Escolar Documentos

Profissional Documentos

Cultura Documentos

Oil&Gas 23 8 12 PL PDF

Enviado por

agarwal.rmTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Oil&Gas 23 8 12 PL PDF

Enviado por

agarwal.rmDireitos autorais:

Formatos disponíveis

Oil & Gas

Strength in refining margins unlikely to sustain

August 23, 2012 Deepak Pareek deepakpareek@plindia.com +91-22-66322241 Dhrushil Jhaveri dhrushiljhaveri@plindia.com +91-22-66322232 Sensex v/s BSE Oil Index

BSE Oil

115 110 105 100 95 90 85 80

Dec-11 Feb-12

Sensex

OMCs continue to suffer from government inaction, higher crude prices and higher product spreads, which have resulted in soaring under-recoveries; losses stand at ~Rs13.75/ltr in diesel (v/s Rs9.4/ltr in July 2012). On petrol, losses have widened to ~Rs3.5/ltr as a result of non-revision in prices since June. Refining margins above US$10 unlikely to sustain: Refining margins have climbed to >US$10 per barrel on the back of buoyancy in product cracks across the board, especially in gasoline, where cracks have averaged at ~US$18 per barrel (Aug 1FN) compared to US$7 and US$11 in June and July, respectively. A slew of unplanned refinery shutdowns at a time of seasonally strong demand has culminated into +US$10 refining margins. Refining restarts and capacity additions are expected to lower refining margins, going forward. We maintain our medium-term outlook of refining capacity additions outpacing demand, resulting in subdued refining margin scenario. Outlook: As per our expectations (outlined in our last report Crude rebounds, LNG prices decline), OMC stock prices have corrected significantly (8-13%) from their highs in July 2012. IGL has moved up ~10% since our upgrade to BUY; we continue our positive stance on the stock. Also, as we believe the current boost in the refining segment is temporary, we would refrain from getting positive on RIL. Post the recent uptick in RIL stock, we believe that limited commodity driven upsides and absence of meaningful E&P news flow in the near term make the risk reward unfavourable. Thus, we are downgrading the stock to Reduce. We maintain our positive stance on Cairn India and Petronet.

Aug-11

Jun-12

Aug-12

Oct-11

Apr-12

Source: Bloomberg

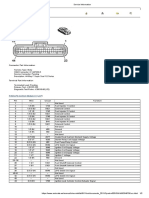

Exhibit 1: Snapshot Particulars Crude prices WTI (USD/bbl) Brent (USD/bbl) Product cracks and GRMs Naphtha cracks (USD/bbl) Gasoline cracks (USD/bbl) Jet/Kerosene cracks (USD/bbl) Diesel cracks (USD/bbl) Fuel oil cracks (USD/bbl) Estimated Singapore GRMs (USD/bbl) Marketing losses Gasoline (INR/ltr) Diesel (INR/ltr) Domestic LPG (INR/cyl) Kerosene (INR/ltr) Source: Bloomberg, PL Research, PPAC

Prabhudas Lilladher Pvt. Ltd. and/or its associates (the 'Firm') does and/or seeks to do business with companies covered in its research reports. As a result investors should be aware that the Firm may have a conflict of interest that could affect the objectivity of the report. Investors should consider this report as only a single factor in making their investment decision. Please refer to important disclosures and disclaimers at the end of the report

Aug -12 (1st fortnight) 91.9 111 (5.8) 17.8 20.9 20.4 (11) 11.1 2.5 12.1 203 27.1

Jul -12 87.9 103.2 (8.5) 11.2 18.3 17.8 (10.4) 8.1 (2.8) 9.4 312 28.8

Jun -12 82.5 95.9 (13.1) 7 16.1 15.4 (8.9) 5.5 (1.9) 10.8 396 30.1

Stock Performance (%) Sensex BSE Oil Cairn India GAIL GSPL Guj. Gas IGL Oil India ONGC Petronet LNG Reliance Ind.

1M 5.7 7.1 4.2 8.5 8.8 0.5 10.7 (3.9) 1.8 4.7 12.4

6M (1.3) (3.3) (12.5) (1.7) (0.8) (19.9) (24.5) (7.2) (1.3) (6.6) (3.6)

12M 8.2 1.8 25.8 (10.9) (23.6) (30.0) (38.2) (10.3) 2.5 (17.4) 5.6

Sector Update

Crude oil prices continue to rise; under recoveries mount: Brent crude prices have risen ~30% from their lows in June 2012 to ~US$115 per barrel on the back of anticipated supply reduction in the North Sea (Buzzard oil field shutdown expected in September 2012), along with geopolitical tensions in the Middle East. Oil prices are in backwardation, with prompt prices premium widening over the last fortnight, while the long-term price curve has declined; hence, prices should correct, going ahead.

Oil & Gas

Crude Oil

Crude oil prices are up ~30% from the lows of June 2012 (WTI US$78, Brent US$89). Aug 1FN average price stood at US$92 and US$111 for WTI and Brent, respectively Exhibit 2: Brent and WTI crude oil price

160 140 120

(US$ / bbl)

Brent

WTI

100

80 60 40 20 0

Feb-08

Feb-09

Feb-10

Feb-11

Aug-07

Aug-08

Aug-09

Aug-10

Aug-11

Feb-12

Nov-07

May-08

Nov-08

May-09

Nov-09

May-10

Nov-10

May-11

Nov-11

Source: Bloomberg, PL Research Exhibit 3: Crude Type West Texas Intermediate (WTI) Cushing Crude Oil Spot Price European Dated Brent African Bonny Light Crude Oil Spot Price OPEC Secretariat Crude Oil Basket Daily Price Source: Bloomberg, PL Research Brent oil prices in INR terms have risen by a similar quantum, given that the exchange rate has remained at ~ 55 levels Exhibit 4: Brent oil (USD) and Brent oil (Rs)

7,000 Brent Brent (RHS) 160 140 120 100 80 60 40 20 0

Crude Oil performance (as on Aug 21) 1W 3.5% 1.7% 1.4% 1.7% 1M 5.0% 7.2% 6.6% 7.5% 3M 4.9% 6.5% 5.2% 6.0% 6M -7.0% -5.1% -6.5% -6.5% 1Y 16.7% 5.0% 2.3% 7.9% 2Y 9.8% 16.4% 15.1% 15.4% 5Y 6.2% 10.8% 9.5% 10.5%

6,000

5,000

May-12

(Rs)

4,000

3,000

2,000

1,000

0

Dec-07 Dec-09 Dec-10 Aug-07 Aug-08 Aug-10 Aug-11 Dec-11

Dec-08

Source: PL Research, Bloomberg

August 23, 2012

Aug-12

Aug-09

Apr-08

Apr-10

Apr-11

Apr-09

Apr-12

(US$ / bbl)

Aug-12

Oil & Gas

Dubai-AH spreads during the fortnight (Aug 1FN) averaged at US$ (0.88)/bbls as against US$0.47/bbls in July12

Exhibit 5: Dubai Crude Arab Heavy spreads

20 15

(US$ / bbl)

10 5 0 -5

-10

Feb-08 Feb-09 Feb-10 Feb-11 Aug-07 Aug-08 Aug-09 Aug-10 Aug-11 Feb-12 Feb-12 May-08 May-12 May-12

May-09 May-10 May-11

Nov-07

Nov-08

Nov-09

Nov-10

Source: Bloomberg, PL Research Based on Saudi Aramcos official selling price for Aug, discount for the Arab heavy crude over Dubai crude has narrowed to US$0.3/bbls as compared to US$1.1/bbls in July12; complex refiners stand to lose Exhibit 6: Saudi Aramco Arab Heavy Dubai spreads

2.00 (2.00)

(4.00) (6.00)

(8.00) (10.00)

Oct-01 Mar-02 Aug-02 Jan-03 Jun-03 Nov-03 Apr-04 Sep-04 Feb-05 Jul-05 Dec-05 May-06 Oct-06 Mar-07 Aug-07 Jan-08 Jun-08 Nov-08 Apr-09 Sep-09 Feb-10 Jul-10 Dec-10 May-11 Oct-11 Mar-12 Aug-12

Source: Bloomberg, PL Research Brents premium to WTI averaged at US$19.1/bbls during the fortnight v/s US$15.3/bbls in July

(US$ / bbl)

Exhibit 7: Brent- WTI spreads

40

30 20 10

0 -10 -20

Feb-08 Feb-09 Feb-10 Aug-09 Feb-11 Aug-11 May-09 May-11

May-08 May-10

Nov-11

Nov-08

Nov-09

Nov-10

Source: Bloomberg, PL Research

August 23, 2012

Nov-11

Nov-07

Aug-12

Aug-07

Aug-08

Aug-10

Aug-12

Oil & Gas

Long-term Brent oil forward curve climbed during the current fortnight as against the last fortnight Oil prices are in backwardation, with prompt prices premium widening over the has declined as supply-side pressure is expected to ease over the medium term last fortnight, while long term price curve

Exhibit 8: Brent Oil forward prices

BRENT Forward

120 115 110 105 100 95 90 85 80

Dec-12 Dec-13

BRENT Forward (15 days back)

(US$ / bbl)

Dec-15

Dec-16

Aug-12

Aug-13

Aug-14

Aug-15

Aug-16

Aug-18

Dec-18

Dec-14

Dec-17

Source: Bloomberg, PL Research Outstanding CFTC Nymex crude noncommercial contract volumes continue to witness an uptick, signalling a rise in speculative activity Exhibit 9: CFTC Nymex Crude oil non-commercial contract/futures only

450,000 400,000 350,000 300,000 250,000 200,000 150,000 100,000 50,000 0

Jul-08 Jul-10 Jul-11 Oct-07 Oct-09 Oct-10 Apr-08 Apr-10 Apr-11 Oct-11

Oct-08

Aug-19 Apr-12

Jul-12

Aug-17

Apr-13

Apr-14

Apr-15

Apr-16

Apr-18

Apr-19 Jan-12

Apr-17

Apr-09

Jan-08

Jan-09

Jan-10

Source: Bloomberg, PL Research Net non-commercial futures volumes on Nymex crude oil inched up by around 18% during the fortnight compared to a 31% increase seen in 1FN of July Exhibit 10: CFTC Nymex Crude oil net non-commercial long contract/futures only

300,000 250,000

200,000

150,000

100,000 50,000

0

-50,000 -100,000

Jul-07

Jul-08

Jul-10

Jan-11

Oct-07

Oct-08

Oct-09

Oct-10

Jul-11

Jul-09

Apr-08

Apr-10

Apr-11

Oct-11

Source: Bloomberg, PL Research

August 23, 2012

Apr-12

Apr-09

Jan-08

Jan-09

Jan-11

Jan-12

Jan-10

Jul-12

Jul-07

Jul-09

Oil & Gas

Commodity Index and Dollar Index averaged at 484.4 and 82.5 in Aug 1FN as against 480.9 and 83 in July 2012, respectively

Exhibit 11: CRB and Dollar Index

CRB CMDT Index 600 550 500 450 400 350 300 250 200 Dollar Index (RHS) 95

90 85

80 75

70

Feb-08 Feb-09 Feb-10 Feb-11 Aug-08 Aug-10 Aug-11 Feb-12 May-09 May-10 May-11 May-12 May-12

May-08

Nov-08

Nov-09

Source: Bloomberg, PL Research Dollar Index and Brent averaged at 82.5 and US$111 in Aug 1FN as against 83 and US$103 in July 2012, respectively

165 145 125 105 85 65 45 25 95

Exhibit 12: Brent and Dollar Index

Bloomberg European Dated Brent Dollar Index (RHS)

Nov-11

Nov-10

Aug-12

Aug-09

90 85

80

75 70

Aug-08 Aug-10 Aug-11 Nov-08 May-09 Nov-09 May-10 May-11

May-08

Nov-11

Nov-10

Source: Bloomberg, PL Research

August 23, 2012

Aug-12

Aug-09

Feb-08

Feb-09

Feb-10

Feb-11

Feb-12

Oil & Gas

US Inventory and Global demand and supply

OPEC crude oil production declined in July 2012, with output standing at 31.2mbpd as against 31.6mbpd in June12 Exhibit 13: OPEC crude oil production

33.0

32.0

31.0

30.0

29.0 28.0

27.0

26.0

Jul-06 Oct-06 Jan-07 Apr-07 Jul-07 Oct-07 Jan-08 Apr-08 Jul-08 Oct-08 Jan-09 Apr-09 Jul-09 Oct-09 Jan-10 Apr-10 Jul-10 Oct-10 Jan-11 Apr-11 Jul-11 Oct-11 Jan-12 Apr-12 Jul-12

Source: Bloomberg, PL Research As per Energy Intelligence group, non-OPEC supplies of the crude witnessed an improvement in July12 by 0.1 mbpd to 51.8mbpd as against 51.7mbpd in June12 Exhibit 14: Liquid fuel supply

OPEC Crude Supply Non-OPEC Supply OPEC NGL Supply

55 50

45 40 35 30

7.0 6.5

6.0 5.5 5.0 4.5

25

Mar-08 Mar-09 Mar-10 Mar-11 Mar-12

89.0 88.3

Mar-07

4.0

Jul-06 Jul-07 Jul-09 Jul-10 Nov-06 Nov-07 Nov-08 Nov-10 Nov-11

Nov-09

Source: Bloomberg, PL Research EIA and IEA have revised their forecasts downwards by ~0.2 & ~0.3mbpd, respectively, for CY12 EIA forecasts Brent prices to be at US$103 in H2CY12 and US$100 per barrel for CY13, upward revision of ~US$3 from their previous forecast Exhibit 15: Global liquid fuel demand estimates

CY11 CY12 CY13 90.5

91.0 90.5 90.0 89.5 89.0 88.5 88.0 87.5 87.0 86.5 86.0

89.5

88.7

89.7

88.8

88.0

89.2

89.6

89.9

87.8

OPEC

Source: PL Research, IEA, EIA and OPEC

EIA

IEA

Average

August 23, 2012

Jul-12

Jul-08

Jul-11

Oil & Gas

Non-OPEC supply forecasts have been revised downwards by ~0.1 mbpd by EIA and IEA from the last month

Exhibit 16: Non-OPEC supply estimate

CY11 54.5 54.1 CY12 53.8 CY13 53.9 53.9

54.0 53.5

53.0

53.2

52.4 51.9

53.2 52.5 52.7

52.3

53.0

52.5 52.0

51.5 51.0

50.5

OPEC EIA IEA Average

Source: PL Research, IEA, EIA and OPEC As per the EIA estimates, OPEC spare capacity is likely to be 2.29mbpd in CY12 and 2.55mbpd in CY13 Exhibit 17: OPEC spare capacity

7

6

5

(m bbl / day)

4

3

2 1

0

2001 2003 2005 2007 2009 2011 2013

Source: EIA, PL Research Total motor gasoline inventories decreased by ~3.9m barrels over the last two weeks, continues to be in the lower limit of average range on account of refinery maintenance in the region Exhibit 18: US motor gasoline Inventory

245,000

235,000 225,000

215,000

205,000 195,000

185,000 175,000

Aug-06 Aug-07 Aug-08 Aug-10

Aug-09 Aug-11 Aug-12

Apr-07

Apr-08

Apr-10

Apr-11

Apr-09

Dec-06

Dec-07

Dec-08

Dec-09

Dec-10

Source: Bloomberg, PL Research

August 23, 2012

Dec-11

Apr-12

Oil & Gas

Distillate inventory decreased by ~1.7m bbls over the last two weeks and stands at the lower end of the average range for this time of the year

Exhibit 19: US Distillate fuel oil Inventory

200,000

180,000 160,000

140,000

120,000 100,000

80,000 60,000

Aug-06 Aug-08 Aug-10 Aug-11 Aug-12 Aug-12

Aug-12 Aug-07 Aug-09

Apr-07

Apr-08

Apr-09

Apr-10

Apr-11

Dec-06

Dec-07

Dec-08

Dec-09

Dec-10

Source: Bloomberg, PL Research US Jet Kerosene inventory increased by 700k bbls over the last 2 weeks and continues to be at the lower end of the average during this time of the year Exhibit 20: US Jet Kerosene total Inventory

50,000 48,000 46,000 44,000 42,000 40,000 38,000 36,000 34,000 32,000 30,000

Aug-06 Aug-07 Aug-08 Aug-09 Aug-10 Aug-11 Apr-07 Dec-07 Dec-08 Dec-09 Dec-10 Dec-11

Dec-11 Dec-06

Dec-11

Source: Bloomberg, PL Research Crude oil inventory has declined by ~10m barrels in the last two weeks but continues to remain at the higher range of the average at this time of the year

355,000 335,000

Exhibit 21: Crude oil Total Inventory

395,000 375,000

315,000 295,000

275,000

Aug-06

Aug-07

Aug-08

Aug-10

Aug-11

Aug-09

Apr-07

Apr-08

Apr-09

Apr-11

Dec-06

Dec-09

Source: Bloomberg, PL Research

August 23, 2012

Dec-10

Dec-07

Dec-08

Apr-12

Apr-10

Apr-12

Apr-08

Apr-09

Apr-10

Apr-11

Apr-12

Oil & Gas

Global Gas Markets

Henry Hub forward gas prices continues to exhibit increase in the prices in the long run, with LNG exports likely to help the matter in the long run

7

Exhibit 22: Henry Hub forward gas prices

Henry hub gas forward curve FUTURE

Henry hub gas forward curve FUTURE (15 days before)

6 5

4 3

2

Jan-13 Jul-13 Jan-15 Jul-15 Jan-16 Jul-16 Jan-17 Jul-17 Jan-19 Jul-19 Jan-20 Jul-20 Jan-21 Jul-21 Jan-23 Jul-23

Jan-14 Jul-14 Jan-18 Jul-18 Jan-22 Jul-22

Source: Bloomberg, PL Research ICE natural gas futures prices remained largely stable compared to the last fortnight

11.5 11.0 10.5 10.0 9.5 9.0 8.5 8.0

Exhibit 23: ICE forward natural gas prices

Jul-12

ICE NAT GAS FUTR (USD/mmbtu) ICE natural gas future (15 days before) US$/mmbtu

Feb-13

Feb-15

Feb-16

Feb-14

Aug-14

Aug-15

Feb-17

May-13

May-14

May-16

Source: Bloomberg, PL Research

August 23, 2012

May-17

May-15

Nov-12

Nov-13

Nov-14

Nov-15

Nov-16

Aug-17

Aug-12

Aug-13

Aug-16

Oil & Gas

Average India spot LNG prices continued to decline despite a sharp increase in crude, prices ruling at ~US$10.5 per mmbtu

Exhibit 24: India spot LNG prices

(US$ / mmbtu)

currently

17.0 16.0 15.0 14.0 13.0 12.0 11.0 10.0 9.0 8.0

17-Aug-11 1-Sep-11 16-Sep-11 1-Oct-11 16-Oct-11 31-Oct-11 15-Nov-11 30-Nov-11 15-Dec-11 30-Dec-11 14-Jan-12 29-Jan-12 13-Feb-12 28-Feb-12 14-Mar-12 29-Mar-12 13-Apr-12 28-Apr-12 13-May-12 28-May-12 12-Jun-12 27-Jun-12 12-Jul-12 27-Jul-12 11-Aug-12

Source: Industry, PL Research Exhibit 25: Comparative prices of alternative fuels with LNG

Implied oil equivalent LNG prices Naphtha Fuel oil

Discount to alternate fuels like naphtha and fuel oil has widened considerably in the last month

135.0 125.0 115.0 105.0 95.0 85.0 75.0 65.0 55.0

17-Aug-11 1-Sep-11 16-Sep-11 1-Oct-11 16-Oct-11 31-Oct-11 15-Nov-11 30-Nov-11 15-Dec-11 30-Dec-11 14-Jan-12 29-Jan-12 13-Feb-12 28-Feb-12 14-Mar-12 29-Mar-12 13-Apr-12 28-Apr-12 13-May-12 28-May-12 12-Jun-12 27-Jun-12 12-Jul-12 27-Jul-12 11-Aug-12

Source: Bloomberg, PL Research

August 23, 2012

(US$ / mmbtu)

10

Oil & Gas

Crude Oil Products

Exhibit 26: Prices Dubai crude Gasoline (US$/bbl) Diesel (US$/bbl) Naphtha (US$/bbl) SKO (US$/bbl) Fuel oil (US$/bbl) Petroleum product prices Aug 1FN 104.8 122.6 125.2 99.1 125.8 99.5 Jul-12 99.2 110.4 117.0 90.8 117.5 94.2 Jun-12 May-12 94.3 101.3 109.7 81.2 110.4 90.6 107.5 118.9 123.1 98.5 123.9 102.6 Apr-12 Q4 FY12 Q3 FY12 Q2 FY12 Q1 FY12 Q4 FY11 Q2FY11 Q1FY11 117.5 131.8 133.1 113.4 133.4 110.9 115.9 127.7 132.4 111.6 131.8 110.3 106.1 114.4 124.5 96.8 124.8 101.9 107.0 121.7 124.6 104.2 125.8 99.9 110.6 122.9 130.2 108.5 131.1 100.4 100.3 110.9 118.5 100.1 120.4 90.3 74.1 80.7 86.3 72.5 86.7 68.0 78.0 85.5 89.2 77.3 89.6 70.2 FY10 69.6 76.2 76.8 68.7 77.4 64.4

Source: PL Research, Bloomberg Benchmark Singapore GRMs continued to increase during the 1FN Aug, with margins at US$11.09/bbls as against US$8.06/bbls in July12. The increase is largely a function of an across-the-board increase in spreads viz. Gasoline, Naphtha, LPG and middle distillate spreads Exhibit 27: Singapore complex GRMs

12.00

10.00 8.00

(US$ / bbl)

6.00 4.00

2.00 (2.00)

Source: Reuters, PL Research Gasoline cracks recovered sharply during the first fortnight of Aug, with cracks averaging at US$17.8/bbls versus US$11.2/bbls in July12 Exhibit 28: Gasoline spreads

30.00 25.00 20.00 15.00 10.00 5.00 (5.00) (10.00) (15.00)

Apr-07 Jun-07 Aug-07 Oct-07 Dec-07 Feb-08 Apr-08 Jun-08 Aug-08 Oct-08 Dec-08 Feb-09 Apr-09 Jun-09 Aug-09 Oct-09 Dec-09 Feb-10 Apr-10 Jun-10 Aug-10 Oct-10 Dec-10 Feb-11 Apr-11 Jun-11 Aug-11 Oct-11 Dec-11 Feb-12 Apr-12 Jun-12 Aug-12

Source: Bloomberg, PL Research

August 23, 2012

Apr-07 Jun-07 Aug-07 Oct-07 Dec-07 Feb-08 Apr-08 Jun-08 Aug-08 Oct-08 Dec-08 Feb-09 Apr-09 Jun-09 Aug-09 Oct-09 Dec-09 Feb-10 Apr-10 Jun-10 Aug-10 Oct-10 Dec-10 Feb-11 Apr-11 Jun-11 Aug-11 Oct-11 Dec-11 Feb-12 Apr-12 Jun-12 Aug-12

11

Oil & Gas

Diesel/gas oil cracks increased to US$20.36 during Aug 1FN as against US$ 17.8/bbls in July12

Exhibit 29: Diesel Spreads

50.00 45.00 40.00 35.00 30.00 25.00 20.00 15.00 10.00 5.00 Apr-07 Jun-07 Aug-07 Oct-07 Dec-07 Feb-08 Apr-08 Jun-08 Aug-08 Oct-08 Dec-08 Feb-09 Apr-09 Jun-09 Aug-09 Oct-09 Dec-09 Feb-10 Apr-10 Jun-10 Aug-10 Oct-10 Dec-10 Feb-11 Apr-11 Jun-11 Aug-11 Oct-11 Dec-11 Feb-12 Apr-12 Jun-12 Aug-12

Source: Bloomberg, PL Research

SKO cracks moved up to US$20.29 in the 1FN Aug as against US$18.3 in July12

Exhibit 30: SKO spreads

50.00 45.00 40.00 35.00 30.00 25.00 20.00 15.00 10.00 5.00 Apr-07 Jun-07 Aug-07 Oct-07 Dec-07 Feb-08 Apr-08 Jun-08 Aug-08 Oct-08 Dec-08 Feb-09 Apr-09 Jun-09 Aug-09 Oct-09 Dec-09 Feb-10 Apr-10 Jun-10 Aug-10 Oct-10 Dec-10 Feb-11 Apr-11 Jun-11 Aug-11 Oct-11 Dec-11 Feb-12 Apr-12 Jun-12 Aug-12

Source: Bloomberg, PL Research

Naphtha cracks also moved up in the current fortnight, with average cracks at (5.8)/bbl as against (8.5) /bbl in July12

Exhibit 31: Naphtha spreads

20.00 15.00 10.00 5.00 (5.00) (10.00) (15.00) (20.00) (25.00) (30.00) (35.00)

Apr-07 Jun-07 Aug-07 Oct-07 Dec-07 Feb-08 Apr-08 Jun-08 Aug-08 Oct-08 Dec-08 Feb-09 Apr-09 Jun-09 Aug-09 Oct-09 Dec-09 Feb-10 Apr-10 Jun-10 Aug-10 Oct-10 Dec-10 Feb-11 Apr-11 Jun-11 Aug-11 Oct-11 Dec-11 Feb-12 Apr-12 Jun-12 Aug-12

Source: Bloomberg, PL Research

August 23, 2012

12

Oil & Gas

FO cracks have weakened slightly in the current fortnight, with average cracks at (11)/bbl as against US$(10.4)/bbl in July12

Exhibit 32: Fuel oil spreads

(5.00) (10.00) (15.00) (20.00) (25.00) (30.00) (35.00) (40.00) (45.00)

Apr-07 Jun-07 Aug-07 Oct-07 Dec-07 Feb-08 Apr-08 Jun-08 Aug-08 Oct-08 Dec-08 Feb-09 Apr-09 Jun-09 Aug-09 Oct-09 Dec-09 Feb-10 Apr-10 Jun-10 Aug-10 Oct-10 Dec-10 Feb-11 Apr-11 Jun-11 Aug-11 Oct-11 Dec-11 Feb-12 Apr-12 Jun-12 Aug-12

Source: Bloomberg, PL Research

August 23, 2012

13

Oil & Gas

Under-recoveries and petroleum product consumption

Petrol price cut, coupled with an increase in crude prices, has resulted in losses once again, with under-recovery of ~Rs2.5/ltr for 1FN Aug compared to an average over Exhibit 33: Under-recoveries on Petrol

Break-even crude oil prices for petrol during Aug 1FN is ~US$100/bbl

(Rs / Litre)

recovery of ~Rs2.76/ltr in July12

12.0 10.0 8.0 6.0 4.0 2.0 0.0 -2.0 -4.0 -6.0 -8.0 -10.0

Aug-09 Aug-10 Aug-11 May-09 May-11

May-10 May-12

May-12

Nov-08

Nov-09

Nov-10

Nov-11

Source: Bloomberg, PL Research Diesel under-recoveries increased to Rs13.76/ltr effective Aug 2FN (12.1/l in Aug 1FN,) compared to an average Rs9.4/ltr in July12 Exhibit 34: Under-recoveries on Diesel

20.0 15.0

(Rs / Litre)

10.0 5.0

Break-even crude oil prices for diesel during the Aug 1FN was around US$77/bbl

(5.0)

Feb-09 Aug-10 Aug-11 Feb-12

Feb-10 Feb-11

Nov-08

May-09

Nov-09

May-10

Nov-10

Source: Bloomberg, PL Research Kerosene under-recoveries during July stand at Rs28.5/litres, up by Rs1.3/litre MoM Exhibit 35: Under-recoveries on Kerosene

35.0

30.0

25.0

(Rs / Litre)

Break-even crude oil prices for Kerosene for 1FN Aug stood at around US$21/bbl

20.0

15.0

10.0

5.0 Aug-08 Aug-09 Aug-10 Aug-11

May-11

Nov-11

May-09

May-10

May-11

Source: Bloomberg, PL Research

August 23, 2012

May-12

Nov-08

Nov-09

Nov-10

Nov-11

Aug-12

Feb-09

Feb-10

Feb-11

Feb-12

Aug-12

Aug-08

Aug-09

Aug-12

Aug-08

Feb-09

Feb-10

Feb-12

Feb-11

14

Oil & Gas

Under-recovery on sale of domestic LPG decreased for Aug 2012 to Rs231/cylinder as against Rs312/cylinder in July12, mainly on account of a decline in crack in July

Exhibit 36: Under-recoveries on Domestic LPG

700 600

(Rs / Cylinder)

500 400 300 200

100 Feb-09 Feb-10 Feb-11 Feb-12

Break- even crude oil prices for Domestic LPG for Aug 2012 stood at ~ US$72.3/bbl

Nov-08

May-09

Nov-09

May-10

Nov-10

May-11

Nov-11

Source: Bloomberg, PL Research Exhibit 37: Consumption of petroleum products Exhibit 38: June Oil & Gas consumption grew 7% YoY aided by 13.7% YoY growth in diesel consumption Dieselisation of the economy continues at a fast clip visible from the increase in its share of petroleum products from 44% (Jun-11) to 46.7 % (Jun-12) Petcoke consumption continued to increase, recording a 27% YoY increase in June Product LPG MS Naphtha+NG ATF SKO HSD LDO Lubes+Grs FO+LSHS Bitumen Pet. Coke Others Total Source: PL Research Jun-12 1,294 1,343 900 422 631 6,075 31 218 648 377 663 400 13,002 Jun-11 1,214 1,249 850 443 675 5,342 39 198 782 362 523 454 12,130 YoY % gr May-12 6.6% 7.6% 5.9% -4.6% -6.5% 13.7% -20.3% 10.0% -17.1% 4.1% 26.8% -11.9% 7.2% 1,310 1,291 1,074 445 623 6,377 37 227 662 460 652 422 13,580 FY12 15,367 14,993 11,188 5,536 8,229 64,753 415 2,769 9,185 4,607 6,068 4,883 147,991 FY11 YoY % gr 14,331 14,194 10,676 5,078 8,928 60,071 455 2,429 10,789 4,536 4,982 4,569 141,040 7.2% 5.6% 4.8% 9.0% -7.8% 7.8% -8.9% 14.0% -14.9% 1.6% 21.8% 6.9% 4.9%

August 23, 2012

May-12

Aug-12

Aug-08

Aug-09

Aug-10

Aug-11

15

Oil & Gas

Exhibit 39: Total Under-recovery- Crude & Exchange rate (FY13) Brent Oil Prices (For Balance Period) ###### Exchange Rate 95.0 100.0 105.0 110.0 115.0

Exhibit 40: Total Under-recovery- Crude & Exchange rate (FY14) Brent Oil Prices ###### 49.0 Exchange Rate 50.0 51.0 52.0 53.0 54.0 95.0 516,193 604,591 692,987 100.0 731,782 105.0 110.0 115.0 947,369 1,162,958 1,378,546

51.0 1,068,671 1,166,619 1,264,567 1,362,515 1,460,464 52.0 1,114,820 1,214,689 1,314,558 1,414,426 1,514,295 53.0 1,160,970 1,262,759 1,364,548 1,466,337 1,568,126 54.0 1,207,119 1,310,829 1,414,539 1,518,248 1,621,958 55.0 1,253,268 1,358,899 1,464,529 1,570,159 1,675,790 56.0 1,299,418 1,406,969 1,514,519 1,622,070 1,729,621 Source: Bloomberg, PL Research Exhibit 41: Diesel Under-recovery- Crude & Exchange rate (FY13) Brent Oil Prices (For Balance Period) ###### 51.0 Exchange Rate 52.0 53.0 54.0 55.0 56.0 95.0 582,017 612,920 643,824 674,727 705,631 736,535 100.0 653,876 686,188 718,501 750,814 783,126 815,439 105.0 725,736 759,457 793,179 826,900 860,622 894,343 110.0 797,595 832,726 867,856 902,987 115.0 869,454 905,994 942,533 979,073 Exchange Rate

824,578 1,044,566 1,264,554 1,484,542 917,375 1,141,763 1,366,150 1,590,538

781,385 1,010,172 1,238,959 1,467,747 1,696,534 869,781 1,102,969 1,336,156 1,569,343 1,802,530 958,179 1,195,766 1,433,353 1,670,939 1,908,526

Source: Bloomberg, PL Research Exhibit 42: Diesel Under-recovery- Crude & Exchange rate (FY14) Brent Oil Prices ###### 49.0 50.0 51.0 52.0 53.0 54.0 95.0 182,803 241,306 299,809 358,312 416,814 475,317 100.0 313,504 374,674 435,844 497,014 558,184 619,355 105.0 444,204 508,042 571,880 635,717 699,555 763,392 110.0 574,905 641,410 707,915 774,420 840,925 115.0 705,605 774,778 843,950 913,123 982,294

938,117 1,015,613 973,248 1,052,152

907,429 1,051,467

Source: Bloomberg, PL Research Exhibit 43: SKO Under-recovery- Crude & Exchange rate (FY13) Brent Oil Prices (For Balance Period) ###### 51.0 Exchange Rate 52.0 53.0 54.0 55.0 56.0 95.0 254,535 257,861 261,186 264,511 267,836 271,162 100.0 262,239 265,715 269,192 272,668 276,144 279,621 105.0 269,943 273,570 277,197 280,825 284,452 288,079 110.0 277,646 281,425 285,203 288,982 292,760 296,538 115.0 285,350

Source: Bloomberg, PL Research Exhibit 44: SKO Under-recovery- Crude & Exchange rate (FY14) Brent Oil Prices ###### 49.0 Exchange Rate 50.0 51.0 52.0 53.0 54.0 95.0 200,347 206,200 212,052 217,905 223,757 229,610 100.0 213,374 219,493 225,611 231,729 237,848 243,966 105.0 226,401 232,785 239,169 245,554 251,938 258,322 110.0 239,428 246,078 252,728 259,378 266,028 272,678 115.0 252,455 259,370 266,286 273,202 280,118 287,034

289,279 293,209 297,138 301,068 304,997

Source: Bloomberg, PL Research Exhibit 45: LPG Under-recovery- Crude & Exchange rate (FY13) Brent Oil Prices (For Balance Period) ###### 51.0 Exchange Rate 52.0 53.0 54.0 55.0 56.0 95.0 263,924 268,378 272,832 277,287 281,741 286,196 100.0 263,924 268,378 272,832 277,287 281,741 286,196 105.0 263,924 268,378 272,832 277,287 281,741 286,196 110.0 263,924 268,378 272,832 277,287 281,741 286,196 115.0 263,924 268,378 272,832 277,287 281,741 286,196

Source: Bloomberg, PL Research Exhibit 46: LPG Under-recovery- Crude & Exchange rate (FY14) Brent Oil Prices ###### 49.0 Exchange Rate 50.0 51.0 52.0 53.0 54.0 95.0 239,178 249,482 259,786 270,090 280,394 290,698 100.0 278,537 289,644 300,751 311,859 322,966 334,073 105.0 317,896 329,806 341,717 353,627 365,538 377,448 110.0 357,254 369,968 382,682 395,396 408,109 420,823 115.0 396,613 410,130 423,647 437,164 450,681 464,198

Source: Bloomberg, PL Research

Source: Bloomberg, PL Research

August 23, 2012

16

Oil & Gas

Petrochemical products

HDPE-Naphtha spreads weakened during the current fortnight due to higher naphtha prices Average spreads for Aug 1FN stood at US$396/tonne against US$459/tonne in Jul12 Exhibit 47: HDPE-Naphtha spreads and Ethylene prices

2,200 2,000 1,800 1,600 1,400 1,200 1,000 800 600 400 200 0 (200)

Feb-08 Aug-07 Aug-08

Ethylene

HDPE-Naphtha (RHS)

1,100 1,000 900 800 700 600 500 400 300 200 100 0 (100)

Aug-12

(US$/ Ton)

Feb-09

Feb-10

Feb-11

Aug-09

Aug-10

Source: Bloomberg, PL Research PP naphtha spreads edged lower during the 1FN of Aug, averaging US$448/tonne as against US$510/tonne in Jul12 Exhibit 48: PP spreads over Naphtha and Propylene prices

2,200 2,000 1,800 1,600 1,400 1,200 1,000 800 600 400 200 0 (200)

Feb-08 Aug-07

Aug-08

Propylene

PP-Naphtha (RHS)

Aug-11

Feb-12

1,100 1,000 900 800 700 600 500 400 300 200 100 0 (100)

Aug-12

Feb-12 May-12

(US$/ Ton)

Feb-10

Feb-11

Aug-09

Aug-10

Source: Bloomberg, PL Research Cracker margins during Aug 1FN stood at US$11/tonne against the 5-year quarterly average of US$182/tonne Integrated PE margins at US$469/tonne during the fortnight lower than the 5-year average of US$539/tonne, down ~US$120/tonne compared to the average in Jul12 Non-integrated PE margins at US$282/tonne as against the 5-year average of US$273/tonne Exhibit 49: Cracker margins PE margins

1,000 800 600 400 200 0 -200

Cracker margins

PE margins (Integrated)

PE margins (Non Integrated)

Feb-08

Feb-09

Feb-10

Aug-07

Aug-10

Feb-11

Aug-11

Aug-11

Feb-12

Feb-09

May-08

May-09

May-10

May-11

Nov-07

Nov-08

Source: Bloomberg, PL Research

August 23, 2012

Nov-11

Nov-09

Nov-10

Aug-12

Aug-08

Aug-09

17

Oil & Gas

International PP margins increased during Aug 1FN to US$64/tonne as against US$32/tonnes (in July) with increase in Propylene price . PVC margins stood at US$463/tonne versus US$471/tonne in July12 5-year quarterly average of PP margins and PVC margins stand at US$173/tonne and 353/tonne, respectively

Exhibit 50: PP margins and PVC margins

600 500 400 300 200 100 0 -100

Feb-08

PP margins

PVC margins

Feb-09

Feb-10

Feb-11

Aug-07

Aug-08

Aug-10

Aug-11

Feb-12

May-09

May-10

May-11

Source: Company Data, PL Research Polyester margins are likely to increase during the month of Aug, from Rs23.8/kg to Rs25.8/kg above the trailing 1-year average margins of Rs21.6/kg Exhibit 51: RIL polyester margins

30 25 20

15 10

5 0

Aug-07 Aug-09 Aug-10 Aug-11 May-08 May-09 May-10 May-12

May-11

May-12

May-08

Nov-07

Nov-08

Nov-09

Nov-11

Nov-10

Nov-07

Nov-08

Nov-09

Nov-10

Nov-11

Source: PL Research, Company Data

August 23, 2012

Aug-12

Aug-08

Feb-08

Feb-10

Feb-11

Feb-12

Feb-09

Aug-12

Aug-09

18

Oil & Gas

Quarterly performance review

Oil sector Cairn India performs well, RIL witnessed a subdued quarter

Oil sector continues to be largely dominated by subdued production profile of PSU oil companies, while production ramp-up continues at Cairn India. RILs earnings quality continues to be weak with other income contributing ~35% of quarterly PBT. On the refining front, Q1 saw RIL posting a decent performance with GRMs of ~US$7.6 per barrel. However, OMCs reported negative GRMs driven by inventory valuation losses emanating from the sharp decline in crude in Q1. Upstream companies posted better-than-expected results driven by a 31.5% share of under-recovery and lower dry well write-offs during the quarter. However, Q1 numbers are based on provisional subsidy-sharing percentage, high system under recoveries and govt inaction on pricing, we believe, remains an overhang on these stocks.

Exhibit 52: Key Trends Company Key Variables Refining segment (36% of EBIT) RIL Petrochemical segment (44% of EBIT) E& P segment (19.9% of EBIT) Crude and natural gas sales volumes Net realisations during the quarter ONGC OVL (O+OEG production) Trend (QoQ) Takeaways Comment While the GRMs ($7.6) during the quarter were GRMS have improved significantly off flat QoQ (despite weak product cracks), Volumes late. We expect moderation in the processed were higher (17.3mt) same. Segment is bound to witness weak Segment EBIT witnessed a 16% QoQ decline on profitability going ahead. Chinese weaker spreads demand is the biggest factor affecting the spreads in the segment. Segment witnessed a significant QoQ decline in Gas production continues to decline the performance from flagship KG-D6 field Production growth continues to be Crude oil and gas production was flat QoQ (-1%) lacklustre for ONGC Standalone net realization stood at US$46.6 per Pending clarity on subsidy burden, we barrel, based on a discount of US$56 per barrel take limited cues from the quarterly on its production performance We assume production of 9.8 and Geopolitical issues led to decline 9.93 for FY13 and FY14, going ahead. (-22% YoY) in production from OVL fields, led by Weak production takes away the decline in Syria (-33%), Sudan (-81%) and Russia cushion against increasing underrecoveries Crude oil production declined to 0.95 mt on Crude oil production is likely to account of maintenance shutdown at stagnate at the same level in the next Numaligarh refinery 2 years Pending clarity on subsidy burden, we Net realization for the quarter stood at US$53.9 take limited cues from the quarterly per barrel performance Crude oil production perked up to 168k bopd in Maintains long term peak production Q1 guidance of 240k bopd Net realization for the quarter stood at US$101 Realisations are bound to track Brent per barrel oil prices, going ahead.

Crude and natural gas sales volumes OINL Net realisations during the quarter Crude production from Rajasthan field Net realisations from Rajasthan field

Cairn India

Source: PL Research, Company Data

August 23, 2012

19

Oil & Gas

Gas sector Petronet LNG and IGL performs well

Gas sector continues to demonstrate the existing trend of declining domestic production due to KG-D6 decline, coupled with fully utilised LNG terminals. The said rationale led to strength in LNG marketing margins, as witnessed in performance by strong performance in trading segment in case of both, GAIL as well as Petronet LNG. On the gas marketing side of the business, IGL as well as Gujarat Gas delivered better-than-expected set of performance, with price hikes resulting in improved margins QoQ. Thus, clearly Petronet LNG and IGL were amongst the performers in the gas value chain. Q1FY13 saw the continued impact of falling KG D6 gas volumes, which declined to 33 mmscmd (v/s 35 in Q4), currently at <30 mmscmd. Transmission volumes for GAIL declined as a result to 110 mmscmd (v/s 115.6mmscmd in Q4). GAIL results were boosted by higher trading margins and lower subsidy burden. Investment outlook for the stock continues to linger largely upon the additional gas availability. Akin to GAIL, GSPL witnessed subdued volumes during the quarter, resulting in flattish profitability. On the LNG front, high spot prices led to a decline in spot volumes for Petronet (-23% QoQ, -16% YoY). However, this was compensated by higher LNG volume outlook for the current quarter which is favourable, given the recent sharp fall in spot LNG prices (-35% from June highs).

Exhibit 53: Key Trends Company Key Variables Trend (QoQ) Takeaways Comment Gas transmission volumes Gas transmission volumes declined during Gas transmission volumes are expected to (32% of EBITDA) the quarter(110 v/s 115.6 QoQ) be weak, going ahead Gas trading segment Trading segment profitability improved 58% Earnings quality continues to weaken due to (28% of EBITDA) YoY higher share of trading segment Petrochemical segment Weak performance led by lower volumes Profitability of the petrochemical segment (11% of EBITDA) (-44% QoQ), EBIT declined 50% QoQ Volumes declined ~5% YoY, owing to ~23% Low spot LNG prices are expected to aid Volumes processed QoQ decline in spot LNG volumes volumes, going forward Marketing margins Volumes processed GSPL Transmission charges CNG volumes growth IGL PNG volumes growth Gross gas spreads Volumes sold Gujarat Gas Gross gas spreads Source: PL Research Marketing margins inched up to ~US$0.97/mmbtu v/s US$0.44 QoQ Volumes flat QoQ at 31.1 mmscmd Marketing margins expected to trend down in the medium term

GAIL

Petronet LNG

Volume outlook subdued on account of deteriorating domestic gas supply Realizations increased 5% YoY to Tariff revision from PNGRB to provide clarity Rs892/'000scm on future realizations CNG volumes up 13% YoY to 183m kg, flat CNG volumes expected to grow at ~15% for QoQ the next 2 years PNG volumes expected to grow at ~24% for PNG volumes grew 23% YoY to 80 m kg the next 2 years Gross spread improved marginally QoQ to Profitability outlook contingent on outcome Rs8.4 per scm of PNGRB court case Gas volumes declined 4% YoY to 3.18 Volume outlook remains weak mmscmd Margins are expected to be aided, going Gross spreads increased to Rs4.56/scm v/s forward, on account of proactive price hikes Rs3.9/scm QoQ by management

August 23, 2012

20

Oil & Gas

Exhibit 54: Q1FY13 Financial Summary Q1FY13 Sales Oil & Natural Gas Corporation EBITDA Margins (%) PAT Sales Reliance Industries EBITDA Margins (%) PAT Sales Cairn India EBITDA Margins (%) PAT Sales GAIL EBITDA Margins (%) PAT Sales Oil India EBITDA Margins (%) PAT Sales Petronet LNG EBITDA Margins (%) PAT Sales Gujarat Gas Company EBITDA Margins (%) PAT Sales Gujarat State Petronet EBITDA Margins (%) PAT Sales Indraprastha Gas EBITDA Margins (%) PAT Source: Company Data, PL Research 201,778 111,305 55.2 60,777 918,750 67,470 7.3 44,730 44,400 34,921 78.7 38,257 110,886 18,991 17.1 11,338 24,396 12,025 49.3 9,299 70,298 4,565 6.5 2,702 7,725 836 10.8 525 2,676 2,465 92.1 1,248 7,607 1,797 23.6 850 Q1FY12 161,990 92,670 57.2 40,949 810,180 99,260 12.3 56,610 37,127 31,748 85.5 27,461 88,674 15,556 17.5 9,847 22,878 11,629 50.8 8,496 46,233 4,381 9.5 2,567 5,852 1,403 24.0 960 2,843 2,619 92.1 1,374 5,374 1,583 29.5 801 6.2 (9.1) 41.5 13.5 (45.3) (5.9) (5.9) 5.3 32.0 (40.4) 9.5 52.1 4.2 15.1 6.6 3.4 39.3 25.0 22.1 (21.0) 19.6 10.0 48.4 13.4 (32.0) YoY gr. (%) 24.6 20.1 Q4FY12 193,399 115,771 59.9 56,444 851,820 65,630 7.7 42,360 36,513 29,812 81.6 21,862 104,546 7,338 7.0 4,833 17,197 4,823 28.0 4,448 63,754 4,230 6.6 2,451 7,240 765 10.6 654 2,763 2,520 91.2 1,293 7,212 1,695 23.5 808 5.3 (3.4) 5.5 6.1 (19.7) (3.2) (2.2) 10.2 6.7 9.3 109.1 10.3 7.9 134.6 41.9 149.3 75.0 6.1 158.8 5.6 21.6 17.1 7.7 7.9 2.8 QoQ gr.(%) 4.3 (3.9)

August 23, 2012

21

Oil & Gas

Exhibit 55: KG Gas production

70

60 50

60 47 34

19

60

59

55

51

49

45

(mmscmd)

41

35

40

33

30 20 10

-

Q2FY10

Q4FY10

Q2FY11

Q4FY11

Q1FY10

Q3FY10

Q1FY11

Q3FY11

Q1FY12

Q2FY12

Q3FY12

Q4FY12

Source: Company Data, PL Research Exhibit 56: GAIL transmission volumes and realizations

NG Transmission Volume 140.0 Realisation (RHS) 1,000

120.0

(mmscmd)

100.0 80.0

800 600 400 200 Q3FY09 Q4FY10 Q4FY11 Q1FY12 Q1FY13

Q1FY13

60.0

40.0 20.0

Q1FY09 Q2FY09 Q4FY09 Q1FY10 Q2FY10 Q3FY10 Q1FY11 Q2FY11 Q3FY11 Q2FY12 Q3FY12 Q4FY12

Source: PL Research, Company Data Exhibit 57: RIL v/s Benchmark Singapore GRMs

Singapore GRMs Spread over Singapore GRMs RIL GRMs

12.0

10.0 8.0 6.8 6.0

7.5

5.9 1.9

7.3 3.8

7.9

9.0 5.5

10.3 10.1 9.2 8.5 9.0 7.9 7.6 7.4 6.8 7.4

7.6 6.7

6.0

4.0

4.1

5.0

4.7

3.1

2.0 Q1FY10 Q2FY10

(2.0)

Q4FY10

Q4FY11

Q4FY12

Q3FY10

Q1FY11

Q2FY11

Q3FY11

Q1FY12

Q2FY12

Q3FY12

Source: Company Data, PL Research

August 23, 2012

Q1FY13

(Rs /'000scm)

22

Oil & Gas

Exhibit 58: Upstream share of subsidy burden as a % of total under recoveries

47.1% 34.3% 41.5%

50.0% 45.0% 40.0% 35.0% 30.0% 25.0% 20.0% 15.0% 10.0% 5.0% 0.0%

35.0%

38.7%

43.9% Q4FY12

6M (1.4) (0.6) (11.8) (0.5) (6.5) (6.4) (23.4) (0.5) (19.3)

FY05

29.5%

FY07

FY06

FY08

FY09

FY10

31.3%

FY11

Q2FY12

Source: PL Research, Company Data

Stock Performance & Valuations

Exhibit 59: Stock performance Absolute 1M Reliance Industries Oil & Natural Gas Corporation Cairn India GAIL Oil India Petronet LNG Indraprastha Gas Gujarat State Petronet Gujarat Gas Company Source: Bloomberg, PL Research 11.8 1.5 2.1 3.5 (3.3) 2.2 8.9 8.4 (0.7) 3M 16.9 16.8 2.7 17.0 8.5 14.3 26.1 17.5 1.8 6M (3.1) (2.2) (13.5) (2.1) (8.1) (8.1) (25.1) (2.2) (20.9) 12M 6.7 (0.1) 25.2 (11.6) (9.5) (13.7) (38.3) (23.2) (26.9) 1M 7.8 (2.5) (1.9) (0.5) (7.3) (1.8) 4.9 4.4 (4.7) Relative to Sensex 3M 5.5 5.5 (8.7) 5.6 (2.9) 3.0 14.7 6.1 (9.5) 12M (2.5) (9.3) 15.9 (20.8) (18.7) (22.9) (47.5) (32.4) (36.1)

Exhibit 60: Valuation and Recommendation Company Indraprastha Gas GAIL Gujarat State Petronet Gujarat Gas Company Petronet LNG Reliance Industries ONGC Cairn India Oil India Reco BUY Reduce Accumulate Accumulate BUY Reduce Accumulate Accumulate Accumulate CMP (Rs) 260 367 74 302 151 808 286 334 480 TP (Rs) 310 345 87 334 176 778 301 403 518 Upside (%) 19.2 -5.9 17.5 10.6 16.8 -3.6 5.2 20.8 7.9 P/E (x) FY13 10.4 12.6 9.8 12.6 10.8 12.9 10.5 6.5 8.4 FY14 9.7 11.6 10.9 11.8 11.1 12.8 8.6 6.8 7.7 P/BV(x) FY13 2.5 2.1 1.5 4.4 2.6 1.4 1.7 1.1 1.4 FY14 2.1 1.9 1.3 4.0 2.2 1.3 1.5 1.0 1.3 EV/EBITDA (x) FY13 5.7 9.2 5.9 8.7 7.9 8.0 4.3 4.2 2.9 FY14 5.1 8.4 6.5 7.9 7.0 7.4 3.5 3.5 2.5

Source: Company Data, PL Research

August 23, 2012

Q1FY13

Q1FY12

Q3FY12

31.50%

33.2%

32.0%

33.0%

23

Oil & Gas

Prabhudas Lilladher Pvt. Ltd. 3rd Floor, Sadhana House, 570, P. B. Marg, Worli, Mumbai-400 018, India Tel: (91 22) 6632 2222 Fax: (91 22) 6632 2209 Rating Distribution of Research Coverage

60%

% of Total Coverage

55.3%

50% 40%

30% 20%

22.7%

21.3%

10% 0% BUY Accumulate Reduce

0.7% Sell

PLs Recommendation Nomenclature

BUY Reduce Trading Buy Not Rated (NR) : : : : Over 15% Outperformance to Sensex over 12-months Underperformance to Sensex over 12-months Over 10% absolute upside in 1-month No specific call on the stock Accumulate Sell Trading Sell Under Review (UR) : : : : Outperformance to Sensex over 12-months Over 15% underperformance to Sensex over 12-months Over 10% absolute decline in 1-month Rating likely to change shortly

This document has been prepared by the Research Division of Prabhudas Lilladher Pvt. Ltd. Mumbai, India (PL) and is meant for use by the recipient only as information and is not for circulation. This document is not to be reported or copied or made available to others without prior permission of PL. It should not be considered or taken as an offer to sell or a solicitation to buy or sell any security. The information contained in this report has been obtained from sources that are considered to be reliable. However, PL has not independently verified the accuracy or completeness of the same. Neither PL nor any of its affiliates, its directors or its employees accept any responsibility of whatsoever nature for the information, statements and opinion given, made available or expressed herein or for any omission therein. Recipients of this report should be aware that past performance is not necessarily a guide to future performance and value of investments can go down as well. The suitability or otherwise of any investments will depend upon the recipient's particular circumstances and, in case of doubt, advice should be sought from an independent expert/advisor. Either PL or its affiliates or its directors or its employees or its representatives or its clients or their relatives may have position(s), make market, act as principal or engage in transactions of securities of companies referred to in this report and they may have used the research material prior to publication. We may from time to time solicit or perform investment banking or other services for any company mentioned in this document.

August 23, 2012

24

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- TM 9-2815-202-34 Engine M 109Documento670 páginasTM 9-2815-202-34 Engine M 109Thoukididis Thoukididou100% (2)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- DPR Engineering CollegeDocumento45 páginasDPR Engineering Collegeagarwal.rmAinda não há avaliações

- Talmage Determining Thickener Unit Areas PDFDocumento4 páginasTalmage Determining Thickener Unit Areas PDFpixulinoAinda não há avaliações

- Test 804: Ursus C-325 (Diesel)Documento2 páginasTest 804: Ursus C-325 (Diesel)tzababagita936Ainda não há avaliações

- Commissioning Procedure For Diesel GeneratorDocumento3 páginasCommissioning Procedure For Diesel Generatorthilanka0650% (4)

- Site Training Manual For Power TransformerDocumento99 páginasSite Training Manual For Power TransformerYadav GaneshAinda não há avaliações

- Spectrometer Is Standard 9879.1998Documento11 páginasSpectrometer Is Standard 9879.1998agarwal.rmAinda não há avaliações

- AHTS Market ReportDocumento45 páginasAHTS Market Reportagarwal.rmAinda não há avaliações

- Ann Way Machine Tools Co., LTDDocumento3 páginasAnn Way Machine Tools Co., LTDagarwal.rmAinda não há avaliações

- Hi-Jet HoldersDocumento4 páginasHi-Jet Holdersagarwal.rmAinda não há avaliações

- Latest 48 Final Air StandardDocumento4 páginasLatest 48 Final Air StandardSuman GhoshAinda não há avaliações

- AHTS Market ReportDocumento45 páginasAHTS Market Reportagarwal.rmAinda não há avaliações

- Steels Suitable For GalvanizingDocumento5 páginasSteels Suitable For Galvanizingagarwal.rmAinda não há avaliações

- O&M Contracts For FPSO FPSO ContractsDocumento6 páginasO&M Contracts For FPSO FPSO Contractsagarwal.rm100% (1)

- Indian Register of Ships PDFDocumento1.060 páginasIndian Register of Ships PDFagarwal.rm100% (5)

- Indian PCB Scenerio (IPCA)Documento12 páginasIndian PCB Scenerio (IPCA)Bhaskar Jay PhukanAinda não há avaliações

- Dolphin Analyst Report 2010Documento29 páginasDolphin Analyst Report 2010agarwal.rmAinda não há avaliações

- HSE in Well OpsDocumento34 páginasHSE in Well OpsethelchudiAinda não há avaliações

- Oil India Tender For MODUDocumento253 páginasOil India Tender For MODUagarwal.rmAinda não há avaliações

- FPSO Forum 2013-PowerpointDocumento18 páginasFPSO Forum 2013-Powerpointagarwal.rmAinda não há avaliações

- FPSO Forum 2013-PowerpointDocumento18 páginasFPSO Forum 2013-Powerpointagarwal.rmAinda não há avaliações

- Rabobank-Outlook Dredging September 2013 PDFDocumento77 páginasRabobank-Outlook Dredging September 2013 PDFagarwal.rmAinda não há avaliações

- The Top 10 Trigger PointsDocumento38 páginasThe Top 10 Trigger PointsThalia Altair100% (2)

- Kavin Engineering - ProjectDocumento2 páginasKavin Engineering - Projectagarwal.rmAinda não há avaliações

- Geir Sjurseth 2014Documento24 páginasGeir Sjurseth 2014agarwal.rmAinda não há avaliações

- Safe Two Wheeler DrivingDocumento10 páginasSafe Two Wheeler Drivingagarwal.rmAinda não há avaliações

- ONGC Pipavav Vessel SpecsDocumento5 páginasONGC Pipavav Vessel Specsagarwal.rmAinda não há avaliações

- Geir Sjurseth 2Documento9 páginasGeir Sjurseth 2agarwal.rmAinda não há avaliações

- India: "Truth Alone Triumphs"Documento37 páginasIndia: "Truth Alone Triumphs"agarwal.rmAinda não há avaliações

- Rig List (Unlocked by WWW - Freemypdf.com)Documento18 páginasRig List (Unlocked by WWW - Freemypdf.com)agarwal.rmAinda não há avaliações

- Did You Know: Slowing Down Isn'T The Only Adjustment You Need To Make When Driving in Bad WeatherDocumento1 páginaDid You Know: Slowing Down Isn'T The Only Adjustment You Need To Make When Driving in Bad Weatheragarwal.rmAinda não há avaliações

- Indian Register of Ships PDFDocumento1.060 páginasIndian Register of Ships PDFagarwal.rm100% (5)

- Adel Shipping LogisticsDocumento5 páginasAdel Shipping Logisticsagarwal.rmAinda não há avaliações

- Dredging in Figures 2012 PDFDocumento9 páginasDredging in Figures 2012 PDFagarwal.rmAinda não há avaliações

- Rabobank-Outlook Dredging September 2013 PDFDocumento77 páginasRabobank-Outlook Dredging September 2013 PDFagarwal.rmAinda não há avaliações

- Ravenol 5W30 MB 229.52Documento4 páginasRavenol 5W30 MB 229.52vsssarmaAinda não há avaliações

- Hydroxy BoostersDocumento265 páginasHydroxy Boostersmars1976100% (3)

- Service Parts: Residential/Commercial Generator SetsDocumento48 páginasService Parts: Residential/Commercial Generator Setswaqarrasheed0% (1)

- Tbi & Tpa Maria Wella ManurungDocumento1 páginaTbi & Tpa Maria Wella ManurungAgnes RK SilalahiAinda não há avaliações

- Ipgcl Summer Training Report PPCLDocumento41 páginasIpgcl Summer Training Report PPCLAnkit SarohaAinda não há avaliações

- Machine Profiles: 793, 793B and 793C Construction and Mining TrucksDocumento8 páginasMachine Profiles: 793, 793B and 793C Construction and Mining TrucksNorberto Galindo CHavezAinda não há avaliações

- Marine Engineering Practice MEP Questions and Answers-Part 5Documento4 páginasMarine Engineering Practice MEP Questions and Answers-Part 5Basuraj Am-bigerAinda não há avaliações

- N61 1491 000 000 TPE331 10TurbopropEngine BroDocumento2 páginasN61 1491 000 000 TPE331 10TurbopropEngine BroDima George100% (1)

- Single Buoy MooringDocumento5 páginasSingle Buoy MooringRachmat Hidayat SapwariAinda não há avaliações

- Air Handlers Service InstructionsDocumento93 páginasAir Handlers Service InstructionsAnonymous uGPcnH0XppAinda não há avaliações

- Installation and Maintenance Manual For Diesel Engine Fire Pump Controller Automatic Controller Model GPDDocumento22 páginasInstallation and Maintenance Manual For Diesel Engine Fire Pump Controller Automatic Controller Model GPDds_engenharia8817Ainda não há avaliações

- Oxyacetylene WELDINGDocumento43 páginasOxyacetylene WELDINGAgel Mark NazarenoAinda não há avaliações

- Metric and Inch (Sae) Fasteners: All ModelsDocumento22 páginasMetric and Inch (Sae) Fasteners: All ModelsMONTACARGAS AVSAinda não há avaliações

- 21ih-In-Valv Solenoide InoxDocumento1 página21ih-In-Valv Solenoide InoxMonica CarrenoAinda não há avaliações

- 500 Technical Questions Safety&Fire-1Documento26 páginas500 Technical Questions Safety&Fire-1Saad GhouriAinda não há avaliações

- D10T Track-Type Tractor Hydraulic System: Dozer Control Valve 5Documento2 páginasD10T Track-Type Tractor Hydraulic System: Dozer Control Valve 5Roberto Antonio Chihuaihuan Araya100% (2)

- K103 LPG Control Module X1 (LCP) : SparkDocumento2 páginasK103 LPG Control Module X1 (LCP) : Sparkابو عمر الغزيAinda não há avaliações

- PHQ250Jackleg BrochureDocumento2 páginasPHQ250Jackleg BrochurePieroGamarraGarciaAinda não há avaliações

- Standard Operating ProceduresDocumento10 páginasStandard Operating ProceduresGaurav SethiyaAinda não há avaliações

- Petrochemical OverviewDocumento8 páginasPetrochemical OverviewAtish NandanwarAinda não há avaliações

- The Fluctuating Price of Oil Has A Big Impact OnDocumento1 páginaThe Fluctuating Price of Oil Has A Big Impact OnAmit PandeyAinda não há avaliações

- Diploma MechanicalDocumento4 páginasDiploma Mechanicaltajshah283Ainda não há avaliações

- 2011 Guide To Additives & CleanersDocumento14 páginas2011 Guide To Additives & CleanersOilLubeNewsAinda não há avaliações

- CYL100 HomeworkDocumento1 páginaCYL100 HomeworkYash GuptaAinda não há avaliações

- Variable Valve Timing and Lifting Technologies in Different Automobiles CompaniesDocumento5 páginasVariable Valve Timing and Lifting Technologies in Different Automobiles CompaniesAwais AnwarAinda não há avaliações