Escolar Documentos

Profissional Documentos

Cultura Documentos

Fin 515 Final Proj

Enviado por

itlnkickerDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Fin 515 Final Proj

Enviado por

itlnkickerDireitos autorais:

Formatos disponíveis

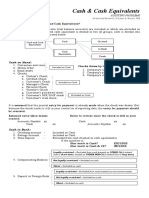

(13-10) Corporate Valuation

The financial statements of Lioi Steel Fabricators are shown belowboth the actual results for 2010 and the projections for 2 a. If operating capital as of 12/31/2010 is $502.2 million, what is the free cash flow for 12/31/2011? b. What is the horizon value as of 12/31/2011? c. What is the value of operations as of 12/31/2010? d. What is the total value of the company as of 12/31/2010? e. What is the intrinsic price per share for 12/31/2010?

The financial statements of Lioi Steel Fabricators are shown belowboth the actual results for 2010 and the projections for 2 a. If operating capital as of 12/31/2010 is $502.2 million, what is the free cash flow for 12/31/2011? Free Cash Flows FCF Acutal 2010 Projected 2011 Net Operating working capital 127.20 134.90 Net Plant & Equipment 375.00 397.50 Net Operating Capital (12/31/12) 502.20 532.40 Investment in Operating Cap. 30.20 NOPAT EBIT*(1-tx rate) 61.50 65.16 Less: Investment in Operating. Capital 30.20 Free Cash Flows FCF = 34.96 b. What is the horizon value as of 12/31/2011? Horizon Value HVt = [FCFt x (1+g)] / (WACC-g) =[ 34.96 x (1+.06)] / (11-6) Horizon Value 741.152 c. What is the value of operations as of 12/31/2010? PV (HVt @WACC + NPVFCF@WACC) PV HVt @WACC 667.70 + NPV FCF@WACC 31.50 Value of Operations as on 12/31/11 = 699.20 d. What is the total value of the company as of 12/31/2010? Vop t + V non operating Assets #NAME? Total Company Value as on 12/31/11 7 = 49.10

e. What is the intrinsic price per share for 12/31/2010? = V firm - V debt - V preference stock V. Debt = N/P + LT Bonds 210.70 V. Preference Stock = 35.00 V. Equity = V[firm-debt-ps] 503.40 PRICE PER SHARE = = V. Equity / Number of Shares Outstanding 50.34

for 2010 and the projections for 2011. Free cash flow is expected to grow at a 6% rate after 2011. The weighted average cost of capital is

for 2010 and the projections for 2011. Free cash flow is expected to grow at a 6% rate after 2011. The weighted average cost of capital is

weighted average cost of capital is 11%.

weighted average cost of capital is 11%.

Você também pode gostar

- The Following Tables Contain Financial Statements For Dynastatics Corporation AlthoughDocumento2 páginasThe Following Tables Contain Financial Statements For Dynastatics Corporation Althoughtrilocksp SinghAinda não há avaliações

- Ratio Analysis Missing FiguresDocumento1 páginaRatio Analysis Missing FiguresFahad Batavia0% (1)

- Chapter 3 AnswersDocumento2 páginasChapter 3 AnswersMac b IBANEZAinda não há avaliações

- FM Assignment 7 - Group 4Documento7 páginasFM Assignment 7 - Group 4Puspita RamadhaniaAinda não há avaliações

- Chapter 12 Factory Overhead Planned, Actual and Applied Variance Analysis (Book 1 & Book 2)Documento37 páginasChapter 12 Factory Overhead Planned, Actual and Applied Variance Analysis (Book 1 & Book 2)Ehsan Umer Farooqi100% (1)

- IBA Suggested Solution First MidTerm Taxation 12072016Documento9 páginasIBA Suggested Solution First MidTerm Taxation 12072016Syed Azfar HassanAinda não há avaliações

- Chapter 12: Corporate Valuation and Financial Planning: Page 1Documento33 páginasChapter 12: Corporate Valuation and Financial Planning: Page 1nouraAinda não há avaliações

- Chapter 7 Materials Controlling and CostingDocumento43 páginasChapter 7 Materials Controlling and CostingNabiha Awan100% (1)

- Soal AkmDocumento5 páginasSoal AkmCarvin HarisAinda não há avaliações

- Aafr Ias 12 Icap Past Paper With SolutionDocumento17 páginasAafr Ias 12 Icap Past Paper With SolutionAqib Sheikh100% (1)

- Solved Jurisdiction Z Levies An Excise Tax On Retail Purchases ofDocumento1 páginaSolved Jurisdiction Z Levies An Excise Tax On Retail Purchases ofAnbu jaromiaAinda não há avaliações

- The Correct Answer For Each Question Is Indicated by ADocumento19 páginasThe Correct Answer For Each Question Is Indicated by Aakash deepAinda não há avaliações

- Question 1Documento8 páginasQuestion 1elvitaAinda não há avaliações

- The Cross-Price Elasticity of Demand For The Two Is CalculatedDocumento3 páginasThe Cross-Price Elasticity of Demand For The Two Is CalculatedhaAinda não há avaliações

- w9 - L2 - Review For Lecture Midterm 2Documento14 páginasw9 - L2 - Review For Lecture Midterm 2Rashid AyubiAinda não há avaliações

- Michael Phelps: Strategy Formulation & ImplementationDocumento7 páginasMichael Phelps: Strategy Formulation & ImplementationTushar Dey100% (1)

- Listing by Way of IntroductionDocumento41 páginasListing by Way of IntroductionJepoy FranciscoAinda não há avaliações

- 01 - Preweek Lecture and ProblemsDocumento15 páginas01 - Preweek Lecture and ProblemsMelody GumbaAinda não há avaliações

- Consolidated Financial Statements - Notes PDFDocumento2 páginasConsolidated Financial Statements - Notes PDFKeanna Denise GonzalesAinda não há avaliações

- Chapter 02 Ratio AnalysisDocumento52 páginasChapter 02 Ratio AnalysisSunita YadavAinda não há avaliações

- Solution 1Documento5 páginasSolution 1Opeyemi OyewoleAinda não há avaliações

- Solution: Wacc 0.98% 1.00% 7.50% 9.48%Documento22 páginasSolution: Wacc 0.98% 1.00% 7.50% 9.48%Narmeen KhanAinda não há avaliações

- Chapter 2 Analysis of Financial StatementDocumento18 páginasChapter 2 Analysis of Financial StatementSuman ChaudharyAinda não há avaliações

- Assignment Chapter 9Documento4 páginasAssignment Chapter 9Anis Trisna PutriAinda não há avaliações

- 03B) Chapter 3 Questions - BrighamDocumento7 páginas03B) Chapter 3 Questions - BrighamMohammad Ather100% (1)

- Chapter 3 SolutionDocumento71 páginasChapter 3 SolutionAatif KahloonAinda não há avaliações

- Advance Financial Accounting (Assignment)Documento3 páginasAdvance Financial Accounting (Assignment)asegidAinda não há avaliações

- Practice of Profitability RatiosDocumento11 páginasPractice of Profitability RatiosZarish AzharAinda não há avaliações

- Problem Solving 16Documento11 páginasProblem Solving 16Ehab M. Abdel HadyAinda não há avaliações

- FINMATHS Assignment2Documento15 páginasFINMATHS Assignment2Wei Wen100% (1)

- CH 2 SolutionDocumento7 páginasCH 2 SolutionJohnAinda não há avaliações

- IAS 16 (CAF5 S18) : (I) (Ii) (Iii) - Rs. in MillionDocumento41 páginasIAS 16 (CAF5 S18) : (I) (Ii) (Iii) - Rs. in MillionShameel IrshadAinda não há avaliações

- RatioDocumento24 páginasRatioSadika KhanAinda não há avaliações

- Esno Finial Fabricating-Self-correction Problems-Capital Budgeting and Estimating Cash FlowsDocumento1 páginaEsno Finial Fabricating-Self-correction Problems-Capital Budgeting and Estimating Cash FlowsRajib DahalAinda não há avaliações

- ACCT-312:: Exercises For Home Study (From Chapter 6)Documento5 páginasACCT-312:: Exercises For Home Study (From Chapter 6)Amir ContrerasAinda não há avaliações

- CVP AnalysisDocumento7 páginasCVP AnalysisKat Lontok0% (1)

- SFM Suggested Answers PDFDocumento352 páginasSFM Suggested Answers PDFAindrila BeraAinda não há avaliações

- Working Capital Problem SolutionDocumento10 páginasWorking Capital Problem SolutionMahendra ChouhanAinda não há avaliações

- Chapter 13 SolutionsDocumento26 páginasChapter 13 SolutionsMathew Idanan0% (1)

- Flexible Budget and Sales Volume Variances Market Share andDocumento1 páginaFlexible Budget and Sales Volume Variances Market Share andtrilocksp SinghAinda não há avaliações

- Chapter Three CVP AnalysisDocumento65 páginasChapter Three CVP AnalysisBettyAinda não há avaliações

- IAS-33 Earning Per ShareDocumento10 páginasIAS-33 Earning Per ShareButt Arham100% (1)

- CH # 8 (By Product)Documento10 páginasCH # 8 (By Product)Rooh Ullah KhanAinda não há avaliações

- Time Value of Money General Instructions:: Activity 4 MfcapistranoDocumento2 páginasTime Value of Money General Instructions:: Activity 4 MfcapistranoAstrid BuenacosaAinda não há avaliações

- 04 Marginal CostingDocumento67 páginas04 Marginal CostingAyushAinda não há avaliações

- Accounting 1 FinalDocumento2 páginasAccounting 1 FinalchiknaaaAinda não há avaliações

- Financial Management - Stock Valuation Assignment 2 - Abdullah Bin Amir - Section ADocumento3 páginasFinancial Management - Stock Valuation Assignment 2 - Abdullah Bin Amir - Section AAbdullah AmirAinda não há avaliações

- Fixed & Flexible BudgetsDocumento15 páginasFixed & Flexible BudgetsAdilNzAinda não há avaliações

- Accounts-Individual Assignment 2 - q3 IDocumento1 páginaAccounts-Individual Assignment 2 - q3 ISshanthineAinda não há avaliações

- Role of Financial Management in OrganizationDocumento8 páginasRole of Financial Management in OrganizationTasbeha SalehjeeAinda não há avaliações

- 1321612987financial AnalysisDocumento15 páginas1321612987financial AnalysisMuhammad Arslan UsmanAinda não há avaliações

- Lab CH 7Documento4 páginasLab CH 7bella100% (1)

- IAS-33 QuestionDocumento2 páginasIAS-33 QuestiontahaAinda não há avaliações

- Question 2: Ias 19 Employee Benefits: Page 1 of 2Documento2 páginasQuestion 2: Ias 19 Employee Benefits: Page 1 of 2paul sagudaAinda não há avaliações

- Assignment 2 - Numerical QuestionsDocumento6 páginasAssignment 2 - Numerical QuestionsGazala KhanAinda não há avaliações

- BF2 AssignmentDocumento3 páginasBF2 AssignmentIbaad KhanAinda não há avaliações

- This Study Resource Was: InstructionsDocumento3 páginasThis Study Resource Was: InstructionsRama fauziAinda não há avaliações

- Economic PaperDocumento3 páginasEconomic PaperAbdullah AlhuraniAinda não há avaliações

- Gitman CH 14 15 QnsDocumento3 páginasGitman CH 14 15 QnsFrancisCop100% (1)

- Odev - Cash - Flow - and - Financial - Planning (1) - Fatih EkerDocumento16 páginasOdev - Cash - Flow - and - Financial - Planning (1) - Fatih EkerfurkanAinda não há avaliações

- ICMAP Past PaperDocumento4 páginasICMAP Past PaperNoman Qureshi100% (2)

- Financial RportingDocumento4 páginasFinancial RportingIrfanAinda não há avaliações

- Advanced Accounitng & Financial Reporting: IGL Identifiable Net Assets On Acquisition Date of Oct. 1, 2010 (100+60+35-10)Documento6 páginasAdvanced Accounitng & Financial Reporting: IGL Identifiable Net Assets On Acquisition Date of Oct. 1, 2010 (100+60+35-10)Ahmer KhanAinda não há avaliações

- Analisis Laporan Keuangan Rumah Sakit Berdasarkan PDFDocumento13 páginasAnalisis Laporan Keuangan Rumah Sakit Berdasarkan PDFNathaniaElizabethAinda não há avaliações

- Substantive Procedures Related To Year End Bank BalancesDocumento3 páginasSubstantive Procedures Related To Year End Bank BalancesMoeer razaAinda não há avaliações

- History of IFRS 9Documento1 páginaHistory of IFRS 9Rainbow VillanuevaAinda não há avaliações

- Evaluating Mutual Fund Investment Information: Source Source Source Criteria Evaluation 1 2 3Documento2 páginasEvaluating Mutual Fund Investment Information: Source Source Source Criteria Evaluation 1 2 3Joel Christian MascariñaAinda não há avaliações

- Nepal SBI Bank LTDDocumento184 páginasNepal SBI Bank LTDSrijana adhikariAinda não há avaliações

- LECTURE NOTES - Aud ProbDocumento15 páginasLECTURE NOTES - Aud ProbJean Ysrael Marquez100% (1)

- Fabm Analysis and Interpretation of Financial Statements 1Documento4 páginasFabm Analysis and Interpretation of Financial Statements 1Mylen Noel Elgincolin Manlapaz0% (1)

- Accounting ExamDocumento25 páginasAccounting ExamJohn Paul PolicarpioAinda não há avaliações

- Application For Registration As An Australian Company: 1 State/territory of RegistrationDocumento10 páginasApplication For Registration As An Australian Company: 1 State/territory of Registrationquaz4Ainda não há avaliações

- SIGNED Questionnaire For Designated Non Financial Businesses and Professions DNFBPsDocumento2 páginasSIGNED Questionnaire For Designated Non Financial Businesses and Professions DNFBPsCoco MondejarAinda não há avaliações

- Introduction To Management Accounting and Financial Statement AnalysisDocumento24 páginasIntroduction To Management Accounting and Financial Statement Analysis24.7upskill Lakshmi V100% (1)

- Cirtek Follow-On Offering Final ProspectusDocumento332 páginasCirtek Follow-On Offering Final ProspectusAlyssa Camille DiñoAinda não há avaliações

- SURYA TutoringDocumento3 páginasSURYA Tutoringhweeping.goh0% (1)

- Single Borrower ExposureDocumento7 páginasSingle Borrower ExposureSiam HasanAinda não há avaliações

- Protfolio Analysis of Different CompaniesDocumento24 páginasProtfolio Analysis of Different CompaniesPrakash Kumar HindujaAinda não há avaliações

- Freddie Mac Executive SummaryDocumento2 páginasFreddie Mac Executive SummaryElla Marie LopezAinda não há avaliações

- Various Topics in MANAGEMENT ACCOUNTING (RESA)Documento2 páginasVarious Topics in MANAGEMENT ACCOUNTING (RESA)Denise ChristinaAinda não há avaliações

- Santos Pays 80,000 For 1/2 Share of Hernandez InterestDocumento9 páginasSantos Pays 80,000 For 1/2 Share of Hernandez InterestGvm Joy MagalingAinda não há avaliações

- Purchase Price Agreens in Private M&ADocumento20 páginasPurchase Price Agreens in Private M&AMeghalsi TarekAinda não há avaliações

- Establishing A Business and More (Role of The Entrepreneur)Documento7 páginasEstablishing A Business and More (Role of The Entrepreneur)Monique McfarlaneAinda não há avaliações

- Pre-Feasibility Study: Bangle Making WorkshopDocumento15 páginasPre-Feasibility Study: Bangle Making WorkshopRohs VantageAinda não há avaliações

- KPI RepositoryDocumento33 páginasKPI RepositoryBOAinda não há avaliações

- Sample-Test Bank Contemporary Financial Management 14th 14EDocumento16 páginasSample-Test Bank Contemporary Financial Management 14th 14EMuhammad YahyaAinda não há avaliações

- Chapter 2 - Statement of Comprehensive IncomeDocumento12 páginasChapter 2 - Statement of Comprehensive IncomeVictor TucoAinda não há avaliações

- Paper LBO Model Example - Street of WallsDocumento6 páginasPaper LBO Model Example - Street of WallsAndrewAinda não há avaliações

- Daily Equity Market Report - 19.09.2022Documento1 páginaDaily Equity Market Report - 19.09.2022Fuaad DodooAinda não há avaliações

- Bata IndiaDocumento10 páginasBata IndiaAnand Shekhar MishraAinda não há avaliações