Escolar Documentos

Profissional Documentos

Cultura Documentos

Trups CDO Primer

Enviado por

Aly KanjiDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Trups CDO Primer

Enviado por

Aly KanjiDireitos autorais:

Formatos disponíveis

Global Credit Research CLO Research AC Rishad Ahluwalia (44-207) 777-1045 Maggie Wang (1-212) 270-7255 J.P.

Morgan Securities LLC

TruPS CDO Primer

Banking on TruPS

(Excerpted from J.P. Morgan CLO weekly published on June 1, 2012) Summary and key themes So as to consider a different risk profile from CLOs, in this special feature we take a look at Bank Trust Preferred Securities (TruPS) CDOs. To review, TruPS is subordinated debt issued by banks (in CDOs, mainly non-rated or sub-IG regional, small, or community), thrifts, insurers, and REITs. Fitch1 tracks 1,813 institutions issued $37.7bn TruPS since 2000, mostly banks ($30.7bn) in CDOs. TruPS CDOs offer a pickup to CLOs, but the gap has narrowed. YTD, first-pay yields declined from 9.5-10.0% to 7.5-8.0% and second-pay from 13.0-15.0% to 10.0%-13.0%, with prices up $5-8 for both. In contrast, CLO first and second pay yields have largely remained around 2.5-3.0% and 4.0-5.0%. Given the rise in Eurozone stress, its possible there is some softness near term, but the lack of supply has cushioned price volatility. Investors should weigh the yield pickup with risks including subordinated exposure to the US banking sector, limited transparency, and low secondary market liquidity. Key themes: Credit performance is pool-specific, but is generally improving. Fitchs rate of new defaulted banks in TruPS CDOs dropped to the lowest level (0.11%) since 2Q 2008, versus 3.5% at the peak Banks may have increasing financial capacity to cure PIKd interest payments as the economy improves. We survey cure data provided by the rating agencies and profitability data provided by our analysts There is upside from banks redeeming their TruPS and we discuss regulatory capital changes (e.g., Collins Amendment in Dodd-Frank), M&A, etc In addition to bond amortization upside from redemptions and M&A, TruPS CDO first pays also benefit from cashflow windfalls (asset PIK cures, etc) Since mid-April, $7.5bn of TruPS CDO notes (c. 25%) have been upgraded, potentially making them more capital efficient for some real money buyers

Exhibit 3: Observed spread ranges (bp) for 87 TRUPS CDO tranches, by current Moody's rating

Current Moo y !s rating #ig$ %& 'Aa1 to A() Mi %& '+aa1 to +aa() Su0 %& '+a1 to +() Distresse 'Caa1 to C) Count 12 1, 2, (/ Lo" 2*( --1 (1* 21, Mean *22 **( 1(2,1*#ig$ 1,120 2,,./ 2,-20 *,11-

Source: J.P. Morgan, PricingDirect. As of May 1, 2012.

Exhibit 4: Return on average assets ROAA of US banks with less than $15bn in assets

140% 120% 100% 80% 60% 40% 20% 0% -20%

1990Y 1991Y 1992Y 1993Y 1994Y 1995Y 1996Y 1997Y 1998Y 1999Y 2000Y 2001Y 2002Y 2003Y 2004Y 2005Y 2006Y 2007Y 2008Y 2009Y 2010Y 2011Y

Source: SNL Financial

TruPS CDO tranches offer a significant yield sensitivity if interest rates rise, largely due to the longer maturities and deeper price discounts

We summarize a representative transaction and then compare risk/reward in TruPS CDOs with CLOs and SF CDOs in Exhibit 11. Secondary market snapshot Bank issuers in TruPS CDOs tend to be private or small regional and community institutions, with little asset pricing data available. As one snapshot on TruPS CDO liabilities, Exhibit 3 shows spreads grouped by current Moodys rating for 87 tranches based on recent observations by PricingDirect, a wholly-owned subsidiary of J.P. Morgan Chase & Co. In general, first pays trade in a 7.5-8.0% yield, versus 2.5-3.0% in US CLOs, and one would have to go down to fourth-pay in CLOs (original BBBs) for similar yields. On the other hand, there is a high degree of price dispersion in TruPS CDOs, even in first pays, so picking points is vital. Our data indicates a range of 800-900bp in highest-rated bonds to a range of 2,000bp+ in lowest-rated bonds.

Fitch Bank TruPS CDO Default and Deferral Index, Fitch, May 22nd, 2012.

Global Credit Research CLO Research AC Rishad Ahluwalia (44-207) 777-1045 Maggie Wang (1-212) 270-7255 J.P. Morgan Securities LLC

Relative Value Themes (1) Improving banks and TruPS CDO performance The US banking sector is an improving credit story, but with some challenges ahead, given the slow recovery since the recession. Our bank credit analysts have a positive view, and are biased towards beaten-up regional banks which needed TARP support. Some institutions have come out of the crisis in much better shape than others, so CDO pool performance will vary. As SNL financial data shows in Exhibit 4, profitability is improving for banks of smaller sizes, which are typical in CDOs. In terms of distress, the US commercial bank failure rate jumped to as high as 2.35% at the peak of the last crisis, but has since declined to 0.38% at present (Exhibit 5). If one has an optimistic view on regional and community banks and the US economy, there is an opportunity to access size at distressed pricing through TruPS CDOs. In the bank collateral pool of TruPS CDOs, and on a cumulative basis, Fitch measures default and deferral rates at 16.9% and 15.5%, respectively. Through the end of April 2012, 204 bank issuers of circa $6.4bn held across 83 TruPS CDOs were in default, and 368 deferring bank issuers were impacting interest payments on $5.8bn of collateral held by 84 TruPS CDOs. Notably, as Exhibits 6-7 show, the rate of new defaulted banks in TruPS CDOs dropped to the lowest level (0.11%) since 2Q 2008, versus 3.5% at the peak. Also, the rate of new bank deferrals continues to decline year over year. A key characteristic of typical TruPS is the issuers ability to defer interest payment for up to five consecutive years, without defaulting under the terms of the securities, as these securities were issued to obtain Tier 1 capital treatment. With the banking sector improving, more deferring banks may be able to resume payments and default rates may remain low, but it is hard to estimate the timing and length of resumed interest payments. Moodys2 estimates that about one-third of all deferring banks in TruPS CDO portfolios have the financial capacity to resume their TruPS interest payments and become current on their cumulative deferred interest in the near future. To be sure, the rate of new cures is still minimal (Exhibit 8). For example, Fitch observes that, out of 626 deferrals since Sep 2007, as a whole, 62 resulted in cures, with 3 their second time

2

Exhibit 5: Bank failure & corporate default rates

6% 5% 4% 3% 2% 1% 0% Co33ercial +an4 Failure 5ate A Cor6. Default 5ate +aa Cor6. Default 5ate +a Cor6. Default 5ate

1980

1982

1984

1986

1988

1990

1992

1994

1996

1998

2000

2002

2004

2006

2008

2010

Mar. 2012

Source: FD%C, Moo y2s

Exhibit 6: Rate of New Defaulted Banks in CDOs

10 9 8 7 6 5 4 3 2 1 0 4.0% 3.5% 3.0% 2.5% 2.0% 1.5% 1.0% 0.5% 0.0%

Source: Fitc$.

Exhibit 7: Rate of New Deferring Banks in CDOs

30 25 20 15 10 5 0 4.0% 3.5% 3.0% 2.5% 2.0% 1.5% 1.0% 0.5% 0.0%

Mar. 2008

Mar. 2009

Mar. 2010

Sept. 2007

Sept. 2008

Sept. 2009

Sept. 2010

Mar. 2011

Sept. 2011

/e0. 2007

/e0. 2008

/e0. 2009

/e0. 2010

# o !an"# $3 %on Mov&n' (vera'e) *+S,

% o -ollateral $.+S,

Moodys Structured Credit Perspective, More Deferring Banks in TruPS CDOs May Resume Interest Payments, April 20th, 2012.

Source: Fitc$.

/e0. 2011

Jun. 2008

Jun. 2009

Jun. 2010

Jun. 2011

Sept. 2007 Nov. 2007 Jan. 2008 Mar. 2008 May-2008 Jul. 2008 Sept. 2008 Nov. 2008 Jan. 2009 Mar. 2009 May-2009 Jul. 2009 Sept. 2009 Nov. 2009 Jan. 2010 Mar. 2010 May-2010 Jul. 2010 Sept. 2010 Nov. 2010 Jan. 2011 Mar. 2011 May-2011 Jul. 2011 Sept. 2011 Nov. 2011 Jan. 2012 Mar. 2012

# o !an"# $3 %on Mov&n' (vera'e) *+S,

% o -ollateral $.+S,

2012

Global Credit Research CLO Research AC Rishad Ahluwalia (44-207) 777-1045 Maggie Wang (1-212) 270-7255 J.P. Morgan Securities LLC

curing. So, roughly 9.9% of deferrals have cured their interest obligations since September 2007, with about half taking place in 2011, but at least 10 that cured are deferring once again. All in all, for private small regional and community banks, the defer or cure decision process may be less transparent to CDO investors, given that many of these institutions have equity or debt securities that is not in public capital markets. (2) The ratings upgrades of TruPS CDOs Moodys and Fitch have been periodically reviewing and upgrading TruPS CDO tranches for some time, and S&P started doing so this year. As ratings for some tranches gravitate towards IG, they (a) become less capital intensive and (b) potentially attractive to new buyer bases, such as real money. On April 16th, S&P updated their rating methodology for US TruPS CDOs3. The new criteria include a decreased emphasis on front-loaded defaults (which are generally more stressful on cashflows) for lower ratings, a potential deferral cure credit in cashflow analysis for deferring bank trust preferred securities, and an assumption that larger banks may redeem their trust preferred securities, due to US regulatory changes that phase out Tier 1 capital credit for such securities. Since mid-April, $7.5bn of TruPS CDO notes (c. 25% of outstandings) have been upgraded. (3) TruPS redemption and bank sector M&A trends The other trend worth mentioning is TruPS redemption by large banks or through bank acquisition. First, because of the Collins amendment in Dodd-Frank Act on capital requirements4, banks with $15bn assets or higher no longer get Tier 1 capital treatment on their TruPS. As a result, it may make sense from a regulatory capital perspective for certain banks to redeem their trust preferreds, depending on their financials. Second, due to M&A activity, large banks holding TruPS securities may redeem because of acquired TruPS at non3

Exhibit 8: Rate of New Cured Banks in CDOs

6 5 4 3 2 1 0 4.0% 3.5% 3.0% 2.5% 2.0% 1.5% 1.0% 0.5% 0.0%

Source: Fitc$. %nclu es re7 eferrals.

Exhibit 9: Total Number of Traditional Bank M&A Deals, with Total Assets Acquired ($ millions)

600 500 400 300 200 100 $1,600,000 $1,400,000 $1,200,000 $1,000,000 $800,000 $600,000 $400,000 $200,000 $0

1979 1982 1985 1988 1991 1994 1997 2000 2003 2006 2009 YTD 2012

Source: SNL Financial.

US Cash Flow CDOs Of Bank Trust Preferred Securities: Updated Methodology And Assumptions, S&P, April 16, 2012. 4 The Collins Amendment in the Dodd-Frank Act establishes that any trust-preferred security issued after May 19, 2010 will no longer be considered an element of Tier 1 capital. For any TruPS issued before May 19, 2010 banks with $15bn of assets or more wont get Tier 1 capital treatment on TruPS issued, there will be a three-year phase-in of exclusions starting in January of 2013 for banks and thrift holding companies with greater than $15 billion in assets. For more information, please refer to the recent Federal Reserve press release: http://www.federalreserve.gov/newsevents/testimony/tarullo20111206a .htm

economic rates and small issue sizes. We observe TruPS CDOs normally have 0-20% exposure to large banks, but with a higher percentage in pre-2005 vintages. The ratio will probably increase with more bank industry consolidation and M&A5. In general, M&A activity is at a low point now (Exhibit 9), and our equity research analysts believe there should be more bank consolidation but with two impediments: 1) future regulatory changes and 2) valuation risk6.

US Mid-and Small-Cap Banks Mergers & Acquisitions Weekly, US Banks Equity Research, J.P. Morgan, May 21, 2012. 6 U.S. Mid- and Small-Cap Banks, ABA Meeting Takeaways on M&A, US Banks Equity Research, JPMorgan, May 8, 2012.

Sept. 2007 Nov. 2007 Jan. 2008 Mar. 2008 May-2008 Jul. 2008 Sept. 2008 Nov. 2008 Jan. 2009 Mar. 2009 May-2009 Jul. 2009 Sept. 2009 Nov. 2009 Jan. 2010 Mar. 2010 May-2010 Jul. 2010 Sept. 2010 Nov. 2010 Jan. 2011 Mar. 2011 May-2011 Jul. 2011 Sept. 2011 Nov. 2011 Jan. 2012 Mar. 2012

# o !an"# $3 %on Mov&n' (vera'e) *+S,

% o -ollateral $.+S,

Total Assets Acquired (in millions) (RHS)

No. of Deals (LHS)

Global Credit Research CLO Research AC Rishad Ahluwalia (44-207) 777-1045 Maggie Wang (1-212) 270-7255 J.P. Morgan Securities LLC

Redemptions benefit first pay bonds, but as banks redeeming their TruPS generate amortization proceeds, this generates potential negative or adverse selection risks for the mezzanine tranches (as presumably, banks that do not have enough capital and/or liquidity to redeem would be the riskier ones and remain in the pool). (4) The structure / OC test play As the majority of bank TruPS CDOs are failing their senior OC tests, first pay bonds stand to benefit directly by proceeds from redemptions, resumed interest payment and excess interest flowing through from swaps maturing, higher rates, etc. For instance, if deferring banks resume interest payment, senior bond holders are entitled to a windfall from excess interest (current coupon + PIKd interest) amortizing the seniors. (5) Floating rate option Last but not least, TruPS CDOs are a cheap floating rates option, with a relatively high sensitivity to future changes in interest rates, given the deeper discounts and longer dated maturities. Any steepening of the forward interest rate curve benefits price and yield, which is important to typical fast money players, who are very yield driven. With US interest rates at very low historical levels, there is an opportunity to have an embedded rates play. For example, in a typical seasoned first-pay TruPS bond priced in the $50s area, the yield rises from about 7.5% to nearly 9.5% with a 100bp forward curve increase, all else equal. In contrast, for a typical seasoned CLO firstpay bond priced in the mid-$90s, the yield rises from about 2.1% to 2.9% with the same interest rate increase. Key risks and sensitivities We see opportunities in first pays and selected short duration second pays. The trade is supported by improving bank performance and capital ratios, tranche rating upgrades, structural paydown, and long-term interest rate rises, among other factors. There are several key risks/sensitivities in the sector when analyzing bank deferral/default assumptions for a TruPS CDO: Most investors need to get access to the collateral from a dealer and most use S&Ls database to get solid credit analysis on the underlying. It is challenging to keep abreast with news information on the underlying issuers, typically 75-150 small, regional or community banks (and mostly private )

Exhibit 10: Sample analysis (PRETSL 19)

Asset +rea4 o" n Par ';3n) +an4 %nsurance 59%8 Cre it Analy sis Par ';3n) Perfor3ing assets Deferring assets Defaulting assets ;,.(.1. ;1,(.1;,,.00 /1.2< 22.0< ..*< 100.0< ;,-..-2 ;11(./1 ;0.00 ;.-0.(1 /0.2< 21.*< 0.0< 100.0<

;.-0.(1 Source: J.P. Morgan, %N89:, eal re6orts.

There are risks of timing redemption and deferral cures, and valuing associated Senior OC passing and junior class leaks Investors need to bear in mind the long swap maturity, and therefore associated drag Moodys has announced they will be downgrading Global Capital Markets Intermediaries (GCMIs) by mid-2012 due to credit concerns (macro uncertainty, low growth, counterparty confidence). While not directly impacting small and community banks in TruPS CDO pools, to the extent the banking market is generally impacted (higher funding spreads, etc) this could make the environment more challenging7.

7 What Is Priced in? Looking at Potential Outcomes of the Moody's GCMI Review, US Banks Credit Research, May 9, 2012.

Global Credit Research CLO Research AC Rishad Ahluwalia (44-207) 777-1045 Maggie Wang (1-212) 270-7255 J.P. Morgan Securities LLC

Exhibit 11: Comparing TruPS CDOs to CLOs and SF CDOs

US HY CLO Outstanding Market Size Collateral Typical pool diversity Manage ent Type !eneric Deal Size Cas" #lo$ Structure Current %verage Li#e &#irst pay 'ond( First pay spreads Yield on #irst pay First pay coupon %%% Su'ordination at issue %% Su'ordination at issue Source: J.P. Morgan. ;2*00n ++=+ +roa ly syn icate le>erage loans ',7/ yrs) 1007200 ?0ligors Manage ;,003n A3orti@ing (7- years 1(006 7 1/-06 2.-7(.0< Floating 'LA 2-06) 2,7(0< 1*72(< US TruPS CDO ;(07,00n +++=++=+=non7rate trust 6referre securities '0an4, t$rift, insurance an 59%8) '-7(0 yrs) /-71-0 ?0ligors Static, fe" 3anage ;-003n A3orti@ing 10A years ,-006 7 --006 /.07*.0< Floating 'LA,006) (-7,0< 2-7(0< US SF CDO ;(000n Non7agency A+S an ot$er CD? /-71-0 ?0ligors Static ;10n A3orti@ing /A years /00 7 *0006 10.0712.0< Floating 'LA(07-006) 1*7(0< *72-<

Sample analysis Exhibit 10 summarizes a representative TruPS CDO, Preferred Term Securities XIX (PRETSL 19), a CDO of mostly bank TrupS (70% of pool) issued in late 2005. The Class A OC ratio of 106% is failing its 128% threshold. This is fairly typical in the market, and means cashflows are being diverted to pay down the senior notes (A1 and A2 factors of 0.91 and 0.98 at present). The performing asset pool ($463mn) is greater than the combined A1 and A2 tranches ($446mn), but by a small amount suggesting principal repayment risk for the A2s depending on how the deferring obligors behave, among other factors. This is only one example, but in general many first-pays (A1s) could be covered, with second-pay (A2) coverage contingent on performance in the remaining assets, any excess interest, when swaps mature and any deferring

asset coupon turning back on. With A1s generically in the $50-60 and A2s in the $35-45 context, there may be upside for investors with a relatively long time horizon. To conclude, in Exhibit 11, we compare some of the key features of TruPS CDOs versus CLOs and SF CDOs (i.e., market size, first-pay bond spread range, current typical pool rating, current typical pool diversity/number of obligors, collateral buckets, etc).

Analyst Certification: The research analyst(s) denoted by an AC on the cover of this report certifies (or, where multiple research analysts are primarily responsible for this report, the research analyst denoted by an AC on the cover or within the document individually certifies, with respect to each security or issuer that the research analyst covers in this research) that: (1) all of the views expressed in this report accurately reflect his or her personal views about any and all of the subject securities or issuers; and (2) no part of any of the research analyst's compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed by the research analyst(s) in this report.

Important Disclosures

Company-Specific Disclosures: Important disclosures are available for compendium reports and all J.P. Morgan covered companies by visiting https://mm.jpmorgan.com/disclosures/company, calling 1-800-477-0406, or emailing research.disclosure.inquiries@jpmorgan.com with your request. Explanation of Credit Research Ratings: Ratings System: J.P. Morgan uses the following sector/issuer portfolio weightings: Overweight (over the next three months, the recommended risk position is expected to outperform the relevant index, sector, or benchmark), Neutral (over the next three months, the recommended risk position is expected to perform in line with the relevant index, sector, or benchmark), and Underweight (over the next three months, the recommended risk position is expected to underperform the relevant index, sector, or benchmark). J.P. Morgan's Emerging Market research uses a rating of Marketweight, which is equivalent to a Neutral rating. Valuation & Methodology: In J.P. Morgan's credit research, we assign a rating to each issuer (Overweight, Underweight or Neutral) based on our credit view of the issuer and the relative value of its securities, taking into account the ratings assigned to the issuer by credit rating agencies and the market prices for the issuer's securities. Our credit view of an issuer is based upon our opinion as to whether the issuer will be able service its debt obligations when they become due and payable. We assess this by analyzing, among other things, the issuer's credit position using standard credit ratios such as cash flow to debt and fixed charge coverage (including and excluding capital investment). We also analyze the issuer's ability to generate cash flow by reviewing standard operational measures for comparable companies in the sector, such as revenue and earnings growth rates, margins, and the composition of the issuer's balance sheet relative to the operational leverage in its business. J.P. Morgan Credit Research Ratings Distribution, as of April 3, 2012

EMEA Credit Research Universe IB clients* Overweight 28% 54% Neutral 49% 62% Underweight 23% 54%

Represents Ratings on the most liquid bond or 5-year CDS for all companies under coverage. *Percentage of investment banking clients in each rating category.

Analysts' Compensation: The research analysts responsible for the preparation of this report receive compensation based upon various factors, including the quality and accuracy of research, client feedback, competitive factors, and overall firm revenues, which include revenues from, among other business units, Institutional Equities, Fixed Income, and Investment Banking.

Other Disclosures

J.P. Morgan ("JPM") is the global brand name for J.P. Morgan Securities LLC ("JPMS") and its affiliates worldwide. J.P. Morgan Cazenove is a marketing name for the U.K. investment banking businesses and EMEA cash equities and equity research businesses of JPMorgan Chase & Co. and its subsidiaries. QIB Only Options related research: If the information contained herein regards options related research, such information is available only to persons who have received the proper option risk disclosure documents. For a copy of the Option Clearing Corporation's Characteristics and Risks of Standardized Options, please contact your J.P. Morgan Representative or visit the OCC's website at http://www.optionsclearing.com/publications/risks/riskstoc.pdf Legal Entities Disclosures U.S.: JPMS is a member of NYSE, FINRA, SIPC and the NFA. JPMorgan Chase Bank, N.A. is a member of FDIC and is authorized and regulated in the UK by the Financial Services Authority. U.K.: J.P. Morgan Securities Ltd. (JPMSL) is a member of the London Stock Exchange and is authorized and regulated by the Financial Services Authority. Registered in England & Wales No. 2711006. Registered Office 125 London Wall, London EC2Y 5AJ. South Africa: J.P. Morgan Equities Limited is a member of the Johannesburg Securities Exchange and is regulated by the FSB. Hong Kong: J.P. Morgan Securities (Asia Pacific) Limited (CE number AAJ321) is regulated by the Hong Kong Monetary Authority and the Securities and Futures Commission in Hong Kong. Korea: J.P. Morgan Securities (Far East) Ltd, Seoul Branch, is regulated by the Korea Financial Supervisory Service. Australia: J.P. Morgan Australia Limited (ABN 52 002 888 011/AFS Licence No: 238188) is regulated by ASIC and J.P. Morgan Securities Australia Limited (ABN 61 003 245 234/AFS Licence No: 238066) is a Market Participant with the ASX and regulated by ASIC. Taiwan: J.P.Morgan Securities (Taiwan) Limited is a participant of the Taiwan Stock Exchange (company-type) and regulated by the Taiwan Securities and Futures Bureau. India: J.P. Morgan India Private Limited, having its registered office at J.P. Morgan Tower, Off. C.S.T. Road, Kalina, Santacruz East, Mumbai - 400098, is a member of the National Stock Exchange of India Limited (SEBI Registration Number - INB 230675231/INF 230675231/INE 230675231)

and Bombay Stock Exchange Limited (SEBI Registration Number - INB 010675237/INF 010675237) and is regulated by Securities and Exchange Board of India. Thailand: JPMorgan Securities (Thailand) Limited is a member of the Stock Exchange of Thailand and is regulated by the Ministry of Finance and the Securities and Exchange Commission. Indonesia: PT J.P. Morgan Securities Indonesia is a member of the Indonesia Stock Exchange and is regulated by the BAPEPAM LK. Philippines: J.P. Morgan Securities Philippines Inc. is a member of the Philippine Stock Exchange and is regulated by the Securities and Exchange Commission. Brazil: Banco J.P. Morgan S.A. is regulated by the Comissao de Valores Mobiliarios (CVM) and by the Central Bank of Brazil. Mexico: J.P. Morgan Casa de Bolsa, S.A. de C.V., J.P. Morgan Grupo Financiero is a member of the Mexican Stock Exchange and authorized to act as a broker dealer by the National Banking and Securities Exchange Commission. Singapore: This material is issued and distributed in Singapore by J.P. Morgan Securities Singapore Private Limited (JPMSS) [MICA (P) 088/04/2012 and Co. Reg. No.: 199405335R] which is a member of the Singapore Exchange Securities Trading Limited and is regulated by the Monetary Authority of Singapore (MAS) and/or JPMorgan Chase Bank, N.A., Singapore branch (JPMCB Singapore) which is regulated by the MAS. Malaysia: This material is issued and distributed in Malaysia by JPMorgan Securities (Malaysia) Sdn Bhd (18146-X) which is a Participating Organization of Bursa Malaysia Berhad and a holder of Capital Markets Services License issued by the Securities Commission in Malaysia. Pakistan: J. P. Morgan Pakistan Broking (Pvt.) Ltd is a member of the Karachi Stock Exchange and regulated by the Securities and Exchange Commission of Pakistan. Saudi Arabia: J.P. Morgan Saudi Arabia Ltd. is authorized by the Capital Market Authority of the Kingdom of Saudi Arabia (CMA) to carry out dealing as an agent, arranging, advising and custody, with respect to securities business under licence number 35-07079 and its registered address is at 8th Floor, Al-Faisaliyah Tower, King Fahad Road, P.O. Box 51907, Riyadh 11553, Kingdom of Saudi Arabia. Dubai: JPMorgan Chase Bank, N.A., Dubai Branch is regulated by the Dubai Financial Services Authority (DFSA) and its registered address is Dubai International Financial Centre - Building 3, Level 7, PO Box 506551, Dubai, UAE. Country and Region Specific Disclosures U.K. and European Economic Area (EEA): Unless specified to the contrary, issued and approved for distribution in the U.K. and the EEA by JPMSL. Investment research issued by JPMSL has been prepared in accordance with JPMSL's policies for managing conflicts of interest arising as a result of publication and distribution of investment research. Many European regulators require a firm to establish, implement and maintain such a policy. This report has been issued in the U.K. only to persons of a kind described in Article 19 (5), 38, 47 and 49 of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (all such persons being referred to as "relevant persons"). This document must not be acted on or relied on by persons who are not relevant persons. Any investment or investment activity to which this document relates is only available to relevant persons and will be engaged in only with relevant persons. In other EEA countries, the report has been issued to persons regarded as professional investors (or equivalent) in their home jurisdiction. Australia: This material is issued and distributed by JPMSAL in Australia to "wholesale clients" only. JPMSAL does not issue or distribute this material to "retail clients". The recipient of this material must not distribute it to any third party or outside Australia without the prior written consent of JPMSAL. For the purposes of this paragraph the terms "wholesale client" and "retail client" have the meanings given to them in section 761G of the Corporations Act 2001. Germany: This material is distributed in Germany by J.P. Morgan Securities Ltd., Frankfurt Branch and J.P.Morgan Chase Bank, N.A., Frankfurt Branch which are regulated by the Bundesanstalt fr Finanzdienstleistungsaufsicht. Hong Kong: The 1% ownership disclosure as of the previous month end satisfies the requirements under Paragraph 16.5(a) of the Hong Kong Code of Conduct for Persons Licensed by or Registered with the Securities and Futures Commission. (For research published within the first ten days of the month, the disclosure may be based on the month end data from two months prior.) J.P. Morgan Broking (Hong Kong) Limited is the liquidity provider/market maker for derivative warrants, callable bull bear contracts and stock options listed on the Stock Exchange of Hong Kong Limited. An updated list can be found on HKEx website: http://www.hkex.com.hk. Japan: There is a risk that a loss may occur due to a change in the price of the shares in the case of share trading, and that a loss may occur due to the exchange rate in the case of foreign share trading. In the case of share trading, JPMorgan Securities Japan Co., Ltd., will be receiving a brokerage fee and consumption tax (shouhizei) calculated by multiplying the executed price by the commission rate which was individually agreed between JPMorgan Securities Japan Co., Ltd., and the customer in advance. Financial Instruments Firms: JPMorgan Securities Japan Co., Ltd., Kanto Local Finance Bureau (kinsho) No. 82 Participating Association / Japan Securities Dealers Association, The Financial Futures Association of Japan, Type II Financial Instruments Firms Association and Japan Securities Investment Advisers Association. Korea: This report may have been edited or contributed to from time to time by affiliates of J.P. Morgan Securities (Far East) Ltd, Seoul Branch. Singapore: JPMSS and/or its affiliates may have a holding in any of the securities discussed in this report; for securities where the holding is 1% or greater, the specific holding is disclosed in the Important Disclosures section above. India: For private circulation only, not for sale. Pakistan: For private circulation only, not for sale. New Zealand: This material is issued and distributed by JPMSAL in New Zealand only to persons whose principal business is the investment of money or who, in the course of and for the purposes of their business, habitually invest money. JPMSAL does not issue or distribute this material to members of "the public" as determined in accordance with section 3 of the Securities Act 1978. The recipient of this material must not distribute it to any third party or outside New Zealand without the prior written consent of JPMSAL. Canada: The information contained herein is not, and under no circumstances is to be construed as, a prospectus, an advertisement, a public offering, an offer to sell securities described herein, or solicitation of an offer to buy securities described herein, in Canada or any province or territory thereof. Any offer or sale of the securities described herein in Canada will be made only under an exemption from the requirements to file a prospectus with the relevant Canadian securities regulators and only by a dealer properly registered under applicable securities laws or, alternatively, pursuant to an exemption from the dealer registration requirement in the relevant province or territory of Canada in which such offer or sale is made. The information contained herein is under no circumstances to be construed as investment advice in any province or territory of Canada and is not tailored to the needs of the recipient. To the extent that the information contained herein references securities of an issuer incorporated, formed or created under the laws of Canada or a province or territory of Canada, any trades in such securities must be conducted through a dealer registered in Canada. No securities commission or similar regulatory authority in Canada has reviewed or in any way passed judgment upon these materials, the information contained herein or the merits of the securities described herein, and any representation to the contrary is an offence. Dubai: This report has been issued to persons regarded as professional clients as defined under the DFSA rules. General: Additional information is available upon request. Information has been obtained from sources believed to be reliable but JPMorgan Chase & Co. or its affiliates and/or subsidiaries (collectively J.P. Morgan) do not warrant its completeness or accuracy except with respect to any disclosures relative to JPMS and/or its affiliates and the analyst's involvement with the issuer that is the subject of the research. All pricing is as of the close of market for the securities discussed, unless otherwise stated. Opinions and estimates constitute our judgment as of the date of this material and are subject to change without notice. Past

performance is not indicative of future results. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. The recipient of this report must make its own independent decisions regarding any securities or financial instruments mentioned herein. JPMS distributes in the U.S. research published by non-U.S. affiliates and accepts responsibility for its contents. Periodic updates may be provided on companies/industries based on company specific developments or announcements, market conditions or any other publicly available information. Clients should contact analysts and execute transactions through a J.P. Morgan subsidiary or affiliate in their home jurisdiction unless governing law permits otherwise. "Other Disclosures" last revised April 18, 2012.

Copyright 2012 JPMorgan Chase & Co. All rights reserved. This report or any portion hereof may not be reprinted, sold or redistributed without the written consent of J.P. Morgan. #$J&098$#*P

Você também pode gostar

- CMBS Strategy WeeklyDocumento14 páginasCMBS Strategy Weeklykkohle03Ainda não há avaliações

- CLO Investing: With an Emphasis on CLO Equity & BB NotesNo EverandCLO Investing: With an Emphasis on CLO Equity & BB NotesAinda não há avaliações

- CMBS Special Topic: Outlook For The CMBS Market in 2011Documento26 páginasCMBS Special Topic: Outlook For The CMBS Market in 2011Yihai YuAinda não há avaliações

- An Options Approach To Commercial Mortgage and CMBS Valuation and Risk AnalysisDocumento24 páginasAn Options Approach To Commercial Mortgage and CMBS Valuation and Risk AnalysisCameronAinda não há avaliações

- 507068Documento43 páginas507068ab3rdAinda não há avaliações

- JPM CDO Research 12-Feb-2008Documento20 páginasJPM CDO Research 12-Feb-2008Gunes KulaligilAinda não há avaliações

- Outlook For The RMBS Market in 2007Documento45 páginasOutlook For The RMBS Market in 2007Dimitri DelisAinda não há avaliações

- CDOPrimerDocumento40 páginasCDOPrimermerton1997XAinda não há avaliações

- Base Correlation ExplainedDocumento20 páginasBase Correlation Explaineds_89Ainda não há avaliações

- CMBS Weekly 011212Documento15 páginasCMBS Weekly 011212sanhemyAinda não há avaliações

- Barclays Securitized Products Weekly Looking Past The EM ContagionDocumento44 páginasBarclays Securitized Products Weekly Looking Past The EM ContagiondhyakshaAinda não há avaliações

- Abs Cdos - A Primer: StrategyDocumento28 páginasAbs Cdos - A Primer: StrategyjigarchhatrolaAinda não há avaliações

- Bank of America Trust IOPO MarketDocumento29 páginasBank of America Trust IOPO Marketsss1453Ainda não há avaliações

- A Deloitte & Touche LLP MBS Structuring Concepts & Techniques PrimerDocumento12 páginasA Deloitte & Touche LLP MBS Structuring Concepts & Techniques PrimerPropertywizzAinda não há avaliações

- Collateralized Mortgage Obligations: An Introduction To Sequentials, Pacs, Tacs, and VadmsDocumento5 páginasCollateralized Mortgage Obligations: An Introduction To Sequentials, Pacs, Tacs, and Vadmsddelis77Ainda não há avaliações

- Agencies JPMDocumento18 páginasAgencies JPMbonefish212Ainda não há avaliações

- Lehman Brothers NonAgency Hybrids A PrimerDocumento16 páginasLehman Brothers NonAgency Hybrids A PrimerMatthew HartAinda não há avaliações

- ING Trups DiagramDocumento5 páginasING Trups DiagramhungrymonsterAinda não há avaliações

- Investor's Guide On CMBSDocumento36 páginasInvestor's Guide On CMBSBalu MahindraAinda não há avaliações

- Constructing A Liability Hedging Portfolio PDFDocumento24 páginasConstructing A Liability Hedging Portfolio PDFtachyon007_mechAinda não há avaliações

- (Lehman Brothers) Securitized Products Outlook 2007 - Bracing For A Credit DownturnDocumento23 páginas(Lehman Brothers) Securitized Products Outlook 2007 - Bracing For A Credit DownturnSiddhantAinda não há avaliações

- A Primer On Whole Business SecuritizationDocumento13 páginasA Primer On Whole Business SecuritizationSam TickerAinda não há avaliações

- ABCs of ABCP, 2009Documento42 páginasABCs of ABCP, 2009ed_nycAinda não há avaliações

- RealPoint CMBS Methodology DisclosureDocumento19 páginasRealPoint CMBS Methodology DisclosureCarneadesAinda não há avaliações

- Ng-Phelps-2010-Barclays Capturing Credit Spread PremiumDocumento24 páginasNg-Phelps-2010-Barclays Capturing Credit Spread PremiumGuido 125 LavespaAinda não há avaliações

- BTRM WP15 - SOFR OIS Curve Construction - Dec 2020Documento23 páginasBTRM WP15 - SOFR OIS Curve Construction - Dec 2020MypatAinda não há avaliações

- The Future Refinancing Crisis in Commercial Real Estate: CMBS ResearchDocumento31 páginasThe Future Refinancing Crisis in Commercial Real Estate: CMBS ResearchRicksCabAinda não há avaliações

- Greenwich Capital CMBS 2006 & Outlook For 2007Documento43 páginasGreenwich Capital CMBS 2006 & Outlook For 2007bvaheyAinda não há avaliações

- Deleveraging Investing Optimizing Capital StructurDocumento42 páginasDeleveraging Investing Optimizing Capital StructurDanaero SethAinda não há avaliações

- (Bank of America) Credit Strategy - Monolines - A Potential CDS Settlement DisasterDocumento9 páginas(Bank of America) Credit Strategy - Monolines - A Potential CDS Settlement Disaster00aaAinda não há avaliações

- CMS Inverse FloatersDocumento8 páginasCMS Inverse FloaterszdfgbsfdzcgbvdfcAinda não há avaliações

- Wells Non QM PDFDocumento21 páginasWells Non QM PDFsinhaaAinda não há avaliações

- Repos A Deep Dive in The Collateral PoolDocumento7 páginasRepos A Deep Dive in The Collateral PoolppateAinda não há avaliações

- Barclays Introduction To Inverse IODocumento20 páginasBarclays Introduction To Inverse IOsriramkannaAinda não há avaliações

- Transforming: Real Estate FinanceDocumento208 páginasTransforming: Real Estate FinanceJay KabAinda não há avaliações

- Mexico 101 (2011 Report)Documento84 páginasMexico 101 (2011 Report)jennifer4217Ainda não há avaliações

- The Benefits of Convertible Bonds: - UBS Asset ManagementDocumento21 páginasThe Benefits of Convertible Bonds: - UBS Asset ManagementHans HermannAinda não há avaliações

- (Nomura) Home Equity ABS BasicsDocumento24 páginas(Nomura) Home Equity ABS BasicsanuragAinda não há avaliações

- Cds - Heading Towards More Stable SystemDocumento28 páginasCds - Heading Towards More Stable SystemReadEverythingAinda não há avaliações

- (Bank of America) Prepayments On Agency Hybrid ARM MBSDocumento11 páginas(Bank of America) Prepayments On Agency Hybrid ARM MBSJay KabAinda não há avaliações

- 0320 US Fixed Income Markets WeeklyDocumento96 páginas0320 US Fixed Income Markets WeeklycwuuuuAinda não há avaliações

- Guide To European CMBSDocumento53 páginasGuide To European CMBSUpendra Choudhary100% (1)

- JPM Global Fixed Income 2012-03-17 810381Documento72 páginasJPM Global Fixed Income 2012-03-17 810381deepdish7Ainda não há avaliações

- Treasury Practice ASSET SWAPSDocumento3 páginasTreasury Practice ASSET SWAPSkevAinda não há avaliações

- 2008 DB Fixed Income Outlook (12!14!07)Documento107 páginas2008 DB Fixed Income Outlook (12!14!07)STAinda não há avaliações

- Lecture21 Cdo & CdsDocumento25 páginasLecture21 Cdo & Cdsfunkchunk33Ainda não há avaliações

- ABACUS 2007 AC-1 Deal Structure and Investment Incentives - Darrell DuffieDocumento16 páginasABACUS 2007 AC-1 Deal Structure and Investment Incentives - Darrell Duffiesjoerd80Ainda não há avaliações

- JP Morgan - Trading Recovery Rates - Digital Default Swaps and Recovery SwapsDocumento6 páginasJP Morgan - Trading Recovery Rates - Digital Default Swaps and Recovery SwapsPeterAinda não há avaliações

- Principal Protected Investments: Structured Investments Solution SeriesDocumento8 páginasPrincipal Protected Investments: Structured Investments Solution SeriessonystdAinda não há avaliações

- Barclays AAA Handbook.6.2010Documento701 páginasBarclays AAA Handbook.6.2010john.gjata6585Ainda não há avaliações

- Barclays UPDATE Global Rates Weekly Withdrawal SymptomsDocumento74 páginasBarclays UPDATE Global Rates Weekly Withdrawal SymptomsVitaly Shatkovsky100% (1)

- CDS Bond BasisDocumento41 páginasCDS Bond BasisSharad DuttaAinda não há avaliações

- CLO Liquidity Provision and the Volcker Rule: Implications on the Corporate Bond MarketNo EverandCLO Liquidity Provision and the Volcker Rule: Implications on the Corporate Bond MarketAinda não há avaliações

- Credit Risk Management In and Out of the Financial Crisis: New Approaches to Value at Risk and Other ParadigmsNo EverandCredit Risk Management In and Out of the Financial Crisis: New Approaches to Value at Risk and Other ParadigmsNota: 1 de 5 estrelas1/5 (1)

- ASEAN+3 Multi-Currency Bond Issuance Framework: Implementation Guidelines for the PhilippinesNo EverandASEAN+3 Multi-Currency Bond Issuance Framework: Implementation Guidelines for the PhilippinesAinda não há avaliações

- Loan Workouts and Debt for Equity Swaps: A Framework for Successful Corporate RescuesNo EverandLoan Workouts and Debt for Equity Swaps: A Framework for Successful Corporate RescuesNota: 5 de 5 estrelas5/5 (1)

- Wallstreetjournal 20230510 TheWallStreetJournal PDFDocumento30 páginasWallstreetjournal 20230510 TheWallStreetJournal PDFRazvan Catalin CostinAinda não há avaliações

- Flashwire US Monthly September-16 PDFDocumento6 páginasFlashwire US Monthly September-16 PDFRishabh BansalAinda não há avaliações

- Weekly Market RecapDocumento2 páginasWeekly Market RecapAlex SmithAinda não há avaliações

- Wire TRF TutDocumento12 páginasWire TRF Tutsnazzy100% (2)

- JP Morgan 8.02.13 PDFDocumento9 páginasJP Morgan 8.02.13 PDFChad Thayer VAinda não há avaliações

- GenericDocumento16 páginasGenericBlake KamminAinda não há avaliações

- Rockefeller File, TheDocumento150 páginasRockefeller File, TheElFinDelFinAinda não há avaliações

- Banking On Our FutureDocumento21 páginasBanking On Our FutureHamilton Place StrategiesAinda não há avaliações

- Springwell V JPMDocumento80 páginasSpringwell V JPMSaqib AlamAinda não há avaliações

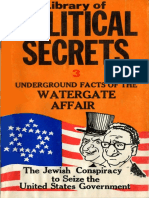

- Aguila Esteban - Underground Facts of The Watergate AffairDocumento33 páginasAguila Esteban - Underground Facts of The Watergate Affairlawrece_acc5589100% (1)

- Harvin's Reply BriefDocumento18 páginasHarvin's Reply BriefAl HarvinAinda não há avaliações

- Lines of Credit Ropes of Bondage - (Robert Goldsborough)Documento48 páginasLines of Credit Ropes of Bondage - (Robert Goldsborough)Ger Peters100% (4)

- New York Urban League Young Professionals 2012-2013 Annual ReportDocumento27 páginasNew York Urban League Young Professionals 2012-2013 Annual ReportnyulypAinda não há avaliações

- JPMorgan Global Manufacturing PMI May 2016Documento3 páginasJPMorgan Global Manufacturing PMI May 2016tobihiAinda não há avaliações

- JP Morgan Chases - Business StrategyDocumento3 páginasJP Morgan Chases - Business StrategyChris ChanAinda não há avaliações

- September StatementDocumento4 páginasSeptember Statementdonbabich8Ainda não há avaliações

- Schedule WireDocumento2 páginasSchedule WireLuana OlianoAinda não há avaliações

- MBNO658 Service Management: Assignment Top Ten Service Companies in The World Submitted BY D.Ragul 3511110622 'J'' SECDocumento5 páginasMBNO658 Service Management: Assignment Top Ten Service Companies in The World Submitted BY D.Ragul 3511110622 'J'' SECVishal PranavAinda não há avaliações

- Investment Banking CoursepackDocumento310 páginasInvestment Banking CoursepackDivjot Singh100% (1)

- Chase False Claim - 87,000 Homeowners Helped February 21, 2013Documento1 páginaChase False Claim - 87,000 Homeowners Helped February 21, 2013larry-612445Ainda não há avaliações

- Emails 3 Sent To Joanna Mccarty From 12-23-2014 To 3-24-2015 On Cassino RequestsDocumento4 páginasEmails 3 Sent To Joanna Mccarty From 12-23-2014 To 3-24-2015 On Cassino Requestsapi-293779854Ainda não há avaliações

- Screenshot 2566-08-02 at 1.05.33 AMDocumento1 páginaScreenshot 2566-08-02 at 1.05.33 AMAntonio Rubio ThomasAinda não há avaliações

- PROJECT HAMMER RELOADED - Mapping The Covert Connections by David GuyatDocumento21 páginasPROJECT HAMMER RELOADED - Mapping The Covert Connections by David GuyatrwdavisAinda não há avaliações

- The Enemy Within - Tax Exempt FoundationsDocumento44 páginasThe Enemy Within - Tax Exempt FoundationsImpello_Tyrannis100% (2)

- SecAB, Assignment#4, Rebecca HamiltonDocumento11 páginasSecAB, Assignment#4, Rebecca HamiltonBeccaAinda não há avaliações

- FMC Pending CalendarDocumento14 páginasFMC Pending CalendarForeclosure FraudAinda não há avaliações

- Statements 9261Documento6 páginasStatements 9261Jaun Tew Theory PhuorrAinda não há avaliações

- City Limits Magazine, December 1984 IssueDocumento32 páginasCity Limits Magazine, December 1984 IssueCity Limits (New York)Ainda não há avaliações

- Lighthouse May 31, 2012Documento40 páginasLighthouse May 31, 2012VCStarAinda não há avaliações