Escolar Documentos

Profissional Documentos

Cultura Documentos

Explanatory Notes On The Application of Withholding Tax 9801 2

Enviado por

Japh DeeDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Explanatory Notes On The Application of Withholding Tax 9801 2

Enviado por

Japh DeeDireitos autorais:

Formatos disponíveis

FEDERAL INLAND REVENUE SERVICE

INFORMATION CIRCULAR

SUBJECT:

NO: 9801

Date: 1st October,1998

Explanatory Notes on the Application of Withholding Tax Provisions to Contracts and Agency Arrangements

1.

Introduction.

It has come to the attention of FIRS that the schedule to the Companies Income Tax [Rate, etc, of Tax Deducted at Sources (Withholding Tax)] Regulations (S.1 10 of 1997) Published as supplement to Official Gazette Extra-Ordinary No.47, Vol.84, of 12th August, 1997-Part B-has generated a lot of controversy, especially regarding: (i) The coverage of the term, all types of contracts and agency arrangement, other than outright sale and purchases of goods and property in the ordinary course of business. The correct interpretation and meaning of the phrase in the ordinary course of business.

(ii)

It is, therefore, necessary to furnish the clarifications blow for the education and information of members of the public, taxpayers and their agents, as well as tax officials and practitioners. 2. Coverage of the Term. The term covers: (i) All types of contracts (whether written or not), and: (ii) All types of agency arrangement.

The only exceptions are those transactions which are, and indeed constitute, outright Sale or purchase of goods and property and which take place in the ordinary course of that Particular Kind of business 3. Contracts.

It is now explicit that all types of contracts whether oral or written come within the scope of this term. Where, for example, there is a written contractual sale of goods or materials by a trading concern to another, the payment for the transaction will be subject to withholding tax at 5%. Similarly, where there is no written contract but through an arrangement, a company places an order for purchase from another company, such a transaction must also attract withholding tax at 5%. Therefore, on the whole, it must be understood that as long a contract can be read into the actions of two or more persons or companies/enterprises, such transaction must attract withholding tax at 5%.

4.

Agency Arrangements.

Just as all types of contracts are caught by the withholding tax provision so are all forms of agency arrangements. Before considering the various forms of agency arrangements, it is necessary, first, to differentiate between payments for the services rendered to the enterprises represented and the payments for the sale for, or purchase from, the enterprise. The former, being commission, will attract 10% withholding tax while the latter, being sale on behalf of the enterprise, will attract 5% withholding tax. At this juncture, it is necessary to consider two types of agents operating ender an arrangement: (i) (ii) Agent of independent status. Agent of dependent status.

4.1 Independent Agent. Ordinarily, an agent of independent status will be regarded as acting in the ordinary course of his business since his actions are not assumed to be controlled by the enterprise being represented. In such a case, he will be liable for the payment of 10% withholding tax on the agency fees or commission only. However, where the transaction between an agent and another enterprise shows control, the agent loses his independent status as he is no longer seen as acting in the ordinary course of his business. He may still remain independent legally but he is no longer so economically. The control may be shown in the way the agent acts exclusively or almost exclusively for the enterprise(s) begin represented. The sales on behalf of the foreign or local enterprises will attract 5% withholding tax. 4.2 Dependent Agent. This is the agent/Principal relationship and an area of great concern to Nigerian tax authorities because of the control of the agent (usually a local company) by the principal (in most cases a non-resident company). The agent has arrangement with the principal for procurements, deliveries, supplies, sales and various similar activities. It may also have arrangement for the sale of patents, franchise, equipment and property. Because of the control, the agent performs these activities which economically belong to the parent company. In this regard, the agent is not acting in the ordinary course of his business. He is a dependent agent economically though legally he may remain a separate entity. The sale is a behalf of the principal will attract 5% withholding tax. This is different form the 10% withholding tax on the commission or fees payable to the agent or the 10% withholding tax on the rent or royalty. 5 The Exception Clause: ..Other than outright sale or purchase of goods and property in the ordinary course of business.

It is instructive to note that the contractual and agency transactions not caught by the withholding tax provisions are such transactions that constitute outright sale or purchase of goods and property in the ordinary course of business. Therefore, for a contract or an agency arrangement to be exempted from source deduction, it must constitute an outright sale and purchase of goods and property. It must also be in the ordinary course of business. 5.1 Exemption under Agency Arrangements:

What constitutes an action in the ordinary course of business under an agency arrangement has been explained in paragraphs 4.1 and 4.2 above. In other words, where the agent is seen as independent both legally and economically in his transactions on behalf of the person represented, he will be considered as acting in the ordinary course of his business and therefore be liable to the payment of withholding tax only on the agency fees. The gross sale on behalf of the enterprise represented will be exempted from the 5% source deduction in such a case. Further, it must be explained that it is not sufficient for the transaction to be executed in the ordinary course of business only. It is also necessary that it must be a once-and-for-all transaction. Once it becomes habitual or repetitive, the sale or purchase becomes liable to source deduction. 5.2 Exemption under Contracts:

The Regulation exempts from source deduction transactions that satisfy two conditions: i. those that constitute outright sale and purchase of goods and property, and where such sales and purchase are in the ordinary course of business Outright Sale and Purchase: Where a sale or purchase transaction becomes repetitive or habitual, it will not qualify for exemption. The sale of goods on a once-for-all basis will qualify for the exemption in so far as it meets the second condition. 5.2.2 Sale in the ordinary course of business: A sale takes place in the ordinary course of business when it takes place in the course of that particular business. Where, for instance, a trader sells goods directly to third parties, he will be seen as acting in the ordinary course of his business, that is, trading. However, where the trader enters into contract for the sale of the goods, he is no longer acting within his ordinary course of business that is, trading, but has made an adventure into another business, that is, contracts. Further, a manufacturer who makes contractual sale or purchase is on longer acting within his ordinary course of business that is manufacturing, but has gone into another business, that is, contract. Although the manufacturer, may us the items purchased or

ii. 5.2.1

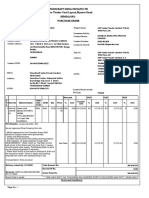

FORM VAT 005

sold in his manufacturing business, the contractual arrangement for the sale or purchase will be subject to 5% withholding tax. 6 Fundamental Issue about Withholding Tax

Withholding tax system is basically to give relief to the taxpayers by allowing him to accumulate the taxes paid in the course of his business transactions and utilize them as set-off against the relevant assessment when he finally makes his annual tax returns. As the name suggests, it is a tax withheld at source, but kept as against future tax liability. Again, the system is designed to prevent tax evasion as taxpayers will be urged to come forward to claim credit for the tax suffered at source during the transaction period. With the above explanation, any controversy surrounding the issue, therefore, is either that of ignorance or a deliberate attempt to perpetuate tax evasion. 7 Enquiries.

Any enquiries on the implementation of this circular or any area requiring further clarification should be referred to Office of the Chairman, Federal Inland Revenue Service, Plot 522, Sokode Crescent, Wuse Zone 5, Abuja. Tel: 09-5236611 Fax: 09-5236612 Fax: 09-5236597. OR The Director Collection, Computerization & Intimation Tax Dept., Federal Inland Revenue Service, Revenue House (Ground Floor), Plot 522, Sokode Crescent, Wuse Zone 5, Abuja. Tel: 09-5236604

Você também pode gostar

- Introduction to Business TaxationDocumento35 páginasIntroduction to Business TaxationIvy TejadaAinda não há avaliações

- Deductions Principles ExplainedDocumento2 páginasDeductions Principles ExplainedAvox EverdeenAinda não há avaliações

- BUSINESS INCOME CALCULATIONDocumento23 páginasBUSINESS INCOME CALCULATIONMaster Kihimbwa100% (1)

- Prentice Halls Federal Taxation 2014 Individuals 27Th Edition Rupert Solutions Manual Full Chapter PDFDocumento37 páginasPrentice Halls Federal Taxation 2014 Individuals 27Th Edition Rupert Solutions Manual Full Chapter PDFDavidGarciaerfq100% (9)

- Prentice Halls Federal Taxation 2014 Individuals 27th Edition Rupert Solutions ManualDocumento30 páginasPrentice Halls Federal Taxation 2014 Individuals 27th Edition Rupert Solutions Manualresedaouchylrq100% (23)

- Quick Sell Repossessed Properties FNB: WWW - Quicksell.co - ZaDocumento9 páginasQuick Sell Repossessed Properties FNB: WWW - Quicksell.co - ZaChristian MakandeAinda não há avaliações

- Topic-1 Taxation of Business IncomeDocumento23 páginasTopic-1 Taxation of Business IncomeMohamedAinda não há avaliações

- DeductionsDocumento6 páginasDeductionsjerome rodejoAinda não há avaliações

- Franchise IFRS 15 2020Documento13 páginasFranchise IFRS 15 2020Divine Victoria100% (1)

- Prentice Halls Federal Taxation 2014 Comprehensive 27th Edition Rupert Solutions Manual 1Documento31 páginasPrentice Halls Federal Taxation 2014 Comprehensive 27th Edition Rupert Solutions Manual 1dion100% (48)

- Prentice Halls Federal Taxation 2014 Comprehensive 27Th Edition Rupert Solutions Manual Full Chapter PDFDocumento36 páginasPrentice Halls Federal Taxation 2014 Comprehensive 27Th Edition Rupert Solutions Manual Full Chapter PDFrobert.dun382100% (13)

- Chamber of Real Estate and Builders Associations, Inc., v. The Hon. Executive Secretary Alberto Romulo, Et AlDocumento6 páginasChamber of Real Estate and Builders Associations, Inc., v. The Hon. Executive Secretary Alberto Romulo, Et AlMathew Beniga GacoAinda não há avaliações

- Business Tax ClassificationsDocumento2 páginasBusiness Tax ClassificationsAlberto NicholsAinda não há avaliações

- Act 4.1Documento3 páginasAct 4.1Tiffany HwangAinda não há avaliações

- Implication of Tax On LeasesDocumento5 páginasImplication of Tax On Leaseswankhidr@yahoo.comAinda não há avaliações

- Auction: SampleDocumento6 páginasAuction: SampleOctavian CiceuAinda não há avaliações

- Abellano - Narrative - STM - Prefinal - ExamDocumento2 páginasAbellano - Narrative - STM - Prefinal - ExamNelia AbellanoAinda não há avaliações

- Chapter One: Tax on Commercial & Industrial ProfitsDocumento18 páginasChapter One: Tax on Commercial & Industrial ProfitsMāhmõūd ĀhmēdAinda não há avaliações

- Prentice Halls Federal Taxation 2014 Comprehensive Rupert 27th Edition Solutions ManualDocumento30 páginasPrentice Halls Federal Taxation 2014 Comprehensive Rupert 27th Edition Solutions ManualJosephWoodsdbjt100% (44)

- 8TH Sem Tax Paper PDFDocumento25 páginas8TH Sem Tax Paper PDFAnamika VatsaAinda não há avaliações

- Registration Procedure Under Central Sales Act (SectionDocumento23 páginasRegistration Procedure Under Central Sales Act (SectionkgudiyaAinda não há avaliações

- 08 Chapter-4 PDFDocumento76 páginas08 Chapter-4 PDFRishikesh KumarAinda não há avaliações

- DeductionsDocumento7 páginasDeductionsConcerned CitizenAinda não há avaliações

- Property Rental Toolkit: 2019-20 Self Assessment Tax Returns Published April 2020Documento28 páginasProperty Rental Toolkit: 2019-20 Self Assessment Tax Returns Published April 2020jonofsAinda não há avaliações

- Prelec Post TestDocumento3 páginasPrelec Post TestPrince PierreAinda não há avaliações

- Law of Sole Proprietorship ExplainedDocumento11 páginasLaw of Sole Proprietorship ExplainedGoitse LithekoAinda não há avaliações

- ATS PDF Fillable 2023MktgDocumento3 páginasATS PDF Fillable 2023MktgMai EspinaAinda não há avaliações

- Chapter - Three: Business & Business EntitiesDocumento18 páginasChapter - Three: Business & Business Entitiesbelay abebeAinda não há avaliações

- UAE Company LawDocumento28 páginasUAE Company LawAgastya ChauhanAinda não há avaliações

- BDB Law’s Tax Implications of Share ReacquisitionDocumento3 páginasBDB Law’s Tax Implications of Share ReacquisitionLarisa SerzoAinda não há avaliações

- Due Diligence-Tax Due DilDocumento4 páginasDue Diligence-Tax Due DilEljoe VinluanAinda não há avaliações

- Profits and Gains of Business or ProfessionDocumento14 páginasProfits and Gains of Business or Professionsadathnoori100% (1)

- Sales Tax GuideDocumento6 páginasSales Tax GuideakhileshkantAinda não há avaliações

- Taxation LawDocumento124 páginasTaxation Lawakshay yadavAinda não há avaliações

- Situs of IncomeDocumento3 páginasSitus of IncomeElsie CayetanoAinda não há avaliações

- Registration of Dealers: Tax Law Project OnDocumento23 páginasRegistration of Dealers: Tax Law Project OnSushant NainAinda não há avaliações

- Legal Aspects of Business: 1. Learning Outcomes of Indian Contract Act (1872)Documento7 páginasLegal Aspects of Business: 1. Learning Outcomes of Indian Contract Act (1872)vaishnavi_p4587Ainda não há avaliações

- 1 Sole Proprietorship Business in IndiaDocumento6 páginas1 Sole Proprietorship Business in IndiaEMBA IITKGPAinda não há avaliações

- (11 Sections) : 3 Types of Activities: Sale of Goods and PropertiesDocumento12 páginas(11 Sections) : 3 Types of Activities: Sale of Goods and PropertiesInna Marie CaylaoAinda não há avaliações

- Other Percentage TaxDocumento2 páginasOther Percentage TaxMonique G. BugnosenAinda não há avaliações

- Income Taxation Taxation of CorporationsDocumento52 páginasIncome Taxation Taxation of CorporationsBianca Denise AbadAinda não há avaliações

- CIR v. Filinvest Development Corporation, G.R. No. 163653, 19 Jul 2011.Documento2 páginasCIR v. Filinvest Development Corporation, G.R. No. 163653, 19 Jul 2011.Kelly RoxasAinda não há avaliações

- LGU Tax Exemption Powers vs Real Property TaxDocumento4 páginasLGU Tax Exemption Powers vs Real Property TaxNikki Beverly G. BacaleAinda não há avaliações

- Morales Taxation Topic 7 Capital Gains and LossesDocumento10 páginasMorales Taxation Topic 7 Capital Gains and LossesMary Joice Delos santosAinda não há avaliações

- Week 11.Ch10.Starting A BusinessDocumento42 páginasWeek 11.Ch10.Starting A BusinessjimmyAinda não há avaliações

- CIR v Ah Koy Fiji High Court Mining Licence Tax AppealDocumento2 páginasCIR v Ah Koy Fiji High Court Mining Licence Tax AppealShivanjani KumarAinda não há avaliações

- Register Your Business for Credibility and BenefitsDocumento6 páginasRegister Your Business for Credibility and BenefitsEncar Marie Salvante NicolasAinda não há avaliações

- 07) CIR V Seagate Tech PhilsDocumento3 páginas07) CIR V Seagate Tech PhilsAlfonso Miguel LopezAinda não há avaliações

- Gavin OFlaherty ITR ArticleDocumento6 páginasGavin OFlaherty ITR ArticleAditya Dani NugrahaAinda não há avaliações

- Topic 4 - Concept of Corporate Entity (1) - 1Documento30 páginasTopic 4 - Concept of Corporate Entity (1) - 1Bernard ChrillynAinda não há avaliações

- Taxation IIDocumento3 páginasTaxation IIAnonymous BNrz1arAinda não há avaliações

- Chapter 4 Commercial and Industrial Activities - Part 2Documento37 páginasChapter 4 Commercial and Industrial Activities - Part 2sherygafaarAinda não há avaliações

- Oman - Agency LAwDocumento3 páginasOman - Agency LAwtvera4040% (1)

- Due Diligence-Tax Due Dil - FinalDocumento6 páginasDue Diligence-Tax Due Dil - FinalEljoe VinluanAinda não há avaliações

- PromotorDocumento6 páginasPromotor26amitAinda não há avaliações

- 0.3 Module 03 - Income Tax ConceptsDocumento18 páginas0.3 Module 03 - Income Tax ConceptsDawn QuimatAinda não há avaliações

- Assignment 2 by Piyush Anad A60006420098Documento3 páginasAssignment 2 by Piyush Anad A60006420098Piyush AnandAinda não há avaliações

- Cha 5Documento13 páginasCha 5Tamru gebregeorgisAinda não há avaliações

- Company lawDocumento6 páginasCompany lawmamta wankhedeAinda não há avaliações

- Online WhatsApp Contacts ListDocumento1 páginaOnline WhatsApp Contacts ListJaph DeeAinda não há avaliações

- Bauchi: Preliminary Re 6.0 Findings Table A: Percent Distribution of Facilities by Background CharacteristicsDocumento27 páginasBauchi: Preliminary Re 6.0 Findings Table A: Percent Distribution of Facilities by Background CharacteristicsjapharAinda não há avaliações

- New in StrategyDocumento1 páginaNew in StrategyJaph DeeAinda não há avaliações

- Table For Signal FunctionDocumento1 páginaTable For Signal FunctionJaph DeeAinda não há avaliações

- 1 Reconciliation of Sofp - 2Documento1 página1 Reconciliation of Sofp - 2Japh DeeAinda não há avaliações

- New in ChessDocumento1 páginaNew in ChessJaph DeeAinda não há avaliações

- Sound SystemDocumento1 páginaSound SystemJaph DeeAinda não há avaliações

- Table For Signal FunctionDocumento1 páginaTable For Signal FunctionJaph DeeAinda não há avaliações

- Creatively Creatively Creatively Creatively Creatively Creatively Creatively Creatively Creatively Creatively Creatively Creatively CreativelyDocumento1 páginaCreatively Creatively Creatively Creatively Creatively Creatively Creatively Creatively Creatively Creatively Creatively Creatively CreativelyJaph DeeAinda não há avaliações

- Research LineDocumento1 páginaResearch LineJaph DeeAinda não há avaliações

- 4 Notes To The AccountsDocumento3 páginas4 Notes To The AccountsJaph DeeAinda não há avaliações

- Table For Signal FunctionDocumento1 páginaTable For Signal FunctionJaph DeeAinda não há avaliações

- CITN Owerri Workshop on Tax IssuesDocumento1 páginaCITN Owerri Workshop on Tax IssuesJaph DeeAinda não há avaliações

- Applicant Transcript FormDocumento1 páginaApplicant Transcript FormJaph DeeAinda não há avaliações

- 5 Reconciliation of Statement of Cash FlowDocumento1 página5 Reconciliation of Statement of Cash FlowJaph DeeAinda não há avaliações

- WellDocumento1 páginaWellJaph DeeAinda não há avaliações

- Nasarawa State University Keffi PHD Application Payment ReceiptDocumento1 páginaNasarawa State University Keffi PHD Application Payment ReceiptJaph DeeAinda não há avaliações

- CITN OWERRI TRAINING WORKSHOP ON GIFMIS FOR COMMUNICATIONS MINISTRYDocumento1 páginaCITN OWERRI TRAINING WORKSHOP ON GIFMIS FOR COMMUNICATIONS MINISTRYJaph DeeAinda não há avaliações

- README2 DatDocumento1 páginaREADME2 DatJaph DeeAinda não há avaliações

- Models and Best Practices for Regulatory Compliance in NigeriaDocumento28 páginasModels and Best Practices for Regulatory Compliance in NigeriaJaph DeeAinda não há avaliações

- A10Documento2 páginasA10Japh DeeAinda não há avaliações

- African Diaspora I Nit Iat Ive: November 5-7, 2013. UK Bello Centre, Minna, Niger StateDocumento2 páginasAfrican Diaspora I Nit Iat Ive: November 5-7, 2013. UK Bello Centre, Minna, Niger StateJaph DeeAinda não há avaliações

- TyuitDocumento1 páginaTyuitJaph DeeAinda não há avaliações

- Well DFDDocumento1 páginaWell DFDJaph DeeAinda não há avaliações

- Data Modeling Using The ER ModelDocumento53 páginasData Modeling Using The ER ModelAdepuravi KrishnaAinda não há avaliações

- Agf Tax Comp 2014 Yoa1Documento6 páginasAgf Tax Comp 2014 Yoa1Japh DeeAinda não há avaliações

- Rovers DiarrryDocumento2 páginasRovers DiarrryJaph DeeAinda não há avaliações

- A Traveler Once Came To The Masjid To See The Prophet MuhammadDocumento2 páginasA Traveler Once Came To The Masjid To See The Prophet MuhammadJaph DeeAinda não há avaliações

- A Traveler Once Came To The Masjid To See The Prophet MuhammadDocumento2 páginasA Traveler Once Came To The Masjid To See The Prophet MuhammadJaph DeeAinda não há avaliações

- The Key Benefits of Forming a CorporationDocumento12 páginasThe Key Benefits of Forming a CorporationKanwarveer SinghAinda não há avaliações

- Chapter 3. Derivatives NewDocumento9 páginasChapter 3. Derivatives NewLê Quỳnh ChiAinda não há avaliações

- Deed of Absolute Sale: RESURRECCION, Kimberly R. Jd4ADocumento3 páginasDeed of Absolute Sale: RESURRECCION, Kimberly R. Jd4AKimberly RamosAinda não há avaliações

- Partnership dissolution and accounting proceduresDocumento2 páginasPartnership dissolution and accounting proceduresStefanRodriguezAinda não há avaliações

- Compliance Examination ManualDocumento1.367 páginasCompliance Examination ManualeffieladureAinda não há avaliações

- Suite Espagnole: GranadaDocumento19 páginasSuite Espagnole: GranadaRokasAinda não há avaliações

- Deed of Sale Portion of Real PropertyDocumento2 páginasDeed of Sale Portion of Real Propertytzy6tl6alfaro100% (1)

- DHFL Bank ScamDocumento7 páginasDHFL Bank ScamPrasannaAinda não há avaliações

- 10 CPT Model Papers - With AnswersDocumento558 páginas10 CPT Model Papers - With AnswersRajesh DorbalaAinda não há avaliações

- Agricultural Leasehold ContractDocumento4 páginasAgricultural Leasehold ContractLouie Sallador100% (6)

- No Co Maker Application Form TSL v.052623Documento2 páginasNo Co Maker Application Form TSL v.052623Rio A. EbueAinda não há avaliações

- Debt Reduction Calculator V1.6Documento3 páginasDebt Reduction Calculator V1.6brianfromboiseAinda não há avaliações

- Separation AgreementDocumento2 páginasSeparation AgreementJoshua Kirby PalAinda não há avaliações

- 5 Flancia v. Court of Appeals, 457 SCRA 224, 231 (2005)Documento12 páginas5 Flancia v. Court of Appeals, 457 SCRA 224, 231 (2005)Ian Kenneth MangkitAinda não há avaliações

- Po 2798 Adp Green WallDocumento3 páginasPo 2798 Adp Green WallAbhimanyu SutharAinda não há avaliações

- Form 4A: Deed of Indemnity & SubrogationDocumento3 páginasForm 4A: Deed of Indemnity & SubrogationHemant Singh SisodiyaAinda não há avaliações

- Chapter 12 Informal Risk Capital Venture Capital and Going PublicDocumento43 páginasChapter 12 Informal Risk Capital Venture Capital and Going Publicmkahnum12Ainda não há avaliações

- Case Digest: Banco Filipino Savings and Mortgage Bank V. Tala Realty Services CorporationDocumento2 páginasCase Digest: Banco Filipino Savings and Mortgage Bank V. Tala Realty Services CorporationRuiz Arenas AgacitaAinda não há avaliações

- Medida vs. Court of AppealsDocumento3 páginasMedida vs. Court of AppealsBibi JumpolAinda não há avaliações

- Parish Priest of Victoria v. RigorDocumento15 páginasParish Priest of Victoria v. RigorXtine CampuPotAinda não há avaliações

- 7 - The Lntestate Estate of Dominador Danan vs. Buencamino, 110 SCRA 352Documento9 páginas7 - The Lntestate Estate of Dominador Danan vs. Buencamino, 110 SCRA 352AttyGalva22Ainda não há avaliações

- Project Management Processes Methodologies and Economics 2nd Edition Shtub Solutions ManualDocumento15 páginasProject Management Processes Methodologies and Economics 2nd Edition Shtub Solutions Manualgirasole.shram.x8md8t100% (25)

- CORPORATE SECRETARY - Buying LotDocumento2 páginasCORPORATE SECRETARY - Buying LotJomar NoblezaAinda não há avaliações

- Civil Law Reviewer 2022 (Revised)Documento23 páginasCivil Law Reviewer 2022 (Revised)atb333100% (1)

- Understanding Contract Law in PakistanDocumento7 páginasUnderstanding Contract Law in PakistanSyeda Sana AliAinda não há avaliações

- Study Guide 2 PDFDocumento94 páginasStudy Guide 2 PDFxnexus100% (2)

- ApartmentDocumento4 páginasApartmentMohammad Kamruzzaman100% (2)

- Company Policy - OvertimeDocumento2 páginasCompany Policy - Overtimeazmi kailanAinda não há avaliações

- Proposed Settlement Agreement - Nevada Marijuana LawsuitDocumento29 páginasProposed Settlement Agreement - Nevada Marijuana LawsuitMichelle RindelsAinda não há avaliações

- PVB V MOLINADocumento6 páginasPVB V MOLINAIrish AnnAinda não há avaliações