Escolar Documentos

Profissional Documentos

Cultura Documentos

ME Ch8 PerfecrCompetition Wosabi

Enviado por

Abdulrahman AlotaibiDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

ME Ch8 PerfecrCompetition Wosabi

Enviado por

Abdulrahman AlotaibiDireitos autorais:

Formatos disponíveis

ECON340

Ch.8: Perfect Competition

Dr. Mohammed Alwosabi

CHAPTER EIGHT (Part 1)

Pricing P i i and d Output O t t Decisions D i i in Perfect Competition

Four Basic Market Types How firms establish their price and output levels in order to achieve their objective of profit maximization (or loss minimization)? The answer to this depends on the market structure in which the firm is operating. There are four main types of market structure: 1. Perfect competition 2. Monopoly 3. Monopolistic Competition 4. Oligopoly

Market structure refers to the size and number of firms in the market.

2

Perfect Competition Perfect competition refers to a market in which 1.there are large number of relatively small firms selling an identical (standardized) product, 2l 2.large number b of f buyers b who h are indifferent i diff t from whom to buy. 3.None of the buyers or sellers has market Power, which refers to the ability to influence the market price of a good or service. Each firm is a price taker.

3

4. 5. 6. 7.

Very easy market entry and exit. Information is available to all. Non-price competition is not possible Firm earns only zero economic profit in the long run. Examples: the markets for agricultural product (corn, wheat, coffee), financial instruments (stocks, bonds, foreign exchange), precious metals (gold, silver, platinum) and the global petroleum industry

4

Monopolistic Competition Monopolistic competition is a market in which: 1.large number of relatively small firms producing similar but differentiated products. 2 E h firm 2.Each fi maintains i t i some control t l of f its it own price. 3.It is easy to enter or exit this market. 4.Non-price competition is possible 5.In the long run, economic profit of any firm in this type of markets is zero.

Examples: Small industries such as retail and service establishments (restaurants, boutiques, luggage stores, shoe stores, stationary stores, repair shops, laundries, beauty parlors) There are many of monopolistic competitive firms in any given city or area of the city. The start-up capital is relatively low, so it is fairly easy to start these types of business. Each one tries its best to stand out among its many competitors by differentiating its product.

ECON340

Ch.8: Perfect Competition

Dr. Mohammed Alwosabi

Oligopoly Oligopoly is a market in which: 1. a small number of relatively large firms producing all or most of the market supply of a particular good or service. 2.The product may be identical (standardized) or differentiated. diff ti t d 3.It is difficult to enter this market. 4.Non-price competition is very important among the firms selling differentiated products

7

5. Firms in this market can make positive economic profit based on whether they compete with each other severely or they have some kind of mutual agreements regarding prices, market share and products. Examples: manufacturing sector, oil refining, certain types of computer hardware and software, chemical and plastics, steel, automobile, soft drinks, airline travel, banking industry, insurance companies, telecommunications, etc

Monopoly Monopoly refers to: 1.one firm that produces the entire market supply of a particular unique good or service that has no close substitutes. 2.The firm is the industry 3.It has market power. It is a price maker. 4.It is very difficult or impossible for any other firm to enter this market. 5.This firm makes high economic profit subject to regulations.

9

6. Firm earn positive economic profit in the long run. 7. Non-price competition is not necessary Examples: Examples of pure monopoly are not easy to find. Electricity and water industry in some countries, ti patent t t laws l sometimes ti provide id companies with temporary monopolies, a company that is so dominant might be said to exhibit monopolistic status (such as Microsoft)

10

Pricing and Output Decisions in Perfect Competition Perfectly competitive market exists when: 1. Each firm (seller/producer) is small relative to market demand firm cannot affect market demand. 2 No 2. N unique i characteristics h t i ti of f each h firms fi product consumers are indifferent about from which firm to buy.

This implies that in competitive market 1. Firm receives the same marginal revenue from the sale of each additional unit of product; equal to the price of the product (MR=P) 2. Average revenue of the firm is also equal to price (AR=P) 3. No limit to the total revenue that the firm can gain in a perfectly competitive market. 4. The firms objective is to maximize its profit in the short run. If it cannot earn a profit, then it seeks to minimize its loss.

12

11

ECON340

Ch.8: Perfect Competition

Dr. Mohammed Alwosabi

The Basic Business Decision: Entering a market on the basis of the following questions: 1. How much should we produce to maximize profit? 2. If a loss rather than a profit is incurred, will it b be worthwhile th hil t to continue ti i in this thi market k t in the long run (in hopes that we will eventually earn a profit) or should we exit?

Market demand curve vs. firm demand curve It is important to distinguish between the market demand curve and the demand curve facing a particular firm. The equilibrium market price is determined by the interaction of market demand and market supply curves. The market demand curve for a product is downward sloping (less than infinite). The market supply curve is upward sloping However, the demand curve facing the perfectly competitive firm is different.

14

13

Since the output of each firm is such a very small share of this total output, no individual firm can affect the market price and therefore is a price taker. The perfectly competitive firm faces a horizontal, perfectly elastic demand curve (with price elasticity of demand equal to infinity). At a fixed price, the firm sells any quantity it wants. No matter of what is the quantity sold the firm charges the same price, i.e., P = D

15

Market

P

Firm

D = MR =AR

D Q Q (in thousands) 16

Given the fixed price and the horizontal demand curve, the perfectly competitive firm faces two SR decisions and two LR decisions. 1. Production decisions in SR: a. Whether to produce or shut down temporarily? b. If it is to produce, how much to produce? And how much profit will it earn?

2. Investment decisions in LR: a. Whether to enter, stay or leave the industry b. If the firm is already in the market, whether to expand or downsize the plant

17

18

ECON340

Ch.8: Perfect Competition

Dr. Mohammed Alwosabi

Short Run Decision: The Production Decision Since a competitive firm cannot affect market price (a price taker), it has to decide what is the amount of output that will maximize the firm's total economic profit (or minimize loss) To find the amount of output that maximizes profit we can use the total analysis or marginal analysis

19

Total Analysis approach: Profit is maximized at Q* where TR-TC is highest Compare the total revenue and total cost schedules and find the level of output that either maximizes the firms profits or minimizes its loss. TR = P * Q. Since a perfectly competitive firm can sell all of its output at one price, the total revenue curve of a perfectly competitive firm is an upward sloping straight line, with slope equal to market (equilibrium) price (P*)

20

In order to calculate profit, we also have to see how costs vary with the rate of output in the short-run. TC is the opportunity cost of production, which includes normal profit. Total costs (TFC + TVC) increase as output expands At first, expands. first they rise slowly due to the increasing marginal returns, and then they increase more quickly due to the diminishing marginal returns.

Since profit depends on the difference between TR and TC, profit is maximized when TR exceeds TC by the largest amount; i.e., where the vertical distance between TR curve and TC curve is the largest.

21

22

TR

TC Loss

TR Break-even Point

R C Loss 0 Profit + 0 Loss a a Q* b

Max Profit Break-even Point

Q Max Profit

Profit Q* b

Marginal Analysis approach: What an additional unit of output brings in revenue is its marginal revenue (MR) and what it costs to produce is its marginal cost (MC). A firm that wants to maximize its profit (or minimize its loss) should produce a level of output at which the additional revenue received from the last unit is equal to the additional cost of producing that unit; i.e., MR=MC.

23 24

Q Loss

ECON340

Ch.8: Perfect Competition

Dr. Mohammed Alwosabi

P, MR,MC

MC

P (MR)= MC � maintain Q P (MR)> MC � �Q

P(MR) < MC��Q P =MR =D

Q Q* 25

Since perfect competition structure implies MR=P, the MR=MC rule may be restated as P=MC. Equating MR (or P) to MC shows us the efficient level of output. However, this level of output does not tell us whether the firm is maximizing profit or minimizing loss. To determine whether a firm is earning an economic profit or incurring an economic loss, we compare the firms average total cost, ATC, at the profit maximizing output with the market price.

26

Profit = TR TC = (P - AC) Q* 1. Total economic profit is maximized if P=MC above ATC (P > ATC) 2. Total economic profit is zero (normal profit) if P = MC = ATC Break-even point @ minimum AC. 3 Total 3. T t l economic i loss l is i minimized i i i d if P=MC P MC below ATC (P < ATC)

1. Profit Maximization: Making Positive Economic Profit If ATC curve is added to the diagram, a profit-maximizing firm will produce at the level of output (Q*) at which P = MC > ATC

27

28

P, MR,Costs

MC ATC C

P=5 A=3

P =MR=AR=D

TR = P Q = 5 * 20 = 100 TC = ATC Q = 3 * 20 = 60 Total economic profit =TR TC = (P-ATC) * Q= 2 * 20 = 40 If a firm is receiving positive economic profits, the owners are receiving a return on th i investment their i t t that th t exceeds d what h t they th could receive if their resources had been used in an alternative occupation.

Q* = 20

Q 29 30

ECON340

Ch.8: Perfect Competition

Dr. Mohammed Alwosabi

2. Zero Economic Profit (Normal Profit) If P = MC = min ATC, firm is earning zero economic profit, i.e., is earning normal profit (this is known also as break-even point)

P, MR, Costs

MC ATC

P=5

P =MR =D

0 31

Q*=20

Q 32

Total profit = (P ATC) * Q, But since P = ATC then (P-ATC) = 0 total profit = 0

3. Loss Minimization and the Temporary Shutdown Decision If P < ATC at the level of output at which MR = MC, the firm will incur economic loss.

33

34

P, MR, Costs

MC ATC

A=8 P=5 P =MR =D

Q*=20

Q 35

Total economic profit = (P-ATC)*Q = -3 * 20 = - 60 Economic loss Now, with this loss, should the firm continue its operations? If the firm suffers a loss, what is the best action? Remember that: Profit = (P ATC) * Q, and that ATC = AFC + AVC Therefore, Profit = (P AFC - AVC) * Q Remember also that fixed costs must be paid even if output = 0.

36

ECON340

Ch.8: Perfect Competition

Dr. Mohammed Alwosabi

Thus, if the firm shuts down its operation it has to pay the fixed costs To determine this, we have to compare the firm's loss if it stays in business with its loss if it shuts down. If the firm decides to shut down, its revenue will equal zero and its costs will equal its fixed costs. (Remember, fixed costs must be paid even if the firm shuts down.) Thus, the firm receives an economic loss equal to its fixed costs if it shuts down.

37

The firm will stay in business in the short run even if it receives an economic loss as long as its loss is less than its fixed costs. This will occur if the revenue received by the firm is large enough to cover its variable costs and some of its fixed costs. In mathematical terms, this means that the firm will stay in business as long as TR = P x Q > TVC

38

Contribution Margin (CM): the amount by which total revenue exceeds total variable cost: CM = TR TVC If CM > 0 �firm will stay in business If CM = 0 �firm might stay in business or might shut down Dividing Di idi both b th sides id of f the th above b expression i by Q, we can say that the firm will stay in business as long as P > AVC The shutdown point is the output and price at which the firm just covers its TVC, where P = MC = min AVC.

39

P, Costs MC c P1 P2 P3 b a ATC AVC

Q3 Q2

Q Q1 40

The Firm Short-run Supply Curve

P, Costs

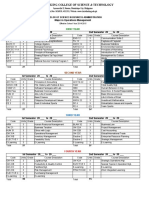

Example: What is the profit maximizing output for a perfectly competitive firm selling its product at $10, with the following cost structure?

Q 4 5 6 7 8

TFC 10 10 10 10 10

TVC 19 25 34 45 57

MC

MC c P1 P2 P3 b a

ATC AVC

0 41

Q3 Q2

Q Q1 42

ECON340

Ch.8: Perfect Competition

Dr. Mohammed Alwosabi

Pricing and Output Decisions in Perfect Competition in the LR In the long run, two adjustments are possible: 1. Existing firms may adjust plant size 2. Entry and exit of firms is possible Both actions will affect market supply and a new market price is established

1. 2. 3.

Existence of economic profit: Invites existing firms to expand plant size invites entry of new firms This shifts the supply curve to the right, decreases price and reduces profits until economic profit is wiped out.

43

44

S1

MC S2 Sn P, MR, Costs P1 P2 Pn ATC

P1 P2 Pn

Economic loss causes exit of firms or shrink plant size which shifts the supply curve to the left, increases price and reduces loss until it is eliminated. Thus, the price in the competitive market in the long-run will settle at the point where firms earn only normal profit (zero economic profit).

D 0 Q 0 Qn Q2 Q1 Q 45 46

Observations in perfectly competitive markets: 1. The earlier the firm enters a market, the better its chances of earning above-normal profit (assuming a strong demand in the market). 2. As new firms enter the market, firms that want to survive and perhaps thrive must find ways to produce at the lowest possible cost, or at least at cost levels below those of their competitors.

3. Firms that find themselves unable to compete on the basis of cost might want to try competing on the basis of product differentiation instead.

47

48

ECON340

Ch.8: Perfect Competition

Dr. Mohammed Alwosabi

Using Calculus: Total analysis: find Q* that maximize profit by differentiating profit function. Marginal analysis: set MR equal to MC and solve for Q* that maximize profit . Exercise: Given P = 170 - 5Q and TC = 40 +50Q + 5Q2. Find optimal output level Q* that maximize profit (Q* = 6, = 320)

49

Exercise: A firm operating in perfectly competitive market has the following total cost function TC = 6000 + 400Q 20Q2 + Q3 a.What is the lowest (minimum) price at which the firm will shut down in the SR? b.If the market price is $310, what would be the profit maximizing output? What is the total profit (loss)? Should the firm produce at this price?

50

a. P = $300 (Minimum AVC, below the firm should shutdown) b. @ P =$310, profit maximizing output Q* =10.5 units, where TR TC is highest, or where MR = MC. (Use quadratic form) @ Q* =10.5, this firm makes a loss of $5897 625 (substitute Q* =10.5 $5897.625 =10 5 in both TR & TC functions. @ Q* =10.5, AVC = $300.5 < P = $310. The firm should continue production so long it covers its AVC (contribution margin is positive)

51 52

53

Você também pode gostar

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- AES Adjusted WACC Case StudyDocumento12 páginasAES Adjusted WACC Case StudyTim Castorena33% (3)

- Marketing Analytics For Data-Rich Environments: Michel Wedel & P.K. KannanDocumento25 páginasMarketing Analytics For Data-Rich Environments: Michel Wedel & P.K. KannanAbhinandan ChatterjeeAinda não há avaliações

- Market Structure ConfluenceDocumento7 páginasMarket Structure ConfluenceSagar BhandariAinda não há avaliações

- Coca-Cola India Case StudyDocumento12 páginasCoca-Cola India Case StudyAnna Sandgren100% (4)

- Equity Forward ContractDocumento6 páginasEquity Forward Contractbloomberg1234Ainda não há avaliações

- Marketing Plan (Handout)Documento16 páginasMarketing Plan (Handout)Grachel Gabrielle Enriquez67% (33)

- ICT 2022 Mentorship - Free DownloadableDocumento297 páginasICT 2022 Mentorship - Free DownloadableSlw habbosAinda não há avaliações

- Chapter 3 Information Systems, Organizations, and StrategyDocumento14 páginasChapter 3 Information Systems, Organizations, and StrategyHASNAT ABULAinda não há avaliações

- Sustainability at Coca Cola PDFDocumento17 páginasSustainability at Coca Cola PDFAbdulrahman AlotaibiAinda não há avaliações

- Coke Vs PepsiDocumento108 páginasCoke Vs PepsiZubair DarksharkAinda não há avaliações

- Inter BusinessDocumento11 páginasInter BusinessAbdulrahman AlotaibiAinda não há avaliações

- Coca Cola Annual ReportDocumento40 páginasCoca Cola Annual ReportLakshitha Dx AmalAinda não há avaliações

- Chuchu Sun Xiaoyi Tang Dylan WeinberDocumento13 páginasChuchu Sun Xiaoyi Tang Dylan WeinberAbdulrahman AlotaibiAinda não há avaliações

- Table of ContentDocumento18 páginasTable of ContentAbdulrahman AlotaibiAinda não há avaliações

- Assignment Report of Business Communication On Coca Cola Beverages Pakistan LimitedDocumento28 páginasAssignment Report of Business Communication On Coca Cola Beverages Pakistan LimitedAbdulrahman AlotaibiAinda não há avaliações

- Ïîpq D#Ôóc: Abdullah A. AliDocumento13 páginasÏîpq D#Ôóc: Abdullah A. AliAbdulrahman AlotaibiAinda não há avaliações

- Marketing Plan FOR Coca-Cola: By:-Sampada MhatreDocumento17 páginasMarketing Plan FOR Coca-Cola: By:-Sampada MhatreAbdulrahman AlotaibiAinda não há avaliações

- Presentationonswotanalysisofcoca Cola 131206050114 Phpapp02Documento28 páginasPresentationonswotanalysisofcoca Cola 131206050114 Phpapp02Abdulrahman AlotaibiAinda não há avaliações

- Cocacolaecommerce 130718100852 Phpapp01Documento42 páginasCocacolaecommerce 130718100852 Phpapp01Abdulrahman Alotaibi100% (1)

- 5poter Coca ColaDocumento27 páginas5poter Coca ColaKhairy Al-HabsheeAinda não há avaliações

- Annual Report 2012Documento114 páginasAnnual Report 2012Jennifer ChapmanAinda não há avaliações

- Final Report On Coca ColaDocumento88 páginasFinal Report On Coca ColaVikas Gupta70% (10)

- Final Report On Coca ColaDocumento88 páginasFinal Report On Coca ColaVikas Gupta70% (10)

- Cocacola1 100315141443 Phpapp02Documento12 páginasCocacola1 100315141443 Phpapp02Varun JainAinda não há avaliações

- Assignment Report: On Coca Cola Beverages Pakistan Limited: Ubmitted BY SİF UssainDocumento23 páginasAssignment Report: On Coca Cola Beverages Pakistan Limited: Ubmitted BY SİF UssainAbdulrahman AlotaibiAinda não há avaliações

- Coca Cola Co SWOT AnalysisDocumento46 páginasCoca Cola Co SWOT AnalysisAbdulrahman AlotaibiAinda não há avaliações

- Coca-Cola 125 Years BookletDocumento27 páginasCoca-Cola 125 Years BookletShahid Muhammed TawhidAinda não há avaliações

- Coca Cola at A GlanceDocumento1 páginaCoca Cola at A GlanceAbdulrahman AlotaibiAinda não há avaliações

- Coca Colacasestudy 120406220553 Phpapp02Documento61 páginasCoca Colacasestudy 120406220553 Phpapp02Syed Ahsan Hussain XaidiAinda não há avaliações

- Project Report of Coca ColaDocumento121 páginasProject Report of Coca Colavarunpunwani1234Ainda não há avaliações

- Coca Cola Co SWOT AnalysisDocumento45 páginasCoca Cola Co SWOT AnalysisMuneer929Ainda não há avaliações

- Swot Analysis On Coca ColaDocumento1 páginaSwot Analysis On Coca ColaAhmad MahmoodAinda não há avaliações

- SWOT of CokeDocumento23 páginasSWOT of CokeAbdulrahman AlotaibiAinda não há avaliações

- Coca Cola SWOTDocumento3 páginasCoca Cola SWOTThu NgaAinda não há avaliações

- Coca Cola Project ReportDocumento31 páginasCoca Cola Project ReportAbdulrahman AlotaibiAinda não há avaliações

- Dr. Mai AssignmentDocumento27 páginasDr. Mai AssignmentChris Johnson AgholorAinda não há avaliações

- Global Case ReportDocumento25 páginasGlobal Case ReportPartha BhattacharjeeAinda não há avaliações

- 13 Costs ProductionDocumento54 páginas13 Costs ProductionAtif RaoAinda não há avaliações

- ASM SOC B. Com. (Hons.) Course Syllabus 2019-22Documento99 páginasASM SOC B. Com. (Hons.) Course Syllabus 2019-22Rajdeep Kumar RautAinda não há avaliações

- Name: Marc Klarenz L. Ocate Section: HUMSS AM-3 Subject: Discipline and Ideas in Social ScienceDocumento7 páginasName: Marc Klarenz L. Ocate Section: HUMSS AM-3 Subject: Discipline and Ideas in Social ScienceLovelyn MaristelaAinda não há avaliações

- Danshui Plant No. 2Documento10 páginasDanshui Plant No. 2AnandAinda não há avaliações

- Citizenship Education for a Global ContextDocumento8 páginasCitizenship Education for a Global ContextLen SamortinAinda não há avaliações

- Ecocomy at WarDocumento40 páginasEcocomy at Wargion trisaptoAinda não há avaliações

- How The NSSF Has Grown Its Asset Base To Shs6 TrillionDocumento2 páginasHow The NSSF Has Grown Its Asset Base To Shs6 TrillionjadwongscribdAinda não há avaliações

- Commanding Heights Episode 1 Movie WorksheetDocumento3 páginasCommanding Heights Episode 1 Movie WorksheetBanana QAinda não há avaliações

- Critique Paper 1Documento3 páginasCritique Paper 1airaa2Ainda não há avaliações

- General Mills Marketing Research for New Yogurt ProductDocumento3 páginasGeneral Mills Marketing Research for New Yogurt ProductVivek Kumar BhagboleAinda não há avaliações

- First Year: Bachelor of Science in Business AdministrationDocumento5 páginasFirst Year: Bachelor of Science in Business AdministrationJaynard ArponAinda não há avaliações

- Economic and Social Environment Solved Assignment Q6Documento2 páginasEconomic and Social Environment Solved Assignment Q6prakash jhaAinda não há avaliações

- D. Basis Risk CalculationDocumento10 páginasD. Basis Risk CalculationPRANJAL BANSALAinda não há avaliações

- Teori Marketing 011 - RA Theory - Business MarktingDocumento11 páginasTeori Marketing 011 - RA Theory - Business MarktingidamAinda não há avaliações

- India's Problem of Rising PricesDocumento4 páginasIndia's Problem of Rising PricesritikaAinda não há avaliações

- Managerial Economics Assignment AnalysisDocumento8 páginasManagerial Economics Assignment AnalysisHammad Aqdas100% (1)

- Econ Ch01 Chapter Test ADocumento3 páginasEcon Ch01 Chapter Test ATony DeCotisAinda não há avaliações

- I Sem MbaDocumento5 páginasI Sem MbaPravin_it14Ainda não há avaliações

- Hood Emerging 1995Documento19 páginasHood Emerging 1995oktayAinda não há avaliações

- Aqa Acc7 W QP Jun08Documento8 páginasAqa Acc7 W QP Jun08Aimal FaezAinda não há avaliações

- Managerial Economics Compilation ReviewDocumento121 páginasManagerial Economics Compilation ReviewMilette CaliwanAinda não há avaliações

- ClothingDocumento2 páginasClothingFHKAinda não há avaliações

- Bba Sem Iv All AssignmentDocumento5 páginasBba Sem Iv All AssignmentYogeshAinda não há avaliações