliações

- Invoice Form 9606099Documento4 páginasInvoice Form 9606099Xx-DΞΛDSH0T-xXAinda não há avaliações

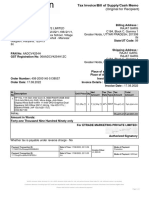

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Documento1 páginaTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)NAGARJUNAAinda não há avaliações

- Invoice 1Documento1 páginaInvoice 1RAJAT GARGAinda não há avaliações

- Sbi Fix Deposit Slip PDFDocumento1 páginaSbi Fix Deposit Slip PDFRahul Kumar46% (37)

- Swargeeya Sanjibhai Rupjibhai Memorial Trust's: ATOM Payment GatewayDocumento2 páginasSwargeeya Sanjibhai Rupjibhai Memorial Trust's: ATOM Payment GatewayAjay SainiAinda não há avaliações

- Wire Transfer Confirmation and ReceiptDocumento4 páginasWire Transfer Confirmation and ReceiptRoger Padron87% (15)

- Secrets To Prevent BIR Audit and Eliminate Tax AssessmentsDocumento49 páginasSecrets To Prevent BIR Audit and Eliminate Tax AssessmentsIamangel10100% (17)

- Sri Lankan Bank Account ComparisonDocumento9 páginasSri Lankan Bank Account ComparisonThusitha DalpathaduAinda não há avaliações

- TLDocumento736 páginasTLsvkraja007Ainda não há avaliações

- Acct Statement - XX0881 - 22082023Documento7 páginasAcct Statement - XX0881 - 22082023Shiv GautamAinda não há avaliações

- FyersDocumento58 páginasFyersNandhaAinda não há avaliações

- CHAPTER 8 Compensation Income (Module)Documento6 páginasCHAPTER 8 Compensation Income (Module)Shane Mark CabiasaAinda não há avaliações

- Revised TENTATIVE SCHEDULE FOR ONLINE COUNSELLING 09.10.2020 PDFDocumento2 páginasRevised TENTATIVE SCHEDULE FOR ONLINE COUNSELLING 09.10.2020 PDFHarshit SrivastavaAinda não há avaliações

- G.R. No. 178090 Panasonic Vs CIRDocumento4 páginasG.R. No. 178090 Panasonic Vs CIRRene ValentosAinda não há avaliações

- Rajat Communication: Butler Plaza Bareilly Bareilly - 243001 Mo. No.Documento2 páginasRajat Communication: Butler Plaza Bareilly Bareilly - 243001 Mo. No.arjun guptaAinda não há avaliações

- 0901 - TS Final Versioncor222rDocumento2 páginas0901 - TS Final Versioncor222rLandsAinda não há avaliações

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Documento1 páginaTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Rohit DuttaAinda não há avaliações

- CIR Vs Japan AirlinesDocumento4 páginasCIR Vs Japan AirlinesJohnde MartinezAinda não há avaliações

- GSTR-1 24ABQPV4297B1Z9 August 2017-18Documento23 páginasGSTR-1 24ABQPV4297B1Z9 August 2017-18Aditya NagoriAinda não há avaliações