Escolar Documentos

Profissional Documentos

Cultura Documentos

Nike Company/ Essay / Paper

Enviado por

AssignmentLab.comTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Nike Company/ Essay / Paper

Enviado por

AssignmentLab.comDireitos autorais:

Formatos disponíveis

Students last name 1

Student Name Instructor Course Name Date Nike Company Financial Data Analyses a. Solvency and profitability are the means by which the companys over position can be determined and near future prospective objected. Solvency is associated with the companys ability to hold enough assets to cover its liabilities when needed. The ratio that reveals companys solvency is current ration. Profitability is related to companys ability to generate earnings while enduring the costs associated with manufacturing products or providing services. Among the tools that help to determine companys profitability are profit margin, return on assets and return on equity ratios (Eisen). b. 1995 Current ratio Working capital 2045928= 1,107,535 2,045,928-1,107,535= (4,760,8342,865,280)*100%= 4,760,834 399664*100%= 1852819 1.85 $938,393 1,770,431= 561,987 1,770,431-561,987= (3,789,6682,301,423)*100%= 3,789,668 298,794= 1,691,884 1994 3.15

$1,208,444

Gross margin Return on equity

39.82% $21.57

39.27% $17.66

Students last name 2

Return on assets

(399,664+24,208)*100%= 2,758,280

$15.37

(298,794+15,282)*100%= 2,280,042

$13.78

c. Nike earned more money in 1995 than in 1995; the major reasons for the growth of income were increase in revenues, from $3,789,668 thousand to $4,760,834 thousand in 1994, and moderate expanses of 1995, also, good assets utilization. d. From looking at Nikes Income statement we can state that in 1995 Nike was more profitable that in 1994 (the profit in 1995 was $ 399,664 thousand and in 1994 $298,794 thousand). The growth was mostly caused by higher revenues of 1995, $ 4,760,834 thousand, comparing to 3,789,668 thousand in 1994. Nike Company was able to manage well its assets, which we can see from a better return on assets ratio, 15.37% in 1995 comparing 13.76% in 1994. Also, increase in total stockholders equity had a positive influence on companys profitability results in 1995 ($3,142,754 thousand in 1995 comparing to $2, 373,815 thousand in 1994). Return on equity ratio serves as a proof of positive influence of this factor on Nike growth of profit: return on equity has grown from 17.66% in 1994 to 21.57% in 1995. e. As of May 31, 1995 Nike had $216,071 thousand in cash and cash equivalents. f. As of May 31, 1995 Nike was in a good position to pay its liabilities, the way to check companys solvency for the given moment is to review its current ratio. The current ration of Nike on May 31, 1995 was 1, 84. In order to be able to cover its debts company should have the current ratio of no less than 1. Therefore, with 1.84 Nike Company would have been able to pay the debts. Also, Nike had a positive working capital of $938,393 thousand at the end of its fiscal year.

Students last name 3

g. Nikes operations in 1995 were a source of cash, until the end of year operational activities resulted in $254,913 thousand of cash inflow. h. Nikes major sources of cash in 1995 were net income, $399,664 thousand, and increase in accounts payable, accrued liabilities and income tax payables account by $172,638 thousand as the parts of operational activities, also, increase in notes payable, $263,874 thousand, in financing activities. Among the major uses of cash in 1995 were activities associated with additions to property, plan and equipment, which resulted in $154,125 thousand expense, acquisition of subsidiarities totally cost $430,020 thousand (sum of both Identifiable intangible assets & Goodwill and Net assets acquired accounts). Also, much cash in 1995 was used for repurchasing of stock, $142,919 thousand. i. Debt Ratios Debt Ratio Debt-Equity Ratio Capitalization Ratio Interest Coverage Ratio Cash Flow to Debt Ratio Total Liabilities Total Assets Total Liabilities Shareholders' Equity Long-term Debt/ Long-term Debt + Shareholders' Equity Earnings Before Interest and Taxes Interest Expense Operating Cash Flow Total Debt 1,177,756 3,142,745 1,177,756 1,964,689 70,221 70,221+1,964,689 674,072 24,208 254,913 1,177,756 1995 37.48% 59.95% 3.45% $27.85 0.22

Students last name 4

Efficiency ratios Collection Period Ratio Sales to Inventory Ratio Assets to Sales Ratio Sales to Net Working Capital Ratio Accounts Payable to Sales Ratio Accounts Receivebavle*365 Days Sales Annual Net Sales Inventory Total Assets Net Sales Sales Net Working Capital Accounts Payable Net Sales 1,053,237*365 4,760,834 4,760,834 629,742 3,142,745 4,760,834 4,760,834 938,393 297,656 4,760,834

1995 81 7.56 66.01% 5.07 6.25%

Glenn Eddleman & Company Financial Data Analyses

1. Analyses of Financial Statements Glenn Eddleman and Company had a Sales Revenue of $14,745 thousands in 2005,

Students last name 5

as of year 2004 the this number was $12,908 thousands, thus the company has experienced growth in sales. The income the Company made in 2005 was $494 thousand, which is less comparing to the previous year; in 2004 the Eddlemans income was $658 thousand. Such decrease in income despite the growth of revenue was caused by increase of cost of goods sold, advertising and sales commissions and general and administrative expenses accounts. Over the year Eddleman has increased its assets by $1,693 thousand, at the same time the current assets for both years were almost the same, $ 5,556 thousand in 2005 and $ 5,279 thousand in 2004, which means that growth happened in Plant and Equipment accounts. Aspect that is worth mentioning is that the Company gets the almost equal amount of capital in cash and accounts receivables. This feature has eventually bad influence on the Cash Flow of the company, which was negative for both 2005 and 2004 years. Therefore, company should pay better attention on managing its cash and equivalents, the aspects the determine companys liquidity.

2. Industry Analyses Assets between $ 10 million and $25 million 2.24 1.33 7.22 5.43 1.76 5,78 7.83 1.95 1.31 9.38 3.16 1.42 5.77 6.54 Eddleman 1.28 0.74 12.09 4.59 1.37 19.00 6.30

Industry analyses Current ratio Quick ratio Net sales to working capital Coverage ratio Total asset turnover Inventory turnover Receivables turnover

Total Industry

Students last name 6

Debt ratio Return on assets Return after tax on equity Return before taxes on equity Profit margin before tax Profit margin after tax

69.51 9.3 16.12 11.11 6.67 4.49

65.99 10.4 15.85 11.73 3.88 2.61

59.08 6.74 12.63 15.78 4.18 3.35

Eddleman Companys ratios are very similar to the ones of the industr y. In order to provide better insights in how the Eddleman doing comparing to its direct competition which is the companies within the industry whose assets are of similar value. Although, the current and quick ratios of Eddleman are lower than those of its competitors, main reason for that is a small number of inventory used in the goods manufacturing process. Though, there is another ratio which benefits from low debit on Manufacturing Inventory account, and that is Inventory Turnover ratio. While the industry average is 5,78, Eddleman shows it as high as 19.00 as that is due to ability to generate revenues while holding inventory low. This aspect characterizes the company as the one that manages its inventory assets very well. Eddleman has good Net sales on working capital ratio, coverage ratio and has a good profit margin. These factors characterize company as profitable and sustainable. At the same time Eddleman should watch its quick ratio and current ratio, as it was stated above, and total asset turnover, receivables turnover, return on assets as those ratios are lower than the averages in the industry. 4. Trend Analyses Current ratio Quick ratio Net sales to working capital Coverage ratio Total asset turnover 2001 2.07 1.00 9.33 6.31 1.11 2003 1.79 1.01 9.97 4.48 1.34 2004 1.32 1.13 10.09 8.39 1.43 2005 1.28 1.12 12.09 4.59 1.37

Students last name 7

Inventory turnover Receivables turnover Debt ratio Return on assets Return after tax on equity Return before taxes on equity Profit margin before tax Profit margin after tax

10.88 4.80 54.95 5.22 10.98 14.48 4.68 3.06

11.81 5.10 61.69 5.34 11.05 15.43 4.44 3.31

18.63 5.18 62.00 8.75 19.75 30.40 7.85 5.10

19.00 6.30 59.08 6.74 12.63 15.78 4.18 3.35

The Company has showed growth in its net sales to working capital ratio, which happened due to increase in revenues in 2005 and keeping liabilities on the level of 2004. Also, inventory turnover ratio has increase, which was, also, caused by the increase in revenue sales, and keeping Manufacturing Inventory low. While return on equity after tax has decreased in 2005 comparing to the previous year only on 7.12%, the return on equity before taxes decreased almost twice. Such big difference was mainly caused by great increase in advertising and sales commission account (in 2004 Eddleman spent $546 thousand and this number almost doubles in 2005 - $1,022 thousand), this consequently had an influence on income statement, and resulted in lower Income before Interest and Tax account, and in lower net Income as well. According to the ratio analyses we may see that 2005 was less successful for the Eddleman Company than previous 2004. Before that, company used to show a steady growing trend.

Students last name 8

Work Cited Eisen, Peter J.. Accounting. 4th ed. Hauppauge, N.Y.: Barron's Educational Series, 2000. Print. (Eisen)

Você também pode gostar

- Extra WorkDocumento3 páginasExtra WorkSarfaraj OviAinda não há avaliações

- The General Electric Mckinsey Matrix Marketing EssayDocumento7 páginasThe General Electric Mckinsey Matrix Marketing EssayHND Assignment HelpAinda não há avaliações

- Customer Relation Management in The Vodafone GroupDocumento7 páginasCustomer Relation Management in The Vodafone GroupAru BhartiAinda não há avaliações

- IB Assignment New - Mode of Entry For Our Garments Business in BangladeshDocumento7 páginasIB Assignment New - Mode of Entry For Our Garments Business in BangladeshMasbah RomanAinda não há avaliações

- Musgrave's Business Environment AssignmentDocumento19 páginasMusgrave's Business Environment AssignmentDerrick FranklinAinda não há avaliações

- Sample Assignment For The Course of International BusinessDocumento14 páginasSample Assignment For The Course of International BusinessAnonymous RoAnGpAAinda não há avaliações

- BFP1100 (Bega Cheese Assignment) 3B: Greenhouse Business Challenge and Carbon FootprintDocumento58 páginasBFP1100 (Bega Cheese Assignment) 3B: Greenhouse Business Challenge and Carbon FootprintrockoAinda não há avaliações

- The Lean Enterprise in Aerospace Marketing EssayDocumento20 páginasThe Lean Enterprise in Aerospace Marketing EssayHND Assignment HelpAinda não há avaliações

- Global Business Environment AssignmentDocumento9 páginasGlobal Business Environment AssignmentJyoti SharmaAinda não há avaliações

- Date received (1 submission) : Nguyễn Hưng Nguyên GBS18656Documento14 páginasDate received (1 submission) : Nguyễn Hưng Nguyên GBS18656NguyênAinda não há avaliações

- An International Business AssignmentDocumento4 páginasAn International Business AssignmentjestinegeorgeAinda não há avaliações

- BUSI 353 Assignment #6 General Instructions For All AssignmentsDocumento4 páginasBUSI 353 Assignment #6 General Instructions For All AssignmentsTan0% (1)

- FIA Sem 2 PACT002 AssignmentDocumento20 páginasFIA Sem 2 PACT002 AssignmentMohammad Fazrul Amin Bin Ramlee100% (1)

- Accounts Assignment: Definition, Types and Rules of Business TransactionsDocumento18 páginasAccounts Assignment: Definition, Types and Rules of Business TransactionsALI HAIDERAinda não há avaliações

- Accounting I 12841Documento94 páginasAccounting I 12841vinay kumarAinda não há avaliações

- Business Ethics AssignmentDocumento4 páginasBusiness Ethics AssignmentNext PersonAinda não há avaliações

- Different Types of Economies and TradeDocumento5 páginasDifferent Types of Economies and TradeSerwaa AkotoAinda não há avaliações

- PMB AssignmentDocumento11 páginasPMB Assignmenttharindu61230% (1)

- Business Stratergies AssignmentDocumento4 páginasBusiness Stratergies AssignmentAnkur SrivastavaAinda não há avaliações

- Business Management AssignmentDocumento6 páginasBusiness Management AssignmentNehaCruiseAinda não há avaliações

- Basics of Management AccountingDocumento16 páginasBasics of Management AccountingSupian Jannatul FirdausAinda não há avaliações

- Dixon Ticonderoga Case StudyDocumento4 páginasDixon Ticonderoga Case StudyVineet SinghAinda não há avaliações

- Week 1 (Session 1) Types of Organisations PDFDocumento56 páginasWeek 1 (Session 1) Types of Organisations PDFchief elerinAinda não há avaliações

- Cambodian Mekong University: Understanding Business AssignmentDocumento19 páginasCambodian Mekong University: Understanding Business AssignmentAli GMAinda não há avaliações

- Due Date: Tuesday September 30 (By 1:50 PM) : Intermediate Financial Accounting I - ADMN 3221H Accounting Assignment #2Documento7 páginasDue Date: Tuesday September 30 (By 1:50 PM) : Intermediate Financial Accounting I - ADMN 3221H Accounting Assignment #2kaomsheartAinda não há avaliações

- Assignment For Business EthicsDocumento1 páginaAssignment For Business EthicsAnurag MishraAinda não há avaliações

- Dell Inc.Documento6 páginasDell Inc.Fahad Umar100% (1)

- Business Strategy Assignment 1Documento5 páginasBusiness Strategy Assignment 1vickyvinAinda não há avaliações

- 586-MKTM028 SPSD2 Assignment22016 17Documento7 páginas586-MKTM028 SPSD2 Assignment22016 17Muhammad Faraz HasanAinda não há avaliações

- AMBO205 - Business Transformation AssignmentDocumento10 páginasAMBO205 - Business Transformation AssignmentAnant BhargavaAinda não há avaliações

- Business Model Assignment 3Documento5 páginasBusiness Model Assignment 3Oyedele AjagbeAinda não há avaliações

- Business Environment AssignmentDocumento9 páginasBusiness Environment AssignmentAbdul RahimAinda não há avaliações

- Assignment Brief (Business Decision Making)Documento8 páginasAssignment Brief (Business Decision Making)Nguyen Dac ThichAinda não há avaliações

- Assignment On Management AccountingDocumento17 páginasAssignment On Management AccountingMarysun Tlengr100% (2)

- Managing foreign exchange risk and exposureDocumento6 páginasManaging foreign exchange risk and exposureAjay PawarAinda não há avaliações

- The Hierarchy Of Strategic IntentDocumento25 páginasThe Hierarchy Of Strategic IntentAkhtar AliAinda não há avaliações

- Business Strategic AssignmentDocumento15 páginasBusiness Strategic AssignmentSheetal JasmeetAinda não há avaliações

- Business Operations Group AssignmentDocumento7 páginasBusiness Operations Group Assignmentankit gangeleAinda não há avaliações

- Business PCL I HR Human Resourse Planning Module AssignmentDocumento3 páginasBusiness PCL I HR Human Resourse Planning Module AssignmentPrabhjot Singh RekhiAinda não há avaliações

- MGT 230 Week 4 Signature Assignment Human Resource Management Organizational Change, Structure, and ManagementDocumento6 páginasMGT 230 Week 4 Signature Assignment Human Resource Management Organizational Change, Structure, and Managementacc4918Ainda não há avaliações

- Business Environment AssignmentDocumento11 páginasBusiness Environment AssignmentlakishikaAinda não há avaliações

- Management AccountingDocumento21 páginasManagement AccountingbelladoAinda não há avaliações

- Business Environment Report for Junior Management PromotionDocumento4 páginasBusiness Environment Report for Junior Management PromotionJohn RobsonAinda não há avaliações

- Food Industry Report on Prima, Bairaha & Elephant HouseDocumento24 páginasFood Industry Report on Prima, Bairaha & Elephant HouseShenal NethminAinda não há avaliações

- Esoft Marketing Assignment 2Documento8 páginasEsoft Marketing Assignment 2sheran230% (1)

- BTEC HND Business - Doc Assignment 1Documento8 páginasBTEC HND Business - Doc Assignment 1Abbasi Naveed Raja50% (4)

- NET SyllabusDocumento10 páginasNET SyllabusansAinda não há avaliações

- Cost-Volume-Profit Relationships: Solutions To QuestionsDocumento90 páginasCost-Volume-Profit Relationships: Solutions To QuestionsKathryn Teo100% (1)

- Edexcel BTEC HND Business Assignment on Dixons RetailDocumento11 páginasEdexcel BTEC HND Business Assignment on Dixons RetailAndrei TomyAinda não há avaliações

- Business To Business Marketing AssignmentDocumento2 páginasBusiness To Business Marketing Assignmentsirisha_bvsAinda não há avaliações

- Value Chain Management Capability A Complete Guide - 2020 EditionNo EverandValue Chain Management Capability A Complete Guide - 2020 EditionAinda não há avaliações

- Project Production Management A Complete Guide - 2020 EditionNo EverandProject Production Management A Complete Guide - 2020 EditionAinda não há avaliações

- Critical Financial Review: Understanding Corporate Financial InformationNo EverandCritical Financial Review: Understanding Corporate Financial InformationAinda não há avaliações

- It’s Not What You Sell—It’s How You Sell It: Outshine Your Competition & Create Loyal CustomersNo EverandIt’s Not What You Sell—It’s How You Sell It: Outshine Your Competition & Create Loyal CustomersAinda não há avaliações

- FIN3CSF Case Studies in FinanceDocumento5 páginasFIN3CSF Case Studies in FinanceDuy Bui100% (2)

- Auditors Report and Financial Analysis of ITCDocumento28 páginasAuditors Report and Financial Analysis of ITCNeeraj BhartiAinda não há avaliações

- Ratio Analysis of The A CompanyDocumento6 páginasRatio Analysis of The A CompanySobia AshrafAinda não há avaliações

- Anamika Chakrabarty Anika Thakur Avpsa Dash Babli Kumari Gala MonikaDocumento24 páginasAnamika Chakrabarty Anika Thakur Avpsa Dash Babli Kumari Gala MonikaAnamika ChakrabartyAinda não há avaliações

- Ratio Analysis of The CompanyDocumento21 páginasRatio Analysis of The CompanyZahid Khan BabaiAinda não há avaliações

- The Problem of Consequences and ForgivenessDocumento4 páginasThe Problem of Consequences and ForgivenessAssignmentLab.comAinda não há avaliações

- The Mini Mental Status ExaminationDocumento4 páginasThe Mini Mental Status ExaminationAssignmentLab.comAinda não há avaliações

- The Pursuit of HappinessDocumento4 páginasThe Pursuit of HappinessAssignmentLab.comAinda não há avaliações

- The Promise by C. Wright MillsDocumento4 páginasThe Promise by C. Wright MillsAssignmentLab.comAinda não há avaliações

- The Microsoft CaseDocumento3 páginasThe Microsoft CaseAssignmentLab.comAinda não há avaliações

- The One Minute ManagerDocumento2 páginasThe One Minute ManagerAssignmentLab.comAinda não há avaliações

- The Polygraph and Lie DetectionDocumento4 páginasThe Polygraph and Lie DetectionAssignmentLab.comAinda não há avaliações

- The Principle of AutonomyDocumento2 páginasThe Principle of AutonomyAssignmentLab.comAinda não há avaliações

- The Principal-Agent ProblemDocumento9 páginasThe Principal-Agent ProblemAssignmentLab.comAinda não há avaliações

- The Old Testament Law and Its Fulfillment in ChristDocumento7 páginasThe Old Testament Law and Its Fulfillment in ChristAssignmentLab.comAinda não há avaliações

- The Origin of My NameDocumento4 páginasThe Origin of My NameAssignmentLab.comAinda não há avaliações

- The MetamorphosisDocumento4 páginasThe MetamorphosisAssignmentLab.comAinda não há avaliações

- The Place of Endangered Languages in A Global SocietyDocumento3 páginasThe Place of Endangered Languages in A Global SocietyAssignmentLab.comAinda não há avaliações

- The Opinion Essay On The Short Story "Seventh Grade" by Gary SotoDocumento2 páginasThe Opinion Essay On The Short Story "Seventh Grade" by Gary SotoAssignmentLab.comAinda não há avaliações

- The Obscurities of Blue Collar Jobs and Sociological Factors Affecting Blue CollarDocumento7 páginasThe Obscurities of Blue Collar Jobs and Sociological Factors Affecting Blue CollarAssignmentLab.comAinda não há avaliações

- The Most Dangerous Moment Comes With VictoryDocumento3 páginasThe Most Dangerous Moment Comes With VictoryAssignmentLab.comAinda não há avaliações

- The Lorax On Easter IslandDocumento4 páginasThe Lorax On Easter IslandAssignmentLab.comAinda não há avaliações

- The Models of Church "As A Communion" and "As A Political Society" TheDocumento7 páginasThe Models of Church "As A Communion" and "As A Political Society" TheAssignmentLab.comAinda não há avaliações

- The LawDocumento4 páginasThe LawAssignmentLab.comAinda não há avaliações

- The Life StyleDocumento3 páginasThe Life StyleAssignmentLab.comAinda não há avaliações

- The Media and The GovernmentDocumento4 páginasThe Media and The GovernmentAssignmentLab.comAinda não há avaliações

- The Merchant of VeniceDocumento5 páginasThe Merchant of VeniceAssignmentLab.comAinda não há avaliações

- The Marketing Mix 2 Promotion and Price CS3Documento5 páginasThe Marketing Mix 2 Promotion and Price CS3AssignmentLab.comAinda não há avaliações

- The Issues Surrounding The Coding of SoftwareDocumento10 páginasThe Issues Surrounding The Coding of SoftwareAssignmentLab.comAinda não há avaliações

- The Implications On Mobile Commerce in The International Marketing CommunicationDocumento2 páginasThe Implications On Mobile Commerce in The International Marketing CommunicationAssignmentLab.comAinda não há avaliações

- The Influence of Families On Children's SchoolDocumento8 páginasThe Influence of Families On Children's SchoolAssignmentLab.comAinda não há avaliações

- The Impact of The Depression of The 1890s On Political Tensions of The TimeDocumento3 páginasThe Impact of The Depression of The 1890s On Political Tensions of The TimeAssignmentLab.com100% (1)

- The Identity of Christianity Given by Early ArtDocumento6 páginasThe Identity of Christianity Given by Early ArtAssignmentLab.comAinda não há avaliações

- The Impact of Media On Illicit Drug UseDocumento6 páginasThe Impact of Media On Illicit Drug UseAssignmentLab.comAinda não há avaliações

- The Human Hand in Global WarmingDocumento10 páginasThe Human Hand in Global WarmingAssignmentLab.comAinda não há avaliações

- Risk and Return FundamentalsDocumento60 páginasRisk and Return FundamentalsasmaAinda não há avaliações

- Deed of Conditional Sale House and Lot DraftDocumento3 páginasDeed of Conditional Sale House and Lot DraftJanmari G. FajardoAinda não há avaliações

- Topic 6 - Inventories Lecture Illustrations: RequiredDocumento4 páginasTopic 6 - Inventories Lecture Illustrations: RequiredMitchell BylartAinda não há avaliações

- Dwnload Full Essentials of Corporate Finance 7th Edition Ross Test Bank PDFDocumento35 páginasDwnload Full Essentials of Corporate Finance 7th Edition Ross Test Bank PDFoutlying.pedantry.85yc100% (12)

- Grade 7 Practice: Calculating Percent Changes and DiscountsDocumento3 páginasGrade 7 Practice: Calculating Percent Changes and DiscountsRizky HermawanAinda não há avaliações

- Functions of IDBI BankDocumento37 páginasFunctions of IDBI Bankangelia3101Ainda não há avaliações

- SalesBill VI 139 DigitallySignedDocumento1 páginaSalesBill VI 139 DigitallySignedKundariya MayurAinda não há avaliações

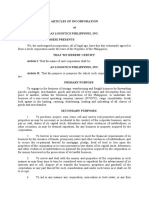

- Articles of IncorporationDocumento4 páginasArticles of IncorporationRuel FernandezAinda não há avaliações

- Caltex v Security Bank: 280 CTDs worth P1.12MDocumento52 páginasCaltex v Security Bank: 280 CTDs worth P1.12MAir Dela CruzAinda não há avaliações

- Audit EvidenceDocumento23 páginasAudit EvidenceAmna MirzaAinda não há avaliações

- A Project Report On TaxationDocumento71 páginasA Project Report On TaxationHveeeeAinda não há avaliações

- Ark Israel Innovative Technology Etf Izrl HoldingsDocumento2 páginasArk Israel Innovative Technology Etf Izrl HoldingsmikiAinda não há avaliações

- Negen Capital: (Portfolio Management Service)Documento5 páginasNegen Capital: (Portfolio Management Service)Sumit SagarAinda não há avaliações

- C11 Principles and Practice of InsuranceDocumento9 páginasC11 Principles and Practice of InsuranceAnonymous y3E7ia100% (2)

- Income Tax CalculatorDocumento5 páginasIncome Tax CalculatorTanmay DeshpandeAinda não há avaliações

- Bills Buying and Selling RatesDocumento2 páginasBills Buying and Selling RatesEnamul Haque100% (1)

- Risk Management Options and DerivativesDocumento13 páginasRisk Management Options and DerivativesAbdu0% (1)

- Passage No 50Documento7 páginasPassage No 50SanchitAinda não há avaliações

- CL Ka and SolutionsDocumento4 páginasCL Ka and SolutionsInvisible CionAinda não há avaliações

- Mitsui OSK Lines Vs Orient Ship AgencyDocumento108 páginasMitsui OSK Lines Vs Orient Ship Agencyvallury chaitanya RaoAinda não há avaliações

- NIFTY Pharma Index captures 20 Indian pharma stocksDocumento2 páginasNIFTY Pharma Index captures 20 Indian pharma stocksJackAinda não há avaliações

- MCTax GuideDocumento1 páginaMCTax Guidekhageshcode89Ainda não há avaliações

- Intra Firm Ratio Analysis of Financial Statements of Bharti Realty Holdings Ltd.Documento37 páginasIntra Firm Ratio Analysis of Financial Statements of Bharti Realty Holdings Ltd.DevAinda não há avaliações

- MBF12 CH3 Question BankDocumento15 páginasMBF12 CH3 Question BankwertyuoiuAinda não há avaliações

- SIP PPT RavirajsinhDocumento21 páginasSIP PPT RavirajsinhJadeja AjayrajsinhAinda não há avaliações

- Chapter 6 Accounting For Foreign Currency TransactionDocumento21 páginasChapter 6 Accounting For Foreign Currency TransactionMisganaw DebasAinda não há avaliações

- Citi Bank Kpi Summary 2021-2022Documento5 páginasCiti Bank Kpi Summary 2021-2022tusharjaipur7Ainda não há avaliações

- Icici Prudential Life InsuranceDocumento19 páginasIcici Prudential Life InsuranceShubhanshu DubeyAinda não há avaliações

- SATURDAYDocumento20 páginasSATURDAYkristine bandaviaAinda não há avaliações

- Case DigestDocumento2 páginasCase DigestBHEJAY ORTIZAinda não há avaliações