Escolar Documentos

Profissional Documentos

Cultura Documentos

Bridging The Superannuation Gap

Enviado por

DovetailSEOTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Bridging The Superannuation Gap

Enviado por

DovetailSEODireitos autorais:

Formatos disponíveis

Bridging the Superannuation Gap

Why is it that some of the most important things in life, we often avoid and put off as long as possible? For example, going to the dentist, filing important paper work and revisiting our superannuation? Superannuation is a one trillion dollar business and arguably one of the biggest social issues in Australia. Recently our research team at Dovetail stumbled across the following statistics:

25% of Australians aged between 65 to 69 are still working Post the GFC, 14% of Australians intend to work until they are 70 years or older An Australian couple will need $56,339 per annum for them to retire comfortably 1 in 4 own their house, however they dont have enough money in retirement 75% of retirees are on some form of welfare

The Australian Government has recently announced a long-term strategy that aims to address some of the issues raised above, by gradually increasing the compulsory employer superannuation contribution rate from 9% to 12% by 1 July 2019. For those under 50, a good piece of advice is to dedicate at least 30 minutes per year to visiting the status of your superannuation fund. To assist you, there are a number of websites, such as Money Smart (www.moneysmart.gov.au/toolsandresources/calculators-and tools/ superannuation-calculator) that can give you foresight and a quick injection of inspiration to put your super and retirement plan firmly on your priority list. So, what if you do not have time on your side, what are your options? Sadly, we often see many of our clients in this situation, however rather than hoping to win Tatts lotto where the chances are only 1 in 45 million, we have a solution that 1 in 5 may be able to benefit from, which enables you to continue living in your home/ community and secure the cash flow you need, just by refiguring the size of your property. To learn more, see Frank and Joans case study below is a few quick facts:

Frank is 67 years old, Joan is 65 years (married for 46 years) Owned their corner block, brick 3 bedroom house for 29 years In 1984, they purchased the house almost new for $58,000 In 2012, their 655 sqm property was worth $652,000 (original bathroom & kitchen) They were spending $60 per fortnight having it mowed and maintained In June 2012, they sourced a seniors loan for $79,500 against their property Dovetail was engaged to subdivide their block, and provided a trusted referral for their bathroom and kitchen renovation Whilst the renovations took place, Joan had a hip operation with the funds By March 2013, their property was subdivided and they decided to sell off the vacant land for $350,000 and they had their property re-valued for $620,000. They paid off the $79,500 loan and put the remaining $270,000 towards their retirement fund.

Você também pode gostar

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Organizational Culture and ChangesDocumento3 páginasOrganizational Culture and ChangesCherry MoldeAinda não há avaliações

- Accounting Crash CourseDocumento7 páginasAccounting Crash CourseschmooflaAinda não há avaliações

- CFC HOO - Refund FormDocumento1 páginaCFC HOO - Refund FormAiza GarnicaAinda não há avaliações

- Far 7 Flashcards - QuizletDocumento31 páginasFar 7 Flashcards - QuizletnikoladjonajAinda não há avaliações

- Listing Reg. EX-50% NED - 1/3 Ned But Related - 50%Documento3 páginasListing Reg. EX-50% NED - 1/3 Ned But Related - 50%Avinash BahadurAinda não há avaliações

- Case Study PahiiiiiiiiiiDocumento4 páginasCase Study Pahiiiiiiiiiirohitbhargo0% (1)

- The Effectiveness of Sales Promotion On Buying BehaviourDocumento116 páginasThe Effectiveness of Sales Promotion On Buying BehaviourMohammed Jamiu100% (2)

- Financial Market and Institutions Ch16Documento8 páginasFinancial Market and Institutions Ch16kellyAinda não há avaliações

- 22 Qualities That Make A Great LeaderDocumento6 páginas22 Qualities That Make A Great LeaderSalisu BorodoAinda não há avaliações

- Financial Statement Analysis - by P.balasubramaniyam - Xmba5 - 9Documento22 páginasFinancial Statement Analysis - by P.balasubramaniyam - Xmba5 - 9Pasupuleti Balasubramaniyam100% (1)

- Apollo Tyres Limited: Rating RationaleDocumento4 páginasApollo Tyres Limited: Rating Rationaleragha_4544vAinda não há avaliações

- PCT CountriesDocumento1 páginaPCT CountriesshamimAinda não há avaliações

- Attorneys 2007Documento12 páginasAttorneys 2007kawallaceAinda não há avaliações

- PT BMI Presentation-17.02.2016Documento55 páginasPT BMI Presentation-17.02.2016Bayumi Tirta JayaAinda não há avaliações

- Production Planning and Inventory ManagementDocumento31 páginasProduction Planning and Inventory ManagementramakrishnaAinda não há avaliações

- Mplus FormDocumento4 páginasMplus Formmohd fairusAinda não há avaliações

- BUS 206 Milestone OneDocumento3 páginasBUS 206 Milestone OneTrish FranksAinda não há avaliações

- JDEtips Article E1PagesCreationDocumento20 páginasJDEtips Article E1PagesCreationValdir AraujoAinda não há avaliações

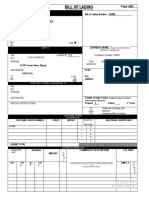

- Conocimiento de Embarque BLDocumento10 páginasConocimiento de Embarque BLMaryuri MendozaAinda não há avaliações

- Tata Aig Booklet BackcoverDocumento9 páginasTata Aig Booklet Backcoversushant pathakAinda não há avaliações

- Bank of Rajasthan LTDDocumento2 páginasBank of Rajasthan LTDProfessor Sameer Kulkarni100% (1)

- 0145 - Positive Brand Friction - CXReport v10Documento19 páginas0145 - Positive Brand Friction - CXReport v10Khanh Thien NguyenAinda não há avaliações

- F&S Velasco Company, Inc. v. MadridDocumento5 páginasF&S Velasco Company, Inc. v. MadridGela Bea BarriosAinda não há avaliações

- Web Design Proposal TemplateDocumento7 páginasWeb Design Proposal TemplateMittal Saurabh100% (1)

- MathSoft b2b Case SolutionDocumento8 páginasMathSoft b2b Case SolutionsankalpgargmdiAinda não há avaliações

- P02-Working Cash Advance Request FormDocumento30 páginasP02-Working Cash Advance Request FormVassay KhaliliAinda não há avaliações

- Selling Groceries On AmazonDocumento120 páginasSelling Groceries On Amazonbaggywrinkle100% (2)

- National Cardiovascular Centre Harapan Kita JULY, 15, 2019Documento30 páginasNational Cardiovascular Centre Harapan Kita JULY, 15, 2019Aya BeautycareAinda não há avaliações

- 810 Pi SpeedxDocumento1 página810 Pi SpeedxtaniyaAinda não há avaliações

- Corporations PDFDocumento16 páginasCorporations PDFkylee MaranteeAinda não há avaliações