Escolar Documentos

Profissional Documentos

Cultura Documentos

The Relationship Between Board Structure and Performance PDF

Enviado por

Nebert MandalaTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

The Relationship Between Board Structure and Performance PDF

Enviado por

Nebert MandalaDireitos autorais:

Formatos disponíveis

The Relationship Between Board Structure and Financial Performance

BY NEBERT OMBAJO MANDALA D80/61102/2011 An Independent Study Paper Submitted in Partial Fulfillment of the Requirements for the Degree of Doctor of Philosophy in Business Administration (Finance) School of Business University Of Nairobi

January, 2013

ombajom@yahoo.com/+254722421422

DECLARATION THIS INDEPENDENT STUDY PAPER IS MY ORIGINAL WORK, AND HAS NOT BEEN PRESENTED FOR THE AWARD OF A DEGREE IN ANY OTHER UNIVERSITY. SIGNED . NEBERT OMBAJO MANDALA DATE

THIS INDEPENDENT STUDY PAPER HAS BEEN SUBMITTED FOR EXAMINATION WITH MY APPROVAL AS THE UNIVERSITY SUPERVISOR. SIGNED .. PROFESSOR ERASMUS KAIJAGE SCHOOL OF BUSINESS, UNIVERSITY OF NAIROBI. DATE ...

iii

DEDICATION To my precious wife Doreen and daughter Leila, for giving me a new purpose for living and a renewed zeal to excel. To my late Dad and Mum Mr. David Mandala and Mrs. Beliah Mandala, for laying the foundation for my academic advancement and outstanding achievements.

iv

ACKNOWLEDGEMENTS First and foremost, I would like to express my deepest gratitude and appreciation to my supervisor, Professor Kaijage without whom I would not have achieved this. His guidance, encouragement and support were of great value. He gave me a push to go on at a time when I almost despaired. Special thanks also go to all my friends, particularly those in my PhD class. Their contribution throughout my study period is highly appreciated. Most importantly, I thank God the Almighty for giving me life, health and the ability to undertake this journey.

ABSTRACT Kenya has characteristics of board structures and ownership concentration similar to those found in most countries. Firms in transition economies are characterized by high degree of ownership concentration. Empirical studies suggest that ownership concentration is related to firms corporate governance, financing and investment policies. Ownership for most firms is distributed among institutional investors and retail investors; with ownership concentrated mainly to institutional investors. The ownership can also be categorized into state ownership and public ownership. The type of ownership structure of a firm ultimately affects the board structure categorized in this study as type 1 board, whose members directly own equity shares in the firm; type 3 board, where the board members do not hold any equity shares in the firm whose board they sit on; and type 2 which is a blend between the two extremes, whose some members own equity shares and some do not hold any equity shares. This study reviews empirical literature related to the relationship between board structure and financial performance. The effectiveness of boards of directors, including board type, board composition, board size, and aspects of board leadership including duality and board busyness are addressed using a number of theories of corporate governance: agency theory, resource dependency theory, entrenchment and convergence of interests theory. The study was motivated by the fact that one could imagine a simple causal structure such that board structure directly influences financial performance and thus the firm value. Type 1 boards would be motivated in ensuring that the entitys financial performance is enhanced while type 3 board members may not be motivated to ensure better financial performance. Type 2 boards that is a combination of the two extremes may be considered the control variable. The study focused on whether empirical literature exists to support these thoughts. This study explored literature related to the issues above to determine any theories and empirical studies carried out in the past. It has established gaps in knowledge, research and methodological problems related to board structures and financial performance.

vi

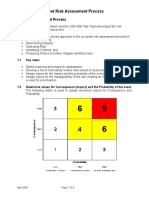

TABLE OF CONTENTS DECLARATION ................................................................................................................. iii DEDICATION ..................................................................................................................... iv ACKNOWLEDGEMENTS................................................................................................... v ABSTRACT ........................................................................................................................ vi 1.0 INTRODUCTION ...................................................................................................... 1 1.1 Statement of the Problem ..................................................................................... 3 1.2 Objectives of the Study........................................................................................ 5 1.3 Corporate Governance ......................................................................................... 5 1.4 Ownership Structure ............................................................................................ 6 1.5 Financial Performance Measures ......................................................................... 7 1.6 Outline of the study ............................................................................................. 8 2.0 THEORETICAL REVIEW ...................................................................................... 10 2.1 Agency Theory .................................................................................................. 10 2.2 Competing Theories .......................................................................................... 14 2.2.1 Convergence-of-interests Theory....................................................................... 14 2.2.2 Entrenchment Theory........................................................................................ 15 3.0 EMPIRICAL REVIEW ............................................................................................ 17 3.1 Introduction ....................................................................................................... 17 3.2 Corporate Governance and Financial Performance............................................. 17 3.3 Board Structure and Financial Performance ....................................................... 18 3.4 Board Composition and Firm Performance ........................................................ 24 3.5 Ownership Structure, Corporate governance and Financial Performance............ 26 3.6 Corporate Governance and Bankruptcy.............................................................. 31 3.7 Corporate Governance Variables and Performance ............................................ 32 3.8 Board Size and Firm Performance ..................................................................... 34 3.9 Board Composition and CEO performance ........................................................ 35 3.10 Research Gaps ................................................................................................... 36 3.11 Conceptual Framework ...................................................................................... 39 4.0 CONCLUSIONS AND RECOMMENDATIONS..................................................... 41 REFERENCES ................................................................................................................... 42

vi i

1.0

INTRODUCTION

Kenya has characteristics of board structures and ownership concentration similar to those found in most countries. Ownership for most firms is distributed among institutional investors and retail investors; with ownership concentrated mainly to institutional investors. The ownership can also be categorized into state ownership and public ownership. The type of ownership structure of a firm ultimately affects the board structure categorized in this study as type 1 board, whose members directly own equity shares in the firm; type 2 board, where the board members do not hold any equity shares in the firm whose board they sit on; and type 3 which is a blend between the two extremes, whose some members own equity shares and some do not hold any equity shares. Agency problems have in the recent past become an integral part of the modern-day corporation, owing to the widening separation of ownership and control responsibilities, growing business diversification and segmentation across industries, business lines, and investor emphasis on near-term performance and return outcomes. Financial scandals further lead to the question of whether firms are being run in the best interests of stakeholders. The board of directors and the executive management have the control responsibilities for the firm while the owners may not be able to offer adequate supervision or accountability, particularly in companies with widely dispersed ownership. Agency conflicts (conflicts that arise from the separation of ownership and control) may not be fully resolved effectively through corporate governance systems hence managers may not act to maximise the returns to shareholders unless appropriate governance structures are implemented in the large corporations to safeguard the interests of shareholders (Jensen and Meckling 1976). Agents or managers may not always act in the best interest of shareholders when the control of a company is separate from its ownership. Herbert (1959) (quoted in Baysinger and Hoskisson, 1990) proclaimed that managers might be satisfiers rather than maximisers, that is, they tend to play it safe and seek an acceptable level of growth because they are more concerned with perpetuating their own existence than with maximising the value of the firm to its shareholders. But shareholders delegate decision-making authority to the agent (Board of Directors) with the expectation that the agent will act in their best interest.

One of the most important functions of the corporate governance system in this context is to ensure the quality of the financial reporting process. Board members, acting as agents of owners, are being held increasingly responsible for controlling the actions of management and for evaluating and implementing effective systems of controls. Recent legislation in Kenya and the guidelines on corporate governance issued by Capital Markets Authority for listed firms require boards to have audit committees and a majority of outside directors and consequently have independent directors. In some instances the ideal numbers of these independent directors is mentioned in the various enabling legislations for the Industries. The intent is to limit the ability of management to engage in earnings management and opportunistic behaviour by increasing the ability of both the board and audit committee to monitor management (Farinha, 2003). Encouraging equity ownership among directors is often used to align the interest of directors with those of the owners. Convergence-of-interests theory and the Entrenchment theory try to explain how members of the board of directors, acting as agents for the stockholders, react to owning stock in the firms they serve. A question that keeps on lingering in corporate governance cycles is why in some cases independent directors are not effective monitors (Pergola and Gilbert, 2009). The explanation may be found by examining the power and incentive of board members to perform their fiduciary duties. In this study, the researcher examines literature on firms with diverse ownership structures, and thus different board structures whose directors act as agents of stockholders with emphasis on how the board structure may impact on the monitoring effectiveness. A great deal of attention has been given to understanding how board structure as a variable of corporate governance affects financial performance. Corporate governance can influence a firms financial performance whenever there is an agency conflict among the various relationships in the firm. In the management-shareholder conflict, the agency problem manifests itself in managements self interest. In the controlling-minority shareholder conflict, controlling shareholders use their power to benefit themselves at the expense of the minority shareholders, in what is called expropriation or private benefits of control. The root of both conflicts is the fact that the managers in the first case, and the controlling shareholders in the second case, receive only a portion of the firms earnings, while they fully appropriate the resources diverted. Thus, it is conceivable that, in light of this incentive

structure, insiders will maximize their pecuniary and non-pecuniary utility even when the firm as a whole will not. Corporate-governance mechanisms assure investors in corporations that they will receive adequate returns on their investments (Shleifer and Vishny, 1997). If these mechanisms did not exist or did not function properly, outside investors would not lend to firms or buy their equity securities. Businesses would be forced to rely entirely on their internally generated cash flows and accumulated financial resources to finance ongoing operations as well as profitable investment opportunities. Overall economic performance is likely to suffer because many good investment opportunities would be missed and temporary financial problems at individual firms would spread quickly to other firms, employees, and consumers. Effective corporate governance also assists in the attainment of high level financial performance and market valuation (Klapper & Love, 2004; Rajagopalan & Zhang, 2008). La Porta, Lopez-de-Silanes, Shleifer, and Vishny (2000) argue that emerging economies have traditionally been discounted in financial markets because of their weak governance. 1.1 Statement of the Problem In the recent past attention and interest in corporate governance has grown exponentially especially with the major boardroom tussles and corporate collapses such as Enron and WorldCom in the US and locally Uchumi Supermarkets, East African Portland and CMC. The underlying thesis is that a crisis of governance is basically a crisis of board of directors. The board of directors have been largely criticised for the decline in shareholders wealth and most of these corporate failures. They have been in the spotlight for the fraud cases that had resulted in the failure of major corporations. The need for strong governance is evidenced by the various reforms and standards developed not only at the country level, but also at an international level (e.g., the Sarbanes-Oxley Act in the US, enhanced listing requirements, and the Corporate Governance Code in Kenya). Typically, corporate governance research has focused on developed economies. However, limited research exists on the extent to which the corporate governance issues of developed economies are applicable to emerging economies. Despite the importance of the board in particular and corporate governance in general, it is not clear whether adequate research has been done to establish the relationship between the board structure and financial performance. The study was therefore expected to broaden our

understanding of the impact of corporate governance variables for instance board structure on financial performance. There exists an ongoing debate on the relationship between corporate governance mechanisms and firm performance. Mixed and contradictory results have been made from previous studies especially the ones that were conducted in the developed nations, particularly USA, UK, Japan, Germany and France. More so, few studies have been conducted on the emerging and developing business environment, Kenya included. This study was motivated by a need to understand whether empirical literature exists on how corporate governance and specifically the structure of the board impacts financial performance. The modern corporate are established in different ways and thus different ownership structures which have an impact on the type of board. This study therefore has explored if literature suggests that despite the formation constraints, the board can be structured to be of value to an organisation. The corporate scene is composed of both the public and private sector. Public sector institutions that form a substantial proportion of the corporate world are characterized by Type 2 board. In the public sector the board is mainly appointed by government chiefs while in the private sector the board members are elected from the ownership. This leads to non share ownership by the board members in the public sector begging the question whether the firms are bound to perform poorly, in line with the convergence of interest theory. Performance measurement on the other hand is characterised by measurement difficulties. Although a great deal of research has focused on performance, researchers lament that the field has yielded little by way of conclusive results, often drawing seemingly conflicting findings regarding the determinants of performance. Performance measures are many and varied with some schools of thought advocating for financial performance measures and others for the non financial performance measures. The study reviewed literature on financial performance measures with the objective of determining whether a strong case exists in literature for there adoption.

1.2

Objectives of the Study

The study reviewed literature on the relationship between board structure and financial performance of firms. It was an attempt to determine whether literature exists explaining these relationships. Specifically the study aimed at; 1. Reviewing the theoretical approach within which board structure impacts on financial performance. 2. Providing a critical review of empirical studies undertaken on how corporate governance and specifically the structure of the board impacts financial performance.

1.3 Corporate Governance Corporate governance has gained global upsurge both in academia and the corporate level mainly due to increased demands for better accountability and governance on all sectors of the economy. It is concerned with the processes and structures through which the firm takes measures to protect the interests of the stakeholders. Good corporate governance is centred on the principles of accountability, transparency, fairness and responsibility in the management of the firm. The separation of ownership and control creates the need for corporate governance, which includes mechanisms to ensure prudent decision making and value maximization. Factors like liberalization and globalization have also accentuated the importance of the concept globally. Globalization has a two fold impact on the economy: it increases the accessibility of world market to the Kenyan corporate world; and intensifies the competition in the home market (with multinational firms). This scenario increases the importance of good governance as a factor for survival and competitive advantage (Dwivedi and Jain, 2005). One difference between countries corporate governance systems is the differences in the ownership control and board structures of firms that exist across countries. Corporate governance structures and systems differ significantly across industries and countries. Maher and Anderson (1999) classify corporate governance systems, on the basis of degree of ownership and control and on the basis of controlling shareholders, into the outsider systems and the insider systems. Systems of corporate governance therefore can be distinguished according to the degree of ownership and control and the identity of controlling shareholders. While some systems are characterized by wide dispersed ownership (outsider systems),

others tend to exhibit concentrated ownership of control (Inside systems). In the Outside systems of corporate governance especially in USA and UK, there exist a basic conflict of interest between strong managers and widely dispersed weak shareholders. On the other hand, in Insider systems (notably Germany and Japan), the basic the basic conflict is between controlling shareholders (or blockholders) and weak minority shareholders. Shleifer and Vishny (1997) view corporate governance as a means to make sure that managers activities concentrate on value maximization of the firm. There are several mechanisms like management ownership, corporate control activities, shareholder activism and trading activities which ensure the same. Governance parameters include board size, board structure, CEO duality, frequency of board meetings, directors shareholding, institutional and foreign shareholding, while the fragmentation in shareholding is captured by public shareholding. Research works indicate that there exists a correlation between corporate governance and financial performance; however, it varies across countries based on the national system of corporate governance. A study done by Gedajlovic and Shapiro (1998) found statistically significant differences in the relationship between ownership concentration and firm performance in the context of Canada, France, Germany, the UK, and the US. Thomsen and Pedersen (2000) also found similar results in their study where they took into consideration 12 European countries.

1.4 Ownership Structure Ownership structure is an important aspect of corporate governance systems, as concentrated ownership may improve the chances of effective monitoring. Klein et al. (2005) stated, Presence of dispersed ownership increases expectation of a positive relationship between measures of corporate governance and firm performance, other things being equal. Studies on the relationship between the ownership structure and firm performance dates back to as early as 1932 when Berle and Means (1932) hypothesized that an inverse correlation should be observed between the diffuseness of shareholdings and firm performance. Therefore, management-controlled firms should be less profitable than owner-controlled firms. Chen et al. (2008) conducted their study on all companies listed on the New Zealand

Stock Exchange for the period 2000-03. The results indicate that none of the two measures of ownership structure was found to be statistically significant with regard to firm performance. Thus, the study showed that there is no strong evidence in New Zealand to support the Berle and Meanss hypotheses of which a reverse relationship exists between ownership concentration and firm performance. Dwivedi and Jain (2005) in their study show that the presence of block equity holders positively affects corporate performance and can be explained by arguing on the lines of cost of capital and effective monitoring. The argument on cost of capital reflects that when the ownership structure is concentrated, financial performance tends to decrease due to an increase in the firms cost of capital. Block holders represented on the board of directors may also prove to be effective monitors of the management owing to their power to influence the board s decision-making process (Shleifer and Vishny, 1997).

1.5 Financial Performance Measures Corporate performance is an important concept that relates to the way and manner in which financial resources available to an organization are judiciously used to achieve the overall corporate objective of an organization, it keeps the organization in business and creates a greater prospect for future opportunities. Extant research addressing corporate governance structures and financial performance has relied on accounting- based financial indicators (e.g., Boyd, 1995; Buchholtz and Ribbins, 1994; Finkelstein and DAveni, 1994; Ocasio, 1994), market-based indicators as well as combinations of both (e.g., Hoskisson et al., 1994). Financial accounting measures have been relied on by many studies though frequently criticized. It has been argued, for example, that such measures (1) are subject to manipulation; (2) may systematically undervalue assets; (3) create distortions due to the nature of accounting policies and methods adopted by the firm; and (4) lack standardization in financial reporting as some jurisdictions have not adopted international financial reporting standards. Also, financial accounting returns are difficult to interpret in the case of multi-industry participation by firms (Nayyar, 1992) or where the ownership structures are varied.

Given the various imprecision involved in measuring and interpreting financial accounting indices, perhaps it is not surprising that observers have suggested that such measures may be seen as more fully under management control (Hambrick and Finkelstein, 1995). This is interesting, even unfortunate, as Joskow, Rose, and Shepard (1993) have suggested that accounting returns provide a more convenient benchmark for boards of directors to evaluate CEOs and firm performance. Perhaps one would expect, then, that studies examining the association between CEO compensation and firm performance have found larger relationships with financial accounting returns than market-based returns (e.g., Hambrick and Finkelstein, 1995; Jensen and Murphy, 1990a; Kerr and Bettis, 1987; Joskow et al., 1993). Interestingly, the choice of accounting vs. market-based financial performance indicators is repeatedly at issue in one of the more fundamental of board decisionsCEO compensation. Market-based returns on the other hand have a number of advantages. They do reflect risk adjusted performance; they are not adversely affected by multi-industry or multinational contexts (Nayyar, 1992). The issue may be, however, that market-based performance indicators are often subject to forces beyond managements control (Deckop, 1987; Hambrick and Finkelstein, 1995; Joskow et al., 1993). As there appears to be no consensus regarding the efficacy of reliance on one set of indicators (accounting-based) or another (market-based), many studies have resorted to using a mix of the many financial performance measures.

1.6 Outline of the study The study is structured as follows; section II outlines the theoretical underpinnings of the corporate governance nexus. The theoretical approach within which board structure impacts on financial performance is described in detail. This theoretical approach is based mainly on agency theory by Jensen and Meckling (1976) together with other two competing theories about how board of director members, acting as agents for the stockholders, react to owning stock in the firms they serve. A review of empirical studies undertaken in the area of study is done in section III. A summary of key empirical literature is provided, which includes a review and a critique with the aim of identifying research gaps in the area. Empirical research is critically reviewed and

its consequences analysed. The section reviews the arguments put forward and its subsequent investigation on; how feasible the theory is in the face of the empirical evidence; how successful are the theoretical constructs and how much further are we now in understanding corporate governance and in particular the impact of board structures on financial performance. This will culminate into a conceptual framework for the study. Finally the conclusions and recommendations arising from the study are provided in section IV. In particular, the study conclusions focus on the gaps in literature.

2.0 THEORETICAL REVIEW Scholars and governance practioners both agree that the relationship between board structure and financial performance is more varied and complex than can be covered by any single governance theory (Nicholson & Kiel, 2007). Neither can the general pattern and links between the two variables be explained fully by any single theory (Jackling and Johl, 2009). The practice and theory of strategic management and business policy has however been greatly influenced by agency theory.

2.1 Agency Theory Agency theory explores the contribution to performance directors play through their various roles. This entails an examination of board structure and board leadership in terms of the impact on performance. The principal-agent theory is generally considered as the starting point for any debate on the issue of corporate governance (Coleman and Biekpe, 2006). Indeed, the theoretical underpinnings for most research studies in corporate governance come from the classic thesis, The Modern Corporation and Private Property by Berle & Means (1932). The thesis describes a fundamental agency problem in modern firms where there is separation of ownership and control. It has long been recognized that modern firms suffer from separation of ownership and control as they are run by professional managers (agents), who are unaccountable to dispersed shareholders (principals). This view fits into the principal-agent paradigm. To this end, the fundamental question is how to ensure that managers follow the interests of shareholders in order to reduce cost associated with principal-agent theory? The principals are hence confronted with two main problems: First, they face an adverse selection problem: selecting the most capable managers. Second, they are also confronted with a moral hazard problem: giving the managers the right incentives to put forth the appropriate effort and make decisions aligned with shareholders interests (e.g., take the right amount of risk and do not engage in empire building). Agency theory connotes that owners are principals and the managers are agents. It argues that in the modern corporation, in which there is diverse and widespread share ownership, managerial actions may not likely be those required to maximise shareholder returns. Therefore there always exists an agency loss which is the extent to which returns to the 10

residual claimants, the owners, fall below what they would be if the principals, exercised direct control of the corporation (Jensen and Meckling 1976). Agency theory further tries to specify mechanisms which may reduce agency loss. These include incentive schemes for managers which may comprise of plans whereby employees obtain shares, perhaps at a reduced price, thus aligning their financial interests with those of shareholders (Jensen and Meckling 1976). Other similar schemes are bonus or performance pay which tie executive compensation and levels of benefits to shareholders returns and have part of executive compensation deferred to the future to reward long-run value maximisation of the corporation and deter short-run executive action which harms corporate value. Jensen & Meckling (1976) further define agency relationship and identify agency costs. Agency relationship is a contract under which one or more persons (principal) engage another person (agent) to perform some service on their behalf, which involves delegating some decision-making authority to the agent. Conflict of interests between managers or controlling shareholders, and outside or minority shareholders refer to the tendency that the former may extract perquisites (or perks) out of a firms resources and less interested to pursue new profitable ventures. Agency costs include monitoring expenditures by the principal such as auditing, budgeting, control and compensation systems, bonding expenditures by the agent and residual loss due to divergence of interests between the principal and the agent. The share price that shareholders (principal) pay reflects such agency costs. To increase firm value, one must therefore reduce agency costs. This is one way to view the linkage between corporate governance and corporate performance. Fama (1980) aptly comments that separation of ownership and control can be explained as a result of efficient form of economic organization. Similar to agency theory, the kindred theory of organisational economics is concerned to forestall managerial opportunistic behaviour which includes shirking and indulging in excessive perquisites at the expense of shareholder interests (Williamson 1985). A major structural mechanism to curtail such managerial opportunism is the board of directors. A corporate board is the primary and dominant internal corporate governance mechanism (Brennan, 2006). Board monitors or supervises management, gives strategic guidelines to the management and even may act to review and ratify management proposals (Jonsson, 2005). A board will work to enhance the firm performance due to legally vested responsibilities or

11

due to its fiduciary duty (Zahra and Pearce II, 1989). the board must spot the problems early and must blow the whistle. Despite the fact that the board may play an important role in corporate governance by monitoring the management, the board culture is an important component of board failure (Jensen, 1993). The wave of corporate scandals at Enron, WorldCom and HIH raise the question to what extent the board is able to monitor the management. Geneen (1984) in a study found that among the board of directors of fortune 500 companies, 95% are not doing what they are legally, morally, and ethically supposed to do. It is criticized that (1) the board is a rubber stamp, (2) the board is dominated by CEO, and (3) the board is plagued with the conflicts of interests; board responds to the wishes of controlling shareholders. Therefore, an important question of monitoring the board may arise. That is, who will monitor the monitors? Although it is argued that the shareholders will monitor the board by exercising their ownership right by appointing and removing board members, shareholders may not be aware of the inside activities of the firm. Agency and organisational economics theories predict that when the CEO also holds the dual role of chairman to the board, then there will be managerial opportunism and agency loss as the interests of the owners will be sacrificed to a degree in favour of management. The human nature underlying agency and organisational economics is that of the self-interested actor rationally maximising their own personal economic gain. The man is individualistic and is predicated upon the notion of an in-built conflict of interest between owner and manager. Moreover, an individual will always calculate likely costs and benefits, and thus seeking to attain rewards and avoid punishment, especially financial ones. This is a model of the type called Theory X by organisational psychologists (McGregor 1960 as cited in Donaldson, 1991). There are, however, other models of man which originate in organisational psychology and organisational sociology. Organisational role-holders are conceived as being motivated by a need to achieve, to gain intrinsic satisfaction through successfully performing inherently challenging work, to exercise responsibility and authority, and thereby to gain recognition from peers and bosses (McClelland 1961). Thus, there are non-financial motivators. While agency theorists posit a clear separation of interests between managers and owners at the objective level (Jensen and Meckling 1976), this may be debatable, and organisational 12

sociologists would point out that what motivates individual calculative action by managers is their personal perception (Silverman1970 as cited in Donaldson, 1991). To the degree that an executive feels their future fortunes are bound to their current corporate employers through an expectation of future employment or pension rights, then the individual executive may perceive their interest as aligned with that of the corporation and its owners, even in the absence of any shareholding by that executive. These theoretical considerations give rise to stewardship theory which argues with a view of managerial motivation alternative to agency theory (Donaldson 1991). The executive manager, under this theory, although being an opportunistic shirker, essentially wants to do a good job, to be a good steward of the corporate assets. Thus, stewardship theory holds that there is no inherent, general problem of executive motivation. Given the absence of an inner motivational problem among executives, there is the question of how far executives can achieve the good corporate performance to which they aspire. Thus, stewardship theory holds that performance variations arise from whether the structural situation in which the executive is located facilitates effective action by the executive. The issue becomes whether or not the organisation structure helps the executive to formulate and implement plans for high corporate performance (Donaldson 1991). Structures will be facilitative of this goal to the extent that they provide clear, consistent role expectations and authorise and empower senior management. Jensen & Meckling (1976) integrates elements from the theory of agency, the theory of property rights and the theory of finance to develop a theory of the ownership structure of the firm. They show the relationship of agency costs to the separation and control issue, and investigate the nature of the agency costs generated by the existence of debt and outside equity. They conclude that agency costs are as real as any other costs due to separation of ownership and control. The level of agency costs depends among other things on statutory and common law and human ingenuity in devising contracts. Both the law and the sophistication of contracts relevant to the modern corporation are the products of a historical process in which there were strong incentives for individuals to minimize agency costs. Related to agency theory is also the resource-dependency theory which posits that the board of directors play an important role in the firm and can create value addition for the firm. This is expounded in the resource-dependency theory (Pfeffer and Salancik 1978), which 13

maintains that boards serve four fundamental roles: providing advice, building legitimacy, strategic oversight, and stakeholder management. An organizations survival prospects are enhanced by these activities as they lead to the acquisition of key resources (Johnson et al. 1996). As the organization relies on the external environment, the board must assist in both managing and forming bridges with relevant outside entities 2.2 Competing Theories Agency conflict can be resolved by encouraging stock ownership among directors so as to align the interest of directors with those of the shareholders. There are two competing theories about how board of directors, acting as agents for the stockholders, react to owning stock in the firms they serve. 2.2.1 Convergence-of-interests Theory Convergence-of-interests theory, posits that when board members have no share ownership, they are self-oriented but they have little power to overcome corporate controls designed to align their actions for the benefit of the stockholders. The corporate governance mechanism in this case includes the existence of independent board members who could influence the managers on the board, which has been shown to result in less fraud and earnings manipulation (Beasley et al., 2000; Klein, 2002a). As stock ownership rises, board members automatically and gradually align their interest with the stockholders leading to better quality decisions that increase the value of the firm (Jensen and Meckling, 1976; Beasley, 1996). Theoretically, as even small increments of stock ownership occur, the interests of the manager incrementally become more aligned with the interests of the stockholders. Increased quality of decision making results in better alignment of actual cash flows with profits, that is, increased earnings quality. As managers interests become more aligned with stockholders interest, managers become increasingly more conscientious, are involved in fewer fraud activities, and would feel less motivated to intentionally manipulate earnings to make performance appear better than it actually is. Ultimately, when they own all the stock, they act as sole proprietors; any action they take against the firms interest only hurts them. At this extreme, no governance mechanisms would be needed. If the convergence-of-interests theory is true, the best strategy for firms is to encourage (or require) stock ownership by managers and board members. Compensation packages that include stock options or awards of free shares and restrictions that delay the ability to sell these shares are designed to

14

gradually build ownership. Fewer governance controls would be needed as stock ownership increases (Pergola & Joseph, 2011) 2.2.2 Entrenchment Theory Morck et al. (1988) in contrast to convergence-of-interest theory argue that there is a negative relationship between board equity ownership and corporate performance. They developed the entrenchment theory, which opines that higher levels of ownership lower the corporate performance. The logic followed is that managers with high equity ownership levels focus more on maximizing market share and technological leadership rather than maximizing profits. Directors shareholding also has a negative impact on firm value (Dwivedi and Jain, 2005). A study conducted by Perrini, Rossi and Rovetta (2008) probed into two aspects of the ownership structure: first, the percentages owned by the top five shareholders (ownership concentration) and the second, managerial shareholding pattern to check its effect on firm performance. Managerial ownership was taken as the shares owned by the members of the corporate board, the CEO and the top management. The findings revealed that the ownership concentration (of the five largest shareholders) showed a positive effect on Tobins Q, while managerial ownership has a negative effect on the valuation in concentrated (ownership) companies. Anderson and Reeb (2003), in their study in the US, came up with an interesting conclusion that the family firms perform better than the non-family firms. The entrenchment theory has similar conclusions about managers and directors at extremely low and extremely high levels of equity ownership. At low ownership levels their interests are not aligned with the stockholders, but they possess so little stock that they have no power to subvert governance mechanisms. At high stock ownership levels, the managers or directors are the stockholders and inappropriate actions would only hurt themselves. It is the middle range of the graph that differs. When managers or board directors obtain relatively large stock ownership (but not extreme ownership levels that would align their interests with those of the stockholders) they may possess sufficient power to overcome governance mechanisms (Fama and Jensen, 1983). This would allow managers to act in their own self interests with little fear of removal or sanctions; they would have become entrenched . Previous studies have indicated that

15

entrenchment can occur at relatively low levels of absolute stock ownership (Morck et al., 1988). If the entrenchment range exists, it should be reflected in poor earnings quality. Poor earnings quality means that managers intentionally manipulate earnings, shirk and make poor accrual decisions, or conduct fraud activities that would also adversely affect earnings. All such activities result in actual cash flows being different from what profits project that cash flows should be. If the entrenchment theory is true, one strategy for firms might be to build stock ownership in managers and board members, but increase governance mechanisms within the entrenchment range. Thus, it becomes important to know where the thresholds into and out of the entrenchment range exist and whether governance mechanisms are able to overcome entrenchment.

16

3.0

EMPIRICAL REVIEW

3.1 Introduction Corporate Governance is arguably one of the most significant subjects in modern finance theory. This is reflected not only in the formal recognition that it has received in recent years but also in the attention that it has continued to receive from researchers for over four decades now. Although the majority of theories of corporate governance are in agreement about explaining the agency problem and resolutions, the empirical research has been handicapped by the unobservability of some key variables. This section provides a review of empirical studies undertaken in the area of study. A summary of key empirical literature is provided, which includes a review and a critique with the aim of identifying research gaps in the area. The section reviews the arguments put forward and its subsequent investigation on; how feasible the theory is in the face of the empirical evidence; how successful are the theoretical constructs and how much further are we now in understanding corporate governance and in particular the impact of board structures on financial performance. 3.2 Corporate Governance and Financial Performance In an important and often-cited paper, Gompers, Ishii, and Metrick (GIM, 2003) study the impact of corporate governance on firm performance during the 1990s. They studied US firms that went through mergers and acquisitions to examine the effect of governance provisions on forced CEO turnover following value-reducing acquisitions. GIM, 2003 modelled a governance index which was used to analyse the impact of various board structure variables on performance. They concluded that stock returns of firms with strong shareholder rights outperform, on a risk-adjusted basis, returns of firms with weak shareholder rights by 8.5 percent per year during this decade. On the policy domain, corporate governance proponents have prominently cited this result as evidence that good governance (as measured by GIM) has a positive impact on corporate performance. Their results showed that managers of firms with staggered boards are less likely to be replaced by the takeover market than are managers of firms with annually-elected boards. Combined with the evidence that CEOs of firms with staggered boards are more likely to pursue value-reducing acquisitions, this finding is consistent with the notion that managers can use staggered board structure to pursue their self interests and to facilitate

17

managerial entrenchment. However, the aggregate indices of governance provisions are not significantly related to force CEO turnover suggesting that they do not measure entrenchment effectively. Although GIM, 2003 reviews board structure their study is limited by the fact that an important aspect of board structure classified as the three board types in this study are ignored. In Kenya a study by Kihara, (2006) on the relationship between ownership structure, governance structure and performance of firms listed at the NSE concluded that privately owned enterprises had better governance structures which further improved their performance compared to state corporations. His study however was limited to one aspect of corporate governance that is the governance structure and looked at ownership structures from the point of view of whether a firm is state or private owned. Other research studies done on corporate governance and firm performance in Kenya include a study by Jebet (2001) in which she set to determine the existing corporate governance structures in publicly quoted companies in Kenya. Her findings were that most listed firms had both executive and non executive directors as the supreme control body assisted by various committees. Others include: Mululu (2005), who studied the relationship between board activity and firm performance and concluded that those firms with active boards performed better than those with inactive boards. Mululu (2005), study found out that the frequency of board meetings is related to the number of corporate governance variables, such as the board size, the number of executive directors, number of total shares held by the largest shareholders, the number of shares held by unaffiliated block holders, the number of percentage of shares held by officers and directors and the number of other directorship held by outside directors. From the study there was evidence that the number of board meetings decrease with the board size. 3.3 Board Structure and Financial Performance Does the structure of a board of directors influence firm performance, or does firm performance influence the structure of the board? There has been indications that both forces may be at work simultaneously, implying that financial performance and board of director structure are endogenously determined. Prior research on the relation between board structure and financial performance has yielded mixed results (Dalton, Daily, Ellstrand & Johnson (1998).

18

The impact of board structure on financial performance is not very clear. This may be due to the fact that board of director structure and financial performance are endogenously determined and that due to fixed board terms and periodic financial reporting, the relation may be intertemporal. Dalton, Daily, Ellstrand & Johnson (1998) find no overall support for the hypothesis that board composition significantly influences financial performance. Although prior research addressing issues of board governance has often relied on board structure as a variable, the measurement of board composition structure has not been uniform. Prior studies have agreed that the key issue is the extent to which there exists independence between the members of a firm's board and its CEO. Several approaches have been used to capture this perspective. One considers the ratio of inside directors to total directors (e.g., Baysinger, Kosnik, & Turk, 1991; Goodstein & Boeker, 1991), mainly because of the recognition that few officers of a firm will be independent of its CEO. Other approaches focus on the ratio of outside directors to total directors. Due to the fact that various researchers have defined outside board members differently, the second ratio is not necessarily the complement of the first. Some authors have defined an outside director as one who is not in the direct employment of the firm on whose board he or she sits (e.g., Kesner & Johnson, 1990; Kesner, Victor, & Lamont, 1986; Singh & Harianto, 1989). However, others have relied on the independent-interdependent distinction made by Wade, O'Reilly, and Chandratat (1990) and Boeker (1992). Independent directors are outside directors who were appointed to a board prior to a current CEO's appointment. Interdependent directors are either inside board members or outside directors appointed by the current CEO. Another approach (e.g., Boeker & Coodstein, 1993; Cochran, Wood, & Jones, 1985; Johnson et al.,1993; Pearce & Zahra, 1991) largely captures the distinction provided by the Securities and Exchange Commission's (SEC's) regulation 14A, item 6b, which sets forth the conditions under which directors' affiliation with a firm must be disclosed in proxy materials Wallace et.al, 2004 developed a theory of intertemporal endogeneity of board composition and financial performance using data from US mutual funds. The results indicate only minimal evidence of intertemporal endogeneity. The evidence that board composition influences financial performance is not very strong and depends on the definitions of financial performance and board composition as well as the type of statistical model 19

employed. They do find somewhat stronger evidence that prior financial performance impacts board composition, but the relation still depends on how board composition is defined. The methodology used in the study is causality tests in panel regressions with three years of data for 130 closed-end mutual funds. The study is limited to the mutual fund industry and thus the findings may not have general applicability. Wallace et.al, 2004 propose a theory that the relation between board composition and financial performance is both endogenous and intertemporal. Inter-temporal endogeneity predicts that financial performance in one period will impact board composition in a later period which in turn influences financial performance in subsequent periods. Financial performance is defined in the study using three different ways, objective-adjusted return on assets, an average of 12 month-end premium/discount ratios, and Jensens (1968) alpha. On the other had board of director composition is also defined in three ways: by percentage of outside directors, by percentage of independent directors plus fund family directors, and by percentage of independent directors. The results are sensitive to the definition of board composition. The significant causal impact of financial performance on board composition is strongest for all measures of financial performance when we measure board composition as percentage of all outside directors, that is when we include affiliated, fund family, and independent directors. The results become insignificant for all three measures of performance when we measure board composition as only independent directors. Wallace et.al, 2004 study however focuses on closed-end mutual funds only the research ought to have been directed at other industries to know if the results can be generalized to other types of companies. In addition, intertemporal endogeneity may apply to other issues as well. For example, Dalton, Daily, Johnson, & Ellstrand (1999) find a positive relation between board size and performance in meta-analysis of 131 samples. Yet others, such as Yermack (1996) find that smaller boards produce better results. Further there is need to redirect the research focus on boards and performance. The relationship between board structure and financial performance has been the moststudied aspect among all board investigations (Bhagat & Black, 1999). Most studies have focused on two areas of board structure which are CEO-chairman duality and insider/outsider directors (Zahra & Pearce, 1989). Under CEO-chairman duality, the CEO of a company plays the dual role of chairman of the board of directors. Several researchers argue that CEO-

20

chairman duality is detrimental to companies as the same person will be marking his "own examination papers". Separation of duties will lead to avoidance of CEO entrenchment; increase of board monitoring effectiveness; availability of board chairman to advise the CEO; and establishment of independence between board of directors and corporate management (Baysinger & Hoskisson, 1990; Fama & Jensen, 1983; Rechner & Dalton, 1991). Opposing views believe that since the CEO and chairman is the same person, the company will; achieve strong, unambiguous leadership; achieve internal efficiencies through unity of command; eliminate potential for conflict between CEO and board chair; and avoid confusion of having two public spokespersons addressing firm stakeholders (Davis, Schoorman & Donaldson, 1997; Donaldson & Davis, 1991). A closer look at the empirical evidence reveals that the relationship between CEO-chairman duality and company performance is mixed and inconclusive. See Table 1 for a list of some of these studies. Table 1: Relationship between CEO-Chairman Duality and Company Performance Study (Year) Dimension Performance Sample Major Findings Indicators Change in value of common Independent CEO-chairman stock was positively related with Dividend Fortune 200 firms ROI growth No relationship with other Stock price indicators growth ROI 21pairs No relationship with Firm bankruptcy (successful/failing financial performance ) of retail firms ROE Independant CEO-chairman 250 Fortune 500 ROI was positively related with firms Profit margin financial performance Dual CEO-chairman was 337 U.S. firms ROE positively related with from S&P financial performance ROA No relationship with ROE Inc. 100 firms financial performance P/E ratio ROA No relationship with ROE 186 small firms financial performance P/E ratio 21

CEO1.Berg & chairman Smith (1978) duality

CEO2.Chaganti et chairman al. (1985) duality 3. Rechner & CEODalton chairman (1991) duality 4. Donaldson CEO& Davis chairman (1991) duality 5. Daily & CEODalton chairman (1992) duality 6.Daily & CEODalton chairman (1993) duality

7. Daily & CEODalton chairman (1994) duality 8. Daily & CEODalton chairman (1995) duality 9.Boyd (1995) CEOchairman duality CEOchairman duality

10.Ong (1999)

Independent CEO-chairman 183 Inc. firms and ROA was positively related with small corporations financial performance Independant CEO-chairman Firm bankruptcy 214 firms was positively related with bankruptcy Dual CEO-chairman was positively related with ROI 192 U.S. firms financial performance in high complexity environments Sales Net profit before 377 Singapore No relationship with tax firms financial performance ROI ROS

Source: Chin and Tai (2002) The second most-studied dimension of board structure is the proposition of outside-inside directors. Some researchers argue that outsiders are likely to show more objectivity in their deliberations and are willing to consider diverse groups in making their decisions (Jones & Goldberg, 1982; Spencer, 1983). Other theorists in contrast noted that outside directors do not have the requisite time and expertise to do their job well. Some claim that since outside directors are chosen and retained by the CEO, they function and rely heavily on information provided by the CEO (Geneen, 1984; Vance, 1983). A list of key studies which relates outside-insider directors to company performance is shown in Table 2. Again, the conclusions are equivocal.

22

Table 2: Relationship between Inside-Outside Directors and Company Performances Study (Year) Dimension Performance Indicators Sample Major Findings

Insiders' representation major 1.Vance was positively firms (1995) associated with financial performance Net income Insiders were 2.Vance Insiders vs 103 major industrial Sales conducive to effective (1995) duality firms (1925-1963) Owners' equity financial performance Long-term debt 3.Schmidt Insiders vs 80 chemical companies No relationship with Dividends (1975) duality (1962-1963) financial performance Current ratio Operating income Insiders' ratio was Insiders' Sales 4.Cochran et 406 Fortune 500 in positively associated representatio ROE al. (1985) 1982 with financial n ROA performance Excess value ratio Companies achieved 5.Baysinger 266 major corporations higher performance did & Butler Outsiders ROE in 1970 and 1980 so without having a (1985) majority of outsiders 21 pairs 6.Caganti et No relationship with Outsiders Firm bankruptcy (successful/failing) of al. (1985) financial performance retail firms Profit margin Proportion of ROE 250 of 1983 Fortune 7.Kesner No relationship with insiders on ROA 500 companies in 27 (1987) financial performance board EPS industries Stock price ROE 8.Zahra & Profit margin on Outsiders' ratio was not Outsiders' 100 Fortune 500 1980Stanton sales associated with ratio 1983 (1988) EPS financial performance DPS Negative relationship 9.Agrawal & Performance 400 large Forbes 800, between number of Knoeber Outsiders index 1987 outside directors and (1996) financial performance Net income 200 Insiders vs Sales manufacturing Outsiders Owners' equity (1925-1950) Source: Chin and Tai (2002) Various reasons have been put forth for the mixed relationship between board structure and board performance. Firstly, there is no consensus as to which structure leads to what level of performance (Johnson, Daily & Ellstrand, 1996; Zahra & Pearce, 1989). Dalton and Daily 23

(1999) noted that in spite of several decades of research designed to link the relationship between board structure and company performance, results have been described as "vexing", "contradictory", "mixed" and "inconsistent". Dalton and Daily (1999) used a meta-analysis of more than 40 years of data from 159 studies to conclude that there is no evidence of a substantive relationship between board structure and financial performance, regardless of the type of performance measures, size of firm or the manner board composition is defined. Dalton and Daily also queried why there should be a relationship between board structure and firm performance in the first place. For example, they noted that while board independence is a legitimate concern, it should not be the only concern. Adding further, a board could be completely independent and at the same time, does badly in its expertise/counsel and service roles. Alternatively, in a board with a majority of inside directors, the directors may fail in its control and monitoring roles. Johnson, Daily and Ellstrand (1996) also shared the above sentiments. They argued that the relationship between board structure and financial performance might not exist at all. Or, if there is a relationship, their magnitude may not be of practical significance. Kesner and Johnson (1990) suggested that under normal circumstances, the board is probably not an important, direct determinant of firm performance. The reason is that boards are not involved in daily decision-making. 3.4 Board Composition and Firm Performance Researchers such as Lorsch and MacIver (1989); Mizruchi (1983); Zahra and Pearce (1989) generally agree that effective boards consist of greater proportions of outside directors. Ezzamel and Watson (1993) find that outside directors are positively associated with profitability among a sample of U.K. firms. In a similar study of 266 U.S. corporations, Baysinger and Butler (1985) report that firms with more outside board members realize higher return on equity. Several other researchers have also reported a positive relationship between outside director representation and firm performance (Pearce and Zahra, 1992; Rosenstein and Wyatt, 1990; Schellenger et al., 1989). Rosenstein and Wyatt (1990) used CRSP financial data and announcements of outside board appointments from the Wall Street Journal and found out that announcements of appointment of an outside director are associated with increase in shareholder wealth. The positive relationship between board composition and shareholder wealth has been corroborated by 24

Brickley et al. (1994) who find a statistically significant, positive relation between the stockmarket reaction to the adoption of poison pills and the fraction of outside directors, a finding consistent with the hypothesis that outside directors represent shareholder interests. Arosa et al. (2010) find that the presence of independents on the board of a non-listed family firm has a positive effect on performance when the firm is run by the first generation. However, no effect on performance is seen when the firm is run by the second and subsequent generations. Two theoretical perspectives underpin the penchant for outside directors. The resource dependence school of thought spearheaded by writers such as Burt (1983 views outside directors as a critical link to the external environment of the firm. Such board members, according to the theory, may provide access to valued resources and information especially in times of adversity (Daily and Dalton, 1994a, 1994b; Sutton and Callahan, 1987). Another theory which justifies the proclivity for outsider-dominated boards is agency theory (Eisenhardt, 1989, and Jensen and Meckling, 1976). Agency theory argues that due to the separation of ownership and control in modern organizations which creates information asymmetry between corporate owners and managers, the latter are likely to exploit the amount and quality of the information they have to their advantage by engaging in selfserving ventures that are injurious to the interest of the former. One of the primary duties of the board of directors is to serve as the monitoring agent for shareholders to check the behaviour of corporate managers (Fleischer et al., 1988; and Waldo, 1985). Therefore, having an insider-dominated board of directors is likely to exacerbate the situation as the boards role as a monitoring agent of shareholders will be curtailed, paving way for managers to harm shareholders wealth. Consequently, agency theory argues that effective boards will consist of outside directors. Notwithstanding the growing interest in outsider-dominated boards, there are studies that do not offer logical basis for such boards. Studies by Chaganti et al. (1985); Daily and Dalton (1992), (1993); and Zahra and Stanton (1988) have found no relationship between board composition and firm performance. Fosberg (1989) is not able to confirm the hypothesis that the presence of outside directors enhances firm performance by its effective discipline of corporate managers. Fosberg argues that the insignificant relationship between the presence of outside directors and firm performance could be explained by the possibility of management of the firms manipulating to get incapable or unwilling to-properly-discipline25

management directors on the board or other controlling mechanisms such as markets for corporate control effectively motivate and discipline management, thus, rendering stale the monitoring role of outside directors. Stewardship theory which argues that managers are inherently trustworthy and are not susceptible to misappropriate corporate resources (Donaldson, 1990; Donaldson and Davis, 1991, 1994; and Pieper et al., 2008) also explains the significance of insider directors. Indeed, Donaldson and Davis (1994: 159) suggest that managers are good stewards of the corporation and diligently work to attain high levels of corporate profit and shareholder returns. According to stewardship theory the main role of the board of directors is to advise and support management rather than to discipline and monitor, a view which is diametrically opposed to the agency theory. The theory asserts that relationship between board independence and firm performance potentially exists due to the counsel and advice that outside directors offer, rather than their monitoring and control activities (Anderson & Reeb, 2004). In congruence with stewardship theory, some studies have found that inside directors are associated with higher firm performance. In a study of Fortune 500 corporations, Kesner (1987) find a positive and significant relationship between the proportion of inside directors and returns to investors. Vance (1978) has also reported a positive association between inside directors and firm performance.

3.5 Ownership Structure, Corporate governance and Financial Performance Firms in transition economies are characterized by high degree of ownership concentration. Empirical studies suggest that ownership concentration is related to firms corporate governance, financing and investment policies. In a sample of firms from 27 mostly developing and transition economies, Durnev and Kim (2005) found a positive association between ownership concentration and corporate governance. Guriev et al (2003) found a similar effect for Russia. Filatotchev et al. (2001) show on a sample of Russian firms that ownership concentration is negatively related to investment. Filatotchev et al. (2007) demonstrate for a sample of Hungarian and Polish firms a hump-shaped relationship between ownership concentration and the managements expectations of relying on public equity finance.

26

A number of studies such as Demsetz (1983), Demsetz and Lehn (1985), Shleifer and Vishny (1986) Morck et al. (1988), La Porta et al. (1998, 1999), Holderness and Seehan (1988) among others, suggest that Berle and Means (1932) model of widely dispersed corporate ownership is not common, even in developed countries. In fact, large shareholders such as family are common in public traded firms around the world (La Porta et al. 1999; Burkart et al., 2003). Anderson and Reeb (2003) show that one-third of S&P 500 firms are family controlled. In Western Europe, the majority of public held firms remain family-controlled (La Porta et al., 1999; Faccio and Lang, 2002; Maury, 2006). Such controlling families often hold large equity stakes and frequently have executive representation (Holderness et al., 1999; Burkart et al., 2003). Shleifer and Vishny, 1997 suggest that ownership concentration creates a trade-off between incentive alignment and entrenchment effects. In this context, the question of whether a family ownership hinders or facilitates firm performance becomes an empirical issue that is related to institutional and politico-regulatory factors (Anderson and Reeb, 2003). According to financial theories, individual investors tend to maintain diversified portfolios, such that they have only a small stake in any one firm and few incentives to monitor the firms managers, a situation that causes principal-agent conflicts (Berle & Means, 1932; Fama, 1980; Jensen & Meckling, 1976). By contrast, institutional investors, such as pension funds, mutual funds, and corporations usually have a greater stake in individual firms, thus increasing their incentives to monitor the managers of such firms (Connelly et al., 2010; Tihanyi, Johnson, Hoskisson, & Hitt, 2003). Therefore, when principal-agency conflicts are a significant problem, institutional ownership can improve monitoring of firm managers, thus mitigating IPO under pricing. However, in emerging economies, market institutions such as pension funds and mutual funds are inactive in equity markets (La Porta et al., 1999). For instance, mutual funds that invested in equity account for only 3.2 per cent of the total stock market in Taiwan, as compared to 24.5 per cent in the United States (Khorana, Servaes, & Tufano, 2005). In Taiwan and other emerging economies, most institutional ownership consists of crossholdings among affiliated firms within business groups. Ownership by other corporations accounts for approximately 30 per cent of the total equities of firms in Taiwan (individuals 27

hold about 50 per cent of total equities). Cross-holdings within business groups make it difficult for minority shareholders to determine where control resides, let alone to monitor it (Young et al., 2008). Complicated cross-holdings also make it difficult for minority shareholders to identify unethical transactions among these firms (La Porta et al., 1999). Olga et.al (2008) analyzes interrelations between ownership structures, corporate governance and investment in three transition countries: Russia, Ukraine and Kyrgyzstan. In contrast to most empirical papers on corporate governance, they study companies with very little exposure to public financial markets. The empirical analysis is based on two years of data obtained through large-scale surveys of firms. Ukrainian companies appear to have the best corporate governance practices, while Russian companies the worst. They find that the relationship between ownership concentration and corporate governance is non-linear. In Russia, the relationship between the share of the largest non-state shareholder and corporate governance is either positive or insignificant when the blockholders stake is below certain threshold; however, a further increase in the blockholder share is associated with worsening corporate governance. They find a similar effect in Ukraine, but only for managerial ownership. In both countries, corporate governance improves as the combined share of small shareholders grows. No robust effects of the ownership structure are found for Kyrgyz firms. The results indicate that there is no link between the quality of corporate governance and either the need for outside finance or actual investments financed with outside funds in any of the three countries. A number of approaches have been employed within the literature to shed light on the existence of agency costs within corporations and the attributes that aid in mitigating such undesirable costs. Firstly, there is a stream of research evaluating the association between different agency-mitigating mechanisms and interpreting from this the agency cost consequences and the attributes that impact prominently on agency costs. Early studies in this regard include Jensen et al. (1992) which identified an interrelationship between levels of inside ownership, leverage and dividend payout, with inside ownership negatively impacting on debt and dividend levels. This suggests that inside ownership and financing policy (leverage and dividend payout) are substitute mechanisms in potentially reducing agency costs.

28

Similar conclusions are drawn by Mohd, Perry and Rimbey (1995) who find that inside ownership and leverage negatively impact on dividend payout ratios, and that higher institutional investment significantly increases payout ratios, suggesting that firm dividend policy is determined in a manner consistent with minimizing agency-related costs. Agrawal and Knoeber (1996) provide some evidence of interrelationships between alternative agency mechanisms, including leverage use, insider ownership, institutional ownership, the existence of block holders and takeover market activity, and Crutchley et al. (1999) provide evidence of simultaneity between various agency-control mechanisms and support for institutional ownership substituting for other attributes mitigating agency costs. The second approach taken in the empirical literature has been the evaluation of the association between agency control mechanisms and firm performance outcomes, with positive performance effects of agency attributes intimated through their contribution to lowering agency costs. Although this strain has spurned extensive research, substantial inconsistency is observed across studies evaluating the impact of individual agencycontrolling mechanisms on firm performance. Potential governance related attributes that have been evaluated in this context include the size of the board of directors (Jensen, 1993 and Yermack 1996), the composition of the board of directors (Hermalin and Weisbach, 1991 and Agrawal Yermack 1996), CEO and board chairperson duality (Daily, Ellstrand and Johnson, 1998; and Dedman and Lin, 2002), board committee formation and independence (Klein, 1998 and Brown and Caylor, 2006), and managerial remuneration and compensation structure (Yermack, 1995 and Shleifer and Vishny, 1997). There has also been significant investigation into the role of shareholding influences on firm performance, with Morck et al. (1988), McConnell and Servaes (1990), Hermalin and Weisbach (1991), providing evidence of a statistically significant non-linear relationship between managerial ownership and firm performance, and McConnell and Servaes (1990) identifying positive relationships between performance and levels of institutional and large external ownership respectively. Contrasting with these results however, Demetz and Villalonga (2001) in relation to managerial ownership, and Morck et al. (1988) evaluating institutional ownership identified no statistically significant performance impacts.

29

Given the inconsistent findings based on the examination of individual attributes, increasing focus has been placed on considering the overall governance or agency structure of firms, using measures such as shareholder rights or takeover vulnerability indices. This approach relates to the expectation that firms offering lower protection for shareholder claims, those with poorer governance practices or firms that are increasingly immune to takeover threat are more likely to experience agency and managerial entrenchment problems leading to incurrence of agency costs and lower relative performance. The evidence in this regard is much more conclusive, with La Porta, Lopezde-silanes, Shleifer and Vishny (1998) and (2000), Black (2001), Gompers, Ishii and Metrick (2003) and Klapper and Love (2004), all finding a positive association between measures representative of superior corporate governance quality, stronger shareholder rights or increased takeover vulnerability and firm performance. The final relevant subset of literature, involves those studies that have directly attempted to measure (or proxy for) the level of agency costs inherent in firms, and then evaluated the factors that significantly impact on the variation in firm agency costs within cross-sectional or longitudinal sample constructs. Ang et al. (2000) applied this method to a sample of nonlisted US small businesses based on measuring agency costs, using operating expense and asset turnover ratios, relative to a zero-agency cost base firm represented by a 100% ownermanager firm. Agency costs were found to be negatively related to the managers ownership interest and the extent of external bank monitoring and positively related to the number of shareholders and the existence of an outside (non owner) manager. Fleming, Heaney and McCosker (2005) identified similar results in an analysis of non-listed Australian firms. Singh and Davidson III (2003) found that larger managerial ownership and smaller-sized boards both enhance asset utilization ratios for larger listed US companies. Doukas et al. (2000) examined agency cost determinants for listed US firms and concluded that greater analyst following generally reduces agency costs, but its effect is more prominent for single-segment as opposed to diversified firms. They also provided evidence of non-linear relationships between inside ownership and leverage and the level of agency costs, whereas agency costs are found to be positively associated with the level of institutional ownership. In a similar study of listed UK firms, Doukas et al. (2005) find that greater analyst following only reduces agency costs for small firms.

30