Escolar Documentos

Profissional Documentos

Cultura Documentos

c5 1998 Jun

Enviado por

saeed_r2000422Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

c5 1998 Jun

Enviado por

saeed_r2000422Direitos autorais:

Formatos disponíveis

Paper C5 Cover 6/7/98 11:55 am Page 1

Certified Accountants Technician Examination Level C

Managing Finances

June 1998

Question Paper Time allowed ALL FOUR questions are compulsory and MUST be answered 3 hours

ALL FOUR questions are compulsory and MUST be attempted.

Weavers Ltd is engaged in the manufacture of carpets and is considering an expansion of production facilities to meet an anticipated increase in demand over the next five years. The board of directors is currently considering two mutually exclusive options. The first option is to acquire an additional loom. (i) The loom will have an initial cost of 800,000 and will have a life of five years. At the end of year five it will have a zero scrap value.

(ii) The loom will produce an additional 1,000 carpets per annum for the next five years. (iii) The sales price of each carpet is 1,000 which has been fixed for the next five years by Government price control. (iv) Each carpet produced by this loom requires: (1) Material costing 400. This will remain constant for the next five years. (2) Direct labour of 10 hours at 10 per hour in year one. For each of the subsequent four years, pay will increase by 2% of the preceding years level. (3) Machine time of 20 hours at 10 per hour. This will remain constant for the next five years. (v) Depreciation is on a straight line basis. The second option is to subcontract production of an additional 1,000 carpets per annum under a fixed contract for the next five years. (i) There is an annual subcontract fee payable at the end of each of the next five years commencing at the end of year one at 150,000. For each of the subsequent four years this fee will increase by 5% of the preceding years level.

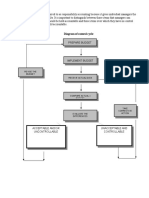

(ii) Over the next five years the subcontractor has agreed to produce and deliver up to a maximum 1,000 carpets each year to the company for an agreed cost per carpet of 700 (in addition to the annual fee in (i)). (iii) The sales price of each carpet is 1,000 which has been fixed for the next five years by Government price control. (iv) Under the contract Weavers Ltd must agree to accept a minimum of 750 carpets per annum. (v) Weavers Ltd has already spent 100,000 conducting research into the viability of this subcontract arrangement. The cost of capital is 10%. See Discount Factors on top of page 3. Ignore taxation. Required: (a) Calculate the net present value of each of the options to the nearest 000. State clearly any assumptions made. (b) (i) On the basis of the calculation made in (a) above, which of the two options would you choose and why? (ii) Briefly outline four key factors which should be considered before a final decision is reached. (4 marks) (c) (i) Explain why it is important to carefully evaluate capital investment decisions. (ii) Identify and discuss the key stages in the capital investment appraisal decision making and control cycle. (iii) Outline two key advantages of auditing the performance of a capital investment project. (2 marks) (40 marks) (4 marks) (10 marks) (18 marks) (2 marks)

Note: The present value of 1 in n years at 10% n (year) 1 2 3 4 5 10% 0909 0826 0751 0683 0621

CAT Ltd manufactures and sells a single product for which the following budget details are available: Selling price per unit Less: Materials 3kg at 10 Labour 1 hr at 15 Contribution per unit Note 1 Budgeted sales units Quarter 1 (Jan to Mar) 5,000 75 (30) (15) 30 Quarter 2 (Apr to Jun) 2,000 Quarter 3 (Jul to Sep) 2,500 Quarter 4 (Oct to Dec) 6,000

Note 2 Opening stocks of finished goods (at the start of quarter one) are 1,000 units. Closing stocks of finished goods at the end of each quarter are budgeted at 10% of sales volume for that quarter. Note 3 The company operates a Just in Time (JIT) system and consequently the stock of raw materials can be assumed to be always zero. Raw material purchases are paid for in the quarter of purchase. Direct labour costs are paid for in the quarter of production. Note 4 Sales revenue is received as follows:- 60% during the quarter of sale, 35% during the following quarter, with the remaining 5% being bad debts. Note 5 Fixed overheads are 40,000 per quarter. This figure includes depreciation of 10,000. Fixed overheads are paid for in the quarter in which they are incurred. Note 6 Machinery costing 100,000 is due to be installed in quarter two and paid for in quarter three. A tax liability of 75,000 and a dividend payment of 40,000 are due to be paid in quarter three. Note 7 Opening debtors balance at the start of quarter one is 60,000 which will be paid during quarter one. Note 8 The opening bank balance at the start of quarter one is nil. The company currently has no overdraft facilities. Required: (a) Prepare a cash budget for each quarter. All relevant calculations must be shown. (b) Identify any cash flow problems over the next year and give might deal with this problem. (16 marks)

three suggestions as to how the company (4 marks) (20 marks)

[P.T.O.

X Ltd was established in 1990 to import and distribute a range of office furniture to a variety of small and medium sized businesses. The business has grown rapidly and demand continues to rise. The most recent financial accounts of X Ltd are as follows: Balance Sheet as at 31 December 1997 Cost Land and buildings 200,000 Fittings and equipment 125,000 Vehicles 50,000 375,000 Current Assets Stocks Debtors Less Creditors: Amounts falling due within one year Trade creditors Taxation Bank overdraft 42,000 65,000 107,000

Fixed Assets

Depreciation Nil 30,000 15,000 45,000

Net 200,000 95,000 35,000 330,000

128,000 13,250 32,000

173,250

(66,250) 263,750

Less Creditors: Amounts falling due beyond one year. 15% Bank loan (secured on land and buildings) Capital and Reserves Issued share capital (par value 1) Profit and loss account * Bank overdraft limit is 32,000 Profit and Loss Account for the year ended 31 December 1997 Sales Less: Cost of sales Gross Profit Less: Administration expenses Selling and distribution expenses Interest payable Profit before taxation Less: Taxation (25%) Profit after taxation Dividends Retained profit for the year 124,000 260,000 23,000

130,000 133,750 60,000 73,750 133,750

960,000 500,000 460,000

407,000 53,000 13,250 39,750 27,825 11,925

The company is a family business and does not have any qualified accountant on its staff. Management accounts are prepared every three months by the auditors and are briefly reviewed by the managing director. The managing director has recently become concerned with the companys cash position. The company has been at its maximum overdraft level for the last year and cash flow projections show no improvement. The bank manager has indicated that the bank are unwilling to sanction any increase in the bank overdraft facilities. You have recently joined X Ltds auditors as a trainee and you have been asked to determine if X Ltd is overtrading. Required: (a) Explain what is meant by overtrading and briefly describe its consequences. (b) Identify four causes of overtrading. (c) Calculate and discuss five financial ratios which may be used to determine if X Ltd is overtrading. (10 marks) (d) State two ways in which X Ltd may overcome the problem of overtrading. (2 marks) (20 marks) (4 marks) (4 marks)

[P.T.O.

Fashions Ltd is a high quality fashion house founded by a former model and a clothes designer. In the period from its foundation in 1990, the business has been very successful. Sales are currently 2m per annum and profits after tax are 025m per annum. The directors consider that it is now an ideal time to expand the business to a number of new geographical locations. This expansion will require considerable long-term finance to acquire new premises and establish the new centres. The directors are considering various sources of finance for the expansion, including approaching a venture capital organisation. Required: (a) Identify the main items to consider when choosing a source of finance. (7 marks)

(b) Briefly explain five factors a venture capital organisation will take into account when deciding whether or not to invest in Fashions Ltd. (10 marks) (c) Identify threeways in which a venture capital organisation may finally realise its investment. (3 marks) (20 marks)

End of Question Paper

Você também pode gostar

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- Choosing The Executor or TrusteeDocumento22 páginasChoosing The Executor or TrusteeSeasoned_Sol100% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Audit of Financial StatementsDocumento4 páginasAudit of Financial StatementsMark Anthony TibuleAinda não há avaliações

- Bussiness Plan For Internet CaffeDocumento17 páginasBussiness Plan For Internet Caffehinsene begnaAinda não há avaliações

- Moodys BankDocumento191 páginasMoodys BankDeepak Kumar Mishra0% (1)

- Country of GuyanaDocumento3 páginasCountry of Guyanasaeed_r2000422Ainda não há avaliações

- Chapter Two Master BudgetDocumento15 páginasChapter Two Master BudgetNigussie BerhanuAinda não há avaliações

- P2 Mar 2012 Exam PaperDocumento16 páginasP2 Mar 2012 Exam Papermigueljorge007Ainda não há avaliações

- Not-For-Profit: TechnicalDocumento3 páginasNot-For-Profit: TechnicalMuntazir HussainAinda não há avaliações

- P2 May 2010 Answers PDFDocumento14 páginasP2 May 2010 Answers PDFjoelvalentinorAinda não há avaliações

- Sa Sept12 p5 BenchmarkingDocumento9 páginasSa Sept12 p5 BenchmarkingIndra ThapaAinda não há avaliações

- Cut and StichDocumento1 páginaCut and Stichsaeed_r2000422Ainda não há avaliações

- D. Bahadur & Co. Chartered Accountants: Prepared By: Reviewed By: Approved byDocumento31 páginasD. Bahadur & Co. Chartered Accountants: Prepared By: Reviewed By: Approved bysaeed_r2000422Ainda não há avaliações

- ACCA P4 Investment International.Documento19 páginasACCA P4 Investment International.saeed_r2000422100% (1)

- Budgetary DiagramDocumento1 páginaBudgetary Diagramsaeed_r2000422Ainda não há avaliações

- F5 Mock 1 AnswerDocumento14 páginasF5 Mock 1 Answersaeed_r2000422Ainda não há avaliações

- 2.4 Mock Exam Jun 06 Answer-AJ PDFDocumento20 páginas2.4 Mock Exam Jun 06 Answer-AJ PDFsaeed_r2000422Ainda não há avaliações

- AP Aging 2013 - AuditDocumento1 páginaAP Aging 2013 - Auditsaeed_r2000422Ainda não há avaliações

- Field Service Schedule 24-29Documento2 páginasField Service Schedule 24-29saeed_r2000422Ainda não há avaliações

- F5 Final Mock June 13Documento7 páginasF5 Final Mock June 13saeed_r2000422Ainda não há avaliações

- Accounting & Business Connections (A.B.C) Expenses: Date Description Inv# AmtDocumento2 páginasAccounting & Business Connections (A.B.C) Expenses: Date Description Inv# Amtsaeed_r2000422Ainda não há avaliações

- Cash PaymentDocumento8 páginasCash Paymentsaeed_r2000422Ainda não há avaliações

- Accounting & Business Connections (A.B.C) Expenses: Date Description Inv# AmtDocumento2 páginasAccounting & Business Connections (A.B.C) Expenses: Date Description Inv# Amtsaeed_r2000422Ainda não há avaliações

- Budget QuizDocumento1 páginaBudget Quizsaeed_r2000422Ainda não há avaliações

- Luke 12:42: w13 7/15 23 Par. 14Documento3 páginasLuke 12:42: w13 7/15 23 Par. 14saeed_r2000422Ainda não há avaliações

- LeDocumento1 páginaLesaeed_r2000422Ainda não há avaliações

- Bible HighlightsDocumento1 páginaBible Highlightssaeed_r2000422Ainda não há avaliações

- Eron LallDocumento4 páginasEron Lallsaeed_r2000422Ainda não há avaliações

- Mock t7Documento3 páginasMock t7saeed@atcAinda não há avaliações

- P3-Syll and SG 2013Documento14 páginasP3-Syll and SG 2013Shazia PashaAinda não há avaliações

- The Health and Fitness GroupDocumento4 páginasThe Health and Fitness Groupsaeed_r2000422Ainda não há avaliações

- Ratiios SummaryDocumento2 páginasRatiios Summarysaeed_r2000422Ainda não há avaliações

- F5 ATC Pass Card 2012 PDFDocumento102 páginasF5 ATC Pass Card 2012 PDFsaeed_r2000422100% (1)

- 2.4 Mock Exam Jun 06 Question-AJDocumento15 páginas2.4 Mock Exam Jun 06 Question-AJsaeed_r2000422Ainda não há avaliações

- Mock Exam Dec 2013Documento4 páginasMock Exam Dec 2013saeed_r2000422Ainda não há avaliações

- 2.4 Mock Exam Jun 06 Answer-AJDocumento20 páginas2.4 Mock Exam Jun 06 Answer-AJsaeed_r2000422Ainda não há avaliações

- Christine Sousa Bags 1Documento6 páginasChristine Sousa Bags 1Lowel PayawanAinda não há avaliações

- 18 PROBLEMS - AND - ANSWERS - FINANCIAL - ASSET - AT - AMORTIZED - COST - Bond - Investment - VERSION - 2.0Documento21 páginas18 PROBLEMS - AND - ANSWERS - FINANCIAL - ASSET - AT - AMORTIZED - COST - Bond - Investment - VERSION - 2.0Sheila Grace BajaAinda não há avaliações

- Quiz On LeasesDocumento1 páginaQuiz On LeasesBambi 1234Ainda não há avaliações

- Ibps Po Prelims 2016 English SolutionsDocumento3 páginasIbps Po Prelims 2016 English SolutionsMohd AmanAinda não há avaliações

- The Importance of Islamic Financial Principles and SystemsDocumento20 páginasThe Importance of Islamic Financial Principles and SystemsNouf AAinda não há avaliações

- Module 2 Conceptual Framework For Financial ReportingDocumento9 páginasModule 2 Conceptual Framework For Financial ReportingVivo V27Ainda não há avaliações

- FM Notes Unit 3&4Documento36 páginasFM Notes Unit 3&4prem nathAinda não há avaliações

- BusCom Exercises AnswerDocumento4 páginasBusCom Exercises AnswerVidgezxc LoriaAinda não há avaliações

- Acc 311 - Week1 - 1-3 MyAccountingLab Homework-Chapters 1 and 2Documento14 páginasAcc 311 - Week1 - 1-3 MyAccountingLab Homework-Chapters 1 and 2Lilian LAinda não há avaliações

- ACC 201 Final Project WorkbookDocumento40 páginasACC 201 Final Project WorkbookSwapan Kumar SahaAinda não há avaliações

- McqsDocumento2 páginasMcqsMuhammad AhmedAinda não há avaliações

- FINAL Q1 22 Shareholder Letter (Netflix)Documento12 páginasFINAL Q1 22 Shareholder Letter (Netflix)Melissa EckAinda não há avaliações

- R T C LTDDocumento32 páginasR T C LTDFarhanAinda não há avaliações

- MGT 201 Mega Quiz File SolvedDocumento263 páginasMGT 201 Mega Quiz File SolvedMuhammad Imran Saeed83% (6)

- How to understand an annual reportDocumento7 páginasHow to understand an annual reportWilson CastanedaAinda não há avaliações

- Class 12 Test 2 AccountsDocumento5 páginasClass 12 Test 2 AccountsPraveen Kumar0% (2)

- 349390137Documento32 páginas349390137Harpy AhmedAinda não há avaliações

- BMAccounting QualitiesDocumento22 páginasBMAccounting QualitiesESTRADAAinda não há avaliações

- Kotak Mahindra BankDocumento23 páginasKotak Mahindra BankSai VasudevanAinda não há avaliações

- 06 Equity InvestmentsDocumento8 páginas06 Equity InvestmentsAllegria AlamoAinda não há avaliações

- Netmeds Marketplace Limited Financial Statements for FY 2022Documento142 páginasNetmeds Marketplace Limited Financial Statements for FY 2022Sagar SangoiAinda não há avaliações

- DocxDocumento11 páginasDocxMikey MadRatAinda não há avaliações

- Synthesis - IFRSDocumento37 páginasSynthesis - IFRSRoseJeanAbingosaPernito0% (1)

- Report To The CommunityDocumento20 páginasReport To The CommunityVillageCareAinda não há avaliações

- Act101 Comprehensive ProblemDocumento11 páginasAct101 Comprehensive ProblemAMNEERA SHANIA LALANTOAinda não há avaliações