Escolar Documentos

Profissional Documentos

Cultura Documentos

Legal Aspects

Enviado por

Isaiah CruzTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Legal Aspects

Enviado por

Isaiah CruzDireitos autorais:

Formatos disponíveis

LEGAL ASPECTS

Doing business in the Philippines, either as single proprietorship, partnership or corporation, calls for legal aspects such as licenses or permits from government. An investor or businessman needs to obtain a business license in the locality where he will establish his business, as well as register his business with the Department of Trade and Industry in case of sole proprietorship, or with the Securities and Exchange Commission in the case of partnerships and corporations.

Department of Trade and Industry (DTI) This is where you register if your enterprise is a single proprietorship. The agency will issue a certificate of registration of business name.

Securities and Exchange Commission (SEC) If your enterprise is a partnership or a corporation, this is where you will register. It will issue a certificate of registration. 1. Verify and reserve the company name with the Securities and Exchange Commission (SEC) The availability of the proposed company name can be verified via the SEC's online verification system at no charge. Reservation of the name, once approved by the SEC, costs Php40/month for the first 30 days. The company name can be reserved for a maximum of 120 days for a fee of PHP 120, which is renewable upon expiration of the period. 2. Partnerships are required to be registered with the Securities and Exchange Commission [SEC]. Registration is done by filing the Articles of Partnership with the SEC. The Articles of Partnership set forth all the terms and conditions mutually agreed by the partners thereto. More specifically, the documents required are as follows: [1] Proposed Articles of Partnership; [2] Name Verification Slip; [3] Bank Certificate of Deposit; [4] Alien Certificate of Registration, Special Investors Resident Visa or proof of other types of visa [in case of foreigner]; [5] Proof of Inward Remittance [in case of non-resident aliens]. It bears noting that corporations are not allowed by law to become partners in a partnership.

Barangay Hall You register with the specific barangay in the municipality or city where you will operate your business. This office will issue the barangay clearance. 1. Obtain barangay clearance. To get the barangay clearance, the following documentary requirements should be submitted to the Barangay: Application form, SEC Certificate of Incorporation and approved articles of incorporation and bylaws, location plan/site map, contract of lease

over the corporation's office. This clearance is obtained from the Barangay where the business is located, and is required to obtain the business permit from the city or municipality. Barangay fees vary for each Barangay since they have the discretion to impose their own fees and charges for as long ast these fees are reasonable and within the limits set by the Local Government Code and city ordinances.

Local Government Unit (LGU) You register with the municipality or city where you will set up your business. This office will issue the business permit. 1. Obtain the business permit to operate from the BPLO. The fees vary depending on the LGU issuing the permit. The rate of license fee imposed in Quezon City is 25% of 1% of the authorized capital stock. Other permits, such as locational clearance, fire safety and inspection certificate, sanitary permit, certificate of electrical inspection, mechanical permit, and other clearances or certificates required depending on the nature of business, are also imposable. The rate of these fees depends on the nature of business and land area occupied by the proposed corporation. *The barangay clearance is a prerequisite for the issuance of business permit to operate . All businesses are required to secure a mayor's permit or municipal license from the municipality or city where they are located. Various cities and municipalities have different registration procedures. The following are the general requirements:

Where to File 1) Concerned Municipal or City Government Office 2) Municipal/City Hall (View Directory) Requirements A) Mayor's/ Business Permit 1) Renewal: a) Latest Mayor's Permit b) Barangay Clearance c) Community Tax Certificate with Gross Receipt d) Financial Statement (Partnerships and Corporations) e) BIR Clearance f) SSS Clearance g) ECC (or CNC) h) Sanitary Permit 2) Additional Requirements for New Business: a) DTI Registration b) SEC Registration (Partnerships and Corporations) c) Building Permit and Occupancy Permit (for newly constructed) d) Zoning Clearance B) Building Permit & Occupancy Permit 1) Building Permit (4 copies each): a) Barangay Clearance b) Building Plan c) Bill of Materials d) Tax Declaration e) Land Title

f) Building & Sanitary Permit Application Form 2) Fire Safety Certificate a) Certificate of Completion 3) Occupancy Permit

Bureau of Internal Revenue (BIR) You register your business with this office and apply for your businesss taxpayer identification number (TIN), registration of books of accounts, authority to print 1. Apply for Certificate of Registration (COR) and TIN at the Bureau of Internal Revenue (BIR) After the taxpayer obtains the TIN, the company must pay the annual registration fee of PHP 500 at any duly accredited bank, using payment form BIR Form 0605). All newly formed corporations subject to SEC registration are issued pre-generated TIN by SEC-Head Office, which is indicated on their SEC Certificate of Registration. The corporation only has to register its pre-generated TIN with the BIR and report all internal revenue taxes that it expects to be liable for. The requirements for application for COR with the BIR are: a. Duly accomplished and filled-out BIR Form No. 1905 (Application for Registration for Partnership); b. Payment Form (BIR Form No. 0605); c. SEC Certification of Partnership; d. Articles of Partnership and By-laws; e. Contract of Lease (with BIR Form No. 2000 and supporting BIR Payment Form as proof of payment of documentary stamp tax on the lease agreement); f. Documentary Stamp Tax Return (BIR Form No. 2000) on the original issuance of shares and Payment Form (for the DST payment); and g. Mayors Permit/Business Permit Application (duly stamped received by the Business Licensing Division of the local government of Manila City). 2. Buy special books of account at bookstore . Special books of accounts are required for registering with the BIR. The books of accounts are sold at bookstores nationwide. One set of journals consisting of four books (cash receipts account, disbursements account, ledger, general journal) costs about PHP 400. If the company has a computerized accounting system (CAS), it may opt to register its CAS under the procedures laid out in BIR Revenue Memorandum Order Nos. 21-2000 and 29-2002. The BIR Computerized System Evaluation Team is required to inspect and evaluate the companys CAS within 30 days from receipt of the application form (BIR Form No. 1900) and complete documentary requirements. 3. Pay the annual community tax and obtain the community tax certificate (CTC) from the City Treasurer's Office (CTO). The company is assessed a basic and an additional community tax. The basic community tax rate depends on whether the company legal form is a corporation, partnership, or association (PHP 500 or lower). The additional community tax (not to exceed Php 10,000.00) depends on the assessed value of real property the company owns in the Philippines at the rate of Php 2.00 for every Php 5,000.00 and on its gross receipts,

including dividends or earnings, derived from business activities in the Philippines during the preceding year, at the rate of Php 2.00 for every Php 5,000.00. 4. Pay the registration fee and documentary stamp taxes (DST) at the AAB. The rate of documentary stamp tax on original issuance of shares of stock shall be Php 1.00 for every Php 200.00 or fractional part thereof, of the par value, of such shares of stock. The documentary stamp tax return shall be filed and the tax paid on or before the fifth (5th) day after the close of the month of approval of SEC registration. 5. Obtain the authority to print receipts and invoices from the BIR. The authority to print receipts and invoices must be secured before the sales receipts and invoices may be printed. The company can ask any authorized printing company to print its official forms, or it can print its own forms (i.e., it uses its computers to print loose-leaf invoice forms) after obtaining a permit from BIR for this purpose. To obtain the authority to print receipts and invoices from the BIR, the company must submit the following documents to the Revenue District Office (RDO): a. Duly completed application for authority to print receipts and invoices (BIR Form No. 1906); b. Job order; c. Final and clear sample of receipts and invoices (machine-printed); d. Application for registration (BIR Form No. 1903); and e. Proof of payment of annual registration fee (BIR Form No. 0605). 6. Print receipts and invoices at the print shops The cost is based on the following specifications of the official receipt: 1/2 bond paper (8 x 5 cm) in duplicate, black print, carbonless. The minimum print volume is 25 booklets. 7. Have books of accounts and Printers Certificate of Delivery (PCD) stamped by the BIR After the printing of receipt s and invoices, the printer issues a Printers Certificate of Delivery of Receipts and Invoices (PCD) to the company, which must submit this to the appropriate BIR RDO (i.e., the RDO which has jurisdiction over the companys principal place of business) for registration and stamping within thirty (30) days from issuance. The company must also submit the following documents: a. All required books of accounts; b. VAT registration certificate; c. SEC registration; d. BIR Form W-5; e. Certified photocopy of the ATP; and f. Notarized taxpayer-users sworn statement enumerating the responsibilities and commitments of the taxpayer-user. The company must also submit a copy of the PCD to the BIR RDO having jurisdiction over the printers principal place of busi ness.

Department of Labor and Employment (DOLE)

If you employ five workers or more, register your business with this agency. The DOLE is asked to promote gainful employment opportunities, protect workers and promote their welfare, develop human resources, and maintain industrial peace.

Social Security System (SSS) You register your business as an employer, yourself as a self-employed or as employee, and your workers as employees. This office will issue an SSS number for your business, for yourself, as well as for your workers. 1. Partnerships Any of the partners of a partnership firm should accomplish SSS Forms R-1 (Employer Registration) and (R-1A (Employment Report) and submit these forms together with a photocopy of the Articles of Partnership. The original copy of the Articles of partnership must be presented to the SSS for Authentication purposes. 2. Register with the Social Security System (SSS) To register with the SSS, the company must submit the following documents: a. Employer registration form (Form R-1); b. Employment report (Form R-1A); c. List of employees, specifying their birth dates, positions, monthly salary and date of employment; and d. Articles of incorporation, by-laws and SEC registration. Upon submission of the required documents, the SSS employer and employee numbers will be released. The employees may attend an SSS training seminar after registration. SSS prefers that all members go through such training so that each member is aware of their rights and obligations.

Home Development Mutual Fund (HDMF) RA 7742 requires all SSS members earning at least P4,000 a month to register with this agency. HDMF administers the Pag-Ibig Fund. 1. Register with Home Development Mutual Fund (Pag-ibig) To register with the HDMF, the corporation must submit the following documents: a. Employer's Data Form (EDF [FPF040]); b. Specimen Signature Form (SSF[FPF170]); c. Copy of SEC Certificate of Incorporation; d. Copy of Approved Articles of Incorporation and By-laws; and e. Board Resolution or Secretarys Certificate indicating the duly designated Authorized Representative. Upon submission of the complete documents and payment of the first contribution to the fund, the Pag-IBIG will issue the HDMF number and the HDMF Certificate of Registration.

Philippine Health Insurance Corp. (PhilHealth) The New National Health Insurance Act (RA 7875) as amended by RA 9241 requires all employers of the government and private sectors and their employees to register with this agency. PhilHealth manages and administers the government health care system. 1. Register with the Philippine Health Insurance Company (PhilHealth) To register with PhilHealth, the company must submit the following documents: a. Employer data record (Form ER1); b. Report of employee-members (Form ER2) c. SEC registration; d. BIR registration; and e. Copy of business permit. Upon submission of the required documents, the company shall get the receiving copy of all the forms as proof of membership until PhilHealth releases the employer and employee numbers within three months.

Other Legal Requirements 1. Registration certificate - Movie & Television Review and Classification Board (MTRCB) 2. Environmental Compliance Certification - Environmental Management Bureau, Department of Environment and Natural Resources 3. Trademarks/Patents registration - Intellectual Property Office 4. Import Commodity Clearance (ICC) Quality Mark to ensure that imported consumer products conform with Philippine national standards - Bureau of Products and Standards 5. Must Conform to ADMINISTRATIVE ORDER NO. 03, Implementing Rules and Regulations Governing the Imposition of Safeguard Measures Under - REPUBLIC ACT 8800 - THE SAFEGUARD MEASURES ACT a. AN ACT PROTECTING LOCAL INDUSTRIES BY PROVIDING SAFEGUARD MEASURES TO BE UNDERTAKEN IN RESPONSE TO INCREASED IMPORTS AND PROVIDING PENALTIES FOR VIOLATION THEREOF b. This Act shall apply to products being imported into the country irrespective of source.

6. Must conform to ADMINISTRATIVE ORDER NO. 01 - Implementing Rules and Regulations

Governing the Imposition of an Anti-Dumping Duty under REPUBLIC ACT 8752 THE ANTIDUMPING ACT OF 1999

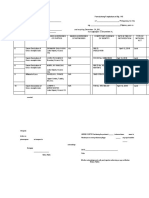

FORM TRQ-02 Page 1/1

BUREAU OF IMPORT SERVICES Import Administration Division

3 Floor, TARA Bldg., #389 Sen. Gil Puyat Avenue, Makati City, Metro Manila, Philippines 1200 Tel. Nos. 430-1417/ 986-8972 Fax Nos. 896-4431 E-mail address: bis_ird@yahoo.com Web Page: www.dti.gov.ph

rd

APPLICATION FOR AUTHORITY TO IMPORT UNDER THE TARIFF RATE QUOTA (TRQ) SCHEME FOR PHILIPPINE IMPORTS OF TINPLATE (TP), HOT ROLLED (HR) AND/OR COLD ROLLED (CR) STEEL FROM JAPAN PURSUANT TO THE JAPAN-PHILIPPINES ECONOMIC PARTNERSHIP AGREEMENT (JPEPA) Basic Information Name of Importer Enterprise Office Address Plant Address Telephone No. Fax No. E-mail Address

Date accredited under the JPEPA TRQ Scheme

Authorized Representative to DTI Name Address Telephone No. Fax No. E-mail address PROPOSED IMPORTATION

HRS Volume (MT) Product description/ specifications AHTN Heading No. Suppliers Name Suppliers Address CRS TP Total

Port of Origin Purchase Price (USD) FOB CNF CIF Period within which the importation is to be made Latest shipment Date

Date Accomplished_______________

________________________________ Signature over printed name of Authorized Representative to DTI

DTI-BIS Form TRQ-02

DOCUMENTS TO BE ATTACHED 1. Photocopy of the DTI letter notifying the approval of the importers application for accreditation under the Scheme; 2. Importers Notarized Affidavit of Intent as final user indicating end-usage and application, among other things (DTI Form TRQ-03); 3. Photocopy of sales contract, sales/purchase order, pro-forma invoice, or like documents, covering the importation, issued in the name of the importer as consignee to whom the shipment will be released by the BOC; provided further that the applicable Japanese

Industrial Standards (JIS ) to which the TP, HR and CR steel being imported conform to (as specified by the importer) is indicted in the said sales contract, sales/purchase

order, pro-forma invoice, or like documents, covering the importation;

4. A written explanation by the importer substantiating his case in the event of a controversy.

Liquidation of Imported Articles - Accountability for goods or merchandise imported tax and duty-free pursuant to the Act shall be discharged as follows: 1. Submission of proof of payment of the corresponding taxes and duties; 2. Submission of proof of re-exportation - this shall consist of the following documents: a. Import Entry b. Certificate of Identification c. Export Declaration d. Packing List e. Certificate of Loading / Landing 3. By condemnation / loss / destruction (including wastage and rejects) - the following shall be submitted: a. Covering Import Entry b. Description c. Quantity d. Affidavit of Loss / Destruction e. Permit to Bring Out of the ECOZONE 4. Exportation of finished products - the following documents shall be submitted: a. Statement of liquidation (reconciliation of raw materials) b. Outward Bill of Lading / Airway Bill c. Certificate of Identification d. Certificate of Inspection and Loading / Landing e. Boatnote

5. Indirect Exportation - the following shall be submitted: a. Receipt of payment covering the sale / contract of sale b. Certificate of Identification c. Boatnote Covering Transfer

d. Certificate of Liquidation of Raw Materials / Raw Materials Consumption 6. Constructive Exportation - the following should be submitted: a. Contract of Sale b. Boatnote / Delivery Receipt

Você também pode gostar

- Civil Case PleadingDocumento18 páginasCivil Case PleadingLegisAinda não há avaliações

- Trading MistakesDocumento6 páginasTrading Mistakesasranka86% (7)

- Golf Tournament LetterDocumento1 páginaGolf Tournament LettergslaboardAinda não há avaliações

- Application For Amendment of Master Deed With Declaration of RestrictionsDocumento1 páginaApplication For Amendment of Master Deed With Declaration of RestrictionsNiel DeygabiAinda não há avaliações

- Private and Confidential: Rowell B. Malabag Law and Notarial OfficeDocumento4 páginasPrivate and Confidential: Rowell B. Malabag Law and Notarial OfficeBessie TibayanAinda não há avaliações

- Strategic Planning and Marketing PlansDocumento55 páginasStrategic Planning and Marketing Plansvenkataiims100% (5)

- Return-of-Summons - SampleDocumento2 páginasReturn-of-Summons - SampleJay SonAinda não há avaliações

- Complaint Babayen-OnDocumento5 páginasComplaint Babayen-OnFlor Cecilie TejadaAinda não há avaliações

- Bureau of Trademarks: Intellectual Property Office of The PhilippinesDocumento1 páginaBureau of Trademarks: Intellectual Property Office of The PhilippinesJerry SerapionAinda não há avaliações

- (RACCO) New Petition Checklist As of 10.07.2022Documento1 página(RACCO) New Petition Checklist As of 10.07.2022ANGEL JOY RABAGOAinda não há avaliações

- Cancellation of Annotation - Petition.uploadDocumento5 páginasCancellation of Annotation - Petition.uploadJef Didulo100% (1)

- Letter RequestDocumento2 páginasLetter Requestejanelene catalanAinda não há avaliações

- Petition For Nullity of Marriage Psychological IncapacityDocumento5 páginasPetition For Nullity of Marriage Psychological IncapacityI-za FeAinda não há avaliações

- FILED Petition For Temporary Restraining Order, (01658178)Documento45 páginasFILED Petition For Temporary Restraining Order, (01658178)the kingfishAinda não há avaliações

- Republic of The Philippines National Capital Judicial Region Regional Trial Court Branch 100 Quezon CityDocumento2 páginasRepublic of The Philippines National Capital Judicial Region Regional Trial Court Branch 100 Quezon CityPretizel Ivy ArtecheAinda não há avaliações

- Doing BusinessDoing Business in The PhilDocumento54 páginasDoing BusinessDoing Business in The PhilDavid JesusAinda não há avaliações

- Cs Cost MCQ Part 11Documento48 páginasCs Cost MCQ Part 11dmaxprasangaAinda não há avaliações

- Chapter08.Cost Volume Profit AnalysisDocumento38 páginasChapter08.Cost Volume Profit AnalysisIsaiah Cruz83% (6)

- (Pagtanggap, Pagpapalaya at Pagpapaubaya) : Receipt, Release and QuitclaimDocumento3 páginas(Pagtanggap, Pagpapalaya at Pagpapaubaya) : Receipt, Release and QuitclaimJovy TorresAinda não há avaliações

- CH 03 Solution Manual Information Technology Auditing 2nd Ed James Hall - EDP Auditing Class - Jakarta State University - Chairul AnwarDocumento27 páginasCH 03 Solution Manual Information Technology Auditing 2nd Ed James Hall - EDP Auditing Class - Jakarta State University - Chairul AnwarSjifa Aulia90% (10)

- Investment Requirements For A Food Truck BusinessDocumento10 páginasInvestment Requirements For A Food Truck BusinessYna Paulite100% (1)

- DOLE Complaint Filing ProcedureDocumento1 páginaDOLE Complaint Filing Procedureraymund_lagdama384Ainda não há avaliações

- 1 Requirements For Petition To LiftDocumento1 página1 Requirements For Petition To LiftMarbe Rica PaladinAinda não há avaliações

- Republic of The Philippines Regional Trial Court BRANCH - Cabarroguis, QuirinoDocumento3 páginasRepublic of The Philippines Regional Trial Court BRANCH - Cabarroguis, QuirinoPrincess Pilove Gawongna100% (1)

- Affidavit of Non Payment of ContributionsDocumento2 páginasAffidavit of Non Payment of ContributionsHRDept. Jehan Shipping Corp.Ainda não há avaliações

- Petitions Involving Certificate of TitleDocumento5 páginasPetitions Involving Certificate of TitleAngela CanaresAinda não há avaliações

- Verify and Reserve Your Corporate NameDocumento3 páginasVerify and Reserve Your Corporate NameDaphne Joyce NocilladoAinda não há avaliações

- Affidavit of No Pending CaseDocumento1 páginaAffidavit of No Pending Casedanny dayanAinda não há avaliações

- Pre-Trial Brief Arya StarkDocumento3 páginasPre-Trial Brief Arya StarkDianeAinda não há avaliações

- A.M. No. 02-11-10-SCDocumento6 páginasA.M. No. 02-11-10-SCRhenfacelManlegroAinda não há avaliações

- Rigen Affidavit GlomarieDocumento2 páginasRigen Affidavit GlomarieAl HangAinda não há avaliações

- Business Plan Gas Station Case Study HelpDocumento9 páginasBusiness Plan Gas Station Case Study Helpkeith maureen dalinasAinda não há avaliações

- Accounting - Enron Scandal PDFDocumento27 páginasAccounting - Enron Scandal PDFArjit AgrawalAinda não há avaliações

- Demand Letter Dated 08 August 2022Documento2 páginasDemand Letter Dated 08 August 2022theresa bautistaAinda não há avaliações

- Compalint For Cancellation of Extrajudicial Partition FajardoDocumento7 páginasCompalint For Cancellation of Extrajudicial Partition Fajardobhem silverioAinda não há avaliações

- Affidavit of UndertakingDocumento1 páginaAffidavit of UndertakingJhodessy Jane BrianAinda não há avaliações

- Borres Realty & Development Corporation Borres Realty & Development CorporationDocumento12 páginasBorres Realty & Development Corporation Borres Realty & Development Corporation09303313316Ainda não há avaliações

- Petitioner,: Formal Entry of Appearance With Motion For PostponementDocumento3 páginasPetitioner,: Formal Entry of Appearance With Motion For PostponementJohnimeAinda não há avaliações

- Walking a Tightrope: Biography of Honorable Mayor Catalino Gabot Hermosilla Sr.No EverandWalking a Tightrope: Biography of Honorable Mayor Catalino Gabot Hermosilla Sr.Ainda não há avaliações

- Legal BillingDocumento1 páginaLegal Billingapi-224104463Ainda não há avaliações

- Motion To Withdraw AppearanceDocumento2 páginasMotion To Withdraw AppearanceOw WawieAinda não há avaliações

- Gadon QuashDocumento9 páginasGadon QuashYNNA DERAYAinda não há avaliações

- Request For BI Clearance CertificateDocumento1 páginaRequest For BI Clearance CertificateNith08Ainda não há avaliações

- Petition For Reconstitution - Heirs of Dela CruzDocumento3 páginasPetition For Reconstitution - Heirs of Dela CruzVanessa Duma-anAinda não há avaliações

- SuccessionDocumento28 páginasSuccessionAngelo Andro SuanAinda não há avaliações

- Aknowledgement Receipt-Lourdes N. Avelino vs. Joselito RosaladoDocumento1 páginaAknowledgement Receipt-Lourdes N. Avelino vs. Joselito RosaladoVon Greggy Moloboco IIAinda não há avaliações

- Certification of Non Stock Non Profit Corporations and Ngos For Donee Institution StatusDocumento6 páginasCertification of Non Stock Non Profit Corporations and Ngos For Donee Institution StatusGlad AlveroAinda não há avaliações

- 04 Real Estate Service ActDocumento21 páginas04 Real Estate Service ActClarkAinda não há avaliações

- In Re Right of InspectionDocumento3 páginasIn Re Right of InspectionClarissa de VeraAinda não há avaliações

- SPA Dayao Loss TitleDocumento1 páginaSPA Dayao Loss TitleChrissy SabellaAinda não há avaliações

- Hlurb-Br 871 2011 Rules of ProcedureDocumento31 páginasHlurb-Br 871 2011 Rules of ProcedureTata Hitokiri0% (1)

- Supplemental Verified ComplaintDocumento83 páginasSupplemental Verified ComplaintJudge Florentino FloroAinda não há avaliações

- Motion For Cancellation of Annotation On Title (Mr. Viray)Documento3 páginasMotion For Cancellation of Annotation On Title (Mr. Viray)Arkim llovitAinda não há avaliações

- ExecutedDocumento2 páginasExecutedlhemnavalAinda não há avaliações

- COMMENT TO FORMAL OFFER P Vs DionesioDocumento2 páginasCOMMENT TO FORMAL OFFER P Vs DionesioJoseph John Madrid AguasAinda não há avaliações

- Release Motor Vehicle Helen PalomoDocumento2 páginasRelease Motor Vehicle Helen PalomoGilianne Kathryn Layco Gantuangco-Cabiling100% (1)

- Bir Ruling No. 508-12: Deguzman Celis & Dionisio Law OfficesDocumento3 páginasBir Ruling No. 508-12: Deguzman Celis & Dionisio Law OfficesThe GiverAinda não há avaliações

- LFW 2Documento35 páginasLFW 2JasOn EvangelistaAinda não há avaliações

- Moa Doj OmbDocumento2 páginasMoa Doj OmbDesai Sarvida100% (1)

- Complaint Affidavit (Final) .April 21, 2015Documento5 páginasComplaint Affidavit (Final) .April 21, 2015Edwin Patricio100% (1)

- Pretrial BriefDocumento4 páginasPretrial BriefLaika CorralAinda não há avaliações

- Heirs of Susana Vs CADocumento12 páginasHeirs of Susana Vs CAQuennie Jane SaplagioAinda não há avaliações

- Jurisprudence Habitual AbsenteeismDocumento12 páginasJurisprudence Habitual AbsenteeismsqbacenaAinda não há avaliações

- Revocation of Special Power of AttorneyDocumento2 páginasRevocation of Special Power of AttorneyJasAinda não há avaliações

- Joint Affidavit of Two Disinterested PersonsDocumento2 páginasJoint Affidavit of Two Disinterested PersonsRodjard Pacete100% (1)

- Updated Rem 1 Cases Set 3Documento722 páginasUpdated Rem 1 Cases Set 3Bediones JAAinda não há avaliações

- War crimes and crimes against humanity in the Rome Statute of the International Criminal CourtNo EverandWar crimes and crimes against humanity in the Rome Statute of the International Criminal CourtAinda não há avaliações

- University of Santo Tomas Senior High School Commission On Elections Executive Order No. 03 Series of 2018-2019Documento7 páginasUniversity of Santo Tomas Senior High School Commission On Elections Executive Order No. 03 Series of 2018-2019Isaiah CruzAinda não há avaliações

- Education 200 Advanced Philosophical & Ethical Foundations of Education Activity 1Documento2 páginasEducation 200 Advanced Philosophical & Ethical Foundations of Education Activity 1Isaiah CruzAinda não há avaliações

- Hamito D.CoquillaDocumento13 páginasHamito D.CoquillaIsaiah CruzAinda não há avaliações

- Written Mancon KEVIN CHUADocumento4 páginasWritten Mancon KEVIN CHUAIsaiah CruzAinda não há avaliações

- Mancon Test QuestionsDocumento2 páginasMancon Test QuestionsIsaiah CruzAinda não há avaliações

- Advanced Stored ProceduresDocumento186 páginasAdvanced Stored ProceduresOleksiy Kovyrin100% (4)

- Address To The MoonDocumento3 páginasAddress To The MoonIsaiah CruzAinda não há avaliações

- Income From House PropertyDocumento6 páginasIncome From House PropertyKamini PawarAinda não há avaliações

- 1588756021-1693-Allegis Servicses Final PrintDocumento9 páginas1588756021-1693-Allegis Servicses Final PrintDehradun MootAinda não há avaliações

- Strides Pharma Science - Elara Securities - 7 February 2021Documento7 páginasStrides Pharma Science - Elara Securities - 7 February 2021Ranjan BeheraAinda não há avaliações

- Test Bank Chapter 10 Employee Training andDocumento16 páginasTest Bank Chapter 10 Employee Training andMuhammad Atif SheikhAinda não há avaliações

- HCF & LCMDocumento55 páginasHCF & LCMMohan KhatriAinda não há avaliações

- PGBP Chart 1Documento2 páginasPGBP Chart 1Aashish Kumar Singh100% (1)

- FBDC VS CirDocumento13 páginasFBDC VS CirRene ValentosAinda não há avaliações

- Financial Report (October 2017)Documento2 páginasFinancial Report (October 2017)Marija DukićAinda não há avaliações

- Bruhat Bengaluru Mahanagara Palike - Revenue Department: Xjdœ LXD - /HZ Eud/ Eĺ Lbx¡E (6 E LDocumento1 páginaBruhat Bengaluru Mahanagara Palike - Revenue Department: Xjdœ LXD - /HZ Eud/ Eĺ Lbx¡E (6 E LGovinda RajuAinda não há avaliações

- 365) - The Income Tax Rate Is 40%. Additional Expenses Are Estimated As FollowsDocumento3 páginas365) - The Income Tax Rate Is 40%. Additional Expenses Are Estimated As FollowsMihir HareetAinda não há avaliações

- Fisher Vs TrinidadDocumento9 páginasFisher Vs TrinidadJanMarkMontedeRamosWongAinda não há avaliações

- Worker's Participation in Company's ProfitDocumento6 páginasWorker's Participation in Company's ProfitJahid HasanAinda não há avaliações

- Advanced Analysis and Appraisal of PerformanceDocumento12 páginasAdvanced Analysis and Appraisal of PerformanceGreghvon MatolAinda não há avaliações

- Foreign Exchange Risk: Foreign Exchange Risk (Also Known As Exchange Rate Risk or Currency Risk) Is ADocumento3 páginasForeign Exchange Risk: Foreign Exchange Risk (Also Known As Exchange Rate Risk or Currency Risk) Is ASonali RawatAinda não há avaliações

- Prob Set 1Documento6 páginasProb Set 1Nikki BulanteAinda não há avaliações

- Int. Acc 3 AssignDocumento3 páginasInt. Acc 3 AssignElea MorataAinda não há avaliações

- Chapt 8 Deduct From Gross IncomeDocumento10 páginasChapt 8 Deduct From Gross IncomeKeysi02Ainda não há avaliações

- Corporate PresentationDocumento19 páginasCorporate Presentationdevendra_abcdAinda não há avaliações

- Instructions Bingham 18editionDocumento36 páginasInstructions Bingham 18editionDanielle Baldwin0% (1)

- Beaumont Budget Fy2017Documento271 páginasBeaumont Budget Fy201712NewsNowAinda não há avaliações

- P Company Acquires 80Documento5 páginasP Company Acquires 80hus wodgyAinda não há avaliações

- Final Report of Saqib Manzoor MalhiDocumento86 páginasFinal Report of Saqib Manzoor MalhiHafiz Saqib JavedAinda não há avaliações

- 1396 Quarter 1 Fiscal Bulletin-FinalDocumento46 páginas1396 Quarter 1 Fiscal Bulletin-FinalMacro Fiscal PerformanceAinda não há avaliações

- Mcdonal's Finanical RatiosDocumento11 páginasMcdonal's Finanical RatiosFahad Khan TareenAinda não há avaliações

- Macaulay's Duration An AppreciationDocumento5 páginasMacaulay's Duration An AppreciationanotheralternateAinda não há avaliações