Escolar Documentos

Profissional Documentos

Cultura Documentos

BMS and A & F Macro PDF

Enviado por

Chetan KhaleTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

BMS and A & F Macro PDF

Enviado por

Chetan KhaleDireitos autorais:

Formatos disponíveis

(A & F),(BMS)

MACRO/MANAGERIAL ECONOMICS II

Page 1

MACRO ECONOMICS :

Macroeconomics is concerned with the nature, relationships and behaviour of such aggregate quantities and averages as national income, total consumption, savings and investment, total employment, general price level, aggregate expenditure and aggregate supply of goods and services. As macroeconomics deals with aggregate quantities of the economy as a whole, it is also called as aggregative economics. Theories of National Income, consumption, saving and investment, theory of employment, theories of economic growth, business cycles and stabilization policies, theories of money supply and demand and theory of foreign trade broadly constitute the subject matter of macroeconomics. Macroeconomic theories seek to answer questions such as how is the level of National Income of a country determined? What determines the levels of overall economic activities in a country? What determines the level of total employment? How is the general level of price determined? etc. The main justification for macroeconomics lies in the need for generalising the behaviour of and relationships between economic aggregates. To study the system as a whole and to explain the behaviour of aggregate quantities and the relationship between them is extremely difficult. Macroeconomic approach has made it possible. It ignores the details pertaining to the individual economic agents and quantities and compresses the unmanageable economic facts to a manageable size and makes them capable of interpretation. Macroeconomic theories are used in formulating public policies. They provide clarity to the macroeconomic concepts and quantities and bring out the relationship between macro variables of the economy in the form of models or equations. Study of macroeconomics is limited to only aggregates. It cannot be applied to explain the behaviour of individual components of the economic system and the individual quantities. Secondly, it ignores the structural changes in constituent elements of the aggregate. Hence conclusions drawn from the analysis of aggregates may involve error of judgement and may be misleading.

CIRCULAR FLOW OF INCOME

An economy can be defined as an integrated system of production, exchange and consumption. In carrying out these economic activities, people are involved in making transactionsthey buy and sell goods and services. Economic transactions generate two kinds of flows : i) Real flow i.e. the flow of goods and services, and ii) Money flow. Real and Money flows go in opposite direction in a circular fashion. The goods flow consists of (a) factor flow, i.e., flow of factor services, and (b) product flow, i.e., flow of goods and services. In a monetized economy, the flow of factor services generates money flows in the form of factor payments which take the form of income flows. The factor payments and expenditure on consumer goods and services take the form of expenditure flows. Both income and expenditure flow in a circular fashion in opposite direction. The magnitude of these flows determines the size of national income. To present the flows of income and expenditure, the economy is divided into four sectors i.e. household sector, business sector, the firms, government sector and foreign sector. These are combined to make the following three models for the purpose of showing the circular flows.

PROF.AVINASH INGOLE

M.A(ECO), NET , SET

(A & F),(BMS)

MACRO/MANAGERIAL ECONOMICS II

Page 2

i) Two sector model including the household and business sectors; ii) Three sector model including the household, business and government sectors iii) Four sector model including the household, business, government and the foreign sectors. Circular flows of income and expenditure Two sector model without Saving :The two sector model consists of only household and firm sectors representing a private closed economy in which there is no government and no foreign trade. It is therefore unrealistic but provides a starting point to analyze the circular flows.

The households are assumed to possess certain specific features : -

the households are the owners of all factors of production their total income consists of wages, rent, interest and profits they are the consumer of all the consumer goods and services they save a part of their income and supply finance to the firms.

The business firms are assumed to have the following features and functions : -

they own no resources of their own they hire and use the factors of production from the households they produce and sell goods and services to the households they do not save, i.e. there is no corporate saving.

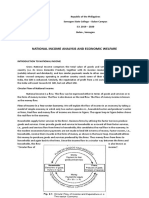

The working of a Two sector economy and the circular flows of incomes and expenditure are illustrated in the following figure.

PROF.AVINASH INGOLE

M.A(ECO), NET , SET

(A & F),(BMS)

MACRO/MANAGERIAL ECONOMICS II

Page 3

There are two sectors i.e. households and firms. They divide the diagram in two parts. The upper half represents the factor market and the lower half represents the commodity market. Both the markets generate two kinds of flows- real and money flows. In the factor market, factors of production flows from households to firms. This makes the real flow shown by a continuous arrow. There is another real flow of factor incomes (wages, interest, rent and profits) which flows from firms to households. In the commodity market (lower half) the goods and services produced by the firms flow from the firms to the households. The payment made by the households for the goods and services creates money flow. By combining the goods and money flows we get a circular flow. In reality, there are leakages from and additions to the circular flows of income and expenditure. They are also called as withdrawals and injections. A withdrawal is the amount that is set aside by the households and firms and is not spent on the domestically produced goods and services over a period of time. On the other hand, an injection is the amount that is spent by households and firms in addition to their incomes generated within the regular economy. The Two sector model with savings :Household do save a part of their income for investment. The financial sector is constituted of a large variety of institutions involved in collecting household savings and passing it on to the business sector. The financial sector includes only banks and financial intermediaries like insurance companies, industrial finance corporations, which accept deposits from the households and invest it in the business sector in the form of loans and advances. It is explained in the following figure. With the inclusion of the financial sector, the households incomes (Y) is divided into two parts : consumption expenditure and savings (S). As shown in the following figure, C and S take different routes to reach the business sector. The consumption expenditure (C) flows directly to the firms, whereas savings (S) are routed through the financial sector as the banks and FIs use the deposits to buy shares and debentures of the firms which is investment (I). In the final analysis the entire money income generated by the firms flows back to the firms which flows back again to the households as factor payments.

PROF.AVINASH INGOLE

M.A(ECO), NET , SET

(A & F),(BMS)

MACRO/MANAGERIAL ECONOMICS II

Page 4

Three sector model :It depicts a more realistic economy. It includes the government which plays an important role in the economy. The economic role of the government has increased tremendously during the post War II period. Here we will include only three fiscal variables to the circular flows, viz. direct taxes, government spending on goods and services and transfer payments. These variables have different kinds of effects on the income and expenditure flows. As seen in the figure below, a part of the household income is claimed by the government in the form of direct taxes. Similarly, a part of the firms income is taxed away in the form of corporate income tax. The firms pass on to the government the indirect taxes also which is collected from the households. The government spends a part of its tax revenue on wages, salaries and transfer payments to the households and a part of it on purchases from the firms and payments of subsidies. Thus, the money that flows from the households and the firms to the government in the form of taxes, flows back to these sectors in the form of government expenditure.

Four sector model : Model with the foreign sector :The Four sector model is formed by adding foreign sector to the three sector model. It consists of two kinds of international transactions : foreign trade i.e. exports and imports of goods and services and inflow and outflow of capital. For simplicity we make following assumptions : -the external sector consists only of exports and imports of goods and services -the export and import of goods and non-labour services are made only by the firms -the households export only labour

PROF.AVINASH INGOLE

M.A(ECO), NET , SET

(A & F),(BMS)

MACRO/MANAGERIAL ECONOMICS II

Page 5

The circular flow is explained in the following figure

The lower part is the circular flows of money in respect of foreign trade. Exports (X) make goods and services flow out of the country and make money (foreign exchange) flow into the country in the form of receipts from export. This is in fact, flow of foreign incomes into the economy. Exports (X) represent injections into the economy. Similarly, imports (M) make inflow of goods and services and flow of money (foreign exchange) out of the country. This is flow of expenditure out of the economy. Imports (M) represent withdrawals from the circular flows. So far as the effect of foreign trade on the magnitude of the overall circular flows is concerned, it depends on the trade balance i.e. X-M. If X > M, it means inflow of foreign income is greater than the outflow of income, or there is a net gain from foreign trade. The net gain increases the magnitude of circular flows of income and expenditure. If X < M it decreases the magnitude of circular flows.

PROF.AVINASH INGOLE

M.A(ECO), NET , SET

(A & F),(BMS)

MACRO/MANAGERIAL ECONOMICS II

Page 6

NATIONAL INCOME :National Income of a country can be defined as the total market value of all final goods and services produced in the economy during a given year. The net output of commodities and services following during year from the countrys productive system in the hands of the ultimate consumers. - SIMON KUZNET National income is that part of objective income of the community, including of course income derived from abroad which can be measured in money. - A.C.PIGOU NATIONAL INCOME = NATIONAL PRODUCT = NATIONAL EXPENDITURE i) It is the sum of value of all final goods and services produced in a year ii) It is the sum of all incomes accruing to factors of production in a year iii) It is the sum of consumers expenditure , net investment expenditure and government expenditure on goods and services.

Concepts of National Income :1. GROSS DOMESTIC PRODUCT(GDP) :Gross domestic product is the money value of all final goods and services produced within the domestic territory of a country during a year

GDP=(P*Q)

where, GDP=Gross Domestic Product P=Price of goods and service Q=Quantity of goods and service denotes the summation of all values. According to expenditure approach, GDP is the sum of consumption, investment, government expenditure, net foreign exports of a country during a year. Algebraic expression under expenditure approach is, GDP=C+I+G+(X-M)

Where,

C=Consumption I=Investment G=Government expenditure (X-M)=Export minus import

GDP includes the following types of final goods and services. They are:

Consumer goods and services. Gross private domestic investment in capital goods. Government expenditure. Exports and imports.

PROF.AVINASH INGOLE

M.A(ECO), NET , SET

(A & F),(BMS)

MACRO/MANAGERIAL ECONOMICS II

Page 7

2. GROSS NATIONAL PRODUCT (GNP) :Its the sum of money value of goods and services produced by a nation during a given year. It is the sum of money worth of consumption , investment , govt. purchases of goods and services and net export. GNP can be expressed as the following equation: GNP=GDP+NFIA (Net Factor Income from Abroad) or GNP=C+I+G+(X-M)+NFIA Hence, GNP includes the following: Consumer goods and services. Gross private domestic investment in capital goods. Government expenditure. Net exports (exports-imports). Net factor income from abroad. 3. NET NATIONAL PRODUCT(NNP) :Net National Product is the market value of all final goods and services after allowing for depreciation. It is also called National Income at market price. When charges for depreciation are deducted from the gross national product, we get it. Thus, NNP=GNP - Depreciation or, NNP=C + I + G + (X - M) + NFIA - Depreciation 4. NET DOMESTIC PRODUCT(NDP) :Net Domestic Product is the market value of all final goods and services after allowing for depreciation. It is also called National Income at market price. When charges for depreciation are deducted from the gross domestic product, we get it. Thus, NDP=GDP - Depreciation So National income as per follows , NI=NNP + Subsidies - Interest Taxes or, NI=GNP - Depreciation + Subsidies - Indirect Taxes or, NI=C + G + I + (X - M) + NFIA - Depreciation - Indirect Taxes + Subsidies

PROF.AVINASH INGOLE

M.A(ECO), NET , SET

(A & F),(BMS)

MACRO/MANAGERIAL ECONOMICS II

Page 8

5. PERSONAL INCOME (PI) :Personal Income i s the total money income received by individuals and households of a country from all possible sources before direct taxes. Therefore, personal income can be expressed as follows: PI=NI - Corporate Income Taxes - Undistributed Corporate Profits - Social Security Contribution + Transfer Payments 6. DISPOSABLE INCOME (DI) :The income left after the payment of direct taxes from personal income is called Disposable Income. Disposable income means actual income which can be spent on consumption by individuals and families. Thus, it can be expressed as: DI=PI-Direct Taxes From consumption approach, DI=Consumption Expenditure + Savings 7. PER CAPITA INCOME (PCI) :Per Capita Income of a country is derived by dividing the national income of the country by the total population of a country. Thus, PCI=Total National Income/Total National Population

PROF.AVINASH INGOLE

M.A(ECO), NET , SET

Você também pode gostar

- Chapter 2 National IncomeDocumento29 páginasChapter 2 National Incomeliyayudi0% (1)

- Circular Flow of IncomeDocumento32 páginasCircular Flow of IncomeTarun SukhijaAinda não há avaliações

- Circular Flow of IncomeDocumento10 páginasCircular Flow of Incomekaliprasad820% (1)

- Circular Flow ModelDocumento12 páginasCircular Flow ModelpodderAinda não há avaliações

- Introduction to Microeconomics and Macroeconomics ConceptsDocumento172 páginasIntroduction to Microeconomics and Macroeconomics ConceptsYash KaleAinda não há avaliações

- Chapter2 DwivediDocumento14 páginasChapter2 Dwivediindrapal kumarAinda não há avaliações

- Circular Flow of Economic Activity - EconTipsDocumento5 páginasCircular Flow of Economic Activity - EconTipsAyush KumarAinda não há avaliações

- Circular Flow Model ExplainedDocumento3 páginasCircular Flow Model ExplainedKarthik Murugesan100% (1)

- Circular Flow of EconomicsDocumento7 páginasCircular Flow of EconomicsAmandeep sainiAinda não há avaliações

- Circular Flow of IncomeDocumento193 páginasCircular Flow of Incomeallah dittaAinda não há avaliações

- Mb1102 Me - U IV - Dr.r.arunDocumento24 páginasMb1102 Me - U IV - Dr.r.arunDr. R. ArunAinda não há avaliações

- Macroeconomic Analysis of National Income and AccountsDocumento233 páginasMacroeconomic Analysis of National Income and AccountsKOPSIS CIPMANDAinda não há avaliações

- Revised Supplementary Material Semester 2 2013Documento98 páginasRevised Supplementary Material Semester 2 2013HeoHamHốAinda não há avaliações

- Circular Flow of Income - GeeksforGeeksDocumento7 páginasCircular Flow of Income - GeeksforGeeksAyush KumarAinda não há avaliações

- Circular Flow of IncomeDocumento9 páginasCircular Flow of IncomeSaad JelaniAinda não há avaliações

- Macro EconDocumento128 páginasMacro EconDawne BrownAinda não há avaliações

- Assignment No. 2Documento2 páginasAssignment No. 2Mary Antonette LastimosaAinda não há avaliações

- Macro Economics AssignmentDocumento20 páginasMacro Economics AssignmentSWAPNIL GUPTAAinda não há avaliações

- Eco CfoiDocumento5 páginasEco CfoiAMNA MOAZZAMAinda não há avaliações

- Macro Environ-Circular Flow of IncomeDocumento33 páginasMacro Environ-Circular Flow of Incomeamankamat2002Ainda não há avaliações

- Republic of The PhilippinesDocumento9 páginasRepublic of The PhilippinesRay PopAinda não há avaliações

- The Circular Flow of Economic ActivityDocumento8 páginasThe Circular Flow of Economic ActivityShrahi Singh KaranwalAinda não há avaliações

- Internals 1Documento16 páginasInternals 1Pavan H.P.Ainda não há avaliações

- Circular Flow of Economic ActivityDocumento8 páginasCircular Flow of Economic ActivityUma BalasubramanianAinda não há avaliações

- Income WelfareDocumento14 páginasIncome WelfareAie GeraldinoAinda não há avaliações

- Tutorial Cc3 Circular Flow-1Documento14 páginasTutorial Cc3 Circular Flow-1sommelierAinda não há avaliações

- Macro EconomicsDocumento5 páginasMacro EconomicsAnurag AwasthiAinda não há avaliações

- MBA I Unit V Managerial EconomicsDocumento11 páginasMBA I Unit V Managerial EconomicsSumitAinda não há avaliações

- Lesson - 19 National: Income - 1 Circular Flow and Measurement of National IncomeDocumento8 páginasLesson - 19 National: Income - 1 Circular Flow and Measurement of National IncomepraneixAinda não há avaliações

- National Income Concept and MeasurementDocumento49 páginasNational Income Concept and MeasurementDipen DhakalAinda não há avaliações

- Chapter 8: Introduction To Macroeconomics 1. IntroductionDocumento12 páginasChapter 8: Introduction To Macroeconomics 1. IntroductionAishwaryaAinda não há avaliações

- 1 MeDocumento17 páginas1 MeRavi ShankarAinda não há avaliações

- Macroeconomics (ECO 101) : National Economy and National Income AnalysisDocumento23 páginasMacroeconomics (ECO 101) : National Economy and National Income AnalysisERICK MLINGWAAinda não há avaliações

- Introduction To The Circular Flow of Economic Activity:: HouseholdsDocumento6 páginasIntroduction To The Circular Flow of Economic Activity:: HouseholdsAmanda SantosAinda não há avaliações

- Circular FlowDocumento12 páginasCircular Flownamratagm1234Ainda não há avaliações

- 2 Circular FlowDocumento28 páginas2 Circular Flownainypassi100% (1)

- Unit 7A National Product and Its Measurement BitinfonepalDocumento57 páginasUnit 7A National Product and Its Measurement BitinfonepalYogendra KshetriAinda não há avaliações

- BMGT 26 Chapter 1 ReviewerDocumento11 páginasBMGT 26 Chapter 1 ReviewerJohn Louie SierraAinda não há avaliações

- Macro EconomicsDocumento7 páginasMacro EconomicsShivam GoelAinda não há avaliações

- Circular Flow of Economic ActivityDocumento7 páginasCircular Flow of Economic ActivityanonymAinda não há avaliações

- Economic Assignment FaizanDocumento6 páginasEconomic Assignment Faizanawais tariqAinda não há avaliações

- CFI IN 3 SECTORDocumento4 páginasCFI IN 3 SECTORtalk2pragatikaAinda não há avaliações

- National Income Definitions and ConceptsDocumento11 páginasNational Income Definitions and ConceptsAmmar AleeAinda não há avaliações

- Module 1 - Cirular Flow of IncomeDocumento18 páginasModule 1 - Cirular Flow of IncomePrashastiAinda não há avaliações

- Module 2 National Income AccountingDocumento12 páginasModule 2 National Income Accountingexequielmperez40Ainda não há avaliações

- Macroeconomics & Economic StatisticsDocumento56 páginasMacroeconomics & Economic Statisticsamankamat2002Ainda não há avaliações

- Chapter Two-Four Sector EconomyDocumento27 páginasChapter Two-Four Sector Economynotes.mcpu0% (1)

- What Is Macroeconomics?Documento16 páginasWhat Is Macroeconomics?THERESA SUBRADOAinda não há avaliações

- The Model of Circular Flow of Income: Perspective in Bangladesh.Documento22 páginasThe Model of Circular Flow of Income: Perspective in Bangladesh.Imran HossainAinda não há avaliações

- Eco1a Module4 PDFDocumento31 páginasEco1a Module4 PDFMel James Quigtar FernandezAinda não há avaliações

- 3 1 The Level of Economic ActivityDocumento75 páginas3 1 The Level of Economic ActivityMohammad Farhan NewazAinda não há avaliações

- 3 Circular Flow of Economic ActiDocumento4 páginas3 Circular Flow of Economic ActiCHINMAY AGRAWALAinda não há avaliações

- Macro Chap - 2Documento15 páginasMacro Chap - 2NamaamAinda não há avaliações

- Basic Microeconomics Module 2Documento10 páginasBasic Microeconomics Module 2jessamaepinas5Ainda não há avaliações

- CIRCULAR FLOW OF INCOME & EQUILIBRIUMDocumento2 páginasCIRCULAR FLOW OF INCOME & EQUILIBRIUMmushfeqaAinda não há avaliações

- Circular Flow of Income in MacroeconomicsDocumento11 páginasCircular Flow of Income in MacroeconomicsbadarAinda não há avaliações

- Summary Of "The Economic Aggregates" By Jorge Souto: UNIVERSITY SUMMARIESNo EverandSummary Of "The Economic Aggregates" By Jorge Souto: UNIVERSITY SUMMARIESAinda não há avaliações

- Business Economics: Business Strategy & Competitive AdvantageNo EverandBusiness Economics: Business Strategy & Competitive AdvantageAinda não há avaliações

- Summary Of "The Economic System" By Armando Fastman: UNIVERSITY SUMMARIESNo EverandSummary Of "The Economic System" By Armando Fastman: UNIVERSITY SUMMARIESAinda não há avaliações

- Keyboard Shortcuts For WindowsDocumento3 páginasKeyboard Shortcuts For WindowsChetan KhaleAinda não há avaliações

- A PDFDocumento1 páginaA PDFChetan KhaleAinda não há avaliações

- Actual CaseDocumento7 páginasActual CaseChetan KhaleAinda não há avaliações

- Sample Marketing Requirements Document (MRD) : AbstractDocumento11 páginasSample Marketing Requirements Document (MRD) : AbstractChetan KhaleAinda não há avaliações

- Firing Problem at "Tata Nano"Documento4 páginasFiring Problem at "Tata Nano"Chetan KhaleAinda não há avaliações

- BMS and A & F MacroDocumento8 páginasBMS and A & F MacroChetan KhaleAinda não há avaliações

- Hospitality IndustryDocumento14 páginasHospitality IndustryChetan KhaleAinda não há avaliações

- Mac OS X 10.6 Snow Leopard VPATDocumento11 páginasMac OS X 10.6 Snow Leopard VPATBibliothecamAinda não há avaliações

- Samsung Profile 2011: Amounts in Billions WON Dollars EurosDocumento2 páginasSamsung Profile 2011: Amounts in Billions WON Dollars EurosChetan KhaleAinda não há avaliações

- Swot 2Documento1 páginaSwot 2Chetan KhaleAinda não há avaliações

- Management TeamDocumento5 páginasManagement TeamChetan KhaleAinda não há avaliações

- Ug144 PDFDocumento64 páginasUg144 PDFChetan KhaleAinda não há avaliações

- Trade Union in India ExplainedDocumento17 páginasTrade Union in India ExplainedChetan KhaleAinda não há avaliações

- Vision 2020Documento1 páginaVision 2020Chetan KhaleAinda não há avaliações

- Samsung OverviewDocumento18 páginasSamsung OverviewChetan Khale100% (1)

- Business CycleDocumento10 páginasBusiness CycleChetan KhaleAinda não há avaliações

- Service Sector Management Theory WwwmanagementsourceblogspotcomDocumento47 páginasService Sector Management Theory WwwmanagementsourceblogspotcomNitin KashivaleAinda não há avaliações

- b4bf8IBM Case Demand ManagementDocumento12 páginasb4bf8IBM Case Demand Managementmayank_87Ainda não há avaliações

- Sample Marketing Requirements Document (MRD) : AbstractDocumento11 páginasSample Marketing Requirements Document (MRD) : AbstractChetan KhaleAinda não há avaliações