Escolar Documentos

Profissional Documentos

Cultura Documentos

Chapter 8

Enviado por

bumbum12354Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Chapter 8

Enviado por

bumbum12354Direitos autorais:

Formatos disponíveis

Chapter 8

Swaps

Question 8.1. We rst solve for the present value of the cost per two barrels: $22 $23 = 41.033. + 1.06 (1.065)2 We then obtain the swap price per barrel by solving: x x = 41.033 + 1.06 (1.065)2 x = 22.483, which was to be shown. Question 8.2. a) We rst solve for the present value of the cost per three barrels, based on the forward prices: $22 $21 $20 + = 55.3413. + 2 1.06 (1.065) (1.07)3 We then obtain the swap price per barrel by solving: x x x + + = 55.341 2 1.06 (1.065) (1.07)3 x = 20.9519 b) We rst solve for the present value of the cost per two barrels (year 2 and year 3): $21 (1.065)2 + $22 (1.07)3 = 36.473.

We then obtain the swap price per barrel by solving: x (1.065) x

2

x (1.07)3

= 36.473 = 21.481

104

Chapter 8 Swaps

Question 8.3. Since the dealer is paying xed and receiving oating, she generates the cash-ows depicted in column 2. Suppose that the dealer enters into three short forward positions, one contract for each year of the active swap. Her payoffs are depicted in columns 3, and the aggregate net cash ow position is in column 4. Year Net Swap Payment Short Forwards Net Position 1 S1 $20.9519 $20 S1 0.9519 2 S1 $20.9519 $21 S1 +0.0481 3 S1 $20.9519 $22 S1 +1.0481 We need to discount the net positions to year zero. We have: P V (netCF ) = 0.9519 0.0481 1.0481 + + = 0. 1.06 (1.065)2 (1.07)3

Indeed, the present value of the net cash ow is zero. Question 8.4. The fair swap rate was determined to be $20.952. Therefore, compared to the forward curve price of $20 in one year, we are overpaying $0.952. In year two, this overpayment has increased to $0.952 1.070024 = 1.01866, where we used the appropriate forward rate to calculate the interest payment. In year two, we underpay by $0.048, so that our total accumulative underpayment is $0.97066. In year three, this overpayment has increased again to $0.97066 1.08007 = 1.048. However, in year three, we receive a xed payment of 20.952, which underpays relative to the forward curve price of $22 by $22 $20.952 = 1.048. Therefore, our cumulative balance is indeed zero, which was to be shown. Question 8.5. Since the dealer is paying xed and receiving oating, she generates the cash-ows depicted in column 2. Suppose that the dealer enters into three short forward positions, one contract for each year of the active swap. Her payoffs are depicted in columns 3, and the aggregate net position is summarized in column 4. Year Net Swap Payment Short Forwards Net Position 0.952 $20 S1 1 S1 $20.952 2 S1 $20.952 +0.048 $21 S1 3 S1 $20.952 $22 S1 +1.048

105

Part 2 Forwards, Futures, and Swaps

We need to discount the net positions to year zero, taking into account the uniform shift of the term structure. We have: P V (netCF ) = 1.0481 0.0481 0.9519 + = 0.0081. + 2 1.065 (1.07) (1.075)3

The present value of the net cash ow is negative: The dealer never recovers from the increased interest rate he faces on the overpayment of the rst swap payment. P V (netCF ) = 1.0481 0.0481 0.9519 + = +0.0083 + 1.055 (1.06)2 (1.065)3

The present value of the net cash ow is positive. The dealer makes money, because he gets a favorable interest rate on the loan he needs to take to nance the rst overpayment. The dealer could have tried to hedge his exposure with a forward rate agreement or any other derivative protecting against interest rate risk. Question 8.6. In order to answer this question, we use equation (8.13.) of the main text. We assumed that the interest rates and the corresponding zero-coupon bonds were: Quarter 1 2 3 4 5 6 7 8 Interest rate 0.0150 0.0302 0.0457 0.0614 0.0773 0.0934 0.1098 0.1265 Zero-coupon price 0.9852 0.9707 0.9563 0.9422 0.9283 0.9145 0.9010 0.8877

Using formula 8.13., we obtain the following per barrel swap prices: 4-quarter swap price: $20.8533 8-quarter swap price: $20.4284 The total costs of prepaid 4- and 8-quarter swaps are the present values of the payment obligations. They are: 4-quarter prepaid swap price: $80.3768 8-quarter prepaid swap price: $152.9256

106

Chapter 8 Swaps

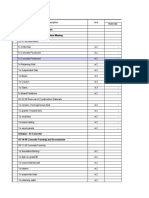

Question 8.7. Using formula 8.13., and plugging in the given zero-coupon prices and the given forward prices, we obtain the following per barrel swap prices: Quarter 1 2 3 4 5 6 7 8 Question 8.8. We use formula (8.4), and replace the forward interest rate with the forward oil prices. In particular, we calculate: X=

6 i =3 P0 (0, ti )F0,ti 6 i =3 P0 (0, ti )

Zero-bond 0.9852 0.9701 0.9546 0.9388 0.9231 0.9075 0.8919 0.8763

Swap price 21.0000 21.0496 20.9677 20.8536 20.7272 20.6110 20.5145 20.4304

= $20.3807

Therefore, the swap price of a 4-quarter oil swap with the rst settlement occurring in the third quarter is $20.3807. Question 8.9. Using the 8-quarter swap price of $20.43, we can calculate the net position by subtracting the swap price from the forward prices. The 1-quarter implied forward rate is calculated from the zero-coupon bond prices. The column implicit loan balance adds the net position of each quarter and the implicit loan balance plus interest of the previous quarter. Please note that the forward curve is invertedwe are initially loaning money because the swap price is lower than the forward price. Quarter 1 2 3 4 5 6 7 8 Net position 0.5696 0.6696 0.3696 0.0696 0.2304 0.4304 0.5304 0.6304 Implied forward rate 1.0150 1.0156 1.0162 1.0168 1.0170 1.0172 1.0175 1.0178

107

Implicit loan balance 0.5696 1.2480 1.6379 1.7350 1.5341 1.1300 0.6194 0.0000

Part 2 Forwards, Futures, and Swaps

Question 8.10. We use equation (8.6) of the main text to answer this question: X=

8 i =1 Qti P0 (0, ti )F0,ti , whereQ 8 i =1 Qti P0 (0, ti )

= [1, 2, 1, 2, 1, 2, 1, 2]

After plugging in the relevant variables given in the exercise, we obtain a value of $20.4099 for the swap price. Question 8.11. We are now asked to invert our equations. The swap prices are given, and we want to back out the forward prices. We do so recursively. For a one-quarter swap, the swap price and the forward price are identical. Given the one-quarter forward price, we can nd the second quarter forward price, etc. Doing so yields the following forward prices: Quarter 1 2 3 4 5 6 7 8 Question 8.12. With a swap price of $2.2044, and the forward prices of question 8.11., we can calculate the implied loan amount. We can calculate the net position by subtracting the swap price from the forward prices. The 1-quarter implied forward rate is calculated from the zero-coupon bond prices. The column implicit loan balance adds the net position each quarter and the implicit loan balance plus interest of the previous quarter. Please note that the shape of the forward curvewe are initially loaning money, because the swap price is lower than the forward price. Forward price 2.25 2.60 2.20 1.90 2.20 2.50 2.15 1.80

108

Chapter 8 Swaps

Quarter 1 2 3 4 5 6 7 8 Question 8.13.

Forward price 2.25 2.60 2.20 1.90 2.20 2.50 2.15 1.80

Net balance 0.0456 0.3955 0.0042 0.3046 0.0043 0.2954 0.0543 0.4042

Forward interest rate 1.0150 1.0156 1.0162 1.0168 1.0170 1.0172 1.0175 1.0178

Implicit loan balance 0.0456 0.4418 0.4447 0.1476 0.1458 0.4437 0.3971 0.0000

From the given zero-coupon bond prices, we can calculate the one-quarter forward interest rates. They are: Quarter 1 2 3 4 5 6 7 8 Forward interest rate 1.0150 1.0156 1.0162 1.0168 1.0170 1.0172 1.0175 1.0178

Now, we can calculate the deferred swap price according to the formula: X= Question 8.14. From the given zero-coupon bond prices, we can calculate the one-quarter forward interest rates. They are: Quarter 1 2 3 4 5 6 7 8 Forward interest rate 1.0150 1.0156 1.0162 1.0168 1.0170 1.0172 1.0175 1.0178

109

6 i =2 P0 (0, ti )r0 (ti 1 , ti ) 6 i =2 P0 (0, ti )

= 1.66%

Part 2 Forwards, Futures, and Swaps

Now, we can calculate the swap prices for 4 and 8 quarters according to the formula: X=

n i =1 P0 (0, ti )r0 (ti 1 , ti ) , n i =1 P0 (0, ti )

where n = 4 or 8

This yields the following prices: 4-quarter xed swap price: 1.59015% 8-quarter xed swap price: 1.66096% Question 8.15. We can calculate the value of an 8-quarter dollar annuity that is equivalent to an 8-quarter Euro annuity by using equation 8.8. of the main text. We have: X=

8 i =1 P0 (0, ti )R F0,ti 8 i =1 P0 (0, ti ) ,

where R is the Euro annuity of 1 Euro.

Plugging in the forward price for one unit of Euros delivered at time ti , which are given in the price table, yields a dollar annuity value of $0.9277. Question 8.16. The dollar zero-coupon bond prices for the three years are: P0,1 = P0,2 = P0,3 = 1 1.06 1 (1.06)2 1 (1.06)3 = 0.9434 = 0.8900 = 0.8396

R is 0.035, the Euro-bond coupon rate. The current exchange rate is 0.9$/E. Plugging all the above variables into formula (8.9) indeed yields 0.06, the dollar coupon rate: R=

3 i =1 P0 (0, ti )R F0,ti /x0 + P0,3 3 i =1 P0 (0, ti )

F0,tn /x0 1

0.098055 + 0.062317 = 0.060 2.673

Question 8.17. We can use the standard swap price formula for this exercise, but we must pay attention to taking the right zero-coupon bonds, and the right Euro-denominated forward interest rates. From the given Euro zero-coupon bond prices, we can calculate the one-quarter forward interest rates. They are:

110

Chapter 8 Swaps

Quarter 1 2 3 4 5 6 7 8

Euro denominated implied forward interest rate 0.0088 0.0090 0.0092 0.0095 0.0096 0.0097 0.0098 0.0100

Now, we can calculate the swap prices for 4 and 8 quarters according to the formula: X=

n i =1 P0 (0, ti )r0 (ti 1 , ti ) n i =1 P0 (0, ti ) ,

where n = 4 or 8

This yields the following prices: 4-quarter xed swap price: 0.91267% 8-quarter xed swap price: 0.94572% Question 8.18. We can use equation (8.9), but there is a complication: We do not have the current spot exchange rate. However, it is possible to back it out by using the methodology of the previous chapters: We know that the following relation must hold: F0,1 = X0 e(r r ) , where the interest rates are already on a quarterly level. We can back out the interest rates from the given zero-coupon prices. Doing so yields a current exchange rate of 0.90 $/Euro. R is the 8-quarter xed swap price payment of 0.0094572. By plugging in all the relevant variables into equation 8.9, we can indeed see that this yields a swap rate of 1.66%, which is the same rate that we calculated in exercise 8.14.

111

Você também pode gostar

- Finance for Non-Financiers 1: Basic FinancesNo EverandFinance for Non-Financiers 1: Basic FinancesAinda não há avaliações

- Hw1 Bus424 SolDocumento17 páginasHw1 Bus424 SolnobuyukiAinda não há avaliações

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsAinda não há avaliações

- Chapter 6 Problems PDFDocumento4 páginasChapter 6 Problems PDFThinh Doan100% (1)

- Chapter 7 DerrivsDocumento7 páginasChapter 7 DerrivsMbusoThabetheAinda não há avaliações

- Ps Bonds SolutionsDocumento20 páginasPs Bonds SolutionsnazAinda não há avaliações

- CT1 Sol 0605Documento15 páginasCT1 Sol 0605AmitAinda não há avaliações

- Hull-OfOD8e-Homework Answers Chapter 05Documento3 páginasHull-OfOD8e-Homework Answers Chapter 05hammernickyAinda não há avaliações

- Actuarial Notation: AnnuitiesDocumento12 páginasActuarial Notation: AnnuitiesCallum Thain BlackAinda não há avaliações

- Solutions to Chapter 5 Bond Valuation ProblemsDocumento8 páginasSolutions to Chapter 5 Bond Valuation ProblemsCandace WagnerAinda não há avaliações

- HW 06 CorrectionDocumento3 páginasHW 06 Correctiondhruvg14Ainda não há avaliações

- Tutorial Chapter 11 SolDocumento7 páginasTutorial Chapter 11 SolMadina SuleimenovaAinda não há avaliações

- 644 - Corporate Finance SolutionDocumento7 páginas644 - Corporate Finance Solutionrayan.wydouwAinda não há avaliações

- Tutorial Chapter 6 - Sol.Documento6 páginasTutorial Chapter 6 - Sol.Madina SuleimenovaAinda não há avaliações

- Futures and Swaps Arbitrage OpportunitiesDocumento6 páginasFutures and Swaps Arbitrage Opportunitiesnoname19753Ainda não há avaliações

- Assignment 3.Documento5 páginasAssignment 3.Yusuf RaharjaAinda não há avaliações

- OPT SolutionDocumento52 páginasOPT SolutionbocfetAinda não há avaliações

- Exam FM Practice Exam With Answer KeyDocumento71 páginasExam FM Practice Exam With Answer KeyAki TsukiyomiAinda não há avaliações

- Im AnswersDocumento6 páginasIm Answersromal_talwarAinda não há avaliações

- Exam FM Practice Exam 1 Answer KeyDocumento71 páginasExam FM Practice Exam 1 Answer Keynad_natt100% (1)

- CH03Documento5 páginasCH03Mohsin SadaqatAinda não há avaliações

- FinancialAssignment CompletedDocumento10 páginasFinancialAssignment CompletedfinancemakeeasyAinda não há avaliações

- Bond Valuation Chapter Explains Key ConceptsDocumento61 páginasBond Valuation Chapter Explains Key ConceptsnightdazeAinda não há avaliações

- Interest Rates and Bond Valuation: Solutions To Questions and ProblemsDocumento7 páginasInterest Rates and Bond Valuation: Solutions To Questions and ProblemsFelipeAinda não há avaliações

- The Theory of Interest - Solutions ManualDocumento9 páginasThe Theory of Interest - Solutions ManualMaryel2014Ainda não há avaliações

- Week 3Documento13 páginasWeek 3sdfklmjsdlklskfjdAinda não há avaliações

- Assignment1 SolutionDocumento9 páginasAssignment1 SolutionAlexa Mouawad100% (1)

- Extra Questions and Problems on Bond Pricing and YieldsDocumento8 páginasExtra Questions and Problems on Bond Pricing and YieldsDeepak SandhuAinda não há avaliações

- Extra Practice Exam 2 SolutionsDocumento9 páginasExtra Practice Exam 2 SolutionsSteve SmithAinda não há avaliações

- Practice Problems SolutionsDocumento13 páginasPractice Problems SolutionsEMILY100% (1)

- Session 6.4-Bootstrapping LectureDocumento4 páginasSession 6.4-Bootstrapping LectureQamber AliAinda não há avaliações

- Interest Theory SolutionsDocumento38 páginasInterest Theory Solutionsshivanithapar13Ainda não há avaliações

- The Theory of Interest - Solutions ManualDocumento11 páginasThe Theory of Interest - Solutions ManualwidyasAinda não há avaliações

- Tutorial1 SolutionsDocumento5 páginasTutorial1 Solutionsfgdfdfgd3Ainda não há avaliações

- Solution To Theory of Interest Bchapter 4 Third EditionDocumento12 páginasSolution To Theory of Interest Bchapter 4 Third EditionDaniel D. RaphaelAinda não há avaliações

- FNCE 4040 Spring 2012 Midterm 2 With AnswersDocumento6 páginasFNCE 4040 Spring 2012 Midterm 2 With AnswersAustin LindseyAinda não há avaliações

- Questions On Bond PricingDocumento11 páginasQuestions On Bond PricingMinji Michelle JAinda não há avaliações

- Edu 2015 Exam FM Sol TheoryDocumento38 páginasEdu 2015 Exam FM Sol TheoryTom YanAinda não há avaliações

- Exam FM Practice Exam 3Documento71 páginasExam FM Practice Exam 3nad_nattAinda não há avaliações

- Chapter 4. The Time Value of Money and Discounted Cash Flow AnalysisDocumento15 páginasChapter 4. The Time Value of Money and Discounted Cash Flow Analysisw4termel0n33Ainda não há avaliações

- FM Textbook Solutions Chapter 8 Second EditionDocumento11 páginasFM Textbook Solutions Chapter 8 Second EditionlibredescargaAinda não há avaliações

- 4-35 Model ProblemDocumento18 páginas4-35 Model Problemcherishwisdom_997598100% (1)

- Chapter 5 Solutions V1Documento16 páginasChapter 5 Solutions V1meemahsAinda não há avaliações

- Tutorial 4 SolutionsDocumento4 páginasTutorial 4 SolutionsmarvinaliAinda não há avaliações

- Week 2 Solutions To ExercisesDocumento5 páginasWeek 2 Solutions To ExercisesBerend van RoozendaalAinda não há avaliações

- Sapm Compre Partb QPDocumento15 páginasSapm Compre Partb QPXavier CharlesAinda não há avaliações

- SOA Exam MFE and CAS Exam 3 FE Solution to Derivatives MarketsDocumento25 páginasSOA Exam MFE and CAS Exam 3 FE Solution to Derivatives MarketsNga BuiAinda não há avaliações

- EX 1718 SolDocumento10 páginasEX 1718 SolJoana SilvaAinda não há avaliações

- Ratio of Price To Book 2.22Documento14 páginasRatio of Price To Book 2.22Lê Hữu LựcAinda não há avaliações

- Calculate forward and futures pricesDocumento10 páginasCalculate forward and futures pricesVanessa ThuyAinda não há avaliações

- Financial Mathematics For Actuaries: Bond Management Learning ObjectivesDocumento63 páginasFinancial Mathematics For Actuaries: Bond Management Learning ObjectivesRehabUddinAinda não há avaliações

- Chap 6 Notes To Accompany The PP TransparenciesDocumento8 páginasChap 6 Notes To Accompany The PP TransparenciesChantal AouadAinda não há avaliações

- 03a 1Documento5 páginas03a 1ravi.gullapalliAinda não há avaliações

- Build a Model ChapterDocumento17 páginasBuild a Model ChapterAbhishek Surana100% (2)

- Convexity and DurationDocumento20 páginasConvexity and DurationNikka CasyaoAinda não há avaliações

- FIXED INCOME DURATIONDocumento111 páginasFIXED INCOME DURATIONsawilson1Ainda não há avaliações

- GF520 Unit2 Assignment CorrectionsDocumento7 páginasGF520 Unit2 Assignment CorrectionsPriscilla Morales86% (7)

- Time Value SolnDocumento34 páginasTime Value SolnAlim Ahmed Ansari100% (1)

- FinanceDocumento9 páginasFinanceNikhil MittalAinda não há avaliações

- Chapter 4 - Build A Model SpreadsheetDocumento9 páginasChapter 4 - Build A Model SpreadsheetSerge Olivier Atchu Yudom100% (1)

- FIN402 ReviewDocumento6 páginasFIN402 Reviewbumbum12354Ainda não há avaliações

- Financial forwards and futures questionsDocumento14 páginasFinancial forwards and futures questionsbumbum12354Ainda não há avaliações

- Chapter 8Documento8 páginasChapter 8bumbum12354Ainda não há avaliações

- Chapter 8Documento8 páginasChapter 8bumbum12354Ainda não há avaliações

- Hedging Oil Prices: A Case Study On GotlandsbolagetDocumento44 páginasHedging Oil Prices: A Case Study On Gotlandsbolagetbumbum12354Ainda não há avaliações

- KJR 20 880 PDFDocumento14 páginasKJR 20 880 PDFNam LeAinda não há avaliações

- Bahasa Inggris Kelas XIIDocumento2 páginasBahasa Inggris Kelas XIIMuhammad ImadudinAinda não há avaliações

- 02 1 Cohen Sutherland PDFDocumento3 páginas02 1 Cohen Sutherland PDFSarra AnitaAinda não há avaliações

- VDR G4 Manual Steinsohn PDFDocumento185 páginasVDR G4 Manual Steinsohn PDFVariya Dharmesh100% (1)

- Sem Iii Sybcom Finacc Mang AccDocumento6 páginasSem Iii Sybcom Finacc Mang AccKishori KumariAinda não há avaliações

- 0520 Int OTG P4 MSDocumento12 páginas0520 Int OTG P4 MSTrévina JosephAinda não há avaliações

- DaburDocumento3 páginasDaburchiru94Ainda não há avaliações

- ArchimedesDocumento22 páginasArchimedessharfexAinda não há avaliações

- CHM131 Presentation - Oxidation of MetalsDocumento11 páginasCHM131 Presentation - Oxidation of MetalsNazrul ShahAinda não há avaliações

- Mla 8 Mla Citation PageDocumento4 páginasMla 8 Mla Citation Pageapi-458274061Ainda não há avaliações

- Classification of AnimalsDocumento6 páginasClassification of Animalsapi-282695651Ainda não há avaliações

- Phy Worksheet IG 3 Phase 2Documento6 páginasPhy Worksheet IG 3 Phase 2Umair RazaAinda não há avaliações

- Quantification Skills in The Construction IndustryDocumento34 páginasQuantification Skills in The Construction IndustryBRGRAinda não há avaliações

- PathFit 1 (Lessons)Documento10 páginasPathFit 1 (Lessons)Patawaran, Myka R.Ainda não há avaliações

- Satisfaction ExtraDocumento2 páginasSatisfaction ExtraFazir AzlanAinda não há avaliações

- Unit Rates and Cost Per ItemDocumento213 páginasUnit Rates and Cost Per ItemDesiree Vera GrauelAinda não há avaliações

- Sunera Best Practices For Remediating SoDsDocumento7 páginasSunera Best Practices For Remediating SoDssura anil reddyAinda não há avaliações

- A Generation of Contradictions-Unlocking Gen Z 2022 China FocusDocumento25 páginasA Generation of Contradictions-Unlocking Gen Z 2022 China FocusCindy Xidan XiaoAinda não há avaliações

- Management Theory and Practice: Methods of Performance AppraisalDocumento3 páginasManagement Theory and Practice: Methods of Performance AppraisalRadha maiAinda não há avaliações

- Danbury BrochureDocumento24 páginasDanbury BrochureQuique MartinAinda não há avaliações

- Deviser TV Analyser S7000: Bagian 1: Fungsi AnalyzerDocumento15 páginasDeviser TV Analyser S7000: Bagian 1: Fungsi AnalyzerAlexander WieseAinda não há avaliações

- Nitobond SBR (Latex)Documento4 páginasNitobond SBR (Latex)Samarakoon Banda100% (1)

- Mycophenolic Acid Chapter-1Documento34 páginasMycophenolic Acid Chapter-1NabilaAinda não há avaliações

- Annual Report 18Documento363 páginasAnnual Report 18Safeer UllahAinda não há avaliações

- European Journal of Internal MedicineDocumento4 páginasEuropean Journal of Internal Medicinesamer battatAinda não há avaliações

- Altered Ventilatory Function Assessment at Pamantasan ng CabuyaoDocumento27 páginasAltered Ventilatory Function Assessment at Pamantasan ng Cabuyaomirai desuAinda não há avaliações

- DataSheet IMA18-10BE1ZC0K 6041793 enDocumento8 páginasDataSheet IMA18-10BE1ZC0K 6041793 enRuben Hernandez TrejoAinda não há avaliações

- Multibody Simulation of A Freight Bogie With Friction DampersDocumento10 páginasMultibody Simulation of A Freight Bogie With Friction DampersGermán GoñiAinda não há avaliações

- Board Question Paper: March 2018: Geography and EconomicsDocumento2 páginasBoard Question Paper: March 2018: Geography and EconomicsVishvajit PatilAinda não há avaliações

- X-Ray Generator Communication User's Manual - V1.80 L-IE-4211Documento66 páginasX-Ray Generator Communication User's Manual - V1.80 L-IE-4211Marcos Peñaranda TintayaAinda não há avaliações