Escolar Documentos

Profissional Documentos

Cultura Documentos

Weekly Agri Report 7 OCT 2013

Enviado por

epicresearch4Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Weekly Agri Report 7 OCT 2013

Enviado por

epicresearch4Direitos autorais:

Formatos disponíveis

NCDEX AGRI COMMODITIES WEEKLY REPORT

INDEX WATCH: 1. NCDEX Agri Commodity Weekly Wrap Up. 2. NCDEX Oil and Oil Seeds Weekly Technical Chart and Level. 3. NCDEX Pulses Weekly Technical Chart and Level. 4. NCDEX Spices Weekly Technical Chart and Level. 5. Company Disclaimer. 6. Contact Details.

EPIC Research Report

This Report contains all the study and strategy required by trader to trade on NCDEX AGRI commodities. Refer to the chart attracted in the Report to take proper Trading Decision.

EPIC RESEARCH TEAM

NCDEX WEEKLY Newsletter (7-OCTOBER 2013)

NCDEX AGRI COMMODITIES WEEKLY TECHICAL REPORT!!!!

7-OCTOBER-2013, MONDAY

1|Page WWW.EPICRESEARCH.CO CALL: +917316642300

NCDEX WEEKLY Newsletter (7-OCTOBER 2013)

AGRI COMMODITY WEEKLY WRAP UP..!!!!

Chana up 1.2% on Strong demand . Chana prices climbed by 1.24% to Rs 3,018 per quintal in futures trading today as speculators enlarged their positions, supported by strong demand in the spot market. At the National Commodity Derivatives Exchange, chana for delivery in November climbed by Rs 367 or 1.24% to Rs 3018 per quintal with an open interest of 69690 lots. In a similar fashion, the commodity for delivery in October gained Rs 29, or 1%, to Rs 2922 per quintal in 103360 lots Jeera up 0.3% as demand picks up. Jeera prices rose by 0.38% to Rs 12,655 per quintal in futures trading today as speculators engaged in creating fresh positions, driven by pick u p in Demand in the spot market. At the National Commodity and Derivatives Exchange, jeera for delivery in October month rose by Rs 47.50, or 0.38% To Rs 12,655 per quintal with an open interest of 7,488 lots. Similarly, jeera for delivery in November traded higher by Rs 20, or 0.16% to Rs 12,872.50 Per quintal in 5,673 lots. Castor seed up 0.9% on short covering . Castor seed prices rose by Rs 37 to Rs 3,835 per quintal in futures trading today following low level buying by traders, supported by firm spot Markets cues.Marketmen said revival of buying at existing lower levels against firm physical markets sentiment, mainly supported the uptrend. At the National Commodity and Derivatives Exchange, castor seed prices for most active January month recovered by Rs 37, or 0.97%, to Rs 3,835 per Quintal, with an open interest of 96,690 lots.

2|Page WWW.EPICRESEARCH.CO CALL: +917316642300

NCDEX WEEKLY Newsletter (7-OCTOBER 2013)

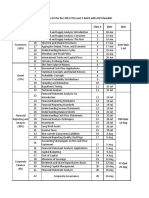

NCDEX OIL & OIL SEEDS WEEKLY TECHNICAL LEVELS

CASTOR SEED DAILY CANDLESTICK CHART

TRADING STRATEGY: CASTORSEED LOOKS IN CONSOLIDATE TREND Immedaite Resistance @ 3590 and Support @ 3400 BUY CASTORSEED OCT ABOVE 3590 TG 3660,3800 SL 3500 SELL CASTORSEED OCT BELOW 3420 TG 3350,3250 SL 3500

3|Page WWW.EPICRESEARCH.CO CALL: +917316642300

NCDEX WEEKLY Newsletter (7-OCTOBER 2013)

NCDEX PULSES WEEKLY TECHNICAL LEVELS

CHANA DAILY CANDLESTICK CHART

TRADING STRATEGY: CHANA NCDEX OCT IS IN CONSOLIDATING TREND. Immediate Resistance @ 2940 and Support @ 2850 BUY CHANA OCT ABOVE 2940 TG 3000,3100 SL 2850 SELL CHANA OCT BELOW 2870 TG 2800,2700 SL 2950

4|Page WWW.EPICRESEARCH.CO CALL: +917316642300

NCDEX WEEKLY Newsletter (7-OCTOBER 2013)

NCDEX SPICES WEEKLY TECHNICAL LEVELS

DHANIYA HOURLY CANDLESTICK CHART

TRADING STRATEGY: DHANIYA NCDEX SEP IS IN BULLISH TREND. Immediate Resistance @ 6260 And Support @ 5900 BUY DHANIYA OCT ABOVE 6200 TG 6300,6400 SL 6100 SELL DHANIYA SEP BELOW 6020 TG 5920,5800 SL 6120 5|Page WWW.EPICRESEARCH.CO CALL: +917316642300

NCDEX WEEKLY Newsletter (7-OCTOBER 2013)

DISCLAIMER

The information and views in this report, our website & all the service we provide are believed to be reliable, but we do not accept any responsibility (or liability) for errors of fact or opinion. Users have the right to choose the product/s that suits them the most. Sincere efforts have been made to present the right investment perspective. The information contained herein is based on analysis and up on sources that we consider reliable. This material is for personal information and based upon it & takes no responsibility The information given herein should be treated as only factor, while making investment decision. The report does not provide individually tailormade investment advice. Epic research recommends that investors independently evaluate particular investments and strategies, and encourages investors to seek the advice of a financial adviser. Epic research shall not be responsible for any transaction conducted based on the information given in this report, which is in violation of rules and regulations of NSE and BSE. The share price projections shown are not necessarily indicative of future price performance. The information herein, together with all estimates and forecasts, can change without notice. Analyst or any person related to epic research might be holding positions in the st ocks recommended. It is understood that anyone who is browsing through the site has done so at his free will and does not read any views expressed as a recommendation for which either the site or its owners or anyone can be held responsible for . Any surfing and reading of the information is the acceptance of this disclaimer. All Rights Reserved. Investment in equity & bullion market has its own risks. We, however, do not vouch for the accuracy or the completeness thereof. we are not responsible for any loss incurred whatsoever for any financial profits or loss which may arise from the recommendations above epic research does not purport to be an invitation or an offer to buy or sell any financial instrument. Our Clients (Paid or Unpaid), Any third party or anyone else have no rights to forward or share our calls or SMS or Report or Any Information Provided by us to/with anyone which is received directly or indirectly by them. If found so then Serious Legal Actions can be taken.

6|Page WWW.EPICRESEARCH.CO CALL: +917316642300

NCDEX WEEKLY Newsletter (7-OCTOBER 2013)

CONTACT US:

WWW.EPICRESEARCH.CO

Epic Research Private Limited Corporate Office 411 Milinda Manor (Suites 409 - 417) 2 RNT MargOpp Central Mall Indore (M.P.) Hotline: +91 731 664 2300 / 2427 / 2230 Alternate: +91 731 664 2320 / 2226 +91 97521 99966 Or give us a missed call at 026 5309 0639

7|Page WWW.EPICRESEARCH.CO CALL: +917316642300

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- CBoe Options Expiration Calendar 2019Documento1 páginaCBoe Options Expiration Calendar 2019Xay Tonus100% (1)

- This Study Resource Was: Problem 5Documento3 páginasThis Study Resource Was: Problem 5Hasan SikderAinda não há avaliações

- Part 1: Framework A Framework For Business Analysis and Valuation Using Financial StatementsDocumento11 páginasPart 1: Framework A Framework For Business Analysis and Valuation Using Financial StatementsFeby nuraeniAinda não há avaliações

- Japanese CandlestickDocumento38 páginasJapanese CandlestickmtcAinda não há avaliações

- Daily Agri Report 15 Oct 2013Documento8 páginasDaily Agri Report 15 Oct 2013epicresearch4Ainda não há avaliações

- Daily Agri Report1 Oct 2013Documento8 páginasDaily Agri Report1 Oct 2013epicresearch4Ainda não há avaliações

- Daily I Forex Report 24 Sep 2013Documento13 páginasDaily I Forex Report 24 Sep 2013epicresearch4Ainda não há avaliações

- Daily I Forex Report 18 SEP 2013Documento15 páginasDaily I Forex Report 18 SEP 2013epicresearch4Ainda não há avaliações

- Daily I Forex Report 23 Sep 2013Documento15 páginasDaily I Forex Report 23 Sep 2013epicresearch4Ainda não há avaliações

- Daily I Forex Report 16 Sep 2013Documento15 páginasDaily I Forex Report 16 Sep 2013epicresearch4Ainda não há avaliações

- Daily I Forex Report 11 Sep 2013Documento15 páginasDaily I Forex Report 11 Sep 2013epicresearch4Ainda não há avaliações

- Chapt 25 Bonds PayableDocumento124 páginasChapt 25 Bonds PayablelcAinda não há avaliações

- Module 1Documento27 páginasModule 1bhumiAinda não há avaliações

- Awareness of Mutual Fund and Its ScopeDocumento64 páginasAwareness of Mutual Fund and Its ScopeLakshman Kota100% (1)

- F5 Bafs 1 AnsDocumento6 páginasF5 Bafs 1 Ansouo So方Ainda não há avaliações

- HFAC130 1 Jan June2023 FA1 Memo LVN V2 20230203Documento18 páginasHFAC130 1 Jan June2023 FA1 Memo LVN V2 20230203nkemokoh.noAinda não há avaliações

- Ec 1723 Problem Set 3Documento5 páginasEc 1723 Problem Set 3tarun singhAinda não há avaliações

- Shareholders EquityDocumento6 páginasShareholders EquityDe Guzman Olchondra Kimberly100% (1)

- Dec 2017 CFA Level 1 ScheduleDocumento2 páginasDec 2017 CFA Level 1 ScheduleSyed AhmadAinda não há avaliações

- Termpapermgt517Documento3 páginasTermpapermgt517Addydutt SharmaAinda não há avaliações

- Channel Trading StrategyDocumento51 páginasChannel Trading StrategyVijay86% (7)

- International Finance Management Case Study-5 The Options SpeculatorDocumento4 páginasInternational Finance Management Case Study-5 The Options SpeculatorSachin D SalankeyAinda não há avaliações

- Demutualization of Stock Exchanges in BangladeshDocumento9 páginasDemutualization of Stock Exchanges in BangladeshWilliam Masterson ShahAinda não há avaliações

- Meseret FeteneDocumento22 páginasMeseret FeteneGetaneh YenealemAinda não há avaliações

- HEBEROLA SFExam 12Documento22 páginasHEBEROLA SFExam 12Marjorie Joyce BarituaAinda não há avaliações

- مرفت العادلیDocumento90 páginasمرفت العادلیsoha mahmoudAinda não há avaliações

- Chapter 9 - Mechanics of Options MarketsDocumento28 páginasChapter 9 - Mechanics of Options MarketsRanil FernandoAinda não há avaliações

- Modules 1.1-1.5 PDFDocumento187 páginasModules 1.1-1.5 PDFElijah MendozaAinda não há avaliações

- CBSE Class 12 Accountancy Accounting Ratios WorksheetDocumento3 páginasCBSE Class 12 Accountancy Accounting Ratios WorksheetJenneil CarmichaelAinda não há avaliações

- The Cause-Effect Relationship Between Economic Growth and Stock Market Development - The Case of VietnamDocumento22 páginasThe Cause-Effect Relationship Between Economic Growth and Stock Market Development - The Case of VietnamTrang Nguyễn Ngọc Hồng TrangAinda não há avaliações

- Exam 2022 AccountingDocumento2 páginasExam 2022 AccountingEditz meniaAinda não há avaliações

- Brooks 3e PPT 05Documento40 páginasBrooks 3e PPT 05Vy HoàngAinda não há avaliações

- CH # 12, Marketing Channels - Delivering Customer ValueDocumento41 páginasCH # 12, Marketing Channels - Delivering Customer ValueSaad MunirAinda não há avaliações

- Long Term InvestingDocumento8 páginasLong Term InvestingkrishchellaAinda não há avaliações

- Tyco Plans To Split Into Four Companies Amid Accounting Questions, Stock SlideDocumento6 páginasTyco Plans To Split Into Four Companies Amid Accounting Questions, Stock SlideYamil PerezAinda não há avaliações

- 21 Inventory Management Kpis To Track 1Documento4 páginas21 Inventory Management Kpis To Track 1Stefanie DutraAinda não há avaliações

- Gann Astrological PDFDocumento1 páginaGann Astrological PDFGenesis TradingAinda não há avaliações