Escolar Documentos

Profissional Documentos

Cultura Documentos

Answer MF0010

Enviado por

TayeworkDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Answer MF0010

Enviado por

TayeworkDireitos autorais:

Formatos disponíveis

Master of Business Administration- MBA Semester 3

201 3

MF0010 Security Analysis and Portfolio Management- 4 Credits

Q1.Describe the investment process. Answer: The Investment Process As investors, we would all like to beat the market handily, and we would all like to pick "great" investments on instinct. However, while intuition is undoubtedly a part of the process of investing, it is just part of the process. As investors, one should follow the subsequent five processes. 1. Setting investment policy This initial step determines the investors objectives and the investible amount. Since there is a definite relationship between risk and return, the objectives should be stated in terms of both risk and return. This step concludes with the asset allocation decision, which is identification of the potential categories of financial assets for consideration in the portfolio that the investor is going to construct. Asset allocation involves dividing an investment portfolio among different asset categories, such as stocks, bonds and cash. 1.1 Time horizon The time horizon is the expected number of months, years, or decades for which the money will be invested. An investor with a longer time horizon may feel more comfortable with a riskier or more volatile investment because he can ride out the economic cycles and the inevitable difficulties of the markets. But an investor, saving for his teenage daughters college education would be less likely to take a large risk because he has a shorter time horizon. 1.2 Risk appetite Risk appetite is an investors ability and willingness to lose some or all of his original investment in exchange for greater potential returns. An aggressive investor with greater risk tolerance is more likely to risk losing money in order to get better results. A conservative investor will favor investment that protects his original investment. Conservative investors keep a "bird in the hand, while aggressive investors seek "two in the bush."While setting the investment policy, the investor also selects the portfolio management style (active vs. passive management). 2. Performing security analysis The second step is security selection. Security analysis involves examining a number of individual securities and identifying those securities that currently appear to be mispriced. Security analysis is done using

Tayework Fantaye Page 1

Master of Business Administration- MBA Semester 3

201 3

fundamental or technical analysis or both (both have been discussed in subsequent units).Fundamental analysis is a method used to evaluate the worth of a security by studying the financial data of the issuer. It scrutinizes the issuer's income and expenses, assets and liabilities, management, and position in its industry. In other words, it focuses on the basics of the business. Technical analysis is a method used to evaluate the worth of a security by studying market statistics. Unlike fundamental analysis, technical analysis disregards an issuers financial statements. Instead, it relies upon market performance of the scrip to ascertain investor sentiment. 3. Portfolio construction The third step identifies the specific assets in which to invest, and determines the amounts to put into each asset. Here selectivity, timing and diversification issues are addressed. Selectivity refers to security analysis and focuses on price movements of individual securities. Timing involves forecasting of price movement of stocks relative to price movements of fixed income securities (such as bonds). Diversification aims at constructing a portfolio that minimizes the investors risk. 4. Portfolio revision This step is the periodic revision of the portfolio using the three previous steps. A portfolio might not be the optimal one forever and needs constant modifications. 5. Portfolio performance evaluation This step involves determining periodically how the portfolio has performed over the review period. Q2.Explain money market features and its compositions. Answer: The money market is a market for financial assets that are close substitutes for money. It is a market for overnight short-term funds and instruments having a maturity period of one or less than one year. The money market facilitates interaction between supply and demand of short-term funds, with maturity of a year or less. Most money market transactions are made in marketable securities which are short-term debt instruments such as T-bills and commercial paper. Money (currency) is not actually traded in the money markets. The securities traded in the money market are short-term with high liquidity and low-risk. They are called money equivalents. Money market provides investors a place for parking surplus funds for short periods of time. It also provides low-cost source of temporary funds to borrowers like firms, government and financial intermediaries. Money markets are associated with the issuance and trading of short-term (less than 1 year) debt obligations of large

Tayework Fantaye Page 2

Master of Business Administration- MBA Semester 3

201 3

corporations, financial institutions (FIs) and governments. Every issue is huge and so only high-quality entities can borrow in the money markets. Money markets are characterised by low default risk and large value instruments. Money market transactions can be executed directly or through an intermediary. Investors in money market instruments include corporations and FIs who have idle cash but are restricted to a shortterm investment horizon. Money markets essentially serve to allocate the nations supply of liquid funds among major short-term lenders and borrowers. The characteristics of money market instruments are: Short-term debt instruments (maturity of less than 1 year) Serves immediate cash needs o Borrowers need short-term working capital. o Lenders need an interest-earning parking space for excess funds. Instruments are traded in an active secondary market. o Liquid market provides easy entry and exit for participants. o Speed and efficiency of transactions allows cash to be active even for very short periods of time (overnight). Large denominations o Transactions costs are low in relative terms. o Individual investors do not usually participate. Low default risk o Only high quality borrowers participate. o Short maturities reduce the risk of changes in borrower quality. Insensitive to interest rate changes o They mature in one year or less from their issue date. Maturity of less than 1 year is too short for securities to be adversely affected, in general, by changes in rates. Q3.Discuss the factors affect industry analysis. Answer: This is because the demand trends of different industries vary. There are many issues outside the control of company management or industry participants that nonetheless affect an industrys viability. Understanding these factors is critical to industry and company research. The primary external factors affecting industries include technology, government, social changes, demographics and foreign influences. The factors affecting industry performance are given as follow; Sensitivity to the business cycle Industries are affected in a different ways to recessions and expansions. For example, heavy industries like steel manufacturers are harshly affected during recession. On the other hand, consumer goods like food and

Tayework Fantaye Page 3

Master of Business Administration- MBA Semester 3

201 3

beverage firms are less affected. In an inflation spiral, regulated industries such as utilities are severely affected as they are powerless to pass price increase to customers. In a booming economy some industries show a better performance when compared to others. This is because the demand trends of different industries vary. Industry life cycle Most industries go through fairly well-defined life cycle stages that affect the growth of companies in that industry, competition climate, the types of profit margins, and overall stability of the market. The industry life cycle has a major effect on the earnings per share and rates of return offered by the industry. As a result, the ability to recognize the industry life cycle stage is a valuable asset for any investor. This concept of an industry life cycle applies to industries or product lines within an industry. Pioneering stage: During this stage, there is a rapid growth in demand for the company. Many companies fail at this stage as a result of strong competitive pressures while others achieve rapid growth in sales and earnings. The investors of such companies have a good chance of earning more than the expected returns. At the same time the risk of the firm failing is also high. Expansion stage: In this stage the pioneer firms that have survived continue to grow and prosper at a moderate growth rate. In this phase, firms focus on improving their products and at times lower prices. As firms have stabilized in financial performance the companies they attract investment capital. This is because investors prefer to invest in these firms with proven track record and low risk of failure. Also the dividends pay-outs are good that make it more attractive for the investor to buy stock of these firms to investors. Stabilization stage (maturity stage): This is a stage of moderate growth for firms. Sales increase, but at a slower rate. Products are standardized and less innovative while competition is stiff, and costs are stable. Such firms continue to operate without significant growth, and are usually headed for stagnation. Industry structure and performance According to Porter, competition has the following five dimensions. Threat of new entrants: New entrants put pressure on price and profits. Therefore barriers to entry can be a key determinant of an industrys profitability. The most attractive segment has high entry barriers and low exit barriers. Although any firm should be able to enter and exit a market, each industry often presents varying

Tayework Fantaye Page 4

Master of Business Administration- MBA Semester 3

201 3

levels of difficulty, commonly driven by economies. Manufacturingbased industries are more difficult to enter than many service-based industries. Barriers to entry protect profitable areas for firms and inhibit additional rivals from entering the market. Bargaining power of buyers: The bargaining power of buyers describes the impact customers have on an industry. Rivalry between existing competitors: Firms make efforts to establish a competitive advantage over their rivals. The intensity of rivalry varies within each industry. Industries that are concentrated, versus fragmented, often display the highest level of rivalry. Threat of substitute products or services: Substitute products are those that are available in other industries that meet an identical or similar need for the end user. As more substitutes become available and affordable, the demand becomes more elastic since customers have more alternatives. Substitute products may limit the ability of firms within an industry to raise prices and improve margins. Bargaining power of suppliers: An industry that produces goods requires raw materials. This leads to buyer-supplier relationships between the industry and firms that provide raw materials. Depending on where the power lies, suppliers may be able to exert an influence on the producing industry.

Q4. Differences between fundamental and technical analysis. Answer: What is the Difference? The difference between fundamental and technical investment analysis is large. Most investors, if they understand the differences, believe they are one or the other. Differences between fundamental and technical analysis are: 1. Charts vs. Financial statements: A technical analyst approaches a security via the charts, while a fundamental analyst studies the financial statements. Technical analysis is the study of price action and trend, while fundamental analysis focuses the companys performance in the backdrop of industry and economy conditions. By looking at the financial statements (income statement, balance sheet and cash flow statement) a fundamental analyst determines a companys value. The technical analyst sees no reason for analyzing the companys fundamentals as he believes that they are already accounted for in the stocks price. All the information that a technical analyst desires is there in the price of the securities that can be found in the charts.

Tayework Fantaye Page 5

Master of Business Administration- MBA Semester 3

201 3

2. Time horizon: Fundamental analysts take a longer term view of the market when compared to the technical analysts. Technical analysis has a timeframe of weeks or even days whereas fundamental analysis often looks at data over a number of years. The difference in the timeframes is because of the different investing styles of fundamental and technical analysis. It can take a long time for an undervalued stock, uncovered by fundamental analysis, to reach its correct value. Fundamental analysis assumes that if the short-term market is wrong (in valuing a stock at less than its intrinsic value) the price of the stock will correct itself over a longer period. Also, the data analyzed in fundamental analysis covers long periods, at least a quarter and usually a year. In contrast the price and volume data that the technical analysts use are generated continually, all the time. 3. Trading vs. investing: The goals of technical and fundamental analysis are often different. Generally fundamental analysis is oriented to investment decisions, while technical analysis is more relevant for trading decisions. Investors buy assets that they believe can increase in value and yield returns over longer periods. Traders buy assets that they believe they can sell quickly at a higher price. 4. Cause vs. effect: While both approaches have the same objective of predicting the direction of prices, the fundamental analyst studies the causes of market movements, while the technical analyst studies the effect of market movements. The fundamental analyst needs to know why the prices have changed. The technical analyst, on the other hand, attempts to find where the prices can be expected to change. Although technical analysis and fundamental analysis may seem to be poles apart, many market participants have achieved success by combining both. Thus a fundamental analyst may use technical analysis to figure out the best time to enter into an undervalued security. Often this opportunity is present when the security is severely oversold. By timing entry into a security, the gains on the investment can be greatly improved. Similarly, some technical traders might look at fundamentals to add strength to a technical signal Q5.Explain the implications of EMH for security analysis and portfolio management. Answer : Meaning and definition of Capital Asset Pricing Model The Capital Asset Pricing Model (CAPM) refers to a model that delineates the relationship between risk and expected return and what is used in the pricing of risky securities. The concept is used for pricing an individual portfolio or security. The basic idea underlying the concept is that investors are required to be compensated in two ways

Tayework Fantaye

Page 6

Master of Business Administration- MBA Semester 3

201 3

Q6.What is Capital Asset Pricing Model (CAPM)? Write the assumptions of CAPM. (5+5) Answer : Capital asset pricing means defining an appropriate riskadjusted rate of return for a given asset. Capital Asset Pricing Model (CAPM) is a model that helps in this exercise. Since the market portfolio includes all the risky assets in their relative proportions, it is a fully diversified portfolio. The inherent risk of each asset that can be eliminated by belonging to the portfolio has already been eliminated. Only the market risk (also called systematic risk) will remain. This has been discussed in detail in the last unit. The CAPM is a model for risky asset pricing. Using a statistical technique called linear regression, the total risk of each risky asset is separated into two components: variability in its returns (i.e., risk) that is related with the variability of returns in the market portfolio (its contribution to systematic risk) Variability in its returns that is unrelated with the variability of returns in the market portfolio (called unsystematic risk). Thus the major conclusion of CAPM is that expected return on an asset is related to its systematic and not to its total risk or standard deviation. Its systematic risk is given by its beta coefficient (). An assets beta is a measure of its co-movement with the market index. The assumptions of CAPM All investors are assumed to follow the mean-variance approach, i.e. the risk-averse investor will ascribe to the methodology of reducing portfolio risk by combining assets with counterbalancing correlations. Assets are infinitely divisible. There is a risk-free rate at which an investor may lend or borrow. This risk-free rate is the same for all investors. Taxes and transactions costs are irrelevant. All investors have same holding period. Information is freely and instantly available to all investors. Investors have homogeneous expectations i.e. all investors have the same expectations with respect to the inputs that are used to derive the Markowitz efficient portfolios (asset returns, variances and correlations). Markets are assumed to be perfectly competitive i.e. the number of buyers and sellers is sufficiently large, and all investors are small enough relative to the market, so that no individual investor can influence an assets price.

Tayework Fantaye

Page 7

Você também pode gostar

- Answer MF0011Documento9 páginasAnswer MF0011TayeworkAinda não há avaliações

- Master of Business Administration-MBA Semester 3Documento1 páginaMaster of Business Administration-MBA Semester 3TayeworkAinda não há avaliações

- Answer MF0051Documento1 páginaAnswer MF0051TayeworkAinda não há avaliações

- Answer MF0050Documento1 páginaAnswer MF0050TayeworkAinda não há avaliações

- Answer MF0013Documento4 páginasAnswer MF0013TayeworkAinda não há avaliações

- Answer MF0012Documento6 páginasAnswer MF0012TayeworkAinda não há avaliações

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Module 1 Packet: College OF CommerceDocumento14 páginasModule 1 Packet: College OF CommerceCJ GranadaAinda não há avaliações

- Acer, Inc: Taiwan's Rampaging DragonDocumento20 páginasAcer, Inc: Taiwan's Rampaging DragonPravin Dhas100% (5)

- Global LCC Outlook v2Documento310 páginasGlobal LCC Outlook v2JcastrosilvaAinda não há avaliações

- RMO NO. 44-2016 - DigestDocumento1 páginaRMO NO. 44-2016 - DigestGar La ARAinda não há avaliações

- TRAIN Law ProvisionsDocumento5 páginasTRAIN Law ProvisionsCarmela WenceslaoAinda não há avaliações

- Scanner CAP II Income Tax VATDocumento162 páginasScanner CAP II Income Tax VATEdtech NepalAinda não há avaliações

- Audit of The Capital Acquisition and Repayment CycleDocumento19 páginasAudit of The Capital Acquisition and Repayment CyclenisasuriantoAinda não há avaliações

- A-4 Purple Form Farewell Grant ApplicationDocumento2 páginasA-4 Purple Form Farewell Grant Applicationabubakar younasAinda não há avaliações

- Q&A Section A AA025 - Lecturer EditionDocumento40 páginasQ&A Section A AA025 - Lecturer EditionSyirleen Adlyna Othman100% (1)

- A Study A Study On Financial Performance Analysis With Reference To Kesoram Cementon Financial Performance Analysis With Reference To Kesoram CementDocumento81 páginasA Study A Study On Financial Performance Analysis With Reference To Kesoram Cementon Financial Performance Analysis With Reference To Kesoram CementjeganrajrajAinda não há avaliações

- Financial Policy For IvcsDocumento11 páginasFinancial Policy For Ivcsherbert pariatAinda não há avaliações

- Deloitte TestDocumento19 páginasDeloitte TestTrà HươngAinda não há avaliações

- The Behavior of Interest RatesDocumento39 páginasThe Behavior of Interest RatesAhmad RahhalAinda não há avaliações

- Ratio Analysis of The Annual Report On Standard BankDocumento15 páginasRatio Analysis of The Annual Report On Standard BankShopno Konna Sarah80% (5)

- BMW Group income statements for Q2 2020Documento7 páginasBMW Group income statements for Q2 2020ali balochAinda não há avaliações

- Cabcharge Research Report CAB ASXDocumento4 páginasCabcharge Research Report CAB ASXzengooiAinda não há avaliações

- Investment Office ANRS: Project Profile On The Establishment of Banana PlantationDocumento24 páginasInvestment Office ANRS: Project Profile On The Establishment of Banana Plantationbig john100% (3)

- What Would You Do With A Million Dollars?: Philip BrewerDocumento4 páginasWhat Would You Do With A Million Dollars?: Philip BrewerKatarina JovanovićAinda não há avaliações

- Immunization StrategiesDocumento20 páginasImmunization StrategiesnehasoninsAinda não há avaliações

- Chapter 4 Land Value Determination and Tax Maps 353172 7Documento38 páginasChapter 4 Land Value Determination and Tax Maps 353172 7Andri SuhartoAinda não há avaliações

- Trade and Capital Flows - GCC and India - Final - May 02 2012Documento55 páginasTrade and Capital Flows - GCC and India - Final - May 02 2012aakashblueAinda não há avaliações

- P.R. Cements LTD Fixed Assets ManagementDocumento71 páginasP.R. Cements LTD Fixed Assets ManagementPochender vajrojAinda não há avaliações

- Introduction Project 1Documento4 páginasIntroduction Project 1Vishal dubeyAinda não há avaliações

- SAUCE (Phil - Tax)Documento9 páginasSAUCE (Phil - Tax)Darren GreAinda não há avaliações

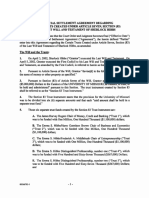

- Settlement Terms Between Mizzou, Hillsdale Over Conservative Donor's InstructionsDocumento74 páginasSettlement Terms Between Mizzou, Hillsdale Over Conservative Donor's InstructionsThe College FixAinda não há avaliações

- Incorporating The Venture Backed LLCDocumento30 páginasIncorporating The Venture Backed LLCRoger RoyseAinda não há avaliações

- Aaya PrakaranaDocumento10 páginasAaya Prakaranaking1q100% (1)

- The Capital Asset Pricing ModelDocumento43 páginasThe Capital Asset Pricing ModelTajendra ChughAinda não há avaliações

- Chapter 2 and 3 Lopez BookDocumento4 páginasChapter 2 and 3 Lopez BookSam CorsigaAinda não há avaliações

- Activity 1 - Manufacturing Accounting Cycle: Problem 1Documento2 páginasActivity 1 - Manufacturing Accounting Cycle: Problem 1AJ OrtegaAinda não há avaliações