Escolar Documentos

Profissional Documentos

Cultura Documentos

Soalan Assignment 3

Enviado por

Nodiey YanaTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Soalan Assignment 3

Enviado por

Nodiey YanaDireitos autorais:

Formatos disponíveis

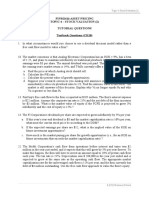

Topic 4: Analyzing Investing Activities 1. a. b. c. 2. What is meant by the factoring of receivables?

What does selling receivables with recourse mean? What does it mean to sell them without recourse? How does selling receivables (particularly with recourse) potentially distort the balance sheet?

Cost for inventory purposes should be determined by the inventory cost flow method best reflecting periodic income. a. Discuss the inventory cost flow assumptions of (1) average cost, (2) FIFO and (3) LIFO. b. Discuss managements usual reasons for using LIFO in an inflationary economy. c. When this evidence the value of inventory, through its disposal in the ordinary course of business, is less than cost, what is the accounting treatment? What concept justifies this treatment? BigBook. Com uses LIFO inventory accounting. Notes to BigBook.Coms Year 9 financial statement disclose the following (it has a marginal tax rate of 35%). Inventories Raw material Finished goods (-) LIFO reserve a. b. c. Year 8(RM) 392,675 401,342 794,017 (46,000) 748,017 Year 9(RM) 369,725 377,104 746,829 (50,000) 696,829

3.

Determined the amount by which Year 9 retained earnings of BigBook.Com changes if FIFO is used. Determine the amount by which Year 9 net income of BigBook.Com changes is FIFO is used for both year 8 and Year 9. Discuss the usefulness of LIFO to FIFO restatements in an analysis of BigBook.Com.

4.

Shasiba Biz, a profitable company, built and equipped a RM2,000,000 plant brought into operation early in Year 1. Earnings of the company (before the depreciation on the new plant and before income taxes) is projected at RM1,500,000 in Year 1; RM2,000,000 in Year 2: RM2,500,000 in Year 3; RM3,000,000 in Year 4 and RM3,500,000 in Year 5. The company can use straight line, double declining balance or sum of years digit depreciation for the new plant. Assume the plants useful life is 10 years with no salvage value and an income tax rate of 50%.

Required: Compute the separate effect that each of these three methods of depreciation would have on: a. Depreciation b. Income taxes c. Net Income d. Cash flow (assumed equal to net income before depreciation) 5. Following is the information regarding property, plant and equipment for BZ Co. Land Buildings Machinery & equipment Accumulated depreciation Year 3 (RM000) 56.3 758.7 1,779.3 1,131.5 Year 2 (RM000) 63.8 746.5 1,657.6 1,017.2

Depreciation expenses for Year 3 were RM194.5; RM184.1 in Year 2 and RM175.9 in Year 1. Required: i. Compute the following analytical measures applied for BZ Co. for both Year 3 and Year 2. a. Average total life span of plant and equipment. b. Average age of plant and equipment c. Average remaining life of plant and equipment. Discuss the important of these ratios for analysis of BZ Co.

ii.

Você também pode gostar

- FSA - Tutorial 5 Analyzing Investing Activities Part 2Documento2 páginasFSA - Tutorial 5 Analyzing Investing Activities Part 2KHOO TAT SHERN DEXTONAinda não há avaliações

- Tutorial 2Documento5 páginasTutorial 2Hirushika BandaraAinda não há avaliações

- Managerial Finance: Professional 1 Examination - April 2019Documento21 páginasManagerial Finance: Professional 1 Examination - April 2019MahediAinda não há avaliações

- FM Assignment 2Documento3 páginasFM Assignment 2Vundi RohitAinda não há avaliações

- Tutorial 4 QuestionsDocumento4 páginasTutorial 4 Questionsguan junyan0% (1)

- Siddharth Education Services LTD: Tel:2443455 TelDocumento3 páginasSiddharth Education Services LTD: Tel:2443455 TelBasanta K SahuAinda não há avaliações

- Accounting For Managers Sample PaperDocumento10 páginasAccounting For Managers Sample Paperghogharivipul0% (1)

- Degree Program: BSAF (6) Course: Financial Statements Analysis Total Marks: 30 Midterm Examination Time: 30m Instructions For The ExamDocumento2 páginasDegree Program: BSAF (6) Course: Financial Statements Analysis Total Marks: 30 Midterm Examination Time: 30m Instructions For The ExamUsman BalochAinda não há avaliações

- Tutorial Questions FMF June 2022 Tutorial 3 B - 6Documento12 páginasTutorial Questions FMF June 2022 Tutorial 3 B - 6Clarinda LeeAinda não há avaliações

- B1 Free Solving Nov 2019) - Set 3Documento5 páginasB1 Free Solving Nov 2019) - Set 3paul sagudaAinda não há avaliações

- MBA Ii Semester Financial Management: Section-ADocumento3 páginasMBA Ii Semester Financial Management: Section-AVundi RohitAinda não há avaliações

- b1 Solving Set 2 May 2018 - OnlineDocumento4 páginasb1 Solving Set 2 May 2018 - OnlineGadafi FuadAinda não há avaliações

- Assignment - Doc 301 Advanced Financial Accounting II - 24042016112440Documento4 páginasAssignment - Doc 301 Advanced Financial Accounting II - 24042016112440waresh36Ainda não há avaliações

- Financial Management: Thursday 9 June 2011Documento9 páginasFinancial Management: Thursday 9 June 2011catcat1122Ainda não há avaliações

- Quiz 6 ProblemsDocumento7 páginasQuiz 6 ProblemsElizabethAinda não há avaliações

- Financial Management and Control: Time Allowed 3 HoursDocumento9 páginasFinancial Management and Control: Time Allowed 3 HoursnsarahnAinda não há avaliações

- ACCA P2 Complex Group AccountingDocumento5 páginasACCA P2 Complex Group AccountingJames XueAinda não há avaliações

- Group II - June 2010 Cost and Management Accounting: The Figures in The Margin On The Right Side Indicate Full MarksDocumento23 páginasGroup II - June 2010 Cost and Management Accounting: The Figures in The Margin On The Right Side Indicate Full MarksMahesh BabuAinda não há avaliações

- Management Accounting: Formation 2 Examination - August 2007Documento19 páginasManagement Accounting: Formation 2 Examination - August 2007Chansa KapambweAinda não há avaliações

- # 2 Assignment On Financial and Managerial Accounting For MBA StudentsDocumento7 páginas# 2 Assignment On Financial and Managerial Accounting For MBA Studentsobsa alemayehuAinda não há avaliações

- Mid-Term Exam: Professor: Kevin Petit-Frère Duration: 180 MinutesDocumento7 páginasMid-Term Exam: Professor: Kevin Petit-Frère Duration: 180 MinutesAbby Hacther0% (2)

- Financial Management-P III - Nov 08Documento4 páginasFinancial Management-P III - Nov 08gundapolaAinda não há avaliações

- Financial Management 201Documento4 páginasFinancial Management 201Avijit DindaAinda não há avaliações

- Activity - Capital Investment AnalysisDocumento5 páginasActivity - Capital Investment AnalysisKATHRYN CLAUDETTE RESENTEAinda não há avaliações

- Institute of Actuaries of India: ExaminationsDocumento8 páginasInstitute of Actuaries of India: ExaminationsVijaya AgrawalAinda não há avaliações

- Financial ManagementDocumento9 páginasFinancial ManagementRajyalakshmi MAinda não há avaliações

- NSE Financial Modeling Sample Exam Paper1Documento10 páginasNSE Financial Modeling Sample Exam Paper1mkg75080% (5)

- 7891FinalGr1paper2ManagementAccountingandFinancilAnalys PDFDocumento32 páginas7891FinalGr1paper2ManagementAccountingandFinancilAnalys PDFPrasanna SharmaAinda não há avaliações

- Bangladesh Open University: BBA Program Semester: 192 (8 Level-AIS & Finance)Documento11 páginasBangladesh Open University: BBA Program Semester: 192 (8 Level-AIS & Finance)monir mahmudAinda não há avaliações

- Importanat Questions - Doc (FM)Documento5 páginasImportanat Questions - Doc (FM)Ishika Singh ChAinda não há avaliações

- MEFA Important Questions JWFILESDocumento14 páginasMEFA Important Questions JWFILESEshwar TejaAinda não há avaliações

- MBG-206 2019-20Documento4 páginasMBG-206 2019-20senthil.jpin8830Ainda não há avaliações

- Famba6e Quiz Mod06 032014Documento7 páginasFamba6e Quiz Mod06 032014aparna jethaniAinda não há avaliações

- Question PaperDocumento3 páginasQuestion PaperAmbrishAinda não há avaliações

- 2-4 2003 Jun QDocumento9 páginas2-4 2003 Jun QAjay TakiarAinda não há avaliações

- Managerial Acc QnaireDocumento5 páginasManagerial Acc QnaireMutai JoseahAinda não há avaliações

- 2-4 2005 Jun QDocumento10 páginas2-4 2005 Jun QAjay TakiarAinda não há avaliações

- FM202 - Exam Q - 2011-2 - Financial Accounting 202 V3 - AM NV DRdocDocumento6 páginasFM202 - Exam Q - 2011-2 - Financial Accounting 202 V3 - AM NV DRdocMaxine IgnatiukAinda não há avaliações

- Mefa Question BankDocumento6 páginasMefa Question BankShaik ZubayrAinda não há avaliações

- Advanced Accounting Unit 2Documento15 páginasAdvanced Accounting Unit 2yasinAinda não há avaliações

- HW3MGT517Documento3 páginasHW3MGT517Jaya PaudwalAinda não há avaliações

- MS-4 Dec 2007Documento4 páginasMS-4 Dec 2007Saket DubeyAinda não há avaliações

- 01 s303 CmapaDocumento3 páginas01 s303 Cmapaimranelahi3430Ainda não há avaliações

- FM Unit-2 QPDocumento3 páginasFM Unit-2 QPbaskarumaAinda não há avaliações

- Final Auditing Question Paper - May - 2008Documento5 páginasFinal Auditing Question Paper - May - 2008Khristine CaserialAinda não há avaliações

- Accounting For ManagersDocumento6 páginasAccounting For ManagerskartikbhaiAinda não há avaliações

- Sem IV (Internal 2010)Documento15 páginasSem IV (Internal 2010)anandpatel2991Ainda não há avaliações

- Acct1511 2013s2c2 Handout 2 PDFDocumento19 páginasAcct1511 2013s2c2 Handout 2 PDFcelopurpleAinda não há avaliações

- Business Analysis: (B) What Is An Operating Turnaround Strategy ? 4Documento4 páginasBusiness Analysis: (B) What Is An Operating Turnaround Strategy ? 4Davies MumbaAinda não há avaliações

- Indian Institute of Technology Kharagpur: (Treat Multiplier As The Reciprocal of Marginal Demand Propensities)Documento2 páginasIndian Institute of Technology Kharagpur: (Treat Multiplier As The Reciprocal of Marginal Demand Propensities)maimslapAinda não há avaliações

- Rayco Suggested SolutionsDocumento5 páginasRayco Suggested Solutions9ry5gsghybAinda não há avaliações

- Steps: Answers To Week 3 Seminar ActivityDocumento10 páginasSteps: Answers To Week 3 Seminar ActivityZubair Afzal KhanAinda não há avaliações

- Financial SimplyDocumento2 páginasFinancial SimplyAj sathesAinda não há avaliações

- MB0045 FinancialDocumento2 páginasMB0045 FinancialAj sathesAinda não há avaliações

- Beyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkNo EverandBeyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkAinda não há avaliações

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosAinda não há avaliações

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosAinda não há avaliações

- Guide to Strategic Management Accounting for ManagerrsNo EverandGuide to Strategic Management Accounting for ManagerrsAinda não há avaliações

- Guide to Strategic Management Accounting for Managers: What is management accounting that can be used as an immediate force by connecting the management team and the operation field?No EverandGuide to Strategic Management Accounting for Managers: What is management accounting that can be used as an immediate force by connecting the management team and the operation field?Ainda não há avaliações

- Self Efficacy Anxiety and Performance in The English Language Among Middle School Students in English Language Program in Satri Si Suriyothai School BangkokDocumento6 páginasSelf Efficacy Anxiety and Performance in The English Language Among Middle School Students in English Language Program in Satri Si Suriyothai School BangkokNodiey YanaAinda não há avaliações

- Soalan Assignment 1Documento1 páginaSoalan Assignment 1Nodiey YanaAinda não há avaliações

- Article 1-Bpmn 6073 Research Methodology-Individual SummaryDocumento8 páginasArticle 1-Bpmn 6073 Research Methodology-Individual SummaryNodiey YanaAinda não há avaliações

- Baron Service Station (BSS) Cost-Volume-Point AnalysisDocumento6 páginasBaron Service Station (BSS) Cost-Volume-Point AnalysisNodiey YanaAinda não há avaliações

- Lec Slide of Prof. DR Zakaria Abas UUMDocumento185 páginasLec Slide of Prof. DR Zakaria Abas UUMNodiey YanaAinda não há avaliações

- Soalan Assignment 1Documento1 páginaSoalan Assignment 1Nodiey YanaAinda não há avaliações

- Whaler CasesDocumento8 páginasWhaler CasesNodiey Yana100% (1)

- Value ChainDocumento31 páginasValue ChainNodiey YanaAinda não há avaliações

- Toyota in Crisis: Denial and MismanagementDocumento1 páginaToyota in Crisis: Denial and MismanagementNodiey YanaAinda não há avaliações

- The Balanced ScorecardDocumento3 páginasThe Balanced ScorecardNodiey YanaAinda não há avaliações

- Blue Ocean Strategy Versus Competitive StrategyDocumento1 páginaBlue Ocean Strategy Versus Competitive StrategyNodiey YanaAinda não há avaliações

- Air Wars in AsiaDocumento2 páginasAir Wars in AsiaNodiey YanaAinda não há avaliações

- Outcome:: When We Have A Sense of Community and Focus, We Create Trust and Can Help Each Other To Achieve Our GoalsDocumento3 páginasOutcome:: When We Have A Sense of Community and Focus, We Create Trust and Can Help Each Other To Achieve Our GoalsNodiey Yana100% (1)

- Whaler CasesDocumento8 páginasWhaler CasesNodiey Yana100% (1)

- Ifm Gretz Tool CompanyDocumento9 páginasIfm Gretz Tool CompanyNodiey YanaAinda não há avaliações

- External Environmental AnalysisDocumento5 páginasExternal Environmental AnalysisNodiey YanaAinda não há avaliações

- External Environmental AnalysisDocumento5 páginasExternal Environmental AnalysisNodiey YanaAinda não há avaliações

- ResepiDocumento6 páginasResepiNodiey YanaAinda não há avaliações

- SukatanDocumento1 páginaSukatanNodiey YanaAinda não há avaliações

- WQA 45 Audit Plan - PT. Nusantara Medika Utama - 9K - IA Stage-2Documento1 páginaWQA 45 Audit Plan - PT. Nusantara Medika Utama - 9K - IA Stage-2OPERASIONALAinda não há avaliações

- 3rd & 4th Party LogisticsDocumento33 páginas3rd & 4th Party LogisticsSharmishtha ChatterjeeAinda não há avaliações

- Problem Set 2Documento2 páginasProblem Set 2nskabra0% (1)

- PAWIM-F-004 Risk Registry Template R10 V2Documento3 páginasPAWIM-F-004 Risk Registry Template R10 V2Joynilenge LavadorAinda não há avaliações

- SAP SRM TrainingDocumento5 páginasSAP SRM Trainingitprofessionalsnetwo0% (1)

- SAP Provides A Separate Solution To Improve The Business of Automotive IndustryDocumento1 páginaSAP Provides A Separate Solution To Improve The Business of Automotive Industryjay_kay70Ainda não há avaliações

- Software Project Management Cmmi: M.RameshDocumento23 páginasSoftware Project Management Cmmi: M.RameshRanjan MishraAinda não há avaliações

- Information Security PolicyDocumento16 páginasInformation Security PolicyKrishna BasetaAinda não há avaliações

- TQM Lecture # 4Documento27 páginasTQM Lecture # 4Dr. Mushtaq AhmedAinda não há avaliações

- ZDHC MRSL Industry Standard Implementation ApproachDocumento9 páginasZDHC MRSL Industry Standard Implementation Approachrahmanshanto623Ainda não há avaliações

- 5fdbb98b29d37cc26751e750 - Ecommerce Business Plan Example - BlueCartDocumento10 páginas5fdbb98b29d37cc26751e750 - Ecommerce Business Plan Example - BlueCartella diazAinda não há avaliações

- Lesson 2.5 - Self-InspectionDocumento3 páginasLesson 2.5 - Self-InspectionMark Harold GonzalesAinda não há avaliações

- Enterprise Content Management StrategyDocumento35 páginasEnterprise Content Management StrategySmitasamrat100% (1)

- 2021.09.20 IGB Case Study 6 - DRW TechnologiesDocumento3 páginas2021.09.20 IGB Case Study 6 - DRW TechnologiesSamar Singh100% (1)

- Chapter 6 - Inventory Control ModelsDocumento40 páginasChapter 6 - Inventory Control ModelsAbo FawazAinda não há avaliações

- Porter's Five Forces Analysis of Tata Tea Ltd.Documento8 páginasPorter's Five Forces Analysis of Tata Tea Ltd.AMAZING FACTSAinda não há avaliações

- 03 Narkhede Challenges of Human Resource Management in Borderless WorldDocumento14 páginas03 Narkhede Challenges of Human Resource Management in Borderless WorldJANET GTAinda não há avaliações

- Inventory Management Just in Time and Costing Methods Multiple Choice Questions - Accounting Quiz Answers 5 PDFDocumento4 páginasInventory Management Just in Time and Costing Methods Multiple Choice Questions - Accounting Quiz Answers 5 PDFSumedha SawniAinda não há avaliações

- Scop of HRMDocumento21 páginasScop of HRMRoshan TiwariAinda não há avaliações

- Vodafone Voip Project AntDocumento17 páginasVodafone Voip Project AntRustam KshettryAinda não há avaliações

- Additional Questions For Maverick CaseDocumento3 páginasAdditional Questions For Maverick Casefranz_karununganAinda não há avaliações

- Skill Matrix DocumentDocumento3 páginasSkill Matrix Documentjagansd3Ainda não há avaliações

- Group 1 BSA 2Y1-2: Operations ManagementDocumento45 páginasGroup 1 BSA 2Y1-2: Operations ManagementAi Eleanor ScarlettAinda não há avaliações

- FRTPDocumento73 páginasFRTPMark AnthonyAinda não há avaliações

- Chapter 11Documento52 páginasChapter 11? cr.Ainda não há avaliações

- Developing An Incentive Scheme For A ProjectDocumento14 páginasDeveloping An Incentive Scheme For A ProjectMansoor KhanaliAinda não há avaliações

- Economic Order Quantity (EOQ) : Cost Management - MFM - Semester IDocumento24 páginasEconomic Order Quantity (EOQ) : Cost Management - MFM - Semester Imongar100% (3)

- Tom Gable - PR Client Service Manual 4th EditionDocumento224 páginasTom Gable - PR Client Service Manual 4th EditionGeorgiana Lupică100% (1)

- Chief Human Resources Officer Program BrochureDocumento16 páginasChief Human Resources Officer Program BrochureNikshep DAinda não há avaliações

- Opti HR SolutionsDocumento16 páginasOpti HR SolutionsCyril ScariaAinda não há avaliações