Escolar Documentos

Profissional Documentos

Cultura Documentos

XX 15G PDF

Enviado por

rajdeeppawarTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

XX 15G PDF

Enviado por

rajdeeppawarDireitos autorais:

Formatos disponíveis

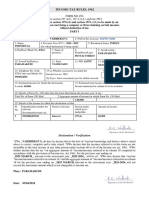

"FORMNO.15G [Seesection197A(1),197A(1A)andrule29C] Declarationundersection197A(1)andsection197A(1A)oftheIncometaxAct,1961tobemadebyanindividualoraperson(notbeingacompanyorfirm)claiming certainreceiptswithoutdeductionoftax. PARTI 2.PANoftheAssessee 1.NameofAssessee(Declarant) 3.AssessmentYear (forwhichdeclarationisbeingmade) 4.Flat/Door/BlockNo. 8.Road/Street/Lane 5.NameofPremises 9.Area/Locality 6.#Status 7.

AssessedinwhichWard/Circle 10.AOCode(underwhomassessedlast time)

AreaCode AOType RangeCode AONo.

11.Town/City/District

12.State 13.PIN 14.LastAssessmentYearinwhich assessed 17.PresentWard/Circle 18.ResidentialStatus(withinthe meaningofSection6oftheIncomeTax Act,1961) 20.PresentAOCode(ifnotsameas above)

AreaCode AOType RangeCode AONo.

15.Email 19.NameofBusiness/Occupation

16.TelephoneNo.(withSTDCode)andMobileNo.

21.JurisdictionalChiefCommissionerofIncometaxorCommissionerofIncometax(ifnotassessedto Incometaxearlier) 22.Estimatedtotalincomefromthesourcesmentionedbelow:

(Pleaseticktherelevantbox) DividendfromsharesreferredtoinScheduleI InterestonsecuritiesreferredtoinScheduleII InterestonsumsreferredtoinScheduleIII IncomeformunitsreferredtoinScheduleIV Theamountofwithdrawalreferredtoinsection80CCA(2)(a)fromNationalSavingsSchemereferredtoinScheduleV 23.EstimatedtotalincomeofthepreviousyearinwhichincomementionedinColumn22istobeincluded 24.Detailsofinvestmentsinrespectofwhichthedeclarationisbeingmade: SCHEDULEI (Detailsofshares,whichstandinthenameofthedeclarantandbeneficiallyownedbyhim) No.of Classofshares& Totalvalue shares Distinctivenumbersoftheshares facevalueofeach Date(s)onwhichtheshareswereacquiredbythe ofshares share declarant(dd/mm/yyyy)

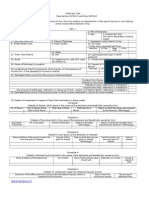

Descriptionof securities

SCHEDULEII (Detailsofthesecuritiesheldinthenameofdeclarantandbeneficiallyownedbyhim) Date(s)of Date(s)onwhichthesecuritieswere Numberofsecurities securities Amountofsecurities acquiredbythedeclarant(dd/mm/yyyy) (dd/mm/yyyy)

SCHEDULEIII (Detailsofthesumsgivenbythedeclarantoninterest) Nameandaddressofthe Amountof persontowhomthesumsare sumsgiven givenoninterest oninterest Dateonwhichthesumsweregivenon interest(dd/mm/yyyy) Periodforwhichsumswere givenoninterest Rateof interest

SCHEDULEIV (Detailsofthemutualfundunitsheldinthenameofdeclarantandbeneficiallyownedbyhim) Nameandaddressofthe Incomeinrespectof Numberof Classofunitsandfacevalueofeach Distinctivenumberofunits mutualfund unit units units

SCHEDULEV (DetailsofthewithdrawalmadefromNationalSavingsScheme) ParticularsofthePostOfficewheretheaccountundertheNationalSavingsScheme ismaintainedandtheaccountnumber Dateonwhichtheaccount wasopened(dd/mm/yyyy) Theamountof withdrawalfromthe account

. **SignatureoftheDeclarant Declaration/Verification

*I/Wedoherebydeclarethattothebestof*my/ourknowledgeandbeliefwhatisstatedaboveiscorrect,completeandistrulystated.*I/We declarethattheincomesreferredtointhisformarenotincludibleinthetotalincomeofanyotherpersonu/s60to64oftheIncometaxAct,1961.*I/Wefurther, declarethatthetax*onmy/ourestimatedtotalincome,including*income/incomesreferredtoinColumn22above,computedinaccordancewiththeprovisions oftheIncometaxAct,1961,forthepreviousyearendingon....................relevanttotheassessmentyear..................willbenil.*I/Wealso,declarethat*my/our *income/incomesreferredtoinColumn22forthepreviousyearendingon....................relevanttotheassessmentyear..................willnotexceedthemaximum amountwhichisnotchargeabletoincometax. Place: Date: .. .. . SignatureoftheDeclarant

PARTII [Forusebythepersontowhomthedeclarationisfurnished] 1.NameofthepersonresponsibleforpayingtheincomereferredtoinColumn22ofPartI 2.PANofthepersonindicatedinColumn1ofPartII 3.CompleteAddress 4.TANofthepersonindicatedinColumn1ofPartII 5.Email 8.DateonwhichDeclarationisFurnished (dd/mm/yyyy) 6.TelephoneNo.(withSTDCode)andMobileNo. 9.Periodinrespectofwhichthedividendhasbeen declaredortheincomehasbeenpaid/credited 7.Status 10.Amountofincomepaid

11.Dateonwhichtheincome hasbeenpaid/ credited(dd/mm/yyyy)

12.Dateofdeclaration,distributionorpaymentofdividend/withdrawalunderthe NationalSavingsScheme(dd/mm/yyyy)

13.AccountNumberofNationalSavingSchemefromwhichwithdrawalhas beenmade

ForwardedtotheChiefCommissionerorCommissionerofIncometax

Place: Date:

.. .

Signatureofthepersonresponsiblefor payingtheincomereferredtoin Column22ofPartI

Notes: 1. 2. 3. 4. 5.

Thedeclarationshouldbefurnishedinduplicate. *Deletewhicheverisnotapplicable.

#

Declarationcanbefurnishedbyanindividualundersection197A(1)andaperson(otherthanacompanyorafirm)undersection197A(1A). **IndicatethecapacityinwhichthedeclarationisfurnishedonbehalfofaHUF,AOP,etc. Beforesigningthedeclaration/verification,thedeclarantshouldsatisfyhimselfthattheinformationfurnishedinthisformistrue,correctandcompleteinall respects.Anypersonmakingafalsestatementinthedeclarationshallbeliabletoprosecutionunder277oftheIncometaxAct,1961andonconvictionbe punishable i) Inacasewheretaxsoughttobeevadedexceedstwentyfivelakhrupees,withrigorousimprisonmentwhichshallnotbelessthan6monthsbutwhich mayextendtosevenyearsandwithfine; ii) Inanyothercase,withrigorousimprisonmentwhichshallnotbelessthan3monthsbutwhichmayextendtotwoyearsandwithfine.

6.

Thepersonresponsibleforpayingtheincomereferredtoincolumn22ofPartIshallnotacceptthedeclarationwheretheamountofincomeofthenaturereferred toinsubsection(1)orsubsection(1A)ofsection197Aortheaggregateoftheamountsofsuchincomecreditedorpaidorlikelytobecreditedorpaidduringthe previousyearinwhichsuchincomeistobeincludedexceedsthemaximumamountwhichisnotchargeabletotax.";

Você também pode gostar

- Area Code AO Type Range Code AO No.: Signature of The DeclarantDocumento2 páginasArea Code AO Type Range Code AO No.: Signature of The DeclarantRakesh DuttaAinda não há avaliações

- "Form No. 15H: Printed From WWW - Incometaxindia.gov - in Page 1 of 2Documento2 páginas"Form No. 15H: Printed From WWW - Incometaxindia.gov - in Page 1 of 2teniyaAinda não há avaliações

- New Form 15G PDFDocumento2 páginasNew Form 15G PDFSoma Sundar50% (2)

- Income-Tax Rules, 1962Documento2 páginasIncome-Tax Rules, 1962Abdul SattarAinda não há avaliações

- "Form No. 15G: AO No. AO Type Range Code Area CodeDocumento2 páginas"Form No. 15G: AO No. AO Type Range Code Area CodePruthvish ShuklaAinda não há avaliações

- PDF Editor: Form No. 15GDocumento2 páginasPDF Editor: Form No. 15GImissYouAinda não há avaliações

- Form 15g TaxguruDocumento3 páginasForm 15g Taxguruulhas_nakasheAinda não há avaliações

- TAX SAVING Form 15g Revised1 SBTDocumento2 páginasTAX SAVING Form 15g Revised1 SBTrkssAinda não há avaliações

- "Form No. 15H (See Section 197A (1C) and Rule 29C (1A) ) Declaration Under Section 197A (1C) of The Income of Sixty Years or More Claiming Certain Receipts Without Deduction of TaxDocumento3 páginas"Form No. 15H (See Section 197A (1C) and Rule 29C (1A) ) Declaration Under Section 197A (1C) of The Income of Sixty Years or More Claiming Certain Receipts Without Deduction of TaxRajanAinda não há avaliações

- Form 15GDocumento3 páginasForm 15Gsriramdutta9Ainda não há avaliações

- Icici Form 15GDocumento2 páginasIcici Form 15Grajanikant_singhAinda não há avaliações

- FORM-15G: (Please Tick The Relevant Box)Documento4 páginasFORM-15G: (Please Tick The Relevant Box)Kayam BalajiAinda não há avaliações

- "Form No. 15H (See Section 197A (1C) and Rule 29C (1A) ) Declaration Under Section 197A (1C) of The Income of Sixty Years or More Claiming Certain Receipts Without Deduction of TaxDocumento3 páginas"Form No. 15H (See Section 197A (1C) and Rule 29C (1A) ) Declaration Under Section 197A (1C) of The Income of Sixty Years or More Claiming Certain Receipts Without Deduction of TaxRajanAinda não há avaliações

- Form 15g NewDocumento4 páginasForm 15g NewnazirsayyedAinda não há avaliações

- Form 15G WordDocumento2 páginasForm 15G WordAsif NadeemAinda não há avaliações

- Bonds Form 15gDocumento3 páginasBonds Form 15gRishi TAinda não há avaliações

- "Form No. 15GDocumento2 páginas"Form No. 15GJayvin ShiluAinda não há avaliações

- OBC Bank Form - 15H PDFDocumento2 páginasOBC Bank Form - 15H PDFKrishnan Vaidyanathan100% (1)

- Adobe Scan 13 Mar 2021Documento1 páginaAdobe Scan 13 Mar 2021Pankaj BhamareAinda não há avaliações

- Income-Tax Rules, 1962: (See Section 197A (1), 197A (1A) and Rule 29C)Documento4 páginasIncome-Tax Rules, 1962: (See Section 197A (1), 197A (1A) and Rule 29C)utuavn evAinda não há avaliações

- Form 15G 3Documento1 páginaForm 15G 3lakshmananksme3007Ainda não há avaliações

- New Form 15H For Fixed Deposits Editable in PDFDocumento2 páginasNew Form 15H For Fixed Deposits Editable in PDFMutual Funds Advisor ANANDARAMAN 944-529-6519Ainda não há avaliações

- 103120000000007845Documento3 páginas103120000000007845arjunv_14100% (1)

- Form 15H Format 1Documento4 páginasForm 15H Format 1ASHISH KINIAinda não há avaliações

- Form 15G WordDocumento2 páginasForm 15G Wordsagar computerAinda não há avaliações

- Form 15gDocumento4 páginasForm 15gcontactus kannanAinda não há avaliações

- TourDocumento4 páginasTourAnup SahAinda não há avaliações

- PPC 1H667511110 2018-19 12042019Documento3 páginasPPC 1H667511110 2018-19 12042019P PalAinda não há avaliações

- "Form No. 15H: Area Code Range Code AO No. AO TypeDocumento2 páginas"Form No. 15H: Area Code Range Code AO No. AO Typepkw007Ainda não há avaliações

- Form 15 HDocumento2 páginasForm 15 Hsingh ramanpreetAinda não há avaliações

- Form15h GH01389401 PDFDocumento3 páginasForm15h GH01389401 PDFNamme KyarakhahaiAinda não há avaliações

- Form No 15GDocumento2 páginasForm No 15Gnarendra1968Ainda não há avaliações

- Form No 15HDocumento3 páginasForm No 15HsaymtrAinda não há avaliações

- Flat/Door/Block No. 7 7. Name of Premises 8.Rond/Street/Lane os9.Area/Locality Vaidn Hna QovDocumento3 páginasFlat/Door/Block No. 7 7. Name of Premises 8.Rond/Street/Lane os9.Area/Locality Vaidn Hna QovVishwini ViswanathanAinda não há avaliações

- 15G FormDocumento2 páginas15G Formgrover.jatinAinda não há avaliações

- PF Form 15GDocumento1 páginaPF Form 15GSorabh BhargavAinda não há avaliações

- PF Form 15G PDFDocumento1 páginaPF Form 15G PDFSorabh BhargavAinda não há avaliações

- Form 15 GDocumento2 páginasForm 15 GRahul SahaniAinda não há avaliações

- Form 15HDocumento2 páginasForm 15HNithya SathyaprasathAinda não há avaliações

- Form 15GDocumento3 páginasForm 15GRahul DattoAinda não há avaliações

- Form 15GDocumento4 páginasForm 15GRavi SainiAinda não há avaliações

- Form No. 15H: Part - IDocumento2 páginasForm No. 15H: Part - Itoton33Ainda não há avaliações

- 26q DetailsDocumento3 páginas26q DetailsAmit TiwariAinda não há avaliações

- Form 27CDocumento2 páginasForm 27Ctulsi22187Ainda não há avaliações

- New Form No 15GDocumento4 páginasNew Form No 15GDevang PatelAinda não há avaliações

- Form15g GH02596993Documento3 páginasForm15g GH02596993Dhana LakshmiAinda não há avaliações

- Form No. 15GDocumento9 páginasForm No. 15Gjpsmu09Ainda não há avaliações

- PDFDocumento4 páginasPDFushapadminivadivelswamyAinda não há avaliações

- Form No. 15H: (IT Dept. Copy)Documento9 páginasForm No. 15H: (IT Dept. Copy)jpsmu09Ainda não há avaliações

- Form Vat-01Documento6 páginasForm Vat-01Manish MahajanAinda não há avaliações

- New GST Rates Wef 25-01-2018Documento5 páginasNew GST Rates Wef 25-01-2018Accounting & TaxationAinda não há avaliações

- GST Returns New Dates For July and August Month - GSTR-1 - GSTR-2 - GSTR-3 and GSTR-3BDocumento3 páginasGST Returns New Dates For July and August Month - GSTR-1 - GSTR-2 - GSTR-3 and GSTR-3BAccounting & TaxationAinda não há avaliações

- GST Chapter Wise RateDocumento213 páginasGST Chapter Wise RateMoneycontrol News92% (280)

- GST Rate Schedule For Certain Goods 3 June 17Documento26 páginasGST Rate Schedule For Certain Goods 3 June 17CharteredAdda.comAinda não há avaliações

- GST Chapter Wise RateDocumento213 páginasGST Chapter Wise RateMoneycontrol News92% (280)

- How To File GSTR 3B Return FilingDocumento32 páginasHow To File GSTR 3B Return FilingAccounting & Taxation100% (1)

- Individual Income Tax Slab Rates For Fy 2018-19 - WWW - Accounts4tutorialsDocumento3 páginasIndividual Income Tax Slab Rates For Fy 2018-19 - WWW - Accounts4tutorialsAccounting & TaxationAinda não há avaliações

- Eco-System For GST and GST Suvidha ProvidersDocumento31 páginasEco-System For GST and GST Suvidha ProvidersAccounting & Taxation76% (17)

- Form ITR-5Documento32 páginasForm ITR-5Accounting & Taxation100% (1)

- Form ITR-3Documento32 páginasForm ITR-3Accounting & Taxation100% (1)

- Form ITR-7Documento21 páginasForm ITR-7Accounting & Taxation100% (4)

- Form Itr-4 SugamDocumento9 páginasForm Itr-4 SugamAccounting & TaxationAinda não há avaliações

- Form ITR-6Documento35 páginasForm ITR-6Accounting & TaxationAinda não há avaliações

- Form ITR-1 SAHAJDocumento1 páginaForm ITR-1 SAHAJAccounting & Taxation100% (1)

- GST Return Business Process For GSTDocumento72 páginasGST Return Business Process For GSTAccounting & Taxation100% (1)

- Form ITR-2 For Ay 2017-18Documento16 páginasForm ITR-2 For Ay 2017-18Accounting & TaxationAinda não há avaliações

- Krishi Kalyan Cess Notes On ClausesDocumento33 páginasKrishi Kalyan Cess Notes On ClausesAccounting & TaxationAinda não há avaliações

- Krishi Kalyan Cess Finance Bill - 2016 Provisions Relating To Direct TaxesDocumento62 páginasKrishi Kalyan Cess Finance Bill - 2016 Provisions Relating To Direct TaxesAccounting & TaxationAinda não há avaliações

- Income Tax Slab Rates For A.y.2015-16 and 2016-17, Applicability of Surcharge and Education CessDocumento7 páginasIncome Tax Slab Rates For A.y.2015-16 and 2016-17, Applicability of Surcharge and Education CessAccounting & TaxationAinda não há avaliações

- GST Return Forms - GSTR 1 To GSTR 11 and GSTTRP 1 To GSTTRP 7Documento129 páginasGST Return Forms - GSTR 1 To GSTR 11 and GSTTRP 1 To GSTTRP 7Accounting & Taxation100% (2)

- Krishi Kalyan Cess Finance Bill - 2016 Provisions Relating To Direct TaxesDocumento62 páginasKrishi Kalyan Cess Finance Bill - 2016 Provisions Relating To Direct TaxesAccounting & TaxationAinda não há avaliações

- Rbi Bulletin August 2015Documento74 páginasRbi Bulletin August 2015Accounting & Taxation100% (1)

- Arun Jaitley's Budget SpeechDocumento77 páginasArun Jaitley's Budget SpeechThe Indian ExpressAinda não há avaliações

- Indian Income Tax: Grant of Approval and Claim of Exemption Us 10 (23c) (Vi) of The Income-Tax Act 1961Documento4 páginasIndian Income Tax: Grant of Approval and Claim of Exemption Us 10 (23c) (Vi) of The Income-Tax Act 1961Accounting & TaxationAinda não há avaliações

- Tax Audit Requirements Ay 2014 15Documento34 páginasTax Audit Requirements Ay 2014 15Accounting & TaxationAinda não há avaliações

- Tax Liability For The Assessment Years 2014-15 and 2015-16Documento11 páginasTax Liability For The Assessment Years 2014-15 and 2015-16Accounting & TaxationAinda não há avaliações

- The Institute of Chartered Accountants of IndiaDocumento2 páginasThe Institute of Chartered Accountants of IndiaAccounting & TaxationAinda não há avaliações

- Income-Tax Settlement CommissionDocumento3 páginasIncome-Tax Settlement CommissionAccounting & TaxationAinda não há avaliações

- Jobs Cma Ca MbaDocumento5 páginasJobs Cma Ca MbaAccounting & TaxationAinda não há avaliações

- Management Trainee Finance Qua: CA or ICWADocumento4 páginasManagement Trainee Finance Qua: CA or ICWAAccounting & TaxationAinda não há avaliações