Escolar Documentos

Profissional Documentos

Cultura Documentos

Financial Services in India Intro N Types

Enviado por

Latasha RamnaniTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Financial Services in India Intro N Types

Enviado por

Latasha RamnaniDireitos autorais:

Formatos disponíveis

Financial Services in India

Last Updated: October 2013 Financial Services in India- Brief Overview Indian financial services industry has been through the toughest of the times and yet stands strong and robust among the world economies. Having a deep impact of the far-reaching changes in the Indian economy since liberalization, the new face of this industry is evolving in a strong, transparent and resilient system. Over the last few years, financial markets have witnessed a significant broadening and deepening of service baskets with the introduction of several new instruments and products in banking, insurance and capital markets space. The sector was opened up to new private players including foreign companies who embraced international best practices and modern technology to offer a more sophisticated range of financial services to corporate, retail and institutional customers. Financial sector regulators too have been visionaries to ensure that new regulations and guidelines are in tandem with global norms. These developments have given a robust boost to the development and modernisation of the financial services sector in India. Insurance Sector

Indian life insurance sector collected new business premiums worth Rs 11,742.7 crore (US$ 1.92 billion) for April-May 2013, according to data from the Insurance Regulatory and Development Authority (IRDA). Life insurers collected Rs 1, 07, 010.7 crore

(US$ 17.47 billion) worth of new premiums for the financial year ended March 31, 2013. Meanwhile, the general insurance industry grew by 19.6 per cent in April-May period of FY14, wherein the non-life insurers collected premium worth Rs 13,552.46 crore (US$ 2.21 billion).

Banking Services

According to the Reserve Bank of India (RBI)s Quarterly Statistics on Deposits and Credit of Scheduled Commercial Banks, March 2013, Nationalised Banks accounted for 52.4 per cent of the aggregate deposits, while the State Bank of India (SBI) and its Associates accounted for 22 per cent. The share of New Private Sector Banks, Old Private Sector Banks, Foreign Banks, and Regional Rural Banks in aggregate deposits was 13.6 per cent, 5.1 per cent, 4 per cent and 2.9 per cent, respectively. Nationalised Banks accounted for the highest share of 51 per cent in gross bank credit followed by State Bank of India and its Associates (22.7 per cent) and New Private Sector Banks (14 per cent). Foreign Banks, Old Private Sector Banks and Regional Rural Banks had shares of around 4.9 per cent, 5 per cent and 2.5 per cent, respectively. Banks credit (loan) growth increased to 18 per cent for the fortnight ended September 6, 2013, while deposits grew by 13.37 per cent showed the data by RBI. India's foreign exchange reserves increased to US$ 277.73 billion as of October 4, 2013.

Mutual Funds Industry in India Indias asset management companies (AMCs) have witnessed growth of 0.7 per cent in August 2013 wherein their average assets under management (AUM) stood at Rs 7.66 lakh crore (US$ 125.10 billion). Private Equity, Mergers & Acquisitions in India

Private equity (PE) and venture capital (VC) firms remained bullish about Indias consumer goods and services sector. PE and VC investments increased by more than 46 per cent in the first half of FY14, with consumer companies in retail, e-commerce, consumer packaged goods and quick service restaurants raising US$ 609.39 million through 51 deals. Meanwhile, Indian merger and acquisition (M&A) space witnessed substantial levels of deal activity in the first nine months of 2013. There happened 377 deals amounting to US$ 23.9 billion, according to a survey by tax advisory firm Grant Thornton.

Foreign Institutional Investors (FIIs) in India

Investments in Indian markets (equity, debt and derivatives) through participatory notes (P-Notes) increased to US$ 23.74 billion by the end of July 2013, according to the data released by Securities and Exchange Board of India (SEBI). P-Notes allow high net-worth individuals (HNI), hedge funds and other foreign institutions to invest in Indian markets through registered FIIs.

The FIIs investments through P-Notes registered a growth of 11.45 per cent in July 2013 as compared to 10.93 per cent in June 2013. Overseas investors infused more than US$ 2 billion in the Indian stock market in the month of September 2013. Since the beginning of 2013, they have pumped a net US$ 13.7 billion in equities. Moreover, given the higher yields offered by Government and corporate debt, the FIIs have been aggressively buying bonds since the beginning of 2013. The debt market attracted a net inflow of about Rs 25,000 crore (US$ 4.08 billion) in January-May 2013. As of October 4, the number of registered FIIs in the country stood at 1, 744 and the total number of subaccounts at 6, 358.

Financial Services in India: Recent Developments

Bangalore-based online retailer Flipkart has raised US$ 200 million from its existing investors including South African technology company Naspers Group and private equity (PE) firms Accel Partners and Tiger Global. The investors have already placed investments to the tune of US$ 181 million in the Indian e-commerce company and this fifth round of funding has marked the single-largest round of investment infusion. The funds would be used to build technology and will help the company strengthen its supply chain and human resource base. Private lender HDFC Bank is planning to launch 500

mini branches, to be handled by one to three people, across India by the end of FY14. The bank has added about 219 mini branches pan-India since 2012. The basic motive behind such a initiative by the bank is to take the formal banking experience to people in unbanked and under-banked areas. A mini branch, manned by one, two or three persons, offers the entire range of products and services including savings and current accounts, fixed deposits, recurring deposits, credit card, instant debit card and also ATM facility. Products such as two wheeler loan, tractor loan, commercial vehicle loan, agricultural and commodities loan among others are also offered. Financial Services: Government Initiatives In order to attract more of foreign capital to Indian markets, SEBI has eased norms for overseas investors in the debt category. As per the new rulings, FIIs will be allowed to buy Government securities (Gilts) directly from the market, rather than from the monthly auction conducted by the regulator to allocate these papers. The move is expected to facilitate more dollar inflows into the country besides making the cost of acquisition of gilts cheaper for foreign investors. In a similar initiative taken earlier in 2013, SEBI had allowed FIIs to buy corporate debt (which were also allocated through auction previously). Road Ahead A report prepared by KPMG prepared in association with the

Confederation of Indian Industry (CII) states that the Indian banking sector is expected to become fifth largest in the world by 2020. The report highlights that India is one of the top 10 economies of the world and with relatively lower domestic credit to gross domestic product (GDP) percentage, their lies a huge scope of growth for the banking sector. Bank credit is expected to grow at a compounded annual growth rate (CAGR) of 17 per cent in the medium term, eventually leading to higher credit penetration in the economy. Meanwhile, IRDA estimates that the insurance business in India would touch Rs 4 lakh crore (US$ 65.32 billion) by the end of FY14. The regulator is considering bringing out norms for sub-brokers of insurance products as well. Exchange Rate Used: INR 1 = US$ 0.01633 as on October 18, 2013 References: Media Reports, Press Releases, RBI Document

Você também pode gostar

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- 1.WhiteGold V Pioneer Insurance DigestDocumento2 páginas1.WhiteGold V Pioneer Insurance Digestmb_estanislaoAinda não há avaliações

- NFG SF110106Documento1 páginaNFG SF110106Mohammed KhaleelAinda não há avaliações

- Activity 3-4 SB CompensationDocumento3 páginasActivity 3-4 SB CompensationNhel Alvaro0% (1)

- SExam2 PDFDocumento4 páginasSExam2 PDFdicheyaAinda não há avaliações

- Practice Question 07-09Documento5 páginasPractice Question 07-09Random Fun clipsAinda não há avaliações

- Bank Duties and RightsDocumento6 páginasBank Duties and RightsSthita Prajna Mohanty100% (1)

- Mortgage Deed (Mortgage Deed by Small Farmer For Agrl - Loans in F/O Pac/Bank)Documento3 páginasMortgage Deed (Mortgage Deed by Small Farmer For Agrl - Loans in F/O Pac/Bank)JC WARGAL100% (1)

- Fixed Assets72Documento102 páginasFixed Assets72Sumanth AmbatiAinda não há avaliações

- Chapter 1 The Assurance Services MarketDocumento18 páginasChapter 1 The Assurance Services MarketYasmine Magdi100% (1)

- PNB Vs Rodriguez and PNB Vs Concepcion MiningDocumento3 páginasPNB Vs Rodriguez and PNB Vs Concepcion MiningDanielleAinda não há avaliações

- Classification of AccountsDocumento4 páginasClassification of Accountsvikas sunnyAinda não há avaliações

- ACCA P2 December 16 NotesDocumento156 páginasACCA P2 December 16 NotesLâm BullsAinda não há avaliações

- 100 Crucial LBO Model Jargons You Need To KnowDocumento16 páginas100 Crucial LBO Model Jargons You Need To Knownaghulk1Ainda não há avaliações

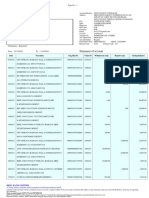

- Month/Year Deductions Carried Out From My Account Repayment Scheduled at The Approval Time of Loan /installments Difference in AmountDocumento1 páginaMonth/Year Deductions Carried Out From My Account Repayment Scheduled at The Approval Time of Loan /installments Difference in AmountAdeenaAinda não há avaliações

- First Name Last Name TitleDocumento6 páginasFirst Name Last Name TitleSME FuturesAinda não há avaliações

- Cash Management:: Revenue DepositsDocumento26 páginasCash Management:: Revenue DepositsMomel FatimaAinda não há avaliações

- Common Business Transactions Using The Rules of Debit and CreditDocumento9 páginasCommon Business Transactions Using The Rules of Debit and CreditSHIERY MAE FALCONITINAinda não há avaliações

- Ross 10e Chap002 PPTDocumento34 páginasRoss 10e Chap002 PPTAramis SantanaAinda não há avaliações

- DDA Flats BookingDocumento7 páginasDDA Flats Bookingamit20415Ainda não há avaliações

- FM Fib 07013Documento4 páginasFM Fib 07013Aftab UddinAinda não há avaliações

- BFIN 241 Final Exam OutlineDocumento3 páginasBFIN 241 Final Exam Outlinevishalgupta9133Ainda não há avaliações

- Acct Statement XX7166 12062023Documento5 páginasAcct Statement XX7166 12062023Save EnvironmentAinda não há avaliações

- R17AMR ReleaseHighlightsDocumento48 páginasR17AMR ReleaseHighlightstayutaAinda não há avaliações

- Non Banking Financial InstitutionsDocumento18 páginasNon Banking Financial InstitutionsNimesh Shah100% (1)

- RBI Format ROI PC PDFDocumento9 páginasRBI Format ROI PC PDFmohana sundaram pAinda não há avaliações

- Stanbic IBTC Bank Product Knowledge Assessment Test Study PackDocumento32 páginasStanbic IBTC Bank Product Knowledge Assessment Test Study PackMike TelkAinda não há avaliações

- Orange Everyday Statement: Free AtmsDocumento2 páginasOrange Everyday Statement: Free AtmssaAinda não há avaliações

- Guide For Credinet WebDocumento58 páginasGuide For Credinet WebVladimir Ramos MachacaAinda não há avaliações

- CF MathDocumento5 páginasCF MathArafat HossainAinda não há avaliações

- Corporate Overview - Oxane PartnersDocumento12 páginasCorporate Overview - Oxane PartnersUtkarsh RastogiAinda não há avaliações