Escolar Documentos

Profissional Documentos

Cultura Documentos

A01150768 Problemascapitulos5y6 Tarea2 3 FinCorpAv

Enviado por

Andrés Emmanuel NuñezDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

A01150768 Problemascapitulos5y6 Tarea2 3 FinCorpAv

Enviado por

Andrés Emmanuel NuñezDireitos autorais:

Formatos disponíveis

MATERIA: FINANZAS CORPORATIVAS AVANZADAS

TITULAR: DR. EDUARDO AUGUSTO OCHOA NEGRETE

TUTOR: LIC. CRISTINA PAOLA MUOZ AGUILA

INTEGRANTES: Andrs Emmanuel Rivera Nuez A01150768

EXERCISE 2.3: CHAPTER 5 AND 6 PRINCIPLE OF CORPORATE FINANCE CHAPTER 5: 2. Write down the equation defining a projects internal rate of return (IRR). In practice how is IRR calculated? To define the IRR equation, we need a Investment, in this case is $1,000, and different cash flows, you could define how many cash flows use, from 1 to 5 of preference, in this case is C1 = 600 and C2 = 500. You calculate this taking the Initial Investment to the Last Cash Flow, and with this amounts of money we obtain an IRR Rate from 7%, this means that the Project is OK because is positive the rate. Cash Flow C0 C1 C2 IRR ($) -1000 600 500 7%

Se est pidiendo la ecuacin y esta se encuentra en la pgina 108 (Cap. 5 del libro de texto) 3. a. Calculate the net present value of the following project for discount rates of 0, 50, and 100%: Cash Flows C0 C1 C2 ($) 6,750 4,500 18,000

Cash Flow ($) Discount Rate C0 -6750 0% 50% C1 4500 $15,750.00 $2,833.33 C2 18000 Recuerda que el flujo del ao cero no se descuenta NPV(0,4500,18000)-6750 = $15,750.00 NPV(50%,4500,18000,)-6750 = $ 4,250.00 NPV(100%,4500,18000)-6750 = 0.00%

100% $0.00

b. What is the IRR of the project? Cash Flow C0 C1 C2 IRR ($) -6750 4500 18000 100%

5. Consider a project with the following cash flows: C0 C1 C2 (-)100 200 75

a. How many internal rates of return does this project have? Two internal rates of return this project has. b. Which of the following numbers is the project IRR: (i) - 50%; (ii) - 12%; (iii) + 5%; (iv) + 50%? These are (i) -50% and (iv) +50%. c. The opportunity cost of capital is 20%. Is this an attractive project? Briefly explain. Yes, this is an attractive project. Check the results. Cash Flow C0 C1 C2 Rate ($) -100 200 -75 20%

NPV $12.15 Recuerda que el flujo del ao cero no se descuenta Igual que en el problema 3 CHAPTER 6:

1. Which of the following should be treated as incremental cash flows when deciding whether to invest in a new manufacturing plant? The site is already owned by the company, but existing buildings would need to be demolished. a. The market value of the site and existing buildings. b. Demolition costs and site clearance. c. The cost of a new access road put in last year. d. Lost earnings on other products due to executive time spent on the new facility. e. A proportion of the cost of leasing the presidents jet airplane. f. Future depreciation of the new plant. g. The reduction in the corporations tax bill resulting from tax depreciation of the new plant. h. The initial investment in inventories of raw materials. i. Money already spent on engineering design of the new plant. 4. How does the PV of depreciation tax shields vary across the recovery-period classes shown in Table 6.4 ? Give a general answer; then check it by calculating the PVs of depreciation tax shields in the five-year and seven-year classes. The tax rate is 35% and the discount rate is 10%. TAX DEPRECIATION SCHEDULES BY PRESENT VALUE RECOVERY PERIOD CLASS Period 5-Year 7-Year 5-Year 7-Year Rate 35% 1 20 14.29 $18.18 12.99 Discount Rate 10% 2 32 24.49 $26.45 20.24 3 19.2 17.49 $14.43 13.14 4 11.52 12.49 $7.87 8.53 5 11.52 8.93 $7.15 5.54 6 5.76 8.92 $3.25 5.04 7 8.93 4.58 8 4.46 2.08 Se est pidiendo una explicacin del efecto en los ahorros fiscales por lo depreciacin cuando se utiliza periodos de recuperacin diferentes (5 y 7 aos)

5. The following table tracks the main components of working capital over the life of a fouryear project. 2010 Accounts receivable Inventory Accounts payable 0 75,000 25,000 2011 150,000 130,000 50,000 2012 225,000 130,000 50,000 2013 190,000 95,000 35,000 2014 0 0 0

Calculate net working capital and the cash inflows and outflows due to investment in working capital.

Concept 2010 2011 2012 2013 2014 Accounts Receivable $$150,000.00 $225,000.00 $190,000.00 $Inventory $75,000.00 $130,000.00 $130,000.00 $95,000.00 $Inflow $75,000.00 $280,000.00 $355,000.00 $285,000.00 $Accounts Payable $25,000.00 $50,000.00 $50,000.00 $35,000.00 $Outflow $25,000.00 $50,000.00 $50,000.00 $35,000.00 $Cash Flow $50,000.00 $230,000.00 $305,000.00 $250,000.00 $2011 Al flujo del 2011 debes restar el flujo del 2010 ($230,000-$50,000)=$180,000 2012 Al flujo del 2012 debes restar el flujo del 2010 y 2011 ($305,000-$50,000-$180,0000)=$75,000 Se contunua de esta forma para el 2013 y 2014 6. When appraising mutually exclusive investments in plant and equipment, financial managers calculate the investments equivalent annual costs and rank the investments on this basis. Why is this necessary? Why not just compare the investments NPVs? Explain briefly55 Sometimes opportunity costs may be very difficult to estimate; however, where the resource can be freely traded, its opportunity cost is simply equal to the market price. Why? It cannot be otherwise. If the value of a parcel of land to the firm is less than its market price, the firm will sell it. On the other hand, the opportunity cost of using land in a particular project cannot exceed the cost of buying an equivalent parcel to replace it Se est pidiendo una explicacin de porqu los administradores determinan en costo anual equivalente cuando se tienen proyectos de inversin mutuamente excluyentes.

Você também pode gostar

- How To Analyze Investment Projects: Instructor's ManualDocumento28 páginasHow To Analyze Investment Projects: Instructor's ManualJim Briggs100% (1)

- Shrieves Casting Company Chapter 12 (11ed-11) Cash Flow Estimation and Risk AnalysisDocumento12 páginasShrieves Casting Company Chapter 12 (11ed-11) Cash Flow Estimation and Risk AnalysisHayat Omer Malik100% (1)

- Module 6 AND 7 AnswerDocumento30 páginasModule 6 AND 7 AnswerSophia DayaoAinda não há avaliações

- Test and Exam Qs Topic 2 - Solutions - v2 PDFDocumento20 páginasTest and Exam Qs Topic 2 - Solutions - v2 PDFCindy YinAinda não há avaliações

- Module No 4 - Capital Gains TaxDocumento9 páginasModule No 4 - Capital Gains TaxLysss EpssssAinda não há avaliações

- Applied Corporate Finance. What is a Company worth?No EverandApplied Corporate Finance. What is a Company worth?Nota: 3 de 5 estrelas3/5 (2)

- Present ValueDocumento8 páginasPresent ValueFarrukhsgAinda não há avaliações

- Sample Questions of Capital BudgetingDocumento17 páginasSample Questions of Capital BudgetingFredy Msamiati100% (1)

- CR Sample L6 Module 2 PDFDocumento4 páginasCR Sample L6 Module 2 PDFDavid JonathanAinda não há avaliações

- Ps 6Documento19 páginasPs 6Da Harlequin GalAinda não há avaliações

- Capital Budgeting Decisions: Key Terms and Concepts To KnowDocumento17 páginasCapital Budgeting Decisions: Key Terms and Concepts To Knownisarg_Ainda não há avaliações

- Year Project A Project B: Total PV NPVDocumento19 páginasYear Project A Project B: Total PV NPVChin EEAinda não há avaliações

- Investment Appraisal AccurateDocumento53 páginasInvestment Appraisal AccurateZachary HaddockAinda não há avaliações

- Fast-Track Tax Reform: Lessons from the MaldivesNo EverandFast-Track Tax Reform: Lessons from the MaldivesAinda não há avaliações

- Assign 4 Jones MDocumento18 páginasAssign 4 Jones Mflatkiller222100% (1)

- Incremental AnalysisDocumento25 páginasIncremental AnalysisAngel MallariAinda não há avaliações

- Capital Budgeting Problems PDFDocumento23 páginasCapital Budgeting Problems PDFJitendra SharmaAinda não há avaliações

- Principles of Finance Work BookDocumento53 páginasPrinciples of Finance Work BookNicole MartinezAinda não há avaliações

- FINAN204-21A - Tutorial 7 Week 10Documento6 páginasFINAN204-21A - Tutorial 7 Week 10Danae YangAinda não há avaliações

- Corporate Finances Problems Solutions Ch.18Documento9 páginasCorporate Finances Problems Solutions Ch.18Egzona FidaAinda não há avaliações

- High-Q Financial Basics. Skills & Knowlwdge for Today's manNo EverandHigh-Q Financial Basics. Skills & Knowlwdge for Today's manAinda não há avaliações

- Sweetheart Loan - Florendo Vs CADocumento2 páginasSweetheart Loan - Florendo Vs CAErmeline TampusAinda não há avaliações

- Collection of Sum of Money - Assignment BDocumento5 páginasCollection of Sum of Money - Assignment BMark ValenciaAinda não há avaliações

- MC AnswerDocumento24 páginasMC AnswerMiss MegzzAinda não há avaliações

- BFF2140 - Practice Questions For Final Exam - With - SolutionsDocumento15 páginasBFF2140 - Practice Questions For Final Exam - With - SolutionsFarah PatelAinda não há avaliações

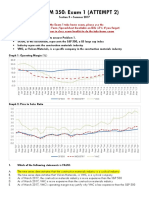

- BUS ADM 350: Exam 1 (ATTEMPT 2)Documento6 páginasBUS ADM 350: Exam 1 (ATTEMPT 2)Maddah HussainAinda não há avaliações

- Answer: $2,400,000Documento7 páginasAnswer: $2,400,000Sony SamAinda não há avaliações

- 2010-10-26 233008 SmayerDocumento6 páginas2010-10-26 233008 Smayernicemann21Ainda não há avaliações

- SolutionDocumento6 páginasSolutionaskdgasAinda não há avaliações

- 9 - Chapter-7-Discounted-Cashflow-Techniques-with-AnswerDocumento15 páginas9 - Chapter-7-Discounted-Cashflow-Techniques-with-AnswerMd SaifulAinda não há avaliações

- Chapter 7 The Analysis of Investment ProjectsDocumento41 páginasChapter 7 The Analysis of Investment ProjectsHùng PhanAinda não há avaliações

- ch6 IM 1EDocumento20 páginasch6 IM 1EJoan MaryAinda não há avaliações

- Corporate Finance Tutorial 4 - SolutionsDocumento22 páginasCorporate Finance Tutorial 4 - Solutionsandy033003Ainda não há avaliações

- Feasibility Assignment 1&2 AnswersDocumento12 páginasFeasibility Assignment 1&2 AnswersSouliman MuhammadAinda não há avaliações

- AU FINC 501 MidTerm Winter 2013hhh SsDocumento16 páginasAU FINC 501 MidTerm Winter 2013hhh SsSomera Abdul QadirAinda não há avaliações

- ch6 IM 1EDocumento20 páginasch6 IM 1Erachel4eva100% (1)

- Chapter 8: Planning Investments - Discounted Cash Flows End of Chapter QuestionsDocumento11 páginasChapter 8: Planning Investments - Discounted Cash Flows End of Chapter QuestionsRavinesh Amit PrasadAinda não há avaliações

- Binder 1Documento105 páginasBinder 1prineetu143Ainda não há avaliações

- CAT T10 - 2010 - Dec - QDocumento10 páginasCAT T10 - 2010 - Dec - QHussain MeskinzadaAinda não há avaliações

- Man Acc 1Documento4 páginasMan Acc 1KathleneGabrielAzasHaoAinda não há avaliações

- Chapter 7: Net Present Value and Capital BudgetingDocumento6 páginasChapter 7: Net Present Value and Capital BudgetingViswanath KapavarapuAinda não há avaliações

- Capital BudgetingDocumento53 páginasCapital BudgetingSaahil LedwaniAinda não há avaliações

- Investment Decision CriteriaDocumento71 páginasInvestment Decision CriteriaBitu GuptaAinda não há avaliações

- Lecture 4-Capital BudgetingDocumento38 páginasLecture 4-Capital BudgetingadmiremukureAinda não há avaliações

- Financial Management Session 11Documento17 páginasFinancial Management Session 11vaidehirajput03Ainda não há avaliações

- Engineering Economy Review III 2010Documento4 páginasEngineering Economy Review III 2010Ma Ella Mae LogronioAinda não há avaliações

- Business Finance II: Exercise 1Documento7 páginasBusiness Finance II: Exercise 1faisalAinda não há avaliações

- MCD2010 - T8 SolutionsDocumento9 páginasMCD2010 - T8 SolutionsJasonAinda não há avaliações

- Chapter 2 Capital Budgeting Principles and Techniques HOMEWORKDocumento6 páginasChapter 2 Capital Budgeting Principles and Techniques HOMEWORKjimmy_chou13140% (1)

- Chuong 6Documento35 páginasChuong 6mummimAinda não há avaliações

- FIN 370 Week 4 Team Assignment Caledonia Products Integrative ProblemDocumento7 páginasFIN 370 Week 4 Team Assignment Caledonia Products Integrative ProblemRambo GantAinda não há avaliações

- Investment DecDocumento29 páginasInvestment DecSajal BasuAinda não há avaliações

- Dani IFM AssignmentDocumento9 páginasDani IFM AssignmentdanielAinda não há avaliações

- SFM FinDocumento159 páginasSFM FinAakashAinda não há avaliações

- Industrial Management and Process Economics Assignment: University of The PunjabDocumento14 páginasIndustrial Management and Process Economics Assignment: University of The PunjabAbubakr KhanAinda não há avaliações

- Situation 1Documento80 páginasSituation 1Junaid RazzaqAinda não há avaliações

- FM10e ch09Documento59 páginasFM10e ch09jawadzaheerAinda não há avaliações

- MBA 504 Ch9 SolutionsDocumento24 páginasMBA 504 Ch9 Solutionspheeyona100% (1)

- Capital Budgeting HandoutsDocumento13 páginasCapital Budgeting HandoutsCoke Aidenry SaludoAinda não há avaliações

- R21 Capital Budgeting Q Bank PDFDocumento10 páginasR21 Capital Budgeting Q Bank PDFZidane KhanAinda não há avaliações

- PAF - Karachi Institute of Economics and Technology Course: Financial Management Faculty: Ali Sajid Class ID: 110217 Total Marks: Examination: Assignment #1 DateDocumento3 páginasPAF - Karachi Institute of Economics and Technology Course: Financial Management Faculty: Ali Sajid Class ID: 110217 Total Marks: Examination: Assignment #1 DateZaka HassanAinda não há avaliações

- CH 12Documento59 páginasCH 12Jean100% (1)

- Remodelers' Cost of Doing Business Study, 2020 EditionNo EverandRemodelers' Cost of Doing Business Study, 2020 EditionAinda não há avaliações

- L5 Financial PlansDocumento55 páginasL5 Financial Plansfairylucas708Ainda não há avaliações

- Decline of Spain SummaryDocumento4 páginasDecline of Spain SummaryNathan RoytersAinda não há avaliações

- Ubte 2013 Entrepreneurship: Universiti Tunku Abdul Rahman (Utar)Documento18 páginasUbte 2013 Entrepreneurship: Universiti Tunku Abdul Rahman (Utar)Jyiou YimushiAinda não há avaliações

- All Sections of Companies Act 2013Documento66 páginasAll Sections of Companies Act 2013RICHA SHARMAAinda não há avaliações

- How To Know Fraud in AdvanceDocumento6 páginasHow To Know Fraud in AdvanceMd AzimAinda não há avaliações

- PT Mega Perintis TBK Dan Entitas AnakDocumento90 páginasPT Mega Perintis TBK Dan Entitas AnakGesti saputra SaputraAinda não há avaliações

- Iyana Melgar Enterprise Chart of Account Assets Liabilities Account Name Account Name Account Code Account CodeDocumento9 páginasIyana Melgar Enterprise Chart of Account Assets Liabilities Account Name Account Name Account Code Account CodeJudy Silvestre BẹnóngAinda não há avaliações

- Inflation and UnemploymentDocumento55 páginasInflation and UnemploymentShubham AgarwalAinda não há avaliações

- 7e - Chapter 10Documento39 páginas7e - Chapter 10WaltherAinda não há avaliações

- Cgtmse MDocumento82 páginasCgtmse MAnonymous EtnhrRvz0% (1)

- F&A Best - SAPOSTDocumento23 páginasF&A Best - SAPOSTsheikh arif khan100% (2)

- Problems - Share-Based PaymentsDocumento3 páginasProblems - Share-Based PaymentshukaAinda não há avaliações

- Solution For Construction AccountingDocumento2 páginasSolution For Construction AccountingAliah CyrilAinda não há avaliações

- Analysis of ITC Financial StatementDocumento7 páginasAnalysis of ITC Financial StatementPrashant AminAinda não há avaliações

- Company Law SummerisedDocumento15 páginasCompany Law SummerisedOkori PaulAinda não há avaliações

- Advanced CandlestickPatterns 2Documento23 páginasAdvanced CandlestickPatterns 2jcferreiraAinda não há avaliações

- General Purpose Loan - FillableDocumento2 páginasGeneral Purpose Loan - Fillablenemo_nadalAinda não há avaliações

- Q 1Documento4 páginasQ 1sam heisenbergAinda não há avaliações

- Royal Caribbean Cruises Client ReportDocumento36 páginasRoyal Caribbean Cruises Client Reportمرزا احسن بیگAinda não há avaliações

- Procedures For Filing of ESTATE TAXDocumento2 páginasProcedures For Filing of ESTATE TAXJennylyn Biltz AlbanoAinda não há avaliações

- Business Studies Paper 1 June 2011 PDFDocumento5 páginasBusiness Studies Paper 1 June 2011 PDFPanashe MusengiAinda não há avaliações

- Summative Test in Math (Part Ii) Quarter 1Documento1 páginaSummative Test in Math (Part Ii) Quarter 1JAY MIRANDAAinda não há avaliações

- FINA3080 Assignment 1 Q&ADocumento4 páginasFINA3080 Assignment 1 Q&AJason LeungAinda não há avaliações

- Monthly GK Digest June PDFDocumento26 páginasMonthly GK Digest June PDFakshaykumarAinda não há avaliações

- MIDTERMDocumento23 páginasMIDTERMJanine LerumAinda não há avaliações

- Financial EconomicsDocumento19 páginasFinancial Economicsseifeldin374Ainda não há avaliações