Escolar Documentos

Profissional Documentos

Cultura Documentos

UST Exhibits

Enviado por

lifeeeDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

UST Exhibits

Enviado por

lifeeeDireitos autorais:

Formatos disponíveis

Debt Policy at UST Inc.

Harvard Business School Case N9-200-069

Case Software 2-200-709

Copyright 2000 by the President and Fellows of Harvard College

This case was prepared by Professor Mark Mitchell, with the assistance of Janet T. Mitchell, as the

basis for class discussion rather than to illustrate either effective or ineffective handling of an

administrative situation.

Exhibit 1

UST Inc. Product Information

Category

Introduction

% 1998

Sales

1998

Average

Retail Cost

per Can

Copenhagen

Full Price

1822

48%

Skoal Fine Cut

Full Price

1935

Skoal Long Cut

Full Price

Skoal Bandits

Full Price

Red Seal

Price Value

Rooster

Full Price

Brands

Description

Competition

$3.13

Top selling brand in the industry. Straight-flavored.

Copenhagen has a "made-date" on bottom of its

container so consumers recognize that it is fresh.

Both fine and long cut varieties. Long cut variety

introduced in the first quarter of 1997.

Timberwolf (Swedish Match)

and Redwood (Swisher)

18%

$2.98

Second largest selling brand in the industry.

Wintergreen and straight-flavored.

Kodiak (Conwood)

1984

29%

$3.11

Available in six varieties: wintergreen, straight,

mint, cherry, classic and spearmint.

Kodiak (Conwood),

Timberwolf (Swedish Match)

and Silver Creek (Helme)

National introduction

in 1983

3%

$3.10

Skoal packed in "tea bags" that are individual

portion packs that make it easy to use and dispose.

Renegades (Swedish

Match)

Third Qtr 1997

1%

$1.29

Available in wintergreen and straight-flavors.

Introduced in a 1.2 oz package.

Timberwolf (Swedish

Match), Cougar, Redwood

(Swisher) and Silver Creek

(Helme)

Test Marketed in

Fourth Qtr 1997;

National introduction

in 1998

<1%

$2.44

Long-cut wintergreen and straight-flavored. Priced

competitively to Copenhagen and Skoal but is

packaged in a 1.5 oz can, offering consumers 25%

more tobacco for their money.

Kodiak (Conwood)

Source: Credit Suisse First Boston research dated August 27, 1999.

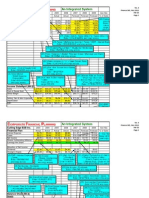

Exhibit 2

UST Inc. Market Share Information, 1991-1998

1991

Industry

Premium Market Share %

Price Value Market Share %

1992

1993

1994

1995

1996

1997

1998

7 Yr. CAGR

99.0%

1.0%

97.9%

2.1%

97.2%

2.8%

96.3%

3.7%

94.9%

5.1%

92.7%

7.3%

90.9%

9.1%

89.2%

10.8%

(1.5%)

40.5%

86.2%

84.6%

(1.9%)

84.6%

0.0%

85.1%

0.6%

85.1%

0.0%

83.8%

(1.5%)

83.8%

0.0%

81.7%

(2.5%)

81.7%

0.0%

79.5%

(2.7%)

79.5%

0.0%

78.2%

(1.6%)

78.2%

0.0%

77.2%

(1.3%)

76.6%

0.6%

(1.6%)

11.3%

11.9%

11.3%

0.0%

10.8%

(4.4%)

10.8%

0.0%

11.1%

2.8%

11.1%

0.0%

11.9%

7.2%

11.9%

0.0%

12.8%

7.6%

12.2%

0.6%

13.1%

2.3%

11.8%

1.3%

13.2%

0.8%

11.6%

1.6%

3.9%

2.0%

11.1%

2.0%

0.0%

1.0%

(50.0%)

1.0%

0.0%

1.1%

10.0%

1.0%

0.1%

1.4%

27.3%

0.8%

0.6%

2.3%

64.3%

0.5%

1.8%

3.0%

30.4%

0.3%

2.7%

4.6%

53.3%

0.3%

4.3%

14.3%

2.8%

33.3%

0.0%

2.8%

3.6%

28.6%

0.0%

3.6%

4.5%

25.0%

0.0%

4.5%

4.9%

8.9%

0.0%

4.9%

5.1%

4.1%

0.0%

5.1%

3.8%

(25.5%)

0.0%

3.8%

21.0%

0.0%

1.0%

2.1%

110.0%

0.0%

2.1%

Other Manufacturers

Total Market Share %

0.9%

Increase/(Decrease)%

Premium Market Share %

0.9%

UST Inc. Price Value Market Share % 0.0%

0.0%

(100.0%)

0.0%

0.0%

0.3%

NM

0.3%

0.0%

0.4%

33.3%

0.4%

0.0%

0.5%

25.0%

0.5%

0.0%

0.5%

0.0%

0.5%

0.0%

0.6%

20.0%

0.6%

0.0%

1.2%

100.0%

0.7%

0.5%

4.2%

UST

Total Market Share %

Increase/(Decrease)%

Premium Market Share %

Price Value Market Share %

Conwood

Total Market Share %

Increase/(Decrease)%

Premium Market Share %

Price Value Market Share %

Swedish Match

Total Market Share %

Increase/(Decrease)%

Premium Market Share %

Price Value Market Share %

Swisher

Total Market Share %

Increase/(Decrease)%

Premium Market Share %

Price Value Market Share %

86.2%

0.0%

10.1%

10.1%

0.0%

1.8%

1.8%

0.0%

1.0%

Source: Credit Suisse First Boston Research dated August 27, 1999. Compiled from A.C. Neilson data and estimates.

(1.7%)

-

2.0%

-

(22.6%)

-

21.0%

(3.5%)

-

Exhibit 3

UST Inc. Summary Financial Information--Eleven Years (1988-1998) (in millions, except per share data and ratios)

Summary Operating Data

Net Sales

Gross Profit

EBITDA

EBIT

Interest Expense (Income)

Pretax Earnings

Net Income

1988

1989

1990

1991

1992

1993

1994

$ 611.9

437.3

277.9

260.2

(1.1)

261.3

162.2

$ 673.9

488.4

315.0

298.4

(3.2)

301.6

190.5

$ 756.4

564.6

368.6

349.0

(3.2)

352.2

223.3

$ 898.4 $ 1,032.2 $ 1,097.5 $ 1,204.0

670.9

775.4

851.1

952.0

446.4

525.2

591.4

668.9

423.8

500.8

564.8

640.7

(2.3)

(1.9)

(2.0)

0.1

426.1

502.6

566.8

640.6

265.9

312.6

347.9

387.5

$ 135.2

-

$ 195.1

-

$ 217.8

-

$ 247.3

-

1995

1996

1997

$ 1,305.8

1,043.6

736.9

707.8

3.2

704.6

429.8

$ 1,371.7

1,098.9

779.2

750.9

6.4

744.5

464.0

$ 1,401.7

1,109.8

749.8

719.3

7.5

703.9

443.9

$ 521.2

-

$ 456.4

-

$ 287.4

$ 8.0

1998

5 Year

CAGR

10 Year

CAGR

Free Operating Cash Flow

Special Charges/Non-Recurring Items (Gains) 2

Basic Earnings per Share

Diluted Earnings per Share

Dividend per Share

Dividend Payout Ratio

$ 0.74

$ 0.71

$ 0.37

50%

Balance Sheet & Cash Flow Data

Cash and Cash Equivalents

Total Assets

Long-Term Debt

Total Debt

Shareholders' Equity

$ 72.7

$ 598.0

$ 21.8

$ 30.8

$ 453.3

Average Basic Shares Outstanding

$ 0.87

$ 0.83

$ 0.46

53%

$ 54.6

$ 630.2

$ 6.8

$ 14.5

$ 482.3

$ 1.04

$ 0.99

$ 0.55

53%

$ 46.6

$ 622.6

$ 3.1

$ 4.8

$ 473.9

$ 1.26

$ 1.20

$ 0.66

52%

$ 41.5

$ 656.5

$ 1.3

$ 482.9

$ 267.9

-

$ 340.7

$ (35.0)

$ 1.49

$ 1.43

$ 0.80

54%

$ 1.67

$ 1.63

$ 0.96

58%

$ 36.4

$ 674.0

$ 516.6

$ 25.3

$ 706.2

$ 40.0

$ 40.0

$ 463.0

$ 399.2

$ 1.92

$ 1.88

$ 1.12

58%

$ 50.7

$ 741.2

$ 125.0

$ 125.0

$ 361.7

$ 2.21

$ 2.17

$ 1.30

59%

$ 69.4

$ 784.0

$ 100.0

$ 200.0

$ 292.8

$ 2.48

$ 2.44

$ 1.48

60%

$ 54.5

$ 806.6

$ 100.0

$ 250.0

$ 281.2

$ 2.41

$ 2.39

$ 1.62

67%

$ 6.9

$ 826.4

$ 100.0

$ 110.0

$ 436.8

$ 1,423.2

1,139.7

785.0

753.3

(2.2)

755.5

467.9

5%

9%

6%

6%

11%

11%

6%

11%

$ 429.5

$ 21.0

5%

12%

9%

9%

11%

13%

13%

16%

5%

13%

$ 2.52

$ 2.50

$ 1.62

64%

$ 33.2

$ 913.3

$ 100.0

$ 100.0

$ 468.3

220.6

219.8

215.2

211.6

209.8

208.5

202.0

194.4

187.4

183.9

185.5

Working Capital

Capital Expenditures3

Dividends Paid

Share Repurchases

$ 221.1

$ 20.8

$ 81.7

$ 67.4

$ 209.3

$ 23.7

$ 101.2

$ 97.5

$ 197.2

$ 37.2

$ 118.3

$ 151.3

$ 210.0

$ 28.4

$ 139.7

$ 184.4

$ 249.0

$ 30.1

$ 168.0

$ 212.6

$ 228.4

$ 54.5

$ 199.7

$ 236.7

$ 221.2

$ 23.7

$ 225.7

$ 298.8

$ 144.8

$ 14.0

$ 252.4

$ 274.8

$ 144.0

$ 36.7

$ 277.3

$ 237.8

$ 275.3

$ 55.8

$ 298.1

$ 45.7

$ 309.9

$ 35.5

$ 301.1

$ 151.6

Stock Price Data

High

Low

Year End

Price/Earnings Ratio4

$ 10.50

$ 6.00

$ 10.25

13.9x

$ 15.38

$ 9.63

$ 15.31

17.6x

$ 18.25

$ 12.38

$ 18.25

17.5x

$ 33.88

$ 16.38

$ 32.75

26.0x

$ 35.38

$ 25.38

$ 32.00

21.5x

$ 32.75

$ 24.38

$ 27.75

16.6x

$ 31.50

$ 23.63

$ 27.88

14.5x

$ 36.00

$ 26.63

$ 33.38

15.1x

$ 35.88

$ 28.25

$ 32.38

13.1x

$ 36.94

$ 25.50

$ 36.94

15.3x

$ 36.88

$ 24.56

$ 34.88

13.8x

Market Equity5

$ 2,260.6

$ 3,366.0

$ 3,926.6

$ 6,930.0

$ 6,713.7

$ 5,785.0

$ 5,630.6

$ 6,487.2

$ 6,066.6

$ 6,794.0

$ 6,470.8

Selected Growth Rates and Ratios

Sales Growth

Net Income Growth

Dividend Growth

7.2%

23.9%

23.3%

10.1%

17.5%

24.3%

12.3%

17.2%

19.6%

18.8%

19.1%

20.0%

14.9%

17.5%

21.2%

6.3%

11.3%

20.0%

9.7%

11.4%

16.7%

8.5%

10.9%

16.1%

5.0%

8.0%

13.8%

2.2%

(4.3%)

9.5%

1.5%

5.4%

0.0%

5-Yr Avg 10-Yr Avg

Gross Profit Margin

EBITDA Margin

EBIT Margin

Net Margin

71.5%

45.4%

42.5%

26.5%

72.5%

46.7%

44.3%

28.3%

74.6%

48.7%

46.1%

29.5%

74.7%

49.7%

47.2%

29.6%

75.1%

50.9%

48.5%

30.3%

77.5%

53.9%

51.5%

31.7%

79.1%

55.6%

53.2%

32.2%

79.9%

56.4%

54.2%

32.9%

80.1%

56.8%

54.7%

33.8%

79.2%

53.5%

51.3%

31.7%

80.1%

55.2%

52.9%

32.9%

79.7%

55.5%

53.3%

32.7%

77.3%

52.7%

50.4%

31.3%

Return on Average Equity

Return on Average Assets

Long-Term Debt/Capitalization

Total Debt/Capitalization

38.0%

28.3%

4.6%

6.4%

40.7%

31.0%

1.4%

2.9%

46.7%

35.6%

0.6%

1.0%

55.6%

41.6%

0.0%

0.3%

62.5%

47.0%

0.0%

0.0%

71.0%

50.4%

8.0%

8.0%

94.0%

53.5%

25.7%

25.7%

131.3%

56.4%

25.5%

40.6%

161.7%

58.3%

26.2%

47.1%

123.7%

54.4%

18.6%

20.1%

103.4%

53.8%

17.6%

17.6%

122.8%

55.3%

22.7%

30.2%

89.1%

48.2%

12.4%

16.3%

Source: Company annual report for fiscal year ended December 31, 1998 and author's adjustments and calculations.

Before the cumulative effect of accounting changes. Excludes settlement charges and other special charges or non-recurring items. All net income adjustments apply a 40% tax rate.

1

2

Authors' estimates of settlement charges and other special charges or non-recurring items. Does not include effect of accounting changes.

Additions of property, plant and equipment net of dispositions.

Based upon year-end stock price and basic earnings per share.

Based upon average basic shares outstanding and year-end stock price.

Exhibit 4

UST Inc. Summary Financial Information--Segment Data (1996-1998) (in millions)

1996

Net Sales (unaffiliated customers)

Tobacco

Wine

Other

Total Net Sales

Operating Profit

Tobacco

Wine

Other

Total Operating Profit

Operating Profit Margin

Tobacco

Wine

Other

Identifiable Assets at December 31

Tobacco

Wine

Other

Corporate

Total Identifiable Assets

% Total

1997

% Total

1998

% Total

$ 1,167.5 85.1%

122.5 8.9%

81.7 6.0%

$ 1,371.7

$ 1,181.8 84.3%

145.0 10.3%

74.9 5.3%

$ 1,401.7

$ 1,245.6 87.5%

148.5 10.4%

29.2 2.1%

$ 1,423.2

$ 745.6 97.6%

17.9 2.3%

0.1 0.0%

$ 763.5

$ 700.4 96.3%

28.2 3.9%

(1.3) (0.2%)

$ 727.3

$ 720.6 96.8%

22.1 3.0%

1.7 0.2%

$ 744.4

63.9%

14.6%

0.1%

59.3%

19.4%

(1.7%)

57.9%

14.9%

5.9%

$ 458.2

194.9

91.6

61.9

$ 806.6

56.8%

24.2%

11.4%

7.7%

$ 468.0

230.9

102.2

25.3

$ 826.4

56.6%

27.9%

12.4%

3.1%

$ 497.6

277.2

87.2

51.3

$ 913.3

54.5%

30.4%

9.5%

5.6%

Capital Expenditures (Gross)

Tobacco

Wine

Other

Corporate

Total Capital Expenditures

$ 29.2

12.0

2.7

0.8

$ 44.7

65.3%

26.9%

6.0%

1.8%

$ 29.4

20.1

6.1

2.5

$ 58.2

50.6%

34.6%

10.5%

4.3%

$ 27.7

25.6

2.5

0.5

$ 56.3

49.2%

45.6%

4.4%

0.8%

Depreciation

Tobacco

Wine

Other

Corporate

Total Depreciation

$ 15.8

8.9

1.8

1.6

$ 28.1

56.2%

31.7%

6.4%

5.8%

$ 16.3

10.4

1.8

1.6

$ 30.1

54.0%

34.6%

6.1%

5.3%

$ 16.1

12.0

1.7

1.7

$ 31.4

51.3%

38.1%

5.3%

5.3%

Source: Company annual report for fiscal year ended December 31, 1998 and author's calculations.

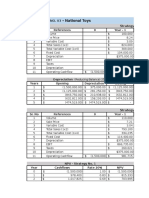

Exhibit 5

Summary Financial Information--Selected Tobacco Companies, Fiscal Years Ended in 1998 (in millions, except per share data and ratios)

UST Inc.

Tobacco Product Manufacturers

North

Atlantic

Philip Morris

Trading Co.

Tobacco Leaf Merchants

RJR

Nabisco

Holdings9

DiMon Inc.

Dec 31, 1998

June 30, 1998

Standard

Commercial

Universal Corp

Summary Operating Data

Fiscal Year End

Dec 31, 1998

Dec 31, 1998

Net Sales

Gross Profit

EBITDA2

EBIT2

Interest Expense (Income)

Pretax Earnings

Net Income

$ 1,423.2

1,139.7

785.0

753.3

(2.2)

755.5

467.9

$ 74,391.0

30,993.0

15,501.0

13,811.0

890.0

12,921.0

7,672.4

$ 93.1

60.9

36.3

29.1

24.9

4.2

1.0

$ 20,563.0

9,493.0

3,602.0

2,467.0

880.0

1,455.0

718.0

$ 2,171.8

266.9

200.2

156.7

83.8

72.9

52.0

$ 429.5

$ 21.0

$ 6,076.4

$ 3,834.0

$ 14.5

-

$ 2,016.0

$ 2,069.0

$ 52.5

$ 16.9

$ (61.3)

-

$ 110.2

$ (16.7)

$ 1.17

$ 1.16

$ 0.66

56%

$ 2.18

$ 2.05

0%

$ 3.71

$ 3.68

$ 1.11

30%

Free Operating Cash Flow

3

Special Charges/Non-Recurring Items (Gains)

Basic Earnings per Share

Diluted Earnings per Share

Dividend per Share (Common)

Dividend Payout Ratio

$ 2.52

$ 2.50

$ 1.62

64%

Balance Sheet & Cash Flow Data

Cash and Cash Equivalents

Total Assets

Long-Term Debt

Total Debt

Preferred Stock & Minority Interest

Shareholders' Equity

$ 33.2

$ 913.3

$ 100.0

$ 100.0

$ 468.3

Average Basic Shares Outstanding

$ 3.16

$ 3.14

$ 1.68

53%

$ 4,081.0

$ 59,920.0

$ 12,615.0

$ 14,662.0

$ 16,197.0

Dec 31, 1998

$ (7.09)

$ (7.09)

0%

185.5

2,429.0

528.2

$ 309.9

$ 35.5

$ 3,851.0

$ 1,804.0

$ 42.0

$ 0.5

Stock Price Data

Fiscal Year End

Price/Earnings Ratio5

$ 34.88

13.8x

Market Equity6

$ 6,470.8

Selected Growth Rates and Ratios

Sales Growth

Gross Profit Margin

EBITDA Margin

EBIT Margin

Net Margin

Return on Average Equity

Return on Average Assets

Long-Term Debt/Capitalization

Total Debt/Capitalization

$ 129,951.5

$ 2.8

$ 260.0

$ 202.6

$ 215.6

$ 39.3

$ (15.4)

Working Capital

Capital Expenditures4

$ 53.50

16.9x

$ 2.22

$ 2.22

$ 2.05

92%

$ 300.0

$ 28,892.0

$ 9,982.0

$ 10,467.0

$ 957.0

$ 7,809.0

323.9

NA

NA

NA

March 31, 1998

$ 1,492.8

145.0

85.8

65.3

37.8

37.1

26.9

$ 18.7

$ 1,797.5

$ 797.0

$ 1,079.5

$ 0.5

$ 421.9

$ 4,287.2

613.6

329.5

278.4

64.0

231.3

130.4

$ 79.8

$ 2,056.7

$ 263.1

$ 849.6

$ 31.7

$ 547.9

44.5

12.4

35.2

$ (259.0)

$ 576.0

$ 706.4

$ 36.6

$ 219.1

$ 9.7

$ 328.8

$ 90.0

$ 29.69

13.4x

$ 11.25

9.6x

$ 15.94

7.3x

$ 37.38

10.1x

$ 500.3

$ 197.3

$ 9,614.4

$ 1,315.2

Median

(excl.

UST)

Mean

(excl.

UST)

1.5%

3.2%

10.2%

(0.5%)

2.2%

10.2%

4.2%

80.1%

55.2%

52.9%

32.9%

41.7%

20.8%

18.6%

10.3%

65.4%

39.0%

31.3%

1.1%

46.2%

17.5%

12.0%

3.5%

12.3%

9.2%

7.2%

2.4%

9.7%

5.7%

4.4%

1.8%

14.3%

7.7%

6.5%

3.0%

28.0%

13.4%

9.6%

2.7%

31.6%

16.7%

13.3%

3.7%

103.4%

53.8%

17.6%

17.6%

49.3%

13.2%

43.8%

47.5%

NM

0.4%

89.4%

90.0%

8.4%

2.4%

53.2%

54.4%

12.5%

2.7%

65.4%

71.9%

22.5%

3.4%

52.3%

72.3%

25.6%

6.5%

31.2%

59.4%

22.5%

3.1%

52.8%

65.7%

23.7%

4.8%

55.9%

65.9%

Source: Company financial statements and author's calculations and adjustments.

Before the cumulative effect of accounting changes and discontinued operations. Excludes settlement charges, special charges, and non-recurring items. Net income adjustments generally apply a 40% tax rate.

1

2

Excludes Other Income and Expense.

Authors' estimates of settlement charges and other special charges or non-recurring items. Does not include discontinued operations or effect of accounting changes.

Additions of property, plant and equipment net of dispositions.

Based upon fiscal year-end stock price and basic earnings per share.

Based upon average basic shares outstanding and fiscal year-end stock price.

Includes impact of preferred stock dividends.

North Atlantic Trading Company is privately held.

$ 34.1

$ 839.5

$ 197.1

$ 469.9

$ 30.3

$ 149.6

June 30, 1998

RJR Nabisco Holdings spun its tobacco business (R.J. Reynolds Tobacco) off to shareholders in 1999.

Exhibit 6

Standard & Poor's Key Financial Ratios for Tobacco Companies

Tobacco Product Manufacturers

Three-years (1996-1998)

Corporate Credit Rating

Outlook

EBIT interest coverage (x)

EBITDA interest coverage (x)

Fund flow/total debt (%)

Free operating cash flow/total debt (%)

Return on capital (%)

Operating income/sales (%)

Total debt/capital (including ST debt) (%)

Source: Standard & Poor's analysis

Data for 1997-1998.

1

2

Excludes UST Inc.

Tobacco Leaf Merchants

Philip Morris

North

Atlantic

Trading

Co.1

RJR Nabisco

DiMon Inc.

A

Stable

B+

Stable

BBBStable

BB+

Negative

11.2

12.7

56.3

41.8

38.4

26.0

49.3

1.3

1.6

6.8

5.6

11.8

38.1

90.6

2.5

3.7

14.5

6.8

10.3

15.6

55.1

2.6

3.3

12.3

10.1

13.4

16.4

67.8

Standard

Commercia

l

Universal Corp

BBPositive

3.3

5.4

6.7

(2.6)

6.6

3.6

77.5

Tobacco

Companies

Median2

UST Inc.

3.0

4.1

13.4

6.2

12.6

16.0

66.8

101.5

105.6

364.0

296.5

140.6

55.7

28.2

AStable

3.5

4.4

18.5

2.9

16.9

7.6

65.8

Exhibit 7

Standard & Poor's Key Financial Ratios

Adjusted Key Industrial Financial Ratios - Senior Debt Ratings

Industrial Long-Term Debt

Three-years (1996-1998) medians

AAA

EBIT interest coverage (x)

EBITDA interest coverage (x)

Fund flow/total debt (%)

Free operating cash flow/total debt (%)

Return on capital (%)

Operating income/sales (%)

Long-term debt/capital (%)

Total debt/capital (including ST debt) (%)

Debt Yields - December 22, 1998

10-Year (%)

20-Year (%)

Investment Grade

AA

A

12.9

18.7

89.7

40.5

30.6

30.9

21.4

31.8

9.2

14.0

67.0

21.6

25.1

25.2

29.3

37.0

AAA

5.60

6.47

AA

5.84

6.76

U.S. Treasury

4.70

5.45

7.2

10.0

49.5

17.4

19.6

17.9

33.3

39.2

BBB

Non-Investment Grade/Speculative

BB

B

CCC

4.1

6.3

32.2

6.3

15.4

15.8

40.8

46.4

2.5

3.9

20.1

1.0

12.6

14.4

55.3

58.5

1.2

2.3

10.5

(4.0)

9.2

11.2

68.8

71.4

(0.9)

0.2

7.4

(25.4)

(8.8)

5.0

71.5

79.4

Corporate Bond Yields

A

BBB

BB+

6.12

6.84

7.70

7.05

7.82

-

BB/BB8.72

-

BB

11.19

-

Formulas for Adjusted Key Industrial Financial Ratios

EBIT interest coverage=

Earnings from continuing operations before interest and taxes/

Gross interest incurred before subtracting capitalized interest and interest income

EBITDA interest coverage=

Earnings from continuing operations before interest, taxes, depreciation and amortization/

Gross interest incurred before subtracting capitalized interest and interest income

Funds from operations/Total debt=

Net income from continuing operations + depreciation, amortization, deferred income taxes, and other non-cash items/

Long-term debt + current maturities, commercial paper, and other short-term borrowings

Free operating cash flow/Total debt=

Funds from operations - capital expenditures - (+) the increase (decrease) in working capital (excl. changes in cash, marketable securities & ST debt)/

Long-term debt + current maturities, commercial paper, and other short-term borrowings

Pretax return on capital=

EBIT + interest expense/

Avg of beginning and ending year capital, including short-term debt, current maturities, long-term debt, non-current deferred taxes & equity

Operating income/Sales=

Sales minus cost of goods manufactured (before depreciation and amortization), SG&A and R&D costs/

Sales

Long-term debt/Capitalization=

Long-term debt/

Long-term debt + shareholders equity (including preferred stock) + minority interest

Total debt/Capitalization=

Long-term debt + current maturities, commercial paper, and other short-term borrowings/

Long-term debt + current maturities, commercial paper and other ST borrowings + shareholders equity (including preferred stock) + minority interest

Source: Standard & Poor's Credit Week, July 28, 1999, and Standard & Poor's The Outlook, January 6, 1999.

Note: Excludes discussion of operating lease equivalents as defined by S&P for simplification purposes .

Você também pode gostar

- US shaving market data 2005-2010 and consumer segmentation analysisDocumento19 páginasUS shaving market data 2005-2010 and consumer segmentation analysisPriyanka BindumadhavanAinda não há avaliações

- Monmouth Group4Documento18 páginasMonmouth Group4Jake Rolly0% (1)

- Debt Policy at Ust IncDocumento18 páginasDebt Policy at Ust InctutenkhamenAinda não há avaliações

- Robertson Tool Company Financial AnalysisDocumento25 páginasRobertson Tool Company Financial AnalysisPerci LunarejoAinda não há avaliações

- Annual Earnings Per Share Growth Rate Price/Earnings Ratio Market/Book RatioDocumento5 páginasAnnual Earnings Per Share Growth Rate Price/Earnings Ratio Market/Book RatiossslucysssAinda não há avaliações

- Lessons From Capital Market History: Return & RiskDocumento46 páginasLessons From Capital Market History: Return & RiskBlue DemonAinda não há avaliações

- MA819 Business Economics Products Marketing PricingDocumento26 páginasMA819 Business Economics Products Marketing PricingAhmad FikriAinda não há avaliações

- Analyst Rating: About Apple IncDocumento8 páginasAnalyst Rating: About Apple Incqwe200Ainda não há avaliações

- Long Duration Program Marketing Analytics SummaryDocumento7 páginasLong Duration Program Marketing Analytics SummaryTamal Sarkar100% (2)

- Revenue Variance ExampleDocumento1 páginaRevenue Variance ExampleImperoCo LLCAinda não há avaliações

- Revenue Variance ExampleDocumento1 páginaRevenue Variance ExampleNakkolopAinda não há avaliações

- Fin Model Practice 1Documento17 páginasFin Model Practice 1elangelang99Ainda não há avaliações

- Natureview Farm - Case AnalysisDocumento11 páginasNatureview Farm - Case AnalysisSubhrata MishraAinda não há avaliações

- HW20Documento18 páginasHW20kayteeminiAinda não há avaliações

- Wet Seal - VLDocumento1 páginaWet Seal - VLJohn Aldridge ChewAinda não há avaliações

- TiO2 FinancialDocumento15 páginasTiO2 Financialbhagvandodiya88% (8)

- Confectionery MarketDocumento96 páginasConfectionery Marketargyr@ath.forthnet.grAinda não há avaliações

- MonmouthDocumento16 páginasMonmouthjamn1979100% (1)

- Dividend Decision at Linear TechnologyDocumento8 páginasDividend Decision at Linear TechnologyNikhilaAinda não há avaliações

- Model-Generated Data AnalysisDocumento24 páginasModel-Generated Data AnalysisJerry K Floater0% (2)

- Financial Ratio Calculator: (Complete The Yellow Cells Only, The Spreadsheet Does The Rest)Documento8 páginasFinancial Ratio Calculator: (Complete The Yellow Cells Only, The Spreadsheet Does The Rest)4Lions1Ainda não há avaliações

- Case2 Team4 v4Documento7 páginasCase2 Team4 v4whatifknowAinda não há avaliações

- Terminal MultipleDocumento39 páginasTerminal MultiplegyanelexAinda não há avaliações

- Revised Income Statement and Balance Sheet Values for Select YearsDocumento7 páginasRevised Income Statement and Balance Sheet Values for Select YearsDrew ShepherdAinda não há avaliações

- Eportfolio MicroeconomicsDocumento16 páginasEportfolio Microeconomicsapi-241510748Ainda não há avaliações

- DMA Case DataDocumento1 páginaDMA Case Datathrust_xoneAinda não há avaliações

- Corporate Finance - Situation No. 03Documento4 páginasCorporate Finance - Situation No. 03Muhammad TalhaAinda não há avaliações

- DCCK TrendsDocumento4 páginasDCCK TrendsSamanthaAinda não há avaliações

- Fusiontomo Inc.: Sales Rep Q1 Q2 Q3 Q4 TotalDocumento8 páginasFusiontomo Inc.: Sales Rep Q1 Q2 Q3 Q4 TotalBillyAinda não há avaliações

- Worksheet Rule TypeDocumento35 páginasWorksheet Rule Typerayna6633100% (1)

- Fischer Price ToysDocumento11 páginasFischer Price ToysAvijit BanerjeeAinda não há avaliações

- Conn's - Follow-Up Report (Click Here To View in Scribd Format)Documento10 páginasConn's - Follow-Up Report (Click Here To View in Scribd Format)interactivebuysideAinda não há avaliações

- Quantitative Methods Case Study: Mattel's Global Expansion: Analysing Growth Trends Name: Taksh Dhami Enrolment No: 20BSP2609 Division: GDocumento7 páginasQuantitative Methods Case Study: Mattel's Global Expansion: Analysing Growth Trends Name: Taksh Dhami Enrolment No: 20BSP2609 Division: GJyot DhamiAinda não há avaliações

- Financial RatiosDocumento78 páginasFinancial Ratiospun33tAinda não há avaliações

- UST SpreadsheetDocumento21 páginasUST SpreadsheetTUAinda não há avaliações

- Number Cell of MAX ValueDocumento21 páginasNumber Cell of MAX Valuepvenky_kkdAinda não há avaliações

- Star Sales DistributionDocumento2 páginasStar Sales DistributionEmmanuelle MiuAinda não há avaliações

- L.E.K. Valuation Toolkit GuideTITLEL.E.K. Business Valuation Model InstructionsTITLEL.E.K. Toolkit for Valuing CompaniesDocumento10 páginasL.E.K. Valuation Toolkit GuideTITLEL.E.K. Business Valuation Model InstructionsTITLEL.E.K. Toolkit for Valuing Companiesmmitre2100% (1)

- Comparable Companies AnalysisDocumento13 páginasComparable Companies AnalysisRehaan_Khan_RangerAinda não há avaliações

- Copycooperative Financial Ratio Calculator 2011Documento10 páginasCopycooperative Financial Ratio Calculator 2011Selly SeftiantiAinda não há avaliações

- EportfoliomircoDocumento3 páginasEportfoliomircoapi-248403849Ainda não há avaliações

- Determinants of IPO ValuationDocumento21 páginasDeterminants of IPO ValuationSiiPoetryKeongAinda não há avaliações

- Lansdale Reporter Rate CardDocumento7 páginasLansdale Reporter Rate CardjrcAinda não há avaliações

- FT MBA Exam Spreadsheet Clean Edge RazorDocumento1 páginaFT MBA Exam Spreadsheet Clean Edge RazorDoshi VaibhavAinda não há avaliações

- Segment Wise Details of Markstrat at The End of Period 4Documento17 páginasSegment Wise Details of Markstrat at The End of Period 4sazk070% (1)

- Case 21 Aurora Textile Company 0Documento17 páginasCase 21 Aurora Textile Company 0nguyen_tridung250% (2)

- JPM Guide To The Markets - Q1 2014Documento71 páginasJPM Guide To The Markets - Q1 2014adamsro9Ainda não há avaliações

- Turtle_Beach_ValuationDocumento46 páginasTurtle_Beach_Valuationcale2kitAinda não há avaliações

- Debt Policy at UST Inc.Documento47 páginasDebt Policy at UST Inc.karthikk1990100% (2)

- Bill French - Write Up1Documento10 páginasBill French - Write Up1Nina EllyanaAinda não há avaliações

- The Asian Financial Crisis: Hung-Gay Fung University of Missouri-St. LouisDocumento32 páginasThe Asian Financial Crisis: Hung-Gay Fung University of Missouri-St. LouisPrateek BatraAinda não há avaliações

- Financial Performance Comparison of Tobacco CompaniesDocumento9 páginasFinancial Performance Comparison of Tobacco Companiesjchodgson0% (2)

- SimVoi 306 ExampleDocumento19 páginasSimVoi 306 ExampleSiddharth Shankar BebartaAinda não há avaliações

- Seagate LBO AnalysisDocumento58 páginasSeagate LBO Analysisthetesterofthings100% (2)

- Fin439 Final Luv Aal UpdatedDocumento91 páginasFin439 Final Luv Aal Updatedapi-323273427Ainda não há avaliações

- Sizing The Market OpportunityDocumento8 páginasSizing The Market OpportunityShreeram VaidyanathanAinda não há avaliações

- Beyond Smart Beta: Index Investment Strategies for Active Portfolio ManagementNo EverandBeyond Smart Beta: Index Investment Strategies for Active Portfolio ManagementAinda não há avaliações

- Macro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsNo EverandMacro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsAinda não há avaliações

- Electroplating, Plating, Polishing, Anodizing & Coloring World Summary: Market Values & Financials by CountryNo EverandElectroplating, Plating, Polishing, Anodizing & Coloring World Summary: Market Values & Financials by CountryAinda não há avaliações

- Commodity Market Trading and Investment: A Practitioners Guide to the MarketsNo EverandCommodity Market Trading and Investment: A Practitioners Guide to the MarketsAinda não há avaliações

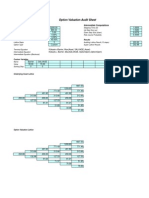

- Option Valuation Audit Sheet Assumptions & ComputationsDocumento1 páginaOption Valuation Audit Sheet Assumptions & ComputationslifeeeAinda não há avaliações

- Option Valuation Audit Sheet: Assumptions Intermediate ComputationsDocumento1 páginaOption Valuation Audit Sheet: Assumptions Intermediate ComputationslifeeeAinda não há avaliações

- R GettingstartedDocumento1 páginaR GettingstartedlifeeeAinda não há avaliações

- Finnews Q5Documento48 páginasFinnews Q5lifeeeAinda não há avaliações

- Finnews Q3Documento48 páginasFinnews Q3lifeee0% (1)

- Finnews Q4Documento48 páginasFinnews Q4lifeeeAinda não há avaliações

- Finnews Q5Documento48 páginasFinnews Q5lifeeeAinda não há avaliações

- Parallel OptionDocumento3 páginasParallel OptionlifeeeAinda não há avaliações

- Report 4 LinksDocumento2 páginasReport 4 LinkslifeeeAinda não há avaliações

- Finnews Q8Documento45 páginasFinnews Q8lifeeeAinda não há avaliações

- Bankinter Customer ProfitabilityDocumento1 páginaBankinter Customer Profitabilitylifeee100% (1)

- PLastic PrateekDocumento21 páginasPLastic PrateeklifeeeAinda não há avaliações

- Finnews Q4Documento48 páginasFinnews Q4lifeeeAinda não há avaliações

- Finnews Q3Documento48 páginasFinnews Q3lifeee0% (1)

- Finnews Q4Documento48 páginasFinnews Q4lifeeeAinda não há avaliações

- Limestone LCI October 2008Documento28 páginasLimestone LCI October 2008bar_gilAinda não há avaliações

- Capital Budgeting Proj A and BDocumento4 páginasCapital Budgeting Proj A and BlifeeeAinda não há avaliações

- Net Flixsoln 1Documento6 páginasNet Flixsoln 1lifeeeAinda não há avaliações

- Indoneia Mining Outlook 2015 PDFDocumento7 páginasIndoneia Mining Outlook 2015 PDFBuahduku BuahdurenAinda não há avaliações

- NCFM SMBM QuestionsDocumento12 páginasNCFM SMBM QuestionslifeeeAinda não há avaliações

- DataDocumento3 páginasDatalifeeeAinda não há avaliações

- Limestone ModelDocumento28 páginasLimestone ModellifeeeAinda não há avaliações

- Current Affairs - Rupee Plunge and DELL: Overview of The Scenario Followed by DiscussionDocumento8 páginasCurrent Affairs - Rupee Plunge and DELL: Overview of The Scenario Followed by DiscussionlifeeeAinda não há avaliações

- Certifications Overview - CFA, FRM and FLIPDocumento7 páginasCertifications Overview - CFA, FRM and FLIPlifeeeAinda não há avaliações

- Results CompiledDocumento41 páginasResults CompiledlifeeeAinda não há avaliações

- Malaysia MineralsDocumento9 páginasMalaysia MineralslifeeeAinda não há avaliações

- FinGame Assignment 1Documento1 páginaFinGame Assignment 1lifeeeAinda não há avaliações

- Revised Workbook SMBMDocumento216 páginasRevised Workbook SMBMlifeeeAinda não há avaliações

- Consolidated Financials 11Documento36 páginasConsolidated Financials 11lifeeeAinda não há avaliações

- Intercompany Loans Observations From A Transfer Pricing PerspectiveDocumento5 páginasIntercompany Loans Observations From A Transfer Pricing PerspectiveHarry0% (1)

- PEZA PresentationDocumento59 páginasPEZA PresentationIsagani DionelaAinda não há avaliações

- Budget Template All DepartmentsDocumento45 páginasBudget Template All DepartmentsAli Azeem Rajwani100% (2)

- Audit FlashcardDocumento12 páginasAudit Flashcardvarghese2007100% (1)

- Chap 008Documento100 páginasChap 008avivdechner83% (6)

- GE1451 NotesDocumento18 páginasGE1451 NotessathishAinda não há avaliações

- Financial Statement Analysis GuideDocumento3 páginasFinancial Statement Analysis GuideAmit KumarAinda não há avaliações

- Cambridge Ordinary LevelDocumento20 páginasCambridge Ordinary LevelMarlene BandaAinda não há avaliações

- Income Taxation Unit 2 - PreludeDocumento8 páginasIncome Taxation Unit 2 - PreludeEllieAinda não há avaliações

- Payslip 2022 2023 8 10025116 AISATSDocumento1 páginaPayslip 2022 2023 8 10025116 AISATSAshok Yadav100% (1)

- WaterPlayPart2 Summer 2019Documento2 páginasWaterPlayPart2 Summer 2019ChaituAinda não há avaliações

- CFA Level 2 FSADocumento3 páginasCFA Level 2 FSA素直和夫Ainda não há avaliações

- Bridge The Gaps Broschure FinalDocumento36 páginasBridge The Gaps Broschure FinalVicente PerezAinda não há avaliações

- CIMA Practice QnsDocumento261 páginasCIMA Practice QnsInnocent Won AberAinda não há avaliações

- Taxation of Cross Border ActivitiesDocumento5 páginasTaxation of Cross Border ActivitiesTriila manillaAinda não há avaliações

- ZaraDocumento22 páginasZarahemantbaid100% (2)

- Numericals On Stock Swap - SolutionDocumento15 páginasNumericals On Stock Swap - SolutionAnimesh Singh GautamAinda não há avaliações

- Accounting Acc1 Unit 1 Financial Accounting: The Accounting Information SystemDocumento12 páginasAccounting Acc1 Unit 1 Financial Accounting: The Accounting Information SystemSaadArshadAinda não há avaliações

- Tax System PDFDocumento6 páginasTax System PDFpalak asatiAinda não há avaliações

- POWER POINT FOR FINAL DEFEND (Mayat)Documento56 páginasPOWER POINT FOR FINAL DEFEND (Mayat)Mary Ann LongakitAinda não há avaliações

- Ind AS 36Documento37 páginasInd AS 36rajan tiwariAinda não há avaliações

- Accounting Equation ExampleDocumento14 páginasAccounting Equation ExampleMD Dee100% (3)

- Hyperlink - Part 1 - RevisedDocumento3 páginasHyperlink - Part 1 - RevisedAnonymous lJYeWYKVScAinda não há avaliações

- Partnership AccountingDocumento20 páginasPartnership AccountingKhuram Shahzad100% (2)

- Atomic Excellence Inc CaseDocumento5 páginasAtomic Excellence Inc CaseZaighum SattarAinda não há avaliações

- Microsoft's Financial Reporting StrategyDocumento6 páginasMicrosoft's Financial Reporting StrategyChi100% (1)

- 2017 AfDocumento249 páginas2017 AfDaniel KwanAinda não há avaliações

- Enb FinalDocumento11 páginasEnb Finalkevin kipkemoiAinda não há avaliações

- Project Report NewDocumento48 páginasProject Report NewPrincy Sony AntonyAinda não há avaliações

- White Paper of AURICOINDocumento29 páginasWhite Paper of AURICOINLuis Saul Castro GomezAinda não há avaliações