Escolar Documentos

Profissional Documentos

Cultura Documentos

Scenario 1# You Do Not Have Outstanding Tax Liability

Enviado por

Bhupendra SharmaDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Scenario 1# You Do Not Have Outstanding Tax Liability

Enviado por

Bhupendra SharmaDireitos autorais:

Formatos disponíveis

Scenario 1# You do not have outstanding tax liability

In case you have already paid your taxes before 31 March, 2009, but could not file the return within the due date, you may file a return at any time before the end of one year from the relevant assessment year, simply put; for the financial year 2008-09 return can be filed at any time before 31st March 2011, however you may invite a tax penalty of Rs 5,000 u/s 271F of income tax act even if all your taxes have been paid if the same return is furnished after 31st March, 2010.

Scenario 2# You do have some Outstanding Tax liability

If you do need to pay any balance tax, there is some financial implication. The basic principle remains the same: The income tax return for a given assessment year can be filed any time till the end of that assessment year without any penalty. If it is filed after the end of the assessment year, there may be a lump-sum penalty of Rs. 5,000. On top of this, there is a penalty of 1% per month on the net tax payable u/s 234A. Example: Say, your income tax liability for the year is Rs. 40,000. You have TDS (Tax Deducted at Source) of Rs. 20,000, and you have paid an advance tax of Rs. 6,000. Thus, the remaining tax payable by you is: Net Tax Payable = Income tax liability for the year TDS Advance tax paid = Rs. 40,000 Rs. 20,000 Rs. 6,000 = Rs. 14,000. [ad#link-unit] Now there are two cases, which we have to consider Case 1: File income tax return before the end of assessment year Say you file your income tax return on 17th September, 2009. In this case, you would be filing your return 2 months late (partial months are considered as full months). Final Amount = Net Tax Payable + Interest for 2 months at the rate of 1% per month Amount payable , = Rs. 14,000 + (2% of Rs. 14,000) = Rs. 14,000 + Rs. 280 = Rs. 14,280 Case 2: File income tax return after the end of assessment year

Say you file your income tax return on 4th June, 2010. In this case, you would be filing your return 11 months late (partial months are considered as full months). On top of this, you would be filing the income tax return after the end of the assessment year for which you are filing the return. So, in this case, Final Amount = Net Tax Payable + Interest for 11 months at the rate of 1% per month + Lump sum penalty of Rs. 5,000 = Rs. 14,000 + (11% of Rs. 14,000) + Rs. 5,000 = Rs. 14,000 + Rs. 1540 + Rs. 5,000 = Rs. 20540 Save some tax by understanding Income clubbing provisions of Income tax

Additional Scenario

You have losses that you need to carry forward. This applies irrespective of whether you have any net tax payable or not. If you do not file the income tax return for a year by the due date, a loss for that year can not be carried forward. The only exception to this rule is loss from house property this loss can be carried forward even if the IT return is not filed in time. Thus, if you have a loss from any of the heads of income (except for the head Income from house property) and you file your income tax return late, you would not be able to carry forward your losses. Thus, you would lose the benefit of set off of these losses against the income of the next year.

Conclusion

Not filing a return on time does have financial implications, especially if you have a net income tax payable and/or if you have losses to be carried forward. This can really hurt especially if the losses to be carried forward are significant. Therefore, your best option is to ensure that you file the income tax return by the deadline.Better late than never is the best policy when it comes to income tax return filing. Notes from Manish:

Disadvantages of filing a late return

As per Income Tax Department of India : Aa tax return may be furnished any time before the expiry of two years from the end of the financial year in which the income was earned. This means that if you earned your income during FY 2009-10, you may file a belated return anytime before 31st March, 2012 . But there are some disadvantages if you dont file your returns on time . They are

You will not be able to carry forward your Business loss (Speculation or otherwise) , capital loss , loss due to owning and maintaining of race horses.

Loss of Interest on refund : You may loose interest on refund u/s 244A specially in case if you are claiming a Major amount as refund. You cannot revise your return.

NOTE: Dear Friends, the above article does not mean to encourage people for filing late return but only to make taxpayers aware about the provision of IT act and help them taking informed decision.

Income Range

Upto Rs. 2,00,000 Rs. 2,00,001 to Rs. 2,50,000 Rs. 2,50,001 to Rs. 5,00,000

Women (Below 60 years of Very Senior Senior Citizens General age) Citizens (Men and Women (non-senior (This category is abolished (Men and above 60 years of citizens) from this year and is thus is Women age), but below 80 Category same as that of General above 80 years Category years of age) Nil Nil Nil Nil 10% 10% 10% 10% 20% 30% Nil 10% 20% 30% Nil Nil 20% 30%

Rs. 5,00,001 to Rs. 10,00,000 20% Above Rs. 10,00,000 30%

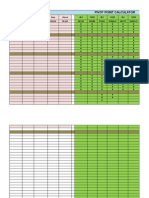

For finanacial year 2011-12 TAX Basic Exemption 10% tax 20% tax 30% tax MEN WOMEN SENIOR CITIZEN 250000 250001 to 500000 500001 to 800000 above 800000

180000 190000 180001 to 190001 to 500000 500000 500001 to 500001 to 800000 800000 above 800000 above 800000 For finanacial year 2010-11

Basic Exemption

160000 190000 240000 160001 to 190001 to 240001 to 10% tax 500000 500000 500000 500001 to 500001 to 500001 to 20% tax 800000 800000 800000 30% tax above 800000 above 800000 above 800000 For finanacial year 2009-10 Basic Exemption 160000 190000 240000 160001 to 190001 to 240001 to 10% tax 300000 300000 300000 300001 to 300001 to 300001 to 20% tax 500000 500000 500000 30% tax above 500000 above 500000 above 500000 For finanacial year 2008-09 Basic Exemption 150000 180000 225000 150001 to 180001 to 225001 to 10% tax 300000 300000 300000 300001 to 300001 to 300001 to 20% tax 500000 500000 500000 above 500000 above 500000 above 500000 For finanacial year 2007-08 Basic Exemption 110000 145000 195000 110001 to 145001 to 10% tax nil 150000 150000 150001 to 150001 to 195001 to 20% tax 250000 250000 250000 30% tax above 250000 above 250000 above 250000 income is note:- there is a greater than 10 10% surcharge if lakh For finanacial year 2006-07 and 2005-06 Basic Exemption 100000 135000 185000 100001 to 135001 to 10% tax nil 150000 150000 150001 to 150001 to 185001 to 20% tax 250000 250000 250000 30% tax above 250000 above 250000 above 250000 For finanacial year 2004-05 and 2003-02 Basic Exemption 50000 50000 50000 10% tax 50001 to 60000 50001 to 60000 50001 to 60000 20% tax 60001 to 150000 60001 to 150000 60001 to 150000

30% tax

Basic Exemption 10% tax 20% tax 30% tax

Basic Exemption 10% tax 20% tax 30% tax

Basic Exemption 10% tax 20% tax 30% tax

above 150000 above 150000 if income is note:- there is a greater than 8.5 10% surcharge lakh For finanacial year 2002-03 50000 50000 50000 50001 to 60000 50001 to 60000 50001 to 60000 60001 to 150000 60001 to 150000 60001 to 150000 above 150000 above 150000 above 150000 if income is note:- there is a greater than 5% surcharge 60000. For finanacial year 2001-02 50000 50000 50000 50001 to 60000 50001 to 60000 50001 to 60000 60001 to 150000 60001 to 150000 60001 to 150000 above 150000 above 150000 above 150000 if income is note:- there is a greater than 2% surcharge 60000. For finanacial year 2000-01 50000 50000 50000 50001 to 60000 50001 to 60000 50001 to 60000 60001 to 150000 60001 to 150000 60001 to 150000 above 150000 above 150000 above 150000 if income is note:- there is a greater than 12% surcharge 60000. if income>150000 surcharge is 17%

above 150000

Saving Scheme

Sec. under which Tax Benefit available

Return

Tax benefits for earnings (i.e. interest received / dividend received) Taxable

Lock in Period and other Remarks

National Saving Certificates - ( NSC scheme )

8.50% for VIII Series 5 Section 80C Year NSCs; and 8.80%

5 years (reduced wef Dec 2011 from 6 years to 5 years for new investments). The yield

for 10 year NSCs for FY 2013-14

on these NSCs will now be revised every year and will be 25 bps above the 5 year government bond yields 3 years

Varies from Equity Linked Savings year to Dividend is tax Section 80C Schemes (ELSS) year (Market free linked) Varies from Varies from Life Insurance Policies Section 80C scheme to year to year scheme Varies from Unit Linked Insurance Varies from Section 80C scheme to Plan (ULIP) year to year scheme Varies from issue to issue. These were around 8%+ in Dec 2011. These have lost their charm Infrastructure Bonds Section 80C as Taxable Additional Tax rebate of Rs 20,000 is NOT given now from FY 2012-13 onwards. Contribution to EPF / Section 80C 8.50% GPF / Voluntary PF

Varies from scheme to scheme Varies from scheme to scheme (15 to 20 years)

3 to 5 years

Till retirement (loans are Interest earned permitted only after 5 is tax free years) Earnings are tax Insurance Policies Section 80C 6 to 7% only free in most of Locked till maturity the cases Market Earnngs are tax Partiail withdrawal ULIPS Section 80C linked free allowed 15 years and extendable. Withdrawals Decreased to Public Provident Fund Interest earned allowed after 7 Section 80C 8.70% for (PPF) is tax free years. Yield on PPF will FY 2013--14 vary and will be fixed at 25 basis point above the

NPS

Section 80C

Market Linked

10 year government bonds. Interest earned Withdrawal not permitted is tax free before maturity

Tuition Fees including admission fees or college fees paid for Section 80C full time education of any two children of the assessee. Repayment of Housing Section 80C Loan (Principal)

Not applicable

Not applicable Not applicable

Not Not applicable Not applicable applicable Varies from bank to bank Bank Fixed Deposits Section 80C (around Nil 5 Years 5 Years 8.00% 9.00%) As per the guidelines issued in December 2011, Senior Citizens Savings 9.20% for there will be spread of Scheme 2004 (from Section 80C Taxable FY 2013-14 100 basis points above the financial year 2007-08) 5 year bonds yields for this scheme.

Post Office Time Deposit Account (from financial 2007-08)

Section 80C

Você também pode gostar

- Request For ReinvestigationDocumento9 páginasRequest For Reinvestigationjoel raz94% (16)

- Paystub 01.06.2023Documento1 páginaPaystub 01.06.2023Crystal SimonAinda não há avaliações

- Tax Presentation-29.01.2023Documento25 páginasTax Presentation-29.01.2023Abhinav Parhi100% (2)

- How To Use Stripe ForeverDocumento5 páginasHow To Use Stripe ForeverAdi S. Gunawan75% (4)

- National Democratic Redistricting CommitteeDocumento3 páginasNational Democratic Redistricting CommitteeNoyb NalAinda não há avaliações

- LTZ-0006260-IN-57101 Liquid Telecom March 2020Documento1 páginaLTZ-0006260-IN-57101 Liquid Telecom March 2020Tadiwanashe ChikoworeAinda não há avaliações

- Power of Attorney and Declaration of RepresentativeDocumento2 páginasPower of Attorney and Declaration of Representativegordon scottAinda não há avaliações

- Latest Income Tax Slabs and Rates For FY 2013-14 and AS 2014-15Documento6 páginasLatest Income Tax Slabs and Rates For FY 2013-14 and AS 2014-15Michaelben MichaelbenAinda não há avaliações

- Income Tax2022 GuidelinesDocumento4 páginasIncome Tax2022 GuidelinesSANDEEP SAHUAinda não há avaliações

- How To Calculate Income TaxDocumento4 páginasHow To Calculate Income TaxreemaAinda não há avaliações

- DeferredDocumento11 páginasDeferredShubham MaheshwariAinda não há avaliações

- Individual Txation FY 203 24Documento44 páginasIndividual Txation FY 203 24Smarty ShivamAinda não há avaliações

- Tax Planning For Year 2010Documento24 páginasTax Planning For Year 2010Mehak BhargavaAinda não há avaliações

- How To Calculate Ur Income TaxDocumento3 páginasHow To Calculate Ur Income TaxrazeemshipAinda não há avaliações

- Tax Slabs & Tax Saving Strategies For New Tax Payers 2011-12Documento5 páginasTax Slabs & Tax Saving Strategies For New Tax Payers 2011-12channaveer sgAinda não há avaliações

- Notes On DTC BillDocumento5 páginasNotes On DTC Billshikah sidarAinda não há avaliações

- Tax Structure in India: Edited and Complied Study Material by (Dr. Durdana Ovais)Documento7 páginasTax Structure in India: Edited and Complied Study Material by (Dr. Durdana Ovais)Harshita MarmatAinda não há avaliações

- Income Tax Saving: Using Only 80C For Tax Saving? New Tax Regime May Be Beneficial For You at This Income - The Economic Times PDFDocumento5 páginasIncome Tax Saving: Using Only 80C For Tax Saving? New Tax Regime May Be Beneficial For You at This Income - The Economic Times PDFDDSingh SinghAinda não há avaliações

- Individual Txation FY 2019 20 With Demo of Return FilingDocumento73 páginasIndividual Txation FY 2019 20 With Demo of Return FilingGanesh PAinda não há avaliações

- Income Tax Calculator Calculate Income Tax For FY 2022-23Documento1 páginaIncome Tax Calculator Calculate Income Tax For FY 2022-23Vivek LakkakulaAinda não há avaliações

- Tax Deduction - DR Sajjad Wani JKASDocumento26 páginasTax Deduction - DR Sajjad Wani JKASMohmad Yousuf100% (1)

- Income Tax On SalaryDocumento23 páginasIncome Tax On SalarySarvesh MishraAinda não há avaliações

- FAQ S On Income Tax 2022-23Documento4 páginasFAQ S On Income Tax 2022-23Ranjan SatapathyAinda não há avaliações

- Taxation Flow PresentationDocumento73 páginasTaxation Flow PresentationMohan ChoudharyAinda não há avaliações

- Portal Investment Proof Verification Guidelines 2022 23Documento11 páginasPortal Investment Proof Verification Guidelines 2022 23yfiamataimAinda não há avaliações

- BudgetDocumento21 páginasBudgetshweta_narkhede01Ainda não há avaliações

- Indian Income Tax Calculator: Double Click The IT Calculator - IT Will Automatically Calculate The Taxable AmountDocumento23 páginasIndian Income Tax Calculator: Double Click The IT Calculator - IT Will Automatically Calculate The Taxable AmountshankarinsideAinda não há avaliações

- Individual Taxation (Ay 2019-20)Documento29 páginasIndividual Taxation (Ay 2019-20)Mudit SinghAinda não há avaliações

- Income Tax - Income Tax Department, IT Returns, E-Filing, Tax Slab FY 2020-21Documento11 páginasIncome Tax - Income Tax Department, IT Returns, E-Filing, Tax Slab FY 2020-21LAKSHMANARAO PAinda não há avaliações

- IFBPDocumento11 páginasIFBPmohanraokp2279Ainda não há avaliações

- Presenting: Direct Tax - Trends in IndiaDocumento27 páginasPresenting: Direct Tax - Trends in IndiatusharAinda não há avaliações

- Old Vs New Tax RegimeDocumento9 páginasOld Vs New Tax Regimescintillating26Ainda não há avaliações

- Taxguru - In-Income Tax Rates For FY 2020-21 Amp FY 2021-22Documento8 páginasTaxguru - In-Income Tax Rates For FY 2020-21 Amp FY 2021-22JiyalalAinda não há avaliações

- Unit 4 Return FillingDocumento71 páginasUnit 4 Return FillingAnshu kumarAinda não há avaliações

- Tax PlanningDocumento7 páginasTax PlanningCharan AdharAinda não há avaliações

- Ammendments in Direct TaxDocumento37 páginasAmmendments in Direct TaxVipul KatariyaAinda não há avaliações

- Income Tax - IT Returns, E Filing, Tax Saving, Income Tax Slabs, Rules & Laws - All About Income TaxDocumento6 páginasIncome Tax - IT Returns, E Filing, Tax Saving, Income Tax Slabs, Rules & Laws - All About Income TaxLAKSHMANARAO P100% (1)

- Income Tax Slabs & Rates For Assessment Year 2013-14Documento37 páginasIncome Tax Slabs & Rates For Assessment Year 2013-14Jigar RavalAinda não há avaliações

- 16thFeb2019EIA Skill DetailsDocumento19 páginas16thFeb2019EIA Skill Detailssubitha samyAinda não há avaliações

- The Tax Season of 2020 Is Going To Be Different Than What You Know - PostDocumento2 páginasThe Tax Season of 2020 Is Going To Be Different Than What You Know - PostShahu PawarAinda não há avaliações

- Taxable Income RahulDocumento18 páginasTaxable Income RahulRahul ParitAinda não há avaliações

- Income Tax Note 02Documento4 páginasIncome Tax Note 02Hashani Anuttara AbeygunasekaraAinda não há avaliações

- TDS (Tax Deducted at Source) : ST STDocumento6 páginasTDS (Tax Deducted at Source) : ST STRuchiRangariAinda não há avaliações

- Income Tax EXPLAINATIONDocumento11 páginasIncome Tax EXPLAINATIONVishwas AgarwalAinda não há avaliações

- Note On Budget Proposals-2020Documento4 páginasNote On Budget Proposals-2020Dhananjai SharmaAinda não há avaliações

- Deduction of Tax at Source - Income-Tax Deduction From Salaries Under Section 192 of The Income-Tax Act, 1961 During The Financial Year 2008-2009Documento70 páginasDeduction of Tax at Source - Income-Tax Deduction From Salaries Under Section 192 of The Income-Tax Act, 1961 During The Financial Year 2008-2009rhldxmAinda não há avaliações

- Tax FinalDocumento21 páginasTax Finalshweta_narkhede01Ainda não há avaliações

- Notes To Investment Proof SubmissionDocumento10 páginasNotes To Investment Proof SubmissionVinayak DhotreAinda não há avaliações

- TdsDocumento4 páginasTdsAdityaAinda não há avaliações

- Tax Deducted at SourceDocumento5 páginasTax Deducted at SourceRajinder KaurAinda não há avaliações

- Income Tax Calculator Ay 2015-16 For Resident Individuals & HufsDocumento3 páginasIncome Tax Calculator Ay 2015-16 For Resident Individuals & HufsVasan GovindAinda não há avaliações

- Income From Other SourcesDocumento6 páginasIncome From Other Sourcesanusaya1988Ainda não há avaliações

- Indian Institute of Technology Madras: CircularDocumento5 páginasIndian Institute of Technology Madras: CircularAravinthram R am18m002Ainda não há avaliações

- 6 Activities For Business Structure & TaxationDocumento16 páginas6 Activities For Business Structure & TaxationDawit TilahunAinda não há avaliações

- 6 Activities For Business Structure & TaxationDocumento16 páginas6 Activities For Business Structure & Taxationyabmitiku123Ainda não há avaliações

- Tax On Salary: Income Tax Law & CalculationDocumento7 páginasTax On Salary: Income Tax Law & CalculationSyed Aijlal JillaniAinda não há avaliações

- Taxation ProjectDocumento23 páginasTaxation ProjectAkshata MasurkarAinda não há avaliações

- Deductions 3Documento35 páginasDeductions 3sanjeev kumar vsAinda não há avaliações

- Tax Planning Guide: 1800 3000 6070 Buyonline@iciciprulifeDocumento14 páginasTax Planning Guide: 1800 3000 6070 Buyonline@iciciprulifeRohitAinda não há avaliações

- 16 Total IncomeDocumento7 páginas16 Total IncomeHritik HarlalkaAinda não há avaliações

- Unit 3 Use of E Tax CalculatorDocumento2 páginasUnit 3 Use of E Tax CalculatorSayan MitraAinda não há avaliações

- The New Direct Tax Code (DTC)Documento18 páginasThe New Direct Tax Code (DTC)aggarwalajay2Ainda não há avaliações

- Income Tax in IndiaDocumento19 páginasIncome Tax in IndiaConcepts TreeAinda não há avaliações

- Income Tax Basics in IndiaDocumento5 páginasIncome Tax Basics in IndiaashankarAinda não há avaliações

- Indian Institute of Space Science and Technology GeoinformticsDocumento20 páginasIndian Institute of Space Science and Technology GeoinformticsBhupendra SharmaAinda não há avaliações

- Project Profiles For MUDRADocumento183 páginasProject Profiles For MUDRAManishGuptaAinda não há avaliações

- Indian Institute of Space Science and Technology GeoinformticsDocumento20 páginasIndian Institute of Space Science and Technology GeoinformticsBhupendra SharmaAinda não há avaliações

- Websitedesign PDFDocumento10 páginasWebsitedesign PDFrajaAinda não há avaliações

- Indian Institute of Space Science and Technology GeoinformticsDocumento20 páginasIndian Institute of Space Science and Technology GeoinformticsBhupendra SharmaAinda não há avaliações

- Mobile ManagementDocumento32 páginasMobile ManagementAkash SonekarAinda não há avaliações

- Dda ResumeDocumento3 páginasDda ResumeBhupendra SharmaAinda não há avaliações

- AdadDocumento1 páginaAdadBhupendra SharmaAinda não há avaliações

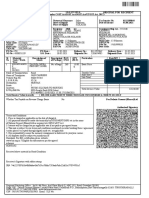

- PM-Kisan Samman Nidhi: Uttar Pradesh Agra Bah Jaitpur Kalan Naugawan - (125Documento2 páginasPM-Kisan Samman Nidhi: Uttar Pradesh Agra Bah Jaitpur Kalan Naugawan - (125Bhupendra SharmaAinda não há avaliações

- Airtel Bill May 7Documento1 páginaAirtel Bill May 7Bhupendra SharmaAinda não há avaliações

- Airtel Bill May 7Documento1 páginaAirtel Bill May 7Bhupendra SharmaAinda não há avaliações

- Retention 649 - 2 MbpsDocumento1 páginaRetention 649 - 2 MbpsBhupendra SharmaAinda não há avaliações

- TPLDOCDocumento1 páginaTPLDOCBhupendra SharmaAinda não há avaliações

- Online Social NetworkDocumento20 páginasOnline Social NetworkBhupendra SharmaAinda não há avaliações

- AstrologyDocumento10 páginasAstrologyBhupendra SharmaAinda não há avaliações

- Bablu 1012Documento2 páginasBablu 1012Bhupendra SharmaAinda não há avaliações

- WL WL: Irctcs E-Ticketing Service Electronic Reservation Slip (Personal User)Documento2 páginasWL WL: Irctcs E-Ticketing Service Electronic Reservation Slip (Personal User)Bhupendra SharmaAinda não há avaliações

- Correction FormDocumento2 páginasCorrection FormBhupendra SharmaAinda não há avaliações

- Parity Price CalculatorDocumento4 páginasParity Price CalculatorBhupendra SharmaAinda não há avaliações

- Irctcs E-Ticketing Service Electronic Reservation Slip (Personal User)Documento2 páginasIrctcs E-Ticketing Service Electronic Reservation Slip (Personal User)Bhupendra SharmaAinda não há avaliações

- Bablu 1012Documento2 páginasBablu 1012Bhupendra SharmaAinda não há avaliações

- Manglik DoshDocumento5 páginasManglik DoshBhupendra SharmaAinda não há avaliações

- Arbitrage Opportunities in BSE: Company Bse CMP Nse CMP Change CHG (%)Documento1 páginaArbitrage Opportunities in BSE: Company Bse CMP Nse CMP Change CHG (%)Bhupendra SharmaAinda não há avaliações

- Irctcs E-Ticketing Service Electronic Reservation Slip (Personal User)Documento2 páginasIrctcs E-Ticketing Service Electronic Reservation Slip (Personal User)Bhupendra SharmaAinda não há avaliações

- BUN Risk CodesDocumento3 páginasBUN Risk CodesBhupendra SharmaAinda não há avaliações

- Parity Price CalculatorDocumento4 páginasParity Price CalculatorBhupendra Sharma100% (1)

- On-Line Payment ReceiptDocumento1 páginaOn-Line Payment ReceiptBhupendra SharmaAinda não há avaliações

- Pivot Point CalculatorDocumento27 páginasPivot Point CalculatorBhupendra SharmaAinda não há avaliações

- PassportDocumento1 páginaPassportBhupendra SharmaAinda não há avaliações

- Inr One Lakh Twenty Three Thousand Two Hundred & Thirty Six OnlyDocumento2 páginasInr One Lakh Twenty Three Thousand Two Hundred & Thirty Six OnlyRaja HussainAinda não há avaliações

- Contoh Pengisian Form KPIDocumento1 páginaContoh Pengisian Form KPItri narwantoAinda não há avaliações

- Capital Gains TaxDocumento3 páginasCapital Gains TaxJeilo FactorAinda não há avaliações

- Deductions: Philippines Gross Estate World Gross Estate Deductible LITDocumento3 páginasDeductions: Philippines Gross Estate World Gross Estate Deductible LITMaria LopezAinda não há avaliações

- PF1 Chapter 3 SlidesDocumento98 páginasPF1 Chapter 3 SlidesNamie NamieAinda não há avaliações

- Group InsuranceDocumento43 páginasGroup InsuranceSonia JainAinda não há avaliações

- VAT Refund Scheme: On Residential Building or ApartmentDocumento7 páginasVAT Refund Scheme: On Residential Building or Apartmentaz ramAinda não há avaliações

- TAX Mock September 2023Documento64 páginasTAX Mock September 2023Saqib IqbalAinda não há avaliações

- Course Outline (Laws and Tax Management) PGDMDocumento2 páginasCourse Outline (Laws and Tax Management) PGDMAmritaAinda não há avaliações

- Roxas vs. CTA, 23 SCRA 276Documento10 páginasRoxas vs. CTA, 23 SCRA 276Machida AbrahamAinda não há avaliações

- Premium Paid CertificateDocumento1 páginaPremium Paid Certificatemsurendra642Ainda não há avaliações

- Magistr OlDocumento1 páginaMagistr OlHuseyn HiseynliAinda não há avaliações

- ES1120Documento2 páginasES1120NanaAinda não há avaliações

- 3 - Acc109 - Introduction To Gross IncomeDocumento49 páginas3 - Acc109 - Introduction To Gross IncomeVictoria CadizAinda não há avaliações

- How To Pass Accounting Entries Under GSTDocumento6 páginasHow To Pass Accounting Entries Under GSTSunando Narayan BiswasAinda não há avaliações

- IT ProjectDocumento13 páginasIT ProjectMichel EricAinda não há avaliações

- Amrit Placement Services Pvt. LTD.: Salary Slip For The Month of JUNE 2022Documento1 páginaAmrit Placement Services Pvt. LTD.: Salary Slip For The Month of JUNE 2022Rohit raagAinda não há avaliações

- Final Project On Service Tax 2017Documento21 páginasFinal Project On Service Tax 2017ansh patelAinda não há avaliações

- GST Flowchart IcaiDocumento17 páginasGST Flowchart Icaiprince2venkatAinda não há avaliações

- Alcan Pakaging Starpack Corporation vs. The City Treasurer of Manila PDFDocumento3 páginasAlcan Pakaging Starpack Corporation vs. The City Treasurer of Manila PDFJuralexAinda não há avaliações

- Donor's, Exempt TaxDocumento3 páginasDonor's, Exempt TaxDanna Karen MallariAinda não há avaliações

- Budget Practice 2023Documento2 páginasBudget Practice 2023Nhi PhạmAinda não há avaliações

- Bantillo - CIR Vs PNBDocumento3 páginasBantillo - CIR Vs PNBAto TejaAinda não há avaliações

- Chapter 6 - Capital Gains TaxationDocumento4 páginasChapter 6 - Capital Gains Taxationclaritaquijano526Ainda não há avaliações