Escolar Documentos

Profissional Documentos

Cultura Documentos

Banking and Financial Awareness - September 2013 PDF

Enviado por

Priya AnandTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Banking and Financial Awareness - September 2013 PDF

Enviado por

Priya AnandDireitos autorais:

Formatos disponíveis

Banking and Financial Awareness

September 2013

Powered by

www.Gr8AmbitionZ.com

your A to Z competitive exam guide

Banking and Financial Awareness of September 2013 Gr8AmbitionZ.com

National Urban Livelihoods Mission (NULM) with an allocation of approximately Rs. 6,405 crore. The Mission of

NULM is to reduce poverty and vulnerability of the urban poor households by enabling them to access gainful self-employment and skilled wage employment opportunities, resulting in an appreciable improvement in their livelihoods on a sustainable basis, through building strong grassroots level institutions of the poor. The mission

would also aim at providing shelter equipped with essential services to the urban homeless in a phased manner. In addition, the Mission would also address livelihood concerns of the urban street vendors also by facilitating access to suitable spaces, institutional credit, social security and skills to the urban street vendors for accessing emerging market opportunities. NULM will rest on the foundation of community mobilization and women empowerment. Under the Mission, City Livelihood Centres (CLCs) will be established in Mission cities to provide a platform whereby the urban poor can market their services and access information on self-employment, skill training and other benefits. NULM will target the urban poor who are occupationally vulnerable for Employment through Skills Training & Placement (EST&P). Through the Self-Employment Programme (SEP), NULM will provide financial assistance to individuals and groups of urban poor to set up gainful self-employment / microenterprise ventures. A mission mode approach in the form of the National Urban Livelihoods Mission (NULM) is considered necessary to organize urban poor in Self Help Groups, creating opportunities for skill development leading to market-based employment and helping them to set up self-employment ventures by ensuring easy

National Urban Livelihoods Mission (NULM) represents a strategic shift in the Governments commitment to urban poverty alleviation. The NULM will be implemented in two phases: Phase I (2013-2017) and Phase II (2017-2022). In Phase I, NULM will target all cities with a population of one lakh or more and district headquarter towns with a population of less than one lakh as per Census of India 2011. However, other towns

Gr

8A m

Uttarakhand), this ratio will be 90:10.

may be allowed in exceptional cases on the request of the States.Funding will be shared between the Centre and the States in the ratio of 75:25. For North Eastern and Special Category States (Arunachal Pradesh, Assam, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, Tripura, Jammu & Kashmir, Himachal Pradesh and

anks will no longer be allowed lump-sum disbursal of sanctioned housing loans. The Reserve Bank of India has told the banks that disbursal of sanctioned loan will have to be closely linked to the stages of

construction of the housing projects/houses. And, the RBI has also made it clear to them that no upfront disbursal should be made in cases of incomplete/under-construction/green field housing projects. The RBI diktat on 3 September, comes in view of the higher risks associated with such lump-sum disbursal of sanctioned housing loans. Banks have tended to join hands with developers/builders to introduce innovative housing loan schemes such as this one upfront disbursal of sanctioned loans sans any linkage to stages of construction of a

For more materials visit us at www.Gr8AmbitionZ.com

bit

access to credit. This will result in the empowerment and dignity of life of the urban poor. The approval of the

ion

Z. co

he Cabinet Committee on Economic Affairs on 3 September, approved the proposal for restructuring of the centrally sponsored Scheme of Swarna Jayanti Shahari Rozgar Yojana (SJSRY) in the 12th Plan and as the

Banking and Financial Awareness of September 2013 Gr8AmbitionZ.com

housing project. At times, these are done through tripartite agreements between the bank, the builder and the

schemes, the RBI said. While directing the banks to link disbursal to stages of project construction, the RBI also told them to take into account the customer suitability and appropriateness issues while introducing any kind of product. Further, it said, banks should ensure that the borrowers/customers were made fully aware of the risks and liabilities under such products.

nternational Paper India on 2nd September, inaugurated state-of-the-art machinery at its Rajahmundrybased Andhra Pradesh Paper Mills Limited, which will allow the plant to increase the conversion capacity of

branded copier paper. International Paper, a global company in packaging and paper, had acquired a 75 per cent stake in Andhra Pradesh Paper Mills Limited two years ago. With the new machinery, the capacity has been

anish pharmaceutical major Novo Nordisk, on 2 September, said it would soon launch its insulin injection Tresiba (insulin degludec) in India. Novo Nordisk is the leading manufacturer of insulin in the world, and

medicine has duration of action beyond 42 hours, and allows flexibility in daily dosing time without reducing efficacy. Novo Nordisk India has 15 per cent share in the diabetes care market with a significant share in insulin. In a bid to provide doctors access to updated and scientific information on insulin therapy, Novo Nordisk has tied up with Indian Academy of Diabetes (IAD) to launch a massive doctor education programme Master Class in

Gr

8A m

T

Insulin. India has 65 million diabetes patients and 130 million pre-diabetes patients said Dr. Shashank Joshi, President, IAD. Yet, only 6 million receive appropriate treatment.

he Reserve Bank of India on 6 September 2013 allowed the Non-Resident Investors including NRIs to purchase shares of Indian entities Under FDI Scheme. The investment can be made as per the mentioned

conditions. RBI has allowed the NRIs to make investment under the FDI scheme only on the listed entities, on recognized stock exchanges. The Reserve Bank of India has decided to include the non-residents, including the NRIs to acquire the shares of domestic companies listed under FDI scheme, on the stock exchanges through a registered broker, if the investor has already acquired and continues to hold control in accordance with SEBI, Substantial Takeover Code. Till now, the FIIs (Foreign Institutional Investor), QFIs (Qualified Foreign Investors) and NRIs were eligible to invest and acquire the shares on the recognized stock exchanges of India in compliance

For more materials visit us at www.Gr8AmbitionZ.com

bit

Tresiba, the new basal insulin, is used for the treatment of Type 1 and Type 2 diabetes. The once-daily use

ion

increased from 25,000 MT per year to 90,000 MT.

Z. co

buyer of the housing unit. These loan products are popularly known by various names such as 80:20, 75:25

Banking and Financial Awareness of September 2013 Gr8AmbitionZ.com

with the FEMA (Foreign Exchange Management Act) regulations. But the NRIs were not allowed to acquire

boldest foray yet into mobile devices and bringing well-regarded Nokia CEO Stephen Elop back into the

fold. Microsoft will pay $5 billion for the Nokia Corp. unit that makes mobile phones, including its line of Lumia smartphones that run Windows Phone software. It is also paying $2.2 billion for a 10-year license to use Nokia's patents, with the option to extend it indefinitely. Finlands Nokia, once the undisputed leader in mobile phones, has been struggling to respond to the challenge from Smartphone makers such as Apple and Samsung Electronics. Nokia Chairman Risto Siilasmaa will stay in his current role and assume the duties of interim CEO. When the deal closes in early 2014, about 32,000 Nokia employees will transfer to Microsoft, the companies said.

ndian IT Company Wipro Ltd on 7 September 2013 signed agreement with the US-based Kana Software to provide customer service solutions to its global insurers through a joint development centre. The agreement

provides Kana with systems integration scalability, as Wipro has presence across 57 countries worldwide. Ana

(on-demand) network to about 900 large enterprises and mid-market organizations, which includes 250 government agencies all over the world. Through its insurance practice division, Wipro works with 35 global insurers which include property and casualty carriers and health insurance providers and life, annuity and pension carriers.

Gr

8A m

T

29 October 2013.

he Reserve Bank of India (RBI) on 20 September 2013 increased the repo rate or the short term lending rate by 25 basis points to 7.5 per cent from 7.25 per cent with immediate effect. This means that the Repo

rate has been increased by 0.25 percent. The Governor of RBI, Raghuram Rajan while reviewing the monetary policy for the first time as a Governor, however, brought down the marginal standing facility (MSF) rate by 0.75 per cent to 9.5 per cent. The MSF rate is the one at which the other banks can borrow from the Central Bank. The cash reserve ratio (CRR) remained unchanged at 4 percent. All these changes were a part of the monetary policy review for September 2013. The next monetary policy review of the Reserve Bank of India (RBI) is scheduled for

For more materials visit us at www.Gr8AmbitionZ.com

bit

Software is located at Silicon Valley in California. It provides customer service solutions using cloud computing

ion

Z. co

icrosoft Corp. on 3rd September said it will buy Nokia's phone business for $7.2 billion, making its

shares on exchange (bourses) under the FDI Scheme.

Banking and Financial Awareness of September 2013 Gr8AmbitionZ.com

Complex in Barmer District in Rajasthan, as a Joint Venture (JV) with Government of Rajasthan under the name HPCL-Rajasthan Refinery Limited (HRRL).The proposed refinery will be a subsidiary of HPCL with its equity of 74% to be held by HPCL and 26% to be held by the Govt. of Rajasthan. The cost of the project is estimated at Rs.

37,230 crore. The project cost is proposed to be sourced with a debt/equity ratio of 1.5:1. Total equity component is Rs.14,892 crore and debt is Rs.22,338 crore. HPCLs equity contribution is Rs.11,020 crore at 74% equity and Govt. of Rajasthans equity contribution is Rs.3,872 crore at 26%.M/s. HPCL has signed a Memorandum of Understanding on 14th May, 2013 with Govt. of Rajasthan in this regard. HPCL has subsequently also signed a JV agreement with Govt. of Rajasthan on 11th July, 2013 on these terms for setting up the refinery as a joint venture. The proposed refinery will process 4.5 MMT of Mangala Crude and 4.5 MMT of Arab/other crude(s).

he Cabinet Committee on Economic Affairs on 20th September has approved setting up of Information Technology Investment Region (ITIR) near Hyderabad subject to fulfilling certain conditions. The Ministry

of Road Transport & Highways, Ministry of Urban Development and Ministry of Railways will be initiating detailed feasibility study/action. The total investment for the ITIR will be about Rs. 2.19 lakh crore of which the IT/ITES (Information Technology / Information Technology Enabled Services) Sector is to attract investments of Rs. 1.18 lakh crore and the Electronic Hardware Manufacturing (EHM) sector of Rs. 1.01 lakh crore. The major investment will be from Public-Private Partnerships. Government of India has also proposed up gradation of three radial roads and extension of the Metro Rail from Falaknuma to Shamshabad International airport at total cost of Rs 3,275 crore. The ITIR is expected to generate direct employment of 14.8 lakh and indirect employment of 55.9 lakh. The Government of Andhra Pradesh has delineated an area of 202 sq. kms. for the proposed ITIR in

Gr

8A m

P

three clusters/ agglomerations viz., (i) Cyberabad Development Area and its surroundings (ii) Hyderabad Airport Development area and Maheshwaram in the south of Hyderabad (iii) Uppal and Pocharam areas in eastern Hyderabad. The ITIR will be implemented in two phases. The Phase I will from 2013 to 2018 and Phase II will be from 2018 to 2038. The ITIR is expected to develop into a key industrial region IT, ITES and Electronic Hardware manufacturing sectors. Special consideration will be given to accommodate Small and Medium Enterprises (SMEs) in the proposed ITIR.

rime Minister Manmohan Singh on 19th September, commissioned the NTPCs 2,980 MW Super Thermal Power Station to the nation at a grand function held at Sipat, in Chhattisgarhs Bilaspur district. He also laid

the foundation stone of 1,600 MW stage-I of NTPCs Lara Super Thermal Power Project. The project to come up at Lara village in the states coal-rich Raigarh district will have two 800 MW units in stage I and an ultimate

For more materials visit us at www.Gr8AmbitionZ.com

bit

ion

Z. co

he Union Cabinet on 20th September, approved the proposal of Hindustan Petroleum Corporation Limited (HPCL), a Public Sector Undertaking to set up a 9 MMTPA Greenfield Refinery cum Petrochemical

Banking and Financial Awareness of September 2013 Gr8AmbitionZ.com

installed capacity of 4,000 MW. The coal-based Sipat Super Thermal Power Station is capable of generating

Madhya Pradesh and as far as Jammu and Kashmir, the prime minister said in his brief speech, dedicating the

project to the nation. He noted that in the 11th Five Year Plan period, India achieved a record power generation capacity of about 55,000 MW which was double the capacity added in the 10th Plan period, and in the 12th Plan a target of adding over 118,000 MW of power generation has been set. Built at an estimated cost of Rs. 13,000 crore, the Sipat plant is the first to have used super critical technology. The prime minister stated that advanced ultra super critical technology is now being developed in the country, and lauded the efforts of NTPC, BHEL and Indira Gandhi Centre for Nuclear Research for working in tandem to develop this technology.

cyber security. Thus, India has become the 17th nation to earn such recognition. This international Arrangement has 26 Member countries. USA, UK, Germany, South Korea, France, Japan, Canada, Australia, Turkey, Malaysia etc. are the other countries who have this recognition. So far India was having the status of Consuming Nation with respect to certification of Electronics and IT products. The status of Authorizing Nation will enable India to test IT and Electronics products and issue Certificates which will be acceptable internationally. The recognition would also remove the bottleneck which as of now had prevented international companies from submitting their products for testing and certification in India. The recognition would also enable investment in setting up infrastructure and labs in public and private sectors in India for testing Electronics and IT products. Standardisation Testing and Quality Certification (STQC) Directorate of the Department of Electronics and Information Technology (DeitY) has been operating Common Criteria Certification (CC Certification) scheme in

8A m

R

of India issued

India for the last 5-6 years. Under it STQC undertakes certification of Electronics and IT products after evaluation of the products at its lab in Kolkata. The Certificates issued by STQC Directorate shall now be acceptable internationally by all CCRA member countries.

eserve Bank of India on 25 September 2013 banned zero per cent interest rate schemes for purchase of consumer goods. The decision has taken in order to protect consumer interest. In this regard Reserve Bank a notification to all the Schedule Commercial Banks and local area banks.

Gr

The very concept of zero per cent interest is non-existent and such schemes only serve the purpose of alluring and exploiting vulnerable customers. Banks should neither resort to any practice that would distort the interest rate structure of a product nor hide any processing fees. All banks must stop these practices as they violate the very principle of fair and transparent pricing of products which beholds customer rights and protection, especially, in

For more materials visit us at www.Gr8AmbitionZ.com

bit

ion

ndia on 18th September has been recognized as Authorizing Nation under the international Common Criteria Recognition Arrangement (CCRA) to test and certify Electronics and IT products with respect to

Z. co

2,980 MW of electricity and it will not only cater to the demands of Chhattisgarh but also adjoining states like

Banking and Financial Awareness of September 2013 Gr8AmbitionZ.com

the more vulnerable retail segment. In the zero percent EMI schemes offered on credit card outstandings, the

work collaboratively to develop a Corporate Social Responsibility (CSR) index, take up capacity building on

CSR, conduct education and awareness programmes, and other activities to facilitate a more effective corporate participation in CSR areas. Indian Institution of Corporate Affairs (IICA) was established by Ministry of Corporate Affairs (MCA), Government of India to act as think-tank and centre of excellence to support the growth of the corporate sector in India through an integrated and multi-disciplinary approach. In the new Companies Act, 2013 it has been mandated for eligible companies to spend 2% of their profits on CSR activities. This initiative of the Ministry of Corporate Affairs which requires companies to look beyond shareholder value

players in the long run and shall attract more investment from investors. The proposed IICA-BSE CSR Index shall assess impact and performance of companies listed at BSE in CSR activities. The Index would also look at the performance of companies in their mandatory CSR spend as per the new Companies Act, 2013 as one of the important and objective criteria. The information provided in the public domain on CSR activities by these listed companies and which is also assured, shall have more preference in the various evaluation parameters of the Index. Performance of the companies in CSR areas would be combined with the market performance of companies for selection of companies. The Index would be sector neutral. Companies eligible to be included in the Index for further evaluation shall ensure basic compliance as per proposed CSR regulations. IICA-BSE proposes to form an Advisory Committee which would guide for CSR index construction and its design. This Advisory Committee would have consultative approach and interact with various stakeholders so that best global

Gr

8A m

T

not be scrutinized under GAAR.

practices are aligned to Indian needs as per Section 135, Companies Act 2013, in the index construction and it becomes benchmark index to assess Indian corporate in CSR. IICA-BSE shall also work on capacity building to assist companies for meeting their agenda of CSR and would conduct awareness programme in next 6 months.

he Union government of India on 26 September 2013 notified GAAR (General Anti Avoidance Rules). It seeks to check tax avoidance by investors routing their funds through tax havens. It will come into effect

from 1 April 2016. The GAAR will apply to entities availing tax benefit of at least 3 crore rupees. It will apply to foreign institutional investors, FIIs that have claimed benefits under any Double Tax Avoidance Agreement (DTAA).Investments made by a non-resident by way of offshore derivative instruments or P-Notes through FIIs, will not be covered by the GAAR provisions. The notification said, investments made before 30 August 2010, will

For more materials visit us at www.Gr8AmbitionZ.com

bit

ion

and make CSR a core driver of their strategy shall bring competitive advantage to Indian Inc with the global

Z. co

ndian Institution of Corporate Affairs (IICA) and BSE Ltd On 23rd September, signed an MoU in Mumbai to

interest element is often camouflaged and passed on to customer in the form of processing fee.

Banking and Financial Awareness of September 2013 Gr8AmbitionZ.com

the country are likely to remain under pressure, with 2014 election dynamics adding to uncertainties. Earlier,

Barclays had projected Indias growth at 5.3 per cent. Indias economic growth had slumped to decade low of five

per cent in 2012-13. It had slid to 4.4 per cent during April-June quarter, the lowest in past several years, pulled

down by a drop in mining and manufacturing output. According to the global financial services major, the broader trend in manufacturing and mining remains sluggish and the likely elevated-for-longer interest rate trajectory is also emerging as another headwind for industrial growth.Moreover, the countrys fiscal health is once again coming under pressure and the upcoming national elections (around April-May 2014) are another source of potential uncertainty for the economy and is likely to be a headwind against a revival of the investment cycle. It said after the surprise rate rise in the September policy meeting, the Reserve Bank of India is not likely to ease repo rates till the middle of next year. We now do not expect any easing in the repo rate until mid-2014, as opposed to our earlier expectation of that happening from December 2013, it said. The central bank has categorically flagged that inflation is higher than its comfort level, the report added.It said the rupee is expected to maintain a stable to positive bias in the near term, reflecting an improving current account, delayed Fed tapering and likely inflows under the FCNR scheme.

Dont forget to LIKE us there for Daily Updates

Gr

8A m

www.facebook.com/Gr8AmbitionZ

For more materials visit us at www.Gr8AmbitionZ.com

bit

We are at Facebook

ion

Z. co

he global financial services major, Barclays on 27th September, has lowered Indias FY14 gross domestic growth (GDP) forecast for the current financial year to 4.7 per cent, saying the growth and fiscal health of

Você também pode gostar

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- All India Mobile SeriesDocumento12 páginasAll India Mobile Seriesajitkumar150% (2)

- ProjectDocumento11 páginasProjectHarikrishnan NadesanAinda não há avaliações

- Optional - 3 L-31 Environment and Its PollutionDocumento8 páginasOptional - 3 L-31 Environment and Its PollutionPriya AnandAinda não há avaliações

- Arc ReportDocumento63 páginasArc ReportPriya AnandAinda não há avaliações

- Agriculture PDFDocumento6 páginasAgriculture PDFGopalDasAinda não há avaliações

- ARC Recommendation SummaryDocumento16 páginasARC Recommendation SummaryPriya AnandAinda não há avaliações

- 2 Political Theory An IntroductionDocumento16 páginas2 Political Theory An IntroductiongopalAinda não há avaliações

- Savarkar Myths and Facts Review of ShamsDocumento3 páginasSavarkar Myths and Facts Review of ShamsShah DrshannAinda não há avaliações

- Evolution of Muslim Separate IdentityDocumento7 páginasEvolution of Muslim Separate Identityhira rajpootAinda não há avaliações

- List of Political Parties and ADDITIONAL FREE SYMBOLS - Amending Notification English 09.03.2019Documento13 páginasList of Political Parties and ADDITIONAL FREE SYMBOLS - Amending Notification English 09.03.2019MD SHAHJADAinda não há avaliações

- Project On DecentralizationDocumento38 páginasProject On Decentralizationkartikbag67Ainda não há avaliações

- Globalization of Foreign Direct Investment in India: 1900s-2000Documento47 páginasGlobalization of Foreign Direct Investment in India: 1900s-2000Keyur BhanderiAinda não há avaliações

- Establishment of A Pulse Processing IndustryDocumento63 páginasEstablishment of A Pulse Processing Industryanoop_narayan100% (1)

- GSXBDocumento47 páginasGSXBSonnet XavierAinda não há avaliações

- Modernization in CricketDocumento11 páginasModernization in Cricketkunal mehtoAinda não há avaliações

- Anisha Rana (1536) Evs AssignmentDocumento13 páginasAnisha Rana (1536) Evs AssignmentAnisha RanaAinda não há avaliações

- EWS230601070195Documento1 páginaEWS230601070195AnjiReddy DurgampudiAinda não há avaliações

- Justice Party English MediumDocumento2 páginasJustice Party English MediumAnantharaman. RAinda não há avaliações

- 555 Reddy'sDocumento19 páginas555 Reddy'sWeare1_busyAinda não há avaliações

- Defence - Sector - Update Jul 14 EDEL PDFDocumento254 páginasDefence - Sector - Update Jul 14 EDEL PDFsharatjuturAinda não há avaliações

- IPL 2014 Phase 1 ScheduleDocumento4 páginasIPL 2014 Phase 1 SchedulemangatvikramAinda não há avaliações

- Nusret HanjalicDocumento61 páginasNusret HanjalicmornaricaAinda não há avaliações

- Chapter 2 To 5 HISTORYDocumento5 páginasChapter 2 To 5 HISTORYyashkansal017Ainda não há avaliações

- British Expansion and Indian Resistance Between 1750Documento3 páginasBritish Expansion and Indian Resistance Between 1750anousheAinda não há avaliações

- State Wise Production and Distribution of Non-Metallic Minerals in IndiaDocumento20 páginasState Wise Production and Distribution of Non-Metallic Minerals in IndiaAshwani KumarAinda não há avaliações

- List of Political Parties Register After 11.01.2017 Till 03.02.2017 RegardingDocumento4 páginasList of Political Parties Register After 11.01.2017 Till 03.02.2017 Regardingcareer sudha44Ainda não há avaliações

- Centre Wise CPI IW September 2019Documento2 páginasCentre Wise CPI IW September 2019Heeranand ChandwaniAinda não há avaliações

- 07 - Chapter 2 PDFDocumento32 páginas07 - Chapter 2 PDFKhushboo JariwalaAinda não há avaliações

- Jstse ResultDocumento7 páginasJstse ResultSHEKHAR KUMAR100% (1)

- End of Poll Comparision - Phase-1 PDFDocumento4 páginasEnd of Poll Comparision - Phase-1 PDFsamm123456Ainda não há avaliações

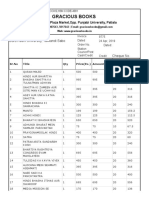

- Book GaciousDocumento6 páginasBook GacioussandeepAinda não há avaliações

- Cbse Aissce Mark StatementDocumento1 páginaCbse Aissce Mark StatementTirtha P. NathAinda não há avaliações

- Ancient History Mahajanpadas, Mauryan English - pdf-82Documento4 páginasAncient History Mahajanpadas, Mauryan English - pdf-82Akhilesh kumar SrivastavaAinda não há avaliações

- Adarsh Bal Vidya Mandir School Mawana Class 8thDocumento5 páginasAdarsh Bal Vidya Mandir School Mawana Class 8thWilliam MassimoAinda não há avaliações

- Commerce 2020-2021Documento239 páginasCommerce 2020-2021BHPCAinda não há avaliações