Escolar Documentos

Profissional Documentos

Cultura Documentos

OCR Peters V Jim Lupient Oldsmobile Company Memorandum Opinion and Order

Enviado por

ghostgrip0 notas0% acharam este documento útil (0 voto)

17 visualizações7 páginasCorrey Peters purchased a used 1989 Ford Probe automobile from Defendant. Along with the vehicle, Peters purchased 30-month credit life and credit disability insurance policies for $65. And $348. Respectively. Peters did not try to negotiate the premium for either policy.

Descrição original:

Título original

OCR Peters v Jim Lupient Oldsmobile Company Memorandum Opinion and Order

Direitos autorais

© Attribution Non-Commercial (BY-NC)

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoCorrey Peters purchased a used 1989 Ford Probe automobile from Defendant. Along with the vehicle, Peters purchased 30-month credit life and credit disability insurance policies for $65. And $348. Respectively. Peters did not try to negotiate the premium for either policy.

Direitos autorais:

Attribution Non-Commercial (BY-NC)

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

17 visualizações7 páginasOCR Peters V Jim Lupient Oldsmobile Company Memorandum Opinion and Order

Enviado por

ghostgripCorrey Peters purchased a used 1989 Ford Probe automobile from Defendant. Along with the vehicle, Peters purchased 30-month credit life and credit disability insurance policies for $65. And $348. Respectively. Peters did not try to negotiate the premium for either policy.

Direitos autorais:

Attribution Non-Commercial (BY-NC)

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 7

CASE 0:97-cv-02349-ADM-AJB Document 25 Filed 05/27/99 Page 1 of 7

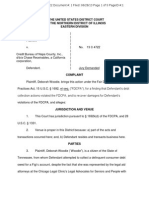

UNITED STATES DISTRICT COURT

DISTRICT OF MINNESOTA

Correy Peters, on behalf of

himself and all others similarly

situated,

Plaintiff,

v.

Jim Lupient Oldsmobile

Company,

Defendant.

MEMORANDUM OPINION

AND ORDER

Civil No. 97-2349 ADM/AJB

Thomas J. Lyons, Jr., Esq., ConsUI11er Justice Center, P.A., Maplewood, Minnesota, and Richard

J. Doherty, Esq., Horwitz, Horwitz & Associates, Chicago. Illinoi,, appeared nn bAhalf nf

Plaintiff.

Sarah E. Murrb, Esq., Lind, J<:nsen & Sullivan, P.A., MilmeapoJis, Minnesota, appeared on

behalf of Defendant.

The above-entitled matter came on for hearing before the undersigned United States

District Judge on May 18, 1999, pursuant to Defendant's Motion for Summary Judgment. For

the reasons set forth below, Defendant's motion is granted.

I. BACKGROUND

1

On April25, 1997, Plaintiff Correy Peters ("Peters") purchased a used 1989 Ford Probe

automobile from Defendant Jim Lupient Oldsmobile Company ("Lupient"). Lyons Aff. Ex. A.

Along with the vehicle, Peters purchased 30-month credit life and credit disability insurance

policies for $65.82 and $348.82 respectively. ilL Peters did not try to negotiate the premium for

1

For purposes of this summary judgment motion, the factual background of this matter is

set forth in a light most favorable to the Plaintiff.

f1UD, __

FRANCIS E. OOSAI., CLERK

JUDGMENT ENTO <' 'Zr . '19

DEPUTYCI.EFtK -----

CASE 0:97-cv-02349-ADM-AJB Document 25 Filed 05/27/99 Page 2 of 7

either policy because he "had no problem with" them. Peters Dep. at 62.

Peters signed a Retail Installment Contract ("Contract") which, among other things,

indicated that the insurance premiums would be paid to one or more insurance companies.

Lyons Aff. Ex. A. The Contract did not disclose that Lupien! would retain a portion of the

premiums as a commission on the sale of the policies. I d. Peters financed the transaction

through an assignment of the Contract to TCF Financial Services, Inc. ("TCF") I d. The Contract

contained a disclosure statement that itemized the total amount financed ($6,007.82), specified a

22.5 percent annual percentage rate, and described a total finance charge of $1 ,<JUJ as "[tjhe

dollar amount credit will cost you." Id.

Lupient collected the premiums for the insurance policies on behalf of the American

National Insurance Company ("American"). Lyons Aff. Ex. Cat 4. American then paid Lupient

commissions on the sale of the credit life aml credit disability pulidt:s in Lhe arnuunts of $26.33

and $156.97 respectively. Id. Lupien! paid a portion of the commissions to Terry Rook, the

business manager who handled Peters' purchase. Lehman Dep. at 42-43.

On October 21, 1997, Peters filed this lawsuit alleging violations of the Truth in Lending

Act, 15 U.S.C. 1638 ("TILA"), the Minnesota Motor Vehicle Retail Installment Sales Act,

Minn. Stat 168.72 ("MMVRISA"), the Prevention of Consumer Fraud Act, Minn. Stat

325F.68 ("CFA"), and common law fraud. TCF repossessed the automobile in April or

May of 1998 after Peters stopped making payments on the loan. Peters Dep. at 56-57. Peters

nPver the credit insurance despite knowing that he would be eligible for a refund of the

unearned premium upon cancellation. hl,_ at 55-56.

2

CASE 0:97-cv-02349-ADM-AJB Document 25 Filed 05/27/99 Page 3 of 7

II. DISCUSSION

This is the third case before this Court in the past year which invites judicial scrutiny of

the auto financing practices of a local automobile dealership under TILA. See Picht v. Stillwater

Ford-Lincoln-Mercm:y. Inc, Civil No. 97-1839 ADM/JGL (D. Minn. Aug. 17, 1998); and

Lindholt v. Walser Ford Inc., Civil No. 97-2140 ADM/AJR (D Minn St>pt ? ~ 199R) T .ike the

defendants in the two prior cases, Lupien! is entitled to summary judgment of Peters' 'l1LA

claim because he has not adduced any proof of actual damages.

In response to a defendant's motion for summary judgment, the plaintiff may not simply

rest on the allegations or denials of his pleadings, but must come forwarcl with sufficient

evidence to demonstrate a genuine issue of material fact tor trial. Anderson v. Liberty Lobby,

Inc., 477 U.S. 242, 248, 106 S. Ct. 2505,2510, 91 L. Ed. 2d 202 (1986). Substantive law defines

which facts are material and only disputes over facts that might affect the outcome of the case

will defeat summary judgment. !d. A factual dispute is genuine if'a reasonable jury could

return a verdict for the non-moving party." Id.

To establish that he has suffered actual damages as a proximate result ofLupient's

alleged TILA violatio11, Peters must demonstrate that: (l) he read the TILA disclosure statement;

(2) he understood the charges being disclosed; (3) had the disclosure statement been accurate, he

would have sought out other insurance policies or a lower price; and ( 4) he would have actually

obtained other policies or a lesser price." Anderson v. Rizza Chevrolet. Inc., 9 F. Supp. 2d 908,

913 (N.D. Ill. 1998). Peters has failed to point to any evidence in the record upon which 8

reasonable jury could conclude that, had he known Lupient was retaining a portion of the

premiums as a commission, he would have sought out, and been able to obtain, different

J

CASE 0:97-cv-02349-ADM-AJB Document 25 Filed 05/27/99 Page 4 of 7

insunu1cc policies 01 a lower price. In tact, Peters concedes that "he does aot currently luwc

proof he could have gotten more favorable terms on a package elsewhere." See Pl.'s Mem. in

Resp. to Def. 's Mot. for Summ. J. at 9.

Peters' reliance upon Lopez y. Orlor. Inc., 176 F.R.D. 35 (D. Conn. 1997), does not save

claim. Tn Llpl:z, the court explained that the defendant's failure to disclose that it was

retaining a portion of the "amount paid to others" listed on the sales contract "made it more

difficult for consumers to compare prices and to use credit on an informed basis, contravening

TILA's stated purpose." However, neither Peters nor the Lopez court offers a reasoned

explanation why a plaintiff should be allowed to recover damages where he can not prove that,

had the dealer made the disclosure, he would have looked elsewhere and been able to find more

favorable terms for the product he purchased. If Peters would not have looked elsewhere and/or

could not have obtained the insurance policies at a better price, then the fact that he w2s 1maware

Lupient was retaining a commission caused him no harm.

Additionally, the fact that Rooks is not an insurance agent and, therefore, may not be

authorized to receive commissions on the sale of msurance policies in the State of Minnesota,

does not establish a TILA violation. The present factual pattern is very different from the one in

In re Brown, 134 B.R. 134 (Bankr. E.D. Pa. 1991)--the case upon which Plaintiff bases his

argument. In that case, the court held that a debtor is entitled to rescind a contract pursuant to

TILA where the creditor discloses a finance chorge that violates state usury luw,1 . .llL at

The debtor in Brown suffered actual damages as a result of the creditor's state law violation

because he was forced to pay more interest to obtain credit than he would have had to pay

otherwise. Here, on the other hand, there is no evidence that Peters would have obtained a better

4

CASE 0:97-cv-02349-ADM-AJB Document 25 Filed 05/27/99 Page 5 of 7

credit arrangement from an agent licensed to sdl inswance in the State of Minnesota. Thus, to

the extent Rooks violated state law by accepting a commission from Americm1 on the sale of

insurm1ce policies to Peters, the Court concludes that the violation was a trivial one that did not

affect the cost of Peters' credit and therefore did not violate TILA. As the Brown court

explained, "not evety. trivial violation or failure to accurately regurgitate state law in a TILA

disclosure statement triggers a TILA violation." !d. at 144.

This Court's jurisdiction over Peters' claims was based upon the federal question

presented by TILA. See 28 U.S.C. 1331; 15 U.S.C. 1601. Along with federal<.juestiun

jurisdiction, this Court has supplemental jurisdiction to consider and adjudicate Plaintiff's state

law statutory m1d common law claims . .See 28 U.S.C. 1367. "When federal claims are

dismissed before trial, the district court has the discretion to dismiss state claims over which the

court has assumed supplemental jurisdiction and, generally, the court should do so in all but the

rarest of instances." Cemail v. Viking Dodge. lnc .. 982 F. Supp. 1296, 1303 (N.D. Ill. 1997)

(citing 28 U.S.C. 1367(c)(3)); lili,Q Im1ovative Home Health Care. Inc. v. P.I.-O.T. Assocs.

of the Black Hills, 141 F .3d 1284, 1287 (S'h Cir. 1998). Because Plaintiff's TILA claim has been

dismissed, the Court does not assert snpplt>m.,ntal jnrisdietinn nver Plaintiffs state law claims.

Plaintitr s state law claims are dismissed without prejudice.

5

CASE 0:97-cv-02349-ADM-AJB Document 25 Filed 05/27/99 Page 6 of 7

III. CONCLUSION

Based on the foregoing, and all of the tiles, records and proceedings herein, IT IS

HEREBY ORDERED that:

Defendant's Motion for Summary Judgment [Docket No. 14] is GRANTED IN PART

and DENIED IN PART. Count I of Plaintiffs' Complaint is DISMISSED WITH

I'REJUDICE; Counts II, III, and IV are DISMISSED WITHOUT PREJUDICE.

LET JUDGMENT BE ENTERED ACCORDINGLY.

6

CASE 0:97-cv-02349-ADM-AJB Document 25 Filed 05/27/99 Page 7 of 7

UNITED STATES DISTRICT COURT

DISTRICT OF MINNESOTA

CIVIL NOTICE

The purpose of this notice is to summarize the time limits for filing with the District

Court Clerk's Office a Notice of Appeal to the Eighth Circuit Court of Appeals from a final

decision of the District Court in a civil case.

71zis is a summary only. For specific infonnatiotz on the time limits for filing

a Notice of Appeal, co11S11lt with your attorney and review tlze applicable federal

dvu and appellate pror:edure rules and statutes.

Rule 4(a) of the Federal Rules of Appellate Procedure (Fed. R. App. P.) requires that

a Notice of Appeal be filed within:

1. Thirty days (60 days if the United States is a party) after the date

of "entry of the judgment or order appealed from;" or

2. Thirty days (60 days if the United States is a party) after the date

of entry of an order denying a timely motion for a new trial under

Fed. R. Civ. P. 59; or

3. Thirty days (60 days if the United States is a party) after the date

of entry of an order granting or denying a timely motion for

judgment under F"d. R. Civ _ P. 50(b), to amend or make

additional findings of fact under Fed. R. Civ. P. 52(b), and/or to

alter or amend the judgment under Fed. R. Civ. P. 59; or

4. Fourteen days after the date on which a previously timely Notice

of Appeal was filed.

If a Notice of Appeal is not timely filed, a party in a civil case can move the District

Court pursuant to Fed. R. App. P. 4(a)(5) to extend the time for filing a Notice of Appeal. This

motion must be filed no later than 30 days after the period for filing a Notice of Appeal expires.

If the motion is filed after the period for filing a Notice of Appeal expires, the party bringing

the motion must give the opposing parties notice of it. The District Court may grant the motion,

but only if excusable neglect or good cause is shown for failing to file a timely Notice of

'Appeal.

Você também pode gostar

- Unilever Hellman's Survey Questions - Hampton CreekDocumento14 páginasUnilever Hellman's Survey Questions - Hampton CreekghostgripAinda não há avaliações

- Urspringer V Pizza Luce ADA Discrimination ComplaintDocumento10 páginasUrspringer V Pizza Luce ADA Discrimination ComplaintghostgripAinda não há avaliações

- Nicolai V NCO Financial Systems Inc Rule 68 Offer of Judgment Erstad RiemerDocumento3 páginasNicolai V NCO Financial Systems Inc Rule 68 Offer of Judgment Erstad RiemerghostgripAinda não há avaliações

- Declaration of Ryu Yokoi Hellman's - Unilever V Hampton Creek Just MayoDocumento13 páginasDeclaration of Ryu Yokoi Hellman's - Unilever V Hampton Creek Just MayoghostgripAinda não há avaliações

- Scheffler V NCO Financial Systems Inc FDCPA ComplaintDocumento5 páginasScheffler V NCO Financial Systems Inc FDCPA ComplaintghostgripAinda não há avaliações

- Mitchell V Chase Receivables Inc FDCPADocumento5 páginasMitchell V Chase Receivables Inc FDCPAghostgripAinda não há avaliações

- Acosta V Credit Bureau of Napa County Chase ReceivablesDocumento13 páginasAcosta V Credit Bureau of Napa County Chase ReceivablesghostgripAinda não há avaliações

- Conopco Unilever Hellman's V Hampton Creek Just Mayo ComplaintDocumento17 páginasConopco Unilever Hellman's V Hampton Creek Just Mayo ComplaintghostgripAinda não há avaliações

- Motion For Class Certification Acosta V Credit Bureau of Napa CountyDocumento6 páginasMotion For Class Certification Acosta V Credit Bureau of Napa CountyghostgripAinda não há avaliações

- Diabate V University of Minnesota ComplaintDocumento9 páginasDiabate V University of Minnesota ComplaintghostgripAinda não há avaliações

- Grazzini-Rucki V Knutson Amended Appendix ECF 17-2 13-CV-02477 Michelle MacDonald MinnesotaDocumento209 páginasGrazzini-Rucki V Knutson Amended Appendix ECF 17-2 13-CV-02477 Michelle MacDonald MinnesotaghostgripAinda não há avaliações

- Mitchell V Chase Receivables Inc FDCPADocumento5 páginasMitchell V Chase Receivables Inc FDCPAghostgripAinda não há avaliações

- Grazzini-Rucki V Knutson Amended Complaint ECF 17 13-CV-02477 Michelle MacDonald MinnesotaDocumento72 páginasGrazzini-Rucki V Knutson Amended Complaint ECF 17 13-CV-02477 Michelle MacDonald Minnesotaghostgrip100% (1)

- Michelle MacDonald Minnesota - Grazzini-Rucki V Knutson 13-CV-02477 Transcript Jan 10Documento51 páginasMichelle MacDonald Minnesota - Grazzini-Rucki V Knutson 13-CV-02477 Transcript Jan 10ghostgripAinda não há avaliações

- Woodie V Chase Receivables FDCPA Complaint IllinoisDocumento5 páginasWoodie V Chase Receivables FDCPA Complaint IllinoisghostgripAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)