Escolar Documentos

Profissional Documentos

Cultura Documentos

Internship PropoInternship Proposal On Deposit Mobilization of National Bank LTD Dhanmondi

Enviado por

sourav4730Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Internship PropoInternship Proposal On Deposit Mobilization of National Bank LTD Dhanmondi

Enviado por

sourav4730Direitos autorais:

Formatos disponíveis

Internship Proposal On

Deposit Mobilization of National Bank Ltd Dhanmondi Branch: Problems, Prospects and Suggestions

Submitted to: Mrs. Afia Akter Assistant Professor in Finance Department of Business Administration Northern University Bangladesh

Prepared By Sakhawat Bhuiyan ID:BBA 090303257 Email: Sam09257@yahoo.com

Introduction:

ational Bank Limited is regarded as the pioneer in the private sector banking of Bangladesh. National Bank started its journey with the noble vision of diversifying banking activities into different activities of client service. The bank is also committed to fulfill its responsibilities to the society and the country. National Bank Limited has its prosperous past, glorious present, prospective future and under processing projects and activities. Established as the first private sector Bank fully owned by Bangladeshi entrepreneurs, NBL has been flourishing as the largest private sector Bank with the passage of time after facing many stress and strain. Moreover, considering its forth-coming future the infrastructure of the Bank has been rearranging. The expectation of all class businessman, entrepreneurs and general public is much more to NBL. Several dynamic entrepreneurs came forward for establishing a bank with a motto to revitalize the economy of the country. National Bank Limited was born as the first hundred percent Bangladeshi owned Bank in the private sector. From the very inception it is the firm determination of National Bank Limited to play a vital role in the national economy. President of the People's Republic of Bangladesh Justice Ahsanuddin Chowdhury inaugurated the bank formally on March 28, 1983 but the first branch at 48, Dilkusha Commercial Area, Dhaka started functioning on March 23, 1983. The 2nd Branch was opened on 11th May 1983 at Khatungonj, Chittagong. Today they have total 76 Branches all over Bangladesh.

Problem Statement:

Banking Industry is one of the most promising industries of our country. The importance of the sector revealed though its contribution in the economic growth of the country. This sector accelerates economic growth though mobilizing funds from surplus unit to the deficit unit. Banking Industry is moving towards rapid changes due to technological innovation and diversified need of its customers. People and govt. itself are very much dependent on the effective and efficient services provided by the banks in the financial markets of the country. Commercial banks act as financial intermediaries by performing the functions of mobilizing the funds and utilizing them in the proper way. In Bangladesh, one common problem is the fact that the cost of funds is very high in the country because of high transaction and ledger cost and limitation in the structure. Sources of funds are also very limited. Competition is intense for

funds in the country. Combining all these issues, financial environment is tough to operate in Bangladesh. National Bank Ltd is a private commercial bank and which has strong contribution in Bangladesh economic growth. Though National Bank Ltd. Is running its business successfully the Bank also has some problems.

Objective of the Study: Main Objective

o To explore the deposit mobilization activities: Problems, Prospects and Suggestions of National Bank Ltd Dhanmondi Branch.

Supporting Objectives

o To know the deposit rate of National Bank Ltd of Dhanmondi Branch. o To know the products offer by National Bank Ltd. o To have practical orientation of the job market. o To identify the problems of National Bank Ltd.

Significance of the study:

This study is conducted to give an overview of National Bank Ltd. & mainly deals with Deposit Mobilization activities of this bank. This study will help a lot who want to acquire an orientation about banking. As well as bank will get some valuable information from this report that will help them to compare and evaluate their performance to the other bank. Bank management will also able to use the information for their decision making.

Methodology:

This report has been prepared on the basis of experience gathered during the period of internship. This study would require collection of primary as well as secondary data. But especially emphasizes on primary data. Both quantitative & qualitative research methods will be adopted to collect primary data.

Sample of the study

40 customers are here considered as sample of the study. Out of which 30 customers are chosen from depositors and 10 customers are chosen from borrowers. We assumed these customers would represent the whole customers of National Bank Ltd.

Sample Design

A non-probability sampling procedure was used for this report because customers were very busy. The judgmental sampling procedure was used here to select the sample units who could allow them to respond to the questioners.

Sampling Techniques

The study has been conducted by using a non-probability sampling techniques.

Source of information:

The sources refer to the origin from where we have collected all information. The reliability of the report depends on the source of information. Both primary & secondary source of the report writing is discussed below.

The Primary Sources

o For collecting primary data, I had to ask the respective officer(s). Others are like o o o o Direct communication with the clients Exposure on different desk of the bank Interviewing the banks officials Observation of banking activities

o Questionnaire survey

The secondary sources

o Annual Report of National Bank Ltd.; o Publications obtained from web site of the bank. o Different publications regarding banking functions and credit policies.

Scope of the study:

The National Bank Limited is one of the leading Banks in Bangladesh. The scope of the study is quite wide as this report has covered the banking activities that Dhanmondi branch performs such as account opening, cash, clearing or transfer transaction, advance or loan, export and import and so on. Moreover some emphasis is given is on Deposit Mobilization activities of NBL Dhanmondi branch .After getting knowledge about these activities an analysis is made on the findings.

Limitations of the study:

Although I have got the full co-operation from employees, clients officers of NBL I have faced some difficulties. These are as followso

Limitation of time was a major constraint in making a complete study, due to time limitation.

It was too limited to cover all the banking area. Many aspects could not be discussed in the present study.

Lack of comprehension of the respondents was the major problem that created a lot of confusion regarding verification of conceptual question. Another limitation of this report is Banks policy of not disclosing some data and information for obvious reason, which could be very much useful.

As being an intern, it also created some problems as I was unable to acquire hands-onexperience in all the departments, due to the banks policy of maintaining secrecy and also because I did not get the opportunity in all the departments.

Budget of the study: Financial Budget

Particulars Semester fee Internship Credit fee (3 credit) Report binding fee Transportation cost for work in the bank Contact with internship supervisor Miscellaneous Total cost for internship (App.) Amount (TK.) 4,000.00 7,500.00 2,000.00 2,000.00 800.0 2,000.00 = Tk. 18,300

Time Frame: Gantt chart

The following Gantt chart will explain the time frame of the internship period. Activities Proposal. 10 days Data collection. 20 Days Report writing 70 days and analyzing data. Submitting of final 7 days Report. Duration Time (Month) May June July August

Source: Self devised

Você também pode gostar

- Developing, Validating and Using Internal Ratings: Methodologies and Case StudiesNo EverandDeveloping, Validating and Using Internal Ratings: Methodologies and Case StudiesAinda não há avaliações

- 5 Report BodyDocumento64 páginas5 Report BodyAsif Rajian Khan AponAinda não há avaliações

- Chapter-1 1.1 Introduction of The ReportDocumento34 páginasChapter-1 1.1 Introduction of The ReportMd Khaled NoorAinda não há avaliações

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Ainda não há avaliações

- Internship Report On Credit Adminitraation of Mutual Trust BankDocumento140 páginasInternship Report On Credit Adminitraation of Mutual Trust BankNazmul Amin AqibAinda não há avaliações

- JANATA BANK Internship ReportDocumento68 páginasJANATA BANK Internship ReportSadia SultanaAinda não há avaliações

- Critical Analysis of Credit Approval Process of The National Bank LimitedDocumento62 páginasCritical Analysis of Credit Approval Process of The National Bank Limitedekab88Ainda não há avaliações

- Report of BCBLDocumento52 páginasReport of BCBLTakia FerdousAinda não há avaliações

- New ReportDocumento66 páginasNew ReportঅচেনামানুষAinda não há avaliações

- Loan Disbusrsement by Syed Habib Anwar PashaDocumento71 páginasLoan Disbusrsement by Syed Habib Anwar PashaPaslikAinda não há avaliações

- National BankDocumento60 páginasNational BankMridhaDeAlamAinda não há avaliações

- PART-1: General Banking Activities of NBLDocumento64 páginasPART-1: General Banking Activities of NBLarifinduAinda não há avaliações

- Bank EvolutionDocumento8 páginasBank EvolutionNishit Acherzee PalashAinda não há avaliações

- 1.1 Background of The StudyDocumento47 páginas1.1 Background of The StudysumonAinda não há avaliações

- Premier BankDocumento127 páginasPremier BankUpama MondalAinda não há avaliações

- Credit Risk Management Techniques at National BankDocumento48 páginasCredit Risk Management Techniques at National Bankms694200% (1)

- General Banking Janata Bank Ltd.Documento55 páginasGeneral Banking Janata Bank Ltd.SharifMahmudAinda não há avaliações

- Prime BankDocumento77 páginasPrime BanktauhidzihadAinda não há avaliações

- Credit Management Policy of NCC Bank LimitedDocumento42 páginasCredit Management Policy of NCC Bank LimitedAshaduzzamanAinda não há avaliações

- General Banking System of Pubali Bank LTDDocumento39 páginasGeneral Banking System of Pubali Bank LTDAhmed Raqeeb100% (1)

- Janata BankDocumento30 páginasJanata Bankrana mumeAinda não há avaliações

- Document From MD NayeemDocumento52 páginasDocument From MD NayeemMd SayeedAinda não há avaliações

- Recruitment and Selection Process at Janata Bank LimitedDocumento67 páginasRecruitment and Selection Process at Janata Bank LimitedNafi Rahman57% (7)

- Research MathodologyDocumento16 páginasResearch MathodologySohelRanaAinda não há avaliações

- Analysis of Employee's Satisfaction and Customer Service Management of Mercantile Bank LimitedDocumento68 páginasAnalysis of Employee's Satisfaction and Customer Service Management of Mercantile Bank LimitedPratikBhowmickAinda não há avaliações

- How E-banking Affects Customer SatisfactionDocumento40 páginasHow E-banking Affects Customer SatisfactionNafeun AlamAinda não há avaliações

- Internship Proposal On Loans and Advances Operation of Sonali Bank Limited: A Study On Mohammadpur Bazar BranchDocumento9 páginasInternship Proposal On Loans and Advances Operation of Sonali Bank Limited: A Study On Mohammadpur Bazar BranchSazidul Islam PrantikAinda não há avaliações

- Internship Report On General Banking of Agrani Bank LimitedDocumento50 páginasInternship Report On General Banking of Agrani Bank Limitedashique50% (4)

- Repoprt On Loans & Advances PDFDocumento66 páginasRepoprt On Loans & Advances PDFTitas Manower50% (4)

- Origin of The StudyDocumento23 páginasOrigin of The StudyrafiAinda não há avaliações

- NCC Bank's Overall Banking SystemDocumento39 páginasNCC Bank's Overall Banking Systemashrafulkabir100% (1)

- Internship Report On South East BankDocumento52 páginasInternship Report On South East Bankm_iham100% (1)

- Research ProposalDocumento7 páginasResearch ProposalNazmul Huda100% (1)

- NCC Bank Report AnalysisDocumento4 páginasNCC Bank Report Analysisইফতি ইসলামAinda não há avaliações

- Main PartDocumento44 páginasMain PartSharifMahmudAinda não há avaliações

- Deposite MobilizationDocumento10 páginasDeposite MobilizationKimberly Fuller100% (1)

- Loan Management System Project ReportDocumento58 páginasLoan Management System Project ReportTamboli Iqbal75% (8)

- Internship ReportDocumento53 páginasInternship Reportm_ihamAinda não há avaliações

- My Proposal of MBLDocumento9 páginasMy Proposal of MBLPrashant Gurung100% (3)

- Credit Risk Analysis: A Case Study of BASIC BankDocumento4 páginasCredit Risk Analysis: A Case Study of BASIC BankSharwarJahanAinda não há avaliações

- Report Janata BankDocumento53 páginasReport Janata BankEhasanul Hamim100% (1)

- Banking Industry OverviewDocumento56 páginasBanking Industry OverviewMd Khaled NoorAinda não há avaliações

- NCC Bank-A New LookDocumento31 páginasNCC Bank-A New LookNazmulBDAinda não há avaliações

- Final - ReportDocumento62 páginasFinal - ReportKibria RiyadeAinda não há avaliações

- Uttara Bank Credit Risk PoliciesDocumento80 páginasUttara Bank Credit Risk PoliciesKhalid FirozAinda não há avaliações

- Profitability of NBLDocumento56 páginasProfitability of NBLpavel108012Ainda não há avaliações

- Loan and Advance Activities of Uttara Bank LTD, Moghbazar Branch, DhakaDocumento51 páginasLoan and Advance Activities of Uttara Bank LTD, Moghbazar Branch, DhakaTowhidul Alam Pavel100% (3)

- Bank of Maharashtra ProjectDocumento32 páginasBank of Maharashtra ProjectAshish Pipara89% (19)

- Deposit Collection Strategies of Rastriya Banijya BankDocumento5 páginasDeposit Collection Strategies of Rastriya Banijya BankRewanth Shah100% (1)

- EBL Internship ReportDocumento59 páginasEBL Internship ReportRiyad AhsanAinda não há avaliações

- Banking Industry and AB Bank Literature ReviewDocumento76 páginasBanking Industry and AB Bank Literature ReviewZoheb21Ainda não há avaliações

- Report E BankingDocumento45 páginasReport E BankingÂb CollectionAinda não há avaliações

- A Business Strategy Analysis On National Bank LTD: Dr. A. K. M. Saiful MajidDocumento22 páginasA Business Strategy Analysis On National Bank LTD: Dr. A. K. M. Saiful MajidAmirus SaleheenAinda não há avaliações

- Internship ReportDocumento58 páginasInternship ReportLenin Azad100% (1)

- Proposal For The Student Internship Affiliation ReportDocumento2 páginasProposal For The Student Internship Affiliation ReportRahatSarker13Ainda não há avaliações

- TJSBDocumento59 páginasTJSBMonik Maru Fakra He63% (8)

- Internship Report Foreign Exchange Operations: Mercantile Bank LimitedDocumento163 páginasInternship Report Foreign Exchange Operations: Mercantile Bank LimitedPushpa BaruaAinda não há avaliações

- Final ProposalDocumento10 páginasFinal ProposalLasta MaharjanAinda não há avaliações

- My Internship ProposalDocumento7 páginasMy Internship Proposalsourav4730Ainda não há avaliações

- Sample Questionnaire For BankDocumento3 páginasSample Questionnaire For Banksourav4730Ainda não há avaliações

- My Internship ProposalDocumento7 páginasMy Internship Proposalsourav4730Ainda não há avaliações

- Joining Letter for Management Trainee PositionDocumento1 páginaJoining Letter for Management Trainee Positionsourav4730Ainda não há avaliações

- Proposal for the Student Internship Affiliation Report Proposal for the Student Internship Affiliation Report Proposal for the Student Internship Affiliation Report Proposal for the Student Internship Affiliation Report Proposal for the Student Internship Affiliation Report Proposal for the Student Internship Affiliation Report Proposal for internship reportDocumento2 páginasProposal for the Student Internship Affiliation Report Proposal for the Student Internship Affiliation Report Proposal for the Student Internship Affiliation Report Proposal for the Student Internship Affiliation Report Proposal for the Student Internship Affiliation Report Proposal for the Student Internship Affiliation Report Proposal for internship reportsourav4730100% (1)

- INTERNSHIP PROPOSAL On Green BankingDocumento7 páginasINTERNSHIP PROPOSAL On Green Bankingsourav4730Ainda não há avaliações

- Proposal of '' Aibl''Documento10 páginasProposal of '' Aibl''sourav4730Ainda não há avaliações

- SS2 8113 0200 16Documento16 páginasSS2 8113 0200 16hidayatAinda não há avaliações

- Julian's GodsDocumento162 páginasJulian's Godsअरविन्द पथिक100% (6)

- The Forum Gazette Vol. 2 No. 23 December 5-19, 1987Documento16 páginasThe Forum Gazette Vol. 2 No. 23 December 5-19, 1987SikhDigitalLibraryAinda não há avaliações

- MAY-2006 International Business Paper - Mumbai UniversityDocumento2 páginasMAY-2006 International Business Paper - Mumbai UniversityMAHENDRA SHIVAJI DHENAKAinda não há avaliações

- Qalandar AmaliyatDocumento2 páginasQalandar AmaliyatMuhammad AslamAinda não há avaliações

- Chapter 8, Problem 7PDocumento2 páginasChapter 8, Problem 7Pmahdi najafzadehAinda não há avaliações

- GPAODocumento2 páginasGPAOZakariaChardoudiAinda não há avaliações

- Miss Daydreame1Documento1 páginaMiss Daydreame1Mary Joy AlbandiaAinda não há avaliações

- Cover Letter IkhwanDocumento2 páginasCover Letter IkhwanIkhwan MazlanAinda não há avaliações

- Surrender Deed FormDocumento2 páginasSurrender Deed FormADVOCATE SHIVAM GARGAinda não há avaliações

- Chengyang Li Archive Cra 23Documento32 páginasChengyang Li Archive Cra 23Li ChengyangAinda não há avaliações

- Container sizes: 20', 40' dimensions and specificationsDocumento3 páginasContainer sizes: 20', 40' dimensions and specificationsStylefasAinda não há avaliações

- Spiritual Warfare - Mystery Babylon The GreatDocumento275 páginasSpiritual Warfare - Mystery Babylon The GreatBornAgainChristian100% (7)

- DSA Interview QuestionsDocumento1 páginaDSA Interview QuestionsPennAinda não há avaliações

- Lucid Motors Stock Prediction 2022, 2023, 2024, 2025, 2030Documento8 páginasLucid Motors Stock Prediction 2022, 2023, 2024, 2025, 2030Sahil DadashovAinda não há avaliações

- GravimetryDocumento27 páginasGravimetrykawadechetan356Ainda não há avaliações

- Kristine Karen DavilaDocumento3 páginasKristine Karen DavilaMark anthony GironellaAinda não há avaliações

- Hidaat Alem The Medical Rights and Reform Act of 2009 University of Maryland University CollegeDocumento12 páginasHidaat Alem The Medical Rights and Reform Act of 2009 University of Maryland University Collegepy007Ainda não há avaliações

- Form 16 PDFDocumento3 páginasForm 16 PDFkk_mishaAinda não há avaliações

- Year 11 Physics HY 2011Documento20 páginasYear 11 Physics HY 2011Larry MaiAinda não há avaliações

- A1. Coordinates System A2. Command Categories: (Exit)Documento62 páginasA1. Coordinates System A2. Command Categories: (Exit)Adriano P.PrattiAinda não há avaliações

- Jurnal Manajemen IndonesiaDocumento20 páginasJurnal Manajemen IndonesiaThoriq MAinda não há avaliações

- HVDC PowerDocumento70 páginasHVDC PowerHibba HareemAinda não há avaliações

- Present Tense Simple (Exercises) : Do They Phone Their Friends?Documento6 páginasPresent Tense Simple (Exercises) : Do They Phone Their Friends?Daniela DandeaAinda não há avaliações

- Iron FoundationsDocumento70 páginasIron FoundationsSamuel Laura HuancaAinda não há avaliações

- Villadolid, Thea Marie J - 1st CENTURY SKILLS CATEGORIESDocumento4 páginasVilladolid, Thea Marie J - 1st CENTURY SKILLS CATEGORIESThea Marie Villadolid100% (1)

- Dues & Scholarship Section: NotificationDocumento6 páginasDues & Scholarship Section: NotificationMUNEEB WAHEEDAinda não há avaliações

- AReviewof Environmental Impactof Azo Dyes International PublicationDocumento18 páginasAReviewof Environmental Impactof Azo Dyes International PublicationPvd CoatingAinda não há avaliações

- Ivan PavlovDocumento55 páginasIvan PavlovMuhamad Faiz NorasiAinda não há avaliações

- FIITJEE Talent Reward Exam 2020: Proctored Online Test - Guidelines For StudentsDocumento3 páginasFIITJEE Talent Reward Exam 2020: Proctored Online Test - Guidelines For StudentsShivesh PANDEYAinda não há avaliações

- You Can't Joke About That: Why Everything Is Funny, Nothing Is Sacred, and We're All in This TogetherNo EverandYou Can't Joke About That: Why Everything Is Funny, Nothing Is Sacred, and We're All in This TogetherAinda não há avaliações

- The Importance of Being Earnest: Classic Tales EditionNo EverandThe Importance of Being Earnest: Classic Tales EditionNota: 4.5 de 5 estrelas4.5/5 (42)

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNo EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassAinda não há avaliações

- The Asshole Survival Guide: How to Deal with People Who Treat You Like DirtNo EverandThe Asshole Survival Guide: How to Deal with People Who Treat You Like DirtNota: 4 de 5 estrelas4/5 (60)

- Welcome to the United States of Anxiety: Observations from a Reforming NeuroticNo EverandWelcome to the United States of Anxiety: Observations from a Reforming NeuroticNota: 3.5 de 5 estrelas3.5/5 (10)

- The House at Pooh Corner - Winnie-the-Pooh Book #4 - UnabridgedNo EverandThe House at Pooh Corner - Winnie-the-Pooh Book #4 - UnabridgedNota: 4.5 de 5 estrelas4.5/5 (5)

- Other People's Dirt: A Housecleaner's Curious AdventuresNo EverandOther People's Dirt: A Housecleaner's Curious AdventuresNota: 3.5 de 5 estrelas3.5/5 (104)

- The Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsNo EverandThe Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsAinda não há avaliações

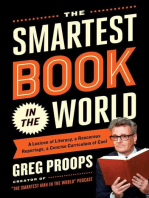

- The Smartest Book in the World: A Lexicon of Literacy, A Rancorous Reportage, A Concise Curriculum of CoolNo EverandThe Smartest Book in the World: A Lexicon of Literacy, A Rancorous Reportage, A Concise Curriculum of CoolNota: 4 de 5 estrelas4/5 (14)

- Lessons from Tara: Life Advice from the World's Most Brilliant DogNo EverandLessons from Tara: Life Advice from the World's Most Brilliant DogNota: 4.5 de 5 estrelas4.5/5 (42)

- Humorous American Short Stories: Selections from Mark Twain, O. Henry, James Thurber, Kurt Vonnegut, Jr. and moreNo EverandHumorous American Short Stories: Selections from Mark Twain, O. Henry, James Thurber, Kurt Vonnegut, Jr. and moreAinda não há avaliações

- Sexual Bloopers: An Outrageous, Uncensored Collection of People's Most Embarrassing X-Rated FumblesNo EverandSexual Bloopers: An Outrageous, Uncensored Collection of People's Most Embarrassing X-Rated FumblesNota: 3.5 de 5 estrelas3.5/5 (7)

- Spoiler Alert: You're Gonna Die: Unveiling Death One Question at a TimeNo EverandSpoiler Alert: You're Gonna Die: Unveiling Death One Question at a TimeNota: 4 de 5 estrelas4/5 (56)

![The Inimitable Jeeves [Classic Tales Edition]](https://imgv2-2-f.scribdassets.com/img/audiobook_square_badge/711420909/198x198/ba98be6b93/1712018618?v=1)